Digital Map Market by Offering (Solutions and Services), Mapping Type (Outdoor Mapping, Indoor Mapping, and 3D and 4D Metaverse), Purpose (Navigation Maps, Satellite Maps, Thematic Maps), Scale, Application, Vertical and Region - Global Forecast to 2029

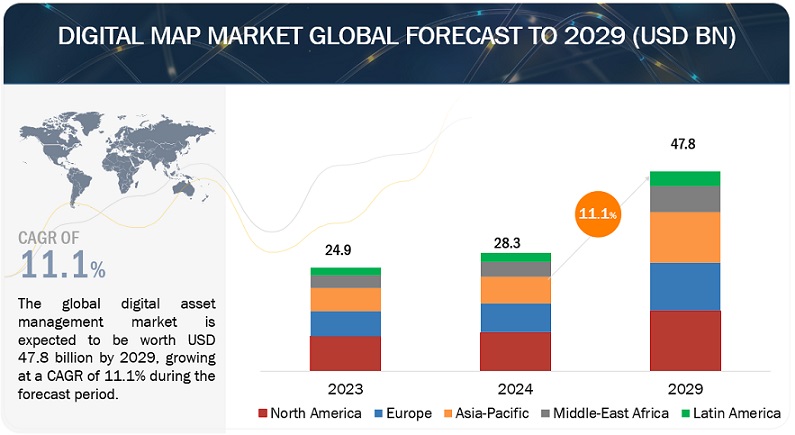

[314 Pages Report] The digital map market is expected to grow from USD 28.3 billion in 2024 to USD 47.8 billion by 2029, at a CAGR of 11.1% during the forecast period. Digital maps have revolutionized how we navigate and interact with the world. These dynamic representations of geographic data provide invaluable insights, from guiding us on our daily commutes to facilitating complex urban planning initiatives. They have become integral to countless industries, including transportation, logistics, urban development, and tourism.

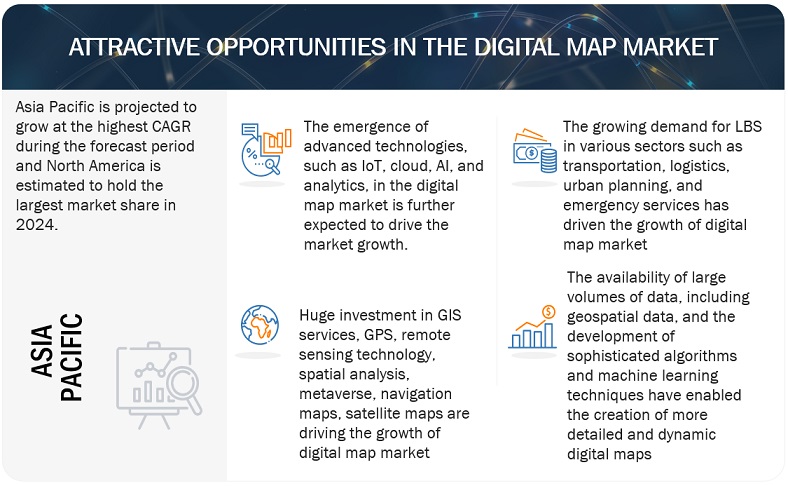

The evolution of digital maps traces back to the early days of geographic information systems (GIS) and cartography, where static paper maps were digitized to create digital counterparts. However, technological advancements have propelled digital maps to the forefront of modern navigation and spatial analysis. In recent years, integrating satellite imagery, GPS technology, and real-time data streams has vastly improved the accuracy and functionality of digital maps. These technologies have enabled turn-by-turn navigation, live traffic updates, and geolocation services on mobile devices, making them indispensable tools for personal and professional use. Also, the rise of artificial intelligence (AI) and machine learning has further enhanced the capabilities of digital maps, allowing for predictive analytics, route optimization, and even the creation of 3D maps with augmented reality overlays.

Emerging technologies like LiDAR (Light Detection and Ranging) are poised to revolutionize digital mapping by capturing highly detailed 3D representations of the environment. As well, advancements in sensor technology and data processing algorithms promise to make digital maps even more dynamic, adaptive, and responsive to user needs.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Digital Map Market

The impact of a recession on the market is primarily medium-term. During a recession, consumers tighten their belts, reducing spending on non-essential items, including digital map services; this can result in a decline in demand for premium mapping solutions. Businesses may reduce expenses, including licensing fees for advanced mapping software or services; this can affect revenues for digital map providers, particularly those reliant on corporate clients. Additionally, economic downturns can intensify competition among digital map providers as companies vie for a shrinking pool of customers; this may lead to pricing pressure and aggressive marketing tactics to maintain market share.

