Conducting Polymers Market by Type (Electrically Conductive, Thermally Conductive) application( ESD/EMI Shielding, Antistatic Packaging, Electrostatic Coating, Capacitor), and Region(APAC, Europe, North America, MEA) - Global Forecast to 2028

Updated on : August 22, 2025

Conducting Polymers Market

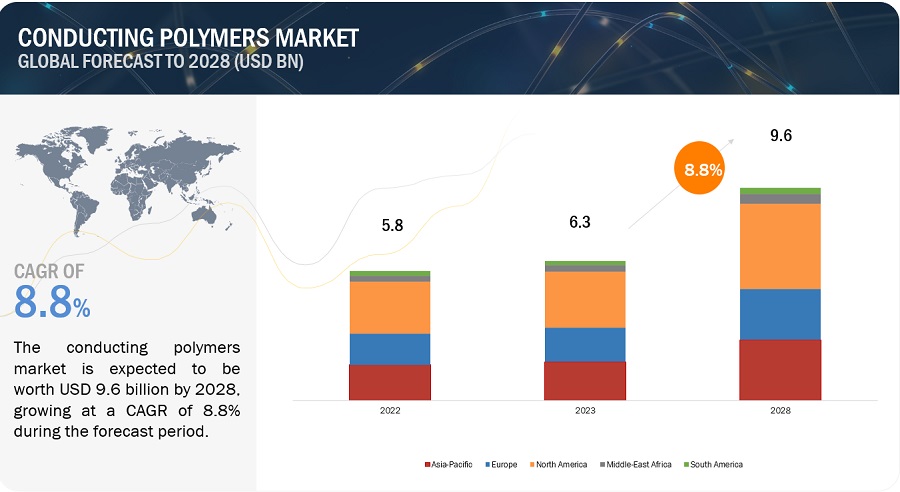

The global conducting polymers market was valued at USD 5.8 billion in 2022 and is projected to reach USD 9.6 billion by 2028, growing at a cagr 8.8% from 2023 to 2028. The market is mainly led by the significant usage of conducting polymers technology in various end-use industries. The growing demand from the electronics industry, rising demand for energy storage materials, and demand form medical industries are driving the market for conducting polymers.

Conducting Polymers Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Conducting Polymers Market

Conducting Polymers Market Dynamics

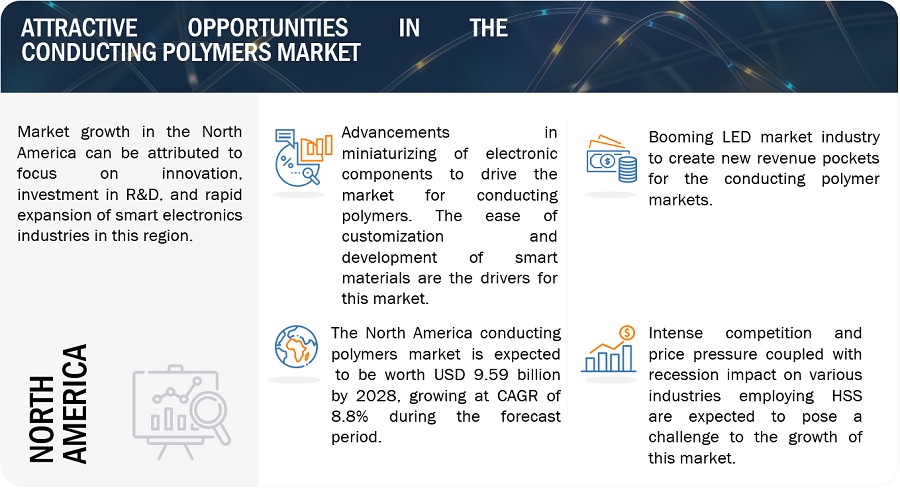

Driver: Advancements in miniaturizing of electronic components

Advancements in the miniaturization of electronic components have been a driving force in the development of conducting polymers. Conducting polymers offer unique advantages and play a significant role in enabling miniaturization in electronics. There are several advantages of miniaturization such as lower costs and higher speed. These developments need for more resourceful materials that can efficiently dissipate thermal energy in even little area of component. These products/materials must have high thermal conductivity in order to transfer heat for cooling.

