Edge Computing Market by Component (Hardware, Software, Services), Application (Real-time Data Processing & Analysis, Predictive Maintenance, & Optimization), Organization Size (Large Enterprises, SMEs), Vertical and Region - Global Forecast to 2029

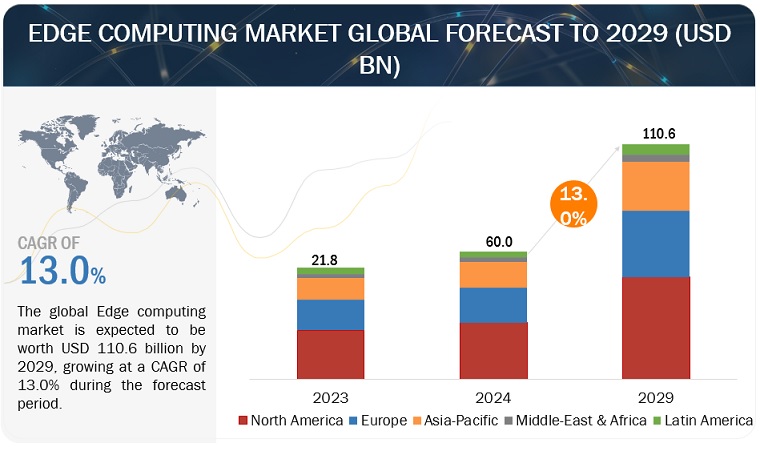

[210 Pages Report] The Edge computing market size is expected to grow from USD 60.0 billion in 2024 to USD 110.6 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 13.0% during the forecast period. The impact of the recession on the market is covered throughout the report. Businesses across industries require real-time insights to drive operational efficiency, improve customer experiences, and enable predictive maintenance. Edge computing facilitates data processing closer to the source, enabling faster decision-making and response times.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Global Edge Computing Market

A recession can significantly impact the Edge computing market across organizations, industry verticals, and regions. Businesses may delay investments in advanced technologies as they prioritize cost-cutting over innovation. Startups in the field may struggle to secure funding as investors become more risk-averse. The impact of a recession on the digital media Edge computing market could be mitigated to some extent by the growth of online advertising. However, the industry/market might encounter hurdles due to reduced consumer spending and intensified competition for advertising revenue. Declining consumer expenditure during economic downturns could dampen the demand for entertainment offerings such as recreational tickets and cable TV subscriptions, reducing the earnings of video solutions and service firms engaged in their production and distribution.

The impact of recession is likely to fuel volatility in the global economy and capital markets in the upcoming three years (2024 through 2027), many economists believe. The experts also foresee an increase in localization, strengthening of geoeconomic blocs, and a widening divergence between the Global North and South over the upcoming three-year timeframe. According to the Chief Economists Outlook survey, World Economic Forum, January 2024, 69% of economists expect Geoeconomic fragmentation to accelerate in 2024. According to chief economists, in the upcoming three years (2024 through 2027), the following geopolitical developments are predicted to sharply increase statistics such as 87% volatility in the global economy, 86% localization of economic activity, 80% stock market volatility, 80% geoeconomic blocs of economic activity, 57% inequality and North-South divergence, 36% disruption in global supply chains, 13% globalization of economic activity. 50% of economists have predicted generative AI to be commercially disruptive through 2024.

Edge computing market Dynamics

Driver: Integration of AI/ML, a critical factor that leverage(s) global Edge computing market significantly

Integrating artificial intelligence (AI) and machine learning (ML) algorithms into edge computing devices enables real-time data analytics and decision-making at the network edge. Edge-based AI/ML applications, such as predictive maintenance, anomaly detection, and personalized content delivery, leverage local processing capabilities to analyze data in near real-time, enabling organizations to derive actionable insights and improve operational efficiency. AI/ML integration drives the edge computing market by allowing real-time data analysis and decision-making at the edge. By deploying AI and ML algorithms closer to where data is generated, organizations can extract valuable insights faster, optimize operations, and enhance user experiences. This integration also reduces the need for extensive data transmission to centralized cloud servers, minimizing latency and bandwidth requirements while improving edge computing solutions' overall efficiency and responsiveness.

