Face Shield Market by Type (Disposable and Reusable), Tier (Premium, Medium, and Value), End-Use (Healthcare, Manufacturing, Oil & Gas, Construction, Transportation), Region - Global Forecast to 2025

Updated on : March 21, 2024

Face Shield Market

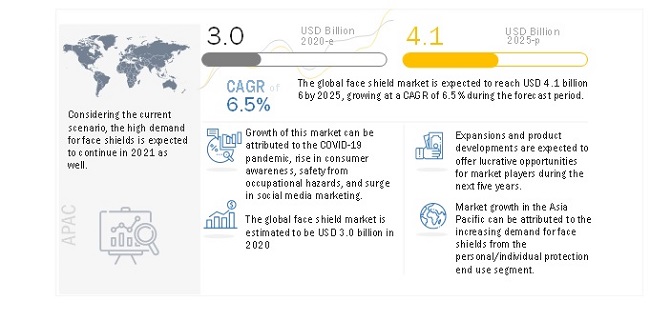

The global face shield market was valued at USD 3.0 billion in 2020 and is projected to reach USD 4.1 billion by 2025, growing at 6.5% cagr from 2020 to 2025. The market is mainly driven by factors such as awareness due to the outbreak of COVID-19 pandemic, stringent regulations pertaining to safety of personnel, and raising awareness about industrial occupational hazards is driving the face shield market. Growing demand for face shield in different end-use industries has created various opportunities for the manufacturers. APAC is the key market for face shield, globally, followed by Europe and North America.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Face Shield Market

The COVID-19 pandemic has positively impacted the global face shields market. This is majorly because of the increasing demand for face shields, as they prevent or slow down the transmission of life-threatening COVID-19 infections. Face shields are being employed as a public and personal health control measure against the spread of SARS-CoV-2. Their use is intended as personal protection against infection and as source control to limit the transmission of the virus in a community or healthcare setting.

Face Shield Market Dynamics

Driver: Increased awareness due to outbreak of COVID-19

As the number of COVID-19 cases is increasing, it is becoming very important for healthcare professionals and other public workers to be safe in order to save more lives. Face shields, along with other PPEs were recommended for use by public healthcare bodies. Due to disruptions in the global supply of PPEs for health workers worldwide, the World Health Organization recommended industries and governments to increase manufacturing by 40% to meet the global need. The face shield increases the lifespan of the face mask. Simulation studies with the use of the face shield have shown a 96% decrease in contamination of a person when droplets come at them from a distance of 18 inches. The face shield also prevents the person from continuously touching his/her face, facilitates facial non-verbal communication between healthcare workers and increases the life of the mask.

Restraints: Volatility in Raw Material Prices

Oil and metal are the main raw materials required for the manufacture of the visors and headgear needed for face shields. Polycarbonate (PC), acetate, and polyethylene terephthalate glycol (PETG) are polymers derived from oil are used in the manufacture of face shields. Hence, the face shield industry is indirectly dependent on the prices of crude oil. As oil is a commodity, it tends to see larger fluctuations in prices.

Opportunities: Growing healthcare industry in emerging economies

Emerging economies such as India, Brazil, China, and South Africa provide significant opportunities for players in the face shield market. According to the IMF, in 2016, these emerging economies accounted for more than 60% of the global GDP. The need for improved healthcare services in these economies is majorly driven by the rapidly increasing aging population, high numbers of patients, growing per capita income, and rising awareness.

Premium tier face shields accounted for the largest share of the overall market in 2019.

Premium face shields have crystal clear visors that offer clear vision. They offer added advantages such as anti-fogging, anti-dust, anti-splash, and clear visibility. These face shields are produced from superior quality materials that are easy to wear and adjustable. These can also be used with face masks and protective goggles, and regular glasses. These face shields also have lens-free frames and attachments on the ear hooks. These can be easily disassembled and cleaned to reuse.

Manufacturing industry to account for the largest share in face shield market

The manufacturing end-use segment includes face shields that are used at manufacturing sites. Use of face shields is necessary at manufacturing sites in order to protect wearers from occupational hazards. These are used as protection against hazardous materials that can be harmful. According to the National Institute for Occupational Safety and Health, approximately 5% of all US workers in approximately 20% work establishments wear face shields at least some of the time while performing their functions. These workers are employed in approximately 1.3 million establishments nationwide.