Restraint: Comparitively lower thermal conductivity than traditional materials

The relatively lower conductivity of thermally conducting polymers compared to traditional materials poses a constraint on their utilization in certain applications, particularly in industries such as power plants and machinery, where high conductivity is a critical factor in addition to design considerations. The need for efficient heat transfer and dissipation in these applications requires materials with superior thermal conductivity properties. While thermally conducting polymers offer advantages in terms of design flexibility and weight reduction, their lower conductivity limits their suitability for applications where conductivity is the primary determining factor.

Opportunity: Booming LED market in developing nations

The thriving LED market provides a substantial opportunity for conducting polymers. Conducting polymers possess distinctive properties that make them well-suited for integration into LEDs, contributing to the expansion and progress of this market. LED lights are recognized as a sustainable alternative to traditional lighting systems, offering significant energy savings. The use of thermally conductive polymers in LEDs aids in enhancing their thermal performance and extends their operational lifespan.

Challenge: Electroactive Stability of Conducting Polymers can be poor

One of the major challenges confronting conducting polymers is their limited electroactive stability. Over time, these polymers can degrade or lose their ability to conduct electricity when exposed to environmental elements. Factors such as moisture, oxygen, and chemical interactions can contribute to this degradation. To overcome the challenge of poor electroactive stability, ongoing research focuses on improving the durability and stability of conducting polymers.

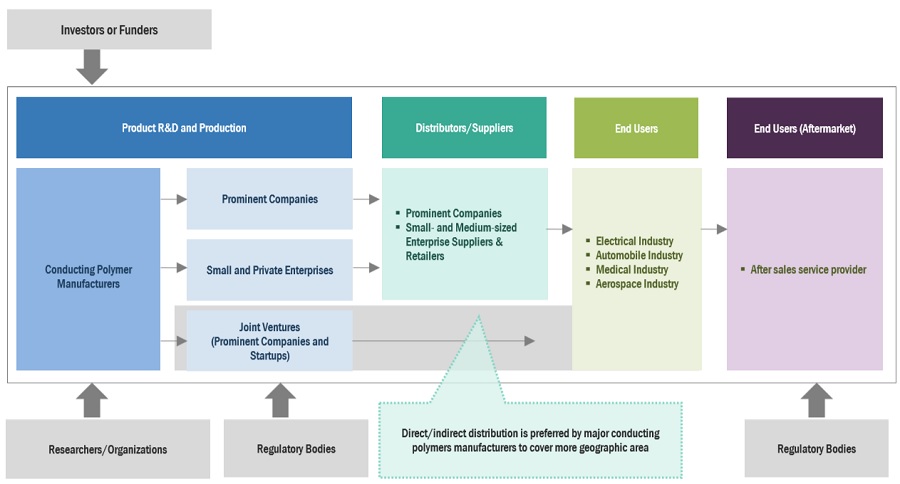

Market Ecosystem

A market ecosystem refers to the interconnected network of individuals, businesses, and other organizations participating in a particular market. It includes various stakeholders such as producers, distributors, retailers, Customers, and regulatory bodies that interact with each other to exchange goods, services, and information. Prominent companies in the market are the ones who are well-established and financially stable and have state-of-the-art technologies and a strong global marketing network and sales record. Saudi Arabia Basic Industries Corporation( Saudi Arabia), Henkel AG & Co. KGaA (Germany) , 3M (US), Agfa- Gevaert NV (Belgium), Celanese Corporation (US), Covestro AG (Germany),Heraeus Holding GMBH (Germany), Avient Corporation (US), Solvay SA (Belgium), The Lubrizol Corporation (US) are the leading manufacturers and service provider of conducting polymers.

Conducting Polymers Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Electrically Conductive Polymers is the largest type of of conducting polymers in 2023, in terms of value"

Electrically Conductive polymers accounted for the largest market share in the global conducting polymer market, in terms of value, in 2023. However, Thermally conductive is projected to grow at the highest CAGR in value during the forecast period. Electrically conducting polymers are in demand as a result of expanding markets in the building and construction, electrical & electronics, and automotive industries.

