Electrical Digital Twin Market by Twin Type (Gas & Steam Power Plant, Wind Farm, Digital Grid, Others), Usage Type (Product, Process, System), Deployment Type (Cloud, On-Premises), End User, Application, and Geography - Global Forecast to 2026

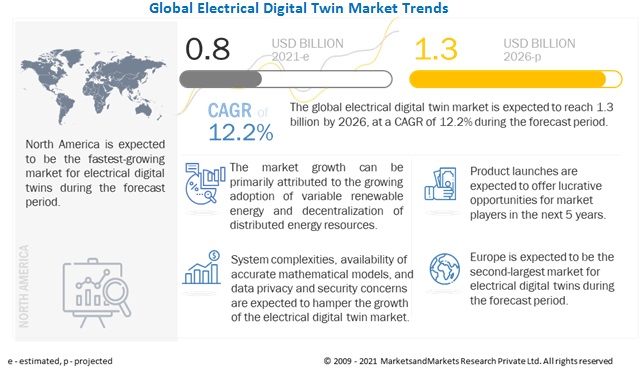

[221 Pages Report] The global electrical digital twin market in terms of revenue was estimated to be worth $0.8 billion in 2021 and is poised to reach $1.3 billion by 2026, growing at a CAGR of 12.2% from 2021 to 2026. The growing need for integration of variable renewable energy with the grid and decentralization of distributed energy resources using electrical digital twins is the main driver for the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Market

COVID-19 has unleashed a devastating blow to the global economy and the energy sector, disrupting supply chains while choking off demand. The power sector witnessed several challenges, such as reduced and remote workforces, decreased commercial energy demand, increased customer calls, and use of digital and self-serve channels during lockdowns. These challenges compelled utilities and grid operators to accelerate digitalization, automation, and decentralization of their operations. The protection measures imposed by various governments reduced workforce availability and mandated strict hygiene and social distancing protocols to maintain operations. The shift in working patterns brought by COVID-19-induced restrictions has boosted the digital transformation efforts of utilities and grid operators. The increasing investments in digital solutions, including electrical digital twins would enable companies to maintain resilient supply chains, operations, and customer management and help reduce the load on their workforces in the future.

During the pandemic, utilities and grid operators required real-time visibility across corporate boundaries and down to supply and demand. The reduction in energy demand brought various technical challenges, such as voltage management, demand forecasting, and management of reactive levels to avoid dangers such as reactive shunts at distribution levels. Electrical digital twins enabled power utility companies to model and examine various scenarios that might unfold and helped organizations plan strategies and take faster, better-informed decisions. Electrical digital twins act as a powerful digital shadow. The use of digital twins enabled data flow, which provided a comprehensive picture of grid health and stability during the lockdowns. In addition, it made distributed and mobile geospatial information accessible across the field workforce to help field engineers find updated information on the position and condition of nearby network assets. Digital twins help extend capabilities, increase flexibility, and mitigate the risk of business failure.

The pandemic presented innumerable challenges to the global power industry; however, it has also accelerated digital transformation for utilities, presenting ample opportunities for emerging technologies, including electrical digital twins. The implementation of electrical digital twins enhances workforce productivity and operational flexibility, which is likely to offer high growth opportunities from utilities.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Electrical Digital Twin Market Dynamics

Driver: Integration of variable renewable energy and decentralization of distributed energy resources using electrical digital twins

With the adoption of the Paris Agreement in 2015, the world needs to harness low-carbon energy sources to control greenhouse gas (GHG) emissions and limit the increase of global mean surface temperature to below 2° C relative to pre-industrial levels by the end of the century. This goal can be achieved by scaling up the deployment of renewable energy systems. Renewable energy technologies, such as wind and solar PV, play a vital role in decarbonizing the power sector while meeting the growing energy demand. Governments worldwide have established policies and support incentives for long-term decarbonization of the electricity grid using renewable energy sources. For instance, supportive policies such as feed-in tariffs and renewable portfolio standards have been developed and implemented to facilitate the integration of renewable energy into the power generation mix in significant global economies such as the US, UK, Germany, China, and India.

According to the International Energy Agency, the share of renewables in global electricity generation was 29% in 2020 compared with 27% in 2019. Renewable electricity generation is expected to grow by 8% to reach 8,300 TWh in 2021. China is expected to account for almost half of the global increase in renewable electricity in 2021, followed by the US, the European Union, and India. The power generation mix is expected to change over the next ten years, and this includes considerable increases in solar (utility-scale), distributed generation and storage, grid-scale energy storage, and wind. The global wind and solar PV installed capacity is projected to increase from 1,226 GW in 2019 to 2,349 GW by 2025, at a CAGR of 11.4% during 2019–2025. In addition, investments in renewable energy technologies have risen globally in the last decade, accounting for USD 359 billion in 2020. The global capital expenditure for renewables increased by around 7% in 2020 compared with 2019, even as the COVID-19 pandemic disrupted the power industry. The rapidly declining installation cost of solar panels owing to fast-paced technological advancements and the shift of multiple countries toward green energy generation are contributing to the rising demand for renewable energy technologies.

Utilities and grid infrastructure operators across regions are increasingly looking toward digital technologies, including electrical digital twins, to help streamline the integration of the growing share of renewable energy technologies into their operational mix. Electrical digital twins enable grid operators to simulate operational scenarios relevant for reliable, efficient, and secure planning, operation, and maintenance of electrical systems. Decentralization of distributed energy resources (DER) increases the complexity of operating and maintaining a grid. Therefore, utilities and grid operators require faster and more efficient solutions, including electrical digital twins, to monitor, control, automate, and operate their power networks. Electrical digital twins can address the complexities associated with grid modernization initiatives, particularly DER integration. These devices help assess the impact of DER and facilitate the planning, analysis, and designing processes of grid modernization. This, in turn, enables utilities to streamline the process of interconnecting DER to improve customer response time, facilitate cost-effective investments, and increase operational efficiency.

