Dextrose Market by Type (Anhydrous, Monohydrate), Form (Solid, and Liquid), Application (Food & Beverages, Pharmaceuticals, Personal Care Products, Paper & Pulp Products, Agricultural Products), Functionality and Region - Global Forecast to 2027

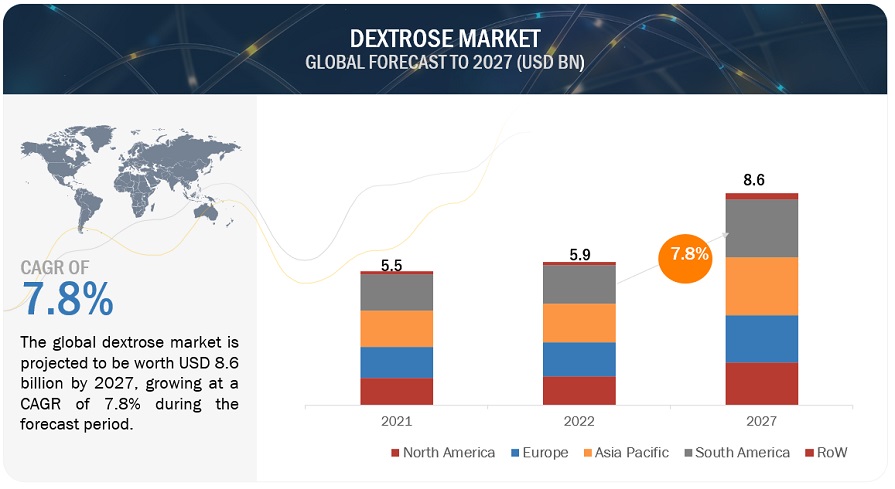

According to MarketsandMarkets, the Dextrose Market size is projected to reach USD 8.6 billion by 2027 from USD 5.9 billion in 2022, at a CAGR of 7.8% during the forecast. With rising demand from the food and beverage industries as a sweetener and source of energy, the dextrose market is on the rise. Growing processed food consumption and an increasingly thriving beverage industry are boosting the market further. Furthermore, dextrose finds key applications in the fields of pharmaceuticals and sports nutrition in which it is used in intravenous solutions and energy supplements, respectively. Growth in developing areas continues to spur industrial applications, while technological advances in production improve supply chain efficiency and the quality of product.

In September 2022, Cargill (US) opened a corn wet mill in Pandaan to support the surge in demand from its customers within the entire Asian and Indonesian markets for starches, sweeteners, and feed. This new facility, slotted under a price tag of USD 100 million, further aims to grow the country's food and beverage industry while helping pump up local economies. The facility can support the supply chain into more than 40 countries in Asia and Africa including Japan, the Philippines, India, South Africa, Australia, Vietnam, and Egypt.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Health-conscious consumers reducing sugar content in their diets

The market for dextrose is driven by the increasing demand from consumers for low-sugar and healthy food. Health-related concerns such as obesity and diabetes have consumers reaching out more and more to limit sugar intake. A report by FMCG Gurus (2021) stated that 40% of all global consumers actively limit sugary foods, while 66% cut down on sugar to improve immune health. Innovations in dextrose-based syrups have made the reduction of sugar content possible in confectionery through Ingredion's Versasweet, and in dairy and bakery products as well, according to the consumer demand for low-sugar variations that are not compromised on taste or texture. This is a huge windfall to the dextrose market.

Restraint: Growth in demand for gums as alternative to dextrose

Growing interest in natural gums, such as guar gum, acacia gum, and xanthan gum, has been at the expense of the dextrose market, as they are perceived to have superior thickening, stabilizing, and emulsifying properties compared to starch-derived products. Guar gum is used with a thickening property nearly 8 times that of cornstarch. This preference toward gums comes in the food and beverage industries due to consumer demand for natural and non-GMO ingredients that are biodegradable. This dependency on corn-based raw materials reduces the levels of starch derivatives such as dextrose, hence hindering the market growth. Other than this, the price of gum also varies as it is linked to the price of crude oil, and the demand for dextrose is affected due to this factor.

Opportunity: Potential alternative sources of dextrose

Opportunities in the dextrose market are impelled by the need to diversify starch sources due to the impact of ethanol policies on corn and wheat supplies. Too much of the crop is wasted in countries where cassava, rice, yam, and other tubers are abundant in regions such as South America, Asia, and Africa and remain untapped. For example, cassava glucose syrup not only milled the economy at the native level but also improves dextrose production. The substitution focus on starch sources is likely to ensure stable supplies and build up rapidly to meet rising demand in food, beverage, and industrial applications.

Challenge: Alternatives uses of corn in ethanol industry

The competition for corn presents a big challenge in the dextrose market as it represents the primary raw material. Dextrose manufacturers are under supply pressure and face rising costs because the larger portion of corn production is steered toward the ethanol and livestock-feed industries. In 2019, 13.66 billion bushels of corn were produced. Out of that, 5.38 billion bushels were used for ethanol production. In addition, corn supply forecasts are lowered, thereby consolidating further the corn supply for dextrose; great demands for corn in substitute industries mean that the quantity will not be there for dextrose, thereby limiting its market growth.

DEXTROSE MARKET ECOSYSTEM

Key players within this market consist of reputable and financially robust dextrose manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks. Prominent dextrose manufacturers are Cargill Incorporated (US), ADM (US), Ingredion (US), Agrana (Austria), Tate & Lyle (UK), Roquette Frères (France), Avebe Group (Netherlands), Tereos (France), Gulshan Polyols Ltd (India), Belgosuc Nv (Belgium), Fooding Group Limited (China), Foodchem International Corporation (China), Grain Processing Corporation (Us), Uniglad, Ingredients UK Ltd (UK), and Now Foods (US).