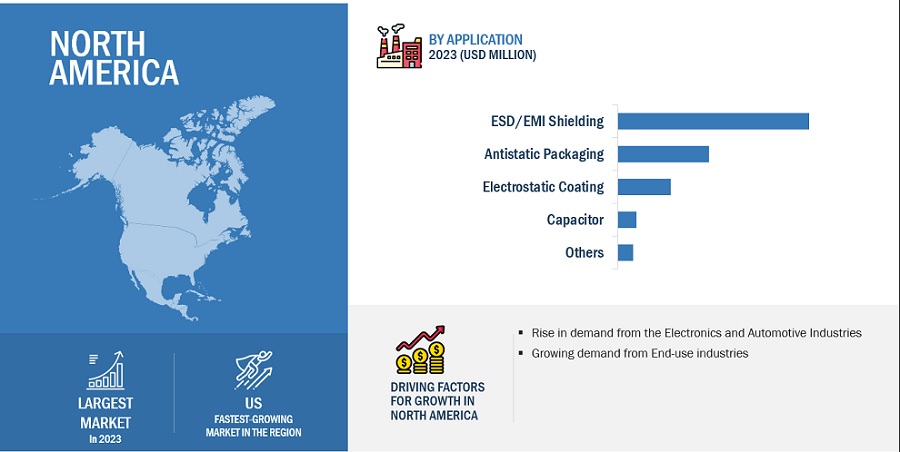

"ESD/EMI Shielding was the largest applicaton for conducting polymers market in 2023, in terms of value"

The ESD/EMI shielding, by application, accounted for the largest market share in the global conducting polymers market, in terms of value, in 2023. However, electrostatic coating is projected to grow at the highest CAGR in value during the forecast period. Electrostatic discharge is prevented by ESD/EMI shielding, and as the electronics industry continues to increase, so will demand for this applications.

"North America was the largest market for conducting polymers in 2023, in terms of value."

North America was the largest market for the global conducting polymers market, in terms of value, in 2023. US is the largest market in the North America. While , Mexico is projected to witness the highest growth during the forecast period considering the increase in demand for electronic application along with the increasing population and urbanization. The major players operating in the North America region include Celanese Corporation, 3M, Avient Corporation, among others.

To know about the assumptions considered for the study, download the pdf brochure

Conducting Polymers Market Players

The key players in this market Saudi Arabia Basic Industries Corporation( Saudi Arabia), Henkel AG & Co. KGaA (Germany) , 3M (US), Agfa- Gevaert NV (Belgium), Celanese Corporation (US), Covestro AG (Germany),Heraeus Holding GMBH (Germany), Avient Corporation (US), Solvay SA (Belgium), The Lubrizol Corporation (US). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of conducting polymers have opted for new product launches to sustain their market position.

Conducting Polymers Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 5.8 billion |

|

Revenue Forecast in 2028 |

USD 9.6 billion |

|

CAGR |

8.8% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Saudi Arabia Basic Industries Corporation( Saudi Arabia), Henkel AG & Co. KGaA (Germany) , 3M (US), Agfa- Gevaert NV (Belgium), Celanese Corporation (US), Covestro AG (Germany),Heraeus Holding GMBH (Germany), Avient Corporation (US), Solvay SA (Belgium), The Lubrizol Corporation (US). |

This report categorizes the global conducting polymers market based on type, application and region.

On the basis of type, the conducting polymers market has been segmented as follows:

- Electrically Conductive

- Thermally Conductive

On the basis of application, the conducting polymers market has been segmented as follows:

- ESD/EMI Shielding

- Antistatic Packaging

- Electrostatic Coating

- Capacitor

- Others.

On the basis of region, the conducting polymers market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- Central & South America

Recent Developments

- In 2022 Celanese Corporation acquired significant portion of DuPont’s Mobility and Materials business to expand its product portfolio.

- In 2023 Henkel AG&Co KgaA announced its partnership with Imakr to provide industrial customers in UK and Ireland with its companys Loctite 3D printing product portfolio.

- In January 2020, Heraeus Holding GMBH announced its partnership with Myant Inc to jointly develop a solution utilizing the company’s Tecticoat coating for electrical sensing applications in textiles.

- In September 2022, Saudi Arabia Basic Industries Corporation partnered with Conventus Polymers, it assigned it as a authorized distributor of its high performance engineering thermoplastics in North America.

- In March 2022, Slovay SA announced its partnership with Mitsubishi Chemicals Advanced Materials and collaborated on a sustainable initiative in regards to Solvays Udel high performance polysulfone thermoplastics.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the conducting polymers market?