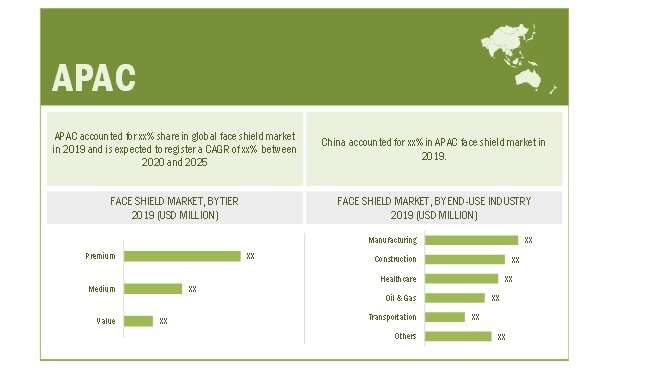

APAC is expected to account for the largest share of the face shield market during the forecast period.

The Asia Pacific is the largest and fastest-growing market. The growing economies in China and India and the growth and improvement in healthcare infrastructure in Southeast Asian countries are the major factors driving this market. In addition, the rising geriatric population in countries such as Japan, growing per capita income, increasing investments in the healthcare industry, expansion of private-sector hospitals to rural areas, and rapid economic growth are also supporting this market. The rise in the construction and manufacturing industry in these regions is also surging the demand for face shields in these industries.

To know about the assumptions considered for the study, download the pdf brochure

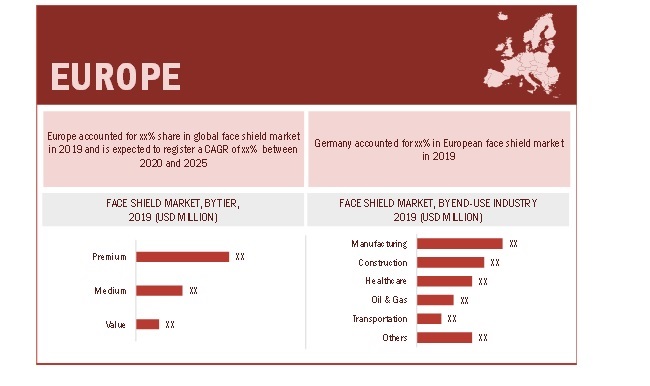

Europe is expected to account for the third largest share of the 1-decanol market during the forecast period

There was high demand of face shield in European market, as the major countries in the region has encountered high number of cases. The face shield market in Europe is expected to witness high growth of value tier face shield. Also, due to presence of major manufacturing and other end-use industries, the demand for premium and medium tier face shields is also expected to grow during the forecast period.

Face Shield Market Players

The key players in the global 1-decanol market are 3M (US), Honeywell International Inc. (US), Kimberly-Clark Corporation (US), MSA Safety Inc. (US), Lakeland Industries (US), Radians Inc (US), DuPont Teijin Films (US), MCR Safety (US), Protective Industrial Products (US), Prestige Ameritech (US).

In Aug 2020, 3M, in collaboration with Nissha Medical Technologies, a global medical device company, created a face shield with anti-fog properties in order to improve visibility and comfort during prolonged clinical wear. Its hydrophilic film contains anti-wicking properties that can direct fluids in a set direction. 3M hydrophilic film is majorly used for microfluidic devices such as blood sugar test strips used by people with diabetes. In the current scenario, this film was used for the manufacture of face shields.

Face Shield Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 3.0 billion |

|

Revenue Forecast in 2025 |

USD 4.1 billion |

|

CAGR |

6.5% |

|

Years considered for the study |

2018 - 2025 |

|

Base Year |

2019 |

|

Forecast period |

2020 - 2025 |

|

Units considered |

Volume (Units); Value (USD Million) |

|

Segments |

Type, Tier, End-Use Industry, and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

3M (US), Honeywell International Inc. (US), Kimberly-Clark Corporation (US), MSA Safety Inc. (US), Lakeland Industries (US), Radians Inc (US), DuPont Teijin Films (US), MCR Safety (US), Protective Industrial Products (US), Prestige Ameritech (US). |

This report categorizes the face shield market based on tier, end-use industry, and region.