Restraints: Complex nature of the edge computing infrastructure

Implementing edge computing solutions often requires significant investment in infrastructure, including edge devices, networking equipment, and management systems. This complexity can pose a barrier to adoption for organizations lacking the expertise or resources to deploy and maintain edge computing environments effectively. The complexity of infrastructure deploying edge computing solutions is a limiting factor for the global market. Organizations often face challenges setting up and managing the required edge devices, networking components, and management systems. This complexity can deter adoption, particularly for businesses lacking the expertise or resources to effectively navigate the intricacies of deploying and maintaining edge computing environments.

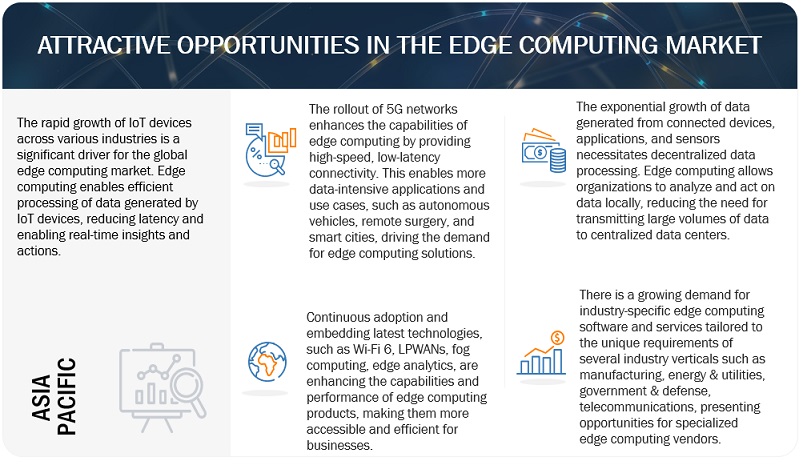

Opportunities: Tailored edge computing solutions address unique challenges and requirements that increase adoption and innovation across sectors

Customizing edge computing solutions to meet various industries' specific requirements presents a significant opportunity for market growth. Industries such as manufacturing, healthcare, transportation & logistics have distinct challenges and demands that can be effectively addressed through tailored edge computing solutions. For instance, in manufacturing, edge computing can optimize production processes and enable predictive maintenance, while in healthcare, it can support remote patient monitoring and real-time data analysis. Similarly, edge computing can enhance customer experiences in retail through personalized services and efficient inventory management. By catering to these industry needs, edge computing providers can unlock new avenues for adoption and innovation, driving the market forward.

Challenges: Challenges in compatibility or interoperability

The heterogeneous nature of edge computing ecosystems, with various devices, protocols, and standards, can lead to interoperability challenges. Integrating disparate edge devices and systems from different vendors may require extensive customization and integration efforts, potentially limiting the scalability and flexibility of edge computing deployments. This can hinder seamless data exchange and collaboration across edge nodes, affecting the overall effectiveness of edge computing solutions. Interoperability issues present a significant challenge to the global edge computing market. As edge solutions involve diverse hardware, software, and networking components from different vendors, ensuring seamless interoperability between these elements becomes crucial. A lack of standardized protocols and interfaces across devices and platforms can lead to compatibility issues, hindering the integration and scalability of edge computing deployments. This challenge complicates adoption and may deter organizations from investing in edge computing solutions.

