Drone Analytics Market by Industry (Agriculture, Engineering & Infrastructure, Insurance, Energy & Power, Defense & Security, Telecommunication, Public Safety, Transportation & Logistics), Application, Type, Solution and Region - Global Forecast to 2027

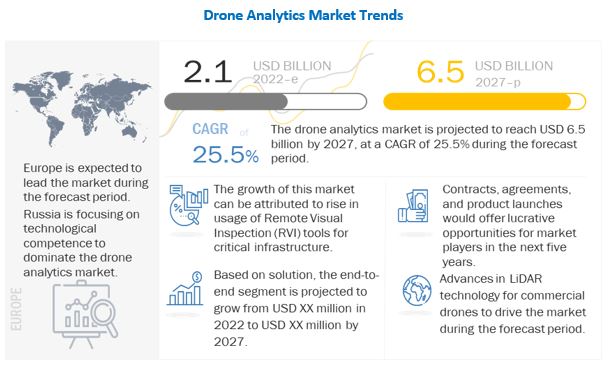

The Drone Analytics Market was valued at USD 2,100 Million in 2022 and is estimated to grow from USD 2,600 Million by 2023 to USD 6,500 Million by 2027 at a CAGR (Compound Annual Growth Rate) of 25.5% during the forecast period. This Drone Analytics Industry growth can be attributed to the rising demand for drones, Due to their benefits, such as timeliness and cost-effective data acquisition, drones have been increasingly used by various industries, such as agriculture, logistics, mining, oil and gas, and real estate. The conventional data collection technique is restricted by time and safety, often leading to a shortage of detailed information for monitoring and evaluation.

To know about the assumptions considered for the study, Request for Free Sample Report

The COVID-19 pandemic has caused a large-scale impact on economies across the world. The global manufacturing of drones, developers, service providers, vendors, etc have been impacted. COVID-19 has led to several challenges for many industries. The drone industry is no exception to that. This puts most research projects on hold. The export of drone analytics services to several countries in the Middle East, Africa, and Latin America has also been reduced. All these scenarios affect the development of drone analytics market.

Drone Analytics Market Dynamics

Driver: Surge in demand for safe and accurate monitoring

Due to their benefits, such as timeliness and cost-effective data acquisition, drones have been increasingly used by various industries, such as agriculture, logistics, mining, oil and gas, and real estate. The conventional data collection technique is restricted by time and safety, often leading to a shortage of detailed information for monitoring and evaluation. Cost-effectiveness, high precision, and extraordinary time efficiency make drones a trustworthy data acquisition tool that can deliver rich basic data and accomplish synchronous monitoring for various applications.

Drones show significant potential in mining monitoring at small or large scales. Drones equipped with different sensors can deliver basic data for various monitoring tasks and, hence, are widely used in several applications, including terrain surveying and 3D modeling, land damage calculation, ecological & geological hazards monitoring, pollution monitoring, land reclamation activities, and ecological restoration assessment.

Restraint: Underqualified operators

Operating drones requires skilled personnel with sufficient training. Though developed countries can hire skilled and trained operators, the situation is not the same with emerging economies. This is generally due to low investment in defense and the absence of adequate infrastructure in developing countries. These factors are expected to hinder the global drone analytics market growth. As per drone pilots, the task of operating a drone is fatiguing and extremely difficult. There have been many reports in the US as well, where drone pilots have quit their jobs due to the challenging nature of the job. Hence, to make drone piloting a favorable job prospect, countries have come up with various deals and increased salary packages. Yet drone technology is in its nascent phase, and better funding and training schemes are required to make drone operators aware of the necessary training required to operate drones.

The Phoenix-based Unmanned Vehicle University (UVU) is training drone pilots. It offers graduate degrees in unmanned systems engineering and hands-on pilot training courses at reasonable prices. Its students do not require a college degree or any previous experience with drones. In February 2021, Airbus started training drone pilots in India. It signed a deal with the India-based Flytech Aviation Academy to train pilots for the remotely piloted aircraft system (RPAS) type of UAVs.

