Driving Simulator Market by Application (Training and Research & Testing), Vehicle Type(Car Simulator and Truck & Bus Simulator), Simulator Type(Training Simulator and Advanced Driving Simulator), Training Simulator Type(Compact Simulator and Full-Scale Simulator), End User, Region - Global Forecast to 2025

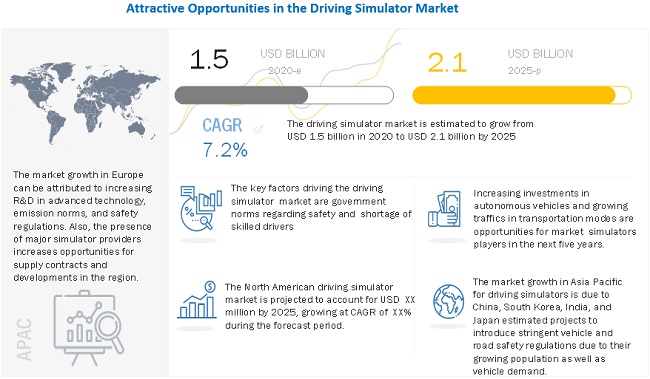

The global Driving Simulator Market was valued at USD 1.5 billion in 2020 and is expected to reach USD 2.1 billion by 2025, growing at a CAGR of 7.2% during the forecast period.

Increasing demand for skilled drivers due to high road accident rates, growing air traffic, upcoming high-speed train projects, and significant R&D investments in autonomous vehicles are primarily driving the demand for driving simulators. The market has witnessed growth in developing as well as developed countries.

Today industries, including railways, aviation, automotive, marine, and defense, are facing a shortage of skilled drivers. As more than 90% of all accidents are caused by human errors, a driving simulator is a much-needed development. The driving simulator is a technology that trains the driver to avoid collisions from all directions with the help of a virtual environment. Thus, globally the requirement of driving simulators is gaining fast pace, boosting the growth of the overall driving simulator market for driving simulators.

To know about the assumptions considered for the study, Request for Free Sample Report

Driving Simulator Market Dynamics:

Driver: Shortage of skilled drivers

Today industries, including railways, aviation, automotive, marine, and defense, are facing a shortage of skilled drivers. As more than 90% of all accidents are caused by human errors, driving simulator is a much-needed development. The driving simulator is a technology that trains the driver to avoid collisions from all directions with the help of a virtual environment. The system accomplishes this function through a 360-degree view and a motion platform providing up to 9 degrees of freedom. This system helps the driver in managing the situation in a controlled manner. Thus, a driving simulator is more efficient and improves safety to a great extent. For instance, the ECA Group has included driving training simulation system for commercial truck driving, which is its most advanced training solution for students and corporate drivers. The company has a wide-angle for technologically advanced professional driving training simulators like next-generation Truck Driving Simulator for truck fleets and training schools.

Restraint: Complexities in real time control

The driving simulator is a model based on physics and statistics to develop a system or a process that undergoes various levels of tests. The virtual model is a computerized, controlled environment, while the physical world is an uncontrolled environment. The virtual world developed using the simulation and analysis technology has repetitive capabilities of formal and limited processes. Due to complexities between the virtual and the real physical world, products and solutions innovated and implemented using simulation and analysis technology need to be updated and improved as per the requirements of the real physical world.

Opportunity: Simulators for police and emergency vehicles

Driving simulators designed for categories requiring specific needs in terms of driving training simulation are customized with advanced technologies like 3D visualization and 360-degree view. Professional simulators for defense, police, and ambulance are fulfilling urgent and skillful training of police, military personnel, firefighters, and ambulance drivers. These simulators ensure training solutions for crew and vehicle safety, mission stress, speed, obstacles, traffic hazards, and road users to increase the proficiency of emergency response from drivers and riders. The recognition of these simulators is gaining pace steadily worldwide. For instance, in December 2020, the Royal Oman Police (ROP) selected Tecknotrove’s TecknoSIM driving simulators for improving road safety and reduce road accidents in Oman. TecknoSIM driving simulators will be customized to incorporate road rules and regulations, as seen in Oman. These driving simulators will be deployed across 11 driver training and testing centers in Oman by early 2021. Similarly, VirTra, Inc., a global provider of training simulators for the law enforcement, military, educational and commercial markets, was awarded an indefinite delivery/indefinite quantity (IDIQ) contract from the Department of State for the Republic of Mexico in April 2020. The contract was valued at USD 1.6 million. VirTra Driver Training Systems (V-DTS) will be supplied to numerous state police academies and correctional facilities in Mexico.

Challenge: Lack of benchmarks and standards

The major challenge for the driving simulator market is the lack of standards and benchmarks to develop and implement a simulation-based virtual environment. Driving simulators address the known problems identified during implementation. In most cases, it is found that simulation enables users to design, develop, and validate the basic processes of R&D. Furthermore, the parameters for verification and validation of developed prototypes are different from vendor to vendor. Vendors of driving simulators do not have assumptions, standards, or benchmarks to understand how simulation should be integrated with an application to solve system and process-related issues. There is a growing need to decide the standards for driving simulators.