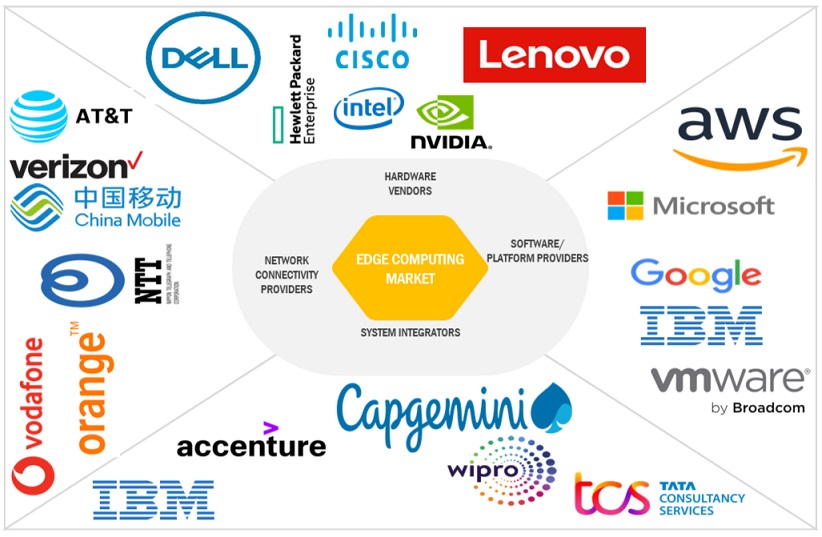

Edge computing Market Ecosystem

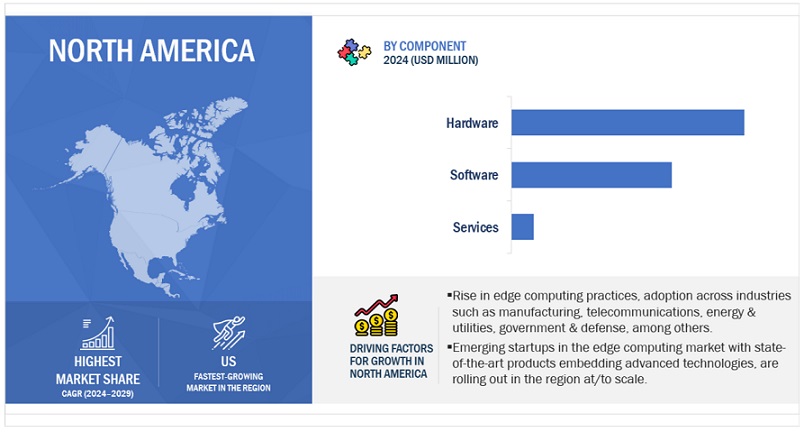

Based on Components, Hardware will hold the largest market share in the Edge computing market during the forecast period.

In the hardware segment of the edge computing market, a diverse array of devices and equipment plays a crucial role in enabling distributed computing closer to data sources. This includes edge servers, routers, switches, gateways, sensors, and specialized edge computing chips. These hardware components are designed to efficiently process and analyze data at the edge, reducing latency and enhancing real-time decision-making capabilities. As edge computing continues to increase across industries, demand for optimized and scalable hardware solutions is rising, driving innovation and investment in this market segment.

Based on Application, the IoT & sensor data utilization segment will record the highest CAGR in the Edge computing market during the forecast period.

Utilizing IoT and sensor data in edge computing involves processing and analyzing data collected from connected devices and sensors at the network edge. Organizations can reduce latency, improve real-time decision-making, and optimize bandwidth usage by processing data closer to the source. This enables faster insights and actions, enhancing operational efficiency and productivity. Additionally, leveraging IoT and sensor data at the edge allows organizations to extract valuable insights, detect anomalies, and predict maintenance needs, leading to improved asset performance, reduced downtime, and lower maintenance costs. Overall, effectively utilizing IoT and sensor data in edge computing drives innovation, accelerates digital transformation, and delivers tangible business benefits.

North America is predicted to hold the largest Edge computing market share during the forecast period.