Digital Map Market Dynamics

Driver: Rise in smartphone and internet usage driving demand for digital maps

The rise in smartphone and internet usage globally has significantly heightened the demand for digital maps, particularly for navigation and real-time tracking. As per the GSMA (Global System for Mobile Communications) report, the number of mobile internet users is projected to reach 5.5 billion by 2030, with smartphone connections expected to rise to 92% by the same year; the necessity for accurate and accessible Digital mapping solutions becomes increasingly evident. This surge in smartphone and internet adoption fuels the need for reliable navigation tools, driving the growth and relevance of digital mapping technologies. Consequently, businesses and individuals seek comprehensive mapping solutions to facilitate efficient route planning, location-based services, and seamless navigation experiences in an increasingly connected world. One of the newest smartphone features is map software, which is pre-installed on devices. Smartphone users use mapping applications on their devices for navigation and driving assistance.

Restraint: Risk of unauthorized access and data breaches hindering the digital map market

Data privacy and security concerns hinder the digital map market. As digital maps collect vast amounts of location-based data, including personal information, the risk of unauthorized access and data breaches becomes evident. Striking a balance between location-based services and user privacy is challenging, particularly with the evolution of real-time tracking and personalized recommendations. Compliance with data protection regulations like GDPR adds complexity and costs to digital mapping services, necessitating robust data protection measures and transparent data handling processes.

Opportunity: Geospatial data analytics driving optimized resource allocation and sustainable development

Geospatial Data Analytics presents a significant opportunity in the Digital Map market, aligning with the UN 2030 Agenda for Sustainable Development and initiatives like the upcoming UN Committee of Experts session. The recent announcement of the National Geospatial Policy 2022 in India underscores the global recognition of the transformative potential of geospatial information, focusing on achieving high-resolution mapping and digital elevation models by 2030. By leveraging advanced analytics tools, businesses and governments can optimize resource allocation, drive sustainable development, and navigate complex challenges effectively. This convergence of global initiatives and policy frameworks underscores the pivotal role of geospatial data analytics in shaping a more resilient and sustainable future. The use of geospatial information has increased considerably over the last couple of years. Geospatial information-based maps and visualizations greatly assist enterprises in understanding business situations and making business decisions. It is a new language that improves communication between different teams, departments, disciplines, professional fields, organizations, and the public.

Companies like Atos use GIS platforms with LBS to offer services to businesses involved in supply chain management, data centers, infrastructure development, urban planning, risk and emergency management, navigation, and healthcare. Moreover, various technological advancements in Digital Maps have delivered information related to roadblocks, traffic updates, updated places of interest, and landmarks, making them user-friendly. Geospatial data collected from various sources is stored, processed, analyzed, and extracted for meaningful outputs, thus utilizing the geospatially analyzed information for decision-making by multiple end-users. Integrating geospatial technology with mainstream technologies, such as IT, telecommunication, and the Internet, enables harnessing the true potential of geospatial information.

Challenge: Limited infrastructure and internet access in underdeveloped countries poses challenges

According to the United Nations, 3.7 billion people currently lack access to the Internet. Limited infrastructure and internet access, affecting approximately half of the global population, present significant challenges for the Digital Map market. Particularly in regions with inadequate connectivity and infrastructure, accessing and updating Digital Maps becomes compromised. With only 19% online, the least developed countries face the most significant connectivity disparities. Network coverage, bandwidth, and reliability further exacerbate the challenge, impacting the delivery of real-time mapping data and user experience. Addressing this hurdle necessitates investment in expanding connectivity, improving network infrastructure, and promoting digital inclusion efforts. Bridging the digital divide through initiatives like broadband expansion and mobile network deployment is crucial for unlocking the full potential of Digital Mapping solutions in underserved regions.

Digital Map Market Ecosystem

Based on application, the geocoding and geopositioning segment will grow to the second-largest market share during the forecast period.

