Food Coating Market by Ingredient Type (Batter, Flours), Application (Bakery, Snacks), Equipment Type (Coaters and Applicators, Enrobers), Form (Dry, Liquid), Mode of Operation (Automatic, Semiautomatic) and Region - Global Forecast to 2028

Food Coating Market Size, and Forecast (2023-2028)

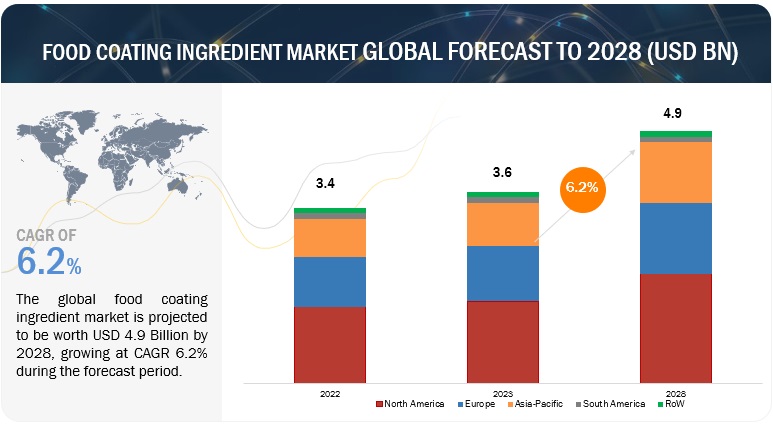

The food coating ingredients market is estimated at USD 3.6 billion in 2023 and is projected to reach USD 4.9 billion by 2028, at a CAGR of 6.2% from 2023 to 2028. The food coating equipment market is estimated at USD 5.7 billion in 2023 and is projected to reach USD 7.7 billion by 2028, at a CAGR of 6.3% from 2023 to 2028.

The elemental function of coating food is to protect the food from spoilage; but, over the past few decades, food coating has developed an entirely new definition in industrial food processing. Food coating is now carried out to enhance the appearance and impart additional flavors to traditional food products. For these reasons, packaged food manufacturers are taking advantage of food coating ingredients to improve the quality and at the same time increase the shelf life of their products. This enables manufacturers to increase sales and reduce wastage during distribution and in the supply chain network. Food coating manufacturers are also focusing on the development of healthy and nutritious coating ingredients such as oats, sugar-free ingredients, gluten-free ingredients, and others to tackle the growing concerns of obesity, diabetes, and allergies among consumers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Food Coating Market Dynamics

Drivers: Rising consumption of processed food to propel the market

The increasing demand for convenient and time-saving food options, driven by the fast-paced and busy lifestyles of consumers in urban areas, has resulted in a significant market for food coating ingredients and equipment. Ready-to-eat and ready-to-cook meat, confectionery products, and bakery food items have gained popularity due to their ease of preparation, nutritional value, and long shelf life. Additionally, consumers' growing preference for protein-based foods, the rise in frozen food consumption, and the increasing snacking habits have further fueled the demand for these products. Consequently, the market is experiencing a surge in the need for various ingredients like spices, fats, oils, cocoa, flours, sugar, and syrups. This increased demand for ingredients is also expected to drive the sales of equipment such as coaters, applicators, and enrobers.

Meat processors select the equipment for processing meat based on the specific meat type. Meat processing involves various physical and chemical treatment methods, generally combining various methods. According to the US Department of Agriculture (USDA), farmers and meatpackers produced a record 4.5 billion pounds of red meat and poultry alone in April 2022, which, in turn, will need more processing capacity, further leading to higher demand for food coating equipment such as bread and batter applicators.

Similarly, snacks and bakery products require coating equipment for flavoring, glazing, and enrobing the end products, adding taste and texture and ensuring longer shelf life. Food coating equipment reduces the product’s ingredient waste, processing time, and cost.