To know about the assumptions considered for the study, download the pdf brochure

The car simulator segment is expected to be the largest vehicle type market

Car simulators consist of real car parts positioned in an ergonomically correct position in the driving simulator cabin. The view screen is placed exactly in front of the driver. The view screen for car simulators varies from 120 to 180 degrees, depending on the application. The high-resolution system generates a 1920 x 1080 pixels front display. To create a better simulation effect, the systems are supported with an HD sound system along with 3D and Doppler Effect. To enhance the real-world driving experience, graphic boards like Nvidia GTX are installed in car simulators. The software used in car simulators keeps track of all driving parameters. Various types of road surfaces can be simulated, including city, rural, mountains, highways, expressways, and off-roads. In dynamic simulators, the motion and vibrations are provided with the help of compact 3-axis platforms with electric actuators. This system provides engine vibration and road texture feedback as a function of the car speed and road surface. Companies like ECA Group offer a range of advanced vehicle simulators, one of which includes training systems for cars. It has a series of educational modules developed under professional guidance.

The advanced training simulator segment in end user will be leading the driving simulator market during the forecast period

The advanced driving simulator segment is expected to capture the largest market share during the forecast period. This can be attributed due to its technologies, such as 360º viewing angle and motion platform, for a realistic experience. Since testing of technologically updated vehicle dynamics requires an augmented environment for analysis and research, advanced driving simulators help in developing intelligent highway designs and human behavior studies. For instance, in 2017, the National Advanced Driving Simulator (NADS) at the University of Iowa conducted a study of automated driving as a part of the SAFER-SIM University Transportation Center research project. Today, the center is known for promoting interdisciplinary research using simulation techniques to handle safety issues prioritized by the US DoT.

The Asia Pacific driving simulator market is projected to be the fastest by 2025

Improving lifestyles, rising number of metro cities and steadily growing population have played a vital role in increasing the production and sales of passenger cars in Asia Pacific. Safety regulations are present in a few Asia Pacific countries, such as Japan and South Korea, and demand in these countries is anticipated to be on the rise for the next five years. China, South Korea, India, and Japan are expected to introduce stringent vehicle and road safety regulations due to their growing population as well as vehicle demand. Factors such as limited infrastructure and increasing number of accidents are likely to trigger the demand for skilled drivers, which will lead to demand for training simulators.

Key Market Players

The global driving simulator market is dominated by major players Cruden B.V. (Netherlands), Cassidian (Germany), ECA Group (France), Tecknotrove Simulator System Pvt. Ltd (India), and Adacel Technologies (Australia). The key strategies adopted by these companies to sustain their market position are new product developments, partnerships, expanisons, collaborations, acquisitions, and contracts & agreements.

Scope of the Report

|

Report Attributes |

Details |

|

Market size: |

USD 1.5 billion in 2020 to USD 2.1 billion by 2025 |

|

Growth Rate: |

7.2% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2020-2025 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Simulator Type, Vehicle Type, Application, Training Simulator Type, End User, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, and Rest of the World |

|

Report Highlights: |

The report covers company profiling and mapping, of 25 key suppliers and small & medium enterprises |

|

Key Market Opportunities: |

Simulators for police and emergency vehicles |

|

Key Market Drivers: |

Shortage of skilled drivers |

This research report categorizes the driving simulator market based on vehicle type, simulator type, training driving simulator type, end user, application, and region.

Based on the vehicle type:

- Car Simulator

- Truck & Bus Simulator

Based on the simulator type:

- Advanced Driving Simulator

- Training Driving Simulator

Based on the training driving simulator :

- Compact Simulator

- Full-Scale Simulator

Based on the application:

- Reseach & Testing

- Training

Based on the end user:

- Advanced Driving Simulator

- Training Driving Simulator

- Professional Training Simulator

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Rest of Europe

-

Rest of the World

- Brazil

- Iran

- Others

Frequently Asked Questions (FAQ):

What is the current size of the global driving simulator market?

The global driving simulator market is estimated to be USD 1.5 billion in 2020 and projected to reach USD 2.1 billion by 2025, at a CAGR of 7.2%

Who are the winners in the global driving simulator market?

Cruden B.V. (Netherlands), Cassidian (Germany), ECA Group (France), Tecknotrove Simulator System Pvt. Ltd (India), and Adacel Technologies (Australia) are the leadrers of driving simulator market. The key strategies adopted by these companies to sustain their market position are new product developments, partnerships, expanisons, collaborations, acquisitions, and contracts & agreement.

Who are the different types of end users for driving simulators ?

Driving simulators by end user are usually segmented into driving training simulator, advanced driving simulator, and professional training simulator. The driving end user varies based on functionality and application.

What are the different training driving simulator types considered in the driving simulator market?

The driving training simulator market has been segmented by training simulator type into compact simulator and full-scale simulator. Compact simulators are expected to dominate the market due to their use in wide-scale applications in cars, motorbikes, trucks, and buses. Moreover, compact simulators are more suitable than full-scale due to their realistic driving interface and a large vision field at a low cost. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR DRIVING SIMULATOR MARKET

1.3 MARKET SCOPE

FIGURE 1 DRIVING SIMULATOR MARKET: MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR DRIVING SIMULATOR MARKET: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET FOR PROFESSIONAL TRAINING: TOP-DOWN APPROACH

FIGURE 8 MARKET FOR PROFESSIONAL TRAINING: RESEARCH DESIGN & METHODOLOGY

FIGURE 9 MARKET FOR PROFESSIONAL TRAINING: RESEARCH METHODOLOGY ILLUSTRATION OF ADACEL REVENUE ESTIMATION

2.2.2 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.3 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 11 DRIVING SIMULATOR FOR PROFESSIONAL TRAINING: MARKET OUTLOOK

FIGURE 12 DRIVING SIMULATOR: MARKET OUTLOOK

FIGURE 13 DRIVING SIMULATOR MARKET: MARKET DYNAMICS

FIGURE 14 MARKET, BY PROFESSIONAL TRAINING APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 15 MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

