Flexible Heater Market by Type (Silicone Rubber, Polyimide, Polyester, Mica), Industry (Electronics & Semiconductor, Medical, Aerospace, Automotive & Transportation, Food & Beverages, Oil & Gas) and Region - Global Forecast to 2027

Updated on : October 23, 2024

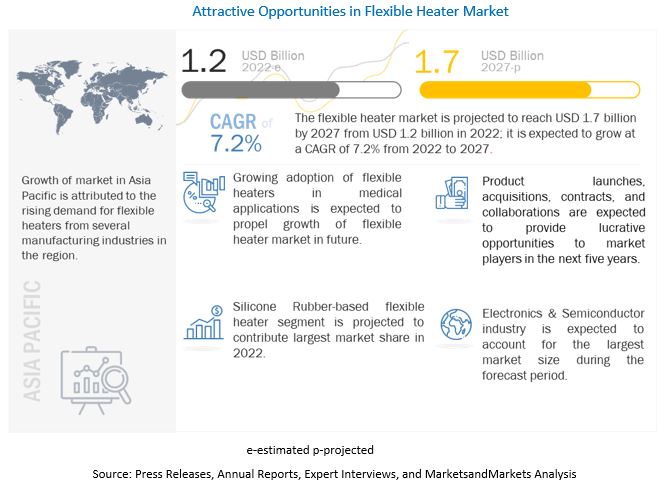

The Flexible heater market size is anticipated to grow from USD 1.2 billion in 2022 to USD 1.7 billion by 2027, growing at a CAGR of 7.2% during the forecast period from 2022 to 2027.

Rising requirements for innovative heating solutions, focus of OEMs on providing novel and efficient flexible heaters due to surging demand in medical, electronics & semiconductor, automotive & transportation and oil & gas industries are some of the major factors propelling the growth of flexible heater industry.

To know about the assumptions considered for the study, Request for Free Sample Report

The market growth market will be showing significant growth due to its various applications in several industries such as automotive & transportation, electronics & semiconductors, aerospace, medical and so on.Various OEMs adapting different strategies such as acquisitions, product launches, sales contracts and so on are driving the growth of flexible heater market.

Market Dynamics

Driver: Broad scope of applications in several industries specially in aerospace and automotive

Flexible heaters can be used in various application environments in aerospace and automotive & transportation. Flexible heaters are used in commercial aircraft systems as well as in various subsystems, such as in fuel tanks/pipes, battery heaters, and fluid delivery and control systems (for stabilizing temperature). They are also used in acquisition systems; vehicle and vessel lighting; water system; fuel cell; bulk cargo; pilot tube; and missile systems and guided munitions. The increasing infrastructural developments as well as rising demand for aircraft systems due to various technological developments in aerospace industry in several countries, such as the US, China, and India, is expected to further drive the flexible heater market in aerospace industry during the forecast period. Furthermore, the rising demand for automotive industry is also paving way for novel flexible heater production. In the automotive industry, flexible heaters are used in various applications, such as battery warmers, safety vision system cameras, steering wheels, and under-floor heating. They are also widely used in side-view mirrors to facilitate melting of ice and snow and to prevent condensation. These heaters are used in hand gloves while operating a snowmobiles and in the tanks on trains to prevent freezing. In addition to this, trends in EVs and HEVs is also expected to boost the market of flexible heaters in the said industry.

Restraint: Requirements of extensive operational costs

Flexible heaters consume power during heating operation; this makes the cost of electricity a major component of the overall operational cost of these heaters. Moreover, the cost of electricity is rising to greater levels year-over-year in response to the growing global energy demand. This leads to higher operational costs of flexible heaters. In addition, the flexible heaters with improved energy efficiency offer a significant advantage over less efficient legacy products. Adding a thermal insulation layer to the flexible heater improves energy efficiency by preventing heat transfer between the heater and ambient atmosphere surrounding it. The availability of thermal insulation layers in some types of flexible heaters, such as silicone-based, significantly reduces heat loss by ~50%. This results in at least 50% less power consumption for such flexible heaters in operation.