Restraints: Rising cost of production due to fluctuating price of ingredients

The increasing prices and unpredictable fluctuations of ingredients have become significant challenges in the field of food coating. The high cost of ingredients not only raises production expenses but also discourages manufacturers from adopting new coating technologies. This is due to the resulting lower profit margins and the longer time required to reach the breakeven point for food manufacturers. To overcome these obstacles, food coating equipment must provide cost-effective solutions in terms of both output and ingredient usage. This is necessary to compensate for the rising ingredient prices and enable food manufacturers to achieve economies of scale. For example, the prices of cocoa beans and sugar, which are crucial ingredients in coating confectionery, chocolates, and snacks, have continuously increased from 2018 to 2022. As a result, the high cost of the final product forces manufacturers to prioritize cost-cutting measures rather than investing in new technologies or equipment for their production facilities.

Opportunities: Growing investment opportunities to develop new food coating technology

With the increasing influence of globalization, consumers are becoming more aware of various food trends. Concurrently, food manufacturing companies are expanding their operations worldwide, thanks to trade liberalization. This expansion has prompted food manufacturers to explore new and untapped markets. Even domestic players are enhancing their product offerings to keep up with the escalating competition in the market. Notably, manufacturers in China, India, and Japan have developed their own food coating equipment that rivals the quality of imported equipment or the offerings of established market leaders in coating technology. To gain a competitive advantage in both domestic and international markets, companies prioritize innovation in their food coating technology. They employ cutting-edge technologies such as electrostatic coating, which achieves a remarkable 98% coating coverage on all products, surpassing traditional flavoring methods and further enhancing coating efficiency.

To cater to the changing demand from food manufacturers, food coating equipment manufacturers focus on the R&D of various technologies used in equipment. The key features required by food manufacturers include better and more large-scale handling of food products, increasing the shelf life of products, improved production capacity, and reducing the wastage of ingredients.

Technological Advancements: Advancements in food coating technology, such as improved coating formulations, production methods, and equipment, can enhance the efficiency and quality of coated food products, potentially driving market growth.

In 2022, IIT Guwahati developed a biodegradable, edible coating that extends the shelf life of fruits and vegetables. According to officials, this coating material, which will prevent wastage, was tested on vegetables such as potatoes, tomatoes, green chili, strawberries, Khasi Mandarin variety of oranges, apples, pineapples, and Kiwi and was found to keep these vegetables fresh for nearly two months.

An example of this is cinnamon essential oils utilized within cosmetics and food as an antimicrobial plant extract additive. It can be utilized as an antimicrobial food packaging product when incorporated within cyclodextrin nanosponges. Garlic essential oils have also been utilized within food packaging for their antimicrobial properties. The innovative approach to incorporating essential oils within edible coatings can be a method to prevent the growth of mold and yeast. This technique would optimize and effectively increase the shelf-life of food products. Nano-emulsions, which are oil-in-water or water-in-oil emulsions, can be a step towards improving the physiochemical properties of edible coatings for further quality control of food products. These advanced coatings have been researched and found to improve fruit quality and sensory characteristics, such as using a nano-emulsion within a pectin-based edible coating on freshly cut orange slices. This next generation of edible coatings may revolutionize the food industry to increase the viability of fruit and vegetables; this technique allows these emulsions to fuse with the components easily.

Challenges: Infrastructural and regulatory challenges in developing countries

The presence of prominent food coating equipment manufacturers and ingredient suppliers has led to saturated and highly competitive markets in countries like the US, the UK, Germany, and France. As a result, manufacturers in developed economies are compelled to seek untapped potential markets and clients in emerging economies to sustain growth in the food processing industry. Expanding into different geographical regions is a strategic goal for ingredient and equipment manufacturers to broaden their consumer base. However, this expansion faces challenges such as regulations, infrastructure limitations, required investments, and economic environments. Setting up a new manufacturing unit in a developing country demands significant investments from food coating and equipment manufacturers. Apart from internal facility investments, manufacturers must allocate substantial resources to develop an efficient supply chain network and storage facilities for raw materials and finished goods. Insufficiently developed infrastructure in countries like Brazil, India, and Argentina, coupled with limited government support for foreign entities in nations such as China, pose significant obstacles for both ingredient and equipment manufacturers, thus hindering the growth of the food coating market. Although lower raw material prices and labor costs can benefit food processors, the costs associated with infrastructural development serve as a major challenge for these companies.

