Electric Bus Market by Propulsion (BEV, FCEV), Battery (LFP, NMC, NCA), Length (<9, 9-14, >14m), Application (City, Coach, Midi, School), Seating/Battery Capacity, Range, Power Output, Autonomy Level, Component, Consumer Region - Global Forecast to 2030

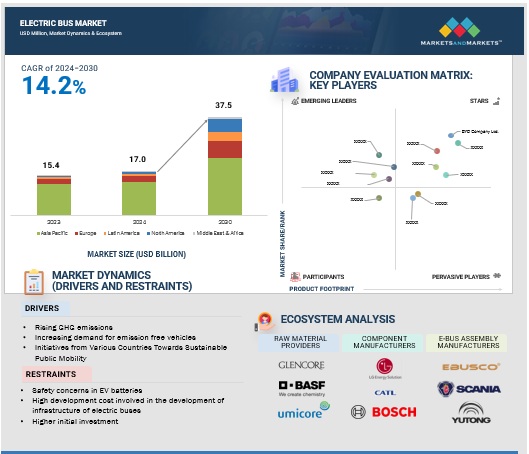

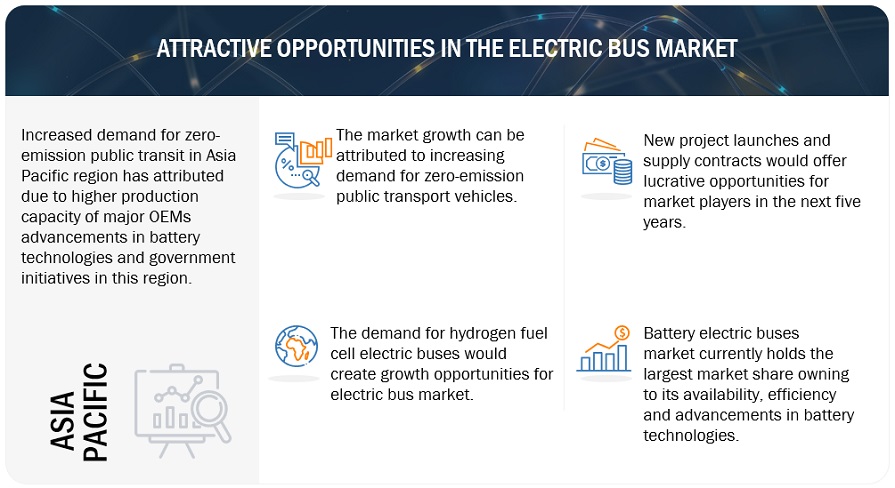

[388 Page Report] The global electric bus market is projected to be USD 17.0 billion in 2024 and to grow to USD 37.5 billion by 2030, at a compound annual growth rate (CAGR) of about 14.2%. The electric bus market will witness high acceleration in the upcoming years due to zero-emission vehicle promotion in countries with respect to their public transportation fleets and government initiatives backing electrification. For the forecast period, it is expected that the Asia Pacific will dominate the market for electric buses. The existence of leading electric bus manufacturers such as BYD and Yutong operating in every major region has influenced this market, coupled with a variety of affordable electric buses due to lower prices of parts and components. Besides, government initiatives, large investment in charging infrastructure, and improvements in battery technologies continue to further drive the market in this region. North America is estimated to grow with the highest CAGR over the forecast period, followed by Latin America and Europe.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Growing demand for zero-emission vehicles

The transportation industry is currently the quickest growing contributor to greenhouse gas emissions, expected to surpass 30%. One of the leading causes of future GHG emissions, and a significant source of air pollution. With the worldwide collection of vehicles anticipated to increase by 100% by 2050, particularly in low and middle-income nations, thorough actions are necessary. The UNEP (United Nations Environment Program) and other international organizations have developed a global program to support this shift. Governments worldwide are adopting electric buses to make urban transport systems more sustainable and fuel-efficient. Initiatives by the government further promote the adoption of electric buses. The transition is being driven by initiatives such as the Electric Transport Green Deal in the Netherlands and the funding for zero emission projects from the US Federal Transit Administration. The goal of the ZEBRA (Zero Emission Bus Rapid-deployment Accelerator) project is to transition new bus purchases in major Latin American cities to low-emission technologies. Metropolitan areas such as Santiago de Chile and Medellin are leading this shift towards emission free public transportation, with Santiago striving to possess the world's second largest electric bus fleet. European Commission is imposing strict CO2 emission goals for new heavy-duty vehicles from 2030 onwards. Newly manufactured urban buses are required to have zero emissions, while emissions from heavy-duty commercial vehicles must be decreased by 45% by 2030, 65% by 2035, and 90% by 2040. In Africa, Asia, Latin America, and the Caribbean, UNEP helps cities develop plans and test projects for eco-friendly public transportation, like electric buses, through its clean bus fleet initiative. These actions aims to change public transportation for better air quality, decrease in noise, and improve fuel efficiency on a global scale. The electric bus market will be driven by all these advancements and projects undertaken by government bodies in various locations.

