Aircraft Electric Motors Market by Application, Type ( AC Motors, DC Motors ), End Use, Aircraft Type (Fixed Wing, Rotary Wing, Unmanned Aerial Vehicles, Advanced Air Mobility), Power Density, Torque, Output Power & Region - Global Forecast to 2027

Updated on : Oct 22, 2024

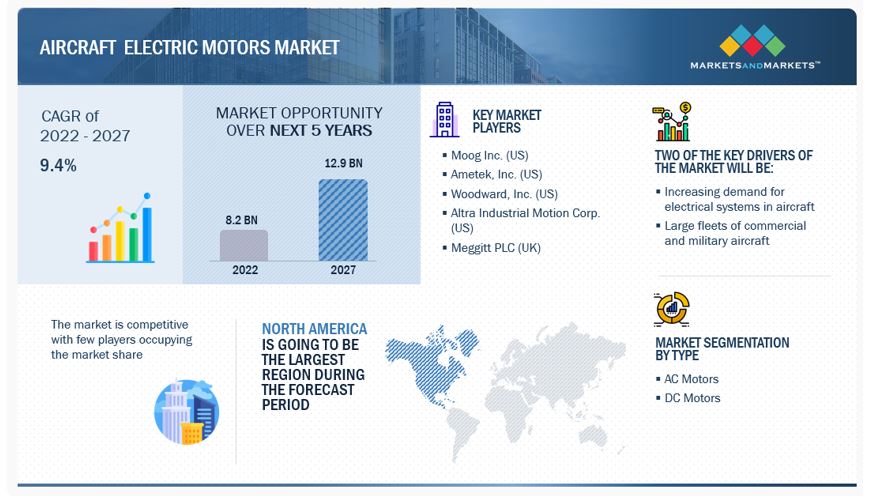

The Global Aircraft Electric Motors Market Size is projected to grow from USD 8.2 billion in 2022 to USD 12.9 billion by 2027, at a CAGR of 9.4% from 2022 to 2027. A variety of factors including an increase in aircraft renewals and an increase in the development of UAVs and hybrid VTOLs, are driving the aircraft electric motors industry. Additionally the aircraft electric motors are becoming more prominent because of the demand for advanced aircraft systems on modern aircraft, which reduces weight and lowers operating costs.

Aircraft Electric Motors Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Electric Motors Market Analysis

Aircraft Electric Motors Market Trends

Aircraft Electric Motors Market Dynamics

Driver: Increase in use of UAVs and hybrid VTOLs

Companies across industries are optimistic about the use of drones to perform critical activities such as medical sample delivery, infrastructure inspections, and imaging capabilities. Electric motors are extensively used in UAVs and e-VTOLs to power their flights, resulting in fully electric propulsion. The multipurpose use of UAVs encourages state and local governments to invest in drone technology and research, with university pilot programs to strengthen smart city models. The market has a strong presence in defense and military applications and seeks to expand in vertical markets. The increasing usability of UAVs in business applications leads to a spike in demand for UAVs.

High voltage and thermal issues of aircraft electrical systems

Transmitting large quantities of electricity around an aircraft (from batteries or generators to electric motors) is ideally done at high voltages. Also, with the use of high-power density batteries and motors in aircraft systems, the operating voltage will be significantly higher during the flight. This may generate hundreds of kilowatts of dissipated heat from multiple sources such as electric motors, batteries, power electronics, or cabling. The overheating can be mitigated with the use of an efficient cooling system in place; the absence of this, however, can have a detrimental effect. The Boeing 787 lithium-ion battery failure incidence of 2013 is one example of overheating in the aircraft’s electrical system. Hence, a heat generation mitigation system should be in place to prevent such incidences and ensure safety. Additionally, improvements in the thermal and electrical insulation materials and other changes are required to cope with the high output power of batteries and motors.

Opportunity: Use of electric aircraft for logistics operations

The logistics sector has been concerned about the emissions resulting from cargo airplanes and is in a race toward zero-emission logistics. Stakeholders in this sector are investing in electric modes of transportation to reduce their carbon footprint. Therefore, the use of all-electric aircraft as a mode of transport in logistics opens up new avenues for electric aircraft manufacturers. Cargo or freight aircraft are used for logistics operated by civil passengers, cargo airlines by private individuals, or defense forces of individual countries. According to Statista, the global air freight volume has increased significantly in the last few years, reaching 55.9 million metric tons in 2020. This volume is expected to increase further, owing to the rise of e-commerce. A few logistics companies have started adding all-electric aircraft to their fleet to minimize the resulting carbon emissions. For example, DHL Express (Germany), an air cargo subsidiary of Deutsche Post AG, has recently ordered 12 fully electric cargo aircraft from Eviation Aircraft Ltd. These aircraft, named Alice, are expected to be delivered by 2024 and will be able to carry 1,179 kg of cargo and travel at a range of 440 nautical miles.

Challenge: Re-designing of aircraft for electrification

The growing preference for more electric aircraft has given rise to a new challenge for aircraft engineers in terms of design considerations. Manufacturers also face the dilemma of developing an all-electric aircraft from scratch or retrofitting electrical systems onboard. This will become even more challenging in large commercial aircraft from Boeing and Airbus. In an aircraft, there are different design requirements for each subsystem component, and this poses a challenge for manufacturers.

