Embedded Antenna Systems Market Size, Share and Industry Growth Analysis Report by Antenna Type (Chip, Patch, PCB Trace and FPC), Connectivity (Wi-Fi/Bluetooth, GNSS/GPS, Cellular, LPWAN, and UWB), End User, and Geography - Global Growth Driver and Industry Forecast to 2027

Updated on : May 30, 2023

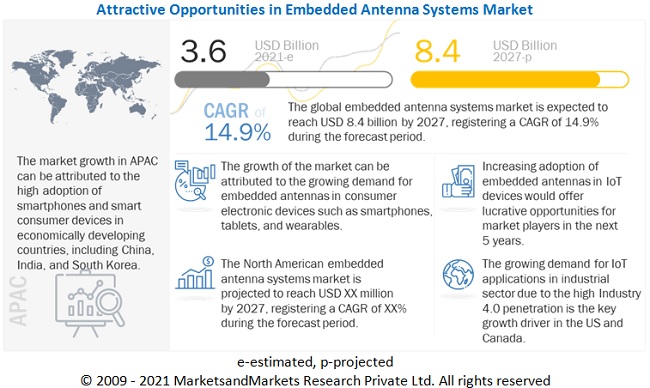

Global embedded antenna systems market in terms of revenue was estimated to be worth USD 3.2 billion in 2020 and is poised to reach USD 8.4 billion by 2027, growing at a CAGR of 14.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

The key factors driving the growth of the embedded antenna systems market include increasing adoption of embedded antenna in Internet of Things devices, increasing demand for low-power wide area (LPWA) networks in IoT applications, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact Of Covid-19 on Embedded Antenna Systems Market

Due to COVID-19, the manufacturing units of major players are highly hampered due to worldwide lockdown and limited availability of labor and raw material. A number of scheduled product launches and related developments have been postponed due to the pandemic. However, the impact of COVID-19 is reducing and is expected to reduce more during the forecast period.

Market Dynamics of Embedded Antenna Systems Market

Driver: Increasing adoption of embedded antenna in Internet of Things devices

The Internet of Things (IoT) ecosystem is growing at a fast rate owing to the availability of various smart products for domestic and industrial applications. The application areas of IoT include smart homes, smart grids, industrial internet, and connected cars, among many others. As the IoT modules used in various applications are becoming compact, the demand for incorporating more than one wireless technology in IoT devices is increasing. Embedded antennas are small, which makes them the best option for low-frequency applications for smaller design of IoT solutions. This has resulted in the high demand for embedded antennas from various IoT applications.

By 2025, 21.5 billion IoT devices and connections are expected to be deployed globally, of which 5 billion are expected to be cellular IoT units ¨C added at a projected volume of 1 billion units every year. Cellular IoT provides the fastest path to develop an IoT system globally by taking advantage of the ubiquitous deployment of cellular networks. From asset-tracking devices to smart meters, smart city sensors, and health monitoring systems and alarms, cellular IoT infrastructure provides the reach to ensure that every device is connected when and wherever needed.

The anticipated growth in IoT devices and connections would create the need for the rapid development of compact, reliable, and low-cost devices. In many instances, using conventional external monopole or dipole antennas is not an option, as wearables, trackers, and many other applications cannot be equipped with external antennas. Hence, the demand for embedded antennas is expected to grow in the coming years.

Restraint: Lack of uniform frequency range for wireless applications

Embedded antennas are used in connectivity applications such as Bluetooth, Zigbee, WLAN, GPS, and others in smartphones, tablets, laptops, and IoT devices, among other such devices. The performance, uniformity, and consistency of these antennas vary for each device. For instance, an antenna used for Bluetooth connectivity in laptops has different performance parameters compared with the antenna used for Bluetooth connectivity in smartphones, which can result in compatibility issues. This also creates the need to produce different antennas for the same application according to the specifications of different devices such as smartphones and laptops.

There are several wireless applications operating at different frequency ranges globally, such as Bluetooth (between 2.4 GHz and 2.485 GHz), GPS (L1 at 1575.42 MHz and L2 at 1227.6 MHz), and WLAN (900 MHz, 2.4 GHz, 3.6 GHz, 4.9 GHz, 5 GHz, 5.9 GHz, 6 GHz, and 60 GHz bands), among others. Spectrum allocation for different applications may differ across countries due to different regulations. Hence, it is difficult for the manufacturers of embedded antennas to produce different antennas for the same application according to the specific regional requirements. For instance, standard bodies such as the International Telecommunication Union (ITU) and the European Conference of Postal and Telecommunications Administrations (CEPT) have allocated different frequency band for wireless communications in different regions. The variation in frequency standards across regions results in the need for region-specific antennas. This acts as a restraint for the manufactures of embedded antennas.

Opportunity: Development of 5G

The demand for embedded antennas is fueled by the developments in the wireless communications industry, such as long-term evolution (LTE), increased adoption of smart devices, higher mobility, and explosive growth in mobile data traffic. New wireless technologies such as LTE and 5G, which are the fastest-growing mobile technologies and would continue to evolve in the future, demand more spectrum and more energy. With the growing number of connected devices, high-speed internet connectivity has become one of the most important parameters in digitally advanced workplaces. With 3G as the absolute wireless broadband technology and 4G rapidly expanding its prospects across numerous applications, the industry focus has shifted toward the development of the 5G technology, which is anticipated to become the next phase of development across the highly dynamic broadband industry. The 5G network infrastructure would help release connectivity of ¡Ý1 Gbps as speculated by leading network providers and cover end-to-end/point-to-point-based ecosystems, enabling a fully connected world, where the network would be highly heterogeneous. The 5G network is expected to offer a high-speed data transfer rate, high device connection density, and deliver real-time services with minimum latency. 5G would operate on the millimeter spectrum, which would require more base stations to provide the same level of coverage as 4G. Therefore, the development of 5G is expected to create lucrative opportunities for the players operating in the embedded antenna systems market during the forecast period.