Food and Beverage segment by application of dextrose market is estimated to dominate market share during the forecast period.

The food and beverage segment accounts for the highest dextrose market share, owing to its importance as a versatile sweetener and source of energy. Dextrose finds massive usage in a wide array of products—from soft drinks to baked goods, candies, and dairy products—because it enhances flavour, texture, and improves shelf life. On the other hand, rising demand for processed and convenience foods and an increasing consumer preference towards low-calorie sweeteners further fuel its consumption. Moreover, the easy digestibility of dextrose has made it quite popular among the ingredients used in sports drinks and energy bars.

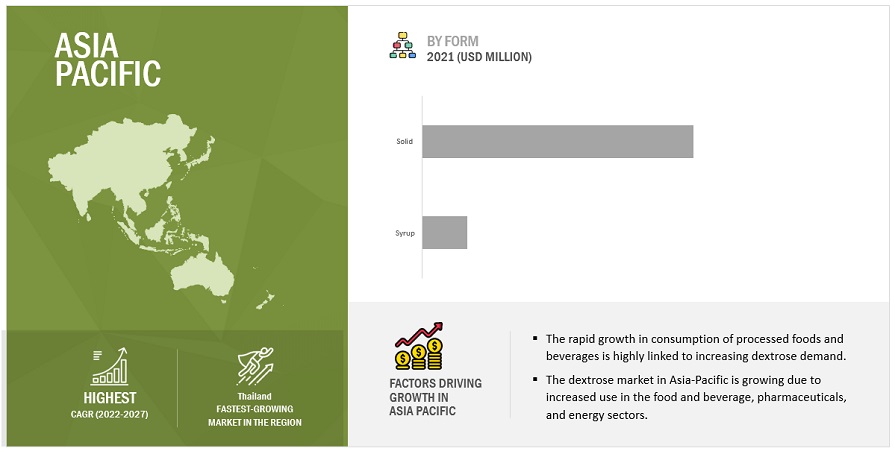

In the form segment, solid dextrose is estimated to dominate market share during the forecast period.

The solid segment accounts for the largest share of the dextrose market, since it has a large number of uses in many industries, particularly in food and beverages, pharmaceuticals, and confectionery. In comparison with liquid forms, solid dextrose, either in powder or granule form, offers more stability, extended shelf life, and better handling properties. It is applied in a broad sense as a sweetener, bulking agent, and energy source in baked goods, snacks, and supplements. The versatility and ease associated with solid dextrose bestow on it the choice in multiple applications, driving market domination.

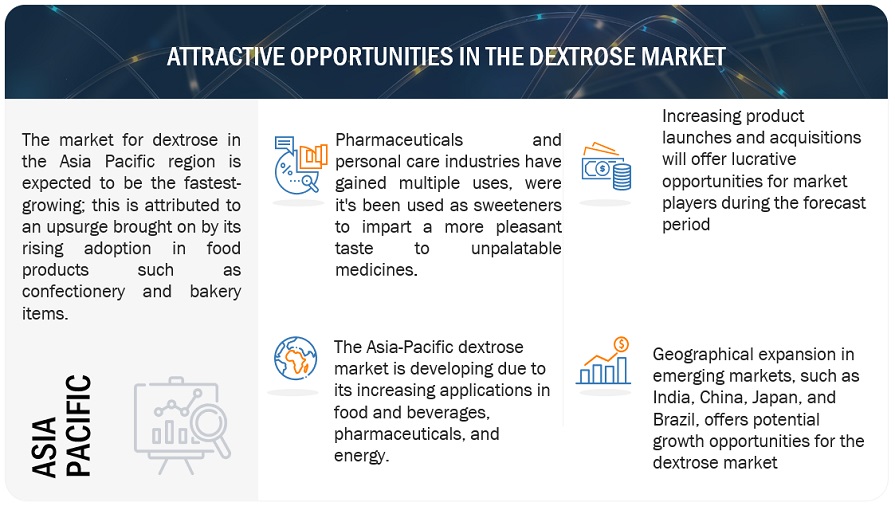

The dextrose market, in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period.

Several key factors keep the CAGR of the dextrose market in the Asia-Pacific region very high. Rapid urbanization, population growth, and change in eating habits toward processed foods and beverages in countries like China and India raise the demand for dextrose as one of its main ingredients. The growing pharmaceutical and healthcare industries in the region also contribute to this since dextrose finds wide applications in medicinal uses such as IV solutions and oral rehydration therapies. Additionally, increase in disposable income and rising health awareness created demand for energy supplements and sports nutrition products, thereby boosting the dextrose market growth in Asia-Pacific.

Key Market Players

The key players in the dextrose market include Cargill Incorporated (US), ADM (US), Ingredion (US), Agrana (Austria), Tate & Lyle (UK), Roquette Frères (France), Avebe Group (Netherlands), Tereos (France), Gulshan Polyols Ltd (India) and Belgosuc Nv (Belgium). These market participants are emphasizing the expansion of their footprint via Product launch and acquisitions. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, Application, Form, Functionality and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies covered |

|

Target Audience

- Dextrose traders, retailers, and distributors.

- Dextrose manufacturers & suppliers.

- Related government authorities, commercial research & development (R&D) institutions.

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions.

- Government and research organizations.

- Venture capitalists and investors.

- Technology providers to Dextrose companies.

- Associations and industry bodies.