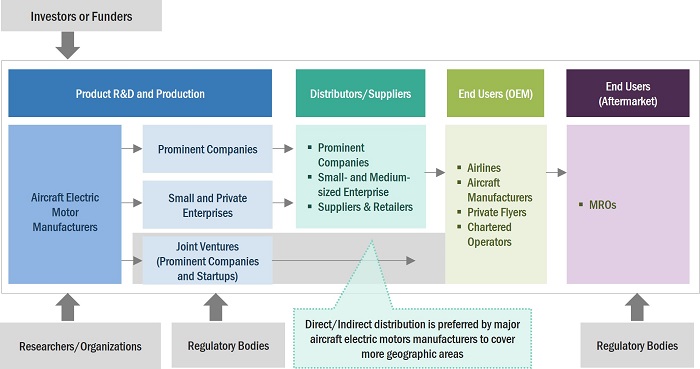

Aircraft Electric Motors Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of aircraft electric motors. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include Moog Inc. (US), Meggitt PLC (UK), and Maxon (Switzerland), Woodward, Inc. (U.S.), Moog Inc. (US), Meggitt plc (UK), Woodward, Inc. (US), and Rolls-Royce PLC (UK). Airlines, global air forces, business jet users, private flyers, MROs, and chartered operators are some of the leading consumers of aircraft electric motors.

Engine Control Systems to dominate market share during the forecast period.

Based on application, the aircraft electric motors market has been segmented into propulsion systems, flight control systems, environmental control systems, engine control systems, avionics systems, door actuation systems, landing and braking systems, cabin interior systems, and other systems. One of the primary factors propelling the engine control segment is the increased demand for advanced and lightweight aircraft electric systems with high performance and better efficiency.

AC Motors to lead the market for aircraft electric motors during the forecast period.

Based on Type, the aircraft electric motors market has been segmented into AC Motors and DC Motors. Increasing demand for the electrification of aircraft systems to enhance efficiency will drive the market. The wide integration with the actuation systems to propel the demand for the AC Motors.

10–200 kW segment to witness higher demand during the forecast period

Based on Output Power, the aircraft electric motors market has been classified into Up to 10kW, 10-200 kW and above 200 kW. The motors are widely adopted for the application in hydraulic pumps, fuel transfer pumps, flap drives, undercarriage drives, helicopter host drives, turret drives, compressor drives, actuator drives, and door actuation.

Up to 10 Nm to acquire the largest market share during the forecast period.

Based on Torque, the aircraft electric motors market has been classified into Up to 1 Nm, 1-50 Nm, 50-200 Nm and above 200 Nm. The growth of motors is attributed to wide adoption in valves and actuators to perform critical operations where speed and quick response are required, such as regulating fuel flow or airflow.

5-10 kW/kg to acquire the largest market share during the forecast period.

Based on power density, the aircraft electric motors market has been classified into Up to 5 kW/kg, 5-10 kW/kg and above 10 kW/kg. Motors with this power density enable the miniaturization of end devices and are of the utmost importance for actuation systems in aircraft. This will enhance the growth of the segment.

Fixed wing system segment to hold major market share during the forecast period.

Based on aircraft type, the aircraft electric motors market has been classified into fixed wing, unmanned aerial vehicles, rotary wing, and advanced air mobility. The increase in the air passenger travel will drive the aviation industry, that will proportionally enhance the market for the market. Additionally growing demand for air travel is one of the major factors driving the commercial fixed-wing segment of the aircraft electric motors market.

OEM segment to hold major market share during the forecast period.

Based on end use, the aircraft electric motors market has been classified into OEM and aftermarket. The growing demand for advanced aircraft, combined with the need for the electrification of aircraft systems, is driving the OEM segment in the market.

Regional Analysis - Aircraft Electric Motors Market

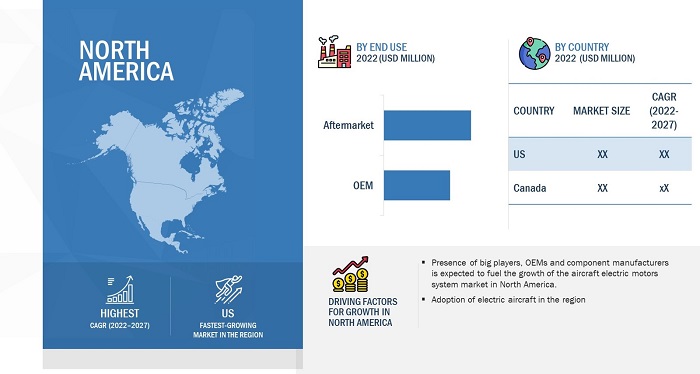

North America is projected to witness the highest market share during the forecast period.

North America leads the aircraft electric motors market due Presence of big players, OEMs, and component manufacturers are some of the factors expected to boost the growth of the aircraft electric motors systems market in North America. The growth in this region can be attributed to the presence of several electrical motors and systems manufacturers such as magniX, H3X, Kollmorgen, Windings Inc., and Honeywell International, Inc, among others in the region. These market players continuously invest in R&D to develop advanced aircraft electric motors with improved efficiency and reliability. They are also focused on developing more electric aircraft systems than hydraulics in aircraft.

Aircraft Electric Motors Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Aircraft Electric Motors Companies - Key Market Players

The aircraft electric motors companies are dominated by globally established players such as Moog Inc. (US), Meggitt plc (UK), Altra Industrial Motion Corporation (US), Woodward, Inc. (US), and Rolls-Royce PLC (UK) are some leading players in the aircraft electric motors market.

