Feed Premix Market by Ingredient Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants), Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Equine, and Pets), Form (Dry and Liquid), and Region - Global Forecast to 2026

Feed Premix Market Size, Share, and Revenue Forecast

The global feed premix market size is predicted to grow at a CAGR of 6.2% between 2021 and 2026, reaching a value of $32.9 billion by 2026 from a projection of $24.3 billion in 2021.

The global feed premix market is expected to grow due to various factors, including increasing demand for animal protein, rising awareness of animal nutrition and health concerns, technological advancements, and the adoption of intensive animal farming practices. As consumers become more conscious about the quality and safety of animal-derived products, the demand for feed premixes to enhance animal health and productivity is increasing. Advances in technology have led to the development of more sophisticated and effective feed premix products, which are expected to further drive the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Feed Premix Market Dynamics

Driver: Increase in the demand and consumption of livestock based products

An increase in the demand and consumption of livestock-based products such as dairy & dairy-based products, meat, and eggs is expected to drive the usage of feed additives for the growth and development of farm animals. According to FAO data, it has been stated that global meat production is projected to be 16% higher by 2025. Poultry meat is the primary driver for the growth of the overall meat production, owing to its high demand, low production cost, and lower product prices, both in developed and developing countries.

According to FAO statistics, it has been stated that the production of poultry meat reached 120.5 million tons in 2017, whereas swine meat recorded 118.7 million tons, bovine meat recorded 70.8 million tons, and ovine meat recorded 14.9 million tons. Owing to the increasing awareness about the role and dynamics of food nutrients, especially protein, on overall physical and mental growth and development, there is a growing inclination toward animal-sourced protein in the form of either meat, eggs, or milk.

Restraint: Ban on antibiotics in different countries

Antibiotics have been used in feed for decades; however, in 2006, the European Union (EU) banned the use of antibiotics in feed as growth promoters, as microbes developed resistance to antibiotics, which are used to treat human and animal infections. Following the ban by the EU, the use of antibiotics declined in many countries around the globe, especially in countries such as China, India, and the US, due to their overexploitation or misuse.

Restriction on the use of antibiotics, as a growth promoter in feed, in many countries, forced companies to stop using antibiotics in feed premixes. This acts as a major restraint for manufacturers that offer antibiotic-based feed premixes.

Opportunity: Developing countries emerge as strong consumers of feed premix

The demand from emerging markets such as Asia Pacific and Latin America accounted for a combined global share of ~47% in 2017. The population of developing countries in the Asia Pacific region—such as India, China, Indonesia, Vietnam, and Thailand—are expected to consume meat at an annual rate of 2.4% till 2030, according to the FAO report on “World Agriculture: Towards 2015/2030.” This has increased the demand for high-quality feed concentrates and premixes to enhance the meat weight and quality of the animals.

Key players in the premix market have sensed this opportunity to start premix production plants in these regions, to meet the growing demand for feed premixes. Similarly, in South America, Brazil housed the largest cattle population in 2017, with a headcount of 330 million, and is projected to grow at a rate well above the regional average, according to the FAO. It is expected that the rising consumer awareness for nutritious products and requirement for export quality meat products can establish a strong demand for feed premixes.

Challenge: Sustainability of feed and livestock chain

The global feed industry focuses on improving feed efficiency by improving the feed conversion rates for all major livestock and farmed fish species. The feed and livestock industries can achieve sustainability by developing a harmonized environmental footprint methodology based on life cycle analysis involving the entire chain. The development of common metrics can also help to calculate a broader range of resource efficiency indicators. The efficient usage of feed ingredients can support the reduction of the environmental impact of livestock farming through resource-efficient feed production. The use of co-products from other processing industries can reduce the pressure on land-grown crops.

Some requirements of an efficient feed and livestock chain include the following:

- Access to safe and cost-effective feed and services

- Clear and transparent legislative framework

- Improved image (animal welfare, quality, and safety of animal products)

- Innovating approaches to mitigate the environmental impact of production systems

- Continuously improving working conditions

- Bringing innovative science to the marketplace

Global organizations such as the International Feed Industry Federation (IFIF) have developed a number of strategic initiatives to measure and benchmark the environmental performance of the livestock production chain. IFIF is a founding member of the Global Feed LCA Institute (GFLI), which will use the FAO LEAP methodology to develop a global standard for assessing and benchmarking the impact of the feed industry to support the reduction of the environmental footprint of livestock products.

The amino acids segment of the feed premix is projected to account for the largest share, by ingredient type

By type, the amino acids segment accounted for the highest share in feed premix market. Amino acids are widely used as feed premixes to provide the nutrients required to overcome dietary deficiencies. Amino acids function as building blocks for protein development in animals and are essential to enhance meat quality and quantity.

The ideal protein concept is one of the most important advances in animal nutrition. It helps the animal maintain a balanced pattern of amino acids to maximize the growth performance and nitrogen retention in the livestock. A variety of amino acids are fed to livestock animals as supplements to increase their efficiency. The commonly used amino acids include methionine and lysine. Generally, feeds, such as corn and soy meal, lack lysine and methionine content that belongs to the first order of limiting amino acids (amino acids present inadequately in a feed for protein synthesis). Lysine and methionine are eventually utilized as feed premixes in the diets of growing pigs and broiler. The supply of these limiting amino acids reduces the protein level requirements in the diet and improves the efficiency of protein utilization.

The market for the dry segment is projected to account for the largest share during the forecast period, by form

By form, the dry segment accounted for the highest market share as well as the highest growth rate in the global market due to the factors such as easy handling and storability, usage in a wide range of livestock applications, and lower manufacturing costs. Feed premixes in the dry form are easier to mix with feed and provide a longer shelf life than in the liquid form, due to which they witness high preference among feed manufacturers.

By livestock, the poultry segment dominated the global feed premix market

The poultry industry consists of four main areas of production—broiler, eggs, pullets, and breeders. It is a fast-evolving industry due to the rapid increase in demand for poultry meat, particularly in India and many Islamic countries. In these countries, the consumption of porcine and livestock meat (India) is projected to be low due to religious beliefs, which, in turn, increases the demand for poultry meat.

In addition, the global demand for poultry meat is further set to rise in the coming years due to the increased cost and reduced availability due to the rise in demand for beef and pig meat. Poultry, the most traded meat category, accounts for over 40% of the total meat trade. According to the FAO, global poultry meat production was nearly 111.8 million tons in 2015. Furthermore, the demand for poultry meat is projected to remain high in developing economies.