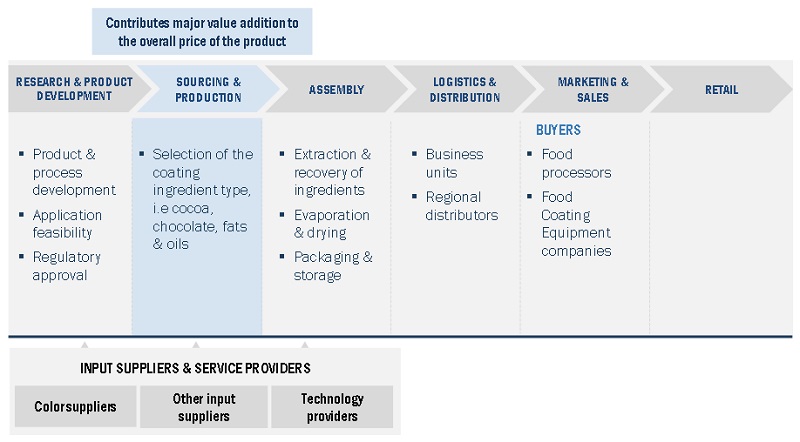

Food Coating Market: Value Chain Analysis

Ecosystem Analysis

The market ecosystem for food coating encompasses various stakeholders and components involved in the production, distribution, and consumption of food coating products. The key elements of the food coating market ecosystem:

Food Coating Manufacturers: These are the companies that specialize in producing food coating ingredients, equipment, and solutions. They develop and manufacture a wide range of coatings, including batter and breading mixes, seasonings, marinades, oils, fats, and specialized coating equipment.

Food Processing Companies: Food processing companies utilize food coating ingredients and equipment to enhance the taste, texture, appearance, and shelf life of their products. They incorporate food coatings into their production processes for various food items such as meat, poultry, seafood, bakery products, confectionery, snacks, and frozen foods.

Raw Material Suppliers: Raw material suppliers play a crucial role in the food coating market ecosystem. They provide ingredients like spices, herbs, flours, sugars, oils, fats, cocoa, starches, and various additives required for food coating formulations. These suppliers may include agricultural producers, ingredient manufacturers, and distributors.

Equipment Manufacturers: Equipment manufacturers produce and supply food coating equipment, such as coaters, applicators, enrobers, and other specialized machinery. These manufacturers focus on developing innovative technologies to improve coating efficiency, productivity, and quality.

Ecosystem Map

Based on equipment type, the coaters & applicators segment is estimated to account for the largest market share of the food coating market.

Coating involves various techniques, such as spraying, dipping, and brushing. It is done to improve palatability, enjoyment, or protection. Over the years, food coating equipment has advanced to handle a variety of coating ingredients to coat a variety of food products, from fragile to frozen. Developed nations are the major markets due to the high demand for bakery, dairy, and meat products. Apart from these applications, a coating can also be utilized to extend the shelf life of perishable food, such as apples. Due to the lack of sophisticated infrastructure for on-farm storage in some developing countries, such as India, a coating produced of wheat straw hemicellulose polysaccharide (WP) improves the shelf-life of products, thereby assisting farmers and suppliers by giving them more time to sell their harvest. Thus, improved palatability, extended shelf life, and improved quality of food & beverage products are likely to drive the market for coating equipment.

Based on Application, the meat & seafood products sub segment of the food coating ingredient market is anticipated to dominate the market.

Commonly used ingredient for the coating of meat & seafood products is flour, which helps to provide appealing colors and flavors. Different coatings are applied to the surface of meat loaves, sausages, and other meat food products. Both fresh and frozen types of meat, when subjected to extended storage, lose substantial water due to evaporation. It is desirable to have the meatloaves coated as the coating lends protection to the product and gives it more appealing organoleptic characteristics.

Based on application, the confectionery products is projected to witness the highest CAGR in food coating equipment market during the forecast period.