3.1 COVID-19 IMPACT ON MARKET FOR PROFESSIONAL TRAINING

3.2 COVID-19 IMPACT ON MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 DRIVING SIMULATOR MARKET TO GROW AT A SIGNIFICANT RATE DURING THE FORECAST PERIOD (2020–2025)

FIGURE 16 INCREASING DEMAND FOR SKILLED DRIVERS AND SAFETY NORMS IN VEHICLES LIKELY TO BOOST MARKET GROWTH

4.2 MARKET FOR PROFESSIONAL TRAINING TO GROW AT A SIGNIFICANT RATE DURING THE FORECAST PERIOD (2020–2025)

FIGURE 17 INCREASING DEMAND FOR SKILLED DRIVERS AND SAFETY NORMS IN VEHICLES LIKELY TO BOOST MARKET GROWTH

4.3 EUROPE IS ESTIMATED TO LEAD THE MARKET IN 2020

FIGURE 18 MARKET SHARE, BY REGION, 2020

4.4 GLOBAL DRIVING SIMULATOR MARKET, BY VEHICLE TYPE AND SIMULATOR TYPE

FIGURE 19 CAR SIMULATOR AND ADVANCED DRIVING SIMULATOR ACCOUNT FOR LARGEST SHARES IN 2020

4.5 MARKET, BY END USER

FIGURE 20 ADVANCED DRIVING SIMULATOR ESTIMATED TO HOLD LARGEST SHARE, 2020 VS. 2025 (USD MILLION)

4.6 MARKET, BY TRAINING DRIVING SIMULATOR

FIGURE 21 COMPACT SIMULATOR EXPECTED TO HOLD LARGEST SHARE, 2020 VS. 2025 (USD MILLION)

4.7 DRIVING SIMULATOR MARKET, BY VEHICLE TYPE

FIGURE 22 CAR SIMULATOR EXPECTED TO HOLD LARGEST SHARE, 2020 VS. 2025 (USD MILLION)

4.8 MARKET, BY APPLICATION TYPE

FIGURE 23 RESEARCH & TESTING ESTIMATED TO HOLD LARGEST MARKET, 2020 VS. 2025 (USD MILLION)

4.9 MARKET FOR PROFESSIONAL TRAINING, BY APPLICATION

FIGURE 24 TRUCK ESTIMATED TO HOLD LARGEST MARKET, 2020 VS. 2025 (USD MILLION)

4.10 MARKET FOR PROFESSIONAL TRAINING, BY REGION

FIGURE 25 EUROPE ESTIMATED TO HOLD LARGEST MARKET, 2020 VS. 2025 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 DRIVING SIMULATOR MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Shortage of skilled drivers

FIGURE 27 DRIVING SIMULATOR: SCENARIO BASED TRAINING (SBT) DEVELOPMENT CYCLE

5.2.1.2 Professional training requirement for new locomotive pilots

TABLE 2 GLOBAL RAIL PROJECTS TO WATCH IN FUTURE

5.2.1.3 Increasing focus on R&D

TABLE 3 EUROPE: ANNUAL NUMBER OF ROAD ACCIDENT FATALITIES, BY COUNTRY (2012-2016)

FIGURE 28 EUROPE: ROAD ACCIDENT FATALITIES, BY TRANSPORT MODE (2017)

FIGURE 29 EUROPE: ROAD ACCIDENT FATALITIES PER MILLION HABITANTS, BY COUNTRY (2018)

5.2.2 RESTRAINTS

5.2.2.1 Complexities in real-time control

5.2.3 OPPORTUNITIES

5.2.3.1 Growing air traffic and airport projects worldwide

TABLE 4 AIRPORT CONSTRUCTION INVESTMENT SUMMARY: CURRENT AND PREDICTED GLOBAL AIRPORT INVESTMENTS (USD MILLION)

TABLE 5 CURRENT AND PREDICTED GLOBAL AIRPORT IMPROVEMENT INVESTMENTS (USD MILLIONS)