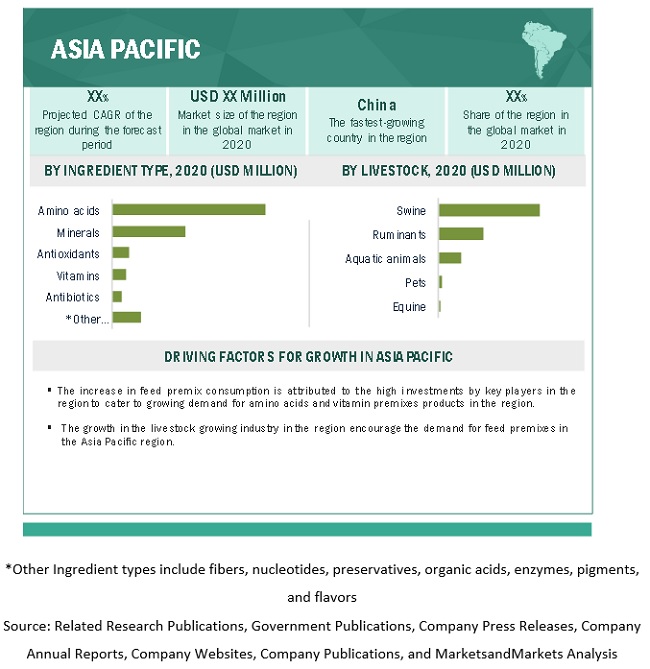

Asia Pacific is the fastest-growing region during the forecast period in the global feed premix market

The key markets in the Asia Pacific region include China, India, Japan, Australia & New Zealand, Thailand, Vietnam, others, and the Rest of Asia Pacific.

The Asia Pacific region accounted for the largest share of 35.6% of the global market in 2020, in terms of value. The market in the region is driven by the presence of a large livestock population (FAO 2016) and their growth rate. Furthermore, the region has witnessed an increase in the number of feed mills and feed production, particularly in India and Japan. This increase in the number of feed mills in the region reflects the growth in feed production. According to the Alltech Feed Survey of 2018, the region experienced a 7% increase in its feed production, from 356.5 million tons in 2012 to 381.1 million tons in 2017. The largest feed producer, China, contributes significantly to the region’s leading position, with Thailand and Indonesia being the emerging feed-producing countries, while India and Japan are demonstrating constant growth in feed production. According to the same source, among the top 20 feed companies in the world, 16 of them are based in the Asia Pacific region, which makes this a highly competitive market.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the report

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 24.3 billion |

|

Revenue Forecast in 2026 |

USD 32.9 billion |

|

Growth Rate |

CAGR of 6.2% from 2021 to 2026 |

|

Research Duration Considered |

2017-2026 |

|

Historical Base Year |

2017 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

Asia Pacific |

|

Key Companies Profiled |

|

|

Feed Premix Market Drivers: |

|

This research report categorizes the feed premix market based on ingredient type, form, livestock, and region.

Market, By Ingredient Type

- Amino acids

- Vitamins

- Minerals

- Antibiotics

- Antioxidants

- Other ingredient types (Fibers, nucleotides, preservatives, organic acids, enzymes, pigments, and flavors)

Market, By Batter Application

- Poultry

- Ruminats

- Swine

- Aquatic animals

- Equine

- Pets

Market, By Form

- Dry

- Liquid

Market, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of World (RoW)*

*Rest of the World (RoW) includes Africa and the Middle East

Recent Developments

- In October 2022, Cargill (US) and its partner Naturisa S.A (Ecuador) have agreed with Skyvest EC Holding SA to create a joint venture to expand shrimp feed production in Ecuador. This feed plant was built in 2018 and will be operated by Cargill (US) that has a production capacity of 156,000 tonnes and employs more than 200 people.

- In September 2022, Cargill (US) inaugurated a corn wet mill in Pandaan, Indonesia to fulfill the growing demand for starches, sweeteners and feed markets in Asia and Indonesia. This initiative is expected to enhance the development of Indonesia’s food, beverage, and feed industry.

- In August 2022, DSM (Netherlands) launched Symphiome, a new class of feed ingredients that helps in the production of microbiome to improve the gut health of birds. This is expected to enhance the company’s business opportunities.

- In July 2022, AB Agri (UK) opened a new feed mill in Tongchuan City, Shaanxi Province, China to expand its production capacity in the region. This site has a 240,000 tonnes capacity spread over 34,000 square meter and is AB Agri China’s second largest facility.

- In June 2022, Nutreco (Netherlands) received USD 4.8 million grant from the Bill & Melinda Gates Foundation to implement sustainable feed production in Sub-Saharan Africa. This will help enhance the ESG initiatives of the company.

- In May 2022, ADM (US) acquired a feed mill in Philippines from South Sunrays Milling Corporation in Polomolok, South Cotabato. The South Cotabato mill along with two other feed production facilities in Cebu and Bulacan, will support the customer growth in this region with offering of wide range of pet food, complete feed, aquaculture, and premix solutions.

- In January 2022, Devenish Nutrition (UK), set up its new production facility in Mexico, that will host the company’s headquarters and a two-line premix production system. This initiative will help in meeting the customer demand in this region.

- In January 2022, Nutreco (Netherlands) entered into an agreement with Unga Group Plc (Kenya) to form two joint ventures with two indirect subsidiaries to meet the growing demand for high quality protein in East African region. The Kenyan subsidiary will increase production capacity at its jointly owned fish feed plant in Nairobi to commercialize these products. The Uganda subsidiary will produce animal feeds and concentrates. This is expected to enhance the growth opportunities for the company.

Report Objectives:

- Define, segment, and estimate the size of the market with respect to its ingredient type, form, livestock, and region

- Provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- Analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- Profile the key players and comprehensively analyze their core competencies

- Analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the Feed premix market.

Frequently Asked Questions (FAQ):

What is the projected market value of the global feed premix market?

The global feed premix market as per revenue was estimated to be worth $24.3 billion in 2021 and is poised to reach $32.9 billion by 2026

What is the estimated growth rate (CAGR) of the global feed premix market for the next five years?

The global feed premix market is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2021 to 2026

What are the major revenue pockets in the feed premix market?