Opportunity: Unfolding applications of flexible heaters in oil & gas and petrochemical industries

Industries such as building and construction, oil & gas, automotive, packaging, metals & mining, and chemical processing are utilizing flexible heaters in a wide range of applications. For instance, in the building and construction industry, flexible heaters are primarily being used in pipe freeze protection, hot water temperature maintenance, roof and gutter deicing, surface snow melting, frost heave prevention, and fire protection system piping. Similarly, in the oil & gas industry, flexible heaters are used in offshore drilling, enhanced oil recovery, downhole heating and steam-assisted gravity drainage, and hydraulic fracturing. The growth of the building and construction, and oil & gas industries is thus expected to impact the flexible heater market positively during the forecasted period

Challenge: Employment of flexible heaters in rugged environments

The application areas of flexible heaters range from oil & gas to healthcare industries. The oil & gas industry is known for its rugged and harsh environment, whereas the healthcare industry involves delicate handling of things, and depends upon the reliable and accurate results from medical devices. Therefore, the manufacturers of flexible heaters need to consider the requirements of different industries, while designing and developing flexible heaters. An ideal flexible heater is expected to be rugged, reliable, accurate, and moisture and chemical resistant. Thus, the manufacturers face challenges while developing flexible heaters that may sustain in the different industrial environments.

Silicone-rubber based type segment is expected to have the largest size of the flexible heater market in 2021.

The market for silicone rubber-based type held the largest share of the overall market in 2021. This type is also expected to grow at the fastest CAGR during the forecast period. Silicone rubber-based flexible heaters are used in semiconductor systems such as IC test handling equipment, plasma etch systems, photo-resist track systems and probing stations as well as in electronics appliances such as coffee maker, refrigeration equipment and wax maker. Increasing demand for such systems is expected to drive the silicone rubber-based flexible heater market towards highest growth during the forecast period. Also. due to their flexibility, faster warm-ups, improved heat transfers, and decreased wattage requirements, the demand for silicone rubber-based heaters is growing exponentially, witnessing the increased demand in electronics & semiconductor as well as medical industries.

The market for electronics & semiconductor is expected account largest market share and grow at a higher CAGR during the forecast period.

The electronics & semiconductor segment is projected to grow at the highest CAGR accounting largest market share during the forecast period. In the electronic & semiconductor industry, flexible heaters are used in semiconductor manufacturing equipment as heat is a critical factor in processing and testing of semiconductors. Flexible heaters are also used in different indoor and outdoor general electronics such as in coffee maker, wax maker, vending machine, ATM machine, LCD screen, computer memory, 3D printing, copy machines, guidance systems, surveillance & security systems outdoor antennas, electrical instrumentation, handheld scanners and electronics printing systems. In the telecommunications industry, flexible heaters are used to keep electronics, fiber optics, and amplifiers operating optimally for 15+ years in above or below-ground enclosures. All these applications are expected to drive the growth of flexible heater market in electronics & semiconductor industry

To know about the assumptions considered for the study, download the pdf brochure

The flexible heater market in Asia Pacific to grow at the highest CAGR during the forecast period.

Asia Pacific is expected to be the largest contributor to flexible heater market during the forecast period. Rapid industrialization and infrastructure developments are driving the growth of electronics and automotive industries in China that is expected to increase the demand for flexible heaters in the region. The electronics, semiconductor, and automotive industries are in the leading position in Asia Pacific, and the market for the medical device and food equipment manufacturing is expected to grow at the fastest rate in this region in the upcoming years. The economic growth of the region and the lower operating costs in countries such as China and India are expected to drive the demand for flexible heaters in Asia Pacific.Also, the surging demand for electronics and automotive due to EVs and HEVs as well as other industrial activities in the region will drive huge demand for flexible heater market in Asia Pacific.

Key Market Players

The flexible heater market’s players have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships, and acquisitions to strengthen their offerings in the market. The major players in the flexible heater companies are Honeywell International (US), NIBE Industrier (Sweden), Omega Engineering (US), Watlow Electric Manufacturing (US) and Smiths Group (UK) among others.

The study includes an in-depth competitive analysis of these key players in the flexible heater market with their company profiles, recent developments, and key market strategies.

Flexible Heater Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 1.2 billion in 2022 |

| Projected Market Size | 1.7 billion by 2027 |

| Growth Rate | CAGR of 7.2% |

|

Years considered |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

Type, Distribution Channel, Industry and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

NIBE Industrier(Sweden), Honeywell International(US), Omega Engineering(US), Watlow Electric Manfacturing(UK) and Smiths Group(UK) |

In this report, the overall flexible heater market has been segmented based on type, distribution channel, industry and region.