5.2.3.2 Simulators for police and emergency vehicles

5.2.3.3 Increasing developments in autonomous and semi-autonomous vehicles

FIGURE 30 EVOLUTION OF AUTONOMOUS VEHICLES

5.2.4 CHALLENGES

5.2.4.1 Integration complexities

5.2.4.2 Lack of benchmarks and standards

TABLE 6 IMPACT OF MARKET DYNAMICS

5.3 REVENUE SHIFT DRIVING MARKET GROWTH

5.4 REVENUE MISSED: OPPORTUNITIES FOR DRIVING SIMULATOR PROVIDERS FOR PROFESSIONAL TRAINING

5.5 PORTER’S FIVE FORCES

FIGURE 31 PORTER’S FIVE FORCES: DRIVING SIMULATOR MARKET

5.6 TECHNOLOGY ANALYSIS

5.6.1 INTRODUCTION

5.6.2 HMI (HUMAN-MACHINE INTERFACE)

5.6.3 AI FOR DRIVING SIMULATOR

5.6.4 ADAS (ADVANCED DRIVER ASSISTANCE SYSTEM)

5.7 EMERGING TREND: VR SIMULATOR

5.7.1 VIRTUAL REALITY (VR) SIMULATOR

5.8 TRAINING SIMULATORS TECHNOLOGY FOR ECO-DRIVING

5.9 OPEN SOURCE SOFTWARE FOR AUTONOMOUS VEHICLES

5.9.1 APOLLO

5.9.2 AUTOWARE

5.9.3 EB ROBINOS & EB ROBINOS PREDICTORS - ELEKTROBIT

5.9.4 NVIDIA DRIVEWORKS

5.9.5 OPENPILOT

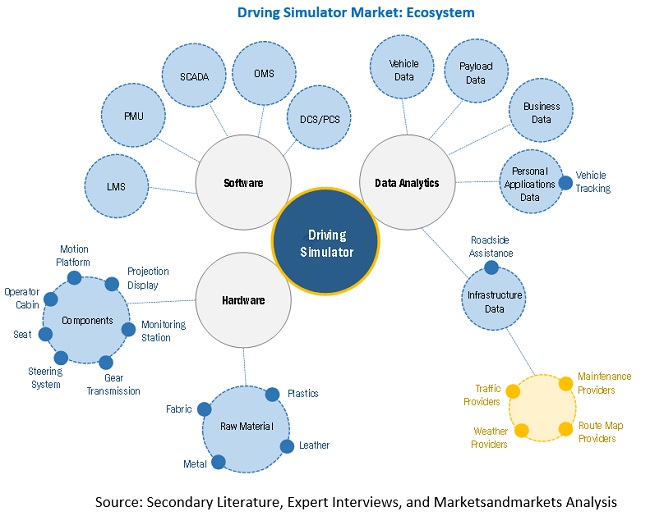

5.10 ECOSYSTEM ANALYSIS

FIGURE 32 DRIVING SIMULATOR MARKET: ECOSYSTEM ANALYSIS

5.11 PRICING ANALYSIS

TABLE 7 MARKET FOR PROFESSIONAL TRAINING: AVERAGE PRICE OF DRIVING SIMULATOR

5.12 SUPPLY CHAIN ANALYSIS

FIGURE 33 MARKET: VALUE CHAIN ANALYSIS

5.13 PATENT ANALYSIS

TABLE 8 IMPORTANT PATENT REGISTRATIONS RELATED TO MARKET

5.14 CASE STUDY ANALYSIS

5.14.1 MAP GENERATION METHOD FOR AUTOMATIC DRIVING SIMULATOR

FIGURE 34 GENERATION OF TRAJECTORIES USING MODEL PREDICTIVE CONTROL

5.14.2 SIEMENS AG

5.14.3 ADVANCED TRAIN LOCATION SIMULATOR (ATLAS)

5.15 DRIVING SIMULATOR MARKET, SCENARIOS (2020–2025)

FIGURE 35 MARKET– FUTURE TRENDS & SCENARIO, 2020–2025 (USD MILLION)

5.15.1 MOST LIKELY SCENARIO

TABLE 9 MARKET: MOST LIKELY SCENARIO, BY REGION, 2020–2025 (USD MILLION)

5.15.2 OPTIMISTIC SCENARIO

TABLE 10 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2020–2025 (USD MILLION)

5.15.3 PESSIMISTIC SCENARIO

TABLE 11 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2020–2025 (USD MILLION)

5.16 MARKET FOR PROFESSIONAL TRAINING, SCENARIOS (2020–2025)

FIGURE 36 MARKET FOR PROFESSIONAL TRAINING– FUTURE TRENDS & SCENARIO, 2020–2025 (USD MILLION)

5.16.1 MOST LIKELY SCENARIO

TABLE 12 MARKET FOR PROFESSIONAL TRAINING: MOST LIKELY SCENARIO, BY REGION, 2020–2025 (USD MILLION)

5.16.2 OPTIMISTIC SCENARIO

TABLE 13 MARKET FOR PROFESSIONAL TRAINING: PTIMISTIC SCENARIO, BY REGION, 2020–2025 (USD MILLION)

5.16.3 PESSIMISTIC SCENARIO

TABLE 14 MARKET FOR PROFESSIONAL TRAINING: PESSIMISTIC SCENARIO, BY REGION, 2020–2025 (USD MILLION)

6 COVID – 19 IMPACT (Page No. - 79)

6.1 IMPACT ON DRIVING SIMULATOR MARKET

6.2 IMPACT ON GLOBAL RAIL INDUSTRY

6.3 IMPACT ON GLOBAL MARKET FOR PROFESSIONAL TRAINING

7 DRIVING SIMULATOR MARKET FOR PROFESSIONAL TRAINING, BY APPLICATION (Page No. - 81)

7.1 INTRODUCTION

FIGURE 37 MARKET FOR PROFESSIONAL TRAINING, BY APPLICATION, 2020 VS. 2025 (USD THOUSAND)

TABLE 15 MARKET FOR PROFESSIONAL TRAINING, BY APPLICATION, 2019–2025 (UNITS)

TABLE 16 MARKET FOR PROFESSIONAL TRAINING, BY APPLICATION, 2019–2025 (USD THOUSAND)

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

TABLE 17 ASSUMPTIONS: BY PROFESSIONAL TRAINING APPLICATION

7.1.3 KEY PRIMARY INSIGHTS

FIGURE 38 KEY PRIMARY INSIGHTS

7.2 RAIL

7.2.1 UNDERGOING PROJECTS FOR HIGH-SPEED TRAINS WILL BOOST DEMAND

TABLE 18 TRAIN SIMULATORS DEVELOPMENTS AND CONTRACTS FOR TRAINING PURPOSES

TABLE 19 RAIL: MARKET FOR PROFESSIONAL TRAINING, BY RAIL TYPE, 2019–2025 (UNITS)

TABLE 20 RAIL: MARKET FOR PROFESSIONAL TRAINING, BY RAIL TYPE, 2019–2025 (USD THOUSAND)