RESTRAINT: Safety concerns in EV batteries and high development costs

Despite the increasing need for electric buses, the market is limited by safety concerns regarding EV batteries and the expensive nature of their production. Concerns about battery safety include the possibility of thermal runaway and fires, making it difficult for widespread adoption. Lithium-ion batteries, particularly LFP (Lithium Iron Phosphate) and NMC (Lithium Nickel Manganese Cobalt Oxide) chemistries are the backbone of battery electric buses. These lithium-ion batteries are widely used batteries in EVs but are prone to fires and explosions which limits their further adoption and applications. Recent events revealed numerous electric bus fires happening while the buses were plugged in or situated in bus terminals, with fires frequently extending to other vehicles. This underscores the importance of strong fire prevention and management plans in transit facilities and maintenance depots. To address safety issues, the battery system must be equipped with various protections against thermal shock, thermal runaway, mechanical and electric abuse, heat/gas generation protection, and others. Electric buses require a huge amount of investment and many regions aiming to replace diesel buses with electric buses are experiencing financial challenges.

OPPORTUNITY:Transition towards hydrogen fuel cell electric mobility

The fuel-cell electric technology offers major opportunities for the electric bus industry. Many regions worldwide are establishing lofty objectives to incorporate fuel-cell electric buses into their public transportation fleets. According to the assessment carried out by SunLine Transit Agency (US), hydrogen fuel cell electric buses have the capability to provide better fuel efficiency than CNG buses, even though their initial fuel and maintenance costs are higher. Due to its better fuel efficiency and 300–400 mile range on a single tank, FCEVs are widely used in transportation industry. There are potential opportunities for companies operating in this market. For instance, in 2021 Toyota integrated the necessary fuel cell components to create a small fuel cell system module. Many players and public entities are directing funds towards the advancement of fuel cell buses. For instance, Intercity Transit in US is intended to invest USD 89.6 million for operational costs and USD 65.3 million for capital investments in 2024.

CHALLENGE: High cost of developing charging infrastructure

Developing charging infrastructure for electric buses poses major challenges for the market because of its high costs. Investing in charging stations, grid upgrades, and maintenance facilities is essential for setting up the infrastructure needed for electric buses. At present, electric buses face a dilemma with their extended charging time and limited driving range per charge, making it difficult for them to function at maximum capacity. Also, unlike developed countries, most of the emerging economies in Asia Pacific lack the necessary charging facilities. An extensive and comprehensive charging infrastructure network is required to ensure the smooth operation of electric buses. Bus companies need to take into account strategic decisions about investing in electric bus fleets, setting up charging infrastructures, and determining where to place those charging infrastructures in the city network.

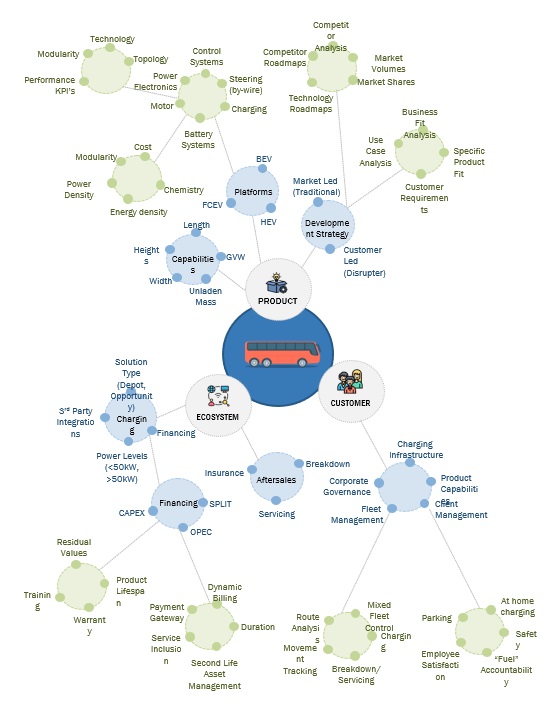

Electric Bus Market Ecosystem.