Restraints: System complexities and availability of accurate mathematical models

Despite the obvious benefits, some utilities and grid operators are yet to implement a digital twin model for assets management and business and operation optimization. A digital twin should be able to model simple as well as complex objects and their relationships by accurately capturing their physical properties and simulating behaviors. For instance, the development of an electrical digital twin requires multiple inputs from operators such as facility managers, design engineers, electrical engineers, equipment vendors, and other parties, which adds complexity to the deployment. Obtaining the asset data from the supplier may pose a challenge, as it requires close collaboration with multiple tiers of the supply chain. Moreover, establishing the required level of communication in a supply chain to retrieve asset data may be challenging to maintain. Another challenge comes from the complexity of the physical item that is to be replicated. For instance, processes such as customer relationship management, prospect marketing, or service delivery funnels are significantly easier to duplicate, as they involve a flow of scenarios, ideas, and software inputs instead of moving parts that must be recorded.

In addition, detailed blueprints of historical systems, equipment failures, and other mathematical systems are required to create a digital twin. For instance, a digital twin should be fed with data about equipment failure modes to predict failures. Any change in equipment or asset configuration or operational state would require remodeling of the digital twin, which increases the complexity of maintaining the digital replica. Any modification made to the physical system would require similar changes to its digital model and algorithms. The risk of errors may escalate with the increasing levels of complexity, as the simulation of certain scenarios, such as the addition of new parts at the machine level or operational level changes, may not be precise.

Adopting digital twins entails considerable investments, collaboration, and sustained commitment from the operator. Operators need to establish the required technology infrastructure such as robust IoT deployments and simulation platforms and integrate data sources across departments and IoT contextual systems to maintain a digital twin. These factors restrict the widespread adoption of electrical digital twins by various stakeholders in the power industry.

Opportunities: Emergence of Energy 4.0 and adoption of advanced technologies for implementation of digital twin applications

Many electric utilities worldwide have started implementing the Industrial Internet of Things (IIoT), machine learning, AI, and cloud computing in their operations for asset performance monitoring and management, smart metering, predictive and prescriptive maintenance, the operations and automation of distributed energy resources (DER), and planning and analysis of fluctuations in decentralized renewable generation systems. An electrical digital twin enables the utilities to forecast, predict, and analyze multiple power generation, transmission, and distribution models and renewable energy integration scenarios, allowing them to constantly update their operations to meet the growing need for electricity. These technologies enable better implementation of electrical digital twin solutions in utilities and are at the early stages of integration into the modeling of digital twin systems. Utilities experts and technology vendors have begun referring to this trend as Energy 4.0 to emphasize the enormity of the digital transformation that these technologies would bring to the electrical power industry.

AI enables electrical grids to have two-way communication between utilities and consumers by embedding smart grids with an information layer. This layer allows communication between the various components of a grid so they can better respond to the rapid changes in energy demand or urgent situations. This information layer is created by installing smart meters and sensors, which allow for data collection, storage, and analysis, and the creation of a digital twin. The implementation of AI, machine learning, IoT, virtual reality, and other technologies are expected to help power system and utility operators analyze the large volume and diverse structure of the datasets generated by digital twins and in efficient decision-making. This analysis can be used for a variety of purposes, including seamless fault detection in meters, predictive maintenance needs, quality monitoring of sustainable energy, as well as renewable energy forecasting. Furthermore, AI and machine learning can automatically suggest insights to power system operators and help in improving business outcomes.

The deployment of IIoT in electrical digital twins optimizes the efficiency of a power plant by predicting failures that could result in an unplanned outage. Monitoring the field performance of power generation, transmission, and distribution activities via a digital twin and IIoT allows real-time comparison of the performance of assets. This process provides valuable real-time feedback for improving the business and operational processes. Electrical digital twins also increase the efficiency of grid design and simulation, as testing in a physical environment consumes not only time but also requires high investments. Enhancements and upgrades can be done and simulated by adjusting parameters of the grid system in the digital twin itself, without any harm to the grid infrastructure and power generation systems. For example, in a wind farm, utilizing an electrical digital twin of turbines enables engineers to study how turbines interact with different landscapes and wind sources, and accordingly mix and match different turbines to optimize the configuration for each pad on a farm.

The power sector in developed countries has already started using AI, data analytics, IoT, and related technologies that allow for communication between smart grids, smart meters, and computer devices. These technologies help prevent power mismanagement, inefficiency, and lack of transparency while increasing the use of renewable energy sources. The major developers of digital twins such as General Electric (US), Siemens (Germany), and Bentley Systems (US) are developing accurate, transparent, interpretable, and fault-tolerant AI, IoT, and machine learning technologies, which would further provide an opportunity for seamless digital transformation and help utilities address the challenges of planning, designing, and operating an integrated network with DER in a highly efficient manner.

Challenges: Limited support for deployment from stakeholders

Despite the many benefits of electrical digital twins, some underlying problems must be addressed for digital twin systems to reach their full potential. For instance, power sector experts believe that encouraging early digital adoption by utilities and power system operators is essential. Many stakeholders in the power sector initially resisted adoption due to the seeming risks involved with the complexity of digital twin deployment, possible upfront expenditures, and uncertainty about successful outcomes following their integration.