7.2.2 PASSENGER TRAIN

7.2.3 FREIGHT

7.2.4 METRO

TABLE 21 LIST OF OPERATIONAL & UNDER CONSTRUCTION METRO PROJECTS IN INDIA

TABLE 22 LIST OF APPROVED METRO PROJECTS IN INDIA

7.2.5 MONORAIL & TRAM

7.3 BUS

7.3.1 INCREASING RATE OF ROAD ACCIDENTS WILL DRIVE SAFE DRIVING SIMULATION TRAINING FOR BUSES

TABLE 23 BUS: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (UNITS)

TABLE 24 BUS: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (USD THOUSAND)

7.4 CAR

7.4.1 REALISTIC INTERPRETATION OF ACTUAL DRIVING CONDITIONS IS MAJOR ADVANTAGE OF CAR SIMULATORS

TABLE 25 CAR: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (UNITS)

TABLE 26 CAR: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (USD THOUSAND)

7.5 TRUCK

7.5.1 PORTABILITY AND EFFECTIVENESS OF TRUCK SIMULATORS WILL DRIVE THE MARKET

TABLE 27 TRUCK: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (UNITS)

TABLE 28 TRUCK: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (USD THOUSAND)

7.6 POLICE

7.6.1 INTRODUCTION OF ADVANCED TACTICAL TRAINING SYSTEMS TO DRIVE DEMAND

TABLE 29 POLICE: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (UNITS)

TABLE 30 POLICE: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (USD THOUSAND

7.7 MOTORBIKE

7.7.1 NEED FOR SAFE RIDING & RISK PREVENTION TO DRIVE DEMAND

TABLE 31 MOTORBIKE: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (UNITS)

TABLE 32 MOTORBIKE: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (USD THOUSAND)

7.8 AIRSIDE DRIVING SIMULATOR

7.8.1 NEED TP INCREASE OPERATIONAL EFFICIENCY OF AIRPORT VEHICLES TO DRIVE DEMAND

TABLE 33 AIRSIDE SIMULATORS BY DIFFERENT COMPANIES

FIGURE 39 AIRSIDE DRIVING/OPERATION SIMULATOR

TABLE 34 AIRSIDE DRIVING SIMULATOR: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (UNITS)

TABLE 35 AIRSIDE DRIVING SIMULATOR: MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2019–2025 (USD THOUSAND)

8 DRIVING SIMULATOR MARKET, BY APPLICATION (Page No. - 99)

8.1 INTRODUCTION

FIGURE 40 MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 36 MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 37 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

TABLE 38 ASSUMPTIONS: BY APPLICATION

8.1.3 KEY PRIMARY INSIGHTS

FIGURE 41 KEY PRIMARY INSIGHTS

8.2 RESEARCH & TESTING

8.2.1 EUROPE TO LEAD THE IN RESEARCH & TESTING SEGMENT

TABLE 39 RESEARCH & TESTING: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 40 RESEARCH & TESTING: MARKET, BY REGION, 2020–2025 (USD MILLION)

8.3 TRAINING

8.3.1 GROWING CONCERNS OVER ROAD ACCIDENTS TO DRIVE THE SEGMENT

TABLE 41 TRAINING: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 TRAINING: MARKET, BY REGION, 2020–2025 (USD MILLION)

9 DRIVING SIMULATOR MARKET, BY END USER (Page No. - 105)

9.1 INTRODUCTION

FIGURE 42 MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

TABLE 43 MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 44 MARKET, BY END USER, 2020–2025 (USD MILLION)

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

TABLE 45 ASSUMPTIONS: BY END USER

9.1.3 KEY PRIMARY INSIGHTS

FIGURE 43 KEY PRIMARY INSIGHTS

9.2 ADVANCED DRIVING SIMULATOR

9.3 TRAINING DRIVING SIMULATOR

9.4 PROFESSIONAL TRAINING SIMULATOR

10 DRIVING SIMULATOR MARKET, BY SIMULATOR TYPE (Page No. - 110)

10.1 INTRODUCTION

FIGURE 44 MARKET, BY SIMULATOR TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 46 MARKET, BY SIMULATOR TYPE, 2017–2019 (USD MILLION)

TABLE 47 MARKET, BY SIMULATOR TYPE, 2020–2025 (USD MILLION)

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

TABLE 48 ASSUMPTIONS: BY SIMULATOR TYPE

10.1.3 KEY PRIMARY INSIGHTS

FIGURE 45 KEY PRIMARY INSIGHTS

10.2 ADVANCED DRIVING SIMULATOR

10.2.1 DIVING SIMULATORS ARE EXPECTED TO HAVE EXCEPTIONAL DEMAND FOR RESEARCH AND TESTING PURPOSES ADVANCED

TABLE 49 ADVANCED DRIVING SIMULATOR: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 50 ADVANCED DRIVING SIMULATOR: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.3 TRAINING DRIVING SIMULATOR

10.3.1 NEED TO TRAIN NEW DRIVERS FOR APPROPRIATE SKILLS EXPECTED TO DRIVE THE SEGMENT

TABLE 51 TRAINING DRIVING SIMULATOR: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 52 TRAINING DRIVING SIMULATOR: MARKET, BY REGION, 2020–2025 (USD MILLION)

11 DRIVING SIMULATOR MARKET, BY TRAINING DRIVING SIMULATOR (Page No. - 116)

11.1 INTRODUCTION

FIGURE 46 SIMULATION TOOLS

FIGURE 47 MARKET, BY TRAINING DRIVING SIMULATOR, 2020 VS. 2025 (USD MILLION)

TABLE 53 MARKET, BY TRAINING DRIVING SIMULATOR, 2017–2019 (USD MILLION)

