Epoxy Adhesives Market by Type (One-component, Two-component), End-Use Industry (Building and Construction, Transportation, Marine, Automotive, Wind Energy, Electrical and Electronics), and Region - Global Forecast to 2027

Updated on : April 15, 2024

Epoxy Adhesives Market

The global epoxy adhesives market size was valued at USD 9.2 billion in 2022 and is projected to reach USD 11.7 billion by 2027, growing at a cagr 5.0% from 2022 to 2027. Two-component epoxy adhesives, by type segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for the market.

Attractive Opportunities in the Epoxy Adhesives Market

Note: e – estimated, p - projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Epoxy Adhesives Market Dynamics

Drivers: Growing demand for lightweight and low carbon-emitting vehicles

The automotive industry is one of the major end users of epoxy adhesives. Adhesives play an important role in enhancing the aesthetics and performance of automobiles. Weight reduction of vehicles is the key to improving fuel efficiency and limiting emission of pollutants. Historically, adhesives were used for laminating, bonding, and assembling automotive interior components. Modern-day adhesives are playing a decisive role in supporting original equipment manufacturers in automobile weight reduction strategies and complying with stringent environmental regulations by keeping carbon emissions at the minimum. This has presented a new growth opportunity for adhesives manufacturers.

Restraints: Stringent environmental regulations in North American and European countries

Europe and North America are strictly regulated by environmental laws regarding the production of chemical and petro-based products. Agencies such as the Epoxy Resin Committee (ERC) and the European Commission (EC) govern the manufacturing of solvent-based products in these regions. This is affecting the production capacities of manufacturers in Europe and North America. The stringent environmental regulations are compelling manufacturers to focus on producing eco-friendly adhesives.

Opportunities: Increasing demand for non-hazardous, green, and sustainable adhesives

Owing to the rising demand for eco-friendly or green products in various applications, the demand for green adhesives or those with low VOC is increasing. Stringent regulations by the USEPA (United States Environmental Protection Association), Europe’s REACH (Registration, Evaluation, Authorization, and Restrictions of Chemicals), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have forced manufacturers to make eco-friendly adhesives with low VOC levels. In light of this regulatory policies, there is a growing trend in the global epoxy adhesives market for environment-friendly or green buildings, which provides an opportunity for the development of green and sustainable adhesive solutions. Such green adhesive solutions are made from renewable, recycled, remanufactured, or biodegradable materials which are health- and environment-friendly.

Challenges: Limited opportunities in developed countries

Developed countries such as the US, Germany, the UK, Japan, and other Western European countries have well-established infrastructure for public, commercial, and transport sectors. The developed infrastructure in these countries signifies low prospects for new construction activities as civil structures are built to last a lifetime. Hence, there is lesser scope for high demand of epoxy adhesives as renovations and maintenance can only be expected from the developed nations in the short term. Manufacturers need to come up with innovative products to capture newer markets such as medical, agriculture, and healthcare. Hence, sustaining and expanding business is a major challenge for manufacturers in the matured markets.

Two-component epoxy adhesives accounted for the largest segment of epoxy adhesives market

Two-component is the largest segment of epoxy adhesives. It start to react under ambient conditions once these adhesives are mixed together. These are often termed room-temperature (RT) curing adhesives. Complete cure times at ambient temperatures for two-component systems range from approximately 10 minutes to several days. While, the one-component epoxy adhesives are more efficient and easier to control than the two-component epoxy adhesives. This is because the curing time for one-component epoxy adhesives is very less compared to that of two-component epoxy adhesives.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is the fastest-growing epoxy adhesives market.

Asia Pacific remains the highest growing region, with key large adhesive producers establishing their manufacturing bases here. The production of manufactured goods is increasing to meet the increasing demand driven by improving living standards, especially in the consumer product and disposable markets, which use large volumes of commodity adhesives. Many new production facilities— export-oriented and for domestic markets—use the latest manufacturing processes designed for using adhesives instead of the older mechanical fastening equipment that manufacturers first used in developed regions.

