GNSS Simulators Market by Component (Software, Hardware, and Services), GNSS Receiver (GPS, Galileo, GLONASS, and BeiDou), Application (Vehicle Assistance Systems, Location-based Services, and Mapping), Vertical, Type and Region - Global Forecast to 2027

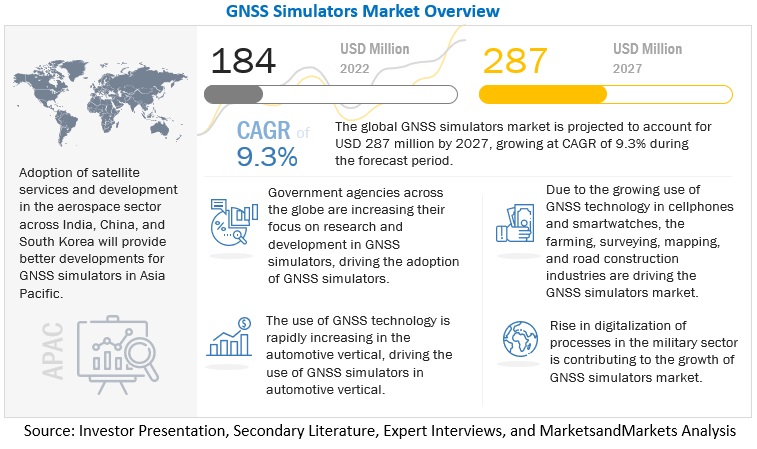

[266 Pages Report] The global GNSS simulators market size is expected to grow from an estimated value of USD 184 million in 2022 to USD 287 million by 2027, at a Compound Annual Growth Rate (CAGR) of 9.3% from 2022 to 2027. Rise in digitization of processes for military and defense sector are driving the GNSS simulators market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

GNSS Simulators Market Market Dynamics

Driver: Rapid penetration of consumer IoT

Consumer IoT refers to the interconnected environment of consumer electronics and devices. It is a key technology driver for GNSS simulators market. GNSS is among the foundational technologies powering the Internet of Things and nearly every connected urban environment used today. GNSS provides real-time tracking, timing, navigation, and other areas of machine-to-machine communication, which is the basis of IoT device management. The ability of devices to be aware of their location, the location of other machines around them, and the ability to collate the data into usable information is simply the importance of GNSS in IoT. A rapid increase has been witnessed in the use of smart and connected consumer devices, such as self-driving cars, drones, smart sensors, connected homes, and wearable devices, which are integrated with GNSS chips to enable real-time data communication. These devices are tested using GNSS simulators. IoT offers a variety of new devices and service options that have the potential to make the lives and jobs of consumers easier. In 2022, Vodafone and Topcon agreed to advance customer trials to develop a new mass-market precise positioning system to locate Internet of Things (IoT) devices. For this, selected customers are being invited by Vodafone to join pilot activities in Germany, Spain, and the UK. These companies aim to test the service, called Vodafone GNSS Corrections, using a wide variety of devices connected to Vodafone’s global IoT network, with more than 150 million connections, and its pan-European network covers 12 countries.

Restrain: Lack of digital infrastructure

It's hard to find important digital infrastructure that doesn't rely on GNSS. The lack of advanced digital infrastructures, such as internet connectivity and ICT infrastructure, is a key factor restraining the adoption of digital, location-based business models and services. Many persistent challenges, such as underdeveloped digital infrastructure, limited digital competencies among workers and consumers, inadequate financial support, weak regulatory framework, and low levels of trust in digital transactions among consumers, businesses, and governments, are faced by low-income developing countries. Some countries have taken steps to build digital infrastructure, but many developing countries are still lagging in terms of digital advancements. Such a situation results in a digital divide, which refers to uneven access to, use of, or impact of ICT between different geographical, social, or geopolitical groups. A digital divide limits the ability to exploit many basic utilities of the GNSS market. In addition, poor integration of business workflows of multiple industries with positioning infrastructure in some developing countries further limits the realization of the full potential of GNSS technology. This scenario might change if countries shifted their focus on resource allocation and policy agenda-setting, from “providing infrastructure and access” to “encouraging usage of the existing infrastructure to add or create value. In India, the pace at which people opt for digital methods in their daily lives was strengthened during the COVID-19 pandemic. An uptick in the seller count has been noted by almost all the e-commerce marketplace platforms.

Opportunity: Growing demand for UAVs

Permits or licenses to operate UAVs commercially is being provided by countries like US, the UK, and Australia. For tracking, recording, and communicating real-time data, UAVs are integrated with GNSS chips. The Federal Aviation Administration (FAA) has enabled law enforcement agencies to fly UAVs that weigh less than 25 pounds below 400 feet. UAVs can be used by the agencies for training, but they need to prove their expertise before they are granted operational permits. GNSS-integrated UAVs customized for different applications have been developed by companies to track their location continuously. Due to stringent government regulations, use of UAVs/Unmanned Ground Vehicles (UGVs) is not fully commercialized in all geographical regions. Septentrio announced a partnership with CompoTec. COmpoTec will distribute Septentrio’s positioning solutions for industrial applications, such as unmanned aerial vehicles (UAVs).

Challenge: Lack of geodetic infrastructure

Geodetic infrastructure provides precise information related to the essential properties of the earth and how they change with time. This information is very helpful in many civil, military, scientific, and commercial applications. Only a few leading companies have a strong geodetic infrastructure, while the rest have poor positioning reference systems. For instance, the US-based federal agencies have contributed to global geodetic infrastructure through investments and initiatives, but the infrastructure is degrading due to age and insufficient support. Investments are needed to modernize and maintain the existing systems to support the development of new and highly sophisticated applications with substantial national security, economic, and scientific benefits.

The lack of geodetic framework capacities in most developing countries is a key challenge faced by the GNSS simulators market and positioning industry. It affects the accuracy of GNSS and positioning solutions and limits the innovation of industrial and research use cases.