Opportunity: Technological advancements in drones

Drones are witnessing rising prospects for application in diverse fields of work. Due to their speed and agility, these winged devices are a concise means of delivering complete and valued results. Currently, drones outfitted with sensors and cameras are establishing their worth in gathering real-time footage that can be stored for later assessment. Un-crewed aerial systems can discover failing structures and equipment in less time and for reasonable prices as compared to traditional methods. In 2020, the American Society of Civil Engineers reckoned that the US alone required USD 3.6 trillion in infrastructure investment just to bring the country’s support systems to satisfactory levels. Innovative technologies like machine learning and laser are broadening the scope of application of these inspection drones where they are getting stocked with the required technologies to perform specific tasks during the inspection. This new capability offers growth prospects for drone manufacturers in the marketplace.

Challenge: State and local regulations

There is no doubt the AI in drone industry is thriving. From inspecting active fire hotspots to sending messages via light shows, drones have come to be increasingly used by government agencies. However, the rising volume of drones would put immense pressure on the procedures of permits as well as exemptions that nearly all countries need for drone use. Huge numbers of drones will also put the implementation of such rules under pressure. Challenges to expanding the usefulness of public safety drones include restrictions on flying beyond visual line of sight (BVLOS), inadequate battery life, flying at or below 400 feet, not flying in restricted airspace, especially near airports, and community-based concerns over privacy. Drones also create challenging situations for insurance companies due to damage caused to assets and liability. Drug trafficking using drones is another area of concern.

Agriculture segment of the Drone Analytics Market by industry, to grow at impressive CAGR during the forecast period

The agriculture segment is projected to be the leading segment in the drone analytics market from 2022 to 2027. This segment is projected to grow from USD 0.5 billion in 2022 to USD 1.3 billion by 2027, at an impressive CAGR of 26.5% during the forecast period.

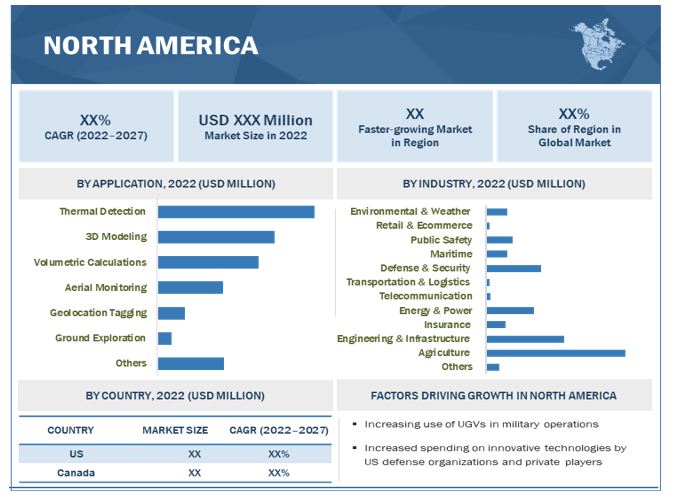

Thermal Detection segment to command the Drone Analytics Market by Application, during the forecast period

Based on the application, the thermal detection segment is estimated to account for a larger share of 28.6% of the drone analytics market in 2022. This segment is projected to grow from USD 0.6 billion in 2022 to USD 2.0 billion by 2027.

The North America market is projected to contribute the largest share from 2022 to 2027

To know about the assumptions considered for the study, download the pdf brochure

Emerging industry trends

Drone data created with point cloud

Point clouds are like natural clouds made of millions of condensed water droplets. Point clouds contain millions of geospatially connected points, producing a three-dimensional virtual mass. From the images created during a drone survey, distinct features are detected that can be observed in several images. Utilizing the location of the camera sensor, the location of each distinct feature can be calculated with triangulation. To establish a coordinate for a distinct point from drone imagery, the point must be taken in two images with known positions. When greater features are discovered in drone images, the point cloud becomes denser. Collectively, these points create a “cloud.” If each known point depicts a feature, the more points, the closer the point cloud would get to copying a real-world topography. If photogrammetry (the science of measuring employing images) is the equation for 3D models, point clouds are some of the dynamic values that can be plugged into the equation, along with raw imagery that was obtained to generate the final output. The final outputs are in the form of a 3D mesh and a digital elevation model (DEM), which is merged with the resultant mosaic orthoimage to visualize a 3D model of a site. When the points are closely packed, the less photogrammetry software must interpolate between two points. Hence, a 99% ccurate 3D model of the mining or construction site could be generated with the point cloud method employing a drone.

