The study involved four major activities for estimating the current size of the global emulsifiers market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of emulsifiers through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the emulsifiers market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the emulsifiers market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The emulsifiers market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the emulsifiers market. Primary sources from the supply side include associations and institutions involved in the emulsifiers market, key opinion leaders, and processing players.

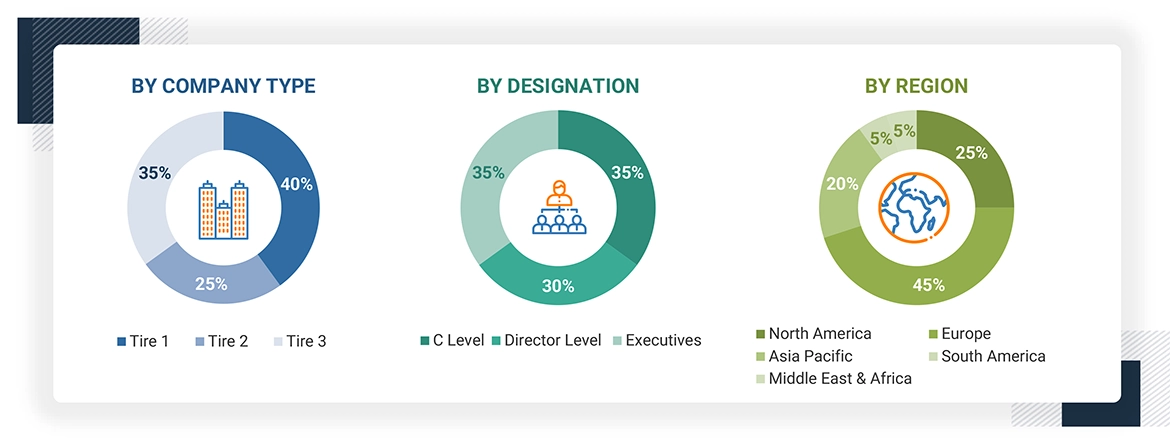

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the emulsifiers market by source, product type, application, and region. The research methodology used to calculate the market size includes the following steps:

-

The key players in the industry and markets were identified through extensive secondary research.

-

In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the emulsifiers market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Emulsifiers are chemical or natural agents that can help stabilize and maintain a mixture of two or more immiscible liquids, such as oil and water, by reducing the surface tension at their interface. It enables the stable formation of an emulsion, and the liquid droplets would not separate from each other over time. Emulsifiers contain hydrophilic and lipophilic elements; hence they can attach to both phases in a mixture. Emulsifiers are commonly used in various industries, such as the food and beverages, cosmetics, pharmaceuticals, and industrial products industries. They improve formulations in terms of texture, consistency, and shelf life. Examples include lecithin, mono- and diglycerides, polysorbates, and other natural options such as gums and starches. It is a critical ingredient within many applications because of its versatility and importance in achieving product stability.

Stakeholders

-

Emulsifier Manufacturers

-

Raw Material Suppliers

-

Regulatory Bodies and Government Agencies

-

Distributors and Suppliers

-

End-Use Industries

-

Associations and Industrial Bodies

-

Market Research and Consulting Firms

Report Objectives

-

To define, describe, and forecast the size of the emulsifiers market in terms of value and volume.

-

To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

-

To forecast the market size based on source, product type, application, and region.

-

To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA),—along with their key countries.

-

To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

-

To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the emulsifiers market.

-

To strategically profile key players and comprehensively analyze their market shares and core competencies.

-

To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Growth opportunities and latent adjacency in Emulsifiers Market