By vertical, consumer electronics vertical to record the highest growth rate during the forecast period

The boom of consumer IoT, which refers to the interconnected world of consumer electronics, devices, and appliances, such as wearables, drones, and smartphones, is driving the rapid adoption of GNSS simulators. There is an increased need for real-time data communication and miniaturization of electronic devices. Wearable and electronic devices are integrated with GNSS chips to extract PNT information, and further innovations in these devices would require GNSS simulators for testing purposes. These devices control or retrieve data from other instruments or computers and support wireless technologies, such as Bluetooth, Wi-Fi, and GPS. Integrating GNSS technology into these products will enable manufacturers to design slimmer and lighter products and keep up with the emerging market trends. Wearable GNSS location devices are more accurate and reliable than GNSS like Galileo, particularly in urban environments where narrow streets and tall buildings often block satellite signals and limit the usefulness of mobile services. Market leaders are leveraging multi-GNSS, combining Galileo, GPS, GLONASS and/or BeiDou, to provide more robust and more precise location and navigation information for wearable device users. Some of the prominent GNSS simulator vendors in the GNSS simulators market catering to the consumer electronics vertical include Spirent Communications (UK) and TeleOrbit (Germany).

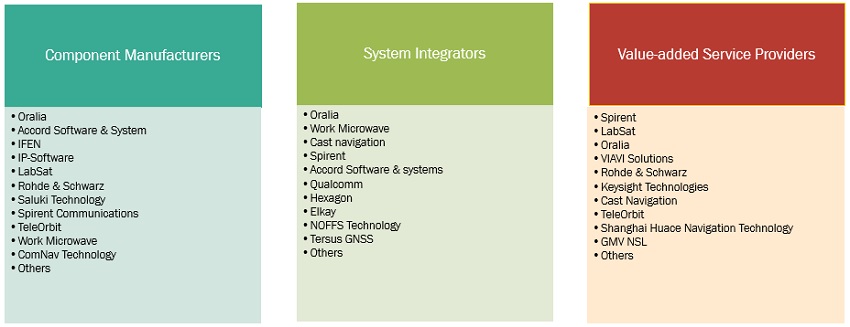

GNSS Simulators Market Eco-System

To know about the assumptions considered for the study, download the pdf brochure

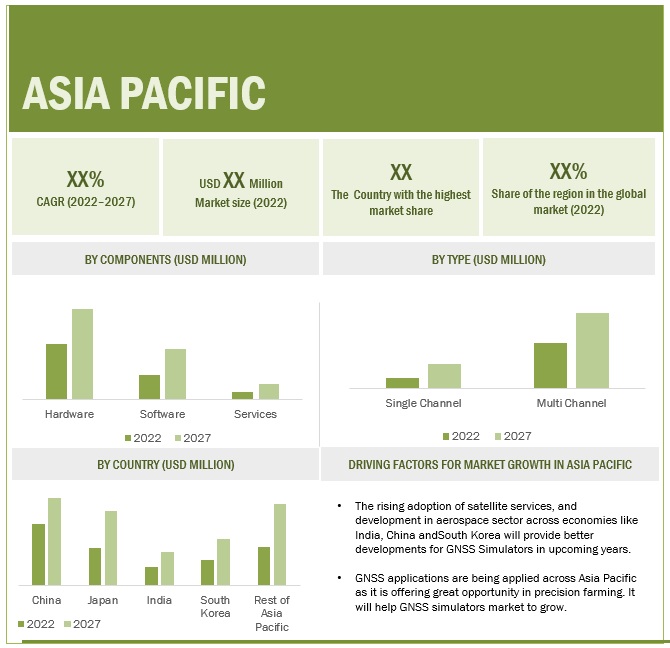

By region, Asia Pacific to grow at the highest CAGR during the forecast period

Developing economies in the region have held hands with other regions to provide and develop GNSS technologies. This has had a positive impact on the GNSS simulators market in Asia Pacific, as technological advancements and adaption are easier, and companies can provide better solutions to end customers. The market in Asia Pacific is expected to record the highest CAGR during the forecast period. The growth of IoT and portable consumer electronic devices and the digitalization of business procedures in countries, such as Japan, China, and India, would present a good opportunity for the GNSS simulations market in the region. GNSS simulator solutions are being adopted in the military and defense, automotive, consumer electronics, marine, aerospace, and transport sectors of the region. Various initiatives have been adopted by governments in the growth of digital solutions in countries.

Key Market Players:

The key players in the global GNSS simulators market include Spirent Communications (UK), Rohde & Schwarz (Germany), Hexagon (Sweden), Syntony GNSS (France), VIAVI Solutions (US), Keysight Technologies (US), u-blox (Switzerland), Averna (Canada), Accord Software & Systems (India), RACELOGIC (UK), GMV NSL (UK), CAST Navigation (US), IFEN (Germany), TeleOrbit (Germany), iP-Solutions (Japan), Jackson Labs Technologies (US), WORK Microwave (Germany), M3 Systems (France), Qascom (Italy), Saluki Technologies (Taiwan), MaxEye Technologies (India), Tersus GNSS (Australia), Digilogic (India), NOFFZ Technologies (Germany), Elkay (India).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By component, type, receiver, application, vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America |

|

Major companies covered |

Spirent Communications (UK), Rohde & Schwarz (Germany), Hexagon (Sweden), Syntony GNSS (France), VIAVI Solutions (US), Keysight Technologies (US), u-blox (Switzerland), Averna (Canada), Accord Software & Systems (India), RACELOGIC (UK), GMV NSL (UK), CAST Navigation (US), IFEN (Germany), TeleOrbit (Germany), iP-Solutions (Japan), Jackson Labs Technologies (US), WORK Microwave (Germany), M3 Systems (France), Qascom (Italy), Saluki Technologies (Taiwan), MaxEye Technologies (India), Tersus GNSS (Australia), Digilogic (India), NOFFZ Technologies (Germany), Elkay (India). |

Market Segmentation:

Recent Development

- In August 2022, V3Novus partnered with RACELOGIC to provide GNSS simulation solutions.

