Digital Signage Software Market Size, Share & Trends by Software Type (Edge Server Software, Content Management System), Services (Installation Services, Maintenance and Support Services), Application (Commercial, Infrastructural), and Geography - Global Forecast to 2023

Digital signage refers to the use of digital displays in order to exhibit digital images, video, and other media. The digital signage market has witnessed various technological advancements and registered remarkably consistent growth and exponential increase in demand in the last decade. The digital signage software market was valued at USD 4.48 billion in 2016 and is expected to reach USD 9.24 billion by 2023, at a CAGR of 10.2% during the forecast period. The base year considered for the study is 2016, and the forecast period is between 2017 and 2023.

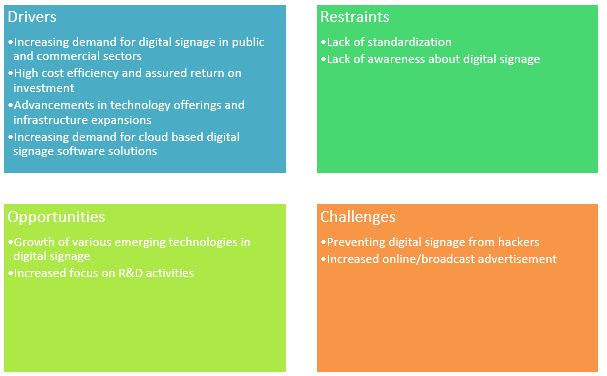

Market Dynamics

High cost efficiency and assured return on investment

Return on investment (ROI) is calculated by considering factors such as venue audience and customer satisfaction. The venue audience helps measure the direct revenue, whereas customer satisfaction helps measure the indirect revenue. Digital signage is gaining ground in various applications because of its benefits and leading to the increasing ROI. It increases the efficiency by limiting the time and cost associated with maintaining letter boards or printing and distributing posters. It can be used to display emergency messages, directional assistance, schedules, and agendas. It also helps drive sales, improve customer experience, and provide a competitive advantage, leading to an increase in the ROI.

The returns on investment for various players in the digital signage market are increasing through direct and indirect revenues. Direct revenue consists of high sales volume for products that are directly promoted via in-store marketing solutions and the revenue generated through the sponsorship of the content of a brand or a company. Indirect revenue includes a measurable increase in brand recognition and awareness of products or services presented on in-store screens.

Digital Signage Software Market Overview by Software Type: Edge Server Software & Content Management System

The digital signage software market has grown into a significant and dynamic segment within the broader digital display ecosystem as organizations increasingly adopt digital screens for communication, advertising, and operational purposes. At its core, this market involves platforms that enable businesses to create, schedule, distribute, and manage content on digital displays, such as monitors, LED walls, kiosks, and interactive panels. In 2023, the global digital signage software market reached underpinned by continued digital transformation and surging demand for real-time engagement.

Within this market, the software type segmentation is crucial as it determines how content is delivered and managed. Content Management Systems (CMS) are the largest software segment, accounting for about 51.87 % of total digital signage software deployments in 2023. CMS platforms provide centralized tools to design multimedia content, set playback schedules, and manage displays remotely, making them ideal for retail chains, corporate campuses, and hospitality venues where consistent messaging is essential. In contrast, Edge Server Software is the fastest-growing segment. By operating close to the display hardware, edge solutions improve latency, reliability, and local processing, making them particularly valuable in environments where connectivity may fluctuate or where real-time responsiveness is critical, such as busy transportation hubs or large event venues.

Businesses benefit from choosing the right software type based on their operational requirements. Organizations focused on centralized control, remote content updates, and cloud-based scalability often gravitate towards robust CMS solutions. At the same time, those needing local performance, offline continuity, and interactive experiences are increasingly implementing edge-oriented software. As digital signage technology evolves, the ongoing integration of AI, analytics, and personalized content delivery will continue to influence how both CMS and edge solutions are developed and deployed across industries.

Key Insights - Software Type Segment

-

CMS Leads Market Share: Content management systems accounted for roughly 51.87 % of global digital signage software deployments in 2023.

-

Edge Growth Momentum: Edge Server Software is the fastest-growing segment, with robust CAGR projections to 2028.