On the basis of Type, the face shield market has been segmented as follows:

- Disposable

- Reusable

On the basis of tier, the face shield market has been segmented as follows:

- Premium

- Medium

- Value

On the basis of end-use industry, the face shield market has been segmented as follows:

- Healthcare

- Manufacturing

- Oil & Gas

- Transportation

- Construction

- Others

On the basis of region, the face shield market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

COVID-19 outbreak has impacted the different end-use industries and report covers the different factors impacting the market due to COVID-19

What are the major factors impacting market growth during the forecast period?

Regulations also plays in growth of face shield market, this report covers the different regulations governing the face shield market.

Which tier of face shield is widely used across a wide range of applications?

In on-going pandemic, value tier face shield is widely used owing to outbreak of COVID-19. Also, in industries, premium and medium tier face shields are used as per respective requirements.

What are the major end-use industries for face shield?

The major end-use industries for face shield is manufacturing, almost 30+% of the current production is being utilized in manufacturing. Construction and healthcare application is also expected to grow. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 FACE SHIELD MARKET, BY TIER: MARKET DEFINITION

TABLE 2 FACE SHIELDS MARKET, BY END USE: MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 3 FACE SHIELD MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 FACE SHIELD MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 FACE SHIELD MARKET: STUDY APPROACH

2.1.1 SUPPLY SIDE APPROACH

2.1.2 DEMAND SIDE APPROACH

2.1.3 SUPPLY SIDE APPROACH - PARENT MARKET

2.2 RESEARCH DATA

FIGURE 2 FACE SHIELD MARKET: RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Primary interviews - Demand and Supply Side

2.2.2.3 Breakdown of primary interviews

2.2.2.4 Key industry insights

2.3 FORECAST NUMBER CALCULATION

2.3.1 DEMAND SIDE

2.4 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION (DEMAND SIDE): FACE SHIELD MARKET

FIGURE 4 MARKET SIZE ESTIMATION (SUPPLY SIDE): FACE SHIELD MARKET

2.5 MARKET ENGINEERING PROCESS

2.5.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.6 DATA TRIANGULATION

2.7 FACTOR ANALYSIS

2.8 ASSUMPTIONS

2.9 LIMITATIONS

2.10 LIMITATIONS & RISKS ASSOCIATED WITH THE FACE SHIELD MARKET

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 4 FACE SHIELD MARKET SNAPSHOT, 2020 & 2025

FIGURE 7 PREMIUM TIER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 8 MANUFACTURING END USE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 9 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR THE LARGEST MARKETSHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE FACE SHIELD MARKET

FIGURE 10 OUTBREAK OF COVID-19 IS DRIVING THE MARKET

4.2 FACE SHIELD MARKET, BY REGION

FIGURE 11 ASIA PACIFIC MARKET PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC FACE SHIELDS MARKET, BY TIER & COUNTRY

FIGURE 12 PREMIUM TIER SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

4.4 FACE SHIELD MARKET, BY MAJOR COUNTRIES

FIGURE 13 FACE SHIELDS MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 MARKET DYNAMICS

FIGURE 14 MARKET DYNAMICS: FACE SHIELDS MARKET

5.1.1 DRIVERS

5.1.1.1 Awareness due to the outbreak of the COVID-19 pandemic

5.1.1.2 Stringent regulations pertaining to the safety of personnelin developed economies

5.1.1.3 Rising awareness about industrial occupational hazards at the workplace

5.1.1.4 Significant growth in emerging economies

5.1.2 RESTRAINTS

5.1.2.1 Volatility in prices of raw materials

FIGURE 15 CRUDE OIL IN BRENT WITNESSED THE SHARPEST DIP IN PRICES, 2015-2019

5.1.2.2 Restricted future growth of value face shields

5.1.3 OPPORTUNITIES

5.1.3.1 Growing healthcare industry in emerging economies

FIGURE 16 INCREASE IN HOSPITALIZATION IN INDIA (MILLION PATIENTS)

5.1.3.2 Rising trend in 3D printed face shields

5.1.4 CHALLENGES

5.1.4.1 Counterfeit face shields in the market

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

5.2.1 THREAT OF SUBSTITUTES

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.3.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 5 GDP GROWTH RATE, 2018-2025 (PERCENTAGE)