- In July 2022, JCB launched new Fastrac iCON tractor. It features the Hexagon | NovAtel’s SMART7 GNSS receiver and optional TerraStar Correction Services. The iCONNECT precision technology package is driven by SMART7 GNSS receiver to offer operators an easy-to-use customizable experience.

- In July 2022, u-blox partners with Position Partners to expand mass-market GPS augmentation service to Australia, New Zealand. The partnership will bring the u-blox PointPerfect services to mass-market applications such as automotive and micromobility.

- In January 2022, Hexagon partnered with Dayou, Chinese positioning company. This collaboration will bring TerraStar X technology to the Chinese market. The TerraStar X technology generates GNSS corrections which enables lane-level accuracy.

- In December 2021, VIAVI Solutions announced its collaboration with Ericsson. VIAVI provides geolocation capabilities to the recently launched Ericsson Intelligent Automation Platform.

Frequently Asked Questions (FAQ):

What is the definition of GNSS simulator?

The European Global Navigation Satellite Systems Agency (EGNSSA) defines GNSS as a constellation of satellites providing signals from space that transmit positioning and timing data to GNSS receivers. The receivers then use this data to determine location of user.

GNSS simulator tests GNSS receivers and the systems that rely on them. It provides control over the signals generated from different GNSS constellations and global testing environments in a box. This enables the testing of signals in controlled laboratory conditions. A GNSS simulator generates the same type of signals transmitted by GNSS satellites. It is an alternative to live environment testing. Unlike live testing, GNSS simulation controls simulated satellite signals and environmental conditions.

What is the projected market value of the global GNSS simulators market?

The global GNSS simulators market size is expected to grow from an estimated value of USD 187 million in 2022 to USD 287 million by 2027, at a Compound Annual Growth Rate (CAGR) of 9.3% from 2022 to 2027.

Who are the key companies influencing the market growth of GNSS simulators?

Spirent Communications (UK), Rohde & Schwarz (Germany), Hexagon (Sweden), Syntony GNSS (France), VIAVI Solutions (US), are the leaders in the GNSS simulators market and are recognized as the star players. These companies account for a major share of the GNSS simulators market. These vendors offer solutions per user requirements and adopting growth strategies to consistently achieve the desired growth and make their presence in the market.

Who are the emerging SMEs that are supporting significantly in the market growth?

MaxEye Technologies (India), Tersus GNSS (Australia), Digilogic (India), NOFFZ Technologies (Germany), Elkay (India) are few of the emerging SMEs that are nurturing market growth with their technical skills and expertise. These startups focus on developing product/service portfolios and bringing innovations to the market compared to their competitors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 1 GNSS SIMULATORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY SOURCES BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

FIGURE 3 KEY INDUSTRY INSIGHTS

2.2 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION PROCESS

2.3 MARKET SIZE ESTIMATION

2.3.1 REVENUE ESTIMATES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1

2.3.2 TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 3 GNSS SIMULATORS MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y %)

TABLE 4 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 7 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GNSS SIMULATORS MARKET

FIGURE 8 INCREASING USE OF WEARABLE DEVICES UTILIZING LOCATION INFORMATION TO FUEL GROWTH OF MARKET

4.2 MARKET, BY COMPONENT

FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR HIGHEST MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY SERVICE

FIGURE 10 PROFESSIONAL SERVICES TO GAIN HIGHEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY TYPE

FIGURE 11 MULTI-CHANNEL TO ACCOUNT FOR HIGHER MARKET SHARE DURING FORECAST PERIOD

4.5 GNSS SIMULATIONS MARKET, BY GNSS RECEIVER

FIGURE 12 GPS TO ACCOUNT FOR HIGHEST MARKET SHARE DURING FORECAST PERIOD

4.6 GNSS SIMULATORS MARKET SHARE OF TOP THREE VERTICALS AND REGIONS

FIGURE 13 MILITARY AND DEFENSE AND NORTH AMERICA TO ACCOUNT FOR HIGHEST RESPECTIVE MARKET SHARES IN 2022

4.7 MARKET INVESTMENT SCENARIO

FIGURE 14 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 GNSS SIMULATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rapid penetration of consumer IoT

5.2.1.2 Contribution of 5G in connectivity

5.2.1.3 Increasing use of wearable devices

5.2.2 RESTRAINTS

5.2.2.1 Lack of digital infrastructure

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for UAVs

5.2.3.2 Recent advancements in power consumption

5.2.3.3 Advent of SDR GNSS simulators

5.2.4 CHALLENGES

5.2.4.1 Lack of geodetic infrastructure

5.2.4.2 Ensuring synchronization accuracy in networks

5.2.4.3 Increase in jamming and spoofing attacks

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: OROLIA’S GSG-8 ADVANCED SIMULATOR DRIVES R&D TESTING FOR STELLANTIS

5.3.2 CASE STUDY 2: LABSAT PROVIDES GNSS TESTING CAPABILITIES TO CAMBIUM NETWORKS FOR ITS PRODUCTION LINE TESTING SOLUTION

5.3.3 CASE STUDY:3 SKYGUIDE COMPLIES WITH NEW FLIGHT PROCEDURES DUE TO IFEN’S NAVX-NCS PROFESSIONAL GNSS SIMULATOR

5.3.4 CASE STUDY 4: OROLIA PROVIDES GSG-8 WITH FULLY OPERATIONAL SBAS FUNCTION TO BECKER AVIONICS

5.3.5 CASE STUDY 5:NI AND M3 SYSTEMS COLLABORATE ON STELLA-NGC ADVENTURE TO CREATE ATTRACTIVE GNSS SIMULATION PRODUCTS

5.4 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN: GNSS SIMULATORS MARKET