Dextrose Market:

-

By Type

- Monohydrate

- Anhydrous

-

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care Products

- Paper & Pulp Products

- Agricultural Products

- Other Applications

-

By Form

- Syrup

- Solid

-

By Functionality

- Sweetener And Source of Energy

- Preservative

- Anti-Caking Agent

- Humectant

- Filler/Binder

- Others

-

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In April 2022, Cargill (US) built its “Global Animal Nutrition Innovation Center” for nutrient research and development in support of the agriculture and food industry customer base. This center can host more than 2,000 visitors yearly. Also, new viewing corridors would offer an opportunity for the visitors to easily view the animal R&D facilities. This move seems to bring Cargill closer to its customers.

- In May 2022, Tate & Lyle (UK) launched the Tate & Lyle Nutrition Center, a digital hub focused on ingredient science to tackle public health issues. This advanced the company's research program and helped food and beverage companies spread across the UK, US, Brazil, and Singapore. Its establishment enhanced the growth of the dextrose market by fostering innovation and meeting nutritional needs in a wide array of applications.

- In April 2021, Avebe Group (Netherlands) collaborated with hybrid potato breeding firm Solynta (Netherlands) to develop new potato varieties for sustainable starch more rapidly than by conventional breeding. This paved the way to more production and possibly higher revenues. Hence, with heightened supplies of high-quality starch coming from these improved varieties, the growth of the dextrose market was now supported by a more stable and reliable source of raw material inputs.

Frequently Asked Questions (FAQ):

Which are the major companies in the dextrose market? What are their major strategies to strengthen their market presence?

The dextrose manufacturers in the market are Cargill Incorporated (US), ADM (US), Ingredion (US), Agrana (Austria), Tate & Lyle (UK), Roquette Frères (France), Avebe Group (Netherlands), Tereos (France), Gulshan Polyols Ltd (India), Belgosuc Nv (Belgium), Fooding Group Limited (China), Foodchem International Corporation (China), Grain Processing Corporation (Us), Uniglad, Ingredients UK Ltd (UK), and Now Foods (US). These players are focusing on increasing their presence through product launches and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are the drivers and opportunities for the dextrose market?

The growth drivers for dextrose demand include rising consumption in processed foods, beverages, and pharmaceuticals. Opportunities in this area include the growing use in sports nutrition, expanding into emerging markets, and advancement of production technologies, which could put on board the needed efficiency and product quality.

Which region is expected to hold the highest market share?

The Asia-Pacific region held the highest market share of dextrose due to rapid industrialization, rising food and beverage consumption, and growing pharmaceutical and nutraceutical sectors. In addition, regional demand and supply are driven by economic growth and advanced production technology.

Which application is expected to hold the highest market share?

The food and beverage application holds the highest market share in the dextrose market due to its widespread use as a sweetener, flavour enhancer, and energy source in various products, including beverages, baked goods, and processed foods.

What is the expected total CAGR for the Dextrose market from 2022 to 2027?

The CAGR is expected to be 7.8% from 2022 to 2027. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASING DIABETIC POPULATION- Rising demand for convenience food

-

5.3 MARKET DYNAMICSDRIVERS- Increasing usage of dextrose in functional beverages and health drinks- Health-conscious consumers reducing sugar content in their dietsRESTRAINTS- Growth in demand for gums as alternative to dextroseOPPORTUNITIES- Potential alternative sources of dextroseCHALLENGES- Fluctuating costs of raw materials- Alternative uses of corn in ethanol industry

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTSOURCING OF RAW MATERIALSPRODUCTION AND PROCESSINGDISTRIBUTION, MARKETING, AND SALES

-

6.3 TECHNOLOGY ANALYSISPHYSICAL METHODSCHEMICAL METHODSENZYMATIC METHODS

- 6.4 PRICING ANALYSIS

-

6.5 PATENT ANALYSIS

-

6.6 MARKET MAPDEMAND SIDESUPPLY SIDE

-

6.7 TRADE SCENARIOCORN STARCHWHEAT STARCH

-

6.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 6.9 KEY CONFERENCES & EVENTS IN 2022-2023

-

6.10 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORKNORTH AMERICAEUROPEASIA PACIFICSOUTH AMERICA

-

6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.12 CASE STUDY ANALYSISION EXCHANGE (I) LTD: INDION 225H & INDION 860 S FOR STARCH INDUSTRYTATE & LYLE: SWEETENERS HELPED IN LOW-SUGAR JELLY CONFECTIONERY PRODUCTION

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 RECESSION IMPACT ON DEXTROSE MARKETMACRO INDICATORS OF RECESSION- Inflation- GDP Growth

- 7.1 INTRODUCTION

-

7.2 MONOHYDRATERISING DEMAND FOR PACKAGED AND CONVENIENCE FOODS TO FUEL MARKET GROWTH- Uses of dextrose monohydrate- Application of dextrose monohydrate in food industry- Industrial applications of dextrose monohydrate

-

7.3 ANHYDROUSLONG SHELF-LIFE AND SWEET TASTE TO HELP SURGE DEMAND FOR DEXTROSE ANHYDROUSAPPLICATIONS OF ANHYDROUS DEXTROSE- Food industry- Beverage industry- Pharmaceutical industry- Health and personal care industries

- 8.1 INTRODUCTION

-

8.2 FOOD & BEVERAGESWIDE RANGE OF APPLICATIONS AND RISING DEMAND FOR PROCESSED AND PACKAGED FOODS TO SUPPORT MARKET GROWTH- Confectionery products- Bakery products- Dairy products- Beverages- Soups, sauces, and dressings- Others