6 INDUSTRY TRENDS (Page No. - 58)

6.1 VALUE CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS FOR THE FACE SHIELD MARKET

6.1.1 RAW MATERIALS

6.1.2 PROCESSED INPUTS

6.1.3 ASSEMBLY

6.1.4 STERILIZATION

6.1.5 TESTING AND PACKAGING

6.1.6 DISTRIBUTION

6.2 TRENDS IN AVERAGE SELLING PRICES

TABLE 6 AVERAGE PRICES OF FACE SHIELDS, BY REGION, 2019 (USD)

6.3 TECHNOLOGY ANALYSIS

TABLE 7 SOME OF THE TECHNOLOGICAL DEVELOPMENTS IN THE FACE SHIELDS MARKET

6.4 PATENT ANALYSIS

TABLE 8 SOME OF THE PATENTS IN THE FACE SHIELD MARKET

6.5 ECOSYSTEM OF PERSONAL PROTECTIVE EQUIPMENT

6.6 CHANGE IN INDUSTRIAL SHIFT IMPACTING REVENUE MIX

6.7 TRADE DATA STATISTICS

TABLE 9 IMPORT DATA FOR FACE SHIELD

6.8 REGULATORY LANDSCAPE - GOVERNMENT REGULATIONS

6.8.1 NORTH AMERICA

TABLE 10 ANSI/ISEA Z87.1-2015: EYE AND FACE PROTECTOR SELECTION CHART

6.8.2 CSA STANDARD Z94.3-15: CANADIAN STANDARDS ASSOCIATION (CSA GROUP)

TABLE 11 CSA STANDARD Z94.3-15: CANADIAN STANDARDS ASSOCIATION

6.8.3 EUROPE

6.8.3.1 European Standards for Eye Protection - EN

TABLE 12 EUROPEAN STANDARDS FOR EYE PROTECTION - EN

6.8.4 2.1.3 ASIA PACIFIC

TABLE 13 AIGA 066/18: EYE AND FACE PROTECTION SELECTION

6.9 CASE STUDIES

FIGURE 19 CASE STUDY 1: MARKET ASSESSMENT OF PERSONALPROTECTIVE EQUIPMENT MARKET

FIGURE 20 CASE STUDY 2: IMPACT OF COVID-19 ON FACE MASK MARKET

6.1 FACE SHIELD MARKET SCENARIOS, 2018-2025

FIGURE 21 OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO OF FACE SHIELD MARKET

6.11 COVID-19 IMPACT

6.11.1 INTRODUCTION

6.11.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COUNTRY-WISE SPREAD OF COVID-19

6.11.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.11.3.1 Impact of COVID-19 on the Economy-Scenario Assessment

FIGURE 24 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 25 SCENARIOS OF COVID-19 IMPACT

6.11.4 IMPACT OF COVID-19 ON THE FACE SHIELD MARKET

7 FACE SHIELD MARKET, BY TYPE (Page No. - 83)

7.1 INTRODUCTION

7.2 DISPOSABLE

7.2.1 INCREASED USE OF PERSONAL PROTECTIVE EQUIPMENT IN HOSPITALS TO DRIVE DEMAND

7.3 REUSABLE

7.3.1 OUTBREAK OF COVID-19 TO SPUR DEMAND

8 FACE SHIELD MARKET, BY TIER (Page No. - 86)

8.1 INTRODUCTION

FIGURE 26 FACE SHIELD MARKET, BY TIER, 2020 & 2025 (USD MILLION)

TABLE 14 FACE SHIELDS MARKET SIZE, BY TIER, 2018-2025 (USD MILLION)

TABLE 15 FACE SHIELD MARKET SIZE, BY TIER, 2018-2025 (MILLION UNITS)

8.2 PREMIUM

8.2.1 PREMIUM SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN 2019

TABLE 16 PREMIUM TIER FACE SHIELD MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 17 PREMIUM TIER FACE SHIELDS MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

8.3 MEDIUM

8.3.1 INCREASED DEMAND FOR MEDIUM TIER FACE SHIELD DUE TO COVID-19

TABLE 18 MEDIUM TIER FACE SHIELD MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 19 MEDIUM TIER FACE SHIELDS MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

8.4 VALUE

8.4.1 CUSTOMIZED FACE SHIELDS TO DRIVE DEMAND

TABLE 20 VALUE TIER FACE SHIELD MARKET SIZE, BY REGION,2018-2025 (USD MILLION)