TABLE 54 MARKET, BY TRAINING DRIVING SIMULATOR, 2020–2025 (USD MILLION)

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

TABLE 55 ASSUMPTIONS: BY TRAINING DRIVING SIMULATOR

11.1.3 KEY PRIMARY INSIGHTS

FIGURE 48 KEY PRIMARY INSIGHTS

11.2 COMPACT SIMULATOR

11.2.1 COMPACTNESS, PORTABILITY, AND LOW COAST TO DRIVE THE SEGMENT

TABLE 56 COMPACT SIMULATOR: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 57 COMPACT SIMULATOR: MARKET, BY REGION, 2020–2025 (USD MILLION)

11.3 FULL-SCALE SIMULATOR

11.3.1 FULLY INSTRUMENTED FIXED CABINS OF FULL-SCALE SIMULATORS ALLOW REALISTIC EXPERIENCE

TABLE 58 FULL-SCALE SIMULATOR: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 59 FULL-SCALE SIMULATOR: MARKET, BY REGION, 2020–2025 (USD MILLION)

12 DRIVING SIMULATOR MARKET, BY VEHICLE TYPE (Page No. - 122)

12.1 INTRODUCTION

FIGURE 49 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 60 MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 61 MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

TABLE 62 ASSUMPTIONS: BY VEHICLE TYPE

12.1.3 KEY PRIMARY INSIGHTS

FIGURE 50 KEY PRIMARY INSIGHTS

12.2 CAR SIMULATOR

12.2.1 REALISTIC INTERPRETATION OF ACTUAL DRIVING CONDITIONS IS MAJOR ADVANTAGE OF CAR SIMULATORS

TABLE 63 CAR SIMULATOR: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 64 CAR SIMULATOR: MARKET, BY REGION, 2020–2025 (USD MILLION)

12.3 TRUCK & BUS SIMULATOR

12.3.1 DEMAND FOR DRIVING TRAINING SIMULATION SYSTEMS FOR COMMERCIAL TRUCKS & BUSES EXPECTED TO INCREASE

TABLE 65 TRUCK & BUS SIMULATOR: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 66 TRUCK & BUS SIMULATOR: MARKET, BY REGION, 2020–2025 (USD MILLION)

13 DRIVING SIMULATOR MARKET FOR PROFESSIONAL TRAINING, BY REGION (Page No. - 129)

13.1 INTRODUCTION

FIGURE 51 MARKET FOR PROFESSIONAL TRAINING, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 67 DRIVING SIMULATOR FOR PROFESSIONAL TRAINING MARKET, BY REGION, 2019–2025 (UNITS)

TABLE 68 DRIVING SIMULATOR FOR PROFESSIONAL TRAINING MARKET, BY REGION, 2019–2025 (USD THOUSAND)

13.2 SOUTH ASIA & OCEANIA

FIGURE 52 6-DOF MOTION BASE USED IN TRAINING SIMULATORS

FIGURE 53 DIM250 SIMULATOR BY VI-GRADE

13.3 EUROPE

FIGURE 54 ARCHITECTURE OF INTEGRATED DRIVING HARDWARE-IN-THE-LOOP (IDHIL) SIMULATOR FOR THE TESTING AND EVALUATION OF COOPERATIVE ECO-DRIVING SYSTEMS

13.4 LATIN AMERICA

FIGURE 55 DIM250 SIMULATOR BY VI-GRADE

13.5 MIDDLE EAST & INDIA

14 DRIVING SIMULATOR MARKET, BY REGION (Page No. - 137)

14.1 INTRODUCTION

FIGURE 56 MARKET, BY REGION, 2020 VS. 2025

TABLE 69 MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 70 MARKET, BY REGION, 2020–2025 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: DRIVING TRAINING SIMULATOR MARKET SNAPSHOT

TABLE 71 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.2.1 CHINA

14.2.1.1 Car simulator segment to lead the market

TABLE 73 CHINA: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 74 CHINA: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.2 JAPAN

14.2.2.1 Presence of key OEMs expected to drive the market

TABLE 75 JAPAN: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 76 JAPAN: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.3 INDIA

14.2.3.1 Government subsidies to private training schools to drive the market

TABLE 77 INDIA: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 78 INDIA: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.4 SOUTH KOREA

14.2.4.1 Increasing adoption of high-end technology and innovations to drive the market

TABLE 79 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 80 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.2.5 REST OF ASIA PACIFIC

TABLE 81 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 82 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3 EUROPE

TABLE 83 EUROPE: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.3.1 FRANCE

14.3.1.1 Rise in automotive technology to drive the market

TABLE 85 FRANCE: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 86 FRANCE: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.2 GERMANY

14.3.2.1 Presence of innovative OEMs to drive the market

TABLE 87 GERMANY: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 88 GERMANY: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.3 SPAIN

14.3.3.1 Growing commercial vehicle production to drive the market

TABLE 89 SPAIN: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 90 SPAIN: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.4 ITALY

14.3.4.1 Growing incorporation of ADAS features to drive the market

TABLE 91 ITALY: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 92 ITALY: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.5 UK

14.3.5.1 Popularity of premium vehicles with high-end features to drive the market

TABLE 93 UK: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 94 UK: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.3.6 REST OF EUROPE

TABLE 95 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 96 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.4 NORTH AMERICA

FIGURE 58 NORTH AMERICA: DRIVING TRAINING SIMULATOR MARKET SNAPSHOT

TABLE 97 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.4.1 US

14.4.1.1 Stringent safety regulations to drive the market

TABLE 99 US: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 100 US: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.4.2 CANADA