By Type

- Silicone Rubber-based

- Polyimide-based

- Polyester-based

- Mica-based

- Others

By Distribution Channel

- Direct

- Indirect

By Industry

- Medical

- Automotive

- Food & Beverages

- Electronics & Semiconductor

- Aerospace

- Oil & Gas

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

-

Middle East

- Saudi Arabia

- UAE

- Rest of Middle East

- Africa

- South America

-

Middle East

Recent Developments

- In October 2021, Rogers Corporation acquires Silicone Engineering Ltd., a leading manufacturer of silicone material solution for application in the industrial heater, medical and other markets. Silicone Engineering will provide Rogers center of excellence to service customer requiring premium silicone solutions

- In February 2020, Elektrotermija was acquired by Backer AB which is member of NIBE group. The company develops and manufactures intelligent, energy-efficient indoor comfort solutions. Elecktrotermija is a producer of electric heaters and devices based out of Serbia.

- In August 2020, All Flex Flexible Circuits Inc announced etched foil heaters solutions. The need for higher wattage heater other than traditional Kapton, polyimide, or silicone rubber for medical diagnostics is fulfilled by etched foil heaters solution launched by All Flex.

Frequently Asked Questions (FAQs):

What is the market size of Flexible heater market expected in 2022?

The Flexible heater market is expected to be valued at USD 1.2 billion in 2022.

What is the total CAGR expected to be recorded for the Flexible heater market during 2022-2027?

The global Flexible heater market is expected to record a CAGR of 7.2% from 2022–2027.

Which are the top players in the Flexible heater market?

The major vendors operating in the Flexible heater market include Honeywell International (US), NIBE Industrier (Sweden), Omega Engineering (US), Watlow Electric Manufacturing (US) and Smiths Group (UK) among others.

Which major countries are considered in the North American region?

The report includes an analysis of the US, Canada, and Mexico countries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 FLEXIBLE HEATER MARKET: SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 INTRODUCTION

FIGURE 2 MARKET: RESEARCH DESIGN

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 List of major secondary sources

2.2.1.2 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary interviews with experts

2.2.2.2 Key data from primary sources

2.2.2.3 Key industry insights

2.2.2.4 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for arriving at market size using top-down analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 RESEARCH LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 7 FLEXIBLE HEATER MARKET, 2018–2027 (USD MILLION)

FIGURE 8 SILICONE RUBBER-BASED FLEXIBLE HEATERS TO ACCOUNT FOR LARGEST SHARE IN 2022

FIGURE 9 ELECTRONICS & SEMICONDUCTORS INDUSTRY TO GROW AT HIGHEST CAGR

FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 11 MEDICAL INDUSTRY TO GROW AT SIGNIFICANT RATE

4.2 MARKET, BY TYPE (2022–2027)

FIGURE 12 SILICONE RUBBER-BASED FLEXIBLE HEATERS TO LEAD MARKET

4.3 MARKET, BY INDUSTRY

FIGURE 13 ELECTRONICS & SEMICONDUCTORS INDUSTRY TO ACCOUNT FOR MAJOR SHARE

4.4 MARKET, BY REGION

FIGURE 14 MARKET IN CHINA TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 FLEXIBLE HEATER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Broad scope in various industries

FIGURE 16 PRIVATE AND COMMERCIAL VEHICLE PRODUCTION, BY COUNTRY, 2021 (UNITS)

5.2.1.2 Technological advancements, innovative products, and flexible form factor

5.2.1.3 Surging adoption in medical applications

FIGURE 17 IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Extensive operational costs

FIGURE 18 IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Investments in IT sector and demand in electronics & semiconductors industry

5.2.3.2 Applications in oil & gas and petrochemical industries

5.2.3.3 Surging demand for electric mobility

FIGURE 19 IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Deployment in rugged environments

FIGURE 20 IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: FLEXIBLE HEATER MARKET

5.4 ECOSYSTEM ANALYSIS

FIGURE 22 ECOSYSTEM: MARKET

TABLE 1 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 ASP ANALYSIS OF KEY PLAYERS

FIGURE 23 ASP OF FLEXIBLE HEATERS BASED ON TYPE

TABLE 2 APPROXIMATE ASPS OF FLEXIBLE HEATERS BASED ON TYPE, BY COMPANY (USD)

5.5.2 ASP TRENDS

TABLE 3 AVERAGE SELLING PRICES OF FLEXIBLE HEATERS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 24 REVENUE SHIFT IN FLEXIBLE HEATER MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 FLEXIBLE PRINTED HEATERS

5.7.2 ELECTRIFICATION AND AUTOMATION TECHNOLOGIES

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE INDUSTRIES

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

5.9.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

TABLE 6 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

5.10 CASE STUDY ANALYSIS

TABLE 7 DUREX INDUSTRIES PROVIDED FLEXIBLE HEATERS TO MAJOR OIL FIELD GAS ANALYZER MANUFACTURER TO ENSURE TEMPERATURE UNIFORMITY AND PREVENT PREMATURE HEATER FAILURE