TABLE 21 VALUE TIER FACE SHIELDS MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

9 FACE SHIELD MARKET, BY END USE (Page No. - 92)

9.1 INTRODUCTION

FIGURE 27 FACE SHIELD MARKET, BY END USE, 2020 & 2025 (USD MILLION)

FIGURE 28 FACE SHIELDS MARKET, BY END USE, OTHERS SEGMENT 2020 & 2025 (USD MILLION)

TABLE 22 FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 23 FACE SHIELDS MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

9.2 HEALTHCARE

9.2.1 REQUIREMENT FOR PERSONAL PROTECTIVE EQUIPMENT IN HEALTHCARE INDUSTRY TO BOOST DEMAND

TABLE 24 FACE SHIELD MARKET SIZE IN HEALTHCARE, BY REGION, 2018-2025 (USD MILLION)

TABLE 25 FACE SHIELDS MARKET SIZE IN HEALTHCARE, BY REGION, 2018-2025 (MILLION UNITS)

9.3 OTHERS

TABLE 26 FACE SHIELD MARKET SIZE, BY OTHERS END USE, 2018-2025 (USD MILLION)

TABLE 27 FACE SHIELDS MARKET SIZE, BY OTHERS END USE, 2018-2025 (MILLION UNITS)

TABLE 28 FACE SHIELD MARKET SIZE IN OTHERS, BY REGION, 2018-2025 (USD MILLION)

TABLE 29 FACE SHIELDS MARKET SIZE IN OTHERS, BY REGION, 2018-2025 (MILLION UNITS)

9.3.1 MANUFACTURING

TABLE 30 FACE SHIELD MARKET SIZE IN MANUFACTURING, BY REGION, 2018-2025 (USD MILLION)

TABLE 31 FACE SHIELDS MARKET SIZE IN MANUFACTURING END USE, BY REGION, 2018-2025 (MILLION UNITS)

9.3.2 CONSTRUCTION

TABLE 32 FACE SHIELD MARKET SIZE IN CONSTRUCTION END USE, BY REGION, 2018-2025 (USD MILLION)

TABLE 33 FACE SHIELDS MARKET SIZE IN CONSTRUCTION END USE, BY REGION,2018-2025 (MILLION UNITS)

9.3.3 OIL & GAS

TABLE 34 FACE SHIELD MARKET SIZE IN OIL & GAS END USE, BY REGION, 2018-2025 (USD MILLION)

TABLE 35 FACE SHIELDS MARKET SIZE IN OIL & GAS END USE, BY REGION, 2018-2025 (MILLION UNITS)

9.3.4 TRANSPORTATION

TABLE 36 FACE SHIELD MARKET SIZE IN TRANSPORTATION END USE, BY REGION, 2018-2025 (USD MILLION)

TABLE 37 FACE SHIELDS MARKET SIZE IN TRANSPORTATION END USE, BY REGION, 2018-2025 (MILLION UNITS)

9.3.5 OTHERS

TABLE 38 FACE SHIELD MARKET SIZE IN OTHERS END USE, BY REGION, 2018-2025 (USD MILLION)

TABLE 39 FACE SHIELDS MARKET SIZE IN OTHERS END USE, BY REGION, 2018-2025 (MILLION UNITS)

10 FACE SHIELD MARKET, BY REGION (Page No. - 102)

10.1 NORTH AMERICA

FIGURE 29 NORTH AMERICA FACE SHIELD MARKET SNAPSHOT

TABLE 40 NORTH AMERICA MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 41 NORTH AMERICA MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 42 NORTH AMERICA MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 43 NORTH AMERICA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

TABLE 44 NORTH AMERICA MARKET SIZE, BY TIER, 2018-2025 (USD MILLION)

TABLE 45 NORTH AMERICA MARKET SIZE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 46 NORTH AMERICA MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (USD MILLION)

TABLE 47 NORTH AMERICA MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 48 NORTH AMERICA MARKET SIZE IN OTHER END-USE, BY TIER, 2018-2025 (USD MILLION)

TABLE 49 NORTH AMERICA MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (MILLION UNITS)

10.1.1 US

10.1.1.1 The US accounted for the largest share of the regional market

FIGURE 30 POPULATION GROWTH IN THE US, 2016 VS. 2030 VS. 2060

10.1.1.2 US: COVID-19 impact analysis

TABLE 50 US FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 51 US MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.1.2 CANADA