-

Local vs. Centralized Control: Edge solutions excel in low-latency, offline environments, while CMS provides centralized content governance.

-

Cloud and Hybrid Models: CMS platforms are increasingly offered in cloud or hybrid configurations to support remote management.

-

Enhanced Functionality: Future software offerings will likely integrate AI and analytics to personalize content.

Digital Signage Software Market by Services: Installation & Maintenance and Support Services

In addition to software platforms, services associated with digital signage represent a critical component of the market, ensuring that implementations perform effectively and deliver long-term value. These services are generally categorized into installation services and maintenance & support services, both of which contribute significantly to the overall deployment and operational success of digital signage networks.

Installation services encompass the physical setup of digital signage hardware, integration with existing IT systems, mounting, configuration of media players, and initial software deployment. Given the variety of screen types and display environments—from indoor corporate lobbies to large outdoor digital billboards—professional installation ensures optimal performance, safety compliance, and correct system integration from the outset. As digital signage projects grow in complexity and scale, installation services have become indispensable for organizations that require seamless deployment and minimal disruption to daily operations.

-

Ongoing Technical Updates: Covers software updates, troubleshooting, and security patches.

-

Service-Driven Growth: Demand increases with system complexity and multi-location deployments.

-

Contract Importance: Long-term support contracts ensure reliability and reduce operational risk.

Digital Signage Software Market by Application: Commercial & Infrastructural Uses

The applications of digital signage software are diverse, spanning a wide range of industries and environments. However, this market can broadly be grouped into commercial and infrastructural segments, each reflecting distinct business needs and deployment strategies.

Commercial applications dominate the digital signage landscape and accounted for the largest portion of deployments in recent years. This includes sectors such as retail, corporate offices, hospitality, and entertainment, where digital displays are used to engage customers, enhance brand visibility, and deliver dynamic promotions. In retail, digital signage software enables real-time updates to promotional content, interactive product showcases, and programmatic advertising that can influence purchasing behavior. Corporate environments leverage signage for internal communication—sharing messages from leadership, displaying operational metrics, and facilitating employee engagement. Hospitality venues implement digital screens for guest information, wayfinding, and promotional activities that elevate customer experiences.

Key Insights – Application Segment

-

Commercial Segment Lead: Commercial uses account for approximately 60 % of deployments.

-

Retail Dominance: Retail remains the largest single application within commercial uses.

-

Corporate and Hospitality: Widely used for internal communication and customer engagement.

-

Infrastructural Growth: Public venues, transportation, healthcare, and smart city projects are expanding use cases.

-

Complex Integrations: Infrastructure signage often integrates real-time data and emergency alerts.

Top 10 Key Highlights – Digital Signage Software Market

-

The digital signage software market is witnessing steady growth due to rising demand for real-time, dynamic, and interactive content across industries.

-

Content Management Systems (CMS) dominate the software type segment as they enable centralized control, remote scheduling, and seamless content updates across multiple locations.

-

Edge Server Software is gaining traction due to its ability to deliver low-latency content, offline playback, and localized data processing close to display hardware.

-

Cloud-based and hybrid deployment models are increasingly preferred, allowing businesses to scale digital signage networks with lower upfront IT costs.

-

Installation services remain a critical entry point for digital signage projects, ensuring proper hardware setup, software integration, and network configuration.

-

Maintenance and support services account for a significant share of service revenue, driven by the need for system uptime, security updates, and performance optimization.

-

The commercial application segment leads the market, supported by strong adoption in retail, corporate offices, hospitality, and entertainment venues.

-

Retailers leverage digital signage software for targeted promotions, personalized messaging, and enhanced in-store customer engagement.

-

Infrastructural applications, including transportation hubs, healthcare facilities, educational institutions, and smart city projects, are expanding rapidly.

-

Integration of analytics, AI-driven insights, and audience measurement tools is shaping the future of digital signage software solutions.