5.5 ECOSYSTEM

FIGURE 17 MARKET: ECOSYSTEM

TABLE 5 MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 QUANTUM TECHNOLOGIES SOLVING COMPLEX NAVIGATION PROBLEMS

5.6.1.1 Quantum navigation algorithms

5.6.1.2 Quantum sensing

5.6.1.3 Quantum encryption

5.6.2 GNSS AND INTERNET OF THINGS

5.6.3 5G AND GNSS

5.6.4 GNSS AND MACHINE LEARNING/ARTIFICIAL INTELLIGENCE

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 GNSS SIMULATORS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 19 KEY STAKEHOLDERS IN BUYING PROCESS: MARKET

5.9 PRICING MODEL ANALYSIS

TABLE 7 SELLING PRICE ANALYSIS OF OROLIA GNSS SIMULATORS

TABLE 8 SELLING PRICE ANALYSIS OF M3 SYSTEMS GNSS SIMULATION SOFTWARE

5.10 PATENT ANALYSIS

FIGURE 20 PATENT ANALYSIS: MARKET

5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 21 TRENDS AND DISRUPTIONS IN GNSS SIMULATORS MARKET IMPACTING CUSTOMER BUSINESS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 EUROPEAN UNION’S REGULATION NO. 1285/2013 - IMPLEMENTATION AND EXPLOITATION OF EUROPEAN SATELLITE NAVIGATION SYSTEMS

5.12.2 EUROPEAN UNION’S REGULATION NO. 2015/758 - ECALL IN-VEHICLE SYSTEM

5.12.3 US SPACE-BASED POSITIONING, NAVIGATION, AND TIMING POLICY

5.12.4 GDPR

5.12.5 ICAO POLICY ON GNSS

5.12.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 GNSS SIMULATOR MARKET: LIST OF CONFERENCES AND EVENTS

6 GNSS SIMULATORS MARKET, BY COMPONENT (Page No. - 82)

6.1 INTRODUCTION

FIGURE 22 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 GNSS SIMULATOR MARKET SHIPMENT (UNITS)

6.2.1 SHIPMENTS: MARKET DRIVERS

TABLE 13 SHIPMENT: MARKET, BY REGION, 2021 (UNITS)

6.3 HARDWARE

6.3.1 HARDWARE-BASED GNSS RECEIVERS ENABLE PROCESSING OF SATELLITE SIGNALS

6.3.2 HARDWARE: MARKET DRIVERS

TABLE 14 HARDWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SOFTWARE

6.4.1 GNSS SIMULATION SOFTWARE ENABLES RECEIVERS TO SIMULATE SIGNALS FROM SATELLITES.

6.4.2 SOFTWARE: GNSS SIMULATORS MARKET DRIVERS

TABLE 16 SOFTWARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 17 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 SERVICES

FIGURE 23 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 MARKET, BY SERVICES, 2016–2021 USD MILLION)

TABLE 19 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 20 SERVICES: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 21 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5.1 PROFESSIONAL SERVICES

6.5.1.1 Demand for complex GNSS simulation solutions to drive growth

6.5.1.2 Professional services: market drivers

TABLE 22 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 23 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5.2 MANAGED SERVICES

6.5.2.1 Managed services to govern hardware and software functions

6.5.2.2 Managed services: GNSS simulators market drivers

TABLE 24 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 25 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 GNSS SIMULATORS MARKET, BY TYPE (Page No. - 91)

7.1 INTRODUCTION

FIGURE 24 SINGLE CHANNEL SIMULATORS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 27 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 SINGLE CHANNEL

7.2.1 SINGLE CHANNE SIMULATORS TO TRACK SENSITIVITY MEASUREMENTS FOR R&D TESTING.

7.2.2 SINGLE CHANNEL: MARKET DRIVERS

TABLE 28 SINGLE CHANNEL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 SINGLE CHANNEL: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 MULTI-CHANNEL

7.3.1 GNSS RF SIGNALS HELP TO DESIGN, MANUFACTURE, AND PRE-LAUNCH TESTS.

7.3.2 MULTI CHANNEL: MARKET DRIVERS

TABLE 30 MULTI CHANNEL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 MULTI CHANNEL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 GNSS SIMULATORS MARKET, BY RECEIVER (Page No. - 95)

8.1 INTRODUCTION

FIGURE 25 GPS TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 32 MARKET, BY RECEIVER, 2016–2021 (USD MILLION)

TABLE 33 MARKET, BY RECEIVER, 2022–2027 (USD MILLION)

8.2 GPS

8.2.1 GPS USED FOR TELEMATICS, IN-VEHICLE SYSTEMS, AND CONSIGNMENT TRACKING

8.2.2 GPS: MARKET DRIVERS

TABLE 34 GPS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 35 GPS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 GALILEO

8.3.1 GALILEO TO SUPPORT EU GREEN DEAL AND DRIVE ECONOMIC GROWTH OF EUROPEAN UNION

8.3.2 GALILEO: MARKET DRIVERS

TABLE 36 GALILEO: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 37 GALILEO: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 GLONASS

8.4.1 GLONASS-K SATELLITE LAUNCHED INTO CALCULATED ORBIT USING FREGAT BOOSTER

8.4.2 GLONASS: GNSS SIMULATORS MARKET DRIVERS

TABLE 38 GLONASS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 39 GLONASS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 BEIDOU

8.5.1 END OF CHINA’S DEPENDENCY ON GPS NETWORK

8.5.2 BEIDOU: MARKET DRIVERS

TABLE 40 BEIDOU: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 41 BEIDOU: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHER

TABLE 42 OTHER: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 43 OTHER: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 GNSS SIMULATORS MARKET, BY APPLICATION (Page No. - 104)

9.1 INTRODUCTION

FIGURE 26 VEHICLE ASSISTANCE SYSTEMS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 44 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 45 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 NAVIGATION

9.2.1 INCREASING USE OF GNSS SIMULATORS FOR TRACKING TO DRIVE DEMAND

9.2.2 NAVIGATION: MARKET DRIVERS

TABLE 46 NAVIGATION: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 47 NAVIGATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 MAPPING

9.3.1 PRECISE POSITIONING BY GALILEO TO BENEFIT MAPPING SECTOR

9.3.2 MAPPING: MARKET DRIVERS

TABLE 48 MAPPING: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 49 MAPPING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 SURVEYING