TABLE 8 FLEXIBLE HEATERS PROVIDED BY CHROMALOX MEET STRINGENT DEMANDS IN THERMAL VACUUM TESTING CHAMBER (TVC)

TABLE 9 HIGH TEMPERATURE CONTROL WITH REDUCED PROFILE THERMOCOUPLE AND FLEXIBLE HEATER

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO

FIGURE 27 IMPORTS, BY KEY COUNTRY, 2017–2021 (USD MILLION)

5.11.2 EXPORT SCENARIO

FIGURE 28 EXPORTS, BY KEY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS (2012–2021)

TABLE 10 TOP 20 PATENT OWNERS IN US (2012–2021)

FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 11 LIST OF SOME PATENTS IN FLEXIBLE HEATER MARKET

5.13 KEY CONFERENCES AND EVENTS (2022–2023)

TABLE 12 MARKET: CONFERENCES AND EVENTS

5.14 REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO FLEXIBLE HEATERS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 STANDARDS AND REGULATIONS RELATED TO FLEXIBLE HEATERS

TABLE 16 NORTH AMERICA: SAFETY STANDARDS FOR MARKET

TABLE 17 EUROPE: SAFETY STANDARDS FOR MARKET

6 DISTRIBUTION CHANNELS FOR FLEXIBLE HEATERS (Page No. - 75)

6.1 INTRODUCTION

FIGURE 31 DISTRIBUTION CHANNELS FOR FLEXIBLE HEATERS

FIGURE 32 DISTRIBUTION CHANNEL ENTITIES IN FLEXIBLE HEATER MARKET

6.2 DIRECT

6.2.1 DIRECT DISTRIBUTION CHANNEL GENERATES MAJOR PROFITS

6.3 INDIRECT

6.3.1 GLOBAL DEMAND TO INCREASE DISTRIBUTORS AND INTERMEDIARIES

7 FLEXIBLE HEATER MARKET, BY TYPE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 33 FLEXIBLE HEATER MARKET, BY TYPE

FIGURE 34 SILICONE RUBBER-BASED SEGMENT TO LEAD AND GROW AT HIGHEST CAGR

TABLE 18 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 SILICONE RUBBER-BASED

7.2.1 SIGNIFICANT APPLICATIONS IN ELECTRONICS & SEMICONDUCTORS INDUSTRY

FIGURE 35 ELECTRONICS & SEMICONDUCTORS SEGMENT TO GROW AT HIGHEST CAGR IN SILICONE RUBBER-BASED MARKET

TABLE 20 SILICONE RUBBER-BASED MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 21 SILICONE RUBBER-BASED MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 22 SILICONE RUBBER-BASED MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 SILICONE RUBBER-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 POLYIMIDE-BASED

7.3.1 DEMAND FOR MEDICAL, ANALYTICAL, AND ELECTRONIC INSTRUMENTS

TABLE 24 POLYIMIDE-BASED MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 25 POLYIMIDE-BASED MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 26 POLYIMIDE-BASED MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 POLYIMIDE-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 POLYESTER-BASED

7.4.1 TECHNOLOGICAL ADVANCEMENTS IN ELECTRONICS, AUTOMOTIVE, AND MEDICAL FIELDS

TABLE 28 POLYESTER-BASED MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 29 POLYESTER-BASED FLEXIBLE HEATER MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 30 POLYESTER-BASED MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 POLYESTER-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 MICA-BASED

7.5.1 DEMAND FROM ELECTRONICS & SEMICONDUCTORS AND AEROSPACE INDUSTRIES

TABLE 32 MICA-BASED MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 33 MICA-BASED MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 34 MICA-BASED MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 MICA-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHERS

TABLE 36 MARKET FOR OTHER TYPES, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR OTHER TYPES, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 38 MARKET FOR OTHER TYPES, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR OTHER TYPES, BY REGION, 2022–2027 (USD MILLION)

8 FLEXIBLE HEATER MARKET, BY INDUSTRY (Page No. - 91)

8.1 INTRODUCTION

FIGURE 36 MARKET, BY INDUSTRY

FIGURE 37 ELECTRONICS & SEMICONDUCTORS SEGMENT TO LEAD AND GROW AT HIGHEST CAGR

TABLE 40 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8.2 ELECTRONICS & SEMICONDUCTORS