This study's forecast period for the conducting polymers market is 2023-2028. The market is expected to grow at a CAGR of 8.8%, in terms of value, during the forecast period.

Who are the major key players in the conducting polymers market?

3. What are the major regulations of the conducting polymers market in various countries?

What are the major regulations of the conducting polymers market in various countries?

Regulatory bodies like Environmental Protection Agency regulates the use and disposal of chemicals, including conducting polymers, to protect human health and the environment. The International Electrotechnical Commission (IEC) develops international standards for electrical and electronic devices, including conducting polymer-based components.

What are the drivers and opportunities for the conducting polymers market?

The demand from the booming LED markets in developing countries along with advancements in minituarization of electronic components.

Which are the key technology trends prevailing in the conducting polymers market?

Conducting polymers find applications in smart packaging and IoT devices, where they enable functionalities such as sensing, wireless communication, and energy harvesting. The integration of conducting polymers with additive manufacturing techniques, such as 3D printing, opens up new possibilities for complex geometries and customized electronic devices. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advancements in miniaturization of electronic components- Ease of customization and design flexibility- Development of smart structuresRESTRAINTS- Lower thermal conductivity than traditional materialsOPPORTUNITIES- Booming LED market in emerging nationsCHALLENGES- Electroactive stability can be poor

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSCONDUCTING POLYMER MANUFACTURERSDISTRIBUTORSCOMPONENT MANUFACTURERSEND-USE INDUSTRIES

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 MACROECONOMIC OVERVIEW AND KEY TRENDSTRENDS AND FORECASTS OF GDP

-

6.5 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPE- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTSLIST OF MAJOR PATENTS

- 7.1 INTRODUCTION

-

7.2 ELECTRICALLY CONDUCTING POLYMERSELECTRONICALLY CONDUCTING POLYMERSIONICALLY CONDUCTING POLYMERS

- 7.3 THERMALLY CONDUCTING POLYMERS

-

7.4 CLASSIFICATION OF CONDUCTING POLYMERSPOLYAMIDEPOLYCARBONATEPOLY (3,4-ETHYLENEDIOXYTHIOPHENE)POLYPYRROLEPOLYBUTYLENE TEREPHTHALATEPOLYANILINEPOLYACETYLENEOTHER TYPES

- 8.1 INTRODUCTION

-

8.2 ESD/EMI SHIELDINGNEED TO SAFEGUARD SENSITIVE ELECTRONICS WITH ESD/EMI SHIELDING SOLUTIONS TO DRIVE MARKET

-

8.3 ANTISTATIC PACKAGINGANTISTATIC PACKAGING SOLUTIONS FOR SAFE STORAGE TO FUEL MARKET

-

8.4 ELECTROSTATIC COATINGSELECTROSTATIC COATING FOR EFFICIENT CORROSION PROTECTION TO DRIVE DEMAND

-

8.5 CAPACITORSGOOD STABILITY AND RELIABILITY IN ELECTRONIC SYSTEMS TO DRIVE MARKET

- 8.6 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- US to remain dominant market in North AmericaCANADA- Advancements in different industries to drive marketMEXICO- Growth in automobile manufacturing to boost market in Mexico

-

9.3 EUROPEGERMANY- Germany to be largest consumer of epoxy resin in EuropeITALY- Demand for thermally conducting polymers in various different industrial applications to drive marketFRANCE- Demand from healthcare and electronics sectors to fuel market growthUK- Packaging industry to boost demand for conducting polymersNETHERLANDS- Development of sustainable materials in conducting polymers market to drive demandSPAIN- Growing construction activity to be major driver of conducting polymers marketRUSSIA- Automotive to be major consumer of conducting polymersREST OF EUROPE

-

9.4 ASIA PACIFICJAPAN- Electronics industry to be major end user of conducting polymersCHINA- Significant industrialization to maintain dominance in Asia PacificINDIA- High population growth and rise in demand for electronics to drive marketSOUTH KOREA- Large automotive industry to fuel demand for conducting polymersTAIWAN- Medical and construction sectors to be significant consumers of conducting polymersINDONESIA- Electrical & electronics industry to be largest end userAUSTRALIA- Strong healthcare system to create opportunities for conducting polymers market in medical applicationsREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICASAUDI ARABIA- Technological advancements to drive conducting polymers marketUAE- High demand in construction industry to fuel market growthIRAN- Growth in automobile sector to drive conducting polymers marketSOUTH AFRICA- High demand for electrically conducting polymers to drive overall marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Increase in demand for electronics due to growing population to fuel marketARGENTINA- ESD/EMI shielding to be largest application of conducting polymersREST OF SOUTH AMERICA