The major OEMs of the electric bus market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the automotive turbocharger market are BYD Company Ltd. (China), Yutong Co., Ltd. (China), VDL Groep (Netherlands), AB Volvo (Sweden), and CAF (Solaris Bus & Coach sp. z o.o.) (Spain).

LFP Battery type is expected to be the largest market by 2030.

Lithium Iron Phosphate (LFP) batteries are estimated to be dominating the electric bus market during the forecast period. This is mainly due to the larger demand for electric buses in the Chinese market (more than 60% of the global demand) which primarily LFP battery chemistry is predominantly favored in the domestic market. The LFP batteries are less expensive compared to other lithium-ion types like NMC or NCA. The main factor causing this disparity in cost is the availability of abundant raw materials such as iron and phosphate, which are essential for LFP batteries. Unlike cobalt and nickel, they are more resistant to changes in price. Furthermore, in China, there is a robust manufacturing industry for LFP batteries, with top companies like CATL, BYD, and SVOLT Energy Technology Co., Ltd leading the way. In addition, LG Energy Solution, Samsung SDI, Panasonic Corporation, and SK Innovation from South Korea and Japan are also major players in the area, possessing significant expertise in producing large battery packs and cells, resulting in cost savings through scale economies and technological advancements. Other Asian companies, many of them are either exporting their e-buses or selling the battery technology which leads to growing adoption of LFP battery chemistry in other regions as well. According to the IEA, the cost of LFP batteries has been significantly affected by the sharp rise in prices of battery minerals over the past few years, mainly due to the increased cost of lithium.Nonetheless, despite the rapid increase in lithium prices, LFP batteries remain more affordable than Nickel Manganese Cobalt (NMC) batteries. By 2023, the cost difference between NMC and LFP batteries has decreased, with NMC batteries now costing less than 25% more than LFP batteries, compared to a 50% price gap in 2021. The market share of LFP batteries in electric buses is projected to increase significantly as OEMs and battery manufacturers expand production and enhance LFP battery technology.

City/ transit bus by application is the largest market in 2024 and is projected to dominate the market by 2030

The usage of electric buses for city application is maximum across all the regions during the forecast period. The demand is mainly prominent for this application due to its suitability for urban environments, comparatively lower travel distance, and fixed defined routes. Local governments are giving benefits and requiring the use of electric buses in their public transportation collections. The pressure from regulations has encouraged Volvo, BYD, and Daimler to develop electric buses tailored for urban environments, with enhancements in maneuverability, seating capacity, and accessibility features. The main motive of the eBRT2030 project in Europe is to enhance urban transportation by developing advanced electric Bus Rapid Transit (BRT) systems. Demonstrations have taken place in several European cities like Amsterdam, Athens, Barcelona, and Prague. As reported in the study funded by C40 in partnership with the Clean Transport Finance Academy 2023 and other backers, there are plans to introduce a fleet of more than 25,000 e-buses by 2030 and surpass 55,000 by 2050 in 32 Latin American cities. Therefore, the electric bus market is projected to remain strong in the future due to advancements like smart charging infrastructure and vehicle-to-grid technologies, which aim to enhance energy efficiency and lower operational expenses for city buses.

The above 400 kWh battery capacity segment is projected to be the fastest-growing market for electric buses from 2024 to 2030.

Above 400 kWh battery capacity electric buses are estimated to grow at the fastest CAGR during the forecast period. This range is usually offered in electric buses for intercity or long-distance commutes. Developments in battery technologies and the reduction in prices of batteries have positively impacted the growth of above 400 kWh batteries. Severe weather has a negative impact on battery performance, requiring larger capacities to maintain efficiency and range. Buses having larger battery capacities can travel more without recharging often, which is important in regions with tough weather and limited charging infrastructure. Long-range electric buses with large capacity batteries are particularly useful in locations with unreliable infrastructure for charging. It is expected that government financing and incentives for electric public transportation projects will favour buses that have larger battery capacities in order to maximise the efficiency and effectiveness of these vehicles. The market is anticipated to expand due to falling battery costs and continuous improvements in battery components.