-

8.3 PHARMACEUTICALSAWARENESS AMONG HEALTH-CONSCIOUS CONSUMERS ABOUT DISEASES AND DISORDERS TO FUEL DEMAND

-

8.4 PERSONAL CARE PRODUCTSINCREASING USAGE OF DEXTROSE IN SKINCARE, HAIR CARE, MAKEUP, AND BATH PRODUCTS TO DRIVE DEMAND

-

8.5 PAPER & PULP PRODUCTSIMPORTANCE AS INGREDIENT IN PAPER AND PULP MANUFACTURING TO CONTRIBUTE TO MARKET GROWTH

-

8.6 AGRICULTURAL PRODUCTSUSAGE AS RAW MATERIAL AND BUFFER IN VETERINARY PRODUCTS AND NUTRITIONAL SUPPLEMENT IN FEED TO DRIVE DEMAND- Cut flower preservation- Nutrition supplements

-

8.7 OTHER APPLICATIONSINCREASED INDUSTRIAL ACTIVITIES IN NORTH AMERICA, EUROPE, AND ASIA PACIFIC TO FUEL DEXTROSE MARKET

- 9.1 INTRODUCTION

- 9.2 SYRUP

- 9.3 SOLID

- 10.1 INTRODUCTION

- 10.2 SWEETENER AND SOURCE OF ENERGY

- 10.3 PRESERVATIVE

- 10.4 ANTI-CAKING AGENT

- 10.5 HUMECTANT

- 10.6 FILLER/BINDER

- 10.7 OTHERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Importance of corn as raw material for dextrose to fuel marketCANADA- Government agencies to incorporate dextrose in various industrial applicationsMEXICO- Growing soft drinks industry to drive demand for dextrose

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Rising consumption of convenience food to contribute to demandUK- Growth of feed industry to contribute to market growthFRANCE- High consumption of dairy products to fuel demand for dextroseSPAIN- Developed food processing industry to propel growth in SpainRUSSIA- Widespread bakery & confectionery industry in Russia to drive demandREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Wide range of applications in food & beverages to be primary driverINDIA- India to be global hub for dextrose productionINDONESIA- Increased demand for processed foods to drive demand for dextroseVIETNAM- High consumption of bakery products to drive demand for dextrose in VietnamTHAILAND- Large-scale production of cassava starch to contribute to market growthREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Rising demand for beauty and personal care products to fuel market growth.REST OF SOUTH AMERICA

-

11.6 REST OF THE WORLD (ROW)REST OF THE WORLD: RECESSION IMPACT ANALYSISSOUTH AFRICA- Increased packaged food growth and processed food industry to drive demandOTHERS IN ROW- Rising consumption of convenience foods to drive usage of dextrose

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2021

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 DEXTROSE MARKET: EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 KEY COMPANIESCARGILL INCORPORATED- Business overview- Products offered- Recent developments- MNM viewADM- Business overview- Products offered- Recent developments- MNM viewINGREDION- Business overview- Products offered- Recent developments- MNM viewAGRANA- Business overview- Products offered- Recent developments- MNM viewTATE & LYLE- Business overview- Products offered- Recent developments- MNM viewROQUETTE FRÈRES- Business overview- Products offered- Recent developments- MNM viewAVEBE GROUP- Business overview- Products offered- Recent developments- MNM viewTEREOS- Business overview- Products offered- Recent developments- MNM viewGULSHAN POLYOLS LTD- Business overview- Products offered- Recent developments- MNM viewBELGOSUC NV- Business overview- Products offered- Recent developments- MNM viewFOODING GROUP LIMITED- Business overview- Products offered- Recent developments- MNM viewFOODCHEM INTERNATIONAL CORPORATION- Business overview- Products offered- Recent developments- MNM viewGRAIN PROCESSING CORPORATION- Business overview- Products offered- Recent developments- MNM viewUNIGLAD INGREDIENTS UK LTD- Business overview- Products offered- Recent developments- MNM viewGUJARAT AMBUJA EXPORTS LIMITED- Business overview- Products offered- Recent developments- MNM view

-

13.3 OTHER PLAYERS (SMES/STARTUPS)SPECTRUM CHEMICAL MFG. CORP.- Business overview- Products offered- Recent developments- MNM viewNOW FOODS- Business overview- Products offered- Recent developments- MNM viewTIRUPATI STARCH & CHEMICALS LTD.- Business overview- Products offered- Recent developments- MNM viewATLANTIC CHEMICALS TRADING GMBH- Business overview- Products offered- Recent developments- MNM viewPENTA MANUFACTURING COMPANY- Business overview- Products offered- Recent developments- MNM viewRAM SHREE CHEMICALSBANGYE INC.BONROY INTERNATIONAL LTDSILVERLINE CHEMICALSQINGYUAN BIOLOGICAL TECHNOLOGY CO., LTD

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 MODIFIED STARCH MARKETMARKET DEFINITIONMARKET OVERVIEWMODIFIED STARCH MARKET, BY RAW MATERIAL- IntroductionMODIFIED STARCH MARKET, BY REGION- Introduction

-

14.4 STARCH DERIVATIVES MARKETMARKET DEFINITIONMARKET OVERVIEWSTARCH DERIVATIVES MARKET, BY TYPE- IntroductionSTARCH DERIVATIVES MARKET, BY REGION- Introduction

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

- TABLE 2 DEXTROSE MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 3 KEY PATENTS PERTAINING TO DEXTROSE MARKET, 2021

- TABLE 4 DEXTROSE MARKET: ECOSYSTEM

- TABLE 5 TOP 10 EXPORTERS AND IMPORTERS OF CORN STARCH, 2021 (KT)

- TABLE 6 TOP 10 EXPORTERS AND IMPORTERS OF WHEAT STARCH, 2021 (KT)

- TABLE 7 DEXTROSE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 DEXTROSE MARKET: CONFERENCES & EVENTS, 2022-2023

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FORM (%)

- TABLE 14 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 15 DEXTROSE MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 16 DEXTROSE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 17 MONOHYDRATE: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 18 MONOHYDRATE: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 19 ANHYDROUS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 20 ANHYDROUS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 22 DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 23 DEXTROSE MARKET, BY APPLICATION, 2017–2021 (KT)