Objective Of The Study

- To define, describe, and forecast the digital signage software market

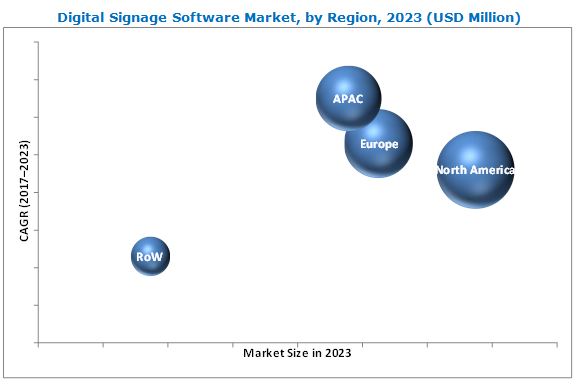

- To forecast the size (in terms of value) of the market segments with respect to 4 regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the digital signage software and services market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with regard to the individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the digital signage software market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the digital signage landscape

- To analyze the opportunities in the market for various stakeholders by identifying high-growth segments of the digital signage software market

- To analyze the competitive environment prevailing in the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2 along with detailing the competitive landscape for the market leaders

- To analyze the competitive intelligence based on the company profiles; key player strategies such as joint ventures, and mergers and acquisitions; and significant developments such as product launches, and research and development (R&D)

In today’s world, digital signage plays a crucial role in the in the field of information and advertising network. The digital signage software market was valued at USD 4.48 billion in 2016 and is expected to reach USD 9.24 billion by 2023, at a CAGR of 10.2% during the forecast period.

The growth of the market is propelled by the increasing demand for digital signage in public and commercial sectors, along with its high cost efficiency and assured return on investment. The market is further driven by factors such as increasing focus on energy consumption, the rising demand of OLED-based displays, and improvements in technology offerings & infrastructure expansions. However, the lack of standardization and the lack of awareness about digital signage are inhibiting the growth of the digital signage market globally. Moreover, the protection of digital signage from power issues and the development of equipment suitable for all weather conditions are the key challenges for the players in this industry. Technological innovations such as touch screen technology, near-field communication technologies, and so on have created opportunities for this market.

Digital signage systems such as displays, media players, and others are supported by software for the ease of accessibility. The sales of these digital signage devices are highly dependent on the user interfaces provided by the software for easy accessibility. The different software considered in the report includes edge server software, content management system, and other software solutions including analytics-related software.

The commercial application held the largest share of the digital signage software market in 2016 and is expected to register the highest CAGR during the forecast period. This is mainly due to increasing demand for digital signage in commercial applications along with improvements in technology offerings & infrastructure expansions. In indoor advertising, especially in the commercial application (retail, healthcare, and hospitality sectors), content needs to be managed and changed periodically because of the high customer interaction in these sectors. As the usage of products such as displays, media players, and projectors in retail and hospitality increases, the content management services in the digital signage market would also experience growth.

North America held the largest share of the digital signage market in 2016, followed by Europe. The digital signage software market is expected to have a high growth rate in APAC, mainly owing to the industrialization in this region. APAC is witnessing the transformation in the digital signage industry, and a number of players are entering this market with new innovations.

In 2016, the digital signage software market was dominated by Scala Inc. (US), Signagelive (UK), Broadsign International LLC (Canada), Omnivex Corporation (Canada), and Navori (Switzerland). This chapter profiles these major players along with other key players such as IntuiLab SA (France), Mvix, Inc. (US), NoviSign Digital Signage Inc. (Israel), Four Winds Interactive (US), Rise Vision (Canada), Planar Systems Inc. (US), NEC Display Solutions (Japan) ADFLOW Networks (Canada), Samsung Electronics Co. ltd (South Korea), and Panasonic Corporation (Japan).

Frequently Asked Questions (FAQs)

1. What is digital signage software?

Digital signage software is a platform that enables organizations to create, manage, schedule, and display multimedia content on digital screens such as LCDs, LEDs, kiosks, and video walls.

2. What are the main types of digital signage software?

The primary types include Content Management Systems (CMS), which provide centralized control and scheduling, and Edge Server Software, which supports local processing and low-latency content delivery.

3. Why are maintenance and support services important in digital signage?

Maintenance and support services ensure smooth system operation through software updates, troubleshooting, security patches, and performance optimization, reducing downtime and operational risks.

4. Which industries are the largest users of digital signage software?

Retail, corporate offices, hospitality, transportation, healthcare, and educational institutions are among the largest adopters of digital signage software solutions.