9.4.1 GNSS SIMULATION OFFERS NAVIGATION SYSTEM TO OPERATE IN ADVERSE ENVIRONMENTS

9.4.2 SURVEYING: GNSS SIMULATORS MARKET DRIVERS

TABLE 50 SURVEYING: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 51 SURVEYING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 LOCATION-BASED SERVICES

9.5.1 LOCATION-BASED SERVICES (LBS) RELY ON GNSS DATA.

9.5.2 LOCATION-BASED SERVICES: MARKET DRIVERS

TABLE 52 LOCATION-BASED SERVICES: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 53 LOCATION-BASED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 VEHICLE ASSISTANCE SYSTEMS

9.6.1 ADVANCED GNSS COMPLEMENTS VEHICLE PERCEPTION TO BE USED WITH IMU (INERTIAL MEASUREMENT UNIT)

9.6.2 VEHICLE ASSISTANCE SYSTEMS: MARKET DRIVERS

TABLE 54 VEHICLE ASSISTANCE SYSTEMS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 55 VEHICLE ASSISTANCE SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 OTHER APPLICATIONS

TABLE 56 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 57 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 GNSS SIMULATORS MARKET, BY VERTICAL (Page No. - 114)

10.1 INTRODUCTION

FIGURE 27 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 58 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 59 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 MILITARY AND DEFENSE

10.2.1 GNSS WITH SITUATIONAL AWARENESS (SA) TO DRIVE DEMAND FOR GNSS SIMULATIONS

10.2.2 MILITARY AND DEFENSE: MARKET DRIVERS

TABLE 60 MILITARY AND DEFENSE: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 61 MILITARY AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 AUTOMOTIVE

10.3.1 GNSS SIMULATIONS TO BE USED IN AUTOMOTIVE TO TRACE LOCATION

10.3.2 AUTOMOTIVE: MARKET DRIVERS

TABLE 62 AUTOMOTIVE: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 63 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 CONSUMER ELECTRONICS

10.4.1 INCREASED IOT USAGE AND WEARABLE DEVICES TO IMPACT MARKET

10.4.2 CONSUMER ELECTRONICS: GNSS SIMULATORS MARKET DRIVERS

TABLE 64 CONSUMER ELECTRONICS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 65 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 MARINE

10.5.1 COMMERCIAL FISHING CONVOYS USE GNSS TO NAVIGATE

10.5.2 MARINE: MARKET DRIVERS

TABLE 66 MARINE: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 67 MARINE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 AEROSPACE

10.6.1 USE OF GNSS IN DRONES TO NAVIGATE

10.6.2 AEROSPACE: MARKET DRIVERS

TABLE 68 AEROSPACE: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 69 AEROSPACE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHER VERTICALS

TABLE 70 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 71 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 GNSS SIMULATOR MARKET, BY REGION (Page No. - 125)

11.1 INTRODUCTION

FIGURE 28 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 72 GNSS SIMULATORS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: GNSS SIMULATOR MARKET DRIVERS

11.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION

TABLE 75 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION

TABLE 77 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION

TABLE 81 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION

TABLE 83 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.3 US

11.2.3.1 Government support results an ideal environment for research and innovation

TABLE 88 US: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION

TABLE 89 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 90 US: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 91 US: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 92 US: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 93 US: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 94 US: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 95 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 US: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 97 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 98 US: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 99 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Use of PNT-Policy for security, emergency preparedness, and science interests

TABLE 100 CANADA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 101 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 102 CANADA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 103 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 104 CANADA: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 105 CANADA: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 106 CANADA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 107 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 CANADA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 109 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 111 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: GNSS SIMULATORS MARKET DRIVERS

11.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 112 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 Developed outline plans for a conventional satellite system as an alternative to American GPS

TABLE 126 UK: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 127 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 128 UK: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 129 UK: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 130 UK: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 131 UK: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 132 UK: MARKET SIZE, BY TYPE, 2016–2021 (USD MILLION)

TABLE 133 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 134 UK: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 135 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 136 UK: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 137 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 GNSS simulation technology to be leveraged heavily by German automobile technology

TABLE 138 GERMANY: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 139 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 140 GERMANY: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 141 GERMANY: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 142 GERMANY: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 143 GERMANY: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 144 GERMANY: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 145 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 146 GERMANY: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 147 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 148 GERMANY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 149 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Government to focus on implementation plan for Performance-Based Navigation (PBN)

TABLE 150 FRANCE: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 151 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 152 FRANCE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 153 FRANCE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 154 FRANCE: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 155 FRANCE: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 156 FRANCE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 157 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 FRANCE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 159 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 160 FRANCE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 161 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 162 REST OF EUROPE: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 163 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 164 REST OF EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 165 REST OF EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 166 REST OF EUROPE: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 167 REST OF EUROPE: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 168 REST OF EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 170 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 REST OF EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: GNSS SIMULATORS MARKET DRIVERS

11.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 174 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.3 CHINA

11.4.3.1 BeiDou created impact on China’s Belt and Road Initiative (BRI)

TABLE 188 CHINA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 189 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 190 CHINA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 191 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 192 CHINA: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 193 CHINA: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 194 CHINA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 195 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 196 CHINA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 197 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 198 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 199 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Government to increase spending on GNSS projects

TABLE 200 JAPAN: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 201 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 202 JAPAN: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 203 JAPAN: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 204 JAPAN: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 205 JAPAN: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 206 JAPAN: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 207 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 208 JAPAN: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 209 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 210 JAPAN: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 211 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.5 INDIA

11.4.5.1 GNSS projects of government to drive GNSS simulation demand

TABLE 212 INDIA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 213 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 214 INDIA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 215 INDIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 216 INDIA: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 217 INDIA: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 218 INDIA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 219 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 220 INDIA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 221 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 222 INDIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 223 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 Government to build GPS under space development plan