8.2.1 SEMICONDUCTOR MANUFACTURING EQUIPMENT AND GENERAL ELECTRONICS TO DRIVE MARKET

FIGURE 38 SILICONE RUBBER-BASED SEGMENT TO BE LARGEST IN ELECTRONICS & SEMICONDUCTORS

TABLE 42 MARKET FOR ELECTRONICS & SEMICONDUCTORS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 43 FLEXIBLE HEATER MARKET FOR ELECTRONICS & SEMICONDUCTORS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 44 MARKET FOR ELECTRONICS & SEMICONDUCTORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR ELECTRONICS & SEMICONDUCTORS, BY REGION, 2022–2027 (USD MILLION)

8.3 MEDICAL

8.3.1 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR

FIGURE 39 MICA-BASED SEGMENT TO GROW AT HIGHEST CAGR IN MEDICAL

TABLE 46 MARKET FOR MEDICAL, BY TYPE, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR MEDICAL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 48 MARKET FOR MEDICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR MEDICAL, BY REGION, 2022–2027 (USD MILLION)

8.4 AEROSPACE

8.4.1 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE

TABLE 50 MARKET FOR AEROSPACE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 51 FLEXIBLE HEATER MARKET FOR AEROSPACE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 52 MARKET FOR AEROSPACE, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR AEROSPACE, BY REGION, 2022–2027 (USD MILLION)

8.5 FOOD & BEVERAGES

8.5.1 THERMAL PROCESSING, FREEZE PROTECTION, AND VISCOSITY CONTROL TO INCREASE DEMAND

TABLE 54 MARKET FOR FOOD & BEVERAGES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR FOOD & BEVERAGES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 56 MARKET FOR FOOD & BEVERAGES, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR FOOD & BEVERAGES, BY REGION, 2022–2027 (USD MILLION)

8.6 AUTOMOTIVE & TRANSPORTATION

8.6.1 RISING TREND IN ELECTRIFICATION

TABLE 58 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 40 AUTOMOTIVE & TRANSPORTATION SEGMENT TO GROW AT HIGHEST CAGR IN ASIA PACIFIC

TABLE 60 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 FLEXIBLE HEATER MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

8.7 OIL & GAS

8.7.1 INCREASING GLOBAL OIL CONSUMPTION

TABLE 62 MARKET FOR OIL & GAS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 63 MARKET FOR OIL & GAS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 64 MARKET FOR OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 MARKET FOR OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

8.8 OTHERS

TABLE 66 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 68 MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

9 FLEXIBLE HEATER MARKET, BY REGION (Page No. - 109)

9.1 INTRODUCTION

FIGURE 41 MARKET IN CHINA TO GROW AT HIGHEST CAGR

TABLE 70 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

TABLE 72 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 75 MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 76 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Aerospace and medical industries to drive market

9.2.2 CANADA

9.2.2.1 Medical and automotive industries drive market

9.2.3 MEXICO

9.2.3.1 Growth of automotive and electronics industries

9.3 EUROPE

FIGURE 43 EUROPE: FLEXIBLE HEATER MARKET SNAPSHOT

TABLE 78 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 79 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 80 MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 81 MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 82 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Largest share of European market

9.3.2 FRANCE

9.3.2.1 Booming aerospace and other industries

9.3.3 UK

9.3.3.1 Automotive industry to witness rapid growth

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: FLEXIBLE HEATER MARKET SNAPSHOT

TABLE 84 MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 86 MARKET IN ASIA PACIFIC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 87 MARKET IN ASIA PACIFIC, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 88 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Largest share of Asia Pacific market

9.4.2 JAPAN

9.4.2.1 Automotive and medical industries to drive growth

TABLE 90 LIST OF MAJOR LOCAL MANUFACTURERS/SUPPLIERS OF FLEXIBLE HEATERS IN JAPAN

9.4.3 INDIA

9.4.3.1 Automotive and semiconductors & electronics to drive demand

9.4.4 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD (ROW)

FIGURE 45 MARKET IN SOUTH AMERICA TO GROW AT HIGHEST CAGR

TABLE 91 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 92 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

TABLE 93 FLEXIBLE HEATER MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 94 MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 95 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST

9.5.1.1 Saudi Arabia

9.5.1.1.1 Key contributor to growth in Middle East

9.5.1.2 UAE

9.5.1.2.1 Major oil & gas companies to support growth

9.5.1.3 Rest of Middle East

TABLE 97 MARKET IN MIDDLE EAST, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 98 MARKET IN MIDDLE EAST, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.2 AFRICA