The Asia Pacific region accounted for the largest share of 35.6% of the global market in 2020, in terms of value. The market in the region is driven by the presence of a large livestock population (FAO 2016) and their growth rate. Furthermore, the region has witnessed an increase in the number of feed mills and feed production, particularly in India and Japan.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 INCLUSIONS & EXCLUSIONS

FIGURE 2 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2017–2019

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key data from primary sources

2.1.2.2 Market data from primary sources

2.1.2.3 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND-SIDE ANALYSIS

2.3.2.1 Food security for the growing population

FIGURE 5 GLOBAL POPULATION PROJECTED TO REACH ~9.5 BILLION BY 2048

2.3.2.2 Developing economies

2.3.2.2.1 Increase in middle-class population, 2009–2030

FIGURE 6 MIDDLE-CLASS POPULATION IN ASIA PACIFIC IS PROJECTED TO GROW AND ACCOUNT FOR A MAJOR SHARE IN THE GLOBAL MARKET BY 2030

2.3.2.2.2 GDP (PPP), 2013

FIGURE 7 TOP 5 ECONOMIES BASED ON GDP (PPP): US, CHINA, INDIA, JAPAN, AND GERMANY, 2013

2.3.3 INCREASE IN GLOBAL MEAT CONSUMPTION

FIGURE 8 GLOBAL MEAT CONSUMPTION, BY MEAT TYPE, 2014–2019 (MILLION TON)

2.3.4 SUPPLY-SIDE ANALYSIS

2.3.4.1 Number of new feed premix products launched

2.3.4.2 Rise in cost of natural feed products

FIGURE 9 INCREASING COST OF SOYBEAN MEAL, 2015–2019 (USD/METRIC TONS)

2.3.4.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

FIGURE 10 FEED PREMIX MARKET SIZE ESTIMATION – SUPPLY-SIDE (1/2)

FIGURE 11 MARKET SIZE ESTIMATION – SUPPLY-SIDE (2/2)

FIGURE 12 MARKET SIZE ESTIMATION – DEMAND-SIDE

2.4.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 13 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 14 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 15 DATA TRIANGULATION METHODOLOGY

2.6 RESEARCH ASSUMPTIONS

2.7 LIMITATIONS

2.8 SCENARIO BASED MODELLING

2.9 COVID-19 HEALTH ASSESSMENT

FIGURE 16 COVID-19 PROPAGATION

FIGURE 17 COVID-19 PROPAGATION: SELECT COUNTRIES

2.10 COVID-19 ECONOMIC ASSESSMENT

FIGURE 18 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.10.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 19 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 20 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 56)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 21 IMPACT OF COVID-19 ON THE FEED PREMIX MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD BILLION)

FIGURE 22 MARKET SIZE FOR FEED PREMIX, BY INGREDIENT TYPE, 2021 VS. 2026 (USD BILLION)

FIGURE 23 MARKET SIZE, BY LIVESTOCK, 2021 VS. 2026 (USD BILLION)

FIGURE 24 MARKET SIZE, BY FORM, 2021 VS. 2026 (USD BILLION)

FIGURE 25 MARKET SNAPSHOT: ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE, 2020

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 26 THE FEED PREMIX MARKET IS AN EMERGING WITH PROMISING GROWTH POTENTIAL

4.2 ASIA PACIFIC: MARKET FOR FEED PREMIX, BY KEY APPLICATION AND COUNTRY

FIGURE 27 ASIA PACIFIC: CHINA ACCOUNTED FOR THE LARGEST MARKET FOR FEED PREMIX IN 2020

4.3 MARKET FOR FEED PREMIX, BY INGREDIENT TYPE

FIGURE 28 MARKET FOR FEED PREMIX, BY INGREDIENT TYPE, 2019–2026 (USD MILLION)

4.4 MARKET SHARE (BY VALUE), BY FORM, 2020

4.5 FEED PREMIX MARKET, BY COUNTRY

FIGURE 29 RUSSIA AND CHINA ARE PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE REVIEW PERIOD

4.6 COVID-19 IMPACT ON THE FEED PREMIX MARKET

FIGURE 30 COVID-19 IMPACT ON THE GLOBAL MARKET BETWEEN 2020 AND 2021

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 31 FEED PREMIX MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increase in the demand and consumption of livestock-based products

FIGURE 32 MAJOR MEAT PRODUCING REGIONS/COUNTRIES, 2015–2017 (KT)

FIGURE 33 MAJOR BOVINE MEAT PRODUCING REGIONS/COUNTRIES, 2015–2017 (KT)

FIGURE 34 MAJOR SWINE MEAT PRODUCING REGIONS/COUNTRIES, 2015–2017 (KT)

FIGURE 35 ANIMAL-BASED PRODUCT CONSUMPTION, BY COMMODITY, 1967–2030 (MILLION TON)

5.2.1.2 Growth in feed production

FIGURE 36 FEED PRODUCTION TREND, 2013–2017 (MILLION TON)

FIGURE 37 REGIONAL FEED PRODUCTION SNAPSHOT, 2017 (MILLION TON)

FIGURE 38 LEADING FEED PRODUCING COUNTRIES, 2017 (MILLION TON)

5.2.1.3 Standardization of meat products owing to disease outbreaks

5.2.1.4 Growth in compound feed consumption

TABLE 3 CONCERN FOR ANIMAL HEALTH & COMPOUND FEED CONSUMPTION PROPEL THE DEMAND FOR FEED PREMIXES

5.2.2 RESTRAINTS

5.2.2.1 Ban on antibiotics in different countries

5.2.2.2 Increase in cost of feed ingredients

5.2.2.3 Stringent regulatory framework

5.2.3 OPPORTUNITIES

5.2.3.1 Developing countries emerge as strong consumers of feed premixes

5.2.4 CHALLENGES

5.2.4.1 Identify and adapt to local customer requirements

5.2.4.2 Sustainability of feed and livestock chain

5.3 RAW MATERIAL ANALYSIS

5.3.1 TOTAL PRODUCTION OF FEED INGREDIENTS AND THEIR USAGE IN FEED

FIGURE 39 TOTAL CORN PRODUCTION AND USAGE IN FEED, 2006–2018 (KT)

FIGURE 40 TOTAL WHEAT PRODUCTION AND USAGE IN FEED, 2006–2018 (KT)

FIGURE 41 TOTAL BARLEY PRODUCTION AND USAGE IN FEED, 2006–2018 (KT)