14.4.2.1 Growing demand for safety and convenience features to drive the market

TABLE 101 CANADA: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 102 CANADA: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.4.3 MEXICO

14.4.3.1 Increasing truck production would require safe driving training

TABLE 103 MEXICO: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 104 MEXICO: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5 REST OF THE WORLD

TABLE 105 ROW: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 106 ROW: DRIVING TRAINING SIMULATOR MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.5.1 BRAZIL

14.5.1.1 Gradual technological growth to drive the market

TABLE 107 BRAZIL: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 108 BRAZIL: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5.2 IRAN

14.5.2.1 Increasing investments by leading OEMs to drive the market

TABLE 109 IRAN: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 110 IRAN: DRIVING T SIMULATOR MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

14.5.3 REST OF ROW

TABLE 111 REST OF ROW: MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 112 REST OF ROW: MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 162)

15.1 EUROPE WILL BE A MAJOR DRIVING SIMULATOR MARKET

15.2 ADVANCED DRIVING SIMULATORS ARE KEY FOR AUTOMOTIVE MARKET IN COMING YEARS

15.3 CONCLUSION

16 COMPETITIVE LANDSCAPE (Page No. - 164)

16.1 MARKET EVALUATION FRAMEWORK

FIGURE 59 MARKET EVALUATION FRAMEWORK

16.2 OVERVIEW

FIGURE 60 KEY DEVELOPMENTS BY LEADING PLAYERS, 2017–2020

16.3 MARKET SHARE ANALYSIS FOR MARKET

FIGURE 61 MARKET SHARE ANALYSIS, 2019

16.4 RANKING ANALYSIS FOR MARKET

FIGURE 62 MARKET RANKING ANALYSIS, 2019

16.5 COMPETITIVE SCENARIO

16.5.1 NEW PRODUCT LAUNCHES

TABLE 113 NEW PRODUCT LAUNCHES, 2018–2020

16.5.2 MERGERS & ACQUISITIONS

TABLE 114 MERGERS & ACQUISITIONS, 2018

16.5.3 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/AGREEMENTS

TABLE 115 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/AGREEMENTS, 2017–2020

16.5.4 EXPANSIONS

TABLE 116 EXPANSIONS, 2018–2020

16.6 COMPETITIVE LEADERSHIP MAPPING (MAJOR ESTABLISHED PLAYERS)

16.6.1 STARS

16.6.2 EMERGING LEADERS

16.6.3 PERVASIVE

16.6.4 PARTICIPANTS

FIGURE 63 DRIVING SIMULATOR MARKET FOR PROFESSIONAL TRAINING: COMPETITIVE LEADERSHIP MAPPING, 2020

16.7 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 64 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET FOR PROFESSIONAL TRAINING

16.8 BUSINESS STRATEGY EXCELLENCE

FIGURE 65 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN DRIVING SIMULATOR MARKET FOR PROFESSIONAL TRAINING

16.9 WINNERS VS. TAIL-ENDERS

TABLE 117 WINNERS VS. TAIL-ENDERS

16.10 COMPETITIVE LEADERSHIP MAPPING FOR DRIVING SIMULATOR PROVIDERS

FIGURE 66 GLOBAL DRIVING SIMULATOR: COMPETITIVE LEADERSHIP MAPPING, 2019

17 COMPANY PROFILES (Page No. - 179)

(Business overview, Product offerings, Developments & MnM View)*

17.1 KEY PLAYERS

17.1.1 CRUDEN B.V

17.1.2 CASSIDIAN

17.1.3 TECKNOTROVE SIMULATOR SYSTEM PVT. LTD

17.1.4 ECA GROUP

FIGURE 67 ECA GROUP: COMPANY SNAPSHOT

17.1.5 ADACEL TECHNOLOGIES LTD.

FIGURE 68 ADACEL TECHNOLOGIES LTD.: COMPANY SNAPSHOT

17.1.6 TRANSURB

17.1.7 EDISER

17.1.8 CORYS

17.1.9 SHRAIL

17.1.10 IPG AUTOMOTIVE

17.1.11 OKTAL SYDAC

17.1.12 VI-GRADE

17.1.13 ENVIRONMENTAL TECTONICS CORPORATION (ETC)

FIGURE 69 ETC: COMPANY SNAPSHOT

TABLE 118 ETC: PRODUCTS OFFERED

TABLE 119 ETC: CONTRACTS

17.1.14 L3 HARRIS TECHNOLOGIES

FIGURE 70 L3 HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 120 L3 HARRIS TECHNOLOGIES: PRODUCTS OFFERED

TABLE 121 L3 HARRIS TECHNOLOGIES: CONTRACTS/MERGERS & ACQUISITIONS

17.1.15 FAAC INC. (UNDER AROTECH CORPORATION)

FIGURE 71 FAAC/AROTECH: COMPANY SNAPSHOT

TABLE 122 FAAC/AROTECH: PRODUCTS OFFERED

TABLE 123 FAAC/AROTECH: ACQUISITIONS/AGREEMENTS/INVESTMENTS

17.1.16 SIMFOR

TABLE 124 SIMFOR: PRODUCTS/SERVICES OFFERED

17.1.17 SIM FACTOR

TABLE 125 SIM FACTOR: PRODUCTS/SERVICES OFFERED

TABLE 126 SIM FACTOR: CONTRACTS/PROJECTS

*Details on Business overview, Product offerings, Developments & MnM View might not be captured in case of unlisted companies.