9.5.2.1 Demand from various industries to drive market

9.5.3 SOUTH AMERICA

9.5.3.1 Market driven by major industries

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT-TO-WIN

TABLE 99 OVERVIEW OF STRATEGIES BY KEY FLEXIBLE HEATER MANUFACTURERS

10.3 REVENUE ANALYSIS FOR TOP FIVE COMPANIES

FIGURE 46 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

10.4 MARKET SHARE ANALYSIS

TABLE 100 MARKET SHARE OF TOP FIVE PLAYERS IN 2021

10.5 COMPETITIVE EVALUATION QUADRANT

10.5.1 STAR PLAYERS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 47 FLEXIBLE HEATER MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 48 MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

10.7 MARKET: COMPANY FOOTPRINT

TABLE 101 OVERALL COMPANY FOOTPRINT

TABLE 102 COMPANY PRODUCT FOOTPRINT

TABLE 103 COMPANY INDUSTRY FOOTPRINT

TABLE 104 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE BENCHMARKING

TABLE 105 MARKET: KEY STARTUPS/SMES

TABLE 106 FLEXIBLE HEATER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.9 COMPETITIVE SCENARIO

TABLE 107 MARKET: PRODUCT LAUNCHES, 2020−2021

TABLE 108 MARKET: DEALS, 2020–2021

11 COMPANY PROFILES (Page No. - 144)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 HONEYWELL INTERNATIONAL

TABLE 109 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 49 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