Geocoding is used to identify the respective geographic coordinates expressed from other geographic data, such as street addresses or ZIP codes. The geographic coordinates are often represented as latitudes and longitudes. The geocoding software helps organizations quickly find an associated textual location or street address from geographic coordinates. Geocoding enables firms to have a real-time impact on customer experience. Furthermore, it assists in detecting customers' locations. It helps analyze the time spent, such as whether it is eating, shopping, or traveling, providing valuable insights. Retailers and social media marketers have already tapped into reverse geocoding to deliver relevant and real-time messaging to their clients. Geopositioning in digital maps refers to determining the precise geographic location of a point or device on the Earth's surface using geographical coordinates. Geopositioning accuracy depends on various factors, such as the number and geometry of visible satellites, atmospheric conditions, and signal interference. Generally, GNSS receivers can achieve accuracy within a few meters under optimal conditions, although more advanced receivers can achieve sub-meter accuracy.

By purpose, the navigation maps segment will hold the largest market size during the forecast period.

Navigation maps depict roads, streets, highways, and other transportation infrastructure, including lane information, traffic signals, and road signs. Different types of roads are typically represented with varying line styles or colors to indicate their classification (e.g., highways, arterials, local roads). Navigation maps provide turn-by-turn directions to guide users along their chosen route from the starting point to the destination. Directions include information about upcoming turns, intersections, exits, and distances, as well as visual cues and voice guidance for navigation.

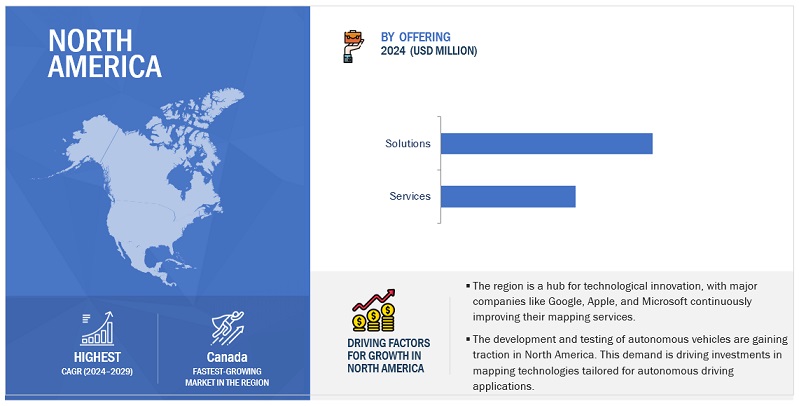

As per region, North America will witness the largest market share during the forecast period.

The adoption of digital map solutions is expected to be the highest in North America compared to other regions. The high adoption rate of technology is changing the market environment and boosting the practice of digital maps in North America. Implementing digital map solutions by tech giants, such as Google, Apple, Esri, Microsoft, and Maxar Technologies, increases the growth of the digital map market in the region. The market is growing due to the many applications of technologies, such as indoor positioning, indoor security, indoor tracking, and more. The growth in the adoption of digital map solutions in various industries, such as automotive, energy and utilities, government and defense, and transportation, to achieve accuracy is adding to the growth in this region.

Governments at the federal, state, and municipal levels in North America invest in digital mapping infrastructure for urban planning, emergency response, environmental management, and public services. These initiatives create opportunities for mapping companies to collaborate with government agencies and provide specialized solutions. In the future, there will be a growing trend towards indoor mapping solutions for navigation within large venues like shopping malls, airports, and stadiums.

Key Market Players

The digital map market is dominated by a few globally established players such as Google (US), Apple (US), TomTom (Netherlands), NearMap (Australia), Esri (US), INRIX (US), HERE Technologies (Netherlands), LightBox (US), ServiceNow (US), Inpixon (US), Microsoft (US), Maxar Technologies (US), Emapa (Poland), Dabeeo (South Korea), Caliper (US), MapmyIndia (India), GeoVerra (Canada), among others, are the key vendors that secured digital map market contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have limited expertise. In the thriving digital map market, the IoT and cloud adoption boom is pivotal in reshaping traditional digital map practices. Companies leveraging cloud-based solutions, digital map capitalizes on several advantages.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market Size Available For Years |

2019–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Mapping Type, Purpose, Scale, Application, and Vertical |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Google (US), Apple (US), TomTom (Netherlands), NearMap (Australia), Esri (US), INRIX (US), HERE Technologies (Netherlands), LightBox (US), ServiceNow (US), Inpixon (US), Microsoft (US), Maxar Technologies (US), Emapa (Poland), Dabeeo (South Korea), Caliper (US), MapmyIndia (India), GeoVerra (Canada), Orbital Insight (US), DigiMap (US), MapQuest (US), IndoorAtlas (Finland), Mapsted (Canada), Mapidea (Portugal), Geocento (UK), Geospin (Germany), Jawg Maps (France), and Barikoi (Bangladesh) |