Drone Analytics Industry Companies: Top Key Market Players

The Drone Analytics Companies is dominated by globally established players such as AgEagle (US), AeroVironment (US) Skydio (US), and ESRI (US) are some of the leading companies in this market. The report covers various industry trends and new technological innovations in the drone analytics Market for the period, 2018-2027.

Drone Analytics Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 2.1 Billion |

|

Projected Market Size |

USD 6.5 Billion |

|

Growth Rate |

25.5% |

|

Forecast Period |

2022-2027 |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Industry, Application, Type, and Solution |

|

Geographies Covered |

|

|

Companies Covered |

AgEagle (US), Skydio (US), Dronedeploy (US), Kespry (US), Insitu (US), Parrot (France), AeroVironment (US), ESRI (US), Draganfly (Canada), among others. (25 Companies) |

The study categorizes the drone analytics market based on industry, application, type, solution, and region

Drone Analytics Market By Industry

- Agriculture

- Engineering And Infrastructure

- Insurance

- Energy & Power

- Telecommunication

- Transportation & Logistics

- Defense & Security

- Maritime

- Public Safety

- Retail & Ecommerce

- Environmental & Weather

- Others

By Application

- Thermal Detection

- Geolocation Tagging

- Aerial Monitoring

- Ground Exploration

- Volumetric Calculations

- 3d Modeling

- Others

By Type

- Service

- Software as a Service

By Solution

- End-to-End solutions

- Point solutions

Drone Analytics Market By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In May 2022, AgEagle announced new and improved technology features and capabilities for Measure Ground Control, which will assist enterprise customers and professional drone service providers across a wide range of sectors in deriving more value from autonomous drones. operations.

- In June 2022, AeroVironment announced receipt of a USD 6,166,952 firm-fixed-price contract award for Puma™ 3 AE small, unmanned aircraft systems (SUAS) and spares for the US Marine Corps. Delivery is anticipated to be completed in year end of 2022.

Frequently Asked Questions (FAQ):

What Are Your Views on the Growth Prospect of the Drone Analytics Market?

The Drone Analytics Market is expected to grow substantially owing to the increased demand for efficient UAVs in emerging fields such as precision agriculture, wildlife preservation, and search & rescue operations, among others, as these UAVs enable the exchange of information, theory, and practical experiences with a view to benchmark best practices and encourage their use in various new application areas.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Drone Analytics?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Drone Analytics Market. Major players, including ESRI (US), Skydio (US), AgEagle (US), Pix4D (Switzerland), Aerovironment (US), and Delta Drone (France) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What Are the New Emerging Technologies and Use Cases Disrupting the Drone Analytics Market?

Some of the major emerging technologies and use cases disrupting the market include AI inspection, open-source software, AR, automated GCS, and swarm drones.

Who Are the Key Players and Innovators in the Ecosystem of the Drone Analytics Market?

Major players and innovators include ESRI (US), Skydio (US), AgEagle (US), Pix4D (Switzerland), Aerovironment (US), Delta Drone (France), Kespry (US), and Insitu (US).

Which Region is Expected to Hold the Highest Market Share in the Drone Analytics Market?

The drone analytics market in North America accounts for a share of 42.4% in 2022. The market in North America is estimated to grow from USD 0.6 billion in 2022 to USD 1.7 billion by 2027, at the CAGR of 23.3% during the forecast period. This growth can be attributed to the rising demand for agricultural drones, increasing use of drones in defense, and new application areas like thermal detection being carried out using drones, among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SCOPE: DRONE ANALYTICS MARKET

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.3 RESEARCH APPROACH AND METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Industry market approach

2.3.1.2 Software market approach

2.3.1.3 Services market approach

2.3.1.4 Regional split of drone analytics market

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION AND VALIDATION

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

2.5.1 ASSUMPTIONS USED IN MARKET SIZING AND FORECAST

2.6 LIMITATIONS

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 AGRICULTURE SEGMENT TO LEAD MARKET