Challenge: Need for reduction of stock-keeping units (SKUs)

The difference in spectrum allocation across regions compels OEMs to produce multiple SKUs of the same IoT devices connected to wide area network (WAN) technologies. This is expected to continue as 2G and 3G networks are phased out and devices transition to LTE and 5G, a technology with more than 40 spectrum bands. 5G is increasing the number of spectrum bands that OEMs need to consider for antenna design.

Smartphone manufacturers can alleviate some of the need for multiple SKUs by using active antenna tuning. However, even these manufacturers require different product SKUs for different regions. IoT devices are less complex and rarely include active antenna tuning ¨C although it is increasing. As a result, for WAN-connected IoT devices, OEMs need to choose between investing in antenna design for SKU reduction, but less global coverage, or offering more SKUs, but with different antenna designs in each. This is a big challenge for the manufacturers of embedded antennas globally.

Chip antenna segment to account for the largest share of embedded antenna systems market during the forecast period

On the basis of antenna type, the embedded antenna systems market has been segmented into PCB trace antenna, chip antenna, patch antenna, FPC antenna and others. The chip antenna segment of the market is projected to hold the largest market share than all other antenna types owing to the heavy consumption of chip antennas by consumer electronics manufacturers globally.

Consumer Electronics to account for the largest share of embedded antenna systems market during the forecast period

Based on end user, the embedded antenna systems market has been segmented into consumer electronics, automotive & transportation, industrial, communication (datacom & telecom), healthcare, aerospace & defense, and others. The consumer electronics segment holds the largest share of the embedded antenna systems industry from 2021 to 2027, as these antennas are used extensively in smartphones, tablets, smart TVs, wearables, gaming consoles, and other peripheral devices for wireless applications such Bluetooth, WLAN, Wi-Fi, GPS, and others.

APAC to account for the largest share of embedded antenna systems market during the forecast period

Among all regions, APAC held the largest market share in 2020. The market in APAC is also expected to grow at the highest CAGR during the forecast period, owing to the concentration of consumer electronics manufacturers in the region. The growing penetration of smartphones and smart home devices in the developing countries in APAC is expected to spur the demand for embedded antennas in the region. Government investments in urban planning and smart city development in China and India are expected to provide new growth opportunities for IoT devices during the forecast period; this, in turn, is expected to drive the adoption of embedded antennas in cellular and LPWAN connectivity devices.

The novel coronavirus has affected the global economy to a large extent. The economies in APAC, including Japan, China, South Korea, India, and Australia, have a significant contribution toward the global economy as they are home to various manufacturing and assembly plants in the world. China, which is known as the manufacturing hub of the world, faced a serious economic crisis owing to the spread of the virus and brought all economic activities to a standstill for weeks. The other countries, such as India, Australia, South Korea, and Japan, have also witnessed a downfall in the economic activities across various sectors.

To know about the assumptions considered for the study, download the pdf brochure

Top Embedded Antenna Systems Companies - Key Market Players

Top embedded antenna systems companies are Molex (US), Taoglas (Ireland), Kyocera AVX (US), Linx Technologies (US), Antenova Ltd. (UK), Yageo Corporation (Taiwan), Abracon (US), Ignion (Spain), TE Connectivity (Switzerland), and so on.

Embedded Antenna System Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2020 |

USD 3.2 Billion |

| Revenue Forecast in 2027 | USD 8.4 Billion |

| Growth Rate | 14.9% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2018–2027 |

|

Forecast Period |

2021–2027 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Increasing adoption of embedded antenna in Internet of Things devices |

| Key Market Opportunity | Development of 5G |

| Largest Growing Region | North America |

| Largest Market Share Segment | Chip Antenna Segment |

| Highest CAGR Segment | Consumer Electronics Segment |

| Largest Application Market Share | Industrial Application |

In this research report, the embedded antenna systems market has been segmented on the basis of antenna type, connectivity, end user, and geography.

Embedded Antenna Systems Market, by Antenna Type

- PCB Trace Antenna

- Chip Antenna

- Patch Antenna

- Flexible Printed Circuit (FPC) Antenna

- Others

Embedded Antenna Systems Market, by Connectivity

- GNSS/GPS

- Wi-Fi/Bluetooth

- Cellular

- mmWave (5G)

- LPWAn

- RFID

- UWB

- Others

Embedded Antenna Systems Market, by End User

- Consumer Electronics

- Communication (Datacom & Telecom)

- Healthcare

- Aerospace & Defense

- Industrial

- Automotive & Transportation

- Others

Geographic Analysis

- North America

- Europe

- APAC

- RoW

Recent Developments

- In April 2021, Kyocera Corporation (Japan) and AVX Corporation (US) established a new integrated brand "KYOCERA AVX" to be used for the Kyocera Group’s electronic components business 2021 onward following the integration of Kyocera’s "Corporate Electronic Components Group" and "AVX" into a new segment, "Electronic Components Business" as of April 1, 2021.

- In July 2021, Yageo Corporation acquired Chilisin Electronics Corp (Taiwan) to accelerate its expansion into high-margin passive component markets through improved product integration. Chilisin would be leveraging Yageo’s strength in passive component deployments and extensive sales channels worldwide as the firm could broaden its product portfolio from chip resistors and capacitors to inductors.