This research report categorizes the digital map market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

-

Solution

- Mapping Data

- Web Mapping

- GPS-enabled Services

- Geographic Information System (GIS) Services

-

Services

- Consulting

- Support & Maintenance

- Deployment & Integration

By Mapping Type:

- Outdoor Mapping

- Indoor Mapping

- 3D & 4D Metaverse

By Purpose:

- Navigation Maps

- Thematic Maps

- Satellite Imagery

- Real-Time Traffic Maps

By Scale:

- Large Scale Maps

- Small Scale Maps

By Application:

- Real-Time Location Data Management

- Geocoding and Geopositioning

- Routing and Navigation

- Asset Tracking

- Reverse Geocoding

- Other Applications

By Vertical:

- Government & Defense

- Infrastructure Development & Construction

- Travel, Transportation, & Logistics

- Automotive

- Retail

- Finance & Insurance

- Manufacturing

- Energy, Utility, & Natural Resources

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- With the latest upgrades, Google Maps offers an enriched user experience through AI-powered functionalities; this includes Lens in Maps for improved location comprehension, upgraded map visuals for enhanced navigation accuracy, and expanded electric vehicle charging information. Additionally, Immersive View for routes offers comprehensive previews, while advanced search delivers photo-centric results and themed recommendations. These advancements signify a new era in navigation, blending cutting-edge technology with user-centric design.

- Esri introduced Landsat Explorer, an online app offering easy access and analysis of Landsat multispectral imagery. It will provide decision-makers with intuitive tools to explore land changes over time, aiding in natural resource management and environmental monitoring.

- Here Technologies and Targa Telematics collaborated to integrate HERE Platform APIs, enhancing fleet management solutions. This partnership aimed to provide real-time insights, optimize operations, and promote sustainable mobility practices, empowering fleet managers with valuable tools for informed decision-making and improved driver safety.

- Nearmap acquired Betterview, a top property intelligence and risk management platform in the insurance industry. This strategic move aimed to bolster Nearmap's offerings for insurance customers by integrating Betterview's AI solutions into its technology stack, enhancing visualization capabilities, and improving underwriting processes.

Frequently Asked Questions (FAQ):

What is a Digital Map?

A digital map is a computerized representation of geographic information, typically displayed on a screen or other digital device. It visually depicts geographic features such as roads, landmarks, bodies of water, and terrain, as well as various spatial data layers such as population density, land use, and environmental conditions. Digital maps can be interactive, allowing users to zoom in, zoom out, pan, and customize the displayed information according to their needs.

Which country is the leader in North America for digital map solutions?

The US leads the digital map solutions market in North America.

Which are the key vendors exploring digital map solutions?

Some of the significant vendors offering digital map solutions across the globe include Google (US), Apple (US), TomTom (Netherlands), NearMap (Australia), Esri (US), INRIX (US), HERE Technologies (Netherlands), LightBox (US), ServiceNow (US), Inpixon (US), Microsoft (US), Maxar Technologies (US), Emapa (Poland), Dabeeo (South Korea), Caliper (US), MapmyIndia (India), GeoVerra (Canada), Orbital Insight (US), DigiMap (US), MapQuest (US), IndoorAtlas (Finland), Mapsted (Canada), Mapidea (Portugal), Geocento (UK), Geospin (Germany), Jawg Maps (France), and Barikoi (Bangladesh).

What is the total CAGR recorded for the digital map market during 2024-2029?

The digital map market will record a CAGR of 11.1% from 2024-2029.

What is the projected market value of the digital map market?