10.1.2.1 Increase in number of surgeries to drive market growth

10.1.2.2 Canada: COVID-19 impact analysis

TABLE 52 CANADA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 53 CANADA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.1.3 MEXICO

10.1.3.1 Increased demand for face shields due to the COVID-19 outbreak

TABLE 54 TOP TEN CAUSES OF DEATHS IN MEXICO, 2017

TABLE 55 MEXICO FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 56 MEXICO MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.2 EUROPE

FIGURE 31 EUROPE FACE SHIELD MARKET SNAPSHOT

TABLE 57 EUROPE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 58 EUROPE MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 59 EUROPE MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 60 EUROPE MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

TABLE 61 EUROPE MARKET SIZE, BY TIER, 2018-2025 (USD MILLION)

TABLE 62 EUROPE MARKET SIZE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 63 EUROPE MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (USD MILLION)

TABLE 64 EUROPE MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 65 EUROPE MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (USD MILLION)

TABLE 66 EUROPE MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (MILLION UNITS)

10.2.1 GERMANY

10.2.1.1 Increasing numbers of patients in hospitals driving market growth

TABLE 67 GERMANY: MACRO INDICATORS FOR THE FACE SHIELDS MARKET

10.2.1.2 Germany: COVID-19 impact analysis

TABLE 68 GERMANY FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 69 GERMANY MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.2.2 UK

10.2.2.1 Increase in hospitalization rates driving demand for face shields

10.2.2.2 UK: COVID-19 impact analysis

TABLE 70 UK FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 71 UK MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.2.3 FRANCE

10.2.3.1 Favorable government initiatives to support market growth

TABLE 72 FRANCE: MACRO INDICATORS FOR THE FACE SHIELDS MARKET

TABLE 73 FRANCE FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 74 FRANCE MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.2.4 ITALY

10.2.4.1 Large geriatric population to support market growth

10.2.4.2 Italy: COVID-19 impact analysis

TABLE 75 ITALY FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 76 ITALY MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.2.5 RUSSIA

10.2.5.1 Increased demand for face shields due to the COVID-19 outbreak

TABLE 77 RUSSIA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 78 RUSSIA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.2.6 REST OF EUROPE

TABLE 79 REST OF THE EUROPE FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 80 REST OF EUROPE MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.3 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC FACE SHIELD MARKET SNAPSHOT

TABLE 81 ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 82 ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 83 ASIA PACIFIC MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 84 ASIA PACIFIC MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

TABLE 85 ASIA PACIFIC MARKET SIZE, BY TIER, 2018-2025 (USD MILLION)

TABLE 86 ASIA PACIFIC MARKET SIZE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 87 ASIA PACIFIC MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (USD MILLION)

TABLE 88 ASIA PACIFIC MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 89 ASIA PACIFIC MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (USD MILLION)

TABLE 90 ASIA PACIFIC MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (MILLION UNITS)

10.3.1 CHINA

10.3.1.1 China accounted for the largest share of the Asia Pacific face shield market in 2019 129

TABLE 91 CHINA: MACRO INDICATORS FOR THE FACE SHIELDS MARKET

10.3.1.2 China: COVID-19 impact analysis

TABLE 92 CHINA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 93 CHINA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.3.2 JAPAN

10.3.2.1 Large geriatric population in Japan to support market growth

TABLE 94 JAPAN: MACRO INDICATORS FOR THE FACE SHIELD MARKET

TABLE 95 JAPAN FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 96 JAPAN MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.3.3 SOUTH KOREA

10.3.3.1 Well-developed healthcare system expected to drive market growth

TABLE 97 SOUTH KOREA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 98 SOUTH KOREA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.3.4 INDIA

10.3.4.1 India is the fastest-growing face shield market in the region

10.3.4.2 India: COVID-19 impact analysis

TABLE 99 INDIA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 100 INDIA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.3.5 INDONESIA

10.3.5.1 Outbreak of COVID-19 to spur demand for face shields in Indonesia

TABLE 101 INDONESIA: MACRO INDICATORS FOR THE FACE SHIELDS MARKET

TABLE 102 INDONESIA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 103 INDONESIA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.3.6 REST OF ASIA PACIFIC