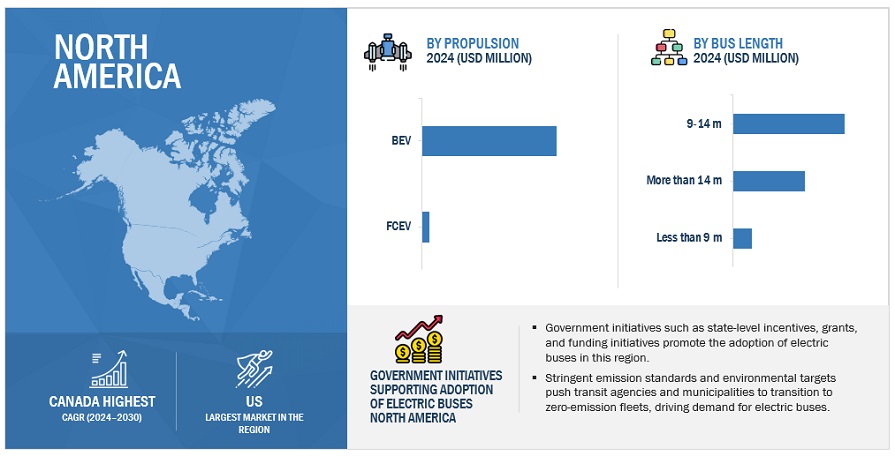

North America will be the fastest-growing market for electric buses from 2024-2030.

North America is estimated to be the fastest-growing market during the forecast period. In North America, government incentives, the presence of individual investors, and technological edge are driving the electric bus market. The US has been leading the electric bus market in this region. The market is expanding due to government incentives, tax breaks, and private investments. The Federal Transit Administration set aside USD 1.7 billion in 2023 for buses, with an emphasis on zero-emission vehicles, even though European acceptance lags lag. This shift is further supported by the USD 5.6 billion set up in the Bipartisan Infrastructure Law for cleaner buses. make at least one-third of its 70,000 public transit buses electric by 2045. Government incentives and public-private partnership (PPP) schemes and policies like Toronto's plan to convert 50% of its fleet to electric by 2050 show the region's commitment to sustainable transport solutions. For instance, in Canada, public-private partnership initiatives and government incentives are being used to introduce electric buses in the market. Canada is rapidly implementing electric buses, with tax breaks and provincial subsidies making the purchase easier. Growth is driven by public-private partnerships and government incentives with the goal of incorporating electric buses into public fleets. Moreover, manufacturers with advance technology that dominate the industry includes NFI Group and Blue Bird Corporation. Due to environmental concerns, public transit has been more popular over time, and this has improved infrastructure, which has contributed to fostering the market's rapid growth in this area.

Key Market Players

The electric bus market is consolidated including BYD Company Ltd. (China), Yutong Co., Ltd. (China), VDL Groep (Netherlands), AB Volvo (Sweden), and CAF (Solaris Bus & Coach sp. z o.o.) (Spain) are the key companies operating in the electric bus market. These companies adopted new product launches, partnerships, and joint ventures to gain traction in the electric bus market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attribute |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2023 |

|

Market Growth forecast |

USD 37.5 Billion by 2030 from USD 17.0 Billion in 2024 at 14.2% CAGR |

|

Forecast period |

2024–2030 |

|

Forecast units |

Volume (Units) and Value (USD Million/Billion) |

|

Segments Covered |

The Electric Bus Market By Propulsion, Electric Bus Market By Battery Type, Electric Bus Market By Consumer Type, Electric Bus Market By Length Of Bus, Electric Bus Market By Seating Capacity, Electric Bus Market Level Of Autonomy, Electric Bus Market Range, Electric Bus Market By Application |

|

Geographies covered |

Asia Pacific, North America, Europe, Latin America, and Middle East and Africa. |

|

Top Players |

BYD Company Ltd. (China), Yutong Co., Ltd. (China), VDL Groep (Netherlands), AB Volvo (Sweden) and CAF (Solaris Bus & Coach sp. z o.o.) (Spain). |

The study categorizes the Electric bus market based on vehicle type, technology, and components at regional and global levels.