Thus, governments and regulators may seek to investigate financial incentives and digital technology requirements to push the power sector to begin its digital transition. Stakeholders such as companies, governments, and universities need to improve their R&D competencies in digital energy technologies to accelerate the adoption of digital twin technologies. The risk of implementing digital twin technologies may be further minimized by developing clear evidence, which would improve market players' confidence in digital outcomes while lowering the threats of digital technology deployment.

By Twin Type, the digital gas & steam power plant segment is expected to make the largest contribution to the electrical digital twin market during the forecast period.

The power sector operators globally are gradually planning to implement digital twins of gas and steam power plants to reduce emission and fuel consumption of gas and steam turbine assets. The digital twins of gas and steam power plants can also help operators optimize their strategies, improve machine and equipment health, and increase reliability through performance management. Furthermore, gas and steam power plants have a higher maintenance requirement compared to power generation facilities. A digital twin of the gas and steam system may help the operator to improve reliability and availability of assets and optimize maintenance operation and costs through demand and outage planning.

By Usage Type, the system digital twin segment is expected to be the largest and fastest growing segment during 2021-2026.

The system digital twin segment is expected to dominate the global electrical digital twin market owing to the need to achieve network-level optimatization. The system digital twin is a collection of products and processes that perform as a system or network-wide functions. It can be used to stimulate systems or networks such as substations, power plants, wind farms, and distributed energy resources. The system twin provides visibility into a set of interdependent equipment and a connected view of the end-to-end network of assets based on actual operational data.

By Deployment Type, the cloud segment is expected to grow at the fastest rate during the forecast period.

The cloud segment of the electrical digital twin market is expected to grow at the highest CAGR during the forecast period, as cloud-based solutions offer various advantages, such as scalability, adaptability, cost-effectiveness, and low energy consumption, due to which their adoption rate is increasing at a significant rate across organizations.

By End User, the utilities segment is expected to dominate to the electrical digital twin market during the forecast period.

The utilities segment is expected to dominate the global market owing to the growing adoption of renewable energy and advanced digital technologies. Several utilities are investing in the deployment of electrical digital twins for analyzing and visualizing data in real time and building robust long-term asset management and business strategies to reduce operational expenditure.

By Application, the utilities segment is expected to dominate to the electrical digital twin market during the forecast period.

The asset performance management segment is expected to dominate the global market owing to the growing need for continuous monitoring and predictive maintenance of assets. The electrical digital twin offers reliability-centered maintenance capabilities and recommends modifications to maintenance strategies for optimal utilization of assets based on budget and reliability risk constraints.

North America is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, and Middle East & Africa are the major regions considered for the study of the electrical digital twin market. The growth of the North American market is driven by the increasing investments for the deployment of advance digital technology to upgrade to aging power generation and distribution infrastructure.

Key Market Players

The major players in the global electrical digital twin market are General Electric (US), Siemens (Germany), ABB (Switzerland), Emerson (US), AVEVA Group (UK), Schneider Electric (France), Microsoft (US), Wipro (India), SAP (Germany), IBM (US), ANSYS (US), and Bentley Systems (US).

Electrical Digital Twin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021: |

USD 0.8 Billion |

|

Projected to reach 2026: |

USD 1.3 Billion |

|

CAGR: |

12.2% |

|

Base Year Considered: |

2020 |

|

Forecast Period: |

2021-2026 |

|

Largest Market: |

North America |

|

Region Covered: |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Segments Covered: |

Twin Type, Usage Type, Deployment Type, End User, and Application |

|

Companies Covered: |

General Electric (US), Siemens (Germany), ABB (Switzerland), Emerson (US), AVEVA Group (UK), Schneider Electric (France), Microsoft (US), Wipro (India), SAS Institute (US), SAP (Germany), IBM (US), ANSYS (US), Bentley Systems (US), Etteplan (Finland), Fujitsu (Japan), ACPD Services (UK), and others. |

This research report categorizes the electrical digital twin market based on twin type, usage type, deployment type, end user, application, and geography.

Based on Twin Type, the market has been segmented as follows:

- Digital Gas & Steam Power Plant

- Digital Wind Farm

- Digital Grid

- Digital Hydropower Plant

- Distributed Energy Resources

Based on Usage Type, the market has been segmented as follows:

- Product Digital Twin

- Process Digital Twin

- System Digital Twin

Based on Deployment Type, the market has been segmented as follows:

- Cloud

- On-premises

Based on End User, the market has been segmented as follows:

- Utilities

- Grid Infrastructure Operators

Based on Application, the market has been segmented as follows:

- Asset Performance Management

- Business & Operations Optimization

Based on the Geography, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In August 2021, General Electric introduced upgrades to its on-premise analytics software, Proficy CSense. The software utilizes AI and machine learning technologies along with process digital twins to identify problems, root causes, predict future performance, and automate actions.

- In June 2021, Siemens and Threedy have signed a collaboration agreement to develop a visual computing platform. The collaboration enriches Sidrive IQ with Threedy’s visual computing platform instant3Dhub. The integration of Threedy’s visualization service is expected to provide users access to visual digital twin information.

- In April 2021, AVEVA Group and Aker Solutions have partnered to work together to deploy engineering services and process simulation, design, engineering, and lifecycle management technologies.

- In December 2020, ABB and Corys collaborated to develop digital twin modeling and simulation technology using ABB Ability 800xA Simulator and Indiss Plus process modeling simulator for the energy and process industries.

- In December 2020, Emerson signed an agreement with Tennessee Valley Authority to modernize and optimize its Magnolia power plant. Emerson will provide Ovation automation system and software and digital twin technologies to enable advanced operations, cybersecurity, and digital twin-enabled training.