- TABLE 24 DEXTROSE MARKET, BY APPLICATION, 2022–2027 (KT)

- TABLE 25 FOOD & BEVERAGES: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 26 FOOD & BEVERAGES: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 FOOD & BEVERAGES: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 28 FOOD & BEVERAGES: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 29 FOOD & BEVERAGES: DEXTROSE MARKET, BY SUB-APPLICATION, 2017–2021 (USD MILLION)

- TABLE 30 FOOD & BEVERAGES: DEXTROSE MARKET, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

- TABLE 31 FOOD & BEVERAGES: DEXTROSE MARKET, BY SUB-APPLICATION, 2017–2021 (KT)

- TABLE 32 FOOD & BEVERAGES: DEXTROSE MARKET, BY SUB-APPLICATION, 2022–2027 (KT)

- TABLE 33 CONFECTIONERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 34 CONFECTIONERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 CONFECTIONERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 36 CONFECTIONERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 37 BAKERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 38 BAKERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 BAKERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 40 BAKERY PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 41 DAIRY PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 42 DAIRY PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 DAIRY PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 44 DAIRY PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 45 BEVERAGES: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 46 BEVERAGES: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 BEVERAGES: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 48 BEVERAGES: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 49 SOUPS, SAUCES, AND DRESSINGS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 50 SOUPS, SAUCES, AND DRESSINGS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 SOUPS, SAUCES, AND DRESSINGS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 52 SOUPS, SAUCES, AND DRESSINGS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 53 OTHER FOOD & BEVERAGE APPLICATIONS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 54 OTHER FOOD & BEVERAGE APPLICATIONS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 OTHER FOOD & BEVERAGE APPLICATIONS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 56 OTHER FOOD & BEVERAGE APPLICATIONS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 57 PHARMACEUTICALS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 58 PHARMACEUTICALS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 PHARMACEUTICALS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 60 PHARMACEUTICALS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 61 PERSONAL CARE PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 62 PERSONAL CARE PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 PERSONAL CARE PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 64 PERSONAL CARE PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 65 PAPER & PULP PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 66 PAPER & PULP PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 PAPER & PULP PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 68 PAPER & PULP PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 69 AGRICULTURAL PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 70 AGRICULTURAL PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 AGRICULTURAL PRODUCTS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 72 AGRICULTURAL PRODUCTS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 73 AGRICULTURAL PRODUCTS: DEXTROSE MARKET, BY SUB-APPLICATION, 2017–2021 (USD MILLION)

- TABLE 74 AGRICULTURAL PRODUCTS: DEXTROSE MARKET, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

- TABLE 75 OTHER APPLICATIONS: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 76 OTHER APPLICATIONS: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 OTHER APPLICATIONS: DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 78 OTHER APPLICATIONS: DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 79 DEXTROSE MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 80 DEXTROSE MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 81 SYRUP: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 82 SYRUP: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 SOLID: DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 84 SOLID: DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 DEXTROSE MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 86 DEXTROSE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 DEXTROSE MARKET, BY REGION, 2017–2021 (KT)

- TABLE 88 DEXTROSE MARKET, BY REGION, 2022–2027 (KT)

- TABLE 89 NORTH AMERICA: DEXTROSE MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: DEXTROSE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: DEXTROSE MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: DEXTROSE MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: DEXTROSE MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: DEXTROSE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (KT)

- TABLE 98 NORTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (KT)

- TABLE 99 NORTH AMERICA: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 111 US: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 112 US: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 113 CANADA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 114 CANADA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 115 MEXICO: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 116 MEXICO: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 117 EUROPE: DEXTROSE MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 118 EUROPE: DEXTROSE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 119 EUROPE: DEXTROSE MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 120 EUROPE: DEXTROSE MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 121 EUROPE: DEXTROSE MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 122 EUROPE: DEXTROSE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 123 EUROPE: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 124 EUROPE: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 125 EUROPE: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (KT)

- TABLE 126 EUROPE: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (KT)

- TABLE 127 EUROPE: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 128 EUROPE: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 129 EUROPE: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 130 EUROPE: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 131 EUROPE: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 132 EUROPE: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 133 EUROPE: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 134 EUROPE: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 135 EUROPE: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 136 EUROPE: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 137 EUROPE: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 138 EUROPE: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 139 GERMANY: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 140 GERMANY: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 141 UK: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 142 UK: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 143 FRANCE: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 144 FRANCE: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 145 SPAIN: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 146 SPAIN: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 147 RUSSIA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 148 RUSSIA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 149 REST OF EUROPE: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 150 REST OF EUROPE: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DEXTROSE MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DEXTROSE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DEXTROSE MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DEXTROSE MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: DEXTROSE MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: DEXTROSE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (KT)

- TABLE 160 ASIA PACIFIC: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (KT)

- TABLE 161 ASIA PACIFIC: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 171 ASIA PACIFIC: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 172 ASIA PACIFIC: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 173 CHINA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 174 CHINA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 175 INDIA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 176 INDIA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 177 INDONESIA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 178 INDONESIA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 179 VIETNAM: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 180 VIETNAM: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 181 THAILAND: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 182 THAILAND: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 185 SOUTH AMERICA: DEXTROSE MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 186 SOUTH AMERICA: DEXTROSE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 187 SOUTH AMERICA: DEXTROSE MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 188 SOUTH AMERICA: DEXTROSE MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 189 SOUTH AMERICA: DEXTROSE MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 190 SOUTH AMERICA: DEXTROSE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 191 SOUTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 192 SOUTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 193 SOUTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (KT)

- TABLE 194 SOUTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (KT)