In North America, the edge computing market is witnessing significant growth driven by the increasing adoption of IoT devices, rising demand for low-latency processing in various industries, and advancements in 5G technology. Major players in the region are investing heavily in edge computing infrastructure to support emerging applications such as autonomous vehicles, smart cities, and industrial automation. Key technology hubs and a robust ecosystem of edge computing vendors contribute to the region's leadership in this market. North America is expected to continue leading the global edge computing market with further investments in edge infrastructure, partnerships, and innovative use cases across industries.

Key market players

The Edge computing market is dominated by startups as well as established companies such as HPE (US), Dell Technologies (US), AWS (US), Cisco (US), and Microsoft (US), among others. These vendors have a large customer base, a strong geographic footprint, and organized distribution channels. They incorporate organic and inorganic growth strategies, including product launches, deals, and business expansions, boosting revenue generation.

The study includes an in-depth competitive analysis of these critical Edge computing market players with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Component, Application, Organization Size, and Vertical |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), HPE (US), Microsoft (US), Dell Technologies (US), Google (US), AWS (US), Cisco (US), NVIDIA (US), Intel (US), Huawei (China), VMware (US), Nokia (Finland), Fastly (US), ADLINK Technology (Taiwan), Juniper Networks (US), Oracle (US), Semtech (US), Moxa (US), Belden (US), GE Digital (US), Digi International (US), Litmus Automation (US), StackPath (US), ClearBlade (US), Vapor IO (US), SixSq (Switzerland) |

This research report categorizes the Edge computing market to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

-

Hardware

- Edge Servers

- Edge Gateways

- Edge Sensors

- Edge Devices

-

Software

- Data management

- Device management

- Application management

- Network management

-

Services

- Professional services

- Managed services

Based on Application:

- Real-time data processing & analytics

- Real-time cargo monitoring

- Predictive maintenance & optimization

- IoT & sensor data utilization

- Personalized customer experiences

Based on Organization Size:

- SMEs

- Large Enterprises

Based on Verticals:

- Manufacturing

- Energy & Utilities

- Government & Defense

- Telecommunications

- Media & Entertainment

- Retail & Consumer Goods

- Transportaion & Logistics

- Healthcare & Life Sciences

- Other Verticals

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

Gulf Cooperation Council (GCC)

- UAE

- Saudi Arabia

- Rest of GCC

- South Africa

- Rest of the Middle East & Africa

-

Gulf Cooperation Council (GCC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2024, AWS entered this agreement to help NTT DOCOMO deploy its nationwide 5G open radio access network (RAN) in Japan. With this development, AWS will continue to enable its truly cloud-native, sustainable, and AI-driven 5G networks. AWS is curious about its journey with NTT DOCOMO to deliver 5G Core and Open RAN with new levels of resiliency, energy efficiency, and enhanced customer experiences. (AWS has been working with CSPs for quite some time to develop solutions in advanced networking, silicon innovation, and edge services for 5G technology).

- In February 2024, Cisco collaborated with Intel. Cisco's innovation center, partners, and other vendors gained the opportunity to authenticate their 5G end devices and demonstration systems using Cisco's advanced Mobility Services Platform and Intel Mobile Edge Computing applications. Moreover, Cisco has collaborated with various radio access network (RAN) vendors to actualize innovative private 5G scenarios tailored for practical deployment in multiple industries.

- In January 2024, HPE acquired Juniper Networks to create the pathway for advanced networking solutions that bring cloud-native capabilities, AI management, and control for hybrid cloud environments when combined with HPE Aruba Networking. It is noteworthy in a related development that Juniper Networks launched its new security services architecture for edge data centers in October 2023.

- In September 2023, Microsoft Advertising launched a new video advertisement (ad) offering called Video and Connected TV (CTV) ads (advertising strategy). CTV feature expands ad-serving possibilities simultaneously while leveraging audience intelligence to target high-value customers and increase the conversion rate. CTV ads are served across Microsoft's sites and publisher partners and on connected TV in the US.

