Fluid Handling System Market by Pumps (Centrifugal and Positive Displacement), Control Valves (Rotary and Linear), Flow Meters (Magnetic, Coriolis, Differential Pressure, Ultrasonic), Industry, and Geography - Global Forecast to 2023

[163 Pages Report] The increasing demand for different types of pumps in the oil and gas industry, high demand for advanced systems in the chemical and wastewater management industries, and increased focus on plant automation are the key factors driving the growth of the market. The fluid handling system market was valued at USD 55.19 Billion in 2016 and is expected to grow at a CAGR of 4.8% during the forecast period. The base year considered for the study is 2016, and the forecast period is between 2017 and 2023. The objective of the report is to provide a detailed analysis of the market on the basis of pump, flow meter, control valve, industry, and geography. The report provides detailed information regarding the major factors influencing the growth of the market. The report also provides a detailed overview of the value chain of the market.

The fluid handling system market is projected to be valued at USD 73.28 Billion by 2023, growing at a CAGR of 4.8% between 2017 and 2023. The growth of this market is propelled by the increasing demand for different types of pumps in the oil and gas industry, high demand for advanced systems in the chemical and wastewater management industries, and increased focus on plant automation.

Pumps are expected to hold the largest share of the overall fluid handling system market in 2017. They are used for a wide range of applications. Additionally, the global pump market is increasingly witnessing the adoption of advanced intelligent pump technology, which is further expected to encourage the growth of the market.

The control valves segment is expected to witness the highest growth in the global fluid handling system market during the forecast period. Some of the major drivers for the growth of the control valves market are the increasing need for wireless infrastructure to maintain/monitor equipment in various plants, revenue shift in the industry, rising demand for control valves for oil and gas and subsea application, rising number of new nuclear plants, and enhancement of existing plants.

The water and wastewater industry is projected to hold the largest share of the overall fluid handling system market during the forecast period. The water and wastewater industry is widely adopting automation and has been integrating centralized control systems to monitor the quality of water. Moreover, it has a strong focus on energy management, and the need to reduce lifecycle costs to improve operating margins would boost the adoption of fluid handling control systems in this industry. Factors such as population growth, especially in urban areas, industrial development, increasing emphasis on wastewater treatment, international commitments and targets, and government policies would drive the growth of the market for the water and wastewater industry.

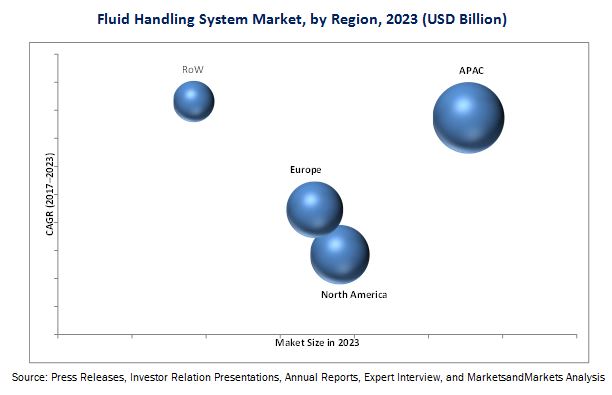

APAC held the largest share of the overall fluid handling system market in 2016 owing to the increasing demand for fluid handling systems in emerging economies such as India, China, and Japan. The rising demand for different types of fluid handling system hardware in various industries, such as water and wastewater, building and construction, energy and power, and oil and gas, is further expected to boost the growth of the market in APAC the coming years. The market in RoW is expected to register the highest CAGR between 2017 and 2023 owing to the major oil and gas industry in the region, as well as the growing water and wastewater, and mining and construction industries. As most countries in the Middle East have a scarcity of freshwater resources, water treatment is a huge source of water for non-potable purposes, such as irrigation and industrial use, which drives the demand for fluid handling systems in the region.

However, the high investment and operational cost for the implementation of fluid handling systems is a major factor restraining the growth of the fluid handling system market. Key market players, including Alfa Laval AB (Sweden), Colfax Corporation (US), Crane Co. (US), Flowserve Corporation (US), and Graco Inc. (US), Bürkert GmbH & Co. KG (Germany), Dover Corporation (US), INDEX Corporation (US), Ingersoll-Rand plc (Ireland), and SPX Flow, Inc. (US), focus on strategies such as product launches, expansions, acquisitions, and contracts to enhance their geographic presence and expand their business.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Value Chain Analysis: Industrial Automation Industry