-

10.1 INTRODUCTIONSTRATEGIES ADOPTED BY KEY PLAYERS IN CONDUCTING POLYMERS MARKET

-

10.2 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERSMARKET SHARE OF KEY PLAYERS- Saudi Arabia Basic Industries Corporation- Henkel AG & Co. KGaA- 3M- Heraeus Holding GMBH- Solvay SA

- 10.3 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.5 COMPETITIVE BENCHMARKING

-

10.6 STARTUPS/SMES EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERS3M- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGFA-GEVAERT NV- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCELANESE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOVESTRO AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENKEL AG & CO KGAA- Business overview- Products /Solutions/Services offered- Recent developments- MnM viewHERAEUS HOLDING GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVIENT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAUDI ARABIA BASIC INDUSTRIES CORPORATION(SABIC)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLVAY SA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE LUBRIZOL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

11.2 OTHER PLAYERSARKEMACABOT CORPORATIONEASTMAN CHEMICAL COMPANYELECTRIPLAST CORPORATIONENSINGERFERRO CORPORATIONKEMET CORPORATIONLATI INDUSTRIA TERMOPLASTICI S.P.A.BEKAERTPREMIX GROUPDSMRTP COMPANYSIGMA-ALDRICHSIMONA AGTECHMER PM

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 THERMAL CONDUCTIVITY OF VARIOUS MATERIALS

- TABLE 2 PORTER’S FIVE FORCES IMPACT ON CONDUCTING POLYMERS MARKET

- TABLE 4 GRANTED PATENTS ACCOUNT FOR 37.6% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 5 LIST OF MAJOR PATENTS FOR CONDUCTING POLYMERS

- TABLE 6 MAJOR PATENTS FOR CONDUCTING POLYMERS

- TABLE 7 CONDUCTING POLYMERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 8 CONDUCTING POLYMER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 9 CONDUCTING POLYMERS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 10 CONDUCTING POLYMER MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 11 CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 12 CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 13 CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 14 CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 15 CONDUCTING POLYMERS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 16 CONDUCTING POLYMER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 CONDUCTING POLYMERS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 18 CONDUCTING POLYMER MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 19 NORTH AMERICA: CONDUCTING POLYMERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 20 NORTH AMERICA: CONDUCTING POLYMER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 22 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 23 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 26 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 27 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 28 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 30 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 31 US: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 US: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 US: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 34 US: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 35 CANADA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 36 CANADA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 CANADA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 38 CANADA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 39 MEXICO: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 40 MEXICO: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 MEXICO: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 42 MEXICO: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 43 EUROPE: CONDUCTING POLYMERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 EUROPE: CONDUCTING POLYMER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 EUROPE: MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 46 EUROPE: MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 47 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 48 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 EUROPE: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 50 EUROPE: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 51 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 54 EUROPE: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 55 GERMANY: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 56 GERMANY: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 GERMANY: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 58 GERMANY: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 59 ITALY: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 ITALY: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 ITALY: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 62 ITALY: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 63 FRANCE: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 64 FRANCE: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 65 FRANCE: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 66 FRANCE: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 67 UK: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 68 UK: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 UK: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 70 UK: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 71 NETHERLANDS: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 72 NETHERLANDS: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 73 NETHERLANDS: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 74 NETHERLANDS: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 75 SPAIN: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 76 SPAIN: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 SPAIN: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 78 SPAIN: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 79 RUSSIA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 80 RUSSIA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 RUSSIA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 82 RUSSIA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 83 REST OF EUROPE: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 84 REST OF EUROPE: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 86 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 87 ASIA PACIFIC: CONDUCTING POLYMERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CONDUCTING POLYMER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 90 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 91 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 94 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 99 JAPAN: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 JAPAN: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 JAPAN: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 102 JAPAN: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 103 CHINA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 CHINA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 CHINA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 106 CHINA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 107 INDIA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 INDIA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 INDIA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 110 INDIA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 111 SOUTH KOREA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 114 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 115 TAIWAN: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 116 TAIWAN: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 TAIWAN: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 118 TAIWAN: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 119 INDONESIA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 120 INDONESIA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 INDONESIA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 122 INDONESIA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 123 AUSTRALIA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 124 AUSTRALIA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 AUSTRALIA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 126 AUSTRALIA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 127 REST OF ASIA PACIFIC: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 130 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: CONDUCTING POLYMERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: CONDUCTING POLYMER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 143 SAUDI ARABIA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 144 SAUDI ARABIA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 SAUDI ARABIA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 146 SAUDI ARABIA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 147 UAE: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 148 UAE: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 UAE: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 150 UAE: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 151 IRAN: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 152 IRAN: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 IRAN: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 154 IRAN: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 155 SOUTH AFRICA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 SOUTH AFRICA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 SOUTH AFRICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 158 SOUTH AFRICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 161 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 162 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 163 SOUTH AMERICA: CONDUCTING POLYMERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 164 SOUTH AMERICA: CONDUCTING POLYMER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 166 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 167 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 168 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 170 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 171 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 172 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 173 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 174 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 175 BRAZIL: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 176 BRAZIL: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 177 BRAZIL: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 178 BRAZIL: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 179 ARGENTINA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 180 ARGENTINA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 181 ARGENTINA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 182 ARGENTINA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 183 REST OF SOUTH AMERICA: CONDUCTING POLYMERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 184 REST OF SOUTH AMERICA: CONDUCTING POLYMER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 185 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 186 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 187 CONDUCTING POLYMERS MARKET: DEGREE OF COMPETITION