Aircraft Electric Motors Industry Overview

The Aircraft Electric Motors Industry is experiencing a paradigm shift as the aviation sector increasingly embraces electrification. This overview highlights the industry's evolution, driven by technological advancements and a growing commitment to reducing the carbon footprint of air travel. The market is characterized by a diverse range of electric motor applications, from propulsion systems to auxiliary power units. Major aerospace manufacturers are integrating electric motors to enhance fuel efficiency and operational performance. The industry is also marked by significant investments in R&D and strategic collaborations, positioning electric motors as a cornerstone of future aviation innovation.

Scope of the Aircraft Electric Motors Market Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 8.2 billion in 2022 |

|

Projected Market Size |

USD 12.9 billion by 2027 |

|

Growth Rate

|

9.4% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Application, By Type, By End Use, By Aircraft Type, By Output Power, By Torque, By Power Density, and By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, Africa, and Latin America |

|

Companies Covered |

Moog Inc. (US), Meggitt PLC (UK), Altra Industrial Motion Corporation (US), Woodward, Inc. (US), and Rolls-Royce PLC (UK) and among others |

Aircraft Electric Motors Market Highlights

This research report categorizes the Aircraft Electric motors Market based on Application, Type, End Use, Aircraft Type, Power Density, Torque, Output Power and Region.

|

Aspect |

Details |

|

By Application |

|

|

By Type |

|

|

By Output Power |

|

|

By Torque |

|

|

By Power Density |

|

|

By Aircraft Type |

|

|

By End Use |

|

|

By Region |

|

Recent Developments

- In April 2021, Maxon supplied six brushed DC motors for NASA's Ingenuity helicopter, which successfully completed its pioneering flight on Mars. This was the first controlled flight of a powered, unmanned spaceflight to another planet.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the aircraft electric motors market?

The market for aircraft electric motors is anticipated to expand significantly as a result of the rising need for advanced electrical systems in aircraft.

What are the key sustainability strategies adopted by leading players operating in the aircraft electric motors market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft electric motors market. The major players include Moog Inc. (US), Meggitt PLC (UK), Altra Industrial Motion Corporation (US), Woodward, Inc. (US), and Rolls-Royce PLC (UK). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Aircraft electric motors market?

Some of the major emerging technologies and use cases disrupting the market include more electric technology, electric propulsion in aircraft, advanced air mobility and the use of fully electric architecture in aviation applications.

Who are the key players and innovators in the ecosystem of the aircraft electric motors market?

The key players in the Aircraft electric motors market include Moog Inc. (US), Meggitt PLC (UK), Altra Industrial Motion Corporation (US), Woodward, Inc. (US), and Rolls-Royce PLC (UK).

Which region is expected to hold the highest market share in the aircraft electric motors market?

The aircraft electric motors market in North America is projected to hold the highest market share during the forecast period due to the presence of several large aircraft electric motors manufacturers in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for electrical systems in aircraft- Rise in aircraft renewals and deliveries- Large fleets of commercial and military aircraft- Increase in use of UAVs and hybrid VTOLsRESTRAINTS- Power density limitations of electric propulsion technology- High voltage and thermal issues of aircraft electrical systemsOPPORTUNITIES- Emergence of advanced air mobility- Use of electric aircraft for logistics operationsCHALLENGES- Limited battery recharging infrastructure at airports- Re-designing of aircraft for electrification- Strict policies and longer clearance period for electric aircraft

-

5.3 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESSESREVENUE SHIFTS AND NEW REVENUE POCKETS FOR AIRCRAFT ELECTRIC MOTOR MANUFACTURERS

- 5.4 TRADE ANALYSIS

-

5.5 CASE STUDY ANALYSISUSE OF ELECTRIC MOTORS IN MORE ELECTRIC AIRCRAFT BY HONEYWELLPARKER AEROSPACE USES AMETEK’S HYDRAULIC PUMP MOTOR FOR T-X JET TRAINER AIRCRAFT

- 5.6 PRICING ANALYSIS

-

5.7 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 TECHNOLOGY ANALYSISTURBOGENERATORS FOR POWERING ELECTRIC MOTORS AND BATTERIESEMERGENCE OF HYDROGEN FUEL CELLS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 RECESSION IMPACT SCENARIO OF AIRCRAFT ELECTRIC MOTORS MARKET

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 VOLUME DATA

- 5.14 KEY CONFERENCES AND EVENTS, 2022–2023

- 5.15 REGULATORY LANDSCAPE

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSELECTRICAL PROPULSIONELECTRICAL SYSTEMSURBAN AIR MOBILITYHIGH-POWER BATTERIES AND MOTORSNEW POWER SOURCES FOR ELECTRICAL SYSTEMSMORE ELECTRIC AIRCRAFTAUTOMATION OF MOTOR CONTROL

-

6.4 IMPACT OF MEGATRENDSIMPLEMENTATION OF INDUSTRY 4.0GLOBALIZATION OF SUPPLY CHAIN FOR AIRCRAFT ELECTRIC MOTORS MANUFACTURING

-

6.5 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 PROPULSION SYSTEMSEMPHASIS ON GREEN-ENERGY MODE OF TRANSPORTATION