- In September 2021, TE Connectivity Ltd. signed a definitive agreement to acquire the antennas business from Laird Connectivity (US), a leading provider of wireless modules, IoT devices, and antennas. The acquisition of Laird’s antennas business complements TE’s broad connectivity product portfolio, particularly in antenna and wireless solutions for IoT devices and edge access. The acquisition also expands TE’s engineering and manufacturing footprint and strengthens TE’s presence in several attractive market segments.

Frequently Asked Questions (FAQ):

What is the current size of the global embedded antenna systems market?

The global embedded antenna systems market was valued at USD 3.2 billion in 2020 and is expected to reach USD 8.4 billion by 2027; it is anticipated to register a CAGR of 14.9% during the forecast period from 2021 to 2027.

Who are the winners in the global embedded antenna systems market?

Some of the key companies operating in the embedded antenna systems market are Molex (US), Taoglas (Ireland), Kyocera AVX (US), Linx Technologies (US), Antenova Ltd. (UK), Yageo Corporation (Taiwan), Abracon (US), Ignion (Spain), TE Connectivity (Switzerland), and so on. These players have adopted various growth strategies such as product launches/developments, partnerships/contracts/ collaborations/acquisitions to expand their global presence and increase their share in the global embedded antenna systems market.

What are the major drivers for the embedded antenna systems market?

The key factors driving the growth of the embedded antenna systems market include increasing adoption of embedded antenna in Interne of Things devices, increasing demand for low-power wide area (LPWA) networks in IoT applications, and others.

What are the growing end use application segment in the embedded antenna systems market?

The embedded antenna systems market is led by consumer electronics. The consumer electronics segment holds the largest share of the embedded antenna systems market from 2021 to 2027, as these antennas are used extensively in smartphones, tablets, smart TVs, wearables, gaming consoles, and other peripheral devices for wireless applications such Bluetooth, WLAN, Wi-Fi, GPS, and others.

What are the impact of COVID-19 on the global embedded antenna systems market?

Due to COVID-19, the manufacturing units of major players are highly hampered due to worldwide lockdown and limited availability of labor and raw material. A number of scheduled product launches and related developments have been postponed due to the pandemic. However, the impact of COVID-19 is expected to reduce during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 EMBEDDED ANTENNA SYSTEMS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.1.2 List of key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews with experts

2.1.2.3 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY¡ªAPPROACH 1 (SUPPLY SIDE): CALCULATION OF MARKET SIZE THROUGH REVENUE OF MARKET PLAYERS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY¡ªAPPROACH 2 (DEMAND SIZE): CALCULATION OF MARKET SIZE THROUGH DEMAND ACROSS CONNECTIVITY TYPES

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.1 Estimating market size using bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2.1 Estimating market size using top-down approach (supply side)

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 COVID-19 IMPACT ANALYSIS

FIGURE 9 EMBEDDED ANTENNA SYSTEMS MARKET TO WITNESS SWOOSH SHAPED RECOVERY STARTING 2021

FIGURE 10 CHIP ANTENNA TO CONTINUE TO HOLD LARGER SIZE OF EMBEDDED ANTENNA SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 11 CONSUMER ELECTRONICS TO CONTINUE TO HOLD LARGEST SHARE IN EMBEDDED ANTENNA SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 12 EMBEDDED ANTENNA SYSTEMS MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 MAJOR OPPORTUNITIES IN EMBEDDED ANTENNA SYSTEMS MARKET

FIGURE 13 EMBEDDED ANTENNA SYSTEMS MARKET TO REGISTER HIGHEST CAGR IN APAC DURING FORECAST PERIOD

4.2 EMBEDDED ANTENNA SYSTEMS MARKET, BY ANTENNA TYPE

FIGURE 14 EMBEDDED ANTENNA SYSTEMS MARKET FOR FPC ANTENNA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 EMBEDDED ANTENNA SYSTEMS MARKET IN APAC, BY ANTENNA TYPE AND COUNTRY

FIGURE 15 CHIP ANTENNA AND CHINA HELD LARGEST SHARE OF EMBEDDED ANTENNA SYSTEMS MARKET IN APAC IN 2020

4.4 EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY

FIGURE 16 CHINA DOMINATED EMBEDDED ANTENNA SYSTEMS MARKET IN 2020

4.5 EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER

FIGURE 17 EMBEDDED ANTENNA SYSTEMS MARKET FOR INDUSTRIAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS FOR EMBEDDED ANTENNA SYSTEMS MARKET

FIGURE 18 INCREASING ADOPTION OF EMBEDDED ANTENNAS IN IOT DEVICES TO DRIVE MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of embedded antennas in IoT devices

FIGURE 19 NUMBER OF GLOBAL ACTIVE IOT CONNECTIONS, 2015¨C2025

5.2.1.2 Increasing demand for low-power wide-area network (LPWAN) in IoT applications

5.2.1.3 Growing trend of miniaturization in consumer electronics

FIGURE 20 IMPACT ANALYSIS OF DRIVERS ON EMBEDDED ANTENNA SYSTEMS MARKET

5.2.2 RESTRAINTS

5.2.2.1 Lack of uniform frequency range for wireless applications

5.2.2.2 Growing popularity of virtual antenna systems

FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS ON EMBEDDED ANTENNA SYSTEMS MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Development of 5G

FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES ON EMBEDDED ANTENNA SYSTEMS MARKET

5.2.4 CHALLENGES

5.2.4.1 US¨CChina trade war

5.2.4.2 Need for reduction of stock-keeping units (SKUs)

FIGURE 23 IMPACT ANALYSIS OF CHALLENGES ON EMBEDDED ANTENNA SYSTEMS MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS (2021): MAJOR VALUE IS ADDED IN COMPONENT DEVELOPMENT AND DEVICE INTEGRATION PHASES