- TABLE 195 SOUTH AMERICA: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 196 SOUTH AMERICA: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 197 SOUTH AMERICA: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 198 SOUTH AMERICA: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 199 SOUTH AMERICA: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 200 SOUTH AMERICA: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 201 SOUTH AMERICA: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 202 SOUTH AMERICA: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 203 SOUTH AMERICA: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 204 SOUTH AMERICA: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 205 SOUTH AMERICA: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 206 SOUTH AMERICA: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 207 BRAZIL: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 208 BRAZIL: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 209 REST OF SOUTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 210 REST OF SOUTH AMERICA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 211 ROW: DEXTROSE MARKET, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

- TABLE 212 ROW: DEXTROSE MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 213 ROW: DEXTROSE MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 214 ROW: DEXTROSE MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 215 ROW: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 216 ROW: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 217 ROW: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (KT)

- TABLE 218 ROW: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (KT)

- TABLE 219 ROW: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

- TABLE 220 ROW: DEXTROSE MARKET FOR FOOD & BEVERAGES, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 221 ROW: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

- TABLE 222 ROW: DEXTROSE MARKET FOR PHARMACEUTICALS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 223 ROW: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

- TABLE 224 ROW: DEXTROSE MARKET FOR PERSONAL CARE PRODUCTS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 225 ROW: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

- TABLE 226 ROW: DEXTROSE MARKET FOR PAPER & PULP PRODUCTS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 227 ROW: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

- TABLE 228 ROW: DEXTROSE MARKET FOR AGRICULTURAL PRODUCTS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 229 ROW: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

- TABLE 230 ROW: DEXTROSE MARKET FOR OTHER APPLICATIONS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

- TABLE 231 SOUTH AFRICA: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 232 SOUTH AFRICA: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 233 OTHERS IN ROW: DEXTROSE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 234 OTHERS IN ROW: DEXTROSE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 235 DEXTROSE MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 236 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 237 COMPANY FOOTPRINT, BY FORM

- TABLE 238 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 239 COMPANY FOOTPRINT, BY REGION

- TABLE 240 OVERALL COMPANY FOOTPRINT

- TABLE 241 DEXTROSE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 242 DEXTROSE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 243 DEXTROSE MARKET: DEALS, 2021

- TABLE 244 DEXTROSE MARKET: OTHERS, 2018-2022

- TABLE 245 CARGILL INCORPORATED: BUSINESS OVERVIEW

- TABLE 246 CARGILL INCORPORATED: PRODUCTS OFFERED

- TABLE 247 CARGILL INCORPORATED: OTHERS

- TABLE 248 ADM: BUSINESS OVERVIEW

- TABLE 249 ADM: PRODUCTS OFFERED

- TABLE 250 INGREDION: BUSINESS OVERVIEW

- TABLE 251 INGREDION: PRODUCTS OFFERED

- TABLE 252 AGRANA: BUSINESS OVERVIEW

- TABLE 253 AGRANA: PRODUCTS OFFERED

- TABLE 254 AGRANA: OTHERS

- TABLE 255 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 256 TATE & LYLE: PRODUCTS OFFERED

- TABLE 257 TATE & LYLE: OTHERS

- TABLE 258 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 259 ROQUETTE FRÈRES: PRODUCTS OFFERED

- TABLE 260 AVEBE GROUP: BUSINESS OVERVIEW

- TABLE 261 AVEBE GROUP: PRODUCTS OFFERED

- TABLE 262 AVEBE GROUP: DEALS

- TABLE 263 TEREOS: BUSINESS OVERVIEW

- TABLE 264 TEREOS: PRODUCTS OFFERED

- TABLE 265 TEREOS: DEALS

- TABLE 266 GULSHAN POLYOLS LTD: BUSINESS OVERVIEW

- TABLE 267 GULSHAN POLYOLS LTD: PRODUCTS OFFERED

- TABLE 268 BELGOSUC NV: BUSINESS OVERVIEW

- TABLE 269 BELGOSUC NV: PRODUCTS OFFERED

- TABLE 270 FOODING GROUP LIMITED: BUSINESS OVERVIEW

- TABLE 271 FOODING GROUP LIMITED: PRODUCTS OFFERED

- TABLE 272 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 273 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS OFFERED

- TABLE 274 GRAIN PROCESSING CORPORATION: BUSINESS OVERVIEW

- TABLE 275 GRAIN PROCESSING CORPORATION: PRODUCTS OFFERED

- TABLE 276 UNIGLAD INGREDIENTS UK LTD: BUSINESS OVERVIEW

- TABLE 277 UNIGLAD INGREDIENTS UK LTD: PRODUCTS OFFERED

- TABLE 278 GUJARAT AMBUJA EXPORTS LIMITED: BUSINESS OVERVIEW

- TABLE 279 GUJARAT AMBUJA EXPORTS LIMITED: PRODUCTS OFFERED

- TABLE 280 SPECTRUM CHEMICAL MFG. CORP.: BUSINESS OVERVIEW

- TABLE 281 SPECTRUM CHEMICAL MFG. CORP.: PRODUCTS OFFERED

- TABLE 282 NOW FOODS: BUSINESS OVERVIEW

- TABLE 283 NOW FOODS: PRODUCTS OFFERED

- TABLE 284 TIRUPATI STARCH & CHEMICALS LTD.: BUSINESS OVERVIEW

- TABLE 285 TIRUPATI STARCH & CHEMICALS LTD.: PRODUCTS OFFERED

- TABLE 286 ATLANTIC CHEMICALS TRADING GMBH: BUSINESS OVERVIEW

- TABLE 287 ATLANTIC CHEMICALS TRADING GMBH: PRODUCTS OFFERED

- TABLE 288 PENTA MANUFACTURING COMPANY: BUSINESS OVERVIEW

- TABLE 289 PENTA MANUFACTURING COMPANY: PRODUCTS OFFERED

- TABLE 290 MODIFIED STARCH MARKET, BY RAW MATERIAL, 2018–2021 (USD MILLION)