TABLE 104 REST OF ASIA PACIFIC FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 105 REST OF ASIA PACIFIC MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.4 MIDDLE EAST & AFRICA

TABLE 106 MIDDLE EAST & AFRICA FACE SHIELD MARKET SIZE, BY TIER, 2018-2025 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA MARKET SIZE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 108 MIDDLE EAST & AFRICA MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 110 MIDDLE EAST & AFRICA MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 112 MIDDLE EAST & AFRICA MARKET SIZE, BY END USE, 2018-2025 (USD MILLION) 140

TABLE 113 MIDDLE EAST & AFRICA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS) 140

TABLE 114 MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION) 141

TABLE 115 MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS) 141

10.4.1 IRAN

10.4.1.1 Iran accounted for the second-largest share of the Middle East & Africa face shield market in 2019

TABLE 116 IRAN: MACRO INDICATORS FOR THE FACE SHIELDS MARKET

TABLE 117 IRAN FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 118 IRAN MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.4.2 SOUTH AFRICA

10.4.2.1 Increased demand for face shields due to COVID-19

TABLE 119 SOUTH AFRICA: MACRO INDICATORS FOR THE FACE SHIELDS MARKET

TABLE 120 SOUTH AFRICA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 121 SOUTH AFRICA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.4.3 REST OF MIDDLE EAST & AFRICA

TABLE 122 REST OF MIDDLE EAST & AFRICA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 123 REST OF MIDDLE EAST & AFRICA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.5 SOUTH AMERICA

TABLE 124 SOUTH AMERICA FACE SHIELD MARKET SIZE, BY TIER, 2018-2025 (USD MILLION)

TABLE 125 SOUTH AMERICA MARKET SIZE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 126 SOUTH AMERICA MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (USD MILLION)

TABLE 127 SOUTH AMERICA MARKET SIZE IN HEALTHCARE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 128 SOUTH AMERICA MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (USD MILLION)

TABLE 129 SOUTH AMERICA MARKET SIZE IN OTHERS END USE, BY TIER, 2018-2025 (MILLION UNITS)

TABLE 130 SOUTH AMERICA MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 131 SOUTH AMERICA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

TABLE 132 SOUTH AMERICA MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 133 SOUTH AMERICA MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

10.5.1 BRAZIL

10.5.1.1 Brazil accounted for the largest share of the South America face shield market in 2019

TABLE 134 BRAZIL FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 135 BRAZIL MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.5.2 ARGENTINA

10.5.2.1 Argentina is the second-largest market for face shields in South America

TABLE 136 ARGENTINA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 137 ARGENTINA ARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

10.5.3 REST OF SOUTH AMERICA

TABLE 138 REST OF SOUTH AMERICA FACE SHIELD MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

TABLE 139 REST OF SOUTH AMERICA MARKET SIZE, BY END USE, 2018-2025 (MILLION UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 152)

11.1 INTRODUCTION

TABLE 140 OVERVIEW OF STRATEGIES ADOPTED BY KEY FACE SHIELD MARKET PLAYERS

11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2019

FIGURE 33 RANKING ANALYSIS OF TOP FIVE PLAYERS IN THE FACE SHIELD MARKET, 2019

11.3 SHARE OF KEY MARKET PLAYERS, 2019

11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2019

11.5 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 PARTICIPANTS

FIGURE 34 FACE SHIELD COMPANY EVALUATION MATRIX, 2019

11.6 SMALL AND MEDIUM SIZE ENTERPRISES (SMES) MATRIX, 2019

FIGURE 35 FACE SHIELD: SMES MATRIX, 2019

11.7 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE FACE SHIELD MARKET, 2019

FIGURE 36 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE FACE SHIELDS MARKET

11.8 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE FACE SHIELD MARKET, 2019

FIGURE 37 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE FACE SHIELDS MARKET

11.9 KEY MARKET DEVELOPMENTS

11.9.1 NEW PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 141 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2017-2020

11.9.2 CONTRACTS

TABLE 142 CONTRACT, 2018

11.9.3 PARTNERSHIPS, AGREEMENTS, INVESTMENTS, FUNDING, EXPANSIONS, AND ACQUISITIONS 163

TABLE 143 PARTNERSHIPS, AGREEMENTS, INVESTMENTS, EXPANSIONS, FUNDING,AND ACQUISITIONS, 2014-2020

12 COMPANY PROFILES (Page No. - 164)

(Business Overview, Products Offered, Recent Developments, winning imperatives, Current Focus and Strategies, Threat from Competition, Right to Win)*