5.4 TARIFFS AND REGULATORY LANDSCAPE

5.4.1 FEDERAL COMMUNICATIONS COMMISSION (FCC)

5.4.2 IEEE-SA

5.4.3 INTERNATIONAL TELECOMMUNICATION UNION (ITU)

5.4.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)/INTERNATIONAL ELECTROTECHNICAL COMMISSION (IEC) JOINT TECHNICAL COMMITTEE (JTC) 1

5.4.5 ISO/IEC JTC1/SC 31/SWG 5

5.5 PORTERS FIVE FORCES ANALYSIS

FIGURE 25 EMBEDDED ANTENNA SYSTEMS MARKET: PORTER¡¯S FIVE FORCES ANALYSIS, 2021

TABLE 2 IMPACT OF EACH FORCE ON EMBEDDED ANTENNA SYSTEMS MARKET

5.5.1 INTENSITY OF COMPETITIVE RIVALRY

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 THREAT OF NEW ENTRANTS

5.6 ECOSYSTEM ANALYSIS

TABLE 3 EMBEDDED ANTENNA SYSTEMS MARKET: ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 ANTENNA OPTIMIZATION FOR LOW-POWER CONNECTIVITY

5.7.2 MINIATURIZATION OF DEVICES

5.8 CASE STUDIES

5.8.1 END-DEVICE CERTIFIED LPWA AND BLUETOOTH 5 MODEM FROM LAIRD CONNECTIVITY ENABLES RAPID DEPLOYMENT OF IOT EDGE APPLICATIONS

5.8.2 ANTENNAS TO GO ¡ª AYANTRA SELECTS TAOGLAS¡¯ PA.25 AND GP.25A

5.8.3 BUILDING AND INTEGRATING LTE ANTENNA IN TINY 4G GATEWAY

5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 26 REVENUE SHIFT IN EMBEDDED ANTENNA SYSTEM MARKET

5.10 PATENTS ANALYSIS

TABLE 4 NOTICEABLE PATENTS RELATED TO EMBEDDED ANTENNA SYSTEMS

5.11 AVERAGE SELLING PRICE (ASP) TRENDS

TABLE 5 ASP OF DIFFERENT TYPES OF EMBEDDED ANTENNAS, 2021

FIGURE 27 ASP TREND FOR DIFFERENT TYPES OF EMBEDDED ANTENNAS

5.12 TRADE ANALYSIS

TABLE 6 IMPORTS DATA FOR HS CODE 847160, BY COUNTRY, 2016¨C2020 (USD MILLION)

TABLE 7 EXPORTS DATA FOR HS CODE 847160, BY COUNTRY, 2016¨C2020 (USD MILLION)

6 EMBEDDED ANTENNA SYSTEMS MARKET, BY ANTENNA TYPE (Page No. - 68)

6.1 INTRODUCTION

FIGURE 28 EMBEDDED ANTENNA SYSTEMS MARKET: BY ANTENNA TYPE

FIGURE 29 CHIP ANTENNA SEGMENT TO HOLD LARGEST SHARE OF EMBEDDED ANTENNA SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 8 EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 9 EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2021¨C2027 (USD MILLION)

6.2 PCB TRACE ANTENNA

6.2.1 PCB ANTENNAS ARE MOST COST-EFFECTIVE COMPARED WITH OTHER EMBEDDED ANTENNA TYPES

TABLE 10 PCB TRACE ANTENNA MARKET, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 11 PCB TRACE ANTENNA MARKET, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 12 PCB TRACE ANTENNA MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 13 PCB TRACE ANTENNA MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

6.3 CHIP ANTENNA

6.3.1 CHIP ANTENNAS ARE SMALLEST AND DISCRETE INTERNAL ANTENNAS

TABLE 14 CHIP ANTENNA MARKET, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 15 CHIP ANTENNA MARKET, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 16 CHIP ANTENNA MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 17 CHIP ANTENNA MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

6.4 PATCH ANTENNA

6.4.1 PATCH ANTENNAS ARE SUITABLE FOR WIRELESS PROTOCOLS WITH EXTREMELY HIGH FREQUENCY

TABLE 18 PATCH ANTENNA MARKET, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 19 PATCH ANTENNA MARKET, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 20 PATCH ANTENNA MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 21 PATCH ANTENNA MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

6.5 FLEXIBLE PRINTED CIRCUIT (FPC) ANTENNA

6.5.1 FPC ANTENNAS ARE EXPENSIVE ANTENNAS CHOSEN TO BYPASS TYPICAL PCB DESIGN CHALLENGES

TABLE 22 FLEXIBLE PRINTED CIRCUIT ANTENNA MARKET, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 23 FLEXIBLE PRINTED CIRCUIT ANTENNA MARKET, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 24 FLEXIBLE PRINTED CIRCUIT ANTENNA MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 25 FLEXIBLE PRINTED CIRCUIT ANTENNA MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

6.6 OTHERS

6.6.1 LOOP ANTENNA

6.6.2 DIPOLE ANTENNA

6.6.3 HELIX ANTENNA

TABLE 26 OTHER ANTENNAS MARKET, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 27 OTHER ANTENNAS MARKET, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 28 OTHER ANTENNAS MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 29 OTHER ANTENNAS MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

7 EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY (Page No. - 81)

7.1 INTRODUCTION

FIGURE 30 EMBEDDED ANTENNA SYSTEMS MARKET: BY CONNECTIVITY

FIGURE 31 LPWAN SEGMENT TO HOLD LARGEST SHARE OF EMBEDDED ANTENNA SYSTEMS MARKET IN 2027

TABLE 30 EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 31 EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

TABLE 32 EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2018¨C2020 (MILLION UNITS)