By Propulsion

- BEVs

- FCEVs

Battery Type

- LFP batteries

- NMC batteries

- NCA batteries

- Other batteries

Consumer

- Government

- Private

Length of Bus

- Up to 9 m

- 9−14 m

- Above 14 m

Seating Capacity

- Up to 40 Seats

- 40−70 Seats

- Above 70 Seats

Level of Autonomy

- Semi-autonomous

- Autonomous

Range

- Up to 200 Miles

- Above 200 Miles

Application

- City/ transit bus

- Coaches

- Midibus

- School Bus

Battery Capacity

- Up to 400 kWh

- Above 400 kWh

Power Output

- Up to 250 Kw

- Above 250 kW

Component

- Batteries

- Motors

- Fuel Cell Stacks

- Battery Management Systems

- Battery Cooling Systems

- DC-DC Converters

- Inverters

- AC/DC Chargers

- EV Connectors

Recent Developments

- In May 2024, Yutong delivered 46 battery-electric apron buses to Spain, where they would be used in 15 major airports. This was China's largest export order for these buses and it will help Spain achieve its green development objectives when building new airports. With more than 70 airports worldwide—including the ones like Madrid, Barcelona, and Rome—Yutong's buses are a popular option in Europe due to its innovative technology.

- The Volvo BZR Electric, electromobility platform which is intended for city, intercity, and commuter operations, was introduced by Volvo Buses in March 2024. This platform for electric vehicles aims to enhance profitability and sustainability for operators around the world. It is available in various configurations. The BZR Electric platform was introduced to meet the increasing demand for electric mobility solutions worldwide. It leveraged the popularity of their low-floor electric buses, currently operational in more than 25 nations.

- In March 2024, Volvo Buses enhanced its European electric mobility options by introducing the Volvo 8900 Electric intercity bus. This electric bus, with easy access, was created for urban, long-distance, and regular commuter services, offered in two- and three-axle versions to improve efficiency and sustainability for companies. In some European cities, the initial versions of bus will be made available for purchase starting in 2025.

- In October 2023, BYD introduced the BD11, a double-decker bus that runs entirely on electricity and is intended for use in London. The bus could accommodate ninety passengers and met environmental standards by offering emission-free transportation, all thanks to BYD's Blade Battery technology.

- In October 2023, the Ministry of Infrastructure & Transport in Greece agreed to buy 250 electric buses from Yutong. This agreement aims to enhance Greece's public transportation system and promote sustainable, environmentally friendly development.

- In March 2023, Solaris and ATM Milano, an Italian transportation company, signed an agreement for the purchase of 105 electric buses. The delivery of these 18-meter-long Urbino articulated buses is set for the first half of 2025. In 2014, Solaris and ATM Milano collaborated after ATM Milano purchased around 500 vehicles from Solaris.

- VDL and KVG Braunschweig reconfirmed their long-standing collaboration in April 2022. KVG Braunschweig received a delivery of sixteen fresh Citeas from the latest generation. The LF-122 vehicles utilized advanced technology and were completely powered by electricity.

Frequently Asked Questions (FAQ):

What is the current size of the global electric bus market?

As of 2024, the global electric bus market is valued at approximately USD 17.0 billion, with Asia Pacific leading the market share.

Which application currently dominates the electric bus market?

The city/ transit electric bus sector currently dominates the electric bus market by application.

Who are the leading companies in the electric bus market, and what strategies have they implemented?

Key players in the electric bus market include BYD Company Ltd. (China), Yutong Co., Ltd. (China), VDL Groep (Netherlands), AB Volvo (Sweden), and CAF (Solaris Bus & Coach sp. z o.o.) (Spain). These companies are focusing on new product launches and securing supply contracts to enhance their market presence.

How does the demand for electric buses differ by region?

Asia Pacific is estimated to be the largest market for electric buses during the forecast period followed by Europe and North America. The market growth in the Asia Pacific region is largely driven by the China e-bus market and the presence of major market players in this region Governments’ support through incentives and subsidies future promote the adoption of zero-emission vehicles in this market.

What are the growth opportunities for the suppliers in the electric bus industry?