5. What trends are shaping the future of the digital signage software market?

Key trends include cloud adoption, edge computing, AI-based content personalization, real-time analytics, and increased deployment in smart city and public infrastructure projects.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Ranking Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities for the Growth of the Digital Signage Software and Services Market

4.2 Digital Signage Software and Services Market

4.3 Digital Signage Software Market, By Type (USD Billion)

4.4 Digital Signage Services Market, By Type (USD Billion)

4.5 Digital Signage Software and Services Market, By Region, 2016

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Digital Signage in Public and Commercial Sectors

5.2.1.2 High Cost Efficiency and Assured Return on Investment

5.2.1.3 Advancements in Technology Offerings and Infrastructure Expansions

5.2.1.4 Increasing Demand for Cloud Based Digital Signage Software Solutions

5.2.2 Restraints

5.2.2.1 Lack of Standardization

5.2.2.2 Lack of Awareness About Digital Signage

5.2.3 Opportunities

5.2.3.1 Growth of Various Emerging Technologies in Digital Signage

5.2.3.2 Increased Focus on R&D Activities

5.2.4 Challenges

5.2.4.1 Preventing Digital Signage From Hackers

5.2.4.2 Increased Online/Broadcast Advertisement

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Latest Trends in the Market

6.3.1 Impact of Latest Technological Trends on Digital Signage

6.3.1.1 Internet of Things (IoT)

6.3.1.2 Big Data

6.3.1.3 Artificial Intelligence (AI)

6.3.2 Rising Popularity of Wireless Digital Signage Solutions

6.3.3 Advancements in Nfc-Enabled Digital Signage Systems is Likely to Transform the Market Scenario

6.3.4 Increasing Deployment of Digital Menu Boards in the Restaurants

6.3.5 Trend Toward Separate Digital Asset Management Platform

6.3.6 Outsourcing of Digital Signage Networks

7 Digital Signage Software Market, By Software Type (Page No. - 44)

7.1 Introduction

7.2 Edge Server Software

7.3 Content Management System

7.4 Others

8 Digital Signage Services Market, By Service (Page No. - 55)

8.1 Introduction

8.2 Installation Services

8.3 Maintenance & Support Services

8.4 Other Services

9 Digital Signage Software and Services Market, By Application (Page No. - 68)

9.1 Introduction

9.2 Commercial

9.2.1 Retail

9.2.1.1 Indoor Advertisement

9.2.1.2 Outdoor Advertisement

9.2.2 Corporate

9.2.2.1 Indoor Advertisement

9.2.2.2 Outdoor Advertisement

9.2.3 Healthcare

9.2.3.1 Indoor Advertisement

9.2.3.2 Outdoor Advertisement

9.2.4 Hospitality

9.2.4.1 Indoor Advertisement

9.2.4.2 Outdoor Advertisement

9.2.5 Government

9.2.5.1 Indoor Advertisement

9.2.5.2 Outdoor Advertisement

9.3 Infrastructural

9.3.1 Transportation

9.3.1.1 Indoor Advertisement

9.3.1.2 Outdoor Advertisement

9.3.2 Entertainment

9.3.2.1 Indoor Advertisement

9.3.2.2 Outdoor Advertisement

9.4 Institutional

9.4.1 Banking

9.4.1.1 Indoor Advertisement

9.4.1.2 Outdoor Advertisement

9.4.2 Education

9.4.2.1 Indoor Advertisement

9.4.2.2 Outdoor Advertisement

9.5 Industrial

9.5.1 Indoor Advertisement

9.5.2 Outdoor Advertisement

9.6 Other Applications

9.6.1 Indoor Advertisement

9.6.2 Outdoor Advertisement

10 Digital Signage Software and Services Market, By Geography (Page No. - 87)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia Pacific (APAC)

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Australia

10.4.6 Rest of APAC

10.5 Rest of the World (RoW)

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 117)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Strategic Benchmarking