TABLE 224 SOUTH KOREA: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 225 SOUTH KOREA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 226 SOUTH KOREA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 227 SOUTH KOREA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 228 SOUTH KOREA: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 229 SOUTH KOREA: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 230 SOUTH KOREA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 231 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 232 SOUTH KOREA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 233 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 234 SOUTH KOREA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 235 SOUTH KOREA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 236 REST OF ASIA PACIFIC: GNSS SIMULATORS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 237 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 240 REST OF ASIA PACIFIC: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 241 REST OF ASIA PACIFIC: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 242 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 243 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 244 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 245 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 246 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 247 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: GNSS SIMULATORS MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 248 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 249 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 250 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 251 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 252 MIDDLE EAST AND AFRICA: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 253 MIDDLE EAST AND AFRICA: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 254 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 255 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 256 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 257 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 260 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 261 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.3 MIDDLE EAST

11.5.3.1 Government to launch two navigation satellites

11.5.4 AFRICA

11.5.4.1 Africa launches SBAS system

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: GNSS SIMULATORS MARKET DRIVERS

11.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 262 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 263 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 264 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 265 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 266 LATIN AMERICA: MARKET, BY GNSS RECEIVER, 2016–2021 (USD MILLION)

TABLE 267 LATIN AMERICA: MARKET, BY GNSS RECEIVER, 2022–2027 (USD MILLION)

TABLE 268 LATIN AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 269 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 270 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 271 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 272 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 273 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 274 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 275 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.3 BRAZIL

11.6.3.1 Increased usage of GNSS simulation in automobile and IoT

11.6.4 MEXICO

11.6.4.1 Mexico launched Galileo Information Center (GIC)

11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 198)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 31 MARKET EVALUATION FRAMEWORK: 2019–2022 WITNESSED MARKET EXPANSION AND CONSOLIDATION

12.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 32 GNSS SIMULATORS MARKET: REVENUE ANALYSIS

12.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 276 MARKET: DEGREE OF COMPETITION

12.5 HISTORICAL REVENUE ANALYSIS

FIGURE 33 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS 2017–2021 (USD MILLION)

12.6 RANKING OF KEY PLAYERS

FIGURE 34 MARKET KEY PLAYER RANKING, 2021

12.7 KEY COMPANY EVALUATION MATRIX

12.7.1 KEY COMPANY EVALUATION MATRIX (DEFINITIONS AND METHODOLOGY)

12.7.2 STARS

12.7.3 EMERGING LEADERS

12.7.4 PERVASIVE PLAYERS

12.7.5 PARTICIPANTS

FIGURE 35 GNSS SIMULATORS MARKET, KEY PLAYER EVALUATION QUADRANT, 2022

12.8 COMPETITIVE BENCHMARKING

12.8.1 EVALUATION CRITERIA OF KEY COMPANIES

TABLE 277 EVALUATION CRITERIA

TABLE 278 COMPANY INDUSTRY FOOTPRINT

TABLE 279 COMPANY REGION FOOTPRINT

12.9 SME EVALUATION MATRIX

FIGURE 36 SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

FIGURE 37 MARKET, SME EVALUATION MATRIX, 2022

12.9.1 PROGRESSIVE COMPANIES

12.9.2 RESPONSIVE COMPANIES

12.9.3 DYNAMIC COMPANIES

12.9.4 STARTING BLOCKS

12.10 COMPETITIVE SCENARIO

12.10.1 PRODUCT/SOLUTION LAUNCHES

TABLE 280 GNSS SIMULATORS MARKET: PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS 2019-2022

12.10.2 DEALS

TABLE 281 MARKET: DEALS 2019–2022

13 COMPANY PROFILES (Page No. - 213)

13.1 INTRODUCTION

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats)*

13.2 KEY PLAYERS

13.2.1 SPIRENT COMMUNICATIONS

TABLE 282 SPIRENT COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 38 SPIRENT COMMUNICATIONS: COMPANY SNAPSHOT

TABLE 283 SPIRENT COMMUNICATIONS: SOLUTIONS OFFERED

TABLE 284 SPIRENT COMMUNICATIONS: SERVICES OFFERED

TABLE 285 SPIRENT COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 286 SPIRENT COMMUNICATIONS: DEALS

13.2.2 ROHDE & SCHWARZ

TABLE 287 ROHDE & SCHWARZ: BUSINESS OVERVIEW

TABLE 288 ROHDE & SCHWARZ: SOLUTIONS OFFERED

TABLE 289 ROHDE & SCHWARZ: SERVICES OFFERED

TABLE 290 ROHDE & SCHWARZ: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 291 ROHDE & SCHWARZ: DEALS

13.2.3 HEXAGON

TABLE 292 HEXAGON: BUSINESS OVERVIEW

FIGURE 39 HEXAGON: COMPANY SNAPSHOT

TABLE 293 HEXAGON: SOLUTIONS OFFERED

TABLE 294 HEXAGON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 295 HEXAGON: DEALS

13.2.4 SYNTONY GNSS

TABLE 296 SYNTONY GNSS: BUSINESS OVERVIEW

TABLE 297 SYNTONY GNSS: SOLUTIONS OFFERED

TABLE 298 SYNTONY GNSS: DEALS

13.2.5 VIAVI SOLUTIONS

TABLE 299 VIAVI SOLUTIONS: BUSINESS OVERVIEW

FIGURE 40 VIAVI SOLUTIONS: COMPANY SNAPSHOT

TABLE 300 VIAVI SOLUTIONS: SOLUTIONS OFFERED

TABLE 301 VIAVI SOLUTIONS: PRODUCT LAUNCHES

TABLE 302 VIAVI SOLUTIONS: DEALS

13.2.6 KEYSIGHT TECHNOLOGIES

TABLE 303 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 41 KEYSIGHT TECHNOLOGY: COMPANY SNAPSHOT

TABLE 304 KEYSIGHT TECHNOLOGIES: SOLUTIONS OFFERED

TABLE 305 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 306 KEYSIGHT TECHNOLOGIES: DEALS