FIGURE 42 TOTAL SORGHUM PRODUCTION AND USAGE IN FEED, 2006–2018 (KT)

FIGURE 43 TOTAL OATS PRODUCTION AND USAGE IN FEED, 2006–2018 (KT)

FIGURE 44 TOTAL PRODUCTION AND USAGE IN FEED, 2006–2018 (KT)

FIGURE 45 TOTAL MILLET PRODUCTION AND USAGE IN FEED, 2006–2018 (KT)

5.4 IMPACT OF COVID-19

5.5 EFFECT ON GLOBAL MEAT CONSUMPTION

5.6 EFFECTS ON ANIMAL HEALTH

5.7 EFFECTS ON FEED CONSUMPTION

5.8 REGULATORY ENVIRONMENT

5.8.1 EUROPEAN UNION

5.8.2 US

5.8.3 CHINA

5.8.4 CANADA

6 INDUSTRY TRENDS (Page No. - 81)

6.1 INTRODUCTION

6.2 TECHNOLOGY ANALYSIS

6.2.1 AGGLOMERATION (PELLETIZING)

6.3 PRICING ANALYSIS

TABLE 4 MARKET PRICE ANALYSIS

FIGURE 46 PRICE ANALYSIS OF FEED RAW MATERIALS, 2006–2017 (USD/MT)

6.4 PATENT ANALYSIS

FIGURE 47 NUMBER OF PATENTS GRANTED IN A YEAR OVER THE LAST 10 YEARS

FIGURE 48 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 5 SOME OF THE PATENTS PERTAINING TO FEED PREMIX, 2019–2020

TABLE 6 COMPANY MARKET ECOSYSTEM

6.5 ADJACENT MARKET SCENARIO

FIGURE 49 COMPOUND FEED PRODUCTION SHARE (VOLUME), BY KEY COUNTRY/REGION, 2016

FIGURE 50 ANIMAL FEED CONSUMED, BY LIVESTOCK, 2016 (MILLION TON)

FIGURE 51 GLOBAL LIVESTOCK PRODUCTION INDEX, 2000–2013

6.6 YC & YCC SHIFT

FIGURE 52 YC & YCC SHIFT: FEED PREMIX

6.7 VALUE CHAIN ANALYSIS

FIGURE 53 R&D AND RAW MATERIALS & MANUFACTURING: MAJOR PHASES OF VALUE ADDITION

6.7.1 R&D OF PRODUCT

6.7.2 RAW MATERIALS & MANUFACTURING

6.7.3 ASSEMBLY

6.7.4 DISTRIBUTION

6.7.5 MARKETING & SALES

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET SIZE FOR FEED PREMIX, PORTERS FIVE FORCES ANALYSIS

6.8.1 DEGREE OF COMPETITION

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT OF NEW ENTRANTS

6.9 CASE STUDIES

6.9.1 USE CASE 1

TABLE 8 GROWING INNOVATIONS FOR DEMAND FOR NUTRIENTS IN ANIMAL DIET IS PROJECTED TO FUEL THE DEMAND FOR FEED PREMIXES

6.9.2 USE CASE 2

TABLE 9 GROWING DEMAND FROM ASIA PACIFIC REGION FOR DIETS WITH FEED PREMIX FOR LIVESTOCK

7 FEED PREMIX MARKET, BY INGREDIENT TYPE (Page No. - 91)

7.1 INTRODUCTION

FIGURE 54 AMINO ACIDS TO BE THE FASTEST-GROWING SEGMENT IN THE GLOBAL MARKET, 2021 VS. 2026 (USD MILLION)

7.2 INGREDIENT TYPE: FEED PREMIX, MARKET DRIVERS

7.3 COVID-19 IMPACT ON THE FEED PREMIX MARKET, BY LIVESTOCK

7.3.1 REALISTIC SCENARIO

TABLE 10 REALISTIC SCENARIO: MARKET SIZE FOR FEED PREMIX, BY INGREDIENT TYPE, 2021–2026(USD MILLION)

7.3.2 OPTIMISTIC SCENARIO

TABLE 11 OPTIMISTIC SCENARIO: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

7.3.3 PESSIMISTIC SCENARIO

TABLE 12 PESSIMISTIC SCENARIO: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026(USD MILLION)

TABLE 13 MARKET SIZE FOR FEED PREMIX, BY INGREDIENT TYPE, 2017–2020 (USD MILLION)

TABLE 14 MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

TABLE 15 MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (KT)

TABLE 16 MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (KT)

7.4 VITAMINS

7.4.1 VITAMINS ARE ORGANIC SUBSTANCES THAT ARE ESSENTIAL TO THE NORMAL METABOLIC PROCESSES OF ANIMAL ORGANISMS

TABLE 17 VITAMIN CLASSIFICATIONS AND FUNCTIONS IN ANIMAL NUTRITION

TABLE 18 VITAMIN FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 20 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 21 MARKET SIZE, BY REGION, 2021–2026 (KT)

7.5 MINERALS

7.5.1 TRACE ELEMENTS, SUCH AS ZINC, COPPER, AND MANGANESE, ARE ESSENTIAL IN A BALANCED DIET FOR IMPROVED HEALTH AND PRODUCTIVITY IN ANIMALS

TABLE 22 MINERAL FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 24 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 25 MARKET SIZE, BY REGION, 2021–2026 (KT)

7.6 AMINO ACIDS

7.6.1 AMINO ACIDS HELP ANIMALS MAINTAIN ITS BALANCE TO MAXIMIZE THE GROWTH PERFORMANCE AND NITROGEN RETENTION IN THE LIVESTOCK

FIGURE 55 ASIA PACIFIC IS THE LARGEST MARKET FOR AMINO ACIDS FEED PREMIXES

TABLE 26 AMINO ACID FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 28 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 29 MARKET SIZE, BY REGION, 2021–2026 (KT)

7.7 ANTIBIOTICS

7.7.1 THE USE OF ANTIBIOTICS AS GROWTH PROMOTERS LEADS TO ENHANCED DAILY GROWTH RATES OF ANIMALS

TABLE 30 ANTIBIOTIC FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 32 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 33 MARKET SIZE, BY REGION, 2021–2026 (KT)

7.8 ANTIOXIDANTS

7.8.1 ANTIOXIDANTS CONSERVE THE ESSENTIAL NUTRIENTS AND IMPROVE THEIR UTILIZATION BY ANIMALS

7.8.2 BHA

7.8.3 BHT

7.8.4 ETHOXYQUIN

TABLE 34 ANTIOXIDANT FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 37 MARKET SIZE, BY REGION, 2021–2026 (KT)