-

7.3 FLIGHT CONTROL SYSTEMSREDUCTION OF WEIGHT OF AIRCRAFT

-

7.4 ENVIRONMENTAL CONTROL SYSTEMSOPTIMIZES POWER CONSUMPTION OF AIRCRAFT

-

7.5 ENGINE CONTROL SYSTEMSENSURES AIRCRAFT SAFETY

-

7.6 AVIONICS SYSTEMSINTEGRATION WITH SUBSYSTEMS TO ENHANCE OPERATIONAL EFFICIENCY

-

7.7 DOOR ACTUATION SYSTEMSDEPLOYMENT OF ELECTRIC MOTORS TO DECREASE COMPLEXITY AND MAINTAINABILITY

-

7.8 LANDING AND BRAKING SYSTEMSREDUCED AIRCRAFT WEIGHT AND OPERATING COST

-

7.9 CABIN INTERIOR SYSTEMSHIGH POWER DENSITY AND LOW NOISE OPERATION

-

7.10 OTHER SYSTEMSADVANCES IN OPERATIONAL EFFICIENCY

- 8.1 INTRODUCTION

-

8.2 AC MOTORSINDUCTION MOTORS- Use in environmental cooling and other aircraft applicationsSYNCHRONOUS MOTORS- Enhances actuation efficiency

-

8.3 DC MOTORSBRUSHED DC MOTORS- Deployment in climate control systemsBRUSHLESS DC MOTORS- Need for efficient propulsion operations in UAVsSTEPPER MOTORS- Low power input and high efficiency

- 9.1 INTRODUCTION

-

9.2 UP TO 10 KWHIGH POWER EFFICIENCY AND OUTPUT

-

9.3 10–200 KWHIGH ADOPTION OF DRONE TECHNOLOGY

-

9.4 ABOVE 200 KWDEPLOYMENT IN CESSNA AND DHC-2 AIRCRAFT

- 10.1 INTRODUCTION

-

10.2 UP TO 1 NMUSE IN CRITICAL OPERATIONS

-

10.3 1–50 NMINCREASED ADOPTION BY ADVANCED AIR MOBILITY AIRCRAFT MANUFACTURERS

-

10.4 50–200 NMUSED IN PROPULSION SYSTEMS IN MINI-AIRCRAFT

-

10.5 ABOVE 200 NMDEPLOYMENT IN LARGE AND HEAVY APPLICATIONS

- 11.1 INTRODUCTION

-

11.2 UP TO 5 KW/KGENHANCED PERFORMANCE AND WIDE ADOPTION

-

11.3 5–10 KW/KGINCREASING DEMAND FOR AIRCRAFT

-

11.4 ABOVE 10 KW/KGUSED IN HEAVY AIRCRAFT APPLICATIONS

- 12.1 INTRODUCTION

-

12.2 FIXED WINGCOMMERCIAL AVIATION- Narrow-body aircraft- Wide-body aircraft- Regional jetsBUSINESS AND GENERAL AVIATION- Business jets- Light aircraftMILITARY AVIATION- Fighter aircraft- Transport aircraft- Special mission aircraft

-

12.3 ROTARY WINGCOMMERCIAL HELICOPTERS- Demand from leasing companiesMILITARY HELICOPTERS- Used for combat and search & rescue operations

-

12.4 UNMANNED AERIAL VEHICLESFIXED-WING UAVS- Increased use of fixed-wing MALE UAVs in military applicationsFIXED-WING HYBRID VTOL UAVS- Ability to carry heavy payloadsROTARY-WING UAVS- High demand in search & rescue, precision farming, and law enforcement applications

-

12.5 ADVANCED AIR MOBILITYAIR TAXIS- Need for on-demand urban transportationAIR SHUTTLES AND AIR METROS- Need for substitute urban transportation solutionsPERSONAL AERIAL VEHICLES- Need for personal transport alternativesCARGO AERIAL VEHICLES- High demand for intercity and intracity cargo transportationAIR AMBULANCES AND MEDICAL EMERGENCY VEHICLES- Focus on serving medical emergency servicesLAST-MILE DELIVERY VEHICLES- Advances in package delivery solutions

- 13.1 INTRODUCTION

-

13.2 OEMINCREASED DEMAND FOR MORE ELECTRIC AIRCRAFT

-

13.3 AFTERMARKETMAINTENANCE OF ELECTRIC MOTORS AND BATTERIES

- 14.1 INTRODUCTION

- 14.2 FUTURE OF BRUSHLESS DC MOTORS IN AEROSPACE

- 14.3 MARS HELICOPTER AND FUTURE OF EXTRATERRESTRIAL FLIGHT

-

15.1 INTRODUCTIONREGIONAL RECESSION IMPACT ANALYSIS

-

15.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAOEM MARKETAFTERMARKETUS- Largescale presence of leading OEMsCANADA- Aircraft modernization programs

-

15.3 EUROPEPESTLE ANALYSIS: EUROPEOEM MARKETAFTERMARKETUK- Technological advancements in air travelFRANCE- Increased competition between various airlinesGERMANY- Rise in passenger traffic and procurement of advanced jets and helicoptersITALY- High demand for civil and corporate helicoptersRUSSIA- Adoption by law enforcement agenciesREST OF EUROPE- Improved focus on advanced air mobility

-

15.4 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICOEM MARKETAFTERMARKETCHINA- Growing demand for aerospace productsINDIA- Modernization plans of aviation industryJAPAN- In-house development of aircraftAUSTRALIA- Increased procurement of different aircraftSOUTH KOREA- Modernization programs in aviation industryREST OF ASIA PACIFIC- Replacement of aging aircraft

-

15.5 MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTOEM MARKETAFTERMARKETSAUDI ARABIA- Aviation industry modernization programUAE- Widescale adoption of advanced air mobility platforms for commercial applicationsISRAEL- Increased expenditure on R&D of UAVs for military and commercial applicationsTURKEY- Rise in military spending and development of UAVsREST OF MIDDLE EAST- Presence of MRO service providers in aviation industry