13.2.7 U-BLOX

TABLE 307 U-BLOX: BUSINESS OVERVIEW

FIGURE 42 U-BLOX: COMPANY SNAPSHOT

TABLE 308 U-BLOX: SOLUTIONS OFFERED

TABLE 309 U-BLOX: SERVICES OFFERED

TABLE 310 U-BLOX: PRODUCT LAUNCHES

TABLE 311 U-BLOX: DEALS

13.2.8 AVERNA

TABLE 312 AVERNA: BUSINESS OVERVIEW

TABLE 313 AVERNA: SOLUTIONS OFFERED

TABLE 314 AVERNA: PRODUCT LAUNCHES AND ENHANCEMENTS

13.2.9 ACCORD SOFTWARE & SYSTEMS

TABLE 315 ACCORD SOFTWARE & SYSTEMS: BUSINESS OVERVIEW

TABLE 316 ACCORD SOFTWARE & SYSTEMS: SOLUTIONS OFFERED

TABLE 317 ACCORD SOFTWARE & SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

13.2.10 RACELOGIC

TABLE 318 RACELOGIC: BUSINESS OVERVIEW

TABLE 319 RACELOGIC: SOLUTIONS OFFERED

TABLE 320 RACELOGIC: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 321 RACELOGIC: DEALS

13.2.11 GMV NSL

TABLE 322 GMV NSL: BUSINESS OVERVIEW

TABLE 323 GMV NSL: SOLUTIONS OFFERED

TABLE 324 GMV NSL: SERVICES OFFERED

TABLE 325 GMV NSL: DEALS

13.3 OTHER PLAYERS

13.3.1 CAST NAVIGATION

13.3.2 IFEN

13.3.3 TELEORBIT

13.3.4 IP-SOLUTION

13.3.5 JACKSON LABS TECHNOLOGIES

13.3.6 WORK MICROWAVE

13.3.7 M3 SYSTEMS

13.3.8 QASCOM

13.3.9 SALUKI TECHNOLOGIES

13.3.10 MAXEYE TECHNOLOGY

13.3.11 TERSUS GNSS

13.3.12 DIGILOGIC

13.3.13 NOFFZ TECHNOLOGY

13.3.14 ELKAY

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 253)

14.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 326 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 GNSS SIMULATORS MARKET: ADJACENT MARKETS

14.3.1 SIMULATORS MARKET

TABLE 327 SIMULATOR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 328 SIMULATOR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 329 SIMULATOR MARKET, BY SERVICE, 2019–2021 (USD MILLION)

TABLE 330 SIMULATOR MARKET, BY SERVICE, 2022–2027 (USD MILLION)

14.3.2 LOCATION-BASED SERVICES (LBS) AND REAL-TIME LOCATION SYSTEMS (RTLS) MARKET

TABLE 331 LBS AND RTLS MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 332 LBS AND RTLS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 333 TRACKING AND NAVIGATION: LBS AND RTLS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 334 TRACKING AND NAVIGATION: LBS AND RTLS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 335 MARKETING AND ADVERTISING: LBS AND RTLS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 336 MARKETING AND ADVERTING: LBS AND RTLS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 337 LOCATION-BASED SOCIAL NETWORKS: LBS AND RTLS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 338 LOCATION-BASED SOCIAL NETWORKS: LBS AND RTLS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 339 LOCATION-BASED HEALTH MONITORING: LBS AND RTLS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 340 LOCATION-BASED HEALTH MONITORING: LBS AND RTLS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 341 OTHERS: LBS AND RTLS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 342 OTHERS: LBS AND RTLS MARKET, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 259)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

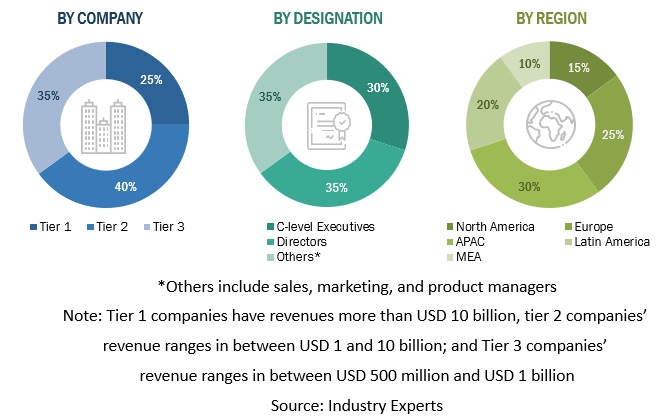

The study involved major activities in estimating the current market size for the GNSS simulators market. Exhaustive secondary research was done to collect information on the GNSS simulators industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, bottom up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the GNSS simulators market.

Secondary Research

Secondary research was used to obtain key information about the industry’s supply chain, country-wise technology spending, the total pool of key players, market classification and segmentation, key developments from market- and technology-oriented perspectives, economic trends, and currency exchange rates. For instance, the market size of companies offering GNSS Simulators to various verticals is based on the secondary data available through paid databases and publicly available information.

In the secondary research process, various sources were referred to for identifying and collecting information, including annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles from recognized authors; directories; and databases. The product portfolio of the major companies in the ecosystem was analyzed, and the companies are rated based on their performance and quality.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating on the GNSS simulators market.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

In used approach for market estimation, the key companies offering the GNSS simulators and services, such as Spirent Communications, Rohde & Schwarz, Hexagon, Syntony GNSS, VIAVI Solutions are identified, which contribute a major part of the GNSS simulators market. After finalizing these companies, validation of the data was done from industry experts through primary interviews related to the leading vendors of the market. Furthermore, we estimated their total revenue through annual reports, US Securities and Exchange Commission (SEC) filings, and paid databases.