TABLE 33 EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2021¨C2027 (MILLION UNITS)

7.2 GNSS/GPS

7.2.1 INCREASING USE OF SMART DEVICES EQUIPPED WITH GPS DRIVES THIS SEGMENT

TABLE 34 EMBEDDED ANTENNA SYSTEMS MARKET FOR GNSS/GPS, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 35 EMBEDDED ANTENNA SYSTEMS MARKET FOR GNSS/GPS, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 36 EMBEDDED ANTENNA SYSTEMS MARKET FOR GNSS/GPS, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 37 EMBEDDED ANTENNA SYSTEMS MARKET FOR GNSS/GPS, BY TYPE, 2021¨C2027 (USD MILLION)

7.3 WI-FI/BLUETOOTH

7.3.1 WI-FI AND BLUETOOTH ARE PROMINENT WLAN CONNECTIVITY TECHNOLOGIES

TABLE 38 EMBEDDED ANTENNA SYSTEMS MARKET FOR WI-FI/BLUETOOTH, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 39 EMBEDDED ANTENNA SYSTEMS MARKET FOR WI-FI/BLUETOOTH, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 40 EMBEDDED ANTENNA SYSTEMS MARKET FOR WI-FI/BLUETOOTH, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 41 EMBEDDED ANTENNA SYSTEMS MARKET FOR WI-FI/BLUETOOTH, BY TYPE, 2021¨C2027 (USD MILLION)

7.4 CELLULAR

7.4.1 CELLULAR NETWORKS ARE IDEAL FOR IOT APPLICATIONS OPERATING OVER LONG DISTANCES

TABLE 42 EMBEDDED ANTENNA SYSTEMS MARKET FOR CELLULAR, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 43 EMBEDDED ANTENNA SYSTEMS MARKET FOR CELLULAR, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 44 EMBEDDED ANTENNA SYSTEMS MARKET FOR CELLULAR, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 45 EMBEDDED ANTENNA SYSTEMS MARKET FOR CELLULAR, BY TYPE, 2021¨C2027 (USD MILLION)

7.5 MMWAVE (5G)

7.5.1 MMWAVE FREQUENCY BAND IS USED FOR HIGH-SPEED WIRELESS COMMUNICATIONS

TABLE 46 EMBEDDED ANTENNA SYSTEMS MARKET FOR MMWAVE, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 47 EMBEDDED ANTENNA SYSTEMS MARKET FOR MMWAVE, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 48 EMBEDDED ANTENNA SYSTEMS MARKET FOR MMWAVE, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 49 EMBEDDED ANTENNA SYSTEMS MARKET FOR MMWAVE, BY TYPE, 2021¨C2027 (USD MILLION)

7.6 LOW-POWER WIDE-AREA NETWORK (LPWAN)

7.6.1 LPWAN IS POWER-EFFICIENT NETWORK THAT SIMULTANEOUSLY ALLOWS MASSIVE NUMBER OF CONNECTED DEVICES

TABLE 50 EMBEDDED ANTENNA SYSTEMS MARKET FOR LPWAN, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 51 EMBEDDED ANTENNA SYSTEMS MARKET FOR LPWAN, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 52 EMBEDDED ANTENNA SYSTEMS MARKET FOR LPWAN, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 53 EMBEDDED ANTENNA SYSTEMS MARKET FOR LPWAN, BY TYPE, 2021¨C2027 (USD MILLION)

7.7 RADIOFREQUENCY IDENTIFICATION (RFID)

7.7.1 RFID TAGS ON CONTAINERS AND FREIGHT SYSTEMS OFFERS REAL-TIME CARGO VISIBILITY

TABLE 54 EMBEDDED ANTENNA SYSTEMS MARKET FOR RFID, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 55 EMBEDDED ANTENNA SYSTEMS MARKET FOR RFID, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 56 EMBEDDED ANTENNA SYSTEMS MARKET FOR RFID, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 57 EMBEDDED ANTENNA SYSTEMS MARKET FOR RFID, BY TYPE, 2021¨C2027 (USD MILLION)

7.8 ULTRA-WIDEBAND (UWB)

7.8.1 EXTREMELY LOW POWER CONSUMPTION PROVIDES LONGER BATTERY LIFE TO UWB-POWERED DEVICES

TABLE 58 EMBEDDED ANTENNA SYSTEMS MARKET FOR UWB, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 59 EMBEDDED ANTENNA SYSTEMS MARKET FOR UWB, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 60 EMBEDDED ANTENNA SYSTEMS MARKET FOR UWB, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 61 EMBEDDED ANTENNA SYSTEMS MARKET FOR UWB, BY TYPE, 2021¨C2027 (USD MILLION)

7.9 OTHERS

7.9.1 ZIGBEE

7.9.2 WIMAX

7.9.3 Z-WAVE

TABLE 62 EMBEDDED ANTENNA SYSTEMS MARKET FOR OTHERS, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 63 EMBEDDED ANTENNA SYSTEMS MARKET FOR OTHERS, BY REGION, 2021¨C2027 (USD MILLION)

TABLE 64 EMBEDDED ANTENNA SYSTEMS MARKET FOR OTHERS, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 65 EMBEDDED ANTENNA SYSTEMS MARKET FOR OTHERS, BY TYPE, 2021¨C2027 (USD MILLION)

8 EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER (Page No. - 101)

8.1 INTRODUCTION

FIGURE 32 EMBEDDED ANTENNA SYSTEMS MARKET: BY END USER

FIGURE 33 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF EMBEDDED ANTENNA SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 66 EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2018¨C2020 (USD MILLION)

TABLE 67 EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2021¨C2027 (USD MILLION)