-

15.6 LATIN AMERICAPESTLE ANALYSIS: LATIN AMERICAOEM MARKETAFTERMARKETBRAZIL- Increase in air passenger trafficMEXICO- Adoption by government agenciesREST OF LATIN AMERICA- Modernization of existing aircraft fleet

-

15.7 AFRICAPESTLE ANALYSIS: AFRICAOEM MARKETAFTERMARKETSOUTH AFRICA- Growing use of private jets and expanding tourism industryNIGERIA- Rising commercial fleetsREST OF AFRICA- Need for modern commercial aircraft

- 16.1 INTRODUCTION

- 16.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- 16.3 RANKING ANALYSIS OF TOP FIVE PLAYERS, 2021

- 16.4 COMPETITIVE BENCHMARKING

-

16.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

16.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

16.7 COMPETITIVE SCENARIOSMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

- 17.1 INTRODUCTION

-

17.2 KEY PLAYERSMOOG, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMEGGITT PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALTRA INDUSTRIAL MOTION CORP.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWOODWARD, INC.- Business overview- Products/Solutions/Services offered- MnM viewROLLS-ROYCE PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALLIED MOTION, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsAMETEK, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsMGM COMPRO- Business overview- Products/Solutions/Services offeredEMRAX D.O.O.- Business overview- Products/Solutions/Services offeredMAXON- Business overview- Products/Solutions/Services offered- Recent developmentsFAULHABER MICROMO, LLC- Business overview- Products/Solutions/Services offeredTHINGAP, INC.- Business overview- Products/solutions/services offeredTURNIGY POWER SYSTEMS- Business overview- Products/Solutions/Services offeredELECTROMECH TECHNOLOGIES- Business overview- Products/Solutions/Services offeredTECHNODINAMIKA- Business overview- Products/Solutions/Services offeredWINDINGS INC.- Business overview- Products/Solutions/Services offeredARC SYSTEMS INC.- Business overview- Products/Solutions/Services offeredXOAR INTERNATIONAL LLC- Business overview- Products/Solutions/Services offeredKDE DIRECT- Business overview- Products/Solutions/Services offeredPIPISTREL D.O.O.- Business overview- Products/Solutions/Services offered

-

17.3 OTHER PLAYERSMAGNIXT-MOTOREVOLITO LIMITEDMAGNETO AERO DYNAMICS (MAD COMPONENTS)H3X TECHNOLOGIES INC.

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 INCLUSIONS AND EXCLUSIONS

- TABLE 3 REGIONAL OUTLOOK ON GROWTH OF AIR TRAFFIC, FLEET, AND AIRCRAFT DELIVERIES

- TABLE 4 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

- TABLE 5 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

- TABLE 6 TRADE DATA FOR AIRCRAFT ELECTRIC MOTORS MARKET

- TABLE 7 AVERAGE SELLING PRICE RANGE

- TABLE 8 AIRCRAFT ELECTRIC MOTORS MARKET ECOSYSTEM

- TABLE 9 PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT ELECTRIC MOTORS (%)

- TABLE 11 KEY BUYING CRITERIA FOR AIRCRAFT ELECTRIC MOTORS

- TABLE 12 AIRCRAFT ELECTRIC MOTORS OEM MARKET, BY AIRCRAFT TYPE (UNITS)

- TABLE 13 AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE (UNITS)

- TABLE 14 AIRCRAFT ELECTRIC MOTORS MARKET: CONFERENCES AND EVENTS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 AIRCRAFT ELECTRIC MOTORS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 20 AIRCRAFT ELECTRIC MOTORS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 21 AIRCRAFT ELECTRIC MOTORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 22 AIRCRAFT ELECTRIC MOTORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 23 AIRCRAFT AC MOTORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 24 AIRCRAFT AC MOTORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 25 AIRCRAFT DC MOTORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 26 AIRCRAFT DC MOTORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 27 AIRCRAFT ELECTRIC MOTORS MARKET, BY OUTPUT POWER, 2018–2021 (USD MILLION)

- TABLE 28 AIRCRAFT ELECTRIC MOTORS MARKET, BY OUTPUT POWER, 2022–2027 (USD MILLION)

- TABLE 29 AIRCRAFT ELECTRIC MOTORS MARKET, BY TORQUE, 2018–2021 (USD MILLION)

- TABLE 30 AIRCRAFT ELECTRIC MOTORS MARKET, BY TORQUE, 2022–2027 (USD MILLION)

- TABLE 31 AIRCRAFT ELECTRIC MOTORS MARKET, BY POWER DENSITY, 2018–2021 (USD MILLION)

- TABLE 32 AIRCRAFT ELECTRIC MOTORS MARKET, BY POWER DENSITY, 2022–2027 (USD MILLION)

- TABLE 33 AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 34 AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 35 COMMERCIAL AVIATION MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 36 COMMERCIAL AVIATION MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 37 BUSINESS AND GENERAL MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 38 BUSINESS AND GENERAL AVIATION MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 39 MILITARY AVIATION MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 40 MILITARY AVIATION MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 41 ROTARY WING MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 42 ROTARY WING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 43 UNMANNED AERIAL VEHICLES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 44 UNMANNED AERIAL VEHICLES MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 45 ADVANCED AIR MOBILITY MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 46 AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 47 AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 48 SUPPLIERS OF SPACECRAFT AND SATELLITE BEARINGS