The rising demand for hydrogen fuel cell electric buses is expected to create significant growth opportunities for suppliers in the electric bus market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

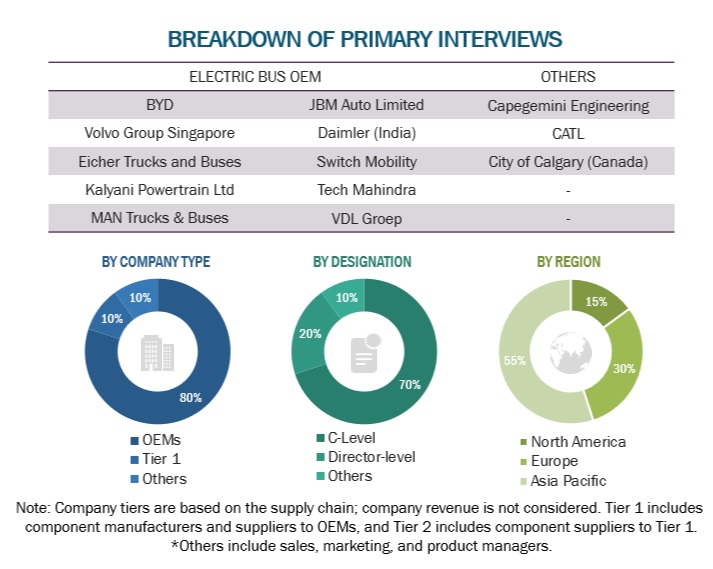

The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, automotive powertrain magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the Electric Bus Market. Primary sources—experts from related industries, including electric bus OEMs, battery, and other component suppliers —were interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study included electric vehicle industry organizations such as the World Electric Vehicle Association and corporate filings such as annual reports, investor presentations, and financial statements. Secondary data was collected and analyzed to determine the total market size, further validated by primary research.

Primary Research

Extensive primary research was conducted through secondary research after understanding the electric bus market scenario. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (electric bus and component manufacturers) sides across major regions, namely Asia Pacific, Europe, Latin America, the Middle East & Africa, and North America. Approximately 80% and 20% of primary interviews were conducted with the OEM and Tier I/Other players, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This and the in-house subject matter experts’ opinions led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

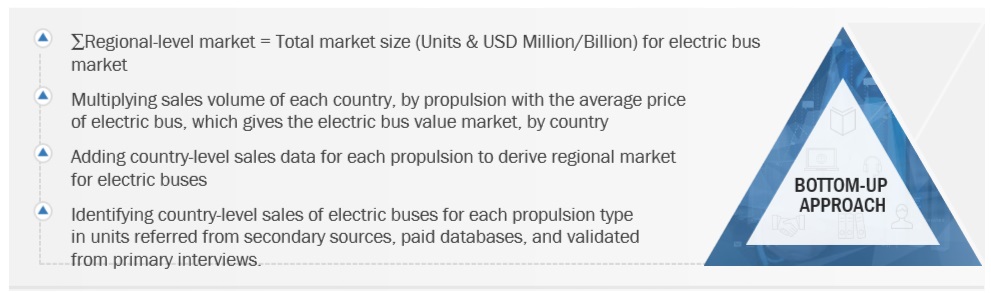

BOTTOM-UP APPROACH: ELECTRIC BUS MARKET

The bottom-up approach was used to estimate and validate the size of the electric bus market. The size of the electric bus market, by propulsion, in terms of volume and value, was derived by collecting country-level sales of electric buses in units. This gives the volume market for electric buses. Further, the summation of all countries led to the regional-level market in volume.