- TABLE 188 CONDUCTING POLYMER MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 189 CONDUCTING POLYMERS MARKET: COMPANY TYPE FOOTPRINT

- TABLE 190 CONDUCTING POLYMER MARKET: COMPANY REGION FOOTPRINT

- TABLE 191 CONDUCTING POLYMERS MARKET: KEY STARTUPS/SMES

- TABLE 192 CONDUCTING POLYMER MARKET: SMES APPLICATION FOOTPRINT

- TABLE 193 CONDUCTING POLYMERS MARKET: SMES TYPE FOOTPRINT

- TABLE 194 CONDUCTING POLYMER MARKET: SMES REGION FOOTPRINT

- TABLE 195 CONDUCTING POLYMERS MARKET: PRODUCT LAUNCHES (2019–2023)

- TABLE 196 CONDUCTING POLYMER MARKET: DEALS (2019–2023)

- TABLE 197 CONDUCTING POLYMERS: OTHER DEVELOPMENTS (2019–2023)

- TABLE 198 3M: COMPANY OVERVIEW

- TABLE 199 3M: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 200 3M: PRODUCT LAUNCHES

- TABLE 201 AGFA-GEVAERT NV: COMPANY OVERVIEW

- TABLE 202 AGFA-GEVAERT NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 AGFA-GEVAERT: DEALS

- TABLE 204 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 205 CELANESE CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 CELANESE CORPORATION: DEALS

- TABLE 207 CELANESE CORPORATION: OTHERS

- TABLE 208 COVESTRO AG: COMPANY OVERVIEW

- TABLE 209 COVESTRO AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 COVESTRO AG: DEALS

- TABLE 211 COVESTRO AG: OTHERS

- TABLE 212 HENKEL AG & CO KGAA: COMPANY OVERVIEW

- TABLE 213 HENKEL AG & CO KGAA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 214 HENKEL AG & CO KGAA: PRODUCT LAUNCHES

- TABLE 215 HENKEL AG & CO KGAA: DEALS

- TABLE 216 HENKEL AG & CO KGAA: OTHERS

- TABLE 217 HERAEUS HOLDING GMBH: COMPANY OVERVIEW

- TABLE 218 HERAEUS HOLDING GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 219 HERAEUS HOLDING GMBH: DEALS

- TABLE 220 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 221 AVIENT CORPORATION: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 222 AVIENT CORPORATION: OTHERS

- TABLE 223 SAUDI ARABIA BASIC INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 224 SAUDI ARABIA BASIC INDUSTRIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 225 SAUDI ARABIA BASIC INDUSTRIES CORPORATION: PRODUCT LAUNCHES