- TABLE 49 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 50 AIRCRAFT ELECTRIC MOTORS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 51 AIRCRAFT ELECTRIC MOTORS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 53 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 57 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 64 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 65 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 66 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN ADVANCED AIR MOBILITY, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 68 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 70 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 72 NORTH AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 74 NORTH AMERICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 75 US: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 76 US: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 77 US: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 78 US: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 79 CANADA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 80 CANADA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 81 CANADA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 82 CANADA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 83 EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 84 EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 85 EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 86 EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 87 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 88 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 89 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 90 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 91 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 92 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 93 EUROPE: ROTARY-WING AIRCRAFT ELECTRIC MOTORS, OEM MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 94 EUROPE: ROTARY-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 95 EUROPE: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 96 EUROPE: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 97 EUROPE: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN ADVANCED AIR MOBILITY, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 98 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 99 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 100 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 101 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 102 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 103 EUROPE: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 104 EUROPE: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 105 EUROPE: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 106 UK: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 107 UK: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 108 UK: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 109 UK: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 110 FRANCE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 111 FRANCE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 112 FRANCE: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 113 FRANCE: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 114 GERMANY: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 115 GERMANY: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 116 GERMANY: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 117 GERMANY: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 118 ITALY: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 119 ITALY: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 120 ITALY: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 121 ITALY: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 122 RUSSIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 123 RUSSIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 124 RUSSIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 125 RUSSIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 126 REST OF EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 127 REST OF EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 128 REST OF EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 129 REST OF EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 134 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 135 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 136 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 138 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 139 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 141 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 142 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN ADVANCED AIR MOBILITY, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 151 CHINA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 152 CHINA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 153 CHINA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 154 CHINA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 155 INDIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 156 INDIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 157 INDIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 158 INDIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 159 JAPAN: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 160 JAPAN: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 161 JAPAN: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 162 JAPAN: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 163 AUSTRALIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 164 AUSTRALIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 165 AUSTRALIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 166 AUSTRALIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 167 SOUTH KOREA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 168 SOUTH KOREA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 169 SOUTH KOREA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 170 SOUTH KOREA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 175 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 176 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 177 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 178 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 179 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 180 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 181 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 182 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 183 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN ADVANCED AIR MOBILITY, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 184 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 185 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 186 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 187 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 188 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 189 MIDDLE EAST: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 190 MIDDLE EAST: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 191 MIDDLE EAST: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 192 SAUDI ARABIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 193 SAUDI ARABIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 194 SAUDI ARABIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 195 SAUDI ARABIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 196 UAE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 197 UAE: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 198 UAE: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 199 UAE: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 200 ISRAEL: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 201 ISRAEL: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 202 ISRAEL: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 203 ISRAEL: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 204 TURKEY: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 205 TURKEY: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 206 TURKEY: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 207 TURKEY: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 211 REST OF MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 212 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 213 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 214 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 215 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 216 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 217 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 218 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 219 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 220 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 221 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 222 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN ADVANCED AIR MOBILITY, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 223 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 224 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 225 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 226 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 227 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 228 LATIN AMERICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 229 LATIN AMERICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 230 LATIN AMERICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 231 BRAZIL: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 232 BRAZIL: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 233 BRAZIL: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 234 BRAZIL: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 235 MEXICO: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 236 MEXICO: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 237 MEXICO: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 238 MEXICO: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 239 REST OF THE LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 240 REST OF THE LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 241 REST OF THE LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 242 REST OF THE LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 243 AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2 018–2021 (USD MILLION)

- TABLE 244 AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 245 AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 246 AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 247 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 248 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 249 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 250 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 251 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 252 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 253 AFRICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS, OEM MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 254 AFRICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS OEM MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 255 AFRICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 256 AFRICA: AIRCRAFT ELECTRIC MOTORS OEM MARKET IN UNMANNED AERIAL VEHICLES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 257 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 258 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 259 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 260 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 261 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 262 AFRICA: FIXED-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 263 AFRICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 264 AFRICA: ROTARY-WING AIRCRAFT ELECTRIC MOTORS AFTERMARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 265 SOUTH AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 266 SOUTH AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 267 SOUTH AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 268 SOUTH AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 269 NIGERIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 270 NIGERIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 271 NIGERIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 272 NIGERIA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 273 REST OF AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

- TABLE 274 REST OF AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

- TABLE 275 REST OF AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2018–2021 (USD MILLION)

- TABLE 276 REST OF AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027 (USD MILLION)

- TABLE 277 AIRCRAFT ELECTRIC MOTORS MARKET: DEGREE OF COMPETITION

- TABLE 278 KEY DEVELOPMENTS BY LEADING PLAYERS, 2019–2022

- TABLE 279 COMPANY PRODUCT FOOTPRINT

- TABLE 280 COMPANY MOTOR TYPE FOOTPRINT

- TABLE 281 COMPANY APPLICATION FOOTPRINT

- TABLE 282 REGIONAL FOOTPRINT

- TABLE 283 AIRCRAFT ELECTRIC MOTORS MARKET: KEY STARTUP/SME

- TABLE 284 AIRCRAFT ELECTRIC MOTORS MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020–NOVEMBER 2020

- TABLE 285 AIRCRAFT ELECTRIC MOTORS MARKET: DEALS, DECEMBER 2018– APRIL 2021

- TABLE 286 AIRCRAFT ELECTRIC MOTORS MARKET: OTHER DEVELOPMENTS, JUNE 2019– APRIL 2021

- TABLE 287 MOOG INC.: BUSINESS OVERVIEW

- TABLE 288 MOOG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 MOOG INC.: DEALS