- TABLE 291 MODIFIED STARCH MARKET, BY RAW MATERIAL, 2022–2027 (USD MILLION)

- TABLE 292 MODIFIED STARCH MARKET, BY RAW MATERIAL, 2018–2021 (KT)

- TABLE 293 MODIFIED STARCH MARKET, BY RAW MATERIAL, 2022–2027 (KT)

- TABLE 294 MODIFIED STARCH MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 295 MODIFIED STARCH MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 296 MODIFIED STARCH MARKET, BY REGION, 2018–2021 (KT)

- TABLE 297 MODIFIED STARCH MARKET, BY REGION, 2022–2027 (KT)

- TABLE 298 STARCH DERIVATIVES MARKET, BY TYPE, 2017–2019 (USD MILLION)

- TABLE 299 STARCH DERIVATIVES MARKET, BY TYPE, 2020–2025 (USD MILLION)

- TABLE 300 STARCH DERIVATIVES MARKET, BY REGION, 2017–2019 (USD MILLION)

- TABLE 301 STARCH DERIVATIVES MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 302 STARCH DERIVATIVES MARKET, BY REGION, 2018–2025 (KT)

- FIGURE 1 DEXTROSE MARKET SEGMENTATION

- FIGURE 2 DEXTROSE MARKET, BY REGION

- FIGURE 3 DEXTROSE: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION: SUPPLY SIDE

- FIGURE 8 DATA TRIANGULATION: DEMAND SIDE

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 DEXTROSE MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 DEXTROSE MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 DEXTROSE MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 DEXTROSE MARKET, BY REGION, 2021

- FIGURE 14 INCREASED CONSUMPTION OF DEXTROSE IN FOOD & BEVERAGES SEGMENT TO DRIVE MARKET GROWTH

- FIGURE 15 INDONESIA ACCOUNTED FOR LARGEST SHARE WHILE FOOD & BEVERAGES DOMINATED IN TERMS OF APPLICATION IN 2021

- FIGURE 16 THAILAND TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC DOMINATED DEXTROSE MARKET ACROSS ALL APPLICATIONS IN 2022

- FIGURE 18 SOLID SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2027

- FIGURE 19 FOOD & BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 20 ANHYDROUS SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2027

- FIGURE 21 DIABETES IN 2021 (WORLDWIDE)

- FIGURE 22 US: TRENDS IN PREVALENCE OF DIAGNOSED, UNDIAGNOSED, AND TOTAL DIABETES AMONG ADULTS AGED 18 YEARS OR OLDER, 2001–2020

- FIGURE 23 INCREASING SALES FOR CONVENIENCE FOODS, 2020 (CHANGE IN SALES)

- FIGURE 24 US: FAST FOOD INDUSTRY REVENUE, 2011–2021

- FIGURE 25 DEXTROSE MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 TOTAL CORN PRODUCTION AND PORTION USED FOR FUEL ETHANOL (BUSHELS)

- FIGURE 27 DEXTROSE MARKET: VALUE CHAIN

- FIGURE 28 DEXTROSE MARKET: TECHNOLOGY ANALYSIS

- FIGURE 29 PRICING ANALYSIS, 2017–2022 (MILLION/KT)

- FIGURE 30 PRICING TREND FOR APPLICATIONS OF DEXTROSE, 2017–2022 (MILLION/KT)

- FIGURE 31 PATENTS GRANTED FOR DEXTROSE MARKET, 2011-2021

- FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DEXTROSE MARKET, 2011-2021

- FIGURE 33 DEXTROSE MARKET MAP

- FIGURE 34 CORN STARCH: IMPORT VALUE, BY KEY COUNTRY, 2021 (KT)

- FIGURE 35 CORN STARCH: EXPORT VALUE, BY KEY COUNTRY, 2021 (KT)

- FIGURE 36 WHEAT STARCH: IMPORT VALUE, BY KEY COUNTRY, 2021 (KT)

- FIGURE 37 WHEAT STARCH: EXPORT VALUE, BY KEY COUNTRY, 2021 (KT)

- FIGURE 38 REVENUE SHIFT FOR DEXTROSE MARKET

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FORM

- FIGURE 40 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 41 INDICATORS OF RECESSION

- FIGURE 42 WORLD INFLATION RATE, 2011-2021

- FIGURE 43 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 44 GLOBAL DEXTROSE MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 45 RECESSION INDICATORS AND THEIR IMPACT ON DEXTROSE MARKET

- FIGURE 46 DEXTROSE MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 47 DEXTROSE MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 48 US HELD LARGEST SHARE IN DEXTROSE MARKET, 2021

- FIGURE 49 NORTH AMERICAN DEXTROSE MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 50 EUROPEAN DEXTROSE MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 51 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 52 SOUTH AMERICAN DEXTROSE MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 53 REST OF THE WORLD DEXTROSE MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 54 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

- FIGURE 55 DEXTROSE MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 56 DEXTROSE MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- FIGURE 57 CARGILL INCORPORATED: COMPANY SNAPSHOT

- FIGURE 58 ADM: COMPANY SNAPSHOT

- FIGURE 59 INGREDION: COMPANY SNAPSHOT

- FIGURE 60 AGRANA: COMPANY SNAPSHOT

- FIGURE 61 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 62 AVEBE GROUP: COMPANY SNAPSHOT