FIGURE 9 THERMAL DETECTION TO ACCOUNT FOR LARGER SHARE OF MARKET

FIGURE 10 SAAS ESTIMATED TO DOMINATE MARKET

FIGURE 11 END-TO-END SOLUTIONS SEGMENT TO LEAD MARKET

FIGURE 12 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRONE ANALYTICS MARKET

FIGURE 13 INCREASING DEMAND FOR DRONES IN AGRICULTURE, ENERGY & POWER, AND DEFENSE TO DRIVE THE MARKET

4.2 DRONE ANALYTICS MARKET, BY INDUSTRY

FIGURE 14 DEFENSE & SECURITY TO DOMINATE MARKET

4.3 DRONE ANALYTICS MARKET, BY APPLICATION

FIGURE 15 THERMAL DETECTION TO LEAD MARKET

4.4 DRONE ANALYTICS MARKET, BY TYPE

FIGURE 16 SAAS TO HOLD LARGER MARKET SHARE

4.5 DRONE ANALYTICS MARKET, BY SOLUTION

FIGURE 17 END-TO-END SOLUTIONS TO ACCOUNT FOR LARGER MARKET SHARE

4.6 DRONE ANALYTICS MARKET, BY COUNTRY

FIGURE 18 UAE TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR DRONE ANALYTICS MARKET DURING FORECAST PERIOD

5.2.1 DRIVERS

5.2.1.1 Surge in demand for safe and accurate monitoring

5.2.1.2 Use of drones as Remote Visual Inspection (RVI) tool for critical infrastructure applications

5.2.1.3 Increased savings on downtime and liability insurance

5.2.1.4 Ready availability of high-resolution cameras and infrared sensors

5.2.1.5 Competitive costing of dedicated mapping and inspection drones

5.2.2 RESTRAINTS

5.2.2.1 Underqualified operators

5.2.2.2 Safety and security issues

5.2.2.3 Data privacy and cyber security concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements in drones

5.2.3.2 Advancements in LiDAR technology for commercial drones

5.2.3.3 AI and software automation

5.2.4 CHALLENGES

5.2.4.1 State and local regulations

5.2.4.2 Limited flight endurance and payload capacity

5.3 AVERAGE SELLING PRICE

TABLE 1 AVERAGE SELLING PRICE OF DRONES ACCORDING TO VARIOUS APPLICATIONS

5.4 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS

5.5 MARKET ECOSYSTEM MAP

FIGURE 21 ECOSYSTEM MAP

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 22 REVENUE SHIFT CURVE FOR DRONE ANALYTICS MARKET

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWERS OF SUPPLIERS

5.7.4 BARGAINING POWERS OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 TARIFF AND REGULATORY LANDSCAPE

5.9 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 2 DRONE ANALYTICS MARKET: LIST OF CONFERENCES & EVENTS

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 DRONE DATA CREATED WITH POINT CLOUD