- TABLE 290 MEGGITT PLC: BUSINESS OVERVIEW

- TABLE 291 MEGGITT PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 MEGGITT PLC: DEALS

- TABLE 293 ALTRA INDUSTRIAL MOTION CORP.: BUSINESS OVERVIEW

- TABLE 294 ALTRA INDUSTRIAL MOTION CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 ALTRA INDUSTRIAL MOTION CORP.: PRODUCT LAUNCHES

- TABLE 296 ALTRA INDUSTRIAL MOTION CORP.: DEALS

- TABLE 297 WOODWARD INC.: BUSINESS OVERVIEW

- TABLE 298 WOODWARD INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 ROLLS-ROYCE PLC: BUSINESS OVERVIEW

- TABLE 300 ROLLS-ROYCE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 ROLLS-ROYCE PLC: PRODUCT LAUNCHES

- TABLE 302 ROLLS-ROYCE PLC: DEALS

- TABLE 303 ALLIED MOTION, INC.: BUSINESS OVERVIEW

- TABLE 304 ALLIED MOTION, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 ALLIED MOTION, INC.: DEALS

- TABLE 306 AMETEK, INC.: BUSINESS OVERVIEW

- TABLE 307 AMETEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 AMETEK, INC.: DEALS

- TABLE 309 MGM COMPRO: BUSINESS OVERVIEW

- TABLE 310 MGM COMPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 EMRAX D.O.O.: BUSINESS OVERVIEW

- TABLE 312 EMRAX D.O.O.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 MAXON: BUSINESS OVERVIEW

- TABLE 314 MAXON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 MAXON: DEALS

- TABLE 316 FAULHABER MICROMO, LLC: BUSINESS OVERVIEW

- TABLE 317 FAULHABER MICROMO, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 THINGAP, INC.: BUSINESS OVERVIEW

- TABLE 319 THINGAP, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 TURNIGY POWER SYSTEMS: BUSINESS OVERVIEW

- TABLE 321 TURNIGY POWER SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 ELECTROMECH TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 323 ELECTROMECH TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 TECHNODINAMIKA: BUSINESS OVERVIEW

- TABLE 325 TECHNODINAMIKA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 WINDINGS INC.: BUSINESS OVERVIEW

- TABLE 327 WINDINGS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 ARC SYSTEMS INC.: BUSINESS OVERVIEW

- TABLE 329 ARC SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 XOAR INTERNATIONAL LLC: BUSINESS OVERVIEW

- TABLE 331 XOAR INTERNATIONAL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 KDE DIRECT: BUSINESS OVERVIEW

- TABLE 333 KDE DIRECT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 PIPISTREL D.O.O.: BUSINESS OVERVIEW

- TABLE 335 PIPISTREL D.O.O.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 MAGNIX: COMPANY OVERVIEW

- TABLE 337 T-MOTOR: COMPANY OVERVIEW

- TABLE 338 EVOLITO LIMITED: COMPANY OVERVIEW

- TABLE 339 MAGNETO AERO DYNAMICS (MAD COMPONENTS): COMPANY OVERVIEW

- TABLE 340 H3X TECHNOLOGIES INC.: COMPANY OVERVIEW

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE CALCULATION FOR OEM

- FIGURE 4 MARKET SIZE CALCULATION FOR AFTERMARKET

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 QUARTERLY REVENUE FOR TOP AIRCRAFT ELECTRIC MOTOR MANUFACTURERS, 2022–2023

- FIGURE 9 QUARTERLY REVENUE FOR TOP AIRCRAFT MANUFACTURERS, 2022–2023

- FIGURE 10 RESEARCH ASSUMPTIONS

- FIGURE 11 10–200 KW SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 12 AC MOTORS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 AFTERMARKET REGISTERED LARGER MARKET SHARE IN 2022

- FIGURE 14 NORTH AMERICA SURPASSED OTHER REGIONS IN 2022

- FIGURE 15 DEMAND FOR ENVIRONMENT-FRIENDLY AIRCRAFT TO DRIVE MARKET BY 2027

- FIGURE 16 FIXED WING TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 17 ENGINE CONTROL SYSTEMS TO COMMAND LEADING MARKET POSITION BY 2027

- FIGURE 18 OEM WILL LIKELY SHOW HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 AIRCRAFT ELECTRIC MOTORS MARKET DYNAMICS

- FIGURE 20 REVENUE SHIFTS IN AIRCRAFT ELECTRIC MOTORS MARKET

- FIGURE 21 AIRCRAFT ELECTRIC MOTORS MARKET ECOSYSTEM MAP

- FIGURE 22 AIRCRAFT ELECTRIC MOTORS MARKET VALUE CHAIN ANALYSIS

- FIGURE 23 AIRCRAFT ELECTRIC MOTORS MARKET PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 UNCERTAINTY ANALYSIS OF AIRCRAFT ELECTRIC MOTORS MARKET