- TABLE 226 SAUDI ARABIA BASIC INDUSTRIES CORPORATION: DEALS

- TABLE 227 SOLVAY SA: COMPANY OVERVIEW

- TABLE 228 SOLVAY SA: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 229 SOLVAY SA: PRODUCT LAUNCHES

- TABLE 230 SOLVAY SA: DEALS

- TABLE 231 SOLVAY SA: OTHERS

- TABLE 232 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 233 THE LUBRIZOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 THE LUBRIZOL CORPORATION: DEALS

- TABLE 235 ARKEMA: COMPANY OVERVIEW

- TABLE 236 CABOT CORPORATION: COMPANY OVERVIEW

- TABLE 237 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 238 ELECTRIPLAST CORPORATION: COMPANY OVERVIEW

- TABLE 239 ENSINGER: COMPANY OVERVIEW

- TABLE 240 FERRO CORPORATION: COMPANY OVERVIEW

- TABLE 241 KEMET CORPORATION: COMPANY OVERVIEW

- TABLE 242 LATI INDUSTRIA TERMOPLASTICI S.P.A: COMPANY OVERVIEW

- TABLE 243 BEKAERT: COMPANY OVERVIEW

- TABLE 244 PREMIX GROUP: COMPANY OVERVIEW

- TABLE 245 DSM: COMPANY OVERVIEW

- TABLE 246 RTP COMPANY: COMPANY OVERVIEW

- TABLE 247 SIGMA-ALDRICH: COMPANY OVERVIEW

- TABLE 248 SIMONA AG: COMPANY OVERVIEW

- TABLE 249 TECHMER PM: COMPANY OVERVIEW

- FIGURE 1 CONDUCTING POLYMERS MARKET SEGMENTATION

- FIGURE 2 CONDUCTING POLYMERS MARKET: RESEARCH DESIGN

- FIGURE 3 CONDUCTING POLYMERS MARKET: DATA TRIANGULATION

- FIGURE 4 ELECTRICALLY CONDUCTING POLYMERS TO DOMINATE OVERALL MARKET BETWEEN 2023 AND 2028

- FIGURE 5 ESD/EMI SHIELDING APPLICATION TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 6 NORTH AMERICA ACCOUNTS FOR LARGEST SHARE OF CONDUCTING POLYMERS MARKET

- FIGURE 7 INCREASING DEMAND FOR MINIATURIZATION OF ELECTRONIC COMPONENTS TO DRIVE MARKET

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN CONDUCTING POLYMERS MARKET

- FIGURE 9 THERMALLY CONDUCTING POLYMERS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 10 ELECTROSTATIC COATING TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONDUCTING POLYMERS MARKET

- FIGURE 12 VALUE CHAIN ANALYSIS

- FIGURE 13 CONDUCTING POLYMERS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 14 NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS

- FIGURE 15 REGIONAL ANALYSIS OF PATENT GRANTED FOR CONDUCTING POLYMERS MARKET, 2023

- FIGURE 16 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST TEN YEARS

- FIGURE 17 ELECTRICALLY CONDUCTING POLYMERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 ESD/EMI SHIELDING APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA: CONDUCTING POLYMERS MARKET SNAPSHOT

- FIGURE 20 EUROPE: CONDUCTING POLYMERS MARKET SNAPSHOT

- FIGURE 21 ASIA PACIFIC: CONDUCTING POLYMERS MARKET SNAPSHOT

- FIGURE 22 MIDDLE EAST & AFRICA: CONDUCTING POLYMERS MARKET SNAPSHOT

- FIGURE 23 SOUTH AMERICA: CONDUCTING POLYMERS MARKET SNAPSHOT

- FIGURE 24 RANKING OF TOP FIVE PLAYERS IN CONDUCTING POLYMERS MARKET, 2022

- FIGURE 25 CONDUCTING POLYMERS MARKET: SHARE OF KEY PLAYERS

- FIGURE 26 CONDUCTING POLYMERS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 27 CONDUCTING POLYMERS MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 28 3M: COMPANY SNAPSHOT

- FIGURE 29 AGFA-GEVAERT NV: COMPANY SNAPSHOT

- FIGURE 30 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 31 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 32 HENKEL AG & CO KGAA: COMPANY SNAPSHOT

- FIGURE 33 HERAEUS HOLDING GMBH: COMPANY SNAPSHOT

- FIGURE 34 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 35 SAUDI ARABIA BASIC INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 36 SOLVAY SA: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the conducting polymers market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The conducting polymer market comprises several stakeholders in the value chain, which include raw material suppliers, component manufacturers, distribution and end-users. Various primary sources from the supply and demand sides of the conducting polymers market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the conducting polymers industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of conducting polymer and the future outlook of their business, which will affect the overall market.