TABLE 110 HONEYWELL INTERNATIONAL: PRODUCT OFFERINGS

11.1.2 NIBE INDUSTRIER

TABLE 111 NIBE INDUSTRIER: BUSINESS OVERVIEW

FIGURE 50 NIBE INDUSTRIER: COMPANY SNAPSHOT

TABLE 112 NIBE INDUSTRIER: PRODUCT OFFERINGS

TABLE 113 NIBE INDUSTRIER: DEALS

11.1.3 OMEGA ENGINEERING

TABLE 114 OMEGA ENGINEERING: BUSINESS OVERVIEW

FIGURE 51 OMEGA ENGINEERING: COMPANY SNAPSHOT

TABLE 115 OMEGA ENGINEERING: PRODUCT OFFERINGS

11.1.4 WATLOW ELECTRIC MANUFACTURING

TABLE 116 WATLOW ELECTRIC MANUFACTURING: BUSINESS OVERVIEW

TABLE 117 WATLOW ELECTRIC MANUFACTURING: PRODUCT OFFERINGS

TABLE 118 WATLOW ELECTRIC MANUFACTURING: DEALS

11.1.5 SMITHS GROUP

TABLE 119 SMITHS GROUP: BUSINESS OVERVIEW

FIGURE 52 SMITHS GROUP: COMPANY SNAPSHOT

TABLE 120 SMITHS GROUP: PRODUCT OFFERINGS

TABLE 121 SMITHS GROUP: DEALS

11.1.6 ALL FLEX FLEXIBLE CIRCUITS

TABLE 122 ALL FLEX FLEXIBLE CIRCUITS: BUSINESS OVERVIEW

TABLE 123 ALL FLEX FLEXIBLE CIRCUITS: PRODUCT OFFERINGS

TABLE 124 ALL FLEX FLEXIBLE CIRCUITS: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.7 CHROMALOX

TABLE 125 CHROMALOX: BUSINESS OVERVIEW

TABLE 126 CHROMALOX: PRODUCT OFFERINGS

11.1.8 MINCO

TABLE 127 MINCO: BUSINESS OVERVIEW

TABLE 128 MINCO: PRODUCT OFFERINGS

11.1.9 ROGERS CORPORATION

TABLE 129 ROGERS CORPORATION: BUSINESS OVERVIEW

FIGURE 53 ROGERS CORPORATION: COMPANY SNAPSHOT

TABLE 130 ROGERS CORPORATION: PRODUCT OFFERINGS

TABLE 131 ROGERS CORPORATION: PRODUCT LAUNCHES

TABLE 132 ROGERS CORPORATION: DEALS

11.1.10 ZOPPAS INDUSTRIES

TABLE 133 ZOPPAS INDUSTRIES: BUSINESS OVERVIEW

TABLE 134 ZOPPAS INDUSTRIES: PRODUCT OFFERINGS

11.2 OTHER PLAYERS

11.2.1 BIRK MANUFACTURING INC

TABLE 135 BIRK MANUFACTURING INC: COMPANY OVERVIEW

11.2.2 BUCAN

TABLE 136 BUCAN: COMPANY OVERVIEW

11.2.3 DELTA/ACRA

TABLE 137 DELTA/ACRA: COMPANY OVERVIEW

11.2.4 DUREX INDUSTRIES

TABLE 138 DUREX INDUSTRIES: COMPANY OVERVIEW

11.2.5 EPEC ENGINEERED TECHNOLOGIES

TABLE 139 EPEC ENGINEERED TECHNOLOGIES: COMPANY OVERVIEW

11.2.6 HOLROYD COMPONENTS

TABLE 140 HOLROYD COMPONENTS: COMPANY OVERVIEW

11.2.7 HOTSET

TABLE 141 HOTSET: COMPANY OVERVIEW

11.2.8 KLC CORPORATION

TABLE 142 KLC CORPORATION: COMPANY OVERVIEW

11.2.9 MIYO TECHNOLOGY

TABLE 143 MIYO TECHNOLOGY: COMPANY OVERVIEW

11.2.10 NATIONAL PLASTIC HEATER

TABLE 144 NATIONAL PLASTIC HEATER: COMPANY OVERVIEW

11.2.11 NEL TECHNOLOGIES

TABLE 145 NEL TECHNOLOGIES: COMPANY OVERVIEW

11.2.12 SINOMAS

TABLE 146 SINOMAS: COMPANY OVERVIEW

11.2.13 TEMPCO ELECTRIC HEATER

TABLE 147 TEMPCO ELECTRIC HEATER: COMPANY OVERVIEW

11.2.14 THERMO HEATING ELEMENTS

TABLE 148 THERMO HEATING ELEMENTS: COMPANY OVERVIEW

11.2.15 THERMOCOAX

TABLE 149 THERMOCOAX: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT MARKETS (Page No. - 175)

12.1 UNDERFLOOR HEATING SYSTEM MARKET

12.2 INTRODUCTION

FIGURE 54 MARKET FOR HYDRONIC UNDERFLOOR HEATING TO LEAD

TABLE 150 UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 151 UNDERFLOOR HEATING MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

12.3 HYDRONIC UNDERFLOOR HEATING (WET SYSTEM)

FIGURE 55 MANIFOLDS AND VALVES TO HOLD LARGEST SHARE OF HYDRONIC UNDERFLOOR HEATING HARDWARE MARKET IN 2022

TABLE 152 HYDRONIC UNDERFLOOR HEATING MARKET FOR HARDWARE, BY COMPONENTS, 2018–2021 (USD MILLION)

TABLE 153 HYDRONIC UNDERFLOOR HEATING MARKET FOR HARDWARE, BY COMPONENTS, 2022–2027 (USD MILLION)

TABLE 154 HYDRONIC UNDERFLOOR HEATING MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 155 HYDRONIC UNDERFLOOR HEATING MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 156 HYDRONIC UNDERFLOOR HEATING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 157 HYDRONIC UNDERFLOOR HEATING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 158 HYDRONIC UNDERFLOOR HEATING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 159 HYDRONIC UNDERFLOOR HEATING MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 160 HYDRONIC UNDERFLOOR HEATING MARKET FOR RESIDENTIAL APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 161 HYDRONIC UNDERFLOOR HEATING MARKET FOR RESIDENTIAL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 162 HYDRONIC UNDERFLOOR HEATING MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 163 HYDRONIC UNDERFLOOR HEATING MARKET, FOR COMMERCIAL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 164 HYDRONIC UNDERFLOOR HEATING MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 165 HYDRONIC UNDERFLOOR HEATING MARKET, FOR INDUSTRIAL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 166 HYDRONIC UNDERFLOOR HEATING MARKET, FOR HEALTHCARE APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 167 HYDRONIC UNDERFLOOR HEATING MARKET, FOR HEALTHCARE APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 168 HYDRONIC UNDERFLOOR HEATING MARKET, FOR SPORTS & ENTERTAINMENT APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 169 HYDRONIC UNDERFLOOR HEATING MARKET, FOR SPORTS & ENTERTAINMENT APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 170 HYDRONIC UNDERFLOOR HEATING MARKET, FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 171 HYDRONIC UNDERFLOOR HEATING MARKET, FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