- FIGURE 25 FACTORS IMPACTING AIRCRAFT ELECTRIC MOTORS MARKET

- FIGURE 26 SCENARIO IMPACT ON AIRCRAFT ELECTRIC MOTORS MARKET

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT ELECTRIC MOTORS

- FIGURE 28 KEY BUYING CRITERIA FOR AIRCRAFT ELECTRIC MOTORS

- FIGURE 29 SUPPLY CHAIN ANALYSIS

- FIGURE 30 AIRCRAFT ELECTRIC MOTORS MARKET, BY APPLICATION, 2022–2027

- FIGURE 31 AIRCRAFT ELECTRIC MOTORS MARKET, BY TYPE, 2022–2027

- FIGURE 32 AIRCRAFT ELECTRIC MOTORS MARKET, BY OUTPUT POWER, 2022–2027

- FIGURE 33 AIRCRAFT ELECTRIC MOTORS MARKET, BY TORQUE, 2022–2027

- FIGURE 34 AIRCRAFT ELECTRIC MOTORS MARKET, BY POWER DENSITY, 2022–2027

- FIGURE 35 AIRCRAFT ELECTRIC MOTORS MARKET, BY AIRCRAFT TYPE, 2022–2027

- FIGURE 36 NARROW-BODY AIRCRAFT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 BUSINESS JETS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 FIGHTER AIRCRAFT TO SURPASS OTHER AIRCRAFT DURING FORECAST PERIOD

- FIGURE 39 COMMERCIAL HELICOPTERS TO ACQUIRE DOMINANT MARKET POSITION DURING FORECAST PERIOD

- FIGURE 40 ROTARY-WING UAVS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 AIRCRAFT ELECTRIC MOTORS MARKET, BY END USE, 2022–2027

- FIGURE 42 AIRCRAFT ELECTRIC MOTORS MARKET: REGIONAL SNAPSHOT

- FIGURE 43 NORTH AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET SNAPSHOT

- FIGURE 44 EUROPE: AIRCRAFT ELECTRIC MOTORS MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: AIRCRAFT ELECTRIC MOTORS MARKET SNAPSHOT

- FIGURE 46 MIDDLE EAST: AIRCRAFT ELECTRIC MOTORS MARKET SNAPSHOT

- FIGURE 47 LATIN AMERICA: AIRCRAFT ELECTRIC MOTORS MARKET SNAPSHOT

- FIGURE 48 AFRICA: AIRCRAFT ELECTRIC MOTORS MARKET SNAPSHOT

- FIGURE 49 SHARE OF TOP PLAYERS IN AIRCRAFT ELECTRIC MOTORS MARKET, 2021

- FIGURE 50 MARKET RANKING OF TOP FIVE PLAYERS, 2021

- FIGURE 51 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

- FIGURE 52 KEY PLAYERS COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 53 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 54 MOOG, INC.: COMPANY SNAPSHOT

- FIGURE 55 MEGGITT PLC: COMPANY SNAPSHOT

- FIGURE 56 ALTRA INDUSTRIAL MOTION CORP.: COMPANY SNAPSHOT

- FIGURE 57 WOODWARD INC.: COMPANY SNAPSHOT

- FIGURE 58 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- FIGURE 59 ALLIED MOTION, INC.: COMPANY SNAPSHOT

- FIGURE 60 AMETEK, INC.: COMPANY SNAPSHOT

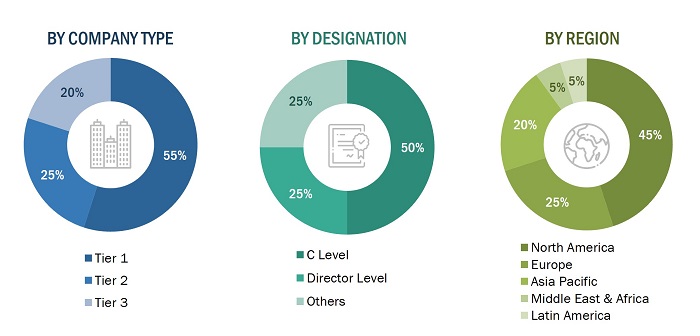

The study involved four major activities in estimating the current market size for the aircraft electric motors market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The aircraft electric motors market comprises several stakeholders, such as raw material providers, aircraft electric motors manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft electric motors market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

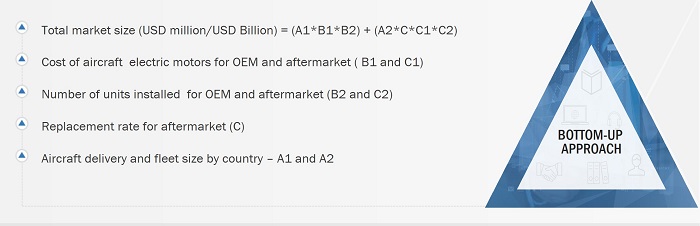

Market Size Estimation Methodology: Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the aircraft electric motors market from the demand for such systems and components by end-users in each country, and the average cost of integration for both line-fit and retrofit installations was multiplied by the new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

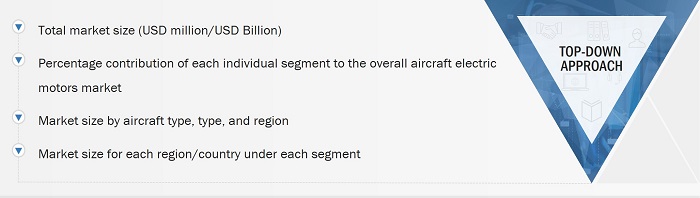

Market Size Estimation Methodology: Top-Down Approach

In the top-down approach, aircraft electric motor manufacturers were identified, and their revenue specific to the aircraft electric motors market was identified. The base market number for each player was arrived at by assigning a weight to aircraft electric motor contracts.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the aircraft Electric motors market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the aircraft electric motors market.

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for six regions, namely, North America, Europe, Asia Pacific, Middle East, Africa and Latin America, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Electric Motors Market

I am a graduate student and the title of my dissertation is designing and modeling a hybrid propulsion system for a flying car.so I need the specifications of electric motors. If you have information about the selection of engine, battery, etc. of this system, thank you for leaving them at my disposal.