2.3 Secondary and Primary Research

2.3.1 Secondary Data

2.3.1.1 Secondary Sources

2.3.2 Primary Data

2.3.2.1 Primary Interviews With Experts

2.3.2.2 Key Industry Insights

2.3.2.3 Breakdown of Primaries

2.3.2.4 Key Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.4.2 Top-Down Approach

2.4.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Market, 2017–2023 (USD Billion)

4.2 Control Valves in Fluid Handling Systems, By Type (2017-2023)

4.3 System Market for Pumps, By Type (2017)

4.4 North American Fluid Handling System Market, By Hardware and Country (2017)

4.5 Market, By Geography (2017)

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Different Types of Pumps in the Oil and Gas Industry

5.2.1.2 Growing Need for Advanced Systems in the Chemical and Wastewater Management Industries

5.2.1.3 Rising Focus on Plant Automation

5.2.2 Restraints

5.2.2.1 High Investment and Operational Costs of Fluid Handling Systems

5.2.3 Opportunities

5.2.3.1 Integration of Iiot With Fluid Handling Systems

5.2.4 Challenges

5.2.4.1 Tough Competition From Local Manufacturers

5.3 Value Chain Analysis

6 Services and IoT Solutions for Fluid Handling Systems (Page No. - 45)

6.1 Introduction : Services for Fluid Handling Systems

6.1.1 Installation and Commissioning

6.1.2 Maintenance

6.1.3 Support

6.1.4 Replacement and Retrofit

6.2 Introduction: IoT Solutions for Fluid Handling Systems

6.2.1 Sensors

6.2.2 Remote Monitoring

6.2.3 Predictive and Preventive Maintenance

7 Pump Based Fluid Handling System Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Centrifugal Pumps

7.2.1 Advantages of Centrifugal Pumps

7.3 Positive Displacement Pump

7.3.1 Advantages of Positive Displacement Pumps

8 Control Valve Based Fluid Handling System Market, By Type (Page No. - 58)

8.1 Introduction

8.2 Rotary Valve

8.2.1 Ball Valves

8.2.2 Butterfly Valves

8.2.3 Plug Valves

8.3 Linear Valves

8.3.1 Gate Valves

8.3.2 Diaphragm Valves

8.3.3 Other Valves

9 Flow Meter Based Fluid Handling System Market, By Type (Page No. - 68)

9.1 Introduction

9.2 Magnetic Flow Meters

9.3 Coriolis

9.4 Ultrasonic

9.5 Vortex

9.6 Multiphase

9.7 Thermal

9.8 Variable Area

9.9 Differential Pressure

9.10 Turbine

10 Market Analysis, By Industry (Page No. - 77)

10.1 Introduction

10.2 Oil and Gas

10.3 Water and Wastewater

10.4 Chemical

10.5 Energy and Power

10.6 Food and Beverages

10.7 Pulp and Paper

10.8 Metal and Mining

10.9 Pharmaceutical

10.10 Building and Construction

10.11 Others

11 Geographic Analysis (Page No. - 92)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Increasing Investment in the Chemical, and Water and Wastewater Industries

11.2.2 Canada

11.2.2.1 Favorable Government Regulations and Development in Various End-User Industries

11.2.3 Mexico

11.3 Europe

11.3.1 UK

11.3.1.1 Increasing Demand From Various Industries

11.3.2 Germany

11.3.2.1 Events and Conferences Related to Fluid Handling Systems

11.3.3 France

11.3.3.1 Increasing Government Initiatives and Support

11.3.4 Rest of Europe

11.4 APAC

11.4.1 China

11.4.1.1 Favorable Government Policies and Increasing Investment

11.4.2 Japan

11.4.2.1 Increasing Demand From the Water and Wastewater and Building and Construction Industries

11.4.3 India

11.4.3.1 Rapid Industrialization and Infrastructural Development in the Country

11.4.4 Rest of APAC

11.5 RoW

11.5.1 South America

11.5.2 Middle East

11.5.3 Africa

12 Competitive Landscape (Page No. - 117)

12.1 Overview

12.2 Market Ranking Analysis: Fluid Handling System Market, 2016

12.3 Competitive Situation and Trends

12.3.1 New Product Launches and Developments

12.3.2 Expansions and Acquisitions

12.3.3 Contracts

13 Company Profiles (Page No. - 123)

(Business Overview, Products Offered, Strength of product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships)*

13.1 Introduction

13.2 Alfa Laval

13.3 Colfax

13.4 Crane

13.5 Graco

13.6 Flowserve

13.7 Ingersoll-Rand

13.8 IDEX

13.9 SPX Flow

13.10 Dover

13.11 Bürkert

*Details on Business Overview, Products Offered, Strength of product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships might not be captured in case of unlisted companies.