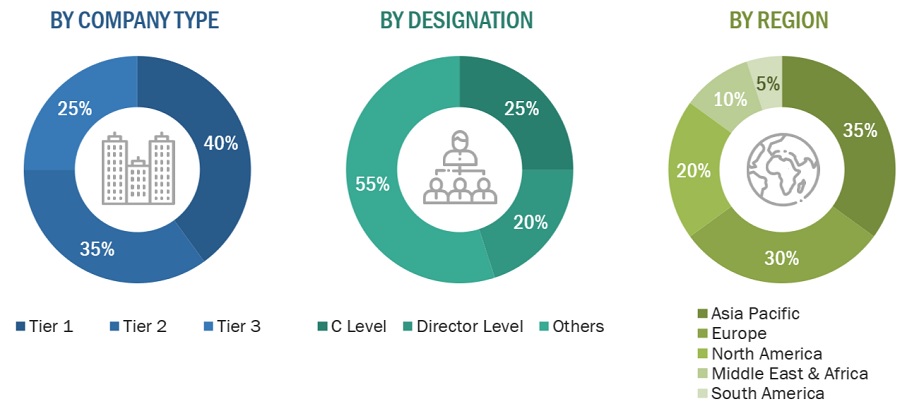

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

3M |

Individual Industry Expert |

|

Agfa-Gevaert NV |

Sales Manager |

|

Celanese Corporation |

Director |

|

Covestro AG |

Marketing Manager |

|

Henkel AG & Co KGaA |

R&D Manager |

Market Size Estimation

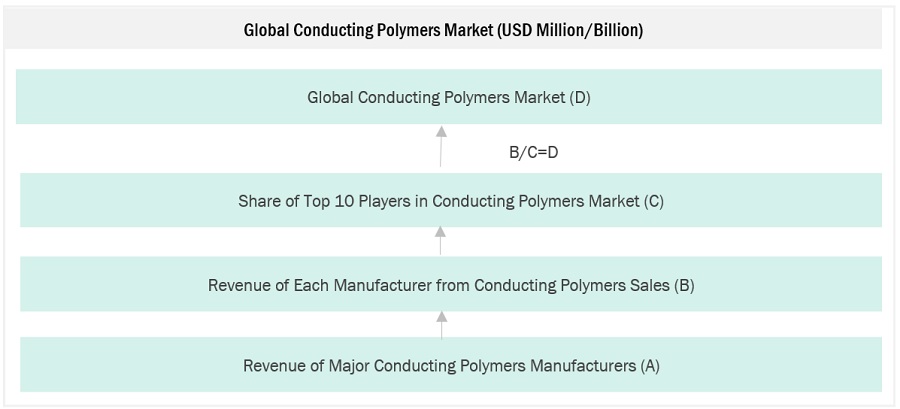

The top-down and bottom-up approaches have been used to estimate and validate the size of the conducting polymers market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Conducting Polymers Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Conducting Polymers Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Conducting polymers possess an extended pi-conjugated system, characterized by the overlap of singly occupied p-orbitals along the polymer chain. This unique molecular structure gives rise to a range of properties such as electrical conductivity, optical behavior, electronic, magnetic , microwave absorption, wetting characteristics, and mechanical properties. The conductivity of conducting polymers is influenced by factors such as the length of conjugation, arrangement of polymer chains, level of doping, and purity of the sample. Conducting polymers possess a distinct characteristic wherein the main chain of the polymer exhibits a conjugated molecular structure. This molecular arrangement enables the polymers to acquire conducting properties upon doping.

Key Stakeholders

- Conducting polymer manufacturers

- Conducting polymer suppliers

- Raw material suppliers

- Service providers

- Government bodies

- Conducting polymer distributors

Report Objectives

- To define, describe, and forecast the size of the conducting polymers market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, application and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and Central & South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Conducting Polymers Market