17.2 OTHER KEY PLAYERS

17.2.1 NORTH AMERICA

17.2.1.1 Ford

17.2.1.2 General Motors

17.2.1.3 Virage Simulation

17.2.1.4 WAYMO

17.2.1.5 Mechanical Simulation Corporation

17.2.2 EUROPE

17.2.2.1 Daimler

17.2.2.2 BMW

17.2.2.3 Rexroth

17.2.2.4 Volkswagen

17.2.2.5 Volvo

17.2.2.6 AImotive

17.2.2.7 CARLA

17.2.2.8 AB Dynamics

17.2.2.9 XPI Simulation

17.2.2.10 rFpro

17.2.3 ASIA PACIFIC

17.2.3.1 Toyota

17.2.3.2 Nissan

17.2.3.3 CVEDIA

17.2.3.4 Honda

17.2.4 REST OF THE WORLD

17.2.4.1 Cognata

18 APPENDIX (Page No. - 213)

18.1 KEY INSIGHTS OF INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.4 AVAILABLE CUSTOMIZATIONS

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

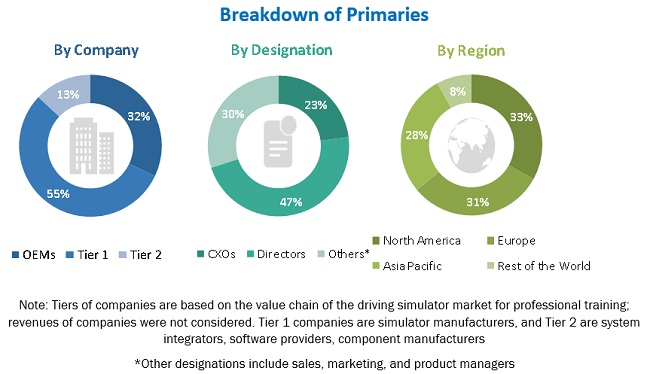

Exhaustive secondary research was done to collect information on the driving simulator market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include publications from government sources [such as country level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; free and paid automotive databases Driving Simulation Association (DSA), National Training Systems Association (NTSA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global driving simulator market, which was validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the global market for professional training scenarios through secondary research. Several primary interviews were conducted with driving simulator market experts from both the demand (country-level government associations, and trade associations, training institutes, R&D centers, OEMs/vehicle manufacturers) and supply (simulator manufacturers, system integrators, software providers, and component manufacturers) side across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 18% of the experts involved in primary interviews were from the demand side, and 82% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach has been used to estimate and validate the size of the driving simulator market by vehicle type, application type, simulator type, training driving simulator type, and region. In this approach, the global market size is derived by calculating the segmental revenue of driving simulator for key market players. After deriving the total market size, the market share for each region is identified. Now, the total market in each region based on the market share for each region is broken down to derive the market at the regional level. To calculate the country-level driving simulator market, the number of authorized driving schools and OEM research centers are mapped to identify the penetration ratio for each country in all the regions. To derive the country-level driving simulator market, the penetration ratio for each country is multiplied by the total market of that particular region. All country-level data is added to derive the global market by application type, vehicle type, simulator type, and driving training simulator type.

The size of the driving simulator market for professional training applications in terms of value is derived by calculating the segmental revenue of driving simulators for professional training applications for key market players. To derive the market size for each professional training application, the percentage share is identified for each application. Then the overall market size at global level is broken down for each application. After deriving the total market size in terms of value for each application, the market share for each region is identified. Now, the total market in each region based on the market share is broken down to derive the driving simulator market for professional training at regional level in terms of value. To derive the size of the global market for professional training in terms of volume, the average selling price (ASP) is identified with various secondary and primary sources for each professional training application. The market size for each application in terms of volume is derived by dividing the global market size in value by the ASP. The market size for each professional training application in terms of volume is derived by multiplying the penetration of each application with the overall market size in terms of volume.

Data Triangulation

After arriving at the overall driving simulator market size of the global market through the abovementioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated driving simulator market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- To segment and forecast the global market size in terms of value (USD million)

- To define, describe, and forecast the global market based on simulator type, vehicle type, application, training simulator type, end user, and region

-

To segment and forecast the driving simulator market size based on simulator type

(training simulator and advanced driving simulator) -

To segment and forecast the market size based on end user

(training simulator, advanced driving simulator, and professional training simulator) -

To segment and forecast the driving simulator market size based on application type

(research & testing and training) - To segment and forecast the global market size based on vehicle type (car simulator and truck & bus simulator)

- To segment and forecast the market size based on training simulator type (compact simulator and full-scale simulator)

- To forecast the driving simulator market size with respect to four key regions, namely, Asia Pacific, Europe, North America, and Rest of the World

- To profile key players based on certain parameters to define them as dynamic differentiators, innovators, emerging companies, and visionary leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies and analyze recent product launches, product innovations, collaborations, partnerships, supply contracts, and acquisitions in the driving simulator

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the regional markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the impact of the COVID-19 on the global market

- To analyze the impact of the COVID-19 on the automotive industry

- To analyze the impact of the COVID-19 on the rail industry

- To analyze the impact of the COVID-19 on the driving simulator market for professional training

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Driving Simulator Market, By Simulator Type at country level (For countries covered in the report)

- Driving Simulator Market, By Application at country level (For countries covered in the report)

- Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Driving Simulator Market

We would like to know about the new feature providing remote training opportunities to train and maintain the skills of employees, also provide Driving Simulator Market industry growth till 2027.

We are interested in Driving Simulator Market size for the North US region for the 2022 to 2027 Forecast year.

In the Driving Simulator Market, how are new markets providing revenue expansion opportunities?