13.12 Key Innovators

13.12.1 Fluid Global Solutions

13.12.2 Alpeco

13.12.3 Ebara International

14 Appendix (Page No. - 155)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (69 Tables)

Table 1 Major Secondary Sources

Table 2 Fluid Handling System Market for Pumps, in Terms of Value and Volume, 2014–2023

Table 3 Market for Pumps, By Type, 2014–2023 (USD Billion)

Table 4 Market for Pumps, By Industry, 2014–2023 (USD Billion)

Table 5 Market for Pumps, By Region, 2014–2023 (USD Billion)

Table 6 Market for Pumps in North America, By Country, 2014–2023 (USD Million)

Table 7 Market for Pumps in Europe, By Country, 2014–2023 (USD Million)

Table 8 Market for Pumps in APAC, By Country, 2014–2023 (USD Million)

Table 9 Market for Pumps in RoW, By Region, 2014–2023 (USD Million)

Table 10 Market for Centrifugal Pumps, By Industry, 2014–2023 (USD Million)

Table 11 Market for Positive Displacement Pumps, By Industry, 2014–2023 (USD Million)

Table 12 Market for Control Valves, in Terms of Value and Volume, 2014–2023

Table 13 Market for Control Valves, By Valve Type, 2014–2023 (USD Billion)

Table 14 Market for Control Valves, By Industry, 2014–2023 (USD Million)

Table 15 Market for Control Valves, By Region, 2014–2023 (USD Million)

Table 16 Market for Control Valves in North America, By Country, 2014–2023 (USD Million)

Table 17 Market for Control Valves in Europe, By Country, 2014–2023 (USD Million)

Table 18 Market for Control Valves in APAC, By Country, 2014–2023 (USD Million)

Table 19 Market for Control Valves in RoW, By Region, 2014–2023 (USD Million)

Table 20 Fluid Handling System Market for Rotary Valves, By Type, 2014–2023 (USD Million)

Table 21 Market for Rotary Valve, By Industry, 2014–2023 (USD Million)

Table 22 Market for Linear Valves, By Type, 2014–2023 (USD Million)

Table 23 Market for Linear Valves, By Industry, 2014–2023, (USD Million)

Table 24 Market for Flow Meters, in Terms of Value and Volume, 2014–2023

Table 25 Market for Flow Meters, By Type, 2014–2023 (USD Million)

Table 26 Market for Flow Meters, By Industry, 2014–2023 (USD Million)

Table 27 Market for Flow Meters, By Region, 2014–2023 (USD Million)

Table 28 Market for Flow Meters in North America, By Country, 2014–2023 (USD Million)

Table 29 Market for Flow Meters in Europe, By Country, 2014–2023 (USD Million)

Table 30 Market for Flow Meters in APAC, By Country, 2014–2023 (USD Million)

Table 31 Market for Flow Meters in RoW, By Region, 2014–2023 (USD Million)

Table 32 Market, By Industry, 2014–2023 (USD Million)

Table 33 Market for Oil and Gas, By Hardware, 2014–2023 (USD Million)

Table 34 Market for Water and Wastewater, By Hardware, 2014–2023 (USD Million)

Table 35 Market for Chemical, By Hardware, 2014–2023 (USD Million)

Table 36 Market for Energy and Power, By Hardware, 2014–2023 (USD Million)

Table 37 Market for Food and Beverages, By Hardware, 2014–2023 (USD Million)

Table 38 Market for Pulp and Paper, By Hardware, 2014–2023 (USD Million)

Table 39 Market for Metal and Mining, By Hardware, 2014–2023 (USD Million)

Table 40 Market for Pharmaceutical, By Hardware, 2014–2023 (USD Million)

Table 41 Market for Building and Construction, By Hardware, 2014–2023 (USD Million)

Table 42 Market for Other Industries, By Hardware, 2014–2023 (USD Million)

Table 43 Market, By Region, 2014–2023 (USD Billion)

Table 44 Market in North America, By Hardware, 2014–2023 (USD Billion)

Table 45 Market in North America, By Country, 2014–2023 (USD Million)

Table 46 Market in US, By Hardware, 2014–2023 (USD Million)

Table 47 Market in Canada, By Hardware, 2014–2023 (USD Million)

Table 48 Market in Mexico, By Hardware, 2014–2023 (USD Million)

Table 49 Market in Europe, By Hardware, 2014–2023 (USD Million)

Table 50 Market in Europe, By Country, 2014–2023 (USD Billion)