8.2 CONSUMER ELECTRONICS

8.2.1 INCREASING ADOPTION OF SMART DEVICES IS DRIVING GROWTH OF EMBEDDED ANTENNA SYSTEMS MARKET

TABLE 68 EMBEDDED ANTENNA SYSTEMS MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 69 EMBEDDED ANTENNA SYSTEMS MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021¨C2027 (USD MILLION)

8.3 AUTOMOTIVE & TRANSPORTATION

8.3.1 IOT IS ACCELERATING MODERNIZATION IN AUTOMOTIVE AND TRANSPORTATION INDUSTRY

TABLE 70 EMBEDDED ANTENNA SYSTEMS MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 71 EMBEDDED ANTENNA SYSTEMS MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021¨C2027 (USD MILLION)

8.4 INDUSTRIAL

8.4.1 WLAN IS COMMONLY USED IN INDUSTRIES FOR WIRELESS NETWORKING

TABLE 72 EMBEDDED ANTENNA SYSTEMS MARKET FOR INDUSTRIAL, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 73 EMBEDDED ANTENNA SYSTEMS MARKET FOR INDUSTRIAL, BY REGION, 2021¨C2027 (USD MILLION)

8.5 COMMUNICATION (DATACOM & TELECOM)

8.5.1 WIRELESS COMMUNICATION TECHNOLOGIES OFFER COST-EFFECTIVE AND AFFORDABLE CONNECTIVITY

TABLE 74 EMBEDDED ANTENNA SYSTEMS MARKET FOR COMMUNICATION, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 75 EMBEDDED ANTENNA SYSTEMS MARKET FOR COMMUNICATION, BY REGION, 2021¨C2027 (USD MILLION)

8.6 HEALTHCARE

8.6.1 INCREASING TREND OF REMOTE HEALTH MONITORING IS SUPPORTING MARKET GROWTH

TABLE 76 EMBEDDED ANTENNA SYSTEMS MARKET FOR HEALTHCARE, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 77 EMBEDDED ANTENNA SYSTEMS MARKET FOR HEALTHCARE, BY REGION, 2021¨C2027 (USD MILLION)

8.7 AEROSPACE & DEFENSE

8.7.1 WIRELESS TECHNOLOGIES OFFERS OPPORTUNITIES TO AIRLINES FOR IMPROVEMENT OF BAGGAGE HANDLING AND EQUIPMENT MONITORING PROCESS

TABLE 78 EMBEDDED ANTENNA SYSTEMS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 79 EMBEDDED ANTENNA SYSTEMS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021¨C2027 (USD MILLION)

8.8 OTHERS

8.8.1 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

8.8.2 ENERGY

8.8.3 AGRICULTURE

8.8.4 RETAIL

TABLE 80 EMBEDDED ANTENNA SYSTEMS MARKET FOR OTHERS, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 81 EMBEDDED ANTENNA SYSTEMS MARKET FOR OTHERS, BY REGION, 2021¨C2027 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 113)

9.1 INTRODUCTION

FIGURE 34 EMBEDDED ANTENNA SYSTEMS MARKET: BY REGION

FIGURE 35 APAC TO HOLD LARGEST SHARE OF EMBEDDED ANTENNA SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 82 EMBEDDED ANTENNA SYSTEMS MARKET, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 83 EMBEDDED ANTENNA SYSTEMS MARKET, BY REGION, 2021¨C2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY

FIGURE 37 SNAPSHOT OF EMBEDDED ANTENNA SYSTEMS MARKET IN NORTH AMERICA

TABLE 84 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 85 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2021¨C2027 (USD MILLION)

TABLE 86 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 87 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

TABLE 88 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2018¨C2020 (USD MILLION)

TABLE 89 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2021¨C2027 (USD MILLION)

TABLE 90 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2018¨C2020 (USD MILLION)

TABLE 91 NORTH AMERICA EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2021¨C2027 (USD MILLION)

9.2.1 IMPACT OF COVID-19 ON EMBEDDED ANTENNA SYSTEMS MARKET IN NORTH AMERICA

FIGURE 38 ANALYSIS OF EMBEDDED ANTENNA SYSTEMS MARKET IN NORTH AMERICA: PRE- AND POST-COVID-19 SCENARIOS

9.2.2 US

9.2.2.1 High penetration of IoT devices in home and industries to drive embedded antenna shipments in US

9.2.3 CANADA

9.2.3.1 Short replacement cycle length of personal electronic devices and anticipated rollout of 5G are likely to offer new growth opportunities

9.2.4 MEXICO

9.2.4.1 Shift toward digitalization led by COVID-19 and remote work to drive shipments of embedded antenna-based wireless devices

9.3 EUROPE

FIGURE 39 EUROPEAN EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY

FIGURE 40 SNAPSHOT OF EMBEDDED ANTENNA SYSTEMS MARKET IN EUROPE

TABLE 92 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 93 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2021¨C2027 (USD MILLION)

TABLE 94 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 95 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

TABLE 96 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2018¨C2020 (USD MILLION)

TABLE 97 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2021¨C2027 (USD MILLION)

TABLE 98 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2018¨C2020 (USD MILLION)

TABLE 99 EUROPE EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2021¨C2027 (USD MILLION)