The digital map market will grow from USD 28.3 billion in 2024 to USD 47.8 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 11.1% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

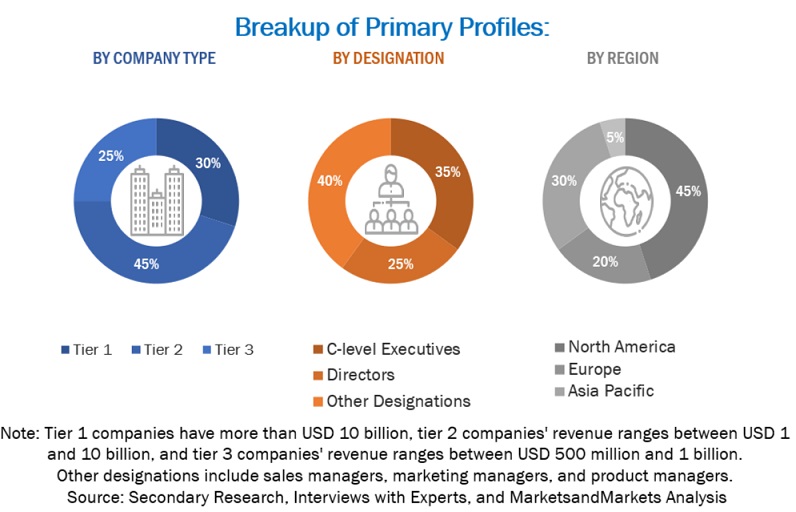

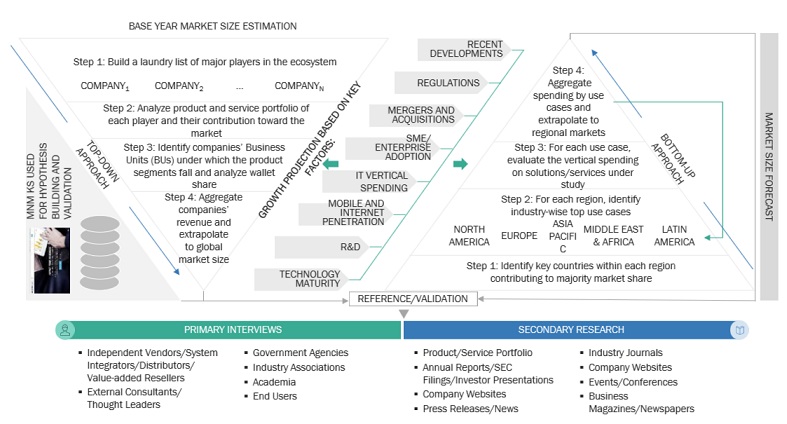

This research study used extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information for the technical, market-oriented, and commercial study of the digital map market. The primary sources are mainly several industry experts from core and related industries and suppliers, manufacturers, distributors, service providers, technology developers, technologists from companies, and organizations related to all segments of this industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future prospects. The following figure shows the research methodology applied in making this report on the digital map market.

The market has been predicted by analyzing the driving factors, such as the emergence of IoT, cloud computing, the growing need for cost-effective businesses, business agility, and faster time to market.

Secondary Research

The market for the companies offering digital map solutions and services was arrived at based on the secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

We used secondary research to obtain critical information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, we interviewed various primary sources from both the supply and demand sides to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related executives from digital map vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technology, offerings, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using digital maps, and digital initiatives project teams were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall digital map market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the digital map and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the digital map market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This entire procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Digital Map Market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the demand and supply sides in the digital map market.

Market Definition

Considering the views of various sources and associations, digital maps, also known as electronic maps or online maps, are graphical representations of geographical areas or spaces stored and viewed electronically on digital devices such as computers, smartphones, tablets, and GPS navigation systems. They visually represent spatial information, including streets, landmarks, topography, transportation networks, points of interest, and more.

Digital maps utilize various data sources and technologies, including satellite imagery, aerial photography, geographic information systems (GIS), and crowdsourced data, to create detailed and interactive representations of the physical world. Key players in the digital maps market include technology companies that develop mapping solutions and services, such as Google Maps, Apple Maps, HERE Technologies, and TomTom. These companies often use a combination of satellite imagery, aerial photography, GIS, and crowdsourced data to create and maintain their digital maps.

Key Stakeholders

- IT service providers

- Support infrastructure equipment providers

- Component providers

- Professional service providers

- Distributors and resellers

- Cloud providers

- Digital map vendors

- Telematics vendors

- Global Positioning System (GPS) vendors

- Cartography players

- Digital map solution providers

- Digital map service providers

- System integrators

- Consultancy and advisory firms

- Regulatory agencies

- Government entities

Report Objectives

- To define, describe, and forecast the digital map market based on offerings, solutions, services, mapping type, scale, purpose, application, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size concerning five central regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market for individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the digital map market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Map Market