Frequently Asked Questions (FAQ):

What is the current size of the electrical digital twin market?

The current market size of global electrical digital twin market is USD 0.7 billion in 2020.

What are the major drivers for electrical digital twin market?

The growing need for integration of variable renewable energy with the grid and decentralization of distributed energy resources using electrical digital twins are some of the major drivers driving the market of well intervention.

Which is the fastest-growing region during the forecasted period in electrical digital twin market?

The growth of the North American market is driven by the increasing investments for the deployment of advance digital technology to upgrade to aging power generation and distribution infrastructure. Furthermore, the increasing need to deliver clean, reliable energy, and a strong focus on renewable energy generation are among a few major factors driving investments in digital technologies such as electrical digital twin.

Which is the fastest-growing segment, by application during the forecasted period in electrical digital twin market?

The asset performance management segment held the largest share of the electrical digital twin market owing to growing need for continuous monitoring and predictive maintenance to improve asset performance. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 ELECTRICAL DIGITAL TWIN MARKET, BY APPLICATION

1.4 MARKET SCOPE

1.4.1 MARKET: SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYSING AND ASSESSING DEMAND FOR ELECTRICAL DIGITAL TWINS

2.3.3.1 Demand side calculations

2.3.3.2 Assumptions for demand side analysis

2.3.4 SUPPLY SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF ELECTRICAL DIGITAL TWINS

FIGURE 7 MARKET: SUPPLY SIDE ANALYSIS

2.3.4.1 Supply side calculations

2.3.4.2 Assumptions for supply side

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 1 ELECTRICAL DIGITAL TWIN MARKET SNAPSHOT

FIGURE 8 NORTH AMERICA DOMINATED MARKET IN 2020

FIGURE 9 DIGITAL GAS & STEAM POWER PLANT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY TWIN TYPE, FROM 2021 TO 2026

FIGURE 10 SYSTEM DIGITAL TWIN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 ON-PREMISE SEGMENT TO HOLD LARGER SHARE OF MARKET, BY DEPLOYMENT TYPE, DURING FORECAST PERIOD

FIGURE 12 UTILITIES SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET, BY END USER, DURING FORECAST PERIOD

FIGURE 13 ASSET PERFORMANCE MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY APPLICATION, FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN ELECTRICAL DIGITAL TWIN MARKET

FIGURE 14 INTEGRATION OF RENEWABLE ENERGY INTO ELECTRIC DISTRIBUTION AND TRANSMISSION SYSTEMS AND DECENTRALIZATION OF DISTRIBUTED ENERGY RESOURCES TO DRIVE GROWTH OF MARKET BETWEEN 2021 AND 2026

4.2 MARKET, BY REGION

FIGURE 15 NORTH AMERICAN MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 NORTH AMERICAN MARKET, BY TWIN TYPE AND COUNTRY

FIGURE 16 DIGITAL GAS & STEAM POWER PLANT SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2020

4.4 MARKET, BY TWIN TYPE

FIGURE 17 DIGITAL GAS & STEAM POWER PLANT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE, BY TWIN TYPE, BY 2026

4.5 MARKET, BY USAGE TYPE

FIGURE 18 SYSTEM DIGITAL TWIN SEGMENT TO DOMINATE MARKET, BY USAGE TYPE, IN 2026

4.6 MARKET, BY DEPLOYMENT TYPE

FIGURE 19 CLOUD TO BE FASTEST-GROWING SEGMENT OF MARKET, BY DEPLOYMENT TYPE, BY 2026

4.7 MARKET, BY APPLICATION

FIGURE 20 ASSET PERFORMANCE MANAGEMENT SEGMENT TO DOMINATE MARKET, BY APPLICATION, IN 2026

4.8 MARKET, BY END USER

FIGURE 21 UTILITIES SEGMENT TO DOMINATE MARKET, BY END USER, IN 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 GLOBAL PROPAGATION OF COVID-19

FIGURE 23 PROPAGATION OF COVID-19 CASES IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 REVISED GDP FOR SELECTED G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 25 ELECTRICAL DIGITAL TWIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Integration of variable renewable energy and decentralization of distributed energy resources using electrical digital twins

FIGURE 26 GLOBAL POWER GENERATION, BY SOURCE, 2010–2020

5.4.1.2 Increase in efficiency and optimization of operations of power sector

5.4.1.3 Reduction in unplanned downtime and operation & maintenance costs

5.4.2 RESTRAINTS

5.4.2.1 System complexities and availability of accurate mathematical models

5.4.2.2 Data privacy and security concerns due to use of IoT and cloud platforms

5.4.3 OPPORTUNITIES

5.4.3.1 Emergence of Energy 4.0 and adoption of advanced technologies for implementation of digital twin applications

5.4.3.2 Achieving network-level optimization

5.4.3.3 Accelerated digital transformation across power sector due to COVID-19

5.4.4 CHALLENGES

5.4.4.1 Limited support for deployment from stakeholders

5.4.4.2 Lack of skilled workforce

5.4.4.3 Uncertainty of cost benefits involved in adoption of electrical digital twins

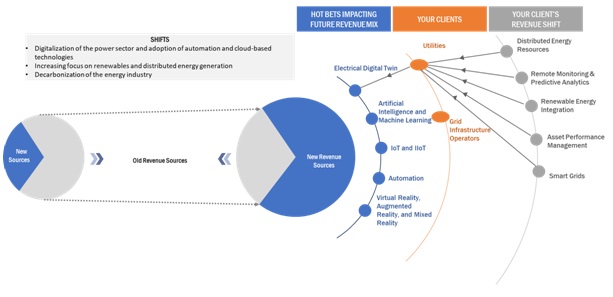

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTRICAL DIGITAL TWIN PROVIDERS