12.1 3M

FIGURE 38 3M: COMPANY SNAPSHOT

FIGURE 39 3M: WINNING IMPERATIVES

12.2 HONEYWELL INTERNATIONAL INC.

FIGURE 40 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 41 HONEYWELL INTERNATIONAL INC.: WINNING IMPERATIVES

12.3 KIMBERLY- CLARK CORPORATION

FIGURE 42 KIMBERLY-CLARK CORPORATION: COMPANY SNAPSHOT

FIGURE 43 KIMBERLY-CLARK CORPORATION: WINNING IMPERATIVES

12.4 MSA SAFETY INC.

FIGURE 44 MSA SAFETY INC.: COMPANY SNAPSHOT

12.5 LAKELAND INDUSTRIES, INC.

FIGURE 45 LAKELAND INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 46 LAKELAND INDUSTRIES INC.: WINNING IMPERATIVES

12.6 DUPONT TEIJIN FILMS

12.7 MCR SAFETY

12.8 RADIANS INC.

12.9 PROTECTIVE INDUSTRIAL PRODUCTS INC.

12.10 PRESTIGE AMERITECH

*Details on Business Overview, Products Offered, Recent Developments, winning imperatives, Current Focus and Strategies, Threat from Competition, Right to Win might not be captured in case of unlisted companies.

12.11 OTHER PLAYERS

12.11.1 E.D. BULLARD COMPANY, INC.

12.11.2 PYRAMEX

12.11.3 SUREWERX (JACKSON SAFETY)

12.11.4 CROSSTEX INTERNATIONAL, INC.

12.11.5 JSP SAFETY

12.11.6 FT-TEC GROUP

12.11.7 GATEWAY SAFETY INC.

12.11.8 LINDSTROM GROUP (FINLAND)

12.11.9 HEXARMOR

12.11.10 PROTECH MEDICAL

12.11.11 ALPHA PRO TECH, LTD.

12.11.12 NATIONAL SAFETY APPAREL

12.11.13 KARAM

12.11.14 STEELBIRD HI-TECH INDIA LTD.

12.11.15 UNIVET

13 APPENDIX (Page No. - 189)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORT

13.5 AUTHOR DETAILS

The study involves four major activities in estimating the market size for the face shield. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study includes annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, and Bloomberg. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

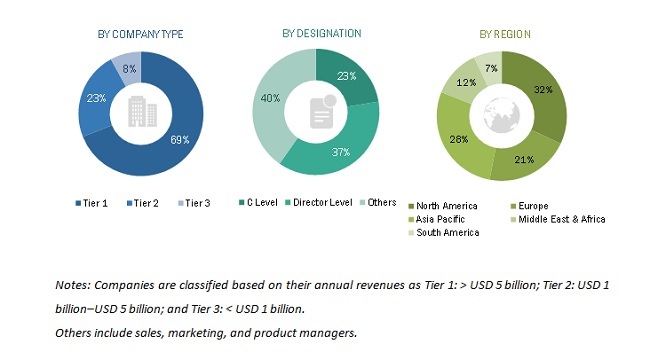

The Face Shield market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of healthcare, manufacturing, oil & gas, building & construction, and transportation industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Notes: Companies are classified based on their annual revenues as Tier 1: > USD 5 billion; Tier 2: USD 1 billion–USD 5 billion; and Tier 3: < USD 1 billion.

Others include sales, marketing, and product managers.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Face shield market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the healthcare, manufacturing, oil & gas, building & construction, and transportation industries.

Report Objectives

- To define, describe, and forecast the Face Shield market size in terms of volume and value

- To provide detailed information regarding the major factors (drivers, restraints, and opportunities) influencing the market growth

- To estimate and forecast the Face Shield market size based on type, tier, and end-use industry

- To forecast the Face Shield market size based on five major regions–Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze recent developments, such as joint venture, expansion, partnership & collaboration, contract & agreement, and new product launch/development, in the market

- To strategically profile the key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Regional Analysis

- A further breakdown of a region with respect to a particular country or additional application

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Face Shield Market