7.9 OTHERS

7.9.1 FIBERS

7.9.2 NUCLEOTIDES

TABLE 38 OTHER FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 40 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 41 MARKET SIZE, BY REGION, 2021–2026 (KT)

8 FEED PREMIX MARKET, BY FORM (Page No. - 110)

8.1 INTRODUCTION

FIGURE 56 MARKET SHARE, BY FORM, 2020 VS. 2026 (USD MILLION)

8.2 COVID-19 IMPACT ON THE GLOBAL MARKET

8.2.1 REALISTIC SCENARIO: COVID-19 IMPACT ON THE FEED PREMIX MARKET SIZE (USD MILLION)

TABLE 42 REALISTIC SCENARIO: FEED PREMIX MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

8.2.2 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FEED PREMIX MARKET SIZE (USD MILLION)

TABLE 43 OPTIMISTIC SCENARIO: MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FEED PREMIX MARKET SIZE (USD MILLION)

TABLE 44 PESSIMISTIC SCENARIO: MARKET SIZE FOR FEED PREMIX, BY FORM, 2019–2022 (USD MILLION)

TABLE 45 MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 46 MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 47 MARKET SIZE, BY FORM, 2017–2020 (KT)

TABLE 48 MARKET SIZE, BY FORM, 2021–2026 (KT)

8.3 DRY

8.3.1 EASY HANDLING, STORABILITY, AND USAGE IN A WIDE RANGE OF LIVESTOCK APPLICATIONS TO DRIVE THE DRY SEGMENT

TABLE 49 DRY: MARKET SIZE FOR FEED PREMIX, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 DRY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 DRY: MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 52 DRY: MARKET SIZE, BY REGION, 2021–2026 (KT)

8.4 LIQUID

8.4.1 UNAVAILABILITY OF LIQUID FEED PREMIXES IN COUNTRIES IN REST OF THE WORLD TO LEAD TO SMALLER SHARE OF THIS SEGMENT

TABLE 53 LIQUID: FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 LIQUID: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 LIQUID: MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 56 LIQUID: MARKET SIZE, BY REGION, 2021–2026 (KT)

9 FEED PREMIX MARKET, BY LIVESTOCK (Page No. - 117)

9.1 INTRODUCTION

FIGURE 57 POULTRY: THE LARGEST FEED PREMIX SEGMENT, 2021 VS. 2026 (USD MILLION)

TABLE 57 MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 58 MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 59 MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 60 MARKET SIZE, BY LIVESTOCK, 2021–2026(KT)

9.2 LIVESTOCK: FEED PREMIX, MARKET DRIVERS

9.3 COVID-19 IMPACT ON GLOBAL MARKET, BY LIVESTOCK

9.3.1 REALISTIC SCENARIO

TABLE 61 REALISTIC SCENARIO: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2021–2026(USD MILLION)

9.3.2 OPTIMISTIC SCENARIO

TABLE 62 OPTIMISTIC SCENARIO: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

9.3.3 PESSIMISTIC SCENARIO

TABLE 63 PESSIMISTIC SCENARIO: MARKET SIZE, BY LIVESTOCK, 2021–2026(USD MILLION)

9.4 POULTRY

9.4.1 FEED PREMIXES SUCH AS VITAMINS, MINERALS, AND AMINO ACIDS ARE THE MAJOR PREMIXES USED IN POULTRY FEED FOR IMPROVED QUALITY PRODUCTION

FIGURE 58 ASIA PACIFIC: THE LARGEST MARKET FOR POULTRY FEED PREMIX, 2021 VS. 2026 (USD MILLION)

TABLE 64 FEED PREMIX MARKET SIZE FOR POULTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET SIZE FOR POULTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 FEED PREMIX MARKET SIZE FOR POULTRY, BY REGION, 2017–2020 (KT)

TABLE 67 MARKET SIZE FOR POULTRY, BY REGION, 2021–2026 (KT)

9.5 RUMINANTS

9.5.1 MINERALS ARE FED TO RUMINANTS DUE TO SEVERAL ADVANTAGES AND HEALTH BENEFITS

TABLE 68 MARKET SIZE FOR RUMINANTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 FEED PREMIX MARKET SIZE FOR RUMINANTS, BY REGION, 2021–2026 (USD MILLION)

TABLE 70 MARKET SIZE FOR RUMINANTS, BY REGION, 2017–2020 (KT)

TABLE 71 MARKET SIZE FOR RUMINANTS, BY REGION, 2021–2026 (KT)

9.6 SWINE

9.6.1 ADDITIVES HELP IN INCREASING THE FEED INTAKE, REPRODUCTIVITY, AND GROWTH PERFORMANCE

TABLE 72 MARKET SIZE FOR SWINE, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET SIZE FOR SWINE, BY REGION, 2021–2026 (USD MILLION)

TABLE 74 SWINE: FEED PREMIX MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 75 SWINE: MARKET SIZE, BY REGION, 2021–2026 (KT)

9.7 AQUATIC ANIMALS

9.7.1 VITAMIN B COMPLEX AND VITAMIN C PLAY AN IMPORTANT ROLE IN THE NORMAL FUNCTIONING OF MARINE ANIMALS

TABLE 76 FEED PREMIX MARKET SIZE FOR AQUATIC ANIMALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 MARKET SIZE FOR AQUATIC ANIMALS, BY REGION, 2021–2026 (USD MILLION)

TABLE 78 MARKET SIZE FOR AQUATIC ANIMALS, BY REGION, 2017–2020 (KT)

TABLE 79 MARKET SIZE FOR AQUATIC ANIMALS, BY REGION, 2021–2026 (KT)

9.8 EQUINE

9.8.1 THE ADDITION OF THESE PREMIXES IMPROVES THE FEED QUALITY BY INCREASING FEED INTAKE AND PROTECTING THE FEED QUALITY

TABLE 80 MARKET SIZE FOR EQUINE, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 MARKET SIZE FOR EQUINE, BY REGION, 2021–2026 (USD MILLION)

TABLE 82 MARKET SIZE FOR EQUINE, BY REGION, 2017–2020 (KT)

TABLE 83 MARKET SIZE FOR EQUINE, BY REGION, 2021–2026 (KT)