Bottom-up APPROACH: By propulsion Type

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up APPROACH: By Region

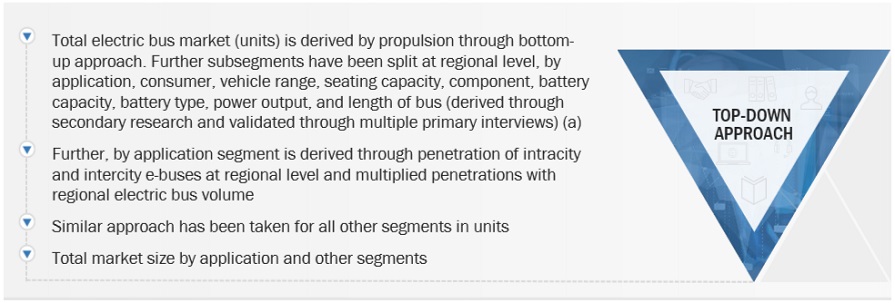

TOP-DOWN APPROACH: ELECTRIC BUS MARKET

The top-down approach was followed for the electric bus market by range, component, length of the bus, battery type, battery capacity, power output, consumer, level of autonomy, seating capacity, and application. For deriving the market size for electric buses by application, in terms of volume, the total volume of the electric bus market was multiplied by the penetration percentage of application (city/transit bus, coaches, midibus, and school bus at the regional level). This gives the electric bus market by application in terms of volume. A similar approach was used for calculating the electric bus market by range, battery type, battery capacity, application, consumer, power output, component, length of bus, and seating capacity.

top-down APPROACH

Data Triangulation

After arriving at the overall size of the vehicles complying with the Electric Bus Market through the methodology mentioned above, the market was split into several segments and subsegments. Data triangulation is a research technique used to increase the validity and reliability of findings by cross-validating data from multiple sources or methods. This technique involves the use of multiple sources of data, such as surveys, interviews, observations, and secondary data, to confirm and corroborate the findings obtained from each source. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the supply and demand sides.

Market Definition

Fully electric buses are powered by batteries, while hybrid buses utilize a combination of ICE and battery power. These buses are used for the mass transportation of passengers. The batteries can be charged through an off-board top-down pantograph, on-board bottom-up pantograph, and connector. According to Proterra (US), an electric bus is a bus that is powered by one or more electric motors, which are powered by a battery or a hydrogen fuel cell system. According to BYD (China), an electric bus is a bus that is powered by an electric motor and a battery pack, which is charged by plugging it into an electric power source.

Key Stakeholders

- Associations, Forums, and Alliances Related to Electric Vehicles

- Automotive Investors

- Automotive Software Manufacturers and Providers

- Companies Operating in Autonomous Vehicle Ecosystem

- Electric Bus Manufacturers

- Electric Pick-up Truck Manufacturers

- Electric Truck Manufacturers

- Electric Van Manufacturers

- EV Charging Equipment Manufacturers

- EV Charging Infrastructure Service Providers

- EV Component Manufacturers

- EV Component Suppliers

- EV Distributors and Retailers

- Government Agencies and Policy Makers

Report Objectives

-

To segment and forecast the electric bus market size in terms of volume & value:

- By propulsion (BEVs and FCEVs)

- By length of the bus (less than 9 m, 9–14 m, more than 14 m)

- By component (batteries, motors, fuel cell stacks, battery management systems, battery cooling systems, DC-DC converters, inverters, AC/DC chargers, and EV connectors)

- By range (up to 200 miles and above 200 miles)

- By power output (up to 250 kW and above 250 kW)

- By battery capacity (up to 400 kWh and above 400 kWh)

- By application (city/transit bus, coaches, midibus, and school bus)

- By battery type (LFP batteries, NMC batteries, NCA batteries, and other batteries)

- By seating capacity (up to 40 seats, 40–70 seats, and above 70 seats)

- By consumers (government and private)

- By level of autonomy (semi-autonomous and autonomous)

- By region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa)

- To provide detailed information about the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market concerning individual growth trends, prospects, and contributions to the total market

- To track and analyze competitive developments, such as product launches, deals, and other activities by key industry participants.

- To strategically analyze the market with value chain analysis, bill of materials, revenue analysis, and regulatory analysis in the electric bus market

- To examine the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Electric Bus Market, by Range at Country-level (For countries covered in the report)

- Up to 200 miles

- Above 200 miles

Electric Bus Market, by Battery Type at Country-level (For countries covered in the report)

- LFP

- NMC

- NCA

- Others

Company Information

- Profiles of Additional Market Players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Bus Market

MnM while conducting the given research on “Electric Bus Market” have contacted and conducted primary interviews from all major players from the Electric Vehicle eco-system consisting of Bus manufacturers, bus components manufacturers, EV charging infrastructure service and equipment providers, EV experts, country level government associations and agencies etc. All major market numbers, penetration rates and growth rates have been discussed and validated through primary interviews.