- In May 2023, Dell launched the NativeEdge software platform that simplifies, secures, and automates edge infrastructure and application deployment. Dell NativeEdge offers extensive capabilities such as secure device onboarding, remote management, and multi-cloud application orchestration. It is uniquely designed to support various enterprise edge scenarios, facilitating seamless deployment without manual intervention. It also features an open system architecture compatible with multiple hardware within Dell's comprehensive portfolio. Equipped with built-in Zero Trust functionality, Dell NativeEdge enhances security measures by safeguarding customers' applications and infrastructure across their entire edge environment.

Frequently Asked Questions (FAQ):

What is the projected market value of the Edge computing market?

The global Edge computing market is expected to grow from USD 60.0 billion in 2024 to USD 110.6 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 13.0% during the forecast period.

Which region has the highest CAGR in the Edge Computing Market?

The Asia Pacific region has the highest Edge computing Market CAGR.

Which component holds a more significant market share during the forecast period?

The hardware segment is forecasted to hold the largest market share in the Edge computing Market.

Which are the major vendors in the Edge Computing Market?

The vendors IBM, Microsoft, HPE, and Google are prominent in the Edge computing market.

What are some of the drivers in the Edge Computing Market?

Enhanced Increasing data volumes, a surge in 5G adoption, enhanced data privacy and security, reduced latency, and cost optimization with less human effort are critical drivers in the market above. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

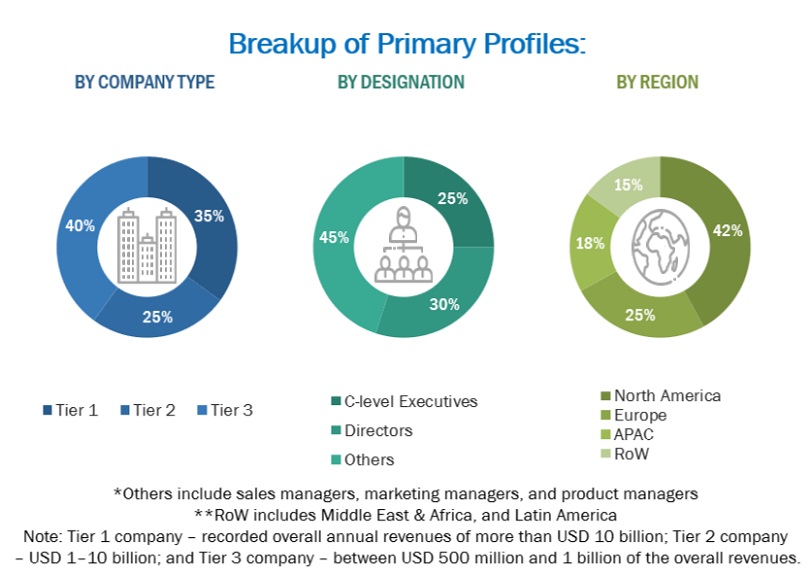

This research study involved extensive secondary sources, directories, and databases, such as Bloomberg BusinessWeek, EconoTimes, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the Edge Computing market. The global Edge Computing market size is obtained by evaluating its penetration among the major vendors and their components in this market. A few startups and private companies were interviewed to gain better visibility and in-depth knowledge of the market across regions. In addition, a few government associations, public sources, conferences, webinars, journals, magazines, articles, and MarketsandMarkets internal repositories were referred to arrive at the actual market size.

The primary sources were mainly the industry experts from the core and related industries and preferred system developers, service providers, system integrators, resellers, partners, standards, and certification organizations from companies and organizations related to various segments of the Edge Computing industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess the prospects.