FIGURE 27 REVENUE SHIFT FOR ELECTRICAL DIGITAL TWIN PROVIDERS

5.6 MARKET MAP

FIGURE 28 MARKET MAP: ELECTRICAL DIGITAL TWIN MARKET

5.7 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS: MARKET

5.7.1 RESEARCH, DESIGN, AND DEVELOPMENT

5.7.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

5.7.3 ELECTRICAL DIGITAL TWIN SOLUTION/SOFTWARE/SERVICE PROVIDERS

5.7.4 END USERS

5.8 TECHNOLOGY ANALYSIS

5.8.1 ELECTRICAL DIGITAL TWINS BASED ON DIFFERENT TECHNOLOGIES

5.8.1.1 Cloud/Software as a Service

5.8.1.2 Internet of Things (IoT) and Industrial Internet of Things (IIoT)

5.8.1.3 Blockchain

5.8.1.4 Artificial Intelligence (AI) and Machine Learning (ML)

5.8.1.5 Augmented Reality (AR)

5.8.1.6 5G

5.9 MARKET: CODES AND REGULATIONS

TABLE 2 ELECTRICAL DIGITAL TWIN: CODES AND REGULATIONS

5.10 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 3 ELECTRICAL DIGITAL TWIN: INNOVATIONS AND PATENT REGISTRATIONS, NOVEMBER 2016–SEPTEMBER 2021

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS FOR ELECTRICAL DIGITAL TWIN MARKET

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF SUBSTITUTES

5.11.2 BARGAINING POWER OF SUPPLIERS

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 THREAT OF NEW ENTRANTS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 CASE STUDY ANALYSIS

TABLE 5 MARKET: CASE STUDY ANALYSIS

6 ELECTRICAL DIGITAL TWIN MARKET, BY TWIN TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 31 MARKET SHARE, BY TWIN TYPE, 2020 (%)

TABLE 6 MARKET, BY TWIN TYPE, 2019–2026 (USD MILLION)

6.2 DIGITAL GAS & STEAM POWER PLANT

6.2.1 GROWING NEED TO ENHANCE EFFICIENCY AND REDUCE FUEL CONSUMPTION AND ENVIRONMENTAL EMISSIONS TO INCREASE IMPLEMENTATION OF DIGITAL GAS & STEAM POWER PLANTS

TABLE 7 ELECTRICAL DIGITAL TWIN MARKET FOR DIGITAL GAS & STEAM POWER PLANT, BY REGION, 2019–2026 (USD MILLION)

6.3 DIGITAL WIND FARM

6.3.1 GROWING NEED FOR ENHANCING TURBINE UPTIME TO DRIVE GROWTH OF DIGITAL WIND FARMS

TABLE 8 ELECTRICAL DIGITAL TWIN MARKET FOR DIGITAL WIND FIND, BY REGION, 2019–2026 (USD MILLION)

6.4 DIGITAL GRID

6.4.1 RISING NEED FOR INTEGRATING RENEWABLES WITH GRIDS TO BOOST DEMAND FOR PROCESS DIGITAL TWINS

TABLE 9 ELECTRICAL DIGITAL TWIN MARKET FOR DIGITAL GRID, BY REGION, 2019–2026 (USD MILLION)

6.5 DIGITAL HYDROPOWER PLANT

6.5.1 INCREASING FOCUS ON MAINTAINING INTEGRITY OF ASSETS TO DRIVE DEMAND FOR DIGITAL HYDROPOWER PLANTS

TABLE 10 ELECTRICAL DIGITAL TWIN MARKET FOR DIGITAL HYDROPOWER PLANT, BY REGION, 2019–2026 (USD MILLION)

6.6 DISTRIBUTED ENERGY RESOURCES

6.6.1 GROWING NEED FOR REAL-TIME MONITORING, CONTROLLING, AND OPTIMIZATION OF DISTRIBUTED ENERGY SOURCES TO BOOST GROWTH OF SEGMENT

TABLE 11 ELECTRICAL DIGITAL TWIN MARKET FOR DISTRIBUTED ENERGY RESOURCES, BY REGION, 2019–2026 (USD MILLION)

7 ELECTRICAL DIGITAL TWIN MARKET, BY USAGE TYPE (Page No. - 83)

7.1 INTRODUCTION

FIGURE 32 MARKET SHARE, BY USAGE TYPE, 2020 (%)

TABLE 12 MARKET, BY USAGE TYPE, 2019–2026 (USD MILLION)

7.2 PRODUCT DIGITAL TWIN

7.2.1 GROWING NEED FOR ASSET MONITORING AND PERFORMANCE MANAGEMENT TO INCREASE IMPLEMENTATION OF ELECTRICAL PRODUCT DIGITAL TWINS

TABLE 13 PRODUCT MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 PROCESS DIGITAL TWIN

7.3.1 GROWING NEED FOR ENHANCING WORKFLOW EFFICIENCY AND PROCESS OPTIMIZATION TO DRIVE GROWTH OF PROCESS DIGITAL TWIN SEGMENT

TABLE 14 PROCESS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4 SYSTEM DIGITAL TWIN

7.4.1 GROWING NEED FOR ACHIEVING NETWORK-LEVEL OPTIMIZATION TO FUEL DEMAND FOR SYSTEM DIGITAL TWINS

TABLE 15 SYSTEM MARKET, BY REGION, 2019–2026 (USD MILLION)