6.2.2 AI INSPECTION

6.2.3 3D PRINTED DRONES

6.2.4 SWARM DRONES

6.2.5 AUTOMATED DRONES

6.2.6 MACHINE LEARNING-POWERED ANALYTICS

6.2.7 OPEN-SOURCE SOFTWARE

6.2.8 AUGMENTED REALITY

6.2.9 CONVERGENCE OF IOT AND DRONE ANALYTICS

6.2.10 AUTOMATED GCS

6.3 TECHNOLOGY ANALYSIS

6.3.1 HYDROGEN POWER

6.3.2 IMPROVED COMPUTER VISION AND MOTION PLANNING

6.3.3 NEW SCOPE FOR DRONE REST AND RECHARGE

6.4 USE CASES FOR DRONE ANALYTICS MARKET

6.4.1 ROOF INSPECTION

6.4.2 OIL & GAS

6.4.3 AGRICULTURE

6.4.4 URBAN PLANNING

6.4.5 TELECOMMUNICATIONS

6.4.6 CONSTRUCTION PLANNING AND INFRASTRUCTURE DEVELOPMENT

6.4.7 HUMANITARIAN AND DISASTER RELIEF

6.4.8 ADVERTISING/VISUALS/NEWS

6.4.9 WEATHER FORECASTING

6.4.10 CONSERVATION

6.5 IMPACT OF MEGATRENDS

6.5.1 MONITORING ENVIRONMENTAL AND ECOLOGICAL CHANGES

6.5.2 IOT-ENABLED DRONES

6.5.3 RAPID URBANIZATION

6.6 PATENT REGISTRATIONS

TABLE 3 PATENT REGISTRATIONS, 2015–2021

TABLE 4 RULES AND GUIDELINES FOR DRONE OPERATIONS IN OTHER COUNTRIES

7 DRONE ANALYTICS MARKET, BY INDUSTRY (Page No. - 77)

7.1 INTRODUCTION

FIGURE 24 AGRICULTURE & FORESTRY TO LEAD MARKET FROM 2022 TO 2027

TABLE 5 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 6 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.2 AGRICULTURE

7.2.1 HIGH-QUALITY DRONE DATA AND PHOTOGRAMMETRY GUARD CROPS

7.3 ENGINEERING AND INFRASTRUCTURE

7.3.1 HIGH-QUALITY 3D IMAGES FROM DRONES FOR BRIDGE MAINTENANCE AND REHABILITATION

7.4 INSURANCE

7.4.1 DRONES USED TO INSPECT AND REVIEW PROPERTIES

7.5 ENERGY & POWER

7.5.1 TOPOGRAPHIC SURVEYS AND ENVIRONMENTAL IMPACT ASSESSMENTS

7.6 TELECOMMUNICATION

7.6.1 MAPPING TELECOMMUNICATION INFRASTRUCTURE USING DRONES

7.7 TRANSPORTATION & LOGISTICS

7.7.1 DRONE IMAGERY AND VIDEOGRAPHY FOR TRANSPORTATION

7.8 DEFENSE & SECURITY

7.8.1 NEED FOR NEAR REAL-TIME MONITORING OF BORDER ACTIVITIES

7.9 MARITIME

7.9.1 DRONE ANALYTICS FOR SECURITY AND ENVIRONMENTAL MONITORING

7.10 PUBLIC SAFETY

7.10.1 CLOSE-UP PHOTOGRAPHY/VIDEOGRAPHY WITHOUT INSPECTORS ON-SITE USING DRONES

7.11 RETAIL & ECOMMERCE

7.11.1 THOROUGH AND RAPID ASSESSMENT WITH DRONES HELPS SAVE MONEY AND TIME

7.12 ENVIRONMENTAL & WEATHER

7.12.1 DRONES CAN TRANSFORM FOREST AND WILDLIFE CONSERVATION RESEARCH

7.13 OTHERS

8 DRONE ANALYTICS MARKET, BY APPLICATION (Page No. - 83)

8.1 INTRODUCTION

FIGURE 25 GEOLOCATION TAGGING TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 7 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 8 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 THERMAL DETECTION