- FIGURE 63 GULSHAN POLYOLS LTD: COMPANY SNAPSHOT

- FIGURE 64 GUJARAT AMBUJA EXPORTS LIMITED: COMPANY SNAPSHOT

- FIGURE 65 TIRUPATI STARCH & CHEMICALS LTD.: COMPANY SNAPSHOT

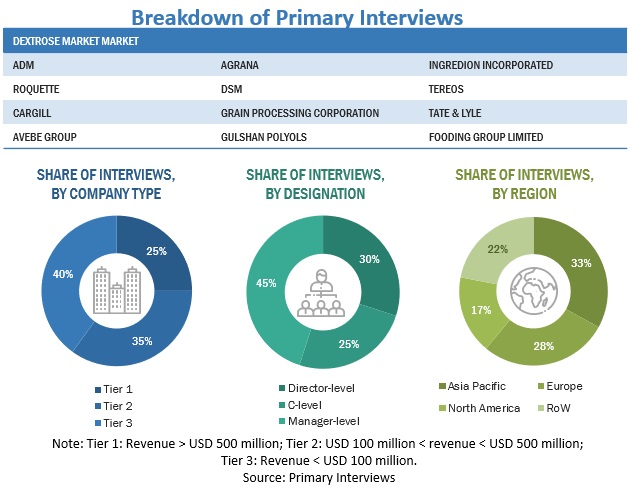

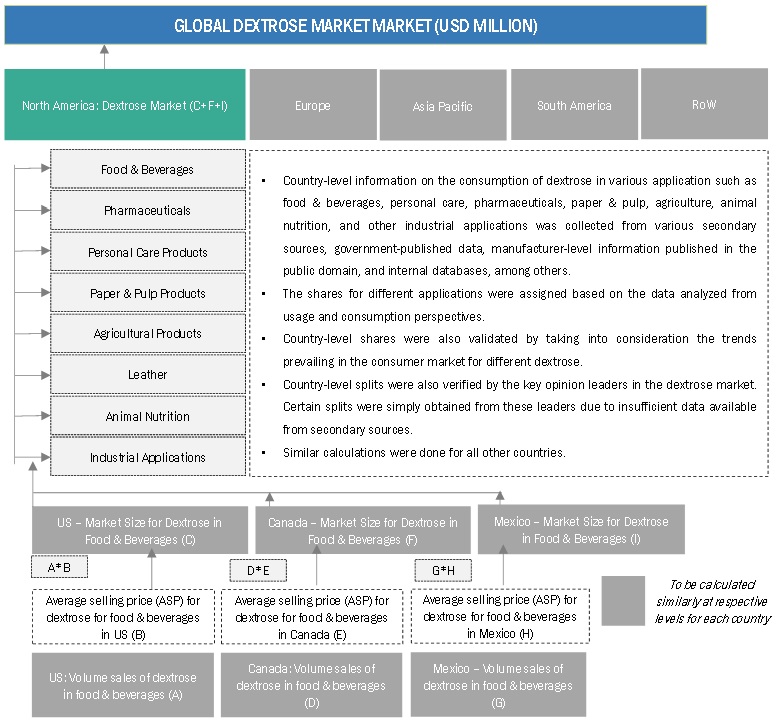

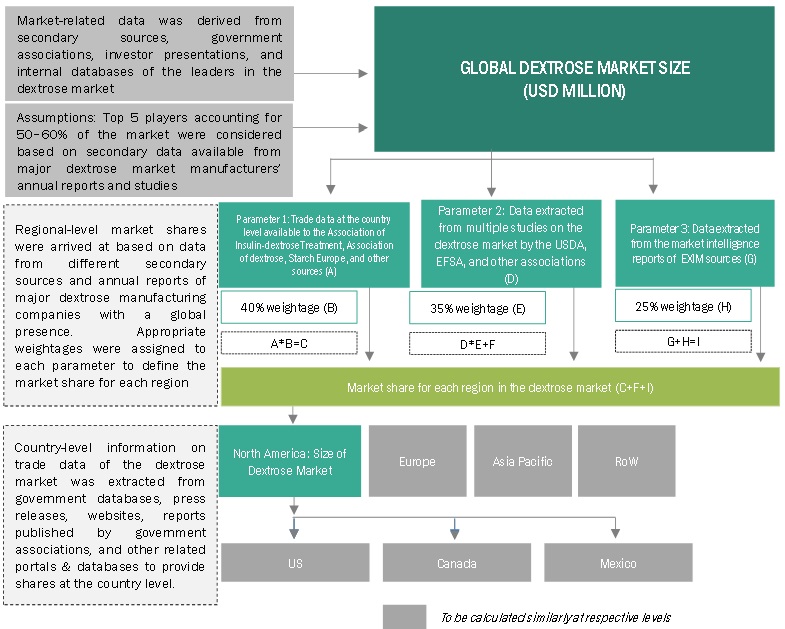

The study involved four major steps in estimating the size of the Dextrose market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers, technology suppliers, and dextrose manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include dextrose manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end consumers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the dextrose market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The dextrose value chain and market size in terms of value and volume have been determined through primary and secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macro-economic and micro-economic factors affecting the growth of the dextrose market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Global Dextrose Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Dextrose Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size from the market estimation process explained above, the total market was split into several segments and subsegments. To complete the overall dextrose market sizing and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- Determining and projecting the size of the dextrose market based on type, form, functionality, application, and region ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

Competitive Intelligence

- Identifying and profiling the key market players in the dextrose market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the supply chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments in product innovations and technology in the dextrose market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of European market for dextrose into Poland and Ukraine.

- Further breakdown of the Rest of Asia Pacific market for dextrose into India, Vietnam, Malaysia, Indonesia, and Thailand.

- Further breakdown of the Rest of South American market for dextrose into Colombia, Paraguay, Uruguay, and Chile.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dextrose Market