Table 51 Market in UK, By Hardware, 2014–2023 (USD Million)

Table 52 Market in Germany, By Hardware, 2014–2023 (USD Million)

Table 53 Market in France, By Hardware, 2014–2023 (USD Million)

Table 54 Market in Rest of Europe, By Hardware, 2014–2023 (USD Million)

Table 55 Fluid Handling System Market in APAC, By Hardware, 2014–2023 (USD Billion)

Table 56 Market in APAC, By Country, 2014–2023 (USD Billion)

Table 57 Market in China, By Hardware, 2014–2023 (USD Million)

Table 58 Market in Japan, By Hardware, 2014–2023 (USD Million)

Table 59 System Market in India, By Hardware, 2014–2023 (USD Million)

Table 60 Market in Rest of APAC, By Hardware, 2014–2023 (USD Million)

Table 61 Market in RoW, By Hardware, 2014–2023 (USD Million)

Table 62 Market in RoW, By Region, 2014–2023 (USD Million)

Table 63 Market in South America, By Hardware, 2014–2023 (USD Million)

Table 64 Market in Middle East, By Hardware, 2014–2023 (USD Million)

Table 65 Market in Africa, By Hardware, 2014–2023 (USD Million)

Table 66 Market Ranking of Leading Manufacturers of Fluid Handling System, 2016

Table 67 New Product Launches and Developments

Table 68 Expansions and Acquisitions

Table 69 Contracts

List of Figures (61 Figures)

Figure 1 Fluid Handling System Market Segmentation

Figure 2 Market: Research Design

Figure 3 Value Chain: Industrial Automation

Figure 4 Bottom-Up Approach to Arrive at the Market Size

Figure 5 Top-Down Approach to Arrive at the Market Size

Figure 6 Data Triangulation

Figure 7 Market for Pumps Expected to Remain Dominant During the Forecast Period

Figure 8 Market for Plug Valves to Register the Highest CAGR Between 2017 and 2023

Figure 9 Market for Building and Construction Industry Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 10 APAC Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 11 High Demand for Advanced Systems in Chemical and Wastewater Management Industries Expected to Drive the Growth of the Market

Figure 12 Market for Rotary Valves Expected to Grow at the Highest CAGR Between 2017 and 2023

Figure 13 Centrifugal Pumps Expected to Lead the Market Between 2017 and 2023

Figure 14 Pumps to Hold the Largest Share of the Market in North America in 2017

Figure 15 US Expected to Hold the Largest Size of the Market in 2017

Figure 16 Drivers, Restraints, Opportunities, and Challenges

Figure 17 Value Chain Analysis: Maximum Value Added During Manufacturing and Assembly Stage

Figure 18 Services for Fluid Handling Systems

Figure 19 IoT Solutions for Fluid Handling Systems

Figure 20 Market for Pumps in APAC Expected to Register the Highest CAGR Between 2017 and 2023

Figure 21 China to Dominate the Market for Pumps in APAC Throughout the Forecast Period

Figure 22 Water and Wastewater Industry Expected to Lead the Market for Centrifugal Pumps

Figure 23 Water and Wastewater Industry to Witness the Highest Growth in the Market for Positive Displacement Pumps Between 2017 and 2023

Figure 24 Ball Valves to Lead the Market for Control Valves Throughout the Forecast Period

Figure 25 Gate Valves to Dominate the Market for Linear Valves Throughout the Forecast Period

Figure 26 Chemical Industry to Witness the Highest Growth in the Market for Flow Meters During the Forecast Period

Figure 27 APAC to Lead the Market for Flow Meters During the Forecast Period

Figure 28 Germany to Register the Highest CAGR in the Market for Flow Meters in Europe Between 2017 and 2023

Figure 29 Market for Flow Meter in South America to Grow at A Higher CAGR in the RoW Region During the Forecast Period

Figure 30 The Market for Water and Wastewater Industry to Remain Dominant Throughout the Forecast Period

Figure 31 Pumps to Dominate the Market for the Oil and Gas Industry Throughout the Forecast Period

Figure 32 Market for Flow Meters in the Chemical Industry to Witness the Highest CAGR Between 2017 and 2023

Figure 33 Control Valve Market for the Food and Beverages Industry to Register the Highest Growth Rate During the Forecast Period

Figure 34 Market for Flow Meters for the Metal and Mining Industry to Witness A Higher Growth Rate Between 2017 and 2023

Figure 35 Pumps to Hold the Larger Market Size for the Building and Construction Industry Throughout the Forecast Period