8.2.1 INCREASING ADOPTION IN AGRICULTURE, MINING, CONSTRUCTION, AND OIL & GAS INDUSTRIES

8.3 GEOLOCATION TAGGING

8.3.1 REQUIRED IN MINING & QUARRYING, OIL & GAS, AND CONSTRUCTION INDUSTRIES

8.4 AERIAL MONITORING

8.4.1 USED IN FORESTRY, INSURANCE, UTILITY, TELECOMMUNICATION, TRANSPORTATION, AND SCIENTIFIC RESEARCH

8.5 GROUND EXPLORATION

8.5.1 NEEDED IN SCIENTIFIC RESEARCH, AGRICULTURE, AND FORESTRY

8.6 VOLUMETRIC CALCULATIONS

8.6.1 USED BY PROFESSIONALS AND SMALL BUSINESSES AND ENTERPRISES

8.7 3D MODELING

8.7.1 WIDELY USED IN CONSTRUCTION, AGRICULTURE, AND INSURANCE VERTICALS

8.8 OTHERS

9 DRONE ANALYTICS MARKET, BY TYPE (Page No. - 87)

9.1 INTRODUCTION

FIGURE 26 SAAS SEGMENT PROJECTED TO GROW AT HIGHER CAGR FROM 2022 TO 2027

TABLE 9 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 SERVICE

9.2.1 INSPECTION

9.2.1.1 Use of high-performance onboard image processing and drone neural networks

9.2.2 DATA ANALYTICS

9.2.2.1 Drones often collect data to be utilized by GIS

9.2.3 TRAINING AND CONSULTING SERVICES

9.2.3.1 Most companies offer training programs

9.2.4 SUPPORT SERVICES

9.2.4.1 Needed to eradicate issues related to analytics-based operations

9.3 SOFTWARE AS A SERVICE

9.3.1 ROUTE PLANNING AND OPTIMIZATION

9.3.1.1 Innovations through self-learning algorithms and auto-flight systems

9.3.2 INVENTORY MANAGEMENT

9.3.2.1 Increasing adoption in enterprises and warehouses and assembly lines

9.3.3 LIVE TRACKING

9.3.3.1 Ensures drones do not enter restricted areas or malfunction

9.3.4 FLEET MANAGEMENT

9.3.4.1 Increasing adoption in construction, agriculture, and forestry

9.3.5 COMPUTER VISION & OBJECT DETECTION

9.3.5.1 Important aspects of drone analytics

10 DRONE ANALYTICS MARKET, BY SOLUTION (Page No. - 93)

10.1 INTRODUCTION

FIGURE 27 END-TO-END SOLUTIONS TO HAVE LARGER MARKET SHARE

TABLE 11 MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 12 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

10.2 END-TO-END SOLUTIONS

10.2.1 INCREASING REQUIREMENT FOR COMPLETE DATA ANALYSIS

10.3 POINT SOLUTIONS

10.3.1 GROWING USE IN AGRICULTURE AND CONSTRUCTION

11 REGIONAL ANALYSIS (Page No. - 96)

11.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 13 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 14 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

TABLE 15 NORTH AMERICA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 16 NORTH AMERICA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 17 NORTH AMERICA MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 18 NORTH AMERICA MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 19 NORTH AMERICA MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 20 NORTH AMERICA MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Increasing investments in defense and agriculture

TABLE 21 US MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 US MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 23 US MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 24 US MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 High demand for hyperspectral imaging

TABLE 25 CANADA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 26 CANADA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 27 CANADA MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 28 CANADA MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 30 EUROPE: MARKET SNAPSHOT

TABLE 29 EUROPE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 30 EUROPE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 31 EUROPE MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 32 EUROPE MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 33 EUROPE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 34 EUROPE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 Technological developments in drones

TABLE 35 UK MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 UK MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 37 UK MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 38 UK MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Government and policymakers planning to integrate drones for various applications

TABLE 39 FRANCE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 FRANCE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 41 FRANCE MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 42 FRANCE MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Drone Innovation Hub (DIH) to encourage and promote technological innovations

TABLE 43 GERMANY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 GERMANY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 45 GERMANY MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 46 GERMANY MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Reduced operational costs of drones

TABLE 47 ITALY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 48 ITALY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 49 ITALY MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 50 ITALY MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3.5 RUSSIA

11.3.5.1 Abundance of minerals and oil & gas fields offers market potential

TABLE 51 RUSSIA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 RUSSIA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 RUSSIA MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 54 RUSSIA MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 55 REST OF EUROPE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 REST OF EUROPE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 57 REST OF EUROPE MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 58 REST OF EUROPE MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 59 ASIA PACIFIC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 ASIA PACIFIC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 61 ASIA PACIFIC MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 62 ASIA PACIFIC MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Policy and regulatory support from government

TABLE 65 CHINA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 CHINA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 67 CHINA MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 68 CHINA MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Developing standards for ICT integration with construction industry

TABLE 69 JAPAN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 70 JAPAN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 71 JAPAN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 72 JAPAN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Conditional exemptions from government for drones

TABLE 73 INDIA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 INDIA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 INDIA MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 76 INDIA MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Policies supporting drone innovations

TABLE 77 SOUTH KOREA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 SOUTH KOREA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 79 SOUTH KOREA MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 80 SOUTH KOREA MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 Government keen on developing data analytics applications