12.3.1 HEATING PIPES

12.3.1.1 Heating pipes installed within floor structures

12.3.2 THERMOSTATS AND SENSORS

12.3.2.1 Thermostats and sensors measure temperature to control flow of heating medium

12.3.3 THERMAL ACTUATORS

12.3.3.1 Thermal actuators are used to sense temperature

12.3.4 ZONE VALVES

12.3.4.1 Zone valves used to control heating operations of different zones of buildings

12.3.5 WIRING CENTERS

12.3.5.1 Wiring centers as hubs to control heating systems and thermostats

12.3.6 MANIFOLDS AND VALVES

12.3.6.1 Manifolds control temperatures in rooms by opening and closing valves according to requirements

12.4 ELECTRIC UNDERFLOOR HEATING (DRY SYSTEM)

FIGURE 56 HEATING MATS TO ACCOUNT FOR LARGEST MARKET SHARE

TABLE 172 ELECTRIC UNDERFLOOR HEATING MARKET FOR HARDWARE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 173 ELECTRIC UNDERFLOOR HEATING MARKET FOR HARDWARE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 174 ELECTRIC UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 175 ELECTRIC UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 176 ELECTRIC UNDERFLOOR HEATING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 177 ELECTRIC UNDERFLOOR HEATING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 ELECTRIC UNDERFLOOR HEATING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 179 ELECTRIC UNDERFLOOR HEATING MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 180 ELECTRIC UNDERFLOOR HEATING MARKET FOR RESIDENTIAL APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 181 ELECTRIC UNDERFLOOR HEATING MARKET FOR RESIDENTIAL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 182 ELECTRIC UNDERFLOOR HEATING MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 183 ELECTRIC UNDERFLOOR HEATING MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 184 ELECTRIC UNDERFLOOR HEATING MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 185 ELECTRIC UNDERFLOOR HEATING MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 186 ELECTRIC UNDERFLOOR HEATING MARKET FOR HEALTHCARE APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 187 ELECTRIC UNDERFLOOR HEATING MARKET FOR HEALTHCARE APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 188 ELECTRIC UNDERFLOOR HEATING MARKET FOR SPORTS & ENTERTAINMENT APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 189 ELECTRIC UNDERFLOOR HEATING MARKET FOR SPORTS & ENTERTAINMENT APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 190 ELECTRIC UNDERFLOOR HEATING MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 191 ELECTRIC UNDERFLOOR HEATING MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

12.4.1 HEATING CABLE

12.4.1.1 Heating cables laid in screed or beneath tiled floors

12.4.2 HEATING MATS

12.4.2.1 Heating mats utilized in DIY-based underfloor heating systems

12.4.3 THERMOSTATS AND SENSORS

12.4.3.1 Thermostats and sensors utilized to monitor and maintain floor temperature

13 APPENDIX (Page No. - 194)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

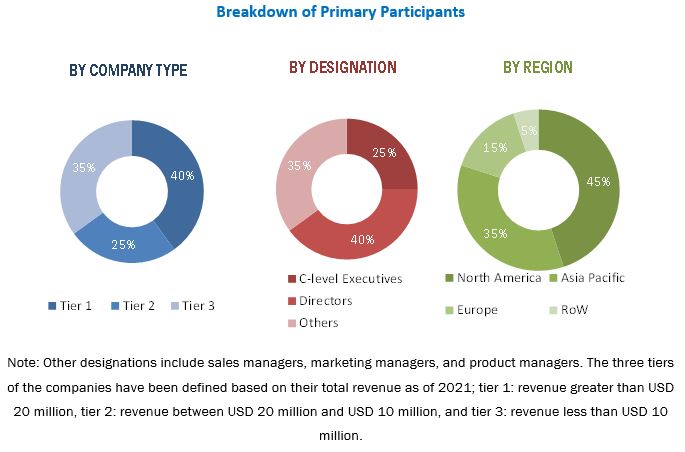

The study involves four major activities for estimating the size of the flexible heater market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the flexible heater market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the flexible heater market through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the flexible heater market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the flexible heater market size based on type and industry in terms of value

- To describe and forecast the market size of various segments for four regions—North America, Asia Pacific, Europe, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the flexible heater value chain and analyze the current and future market trends

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their rankings and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze the strategic approaches adopted by players in the flexible heater market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flexible Heater Market

Hello, I am researching the flexible heating systems industry, and your report looks like it would have some very beneficial information. Thank you in advance. Best regards, Zack Postma

Currently trying to identify market size for flexible heater blankets - particularly those used in composite manufacturing, but also applications of similar products in other sectors.

We mfg flex/polyimide/mica heaters and would love to gain more forecasting knowledge of what the markets are trending towards. Does your report include these information?