Epoxy Adhesives Market Players

Henkel AG & Co. KGaA (Germany), Sika Group (Switzerland), 3M (US), H.B. Fuller Company (US), DuPont (US) are the key players in the global epoxy adhesives market.

Henkel AG & Co. KGaA operates with a well-balanced and diversified portfolio globally. It manufactures and distributes and adhesive products, cosmetics, homecare, and laundry. The company operates through four main business segments: Adhesive Technologies, Laundry & Home Care, Beauty Care, and Corporate. Epoxy adhesives are produced under the adhesive technologies segment. Adhesive technologies cater to the needs of different business areas such as packaging & consumer goods, construction & professional, electronics & industrial, and craftsmen businesses.

Epoxy Adhesives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 9.2 billion |

|

Revenue Forecast in 2027 |

USD 11.7 billion |

|

CAGR |

5.0% |

|

Years Considered for the study |

2018-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Henkel AG & Co. KGaA (Germany), Sika Group (Switzerland), 3M (US), H.B. Fuller Company (US), and DuPont (US). A total of 22 players have been covered. |

This research report categorizes the epoxy adhesives market based on Type, End-use Industry, and Region.

Epoxy Adhesives Market by Type:

- One-component

- Two-component

- Others

Epoxy Adhesives Market by End-use Industry:

- Building & Construction

- Transportation

- Marine

- Automotive

- Wind Energy

- Electrical & Electronics

- Others

Epoxy Adhesives Market by Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In July 2018, Henkel AG & Co. KGaA has acquired Aislantes Nacionales S.A., a private company manufacturing and marketing of products used in building materials. This acquisition will strengthen the product portfolio by adding attractive Chilean building materials market. It will also strengthen the position in Latin America.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of epoxy adhesives?

The global epoxy adhesives market is driven by growing demand for lightweight and low carbon-emitting vehicles.

What are the major applications for epoxy adhesives?

The major end-use industries of epoxy adhesives are one-component, and two-component adhesives.

Who are the major manufacturers?

Henkel AG & Co. KGaA (Germany), Sika Group (Switzerland), 3M (US), H.B. Fuller Company (US), DuPont (US) are some of the leading players operating in the global epoxy adhesives market.

Why epoxy adhesives are gaining market share?

The growth of this market is attributed to the growing demand for lightweight and low-carbon emitting vehicles. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Adhesives Market Overview

The Adhesives Market refers to the industry that produces a wide range of adhesive materials used in various applications such as construction, automotive, packaging, and electronics. Adhesives are used to bond two or more substrates together, and the market includes various types of adhesives such as epoxy, acrylic, silicone, and polyurethane.

Epoxy adhesives are a type of adhesive that are commonly used in the construction industry, as well as in the production of consumer goods such as electronics and automotive parts. They are known for their high strength and durability, and are used in applications where a strong bond is required.

The overall growth of the Adhesives Market is expected to have a positive impact on the growth of the Epoxy Adhesives Market, as epoxy adhesives are a popular type of adhesive used in various industries. As the demand for adhesives increases, the demand for epoxy adhesives is also expected to increase.

Futuristic Growth Use-Cases

Some of the futuristic growth use-cases for Adhesives Market include the development of new, high-performance adhesives for use in aerospace and defense applications, as well as the development of eco-friendly adhesives that are sustainable and do not harm the environment.

Top Companies in Adhesives Market

The top players in the Adhesives Market include 3M Company, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, and Bostik SA.

Impact on Different Industries

The Adhesives Market has a significant impact on various industries, including construction, automotive, packaging, and electronics. For example, adhesives are used in the construction industry for bonding materials such as wood, metal, and concrete, and in the automotive industry for bonding parts such as bumpers and windshields. In the packaging industry, adhesives are used for sealing and bonding packaging materials such as boxes and containers. The electronics industry also relies on adhesives for bonding and sealing various electronic components.

Speak to our Analyst today to know more about Adhesives Market!