9.3.1 IMPACT OF COVID-19 ON EMBEDDED ANTENNA SYSTEMS MARKET IN EUROPE

FIGURE 41 ANALYSIS OF EMBEDDED ANTENNA SYSTEMS MARKET IN EUROPE: PRE- AND POST-COVID-19 SCENARIOS

9.3.2 UK

9.3.2.1 Growing adoption of wireless technologies in consumer electronics would drive demand for embedded antennas

9.3.3 GERMANY

9.3.3.1 Adoption of Industry 4.0 creates opportunities for market growth

9.3.4 FRANCE

9.3.4.1 Increased investments in R&D to modernize industrial sector fueling market growth

9.3.5 REST OF EUROPE

9.4 APAC

FIGURE 42 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY

FIGURE 43 SNAPSHOT OF EMBEDDED ANTENNA SYSTEMS MARKET IN APAC

TABLE 100 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 101 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2021¨C2027 (USD MILLION)

TABLE 102 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 103 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

TABLE 104 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2018¨C2020 (USD MILLION)

TABLE 105 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2021¨C2027 (USD MILLION)

TABLE 106 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2018¨C2020 (USD MILLION)

TABLE 107 APAC EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY, 2021¨C2027 (USD MILLION)

9.4.1 IMPACT OF COVID-19 ON EMBEDDED ANTENNA SYSTEMS MARKET IN APAC

FIGURE 44 ANALYSIS OF EMBEDDED ANTENNA SYSTEMS MARKET IN APAC: PRE- AND POST-COVID-19 SCENARIOS

9.4.2 CHINA

9.4.2.1 High-volume manufacturing of consumer electronics and IoT devices make China most lucrative market for embedded antennas

9.4.3 JAPAN

9.4.3.1 Telecom industry to underpin market growth in Japan

9.4.4 INDIA

9.4.4.1 Ambitious smart city projects and growing penetration of smartphones offer opportunities for wireless devices manufacturing

9.4.5 SOUTH KOREA

9.4.5.1 Presence of global consumer electronics and automotive manufacturers is driving domestic embedded antenna systems market

9.4.6 REST OF APAC

9.5 REST OF THE WORLD (ROW)

FIGURE 45 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY COUNTRY

TABLE 108 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2018¨C2020 (USD MILLION)

TABLE 109 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY TYPE, 2021¨C2027 (USD MILLION)

TABLE 110 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2018¨C2020 (USD MILLION)

TABLE 111 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY CONNECTIVITY, 2021¨C2027 (USD MILLION)

TABLE 112 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2018¨C2020 (USD MILLION)

TABLE 113 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY END USER, 2021¨C2027 (USD MILLION)

TABLE 114 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY REGION, 2018¨C2020 (USD MILLION)

TABLE 115 ROW EMBEDDED ANTENNA SYSTEMS MARKET, BY REGION, 2021¨C2027 (USD MILLION)

9.5.1 IMPACT OF COVID-19 ON EMBEDDED ANTENNA SYSTEMS MARKET IN ROW

FIGURE 46 ANALYSIS OF EMBEDDED ANTENNA SYSTEMS MARKET IN ROW: PRE- AND POST-COVID-19 SCENARIOS

9.5.2 SOUTH AMERICA

9.5.2.1 Increasing use of internet to drive embedded antenna systems market

9.5.3 MIDDLE EAST & AFRICA

9.5.3.1 Rapid urbanization in Middle East and increasing development of cellular technologies in Africa drive demand for embedded antennas

10 COMPETITIVE LANDSCAPE (Page No. - 139)

10.1 OVERVIEW

10.1.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN EMBEDDED ANTENNA SYSTEMS MARKET

10.3 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 116 REVENUE ANALYSIS OF TOP PLAYERS IN EMBEDDED ANTENNA SYSTEMS MARKET, 2018¨C2020, USD MILLION

10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN EMBEDDED ANTENNA SYSTEMS MARKET IN 2020

FIGURE 47 EMBEDDED ANTENNA SYSTEMS MARKET: MARKET SHARE ANALYSIS, 2020

TABLE 117 EMBEDDED ANTENNA SYSTEMS MARKET: DEGREE OF COMPETITION

TABLE 118 EMBEDDED ANTENNA SYSTEMS MARKET RANKING ANALYSIS

10.5 COMPANY EVALUATION QUADRANT, 2020

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 48 EMBEDDED ANTENNA SYSTEMS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

10.6 EMBEDDED ANTENNA SYSTEM MARKET: COMPANY FOOTPRINT

TABLE 119 COMPANY ANTENNA TYPE FOOTPRINT (20 COMPANIES)

TABLE 120 COMPANY END USER FOOTPRINT (20 COMPANIES)

TABLE 121 COMPANY REGION FOOTPRINT (20 COMPANIES)

TABLE 122 COMPANY FOOTPRINT (20 COMPANIES)

10.7 STARTUP/SME EVALUATION QUADRANT, 2020

10.7.1 PROGRESSIVE COMPANY

10.7.2 RESPONSIVE COMPANY

10.7.3 DYNAMIC COMPANY

10.7.4 STARTING BLOCK

FIGURE 49 EMBEDDED ANTENNA SYSTEMS MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2020

TABLE 123 EMBEDDED ANTENNA SYSTEMS MARKET: LIST OF KEY STARTUPS/SMES

TABLE 124 EMBEDDED ANTENNA SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.8 COMPETITIVE SCENARIO AND TRENDS

10.8.1 NEW PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 125 EMBEDDED ANTENNA SYSTEMS MARKET: NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2020¨C2021