11.3.1 Major Strategies Adopted By the Key Players

11.4 Vendor Dive Overview

11.4.1 Vanguards

11.4.2 Dynamic

11.4.3 Innovator

11.4.4 Emerging

11.5 Competitive Benchmarking

11.5.1 Business Strategies Adopted By Major Players in the Digital Signage Software and Services Market (25 Companies)

11.5.2 Analysis of the Product Portfolio of Major Players in the Software and Services Market (25 Companies)

*Top 25 Companies Analyzed for This Study are - Scala Inc. (US), Signagelive (UK), NEC Display Solutions Ltd. (Japan), Broadsign International LLC (Canada), Omnivex Corporation (Canada), Panasonic Corporation (Japan), Planar Systems Inc. (US), Mvix, Inc. (US), Navori (Switzerland), Cisco Systems, Inc. (US), Sharp Corporation (Japan), Samsung Electronics Co. Ltd. (South Korea), Novisign Digital Signage Inc. (Israel), Four Winds Interactive (US), Adflow Networks (Canada), Intuilab Sa (France), Rise Vision (Canada), Acquire Digital (US), Visix, Inc. (US), Xtreme Media Pvt. Ltd. (India), Onelan Limited (UK), Dise International Ab (Sweden), Truknox Technologies Pvt. Ltd. (India), Ycd Multimedia (US), L Squared (Canada).

11.6 Competitive Situation and Trends

11.6.1 Contracts

11.6.2 Partnerships, Collaborations, and Joint Ventures

11.6.3 Product Launches and Patent

11.6.4 Mergers and Acquisitions

12 Company Profiles (Page No. - 130)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

12.1 Introduction

12.2 Scala Inc.

12.3 Signagelive

12.4 Broadsign International LLC

12.5 Omnivex Corporation

12.6 Navori

12.7 Planar Systems Inc.

12.8 Intuilab Sa

12.9 Mvix, Inc.

12.10 Novisign Digital Signage Inc.

12.11 Four Winds Interactive (Fwi)

12.12 Rise Vision

12.13 Panasonic Corporation

12.14 NEC Display Solutions Ltd.

12.15 Adflow Networks

12.16 Samsung Electronics Co. Ltd.

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 169)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (68 Tables)

Table 1 Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 2 Software Market Size, By Type, 2014–2023 (USD Billion)

Table 3 Digital Signage Services Market Size, By Type, 2014–2023 (USD Billion)

Table 4 Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 5 Software Market Size, By Type, 2014–2023 (USD Billion)

Table 6 Digital Signage Software Market Size, By Application, 2014–2023 (USD Million)

Table 7 Software Market Size, By Commercial Application, 2014–2023 (USD Million)

Table 8 Digital Signage Software Market Size, By Infrastructural Application, 2014–2023 (USD Million)

Table 9 Software Market Size, By Institutional Application, 2014–2023 (USD Million)

Table 10 Digital Signage Services Market Size, By Type, 2014–2023 (USD Billion)

Table 11 Digital Signage Services Market Size, By Application, 2014–2023 (USD Million)

Table 12 Digital Signage Services Market Size, By Commercial Application, 2014–2023 (USD Million)

Table 13 Digital Signage Services Market Size, By Infrastructural Application, 2014–2023 (USD Million)

Table 14 Digital Signage Services Market Size, By Institutional Application, 2014–2023 (USD Million)

Table 15 Digital Signage Installation Services Market Size, By Application, 2014–2023 (USD Million)

Table 16 Digital Signage Installation Services Market Size, By Commercial Application, 2014–2023 (USD Million)

Table 17 Digital Signage Installation Services Market Size, By Infrastructural Application, 2014–2023 (USD Million)

Table 18 Digital Signage Installation Services Market Size, By Institutional Application, 2014–2023 (USD Million)

Table 19 Digital Signage Maintenance and Support Services Market Size, By Application, 2014–2023 (USD Million)

Table 20 Digital Signage Maintenance and Support Services Market Size, By Commercial Application, 2014–2023 (USD Million)

Table 21 Digital Signage Maintenance and Support Services Market Size, By Infrastructural Application, 2014–2023 (USD Million)

Table 22 Digital Signage Maintenance and Support Services Market Size, By Institutional Application, 2014–2023 (USD Million)

Table 23 Digital Signage Other Services Market Size, By Application, 2014–2023 (USD Million)

Table 24 Digital Signage Other Services Market Size, By Commercial Application, 2014–2023 (USD Million)

Table 25 Digital Signage Other Services Market Size, By Infrastructural Application, 2014–2023 (USD Million)

Table 26 Digital Signage Other Services Market Size, By Institutional Application, 2014–2023 (USD Million)