9.9 PETS

9.9.1 PREMIXES HELP IN THE DEVELOPMENT OF BONES ENHANCE THE METABOLISM AMONG LIVESTOCK AND CONTRIBUTE TO THE GROWTH OF IMMUNE AND REPRODUCTIVE SYSTEMS

TABLE 84 MARKET SIZE FOR PETS, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 MARKET SIZE FOR PETS, BY REGION, 2021–2026 (USD MILLION)

TABLE 86 MARKET SIZE FOR PETS, BY REGION, 2017–2020 (KT)

TABLE 87 MARKET SIZE FOR PETS, BY REGION, 2021–2026 (KT)

10 FEED PREMIX MARKET, BY REGION (Page No. - 134)

10.1 INTRODUCTION

TABLE 88 MARKET SIZE FOR FEED PREMIX, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 90 MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 91 MARKET SIZE, BY REGION, 2021–2026 (KT)

FIGURE 59 MARKET SHARE, BY KEY COUNTRY, 2020

10.2 COVID-19 IMPACT ON THE GLOBAL MARKET

10.2.1 REALISTIC SCENARIO: COVID-19 IMPACT ON THE FEED PREMIX MARKET SIZE (USD MILLION)

TABLE 92 REALISTIC SCENARIO: FEED PREMIX MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

10.2.2 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FEED PREMIX MARKET SIZE (USD MILLION)

TABLE 93 OPTIMISTIC SCENARIO: MARKET SIZE FOR FEED PREMIX, BY REGION, 2019–2022 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FEED PREMIX MARKET SIZE (USD MILLION)

TABLE 94 PESSIMISTIC: FEED PREMIX MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

10.3 NORTH AMERICA

TABLE 95 NORTH AMERICA: THE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (KT)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (KT)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (KT)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (KT)

10.3.1 US

10.3.1.1 Demand for poultry meat & poultry products and swine meat to grow

TABLE 111 US: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 112 US: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 113 US: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 114 US: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.3.2 CANADA

10.3.2.1 Advantages of lower feed cost due to the small biofuel industry allows more grain input in livestock breeding

TABLE 115 CANADA: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 117 CANADA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 118 CANADA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4 EUROPE

TABLE 119 EUROPE: FEED PREMIX MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 122 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 123 EUROPE: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (KT)

TABLE 126 EUROPE: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (KT)

TABLE 127 EUROPE: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 130 EUROPE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

TABLE 131 EUROPE: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY FORM, 2017–2020 (KT)

TABLE 134 EUROPE: MARKET SIZE, BY FORM, 2021–2026 (KT)

10.4.1 RUSSIA

10.4.1.1 Significant growth in the Russian meat industry to increase the consumption of feed premixes

TABLE 135 RUSSIA: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 136 RUSSIA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 137 RUSSIA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 138 RUSSIA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4.2 FRANCE

10.4.2.1 Increased demand for meat products

TABLE 139 FRANCE: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 140 FRANCE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 141 FRANCE: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 142 FRANCE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4.3 ITALY

10.4.3.1 According to Eurostat data 2017, Italy has a large livestock population

TABLE 143 ITALY: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 144 ITALY: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 145 ITALY: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 146 ITALY: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4.4 UK

10.4.4.1 Adoption of mega-farms and intensive factory farming solutions for cattle, poultry, and swine

TABLE 147 UK: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 148 UK: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 149 UK: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 150 UK: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4.5 SPAIN

10.4.5.1 Increase in the usage of feed premixes to drive the demand for meat and dairy products

TABLE 151 SPAIN: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 152 SPAIN: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 153 SPAIN: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 154 SPAIN: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4.6 GERMANY

10.4.6.1 Adoption of advanced technology in the livestock industry to increase the use of scientific methods livestock production

TABLE 155 GERMANY: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 156 GERMANY: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 157 GERMANY: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 158 GERMANY: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4.7 NETHERLANDS

10.4.7.1 Meat products from the poultry, beef, and fish industries to witness a high demand

TABLE 159 NETHERLANDS: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 160 NETHERLANDS: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 161 NETHERLANDS: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 162 NETHERLANDS: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.4.8 REST OF EUROPE

10.4.8.1 Growth of the livestock industry in the region due to the increased awareness about the benefits of feed additives among livestock producers

TABLE 163 REST OF EUROPE: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 164 REST OF EUROPE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 165 REST OF EUROPE: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 166 REST OF EUROPE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.5 ASIA PACIFIC

FIGURE 60 ASIA PACIFIC: FEED PREMIX MARKET SNAPSHOT

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (KT)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (KT)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2020 (KT)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2026 (KT)

10.5.1 CHINA

10.5.1.1 To reduce the incidence of disease outbreaks, farmers focus on the nutritional needs of livestock in their early life stages

TABLE 183 CHINA: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 184 CHINA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 185 CHINA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 186 CHINA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.5.2 INDIA

10.5.2.1 The feed industry to grow in the next six years in tandem with the country’s livestock sector

TABLE 187 INDIA: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 188 INDIA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 189 INDIA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 190 INDIA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.5.3 JAPAN

10.5.3.1 Stability in feed prices encourages farmers to increase the value-added to feed products to improve feed safety and quality

TABLE 191 JAPAN: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 192 JAPAN: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 193 JAPAN: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 194 JAPAN: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.5.4 SOUTH KOREA

10.5.4.1 Increasing feed production to have a proportional impact on the consumption of feed premix

TABLE 195 SOUTH KOREA: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 196 SOUTH KOREA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 197 SOUTH KOREA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 198 SOUTH KOREA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.5.5 AUSTRALIA & NEW ZEALAND

10.5.5.1 The meat processing industry in Australia & New Zealand to witness significant growth due to the low cost of operations

TABLE 199 AUSTRALIA & NEW ZEALAND: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 200 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 201 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 202 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.5.6 REST OF ASIA PACIFIC

10.5.6.1 Commercialization of livestock due to the increase in demand for livestock products to result in significant changes in feed patterns

TABLE 203 REST OF ASIA PACIFIC: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 204 REST OF ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 206 REST OF ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.6 LATIN AMERICA

FIGURE 61 SOUTH AMERICA: FEED PREMIX MARKET SNAPSHOT, 2020

TABLE 207 LATIN AMERICA: MARKET SIZE FOR FEED PREMIX, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 210 LATIN AMERICA:MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (KT)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (KT)

TABLE 215 LATIN AMERICA:MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 218 LATIN AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