10.8.2 DEALS

TABLE 126 EMBEDDED ANTENNA SYSTEMS MARKET: DEALS, 2020¨C2021

11 COMPANY PROFILES (Page No. - 156)

11.1 INTRODUCTION

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

11.2 KEY PLAYERS

11.2.1 YAGEO CORPORATION

TABLE 127 YAGEO CORPORATION: BUSINESS OVERVIEW

FIGURE 50 YAGEO CORPORATION: COMPANY SNAPSHOT

TABLE 128 YAGEO CORPORATION: DEALS

11.2.2 MOLEX, LLC

TABLE 129 MOLEX, LLC: BUSINESS OVERVIEW

TABLE 130 MOLEX, LLC: DEALS

11.2.3 TE CONNECTIVITY LTD.

TABLE 131 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

FIGURE 51 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

TABLE 132 TE CONNECTIVITY LTD.: PRODUCT LAUNCHES

TABLE 133 TE CONNECTIVITY LTD.: DEALS

11.2.4 KYOCERA AVX COMPONENTS CORPORATION

TABLE 134 KYOCERA AVX COMPONENTS CORPORATION: BUSINESS OVERVIEW

TABLE 135 KYOCERA AVX COMPONENTS CORPORATION: DEALS

11.2.5 TAOGLAS

TABLE 136 TAOGLAS: BUSINESS OVERVIEW

TABLE 137 TAOGLAS: PRODUCT LAUNCHES

TABLE 138 TAOGLAS: DEALS

11.2.6 AIRGAIN, INC.

TABLE 139 AIRGAIN, INC.: BUSINESS OVERVIEW

FIGURE 52 AIRGAIN, INC.: COMPANY SNAPSHOT

TABLE 140 AIRGAIN, INC.: DEALS

11.2.7 MITSUBISHI MATERIALS CORPORATION

TABLE 141 MITSUBISHI MATERIALS CORPORATION: BUSINESS OVERVIEW

FIGURE 53 MITSUBISHI MATERIALS CORPORATION: COMPANY SNAPSHOT

11.2.8 ANTENOVA LTD.

TABLE 142 ANTENOVA LTD.: BUSINESS OVERVIEW

TABLE 143 ANTENOVA LTD.: PRODUCT LAUNCHES

11.2.9 WALSIN TECHNOLOGY CORPORATION

TABLE 144 WALSIN TECHNOLOGY CORPORATION: BUSINESS OVERVIEW

FIGURE 54 WALSIN TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

11.2.10 VISHAY INTERTECHNOLOGY, INC.

TABLE 145 VISHAY INTERTECHNOLOGY, INC.: BUSINESS OVERVIEW

FIGURE 55 VISHAY INTERTECHNOLOGY, INC.: COMPANY SNAPSHOT

11.3 OTHER PLAYERS

11.3.1 ABRACON

11.3.2 PCTEL, INC.

11.3.3 INPAQ TECHNOLOGY CO., LTD.

11.3.4 QUECTEL WIRELESS SOLUTIONS CO., LTD.

11.3.5 JOHANSON TECHNOLOGY, INC.

11.3.6 LYNWAVE TECHNOLOGY LTD.

11.3.7 IGNION

11.3.8 SUNTSU ELECTRONICS, INC.

11.3.9 MAXTENA, INC.

11.3.10 UNICTRON TECHNOLOGIES CORPORATION

11.3.11 HL GLOBAL, INC.

11.3.12 FRACTUS S.A.

11.3.13 COREIOT TECHNOLOGIES LTD.

11.3.14 PARTRON CO., LTD.

11.3.15 LINX TECHNOLOGIES

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 193)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS¡¯ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

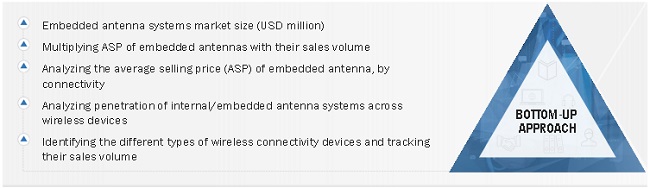

The study involved four major activities in estimating the size of the embedded antenna systems market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Telecommunication Industry Association, Wi-Fi Alliance, Consumer Technology Association, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

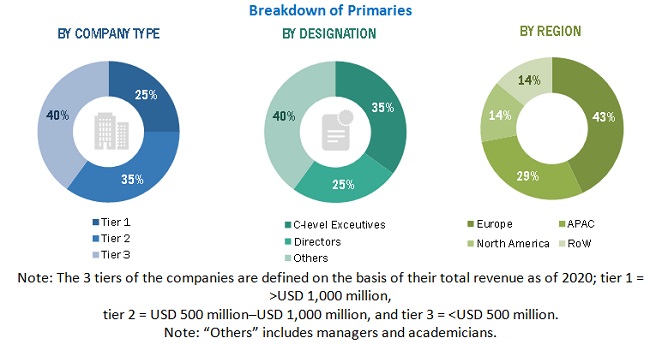

Primary Research

Extensive primary research was conducted after understanding and analyzing the embedded antenna systems market scenario through secondary research. Several primary interviews were conducted with the key opinion leaders from demand and supply sides across four key regions¡ªNorth America, Europe, APAC, and RoW (South America and Middle East & Africa). Approximately 25% of the primary interviews were conducted with the demand side participants, while the remaining were conducted with the supply side participants. The primary data was collected mainly through telephonic interviews, which consist of approximately 70% of the total primary interviews; however, questionnaires and e-mails were also used to collect the data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the embedded antenna systems market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Embedded Antenna Systems Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size¡ªusing the market size estimation processes explained above¡ªthe market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, segment, and forecast the embedded antenna systems market in terms of value based on antenna type, connectivity, and end user

- To describe and forecast the size of the market for four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide qualitative information about different embedded antenna systems devices

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed value chain for the embedded antenna systems market

- To analyze opportunities in the market for stakeholders, along with a detailed competitive landscape of the embedded antenna systems market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2, along with the competitive leadership mapping chart

- To analyze the competitive developments such as product launches/developments, contracts/collaborations/agreements/acquisitions in the embedded antenna systems market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Embedded Antenna Systems Market