8 ELECTRICAL DIGITAL TWIN MARKET, BY DEPLOYMENT TYPE (Page No. - 88)

8.1 INTRODUCTION

FIGURE 33 MARKET SHARE, BY DEPLOYMENT TYPE, 2020

TABLE 16 MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

8.2 ON-PREMISE

8.2.1 SECURITY CONCERNS RELATED TO SENSITIVE DATA TO FUEL DEMAND FOR ON-PREMISE DEPLOYMENT TYPE

TABLE 17 MARKET FOR ON-PREMISE DEPLOYMENT, BY REGION, 2019–2026 (USD MILLION)

8.3 CLOUD

8.3.1 EASE OF DEPLOYMENT, COST-EFFECTIVENESS, AND SCALABILITY TO DRIVE DEMAND FOR CLOUD DEPLOYMENT OF ELECTRICAL DIGITAL TWINS

TABLE 18 MARKET FOR CLOUD DEPLOYMENT, BY REGION, 2019–2026 (USD MILLION)

9 ELECTRICAL DIGITAL TWIN MARKET, BY END USER (Page No. - 92)

9.1 INTRODUCTION

FIGURE 34 MARKET SHARE, BY END USER, 2020 (%)

TABLE 19 MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 UTILITIES

9.2.1 GROWING ADOPTION OF RENEWABLE ENERGY AND ADVANCED DIGITAL TECHNOLOGIES TO DRIVE GROWTH OF UTILITIES SEGMENT

TABLE 20 MARKET FOR UTILITIES, BY REGION, 2019–2026 (USD MILLION)

9.3 GRID INFRASTRUCTURE OPERATORS

9.3.1 GROWING NEED FOR GRID MODERNIZATION TO BOOST GROWTH OF MARKET

TABLE 21 MARKET FOR GRID INFRASTRUCTURE OPERATORS, BY REGION, 2019–2026 (USD MILLION)

10 ELECTRICAL DIGITAL TWIN MARKET, BY APPLICATION (Page No. - 97)

10.1 INTRODUCTION

FIGURE 35 MARKET SHARE, BY APPLICATION, 2020 (%)

TABLE 22 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.2 ASSET PERFORMANCE MANAGEMENT

10.2.1 GROWING NEED FOR CONTINUOUS MONITORING AND PREDICTIVE MAINTENANCE OF ASSETS TO DRIVE GROWTH OF ASSET PERFORMANCE MANAGEMENT SEGMENT

10.2.1.1 Equipment health

10.2.1.2 Reliability management

10.2.1.3 Maintenance optimization

TABLE 23 MARKET FOR ASSET PERFORMANCE MANAGEMENT, BY REGION, 2019–2026 (USD MILLION)

10.3 BUSINESS & OPERATIONS OPTIMIZATION

10.3.1 GROWING NEED FOR OPERATIONAL FLEXIBILITY AND REDUCING DOWNTIME TO BOOST GROWTH OF BUSINESS & OPERATIONS OPTIMIZATION SEGMENT

10.3.1.1 Operational flexibility

10.3.1.2 Outage management

TABLE 24 MARKET FOR BUSINESS & OPERATIONS OPTIMIZATION, BY REGION, 2019–2026 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 103)

11.1 INTRODUCTION

FIGURE 36 MARKET SHARE, BY REGION, 2020 (%)

FIGURE 37 NORTH AMERICAN MARKET TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

TABLE 25 MARKET, BY REGION, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 38 SNAPSHOT: NORTH AMERICAN ELECTRICAL DIGITAL TWIN MARKET

TABLE 26 NORTH AMERICA MARKET, BY TWIN TYPE, 2019–2026 (USD MILLION)

TABLE 27 NORTH AMERICA MARKET, BY USAGE TYPE, 2019–2026 (USD MILLION)

TABLE 28 NORTH AMERICA MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 31 NORTH AMERICA MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Initiatives to upgrade aging infrastructure and increasing federal and private investments to drive growth of US electrical digital twin market

TABLE 32 US MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing adoption of renewables and advanced technologies to boost demand for electrical digital twins in Canada

TABLE 33 CANADA MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increasing investments in renewables and decarbonization of Mexican power sector to fuel demand for electrical digital twins

TABLE 34 MEXICO MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3 EUROPE

FIGURE 39 SNAPSHOT: EUROPEAN ELECTRICAL DIGITAL TWIN MARKET

TABLE 35 EUROPE MARKET, BY TWIN TYPE, 2019–2026 (USD MILLION)

TABLE 36 EUROPE MARKET, BY USAGE TYPE, 2019–2026 (USD MILLION)

TABLE 37 EUROPE MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 38 EUROPE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 39 EUROPE MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 40 EUROPE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Growing need to ensure grid stability to drive growth of German market

TABLE 41 GERMANY MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 Growing demand for wind energy to increase deployment of electrical digital twins in UK

TABLE 42 UK MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Digitalization of legacy infrastructure and growing need for improving operational efficiency to boost demand for electrical digital twins in France

TABLE 43 FRANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.4 NORDIC COUNTRIES

11.3.4.1 Growing preference for real-time and remote monitoring of wind farms to boost market growth

TABLE 44 THE NORDIC COUNTRIES MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 45 REST OF EUROPE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 46 ASIA PACIFIC ELECTRICAL DIGITAL TWIN MARKET, BY TWIN TYPE, 2019–2026 (USD MILLION)