TABLE 219 LATIN AMERICA: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 221 LATIN AMERICA:MARKET SIZE, BY FORM, 2017–2020 (KT)

TABLE 222 LATIN AMERICA: MARKET SIZE, BY FORM, 2021–2026 (KT)

10.6.1 BRAZIL

10.6.1.1 Lucrative opportunities for feed premix manufacturers in the poultry and aquafeed industries

TABLE 223 BRAZIL: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 224 BRAZIL: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 225 BRAZIL: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 226 BRAZIL: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.6.2 ARGENTINA

10.6.2.1 Export opportunities from poultry to boost the sales of feed premixes

TABLE 227 ARGENTINA: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 228 ARGENTINA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 229 ARGENTINA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 230 ARGENTINA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.6.3 MEXICO

10.6.3.1 Lucrative opportunity for premix manufacturers in the poultry industry

TABLE 231 MEXICO: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 232 MEXICO: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 233 MEXICO: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 234 MEXICO: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.6.4 REST OF LATIN AMERICA

10.6.4.1 Rise in demand for livestock-based products in the region and steady increase in the industrialization of livestock rearing to drive the market growth

TABLE 235 REST OF LATIN AMERICA: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 236 REST OF LATIN AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 237 REST OF LATIN AMERICA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 238 REST OF LATIN AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.7 ROW

TABLE 239 REST OF THE WORLD: MARKET SIZE FOR FEED PREMIX, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 240 ROW: FEED PREMIX MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 241 ROW: MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 242 ROW:MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 243 ROW: FEED PREMIX MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (USD MILLION)

TABLE 244 ROW:MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (USD MILLION)

TABLE 245 ROW: MARKET SIZE, BY INGREDIENT TYPE, 2017–2020 (KT)

TABLE 246 ROW: MARKET SIZE, BY INGREDIENT TYPE, 2021–2026 (KT)

TABLE 247 ROW: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 248 ROW: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 249 ROW: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 250 ROW: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

TABLE 251 ROW: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 252 ROW: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 253 ROW: MARKET SIZE, BY FORM, 2017–2020 (KT)

TABLE 254 ROW: MARKET SIZE, BY FORM, 2021–2026 (KT)

10.7.1 MIDDLE EAST

10.7.1.1 Countries such as Saudi Arabia to be the key revenue generators due to the high consumption of poultry products

TABLE 255 MIDDLE EAST: MARKET SIZE FOR FEED PREMIX, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 256 MIDDLE EAST: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 257 MIDDLE EAST: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 258 MIDDLE EAST:MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

10.7.2 AFRICA

10.7.2.1 Rise in population to drive the demand for animal protein sources

TABLE 259 AFRICA: FEED PREMIX MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 260 AFRICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 261 AFRICA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (KT)

TABLE 262 AFRICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (KT)

11 COMPETITIVE LANDSCAPE (Page No. - 215)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

TABLE 263 FEED PREMIX MARKET: DEGREE OF COMPETITION

11.3 KEY PLAYER STRATEGIES

11.4 MAJOR PLAYERS, 2020

11.5 REVENUE ANALYSIS, 2016-2020

11.6 COVID-19-SPECIFIC COMPANY RESPONSES

11.7 COMPANY EVALUATION QUADRANT: DEFINITIONS & METHODOLOGY (OVERALL MARKET)

11.7.1 STARS

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE PLAYERS

11.7.4 PARTICIPANTS

FIGURE 62 MARKET FOR FEED PREMIX : COMPANY EVALUATION QUADRANT, 2019 (OVERALL MARKET)

11.8 PRODUCT FOOTPRINT

TABLE 264 FEED PREMIX MARKET: COMPANY TYPE FOOTPRINT

TABLE 265 COMPANY APPLICATION FOOTPRINT

11.9 REGIONAL FOOTPRINT

TABLE 266 MARKET FOR FEED PREMIX: COMPANY REGION FOOTPRINT

TABLE 267 COMPANY FOOTPRINT

11.10 COMPANY EVALUATION QUADRANT (START-UP/SME)

11.10.1 PROGRESSIVE COMPANIES

11.10.2 STARTING BLOCKS

11.10.3 RESPONSIVE COMPANIES

11.10.4 DYNAMIC COMPANIES

FIGURE 63 FEED PREMIX MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SME)

11.11 COMPETITIVE SCENARIO

11.11.1 NEW PRODUCT LAUNCHES

TABLE 268 NEW PRODUCT LAUNCHES, 2017-2020

11.11.2 DEALS

TABLE 269 DEALS, 2018–2021

11.11.3 OTHERS

TABLE 270 OTHERS, 2018–2020

12 COMPANY PROFILES (Page No. - 233)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 KONINKLIJKE DSM NV

TABLE 271 KONINKLIJKE DSM N.V: BUSINESS OVERVIEW

FIGURE 64 N.V: COMPANY SNAPSHOT

TABLE 272 FOLLOWING ARE THE DEALS BY THIS COMPANY IN THIS MARKET:

12.2 NUTRECO N. V.

TABLE 273 NUTRECO N.V.: BUSINESS OVERVIEW

12.3 CARGILL INCORPORATED

TABLE 274 CARGILL: BUSINESS OVERVIEW

FIGURE 65 CARGILL: COMPANY SNAPSHOT

12.4 ARCHER DANIELS MIDLAND

TABLE 275 ARCHER DANIELS MIDLAND: BUSINESS OVERVIEW

FIGURE 66 ARCHER DANIELS MIDLAND: COMPANY SNAPSHOT

12.5 BEC FEED SOLUTIONS

TABLE 276 BEC FEED SOLUTIONS: BUSINESS OVERVIEW

12.6 DLG GROUP

TABLE 277 DLG GROUP: BUSINESS OVERVIEW

FIGURE 67 DLG GROUP: COMPANY SNAPSHOT

12.7 CHAROEN POKPHAND FOODS PCL

TABLE 278 CHAROEN POKPHAND FOODS PCL: BUSINESS OVERVIEW

FIGURE 68 CHAROEN POKPHAND FOODS PCL: COMPANY SNAPSHOT

12.8 LEXINGTON

TABLE 284 LEXINGTON: BUSINESS OVERVIEW

12.9 DE HEUS ANIMAL NUTRITION

TABLE 285 DE HEUS ANIMAL NUTRITION: BUSINESS OVERVIEW

12.10 MEGAMIX

TABLE 286 MEGAMIX: BUSINESS OVERVIEW

12.11 AGROFEED LTD.

TABLE 287 AGROFEED LTD.: BUSINESS OVERVIEW

12.12 CLADAN

TABLE 288 CLADAN: BUSINESS OVERVIEW

12.13 KAESLER NUTRITION

TABLE 289 KAESLER NUTRITION: BUSINESS OVERVIEW

12.14 AVITECH NUTRITION PVT. LTD

TABLE 290 AVITECH NUTRITION PVT. LTD.: BUSINESS OVERVIEW

12.15 ADVANCED ANIMAL NUTRITION

TABLE 291 ADVANCED ANIMAL NUTRITION: BUSINESS OVERVIEW

12.16 ASSOCIATED BRITISH FOODS

TABLE 292 ASSOCIATED BRITISH FOODS: BUSINESS OVERVIEW

FIGURE 72 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

12.17 ADVANCED ENZYME TECHNOLOGIES

TABLE 293 ADVANCED ENZYME TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 73 ADVANCED ENZYME TECHNOLOGIES: COMPANY SNAPSHOT

12.18 KEMIN INDUSTRIES

TABLE 294 KEMIN INDUSTRIES: BUSINESS OVERVIEW

12.19 NOVUS INTERNATIONAL

TABLE 295 NOVUS INTERNATIONAL: BUSINESS OVERVIEW

12.20 ALLTECH

TABLE 296 ALLTECH: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKETS (Page No. - 299)

13.1 INTRODUCTION

13.1.1 RELATED REPORT

TABLE 297 ADJACENT MARKETS TO FEED PREMIXES

13.2 LIMITATIONS

13.3 FEED ADDITIVES MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

FIGURE 74 FEED ADDITIVES MARKET SIZE, 2018–2023 (USD MILLION)

TABLE 298 FEED ADDITIVES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14 APPENDIX (Page No. - 301)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

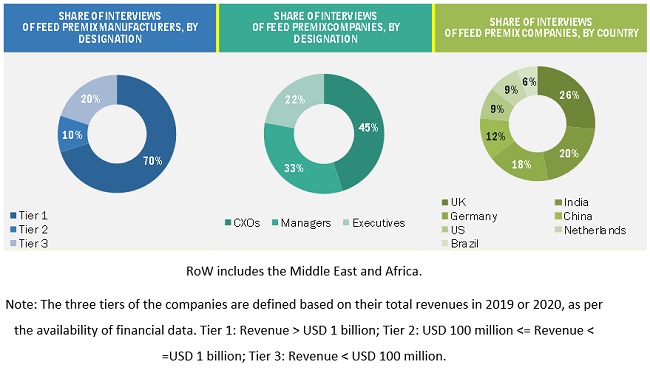

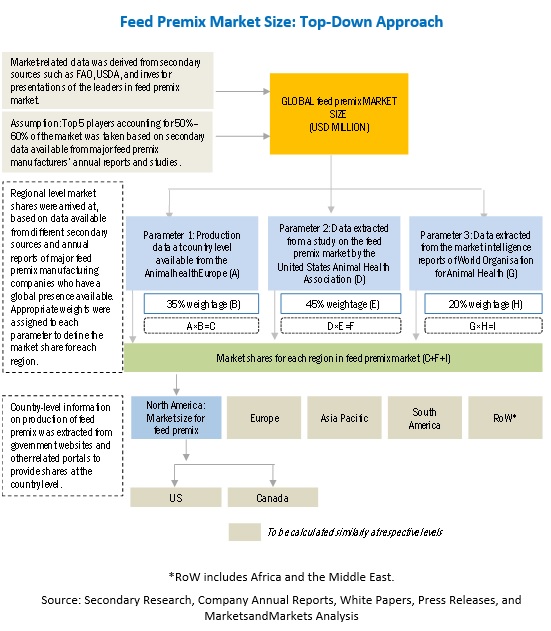

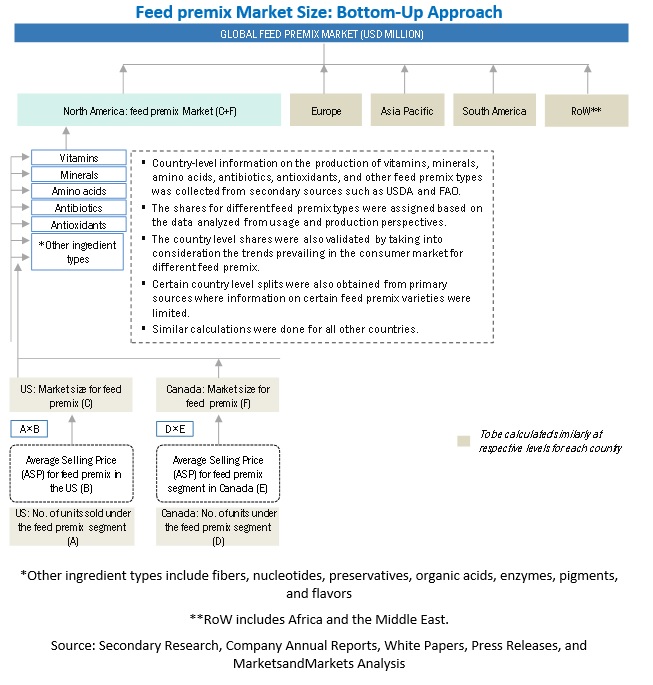

The study involves four major activities to estimate the current size of the feed premix market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The market comprises several stakeholders such as feed manufacturers, feed premix manufacturers wholesalers, traders, research institutes and organization, and regulatory bodies such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), Food Safety Authority of Ireland (FSAI), The Organic Trade Association (OTA), Food and Agriculture Organization (FAO) and Animal Feed Manufacturers Association (AFMA).

The demand side is comprised of strong demand from the various end-user markets, confectionary producers, and convenience food manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Feed Premix Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed premix market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

Geographic Analysis

- Further breakdown of the Rest of Europe market for feed premix which includes countries such as Ireland, Greece, Poland, Austria, and Ukraine.

- Further breakdown of the Rest of Asia Pacific market for Feed premix, which includes countries such as Indonesia, the Philippines, Vietnam, Malaysia, and Thailand.

- Further breakdown of the Rest of Latin America market for Feed premix which includes countries such as Peru, Chile, Colombia, Ecuador, and other Latin American countries.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Feed Premix Market