Figure 36 The Market for Control Valves to Remain Dominant Throughout the Forecast Period

Figure 37 Geographic Snapshot: Global Market

Figure 38 North America: Market Snapshot

Figure 39 US Expected to Lead the Market in North America During the Forecast Period

Figure 40 Control Valves to Witness the Highest Growth Rate in the Fluid Handling Market in Canada

Figure 41 Europe: Market Snapshot

Figure 42 Germany to Witness the Highest Growth Rate in the Market in Europe Between 2017 and 2023

Figure 43 Pumps to Dominate the Fluid Handling Market in Germany Throughout the Forecast Period

Figure 44 APAC: Market Snapshot

Figure 45 China Expected to Dominate the Market During the Forecast Period

Figure 46 Pumps to Dominate the Market in Japan Throughout the Forecast Period

Figure 47 Pumps to Dominate the Market in Rest of APAC Throughout the Forecast Period

Figure 48 Middle East Expected to Dominate the Market in the RoW Region Throughout the Forecast Period

Figure 49 Pumps to Witness the Highest CAGR in the Market in the Middle East Between 2017 and 2023

Figure 50 New Product Launches and Developments—Key Growth Strategies Adopted By Fluid Handling Market Players Between 2015 and 2017

Figure 51 Market Evolution Framework: New Product Launches and Developments Fueled the Growth of the Market (2015–2017)

Figure 52 Battle for Market Share: New Product Launches and Developments Were Key Strategies Adopted By Players

Figure 53 Alfa Laval: Company Snapshot

Figure 54 Colfax: Company Snapshot

Figure 55 Crane : Company Snapshot

Figure 56 Graco Inc.: Company Snapshot

Figure 57 Flowserve: Company Snapshot

Figure 58 Ingersoll-Rand : Company Snapshot

Figure 59 IDEX: Company Snapshot

Figure 60 SPX Flow: Company Snapshot

Figure 61 Dover : Company Snapshot

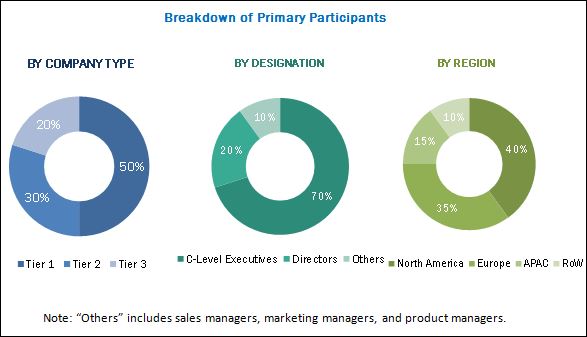

The research methodology used to estimate and forecast the market begins with capturing data on the revenue of key vendors through secondary research. Vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the market from the revenues of key players. After arriving at the overall market size, the total market size has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with key experts such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The fluid handling market ecosystem comprises raw material suppliers, component manufacturers, system integrators, and distributors. Alfa Laval AB (Sweden), Colfax Corporation (US), Crane Co. (US), Flowserve Corporation (US), and Graco Inc. (US) are among the leading players in the fluid handling system market. Other key players in the market include Bürkert GmbH & Co. KG (Germany), Dover Corporation (US), INDEX Corporation (US), Ingersoll-Rand plc (Ireland), and SPX Flow, Inc. (US).

Key Target Audience

- Associations and industrial bodies

- Component suppliers and distributors

- End users of fluid handling systems across industries

- Government bodies such as regulatory authorities and policymakers

- Industrial automation equipment providers

- Market research and consulting firms

- Original equipment manufacturers (OEMs)

- Semiconductor product designers and fabricators

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next 2–5 years for prioritizing efforts and investments.”

Scope of the Report

This research report categorizes the market on the basis of pump, flow meter, control valve, industry, and geography.

Fluid Handling System Market, by Pump

- Centrifugal Pumps

- Positive Displacement Pumps

Market, by Flow Meter

- Magnetic

- Coriolis

- Differential Pressure

- Ultrasonic

- Vortex

- Turbine

- Thermal

- Multiphase

- Variable Area

Market, by Control Valve

-

Linear Valve

- Gate Valve

- Diaphragm Valve

- Other Valves

-

Rotary Valve

- Ball Valves

- Butterfly Valves

- Plug Valves

Market, by Industry

- Oil and Gas

- Water and Wastewater

- Energy and Power

- Pharmaceutical

- Food and Beverage

- Chemical

- Building and Construction

- Pulp and paper

- Metal and Mining

- Others

Fluid Handling System Market, by Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Fluid Handling System Market