TABLE 47 ASIA PACIFIC MARKET, BY USAGE TYPE, 2019–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 49 ASIA PACIFIC MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 50 ASIA PACIFIC MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 51 ASIA PACIFIC MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Increasing renewable capacity addition and development of electric vehicle charging infrastructure to fuel market growth

TABLE 52 CHINA MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Increasing private and public investments in renewable capacity addition to drive growth of market in Japan

TABLE 53 JAPAN MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.3 AUSTRALIA

11.4.3.1 Increasing demand for grid reliability and energy security to boost market growth in Australia

TABLE 54 AUSTRALIA MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 55 REST OF ASIA PACIFIC MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 56 SOUTH AMERICA ELECTRICAL DIGITAL TWIN MARKET, BY TWIN TYPE, 2019–2026 (USD MILLION)

TABLE 57 SOUTH AMERICA MARKET, BY USAGE TYPE, 2019–2026 (USD MILLION)

TABLE 58 SOUTH AMERICA MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 59 SOUTH AMERICA MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 60 SOUTH AMERICA MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 61 SOUTH AMERICA MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increasing government-led investments to improve reliability of power generation, transmission, and distribution assets to fuel market growth

TABLE 62 BRAZIL MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Growing demand for renewable energy and need for improving operational efficiency to fuel demand for electrical digital twins in Argentina

TABLE 63 ARGENTINA MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

TABLE 64 REST OF SOUTH AMERICA MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

TABLE 65 MIDDLE EAST & AFRICA ELECTRICAL DIGITAL TWIN MARKET, BY TWIN TYPE, 2019–2026 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA MARKET, BY USAGE TYPE, 2019–2026 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA MARKET, BY DEPLOYMENT TYPE, 2019–2026 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.6.1 SAUDI ARABIA

11.6.1.1 Grid modernization and digitalization initiatives to boost market growth in Saudi Arabia

TABLE 71 SAUDI ARABIA MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6.2 UAE

11.6.2.1 Rising investments in renewable energy and grid expansion projects to create demand for electrical digital twins in Argentina

TABLE 72 UAE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6.3 SOUTH AFRICA

11.6.3.1 Growing need to prevent outages and improve energy efficiency to fuel growth of market in South Africa

TABLE 73 SOUTH AFRICA ELECTRICAL DIGITAL TWIN MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 74 REST OF MIDDLE EAST & AFRICA MARKET, BY END USER, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 141)

12.1 KEY PLAYERS STRATEGIES

TABLE 75 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, JANUARY 2017–SEPTEMBER 2021

12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 76 ELECTRICAL DIGITAL TWIN MARKET: DEGREE OF COMPETITION

FIGURE 40 MARKET SHARE ANALYSIS, 2020

12.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 41 TOP PLAYERS IN MARKET FROM 2016 TO 2020

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

FIGURE 42 COMPETITIVE LEADERSHIP MAPPING: ELECTRICAL DIGITAL TWIN MARKET, 2020

TABLE 77 APPLICATION: COMPANY FOOTPRINT

TABLE 78 END USER: COMPANY FOOTPRINT

TABLE 79 REGION: COMPANY FOOTPRINT

TABLE 80 COMPANY FOOTPRINT

12.5 COMPETITIVE SCENARIO

TABLE 81 MARKET: PRODUCT LAUNCHES, APRIL 2019–JULY 2021

TABLE 82 MARKET: DEALS, NOVEMBER 2019–JUNE 2021

TABLE 83 MARKET: OTHERS, DECEMBER 2018–SEPTEMBER 2021

13 COMPANY PROFILES (Page No. - 154)

13.1 KEY PLAYERS

(Business and financial overview, Products offered, Recent developments, and MNM view)*

13.1.1 ABB

TABLE 84 ABB: BUSINESS OVERVIEW

FIGURE 43 ABB: COMPANY SNAPSHOT

TABLE 85 ABB: PRODUCTS OFFERED

TABLE 86 ABB: PRODUCT LAUNCHES

TABLE 87 ABB: DEALS

13.1.2 AVEVA GROUP

TABLE 88 AVEVA: BUSINESS OVERVIEW

FIGURE 44 AVEVA GROUP: COMPANY SNAPSHOT

TABLE 89 AVEVA GROUP: PRODUCTS OFFERED

TABLE 90 AVEVA GROUP: DEALS

13.1.3 GENERAL ELECTRIC

TABLE 91 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 45 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 92 GENERAL ELECTRIC: PRODUCTS OFFERED