Data Triangulation

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of GNSS simulators market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies

Report Objectives

- To define, describe, and forecast the Global Navigation Satellite System (GNSS) simulators market by component (shipment, hardware, software, and services), service (professional services and managed services), type, GNSS receiver, application, vertical, and region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Middle East & Africa (MEA), Asia Pacific (APAC), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as acquisitions, product developments, and partnerships, in the market

Global Navigation Satellite System Simulator Market & its impact on GNSS Simulators Market

The Global Navigation Satellite System Simulator Market and the GNSS Simulators Market are essentially the same thing. Both terms refer to the market for GNSS simulators, which are devices used to replicate the signals and behavior of satellite-based navigation systems like GPS, GLONASS, and Galileo. GNSS simulators are used to test and validate GNSS receivers and systems under a wide range of simulated conditions, including different environments, signal strengths, and interference.

The terms "Global Navigation Satellite System (GNSS) Simulator Market" and "GNSS Simulators Market" are used interchangeably to refer to the market for GNSS simulators. This market includes a wide range of companies that offer GNSS simulator hardware and software products for use in testing and validating GNSS receivers and systems across various industries, including aerospace, defense, automotive, and telecommunications.

Here are a few ways in which the Global Navigation Satellite System Simulator market is expected to impact the GNSS Simulators market:

The use of Global Navigation Satellite System Simulator is increasing rapidly across various industries, including aerospace, defense, automotive, and telecommunications, due to their ability to replicate the signals and behavior of satellite-based navigation systems like GPS, GLONASS, and Galileo for testing and validation of GNSS receivers and systems under different simulated conditions.

The growth of the Global Navigation Satellite System Simulator Market is driven by the increasing demand for GNSS simulators for the testing and validation of GNSS receivers and systems in various industries. With the development of advanced technologies like autonomous vehicles, the demand for GNSS simulators is expected to grow further. Additionally, the increasing use of GNSS simulators in the development and testing of new GNSS-based applications is also driving the growth of this market.

The Global Navigation Satellite System Simulator Market is highly competitive and fragmented, with the presence of several global and regional players. These companies are investing heavily in research and development to offer advanced GNSS simulators with improved features and functionalities. The market players are also expanding their geographical presence and collaborating with other companies to enhance their market position.

Futuristic growth use-cases of Global Navigation Satellite System Simulator Market

- Autonomous vehicles: The development and testing of autonomous vehicles rely heavily on GNSS simulators to simulate the signals and behavior of satellite-based navigation systems, such as GPS, GLONASS, and Galileo, under different environmental conditions. GNSS simulators help in testing and validating the accuracy and reliability of the navigation system of autonomous vehicles.

- Internet of Things (IoT): With the increasing demand for connected devices and the internet of things (IoT), GNSS simulators are being used to test and validate the GNSS functionality of various IoT devices, such as smart home appliances, wearables, and asset tracking devices.

- Aerospace and defense: The aerospace and defense industry uses GNSS simulators to test and validate the GNSS functionality of various systems, including navigation systems, communication systems, and missile guidance systems, among others.

- Location-based services: Location-based services, such as navigation apps, ride-hailing apps, and delivery apps, rely on accurate GNSS signals. GNSS simulators are used to test and validate the performance of these apps in different environments, such as urban canyons, tunnels, and indoor locations.

- Agriculture: Precision agriculture uses GNSS technology to optimize farming practices. GNSS simulators are used to test and validate the accuracy and reliability of the GNSS technology used in precision agriculture, such as crop mapping, yield monitoring, and variable rate application.

Some of the Top players in Global Navigation Satellite System Simulator market are Spirent Communications, Orolia, IFEN GmbH, Rohde & Schwarz, CAST Navigation, Jackson Labs Technologies, Syntony GNSS, NSLComm, Skydel Solutions, Accord Software & Systems.

New business opportunities in the Global Navigation Satellite System Simulator market

Here are some of the new business opportunities in the Global Navigation Satellite System Simulator market:

- Integration with emerging technologies: As emerging technologies like 5G, autonomous vehicles, and the Internet of Things (IoT) continue to grow, there is a significant demand for Global Navigation Satellite System Simulator that can integrate with these.

- Customized solutions: Companies can provide customized Global Navigation Satellite System Simulator solutions to cater to the specific needs of industries like aerospace and defense, automotive, and telecommunications. These customized solutions can include specific features and functionalities to meet the unique requirements of these industries.

- Cloud-based solutions: With the increasing demand for cloud-based solutions, companies can develop cloud-based Global Navigation Satellite System Simulator that can be accessed remotely by users. This can provide flexibility and scalability to users and can also reduce the cost of ownership.

- Partnership with system integrators: Companies can partner with system integrators to provide integrated solutions that include Global Navigation Satellite System Simulator and related products. These integrated solutions can provide a complete testing and validation solution to users and can also help in expanding the customer base.

- Expansion into emerging markets: The demand for Global Navigation Satellite System Simulator is growing rapidly in emerging markets like Asia-Pacific and Latin America. Companies can expand their business into these markets to tap into the growing demand.

Industries that are being impacted by the Global Navigation Satellite System Simulator Market

Here are some examples of industries that are being impacted by the Global Navigation Satellite System Simulator market:

- Aerospace and Defense: The aerospace and defense industry is a major user of Global Navigation Satellite System Simulator for testing and validating navigation systems for aircraft, missiles, and other defense applications. The use of GNSS simulators in this industry is expected to grow with the increasing demand for high-precision navigation systems.

- Automotive: The automotive industry is another major user of Global Navigation Satellite System Simulator for testing and validating navigation and driver assistance systems. With the increasing demand for autonomous vehicles, the use of GNSS simulators in this industry is expected to grow significantly in the future.

- Telecommunications: The telecommunications industry is also likely to be impacted by the Global Navigation Satellite System Simulator Market, as GNSS simulators are used for testing and validating location-based services like 5G networks and IoT devices.

- Marine: The marine industry is also a significant user of Global Navigation Satellite System Simulator for testing and validating navigation systems for ships and other marine vessels.

- Research and Development: The use of Global Navigation Satellite System Simulator is also growing in the research and development industry, as researchers use simulators to develop and test new navigation technologies and applications.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in GNSS Simulators Market

Interested in GNSS simulator report