Table 27 Digital Signage Software and Services Market Size, By Application, 2014–2023 (USD Billion)

Table 28 Digital Signage Services Market in Commercial Application, By Type of Services, 2014–2023 (USD Million)

Table 29 Digital Signage Services Market in Retail Application, By Type of Services, 2014–2023 (USD Million)

Table 30 Digital Signage Services Market in Corporate Application, By Type of Services, 2014–2023 (USD Million)

Table 31 Digital Signage Services Market in Healthcare Application, By Type of Services, 2014–2023 (USD Million)

Table 32 Digital Signage Services Market in Hospitality Application, By Type of Services, 2014–2023 (USD Million)

Table 33 Digital Signage Services Market in Government Application, By Type of Services, 2014–2023 (USD Million)

Table 34 Digital Signage Services Market in Infrastructural Application, By Type of Services, 2014–2023 (USD Million)

Table 35 Digital Signage Services Market in Transportation Application, By Type of Services, 2014–2023 (USD Million)

Table 36 Digital Signage Services Market in Entertainment Application, By Type of Services, 2014–2023 (USD Million)

Table 37 Digital Signage Services Market in Institutional Application, By Type of Services, 2014–2023 (USD Million)

Table 38 Digital Signage Services Market in Banking Application, By Type of Services, 2014–2023 (USD Million)

Table 39 Digital Signage Services Market in Education Application, By Type of Services, 2014–2023 (USD Million)

Table 40 Digital Signage Services Market in Industrial Application, By Type of Services, 2014–2023 (USD Million)

Table 41 Digital Signage Services Market in Other Applications, By Type of Services, 2014–2023 (USD Million)

Table 42 Digital Signage Software and Services Market Size, By Region, 2014–2023 (USD Billion)

Table 43 Digital Signage Software Market Size, By Region, 2014–2023 (USD Billion)

Table 44 Digital Signage Services Market Size, By Region, 2014–2023 (USD Billion)

Table 45 North America Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 46 North America Digital Signage Software Market Size, By Country, 2014–2023 (USD Million)

Table 47 North America Digital Signage Services Market Size, By Country, 2014–2023 (USD Million)

Table 48 US Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 49 Europe Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 50 Europe Digital Signage Software Market Size, By Country, 2014–2023 (USD Million)

Table 51 Europe Digital Signage Services Market Size, By Country, 2014–2023 (USD Million)

Table 52 UK Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 53 Germany Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 54 France Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 55 APAC Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 56 APAC Digital Signage Software Market Size, By Country, 2014–2023 (USD Million)

Table 57 APAC Digital Signage Services Market Size, By Country, 2014–2023 (USD Million)

Table 58 China Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 59 Japan Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 60 South Korea Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 61 RoW Digital Signage Software and Services Market Size, By Offering, 2014–2023 (USD Billion)

Table 62 RoW Signage Software Market Size, By Region, 2014–2023 (USD Million)

Table 63 RoW Signage Services Market Size, By Region, 2014–2023 (USD Million)

Table 64 Market Ranking of the Top 5 Players in the Digital Signage Software and Services Market, 2016

Table 65 Contract, 2014–2017

Table 66 Partnerships, Collaborations, and Joint Venture, 2015–2017

Table 67 Product Launches, 2014–2017

Table 68 Mergers and Acquisitions, 2015–2017

List of Figures (58 Figures)

Figure 1 Research Design

Figure 2 Process Flow of Market Size Estimation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulations

Figure 6 Digital Signage Software and Services Market, By Offering, 2017 vs 2023 (USD Billion)

Figure 7 Digital Signage Software and Services Market Expected to Exhibit High Growth Between 2017 and 2023

Figure 8 Software Held A Larger Size of the Digital Signage Software and Services Market in 2016

Figure 9 Market for Content Management System Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 10 Installation Services Expected to Hold the Largest Size of the Market Between 2017 and 2023

Figure 11 Digital Signage Software and Services Market in APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Digital Signage Software and Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 13 Value Chain Analysis: Major Value Added During R&D and Product Development

Figure 14 Software Offerings: Digital Signage Software and Services Market

Figure 15 Digital Signage Software and Services Market, By Offering, 2017 vs 2023 (USD Billion)