TABLE 93 GENERAL ELECTRIC: PRODUCT LAUNCHES

TABLE 94 GENERAL ELECTRIC: DEALS

TABLE 95 GENERAL ELECTRIC: OTHERS

13.1.4 SIEMENS

TABLE 96 SIEMENS: BUSINESS OVERVIEW

FIGURE 46 SIEMENS: COMPANY SNAPSHOT

TABLE 97 SIEMENS: PRODUCTS OFFERED

TABLE 98 SIEMENS: PRODUCT LAUNCHES

TABLE 99 SIEMENS: DEALS

13.1.5 EMERSON

TABLE 100 EMERSON: BUSINESS OVERVIEW

FIGURE 47 EMERSON: COMPANY SNAPSHOT

TABLE 101 EMERSON: PRODUCTS OFFERED

TABLE 102 EMERSON: PRODUCT LAUNCHES

TABLE 103 EMERSON: DEALS

13.1.6 ETTEPLAN

TABLE 104 ETTEPLAN: BUSINESS OVERVIEW

FIGURE 48 ETTEPLAN: COMPANY SNAPSHOT

TABLE 105 ETTEPLAN: PRODUCTS OFFERED

TABLE 106 ETTEPLAN: DEALS

TABLE 107 ETTEPLAN: OTHERS

13.1.7 WIPRO

TABLE 108 WIPRO: BUSINESS OVERVIEW

FIGURE 49 WIPRO: COMPANY SNAPSHOT

TABLE 109 WIPRO: PRODUCTS OFFERED

TABLE 110 WIPRO: DEALS

TABLE 111 WIPRO: OTHERS

13.1.8 MIRCOSOFT

TABLE 112 MICROSOFT: BUSINESS OVERVIEW

FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

TABLE 113 MICROSOFT: PRODUCTS OFFERED

TABLE 114 MICROSOFT: PRODUCT LAUNCHES

TABLE 115 MICROSOFT: DEALS

13.1.9 IBM

TABLE 116 IBM: BUSINESS OVERVIEW

FIGURE 51 IBM: COMPANY SNAPSHOT

TABLE 117 IBM: PRODUCTS OFFERED

TABLE 118 IBM: PRODUCT LAUNCHES

TABLE 119 IBM: DEALS

13.1.10 SCHNEIDER ELECTRIC

TABLE 120 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 52 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 121 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 122 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 123 SCHNEIDER ELECTRIC: DEALS

13.1.11 SAP

TABLE 124 SAP: BUSINESS OVERVIEW

FIGURE 53 SAP: COMPANY SNAPSHOT

TABLE 125 SAP: PRODUCTS OFFERED

TABLE 126 SAP: PRODUCT LAUNCHES

TABLE 127 SAP: DEALS

13.1.12 ANSYS

TABLE 128 ANSYS: BUSINESS OVERVIEW

FIGURE 54 ANSYS: COMPANY SNAPSHOT

TABLE 129 ANSYS: PRODUCTS OFFERED

TABLE 130 ANSYS: PRODUCT LAUNCHES

TABLE 131 ANSYS: DEALS

13.1.13 BENTLEY SYSTEMS

TABLE 132 BENTLEY SYSTEMS: BUSINESS OVERVIEW

FIGURE 55 BENTLEY SYSTEMS: COMPANY SNAPSHOT

TABLE 133 BENTLEY SYSTEMS: PRODUCTS OFFERED

TABLE 134 BENTLEY SYSTEMS: PRODUCT LAUNCHES

TABLE 135 BENTLEY SYSTEMS: DEALS

13.1.14 FUJITSU

TABLE 136 FUJITSU: BUSINESS OVERVIEW

FIGURE 56 FUJITSU: COMPANY SNAPSHOT

TABLE 137 FUJITSU: PRODUCTS OFFERED

TABLE 138 FUJITSU: PRODUCT LAUNCHES

TABLE 139 FUJITSU: OTHERS

13.1.15 ACPD SERVICES

TABLE 140 ACPD SERVICES: BUSINESS OVERVIEW

TABLE 141 ACPD SERVICES: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 ORACLE

13.2.2 SAS INSTITUTE

13.2.3 ALTAIR ENGINEERING

13.2.4 DNV

13.2.5 PHDSOFT

*Details on Business and financial overview, Products offered, Recent developments, and MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 213)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 NOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

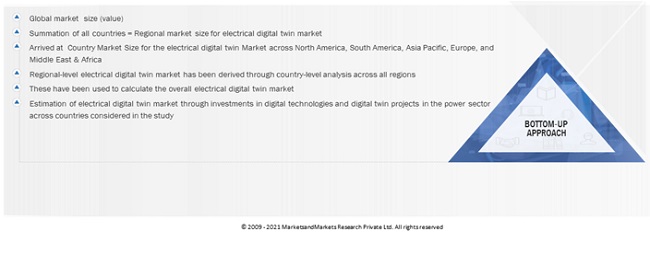

This study involved four major activities in estimating the current size of the electrical digital twin market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the electrical digital twin market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

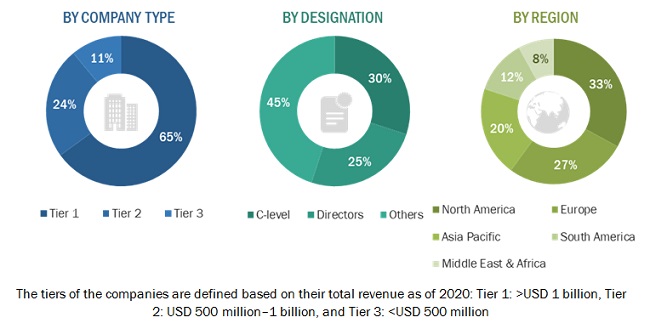

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standard and certification agencies of companies, and organizations related to all the segments of this industry’s value chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global electrical digital twin market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Electrical digital twin Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the electrical digital twin market on the basis of twin type, usage type, deployment type, end user, and application

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze the market opportunities for stakeholders and provide a detailed competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments in the market, including contracts, agreements, expansions, product launches and developments, mergers, partnerships, collaborations, and acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electrical Digital Twin Market

I would like to know which companies hold key market share in Electrical Digital Twin Market.

The Electrical Digital Twin Market report further segments the market by Usage Type: Product Digital Twin, Process Digital Twin, System Digital Twin, by Deployment Type: Cloud and On-premises, further segmented by End User: Utilities, Grid Infrastructure Operators and by Application: Asset Performance Management & Business & Operations Optimization. Market share analysis of key players, including their financials and revenues for the last 3 years, will be studied to derive the market share for top players and ranked them based on their product portfolio strength, global reach, and business strategy excellence. Also, we will profile each player including their service portfolio, regional ranking, key customers, organic and in-organic growth strategies, and SWOT analysis.