TABLE 81 AUSTRALIA MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 AUSTRALIA MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 83 AUSTRALIA MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 84 AUSTRALIA MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 85 REST OF ASIA PACIFIC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 REST OF ASIA PACIFIC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 REST OF ASIA PACIFIC MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 REST OF ASIA PACIFIC MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST

TABLE 89 MIDDLE EAST MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 MIDDLE EAST MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 91 MIDDLE EAST MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 MIDDLE EAST MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 93 MIDDLE EAST MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 94 MIDDLE EAST MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.1 UAE

11.5.1.1 Increased demand for remote monitoring of assets

TABLE 95 UAE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 UAE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 97 UAE MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 98 UAE MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.5.2 TURKEY

11.5.2.1 Focus on indigenization of UAVs and subsystems

TABLE 99 TURKEY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 100 TURKEY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 101 TURKEY MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 102 TURKEY MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.5.3 ISRAEL

11.5.3.1 Telecommunications industry to offer potential

TABLE 103 ISRAEL MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 ISRAEL MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 105 ISRAEL MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 106 ISRAEL MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.5.4 REST OF MIDDLE EAST

TABLE 107 REST OF MIDDLE EAST MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 REST OF MIDDLE EAST MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 REST OF MIDDLE EAST MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 110 REST OF MIDDLE EAST MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 111 REST OF THE WORLD DRONE ANALYTICS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 REST OF THE WORLD DRONE ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 113 REST OF THE WORLD DRONE ANALYTICS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 114 REST OF THE WORLD DRONE ANALYTICS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 115 REST OF THE WORLD DRONE ANALYTICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 116 REST OF THE WORLD DRONE ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6.1 LATIN AMERICA

11.6.1.1 Increasing foreign investments in drone mapping

TABLE 117 LATIN AMERICA DRONE ANALYTICS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 118 LATIN AMERICA DRONE ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 119 LATIN AMERICA DRONE ANALYTICS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 120 LATIN AMERICA DRONE ANALYTICS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Drones used for aerial photography, search & rescue operations, and crop monitoring

TABLE 121 AFRICA DRONE ANALYTICS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 AFRICA DRONE ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 123 AFRICA DRONE ANALYTICS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 124 AFRICA DRONE ANALYTICS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

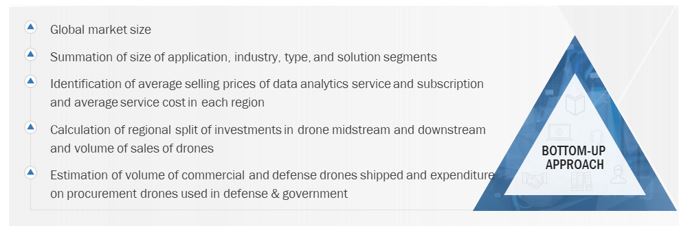

The study involved four major activities in estimating the current size of the drone analytics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market share of companies offering drone analytics was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, sources such as government sources; SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases were used to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry’s value and supply chain and to identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to drone analytics, applications, solutions, and regions, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from drone manufacturers; service providers; software developers; integrators; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the drone analytics market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Drone analytics Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for drone analytics segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Report Objectives

- To define, describe, segment, and forecast the size of the drone analytics market based on industry, application, type, solution, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the drone analytics market with respect to 6 major regions namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World which consists of the Latin America & Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the drone analytics market

- To identify the opportunities for stakeholders in the market by identifying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and Research & Development (R&D) activities in the drone analytics market.

- To anticipate the status of the drone analytics market procurements by different countries, technological advancements in drone analysis; and joint developments undertaken by leading players to analyze the degree of competition in the market

- To provide a comprehensive competitive landscape of the drone analytics market, along with an overview of the different strategies adopted by the key market players to strengthen their position in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the drone analytics market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drone Analytics Market

Hello, We need to assess the market of drones by segments: Agriculture, construction, oil and gas, transportation services, etc. We are considering your reports. Please write what reports you have for us. Thanks, buyan

Conducting drone analytics market research to help facilitate our company's growth objectives and vertical expansion.