Figure 16 Digital Signage Software Market, By Type, 2017 vs 2023 (USD Billion)

Figure 17 Edge Server Software

Figure 18 Processing of Edge Server Software

Figure 19 Functions of Content Management Software

Figure 20 Processes Involved in Distribution & Scheduling Software

Figure 21 Digital Signage Software Market, By Application, 2017 vs 2023 (USD Million)

Figure 22 Software Market, By Commercial Application, 2017 vs 2023 (USD Million)

Figure 23 Software Market, By Infrastructural Application, 2017 vs 2023 (USD Million)

Figure 24 Digital Signage Software Market, By Institutional Application, 2017 vs 2023 (USD Million)

Figure 25 Digital Signage Services Market, By Type

Figure 26 Digital Signage Services Market, By Type, 2017 vs 2023 (USD Billion)

Figure 27 Digital Signage Services Market, By Application, 2017 vs 2023 (USD Million)

Figure 28 Digital Signage Services Market, By Commercial Application, 2017 vs 2023 (USD Million)

Figure 29 Digital Signage Services Market, By Infrastructural Application, 2017 vs 2023 (USD Million)

Figure 30 Digital Signage Services Market, By Institutional Application, 2017 vs 2023 (USD Million)

Figure 31 Digital Signage Market, By Application

Figure 32 Digital Signage Software and Services Market, By Application, 2017 vs 2023 (USD Billion)

Figure 33 Use of Digital Signage Systems in the Retail Sector

Figure 34 Benefits of Digital Signage in the Government Sector

Figure 35 Digital Signage Software and Services Market, By Geography

Figure 36 Software and Services Market, By Region, 2017 vs 2023 (USD Billion)

Figure 37 Digital Signage Software Market, By Region, 2017 vs 2023 (USD Billion)

Figure 38 Digital Signage Services Market, By Region, 2017 vs 2023 (USD Billion)

Figure 39 U.S. Held A Major Share of the North American Digital Signage Software Market in 2016

Figure 40 North America Digital Signage Software and Services Market, By Offering, 2017 vs 2023 (USD Billion)

Figure 41 North America Digital Signage Software Market, By Country, 2017 vs 2023 (USD Million)

Figure 42 North America Digital Signage Services Market, By Country, 2017 vs 2023 (USD Million)

Figure 43 Europe Digital Signage Software and Services Market, By Offering, 2017 vs 2023 (USD Billion)

Figure 44 Europe Digital Signage Software Market, By Country, 2017 vs 2023 (USD Million)

Figure 45 Europe Digital Signage Services Market, By Country, 2017 vs 2023 (USD Million)

Figure 46 Snapshot of the Digital Signage Software Market in APAC

Figure 47 APAC Software and Services Market, By Offering, 2017 vs 2023 (USD Billion)

Figure 48 APAC Software Market, By Country, 2017 vs 2023 (USD Million)

Figure 49 APAC Digital Signage Services Market, By Country, 2017 vs 2023 (USD Million)

Figure 50 RoW Software and Services Market, By Offering, 2017 vs 2023 (USD Billion)

Figure 51 RoW Software Market, By Region, 2017 vs 2023 (USD Million)

Figure 52 RoW Digital Signage Services Market, By Country, 2017 vs 2023 (USD Million)

Figure 53 Companies Adopted Product Launches as the Key Growth Strategy Between 2014 and 2017

Figure 54 Contracts & Patent, Partnership, Joint Venture, & Collaboration, and New Product Launches Were the Major Strategies Adopted By Industry Players

Figure 55 Dive Chart

Figure 56 Battle for Market Share: Contracts and Patent, Partnership, Joint Venture, & Collaboration, and New Product Launches are the Key Strategies Adopted By Companies Between 2014 and 2017