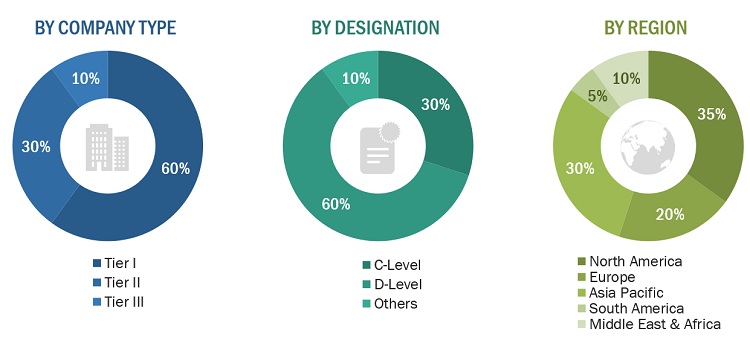

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global epoxy adhesives market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; databases such as D&B, Bloomberg, Chemical Weekly, and Factiva; white papers and articles from recognized authors; and publications and databases from associations such as the Association of European Adhesives and Sealants (FEICA), British Adhesives and Sealants Association (BASA), Adhesives and Sealants Manufacturers Association of Canada, Japan Adhesive Industry Association (JAIA), the Adhesive And Sealant Council (ASC), China Adhesives and Tape Industry Association (CATIA), and other government and private sources to identify and collect information useful for this technical, market-oriented, and commercial study of the epoxy adhesives market.

Primary Research

In the primary research process, experts from the supply and demand sides were interviewed to obtain qualitative and quantitative information and validate the data for this report. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the epoxy adhesives market.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

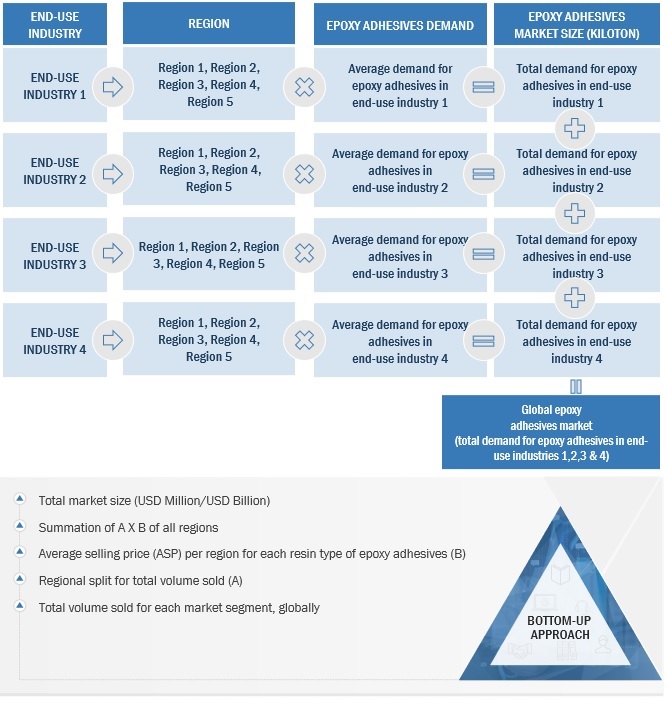

Market Size Estimation

In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to gather, verify, and validate the market figures arrived at. Extensive qualitative and quantitative analysis were performed on the complete market engineering process to provide key information/insights throughout the report. The research methodology used to estimate the market size includes the following steps:

- The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. These data were consolidated and added with detailed inputs and analysis and presented in this report.

Global Epoxy Adhesives Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define and analyze the epoxy adhesives market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, and end-use industry

- To forecast the size of the market with respect to five regions, namely, the Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze the competitive developments such as new product launches, investments and expansions, and mergers & acquisitions in the market

- To profile the key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the subsegments of the global epoxy adhesives market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the epoxy adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Epoxy Adhesives Market

Detailed information on epoxy adhesives for substrates in camera module and automobile sensors

Specific information on epoxy adhesives market in India

Interested in Epoxy Adhesives market; Split of one-component and two-component

Interested in Epoxy Adhesives market; Split of one-component and two-component