Secondary Research

The market size of the company component Edge Computing and services was determined based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on Edge Computing was extracted from the respective sources. Secondary research was mainly used to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Edge Computing vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technology, components, end users, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use, which would affect the overall Edge Computing market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

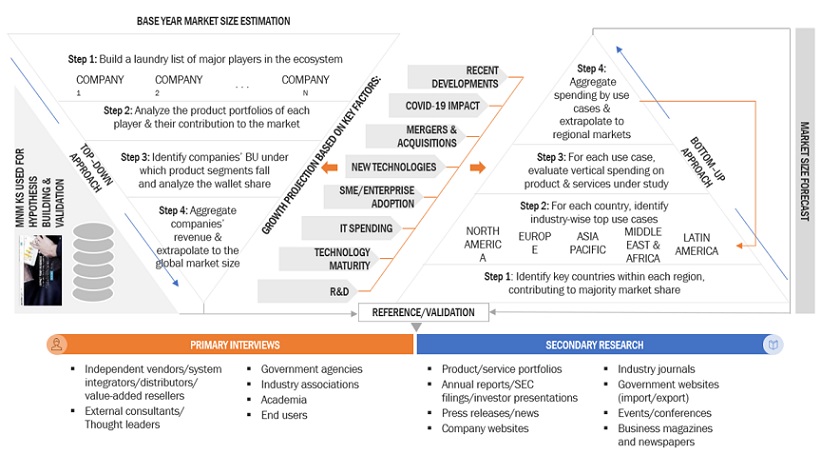

This section of the report highlights different methods to determine the Edge Computing market size. The research method involved the use of top-down and bottom-up approaches.

The top-down and bottom-up approaches were used to estimate and validate the size of the Edge Computing market and the size of various dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This entire procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

- All possible parameters affecting the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed input and analysis from MarketsandMarkets.

Top-down approach

The top-down approach prepared an exhaustive list of all vendors' offerings in the Edge Computing market. The revenue contribution for all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components. The aggregate of all companies' revenues was extrapolated to reach the overall market size. Each subsegment was further studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included obtaining critical insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. The market was derived from adopting Edge Computing solutions by different verticals. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Bottom-up approach

In the bottom-up approach, the adoption trend of Edge Computing in major countries for regions that contribute to most of the market share was identified. The adoption trend of Edge Computing, along with different use cases concerning their business segments, was identified and extrapolated for cross-validation. Weightage was given to the use cases identified in other areas for the calculation. An exhaustive list of all vendors' component solutions and services in the Edge Computing market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with Edge Computing components were considered to evaluate the market size. Each vendor was evaluated based on its components across user types. The aggregate of all companies' revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration.

Based on these numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the market's regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of foremost Edge Computing solutions and service providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, this study determined and confirmed the exact values of the overall market size and its segments' market size.

Edge computing market: Top-down and Bottom-Up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was divided into several segments and subsegments using the previously described market size estimation procedures once the overall market size was determined. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering various sources and associations, MarketsandMarkets defines Edge Computing as "the practice of processing data near the source of generation, rather than relying on a centralized data processing warehouse or cloud server. This approach reduces latency and bandwidth usage by processing data closer to where it is generated, typically at the network's edge, such as on IoT devices, routers, or other connected devices. The market for edge computing encompasses hardware, software, and services aimed at enabling efficient and decentralized data processing, storage, and analysis at the network's edge. It caters to manufacturing, healthcare, transportation, telecommunications, and more industries, where real-time data processing and low-latency applications are essential".

Key Stakeholders

- Training and consulting service providers

- Information Technology (IT) infrastructure providers

- Component providers

- System Integrators (SI)

- Support service providers

- Cloud Service Providers (CSPs)

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the Edge computing market basis component (hardware, software, services), application, organization size, vertical, and region

- To offer comprehensive details regarding the primary variables impacting the market's growth (drivers, restraints, opportunities, and challenges)

- To determine the high-growth market sectors to assess the opportunities for stakeholders in the market

- To forecast the market size for five major regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To create a thorough analysis of the market's major players' profiles, market share, and fundamental skills

- To track and analyze competitive developments in the global Edge computing market, such as product enhancements, product launches, acquisitions, partnerships, and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Edge Computing Market