Figure 57 Panasonic Corporation: Company Snapshot

Figure 58 Samsung Electronics Co. Ltd.: Company Snapshot

Research Methodology

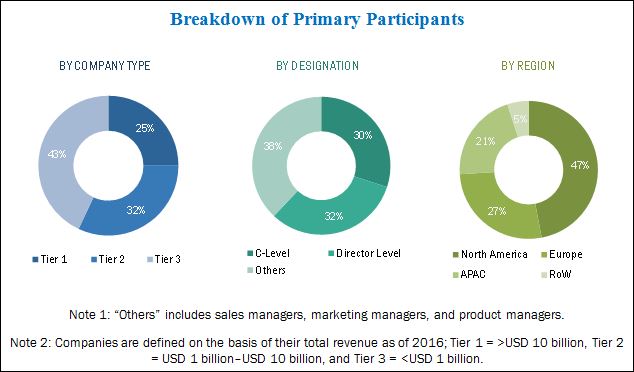

This research incorporates the usage of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the extensive technical, market-oriented, and commercial study of the digital signage software market. Primary sources mainly comprise several industry experts from core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, standards, and certification organizations related to various parts of this industry’s value chain. In-depth interviews with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of key players, and industry consultants have been conducted to obtain and verify critical qualitative and quantitative information as well as assess prospects. The breakdown of the profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The digital signage software market is dominated by Signagelive (UK), Scala Inc. (US), Broadsign International LLC (Canada), Omnivex Corporation (Canada), and Navori (Switzerland). The other players in this market, include IntuiLab SA (France), Mvix, Inc.(US), NoviSign Digital Signage Inc.(Israel), Four Winds Interactive (US), Rise Vision (Canada), Planar Systems Inc.(US), NEC Display Solutions Ltd (Japan), Panasonic Corporation (Japan), Sharp Corporation (Japan), and Samsung Electronics Co. Ltd. (South Korea).

Target Audience

- Software developers

- Electronic design automation (EDA) and design tool vendors

- Software companies providing solutions in various industries that comprise digital signage manufacturers and suppliers of displays

- Digital signage services provider companies

- Manufacturers and suppliers of media players, mounts, and other accessories

- Asset management consultants who specialize in physical asset management

- Research institutes and organizations

- Associations and regulatory authorities related to plant maintenance

- Government bodies, venture capitalists, and private equity firms

Research Scope

The research report segments the digital signage software market into the following submarkets:

Digital Signage Software Market, by Type

- Edge Server Software

- Content Management System

- Others

Digital Signage Services Market, by Type

- Installation Services

- Maintenance and Support Services

- Others

Digital Signage Software and Services Market, by Application

-

Commercial

-

- Retail

- Corporate

- Healthcare

- Hospitality

- Government

-

-

Infrastructural

-

- Transportation

- Entertainment

-

-

Infrastructural

-

- Banking

- Education

-

- Industrial

- Other Applications

Key Player Strategies

- Signagelive collaborated with Brightsign, LLC (US) to design support solution for their digital signage media player. Signagelive has developed a HTML5-based solution with web trigger support for this media player.

- Signagelive entered into a partnership with Phillips Professional Display Solutions (Netherlands) to offer solutions for Android-based system on SoC Philips displays.

- Scala was selected by Formula Kino (Russia), one of the leading cinema chains, to install digital signage solution in the existing 460 screens. Scala solutions enable users to automate functions.

- Scala partnered British Telecommunications Plc (BT) (UK) to provide digital solutions globally. The partnership is likely to offer customized solutions for various industry sectors.

- Laysa Digital LLC (Russia) selected BroadSign to provide automated DOOH software for its transit network in Russia.

- BroadSign received a contract from Mediaperformances SA (France) to provide DOOH advertising solutions to retail networks.

- The San Francisco International Airport (SFO), one of the largest in the US, chose Omnivex Moxie to create an interactive wayfinding tool.

Key Questions

- Which are the top use cases/applications/verticals of digital signage software market to invest in and what are the untapped opportunities?

- Who are the major current and potential competitors in the market and what are their top priorities, strategies, and developments?

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Competitive Landscape

- Detailed analysis and profiling of additional market players

- Detailed analysis and profiling of key players (display solution providers, software/platform developers, and DOOH service provider) in digital signage supply chain

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Industry-Specific Data

- Detailed analysis of specific industries and respective use cases or applications in digital signage software market

- Opportunities for payers in digital signage software market w.r.t. investments in retail spaces, sports stadiums, transportation & airports, education reform, and healthcare in different countries

- Opportunities from emerging trends such as smart store/retail, smart mirror, smart stadium, and IoT in healthcare

Growth opportunities and latent adjacency in Digital Signage Software Market