There has been a rising demand for confectionery products in the European region, which presents a mature market for the confectionery industry. Hence, this region is expected to show slow growth as compared to other regions. Confectionery is generally high in calories and carbohydrates but poor in micronutrients. Industry statistics show that, in terms of sales generated, the Western European region dominated the worldwide confectionery sector. Better-for-you products have become more popular as a response to health issues. The clean label movement has impacted the confectionery market because of the demand for colors that are derived naturally. Many food firms announced plans to reformulate their products to swap out artificial additives and streamline ingredient lists to meet this growing demand. Few companies have made acquisitions, with companies having a strong bakery processing equipment portfolio to enhance their product as well. Gea Group (Germany) has firmly moved into the bakery sector with the acquisition of Comas and Imaforni, the leading suppliers of demanding industrial processing equipment and solutions for the cakes, pies, cookies and biscuits, crackers, and snacks industry.

Food Coating Market Trends

- Health-Conscious Consumer Preferences: Consumers were increasingly seeking healthier food options, leading to a rise in demand for food coatings that are gluten-free, low-fat, and made from natural ingredients. Coatings made from alternative flours (such as chickpea or almond flour) and plant-based proteins were gaining popularity.

- Innovation in Coating Technologies: Food coating manufacturers were investing in research and development to introduce innovative coating technologies. These included advanced coating systems designed to improve texture, flavor, and shelf life while reducing oil absorption during frying.

- Demand for Convenience Foods: The growing demand for convenient food options was driving the market for coated convenience foods such as frozen chicken nuggets, fish sticks, and pre-coated frozen vegetables. Manufacturers were focusing on developing coatings that maintain crispiness after reheating, catering to the needs of busy consumers.

- Expansion in the Snack Industry: The snacking trend was fueling the growth of the food coating market, particularly in the snack food segment. Coatings were being used to enhance the taste and texture of a wide variety of snack products, including chips, pretzels, and popcorn.

- Clean Label Products: Clean label trends were influencing the food coating market, with consumers demanding transparency in ingredient sourcing and processing methods. Manufacturers were responding by offering coatings made from simple, recognizable ingredients with no artificial additives or preservatives.

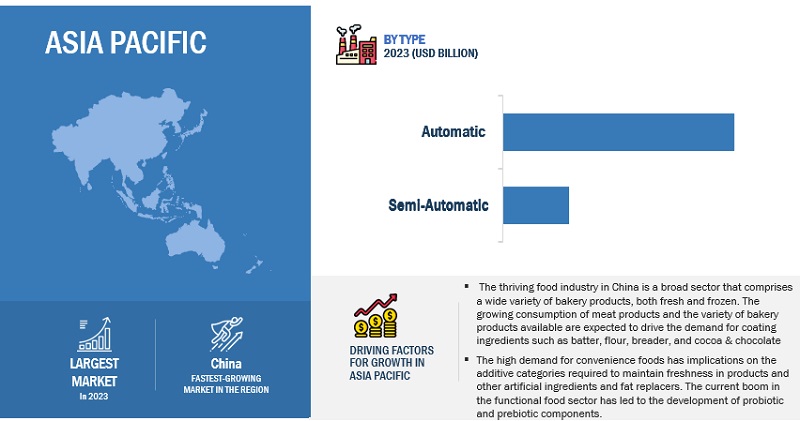

The Asia Pacific market is projected to dominate the food coating equipment market.

The region’s growing demand for processed food, improved manufacturing industry growth over the past decade, and advancements in the food industry have provided new opportunities for the food coating ingredients market. An increase in processed and convenience food production and innovations in segments such as meat, snacks, and bakery & confectionery products drive the demand for coating ingredients in the Asia Pacific region. China and India are set to experience continual demand during the forecast period. Many global companies are focusing on these emerging markets and are increasing their footprint by setting up manufacturing facilities, distribution centers, and R&D centers. India is projected to be the fastest-growing market in the region as there are many investments being made by several multinational corporations due to favorable support of the government and low labor cost. The Asia Pacific food & beverage industry is greatly influenced by rising consumer preference for conscious food habits, the growing trend toward natural & organic foods, and the increasing demand for convenience food products. With emerging economies, growing industrialization, increasing demand for processed foods, and consumer preference for quality products, ingredient suppliers are optimistic about the growth of the food & beverage industry. These trends and preferences have associated with the increasing consumption of coated food products.

Key Market Players

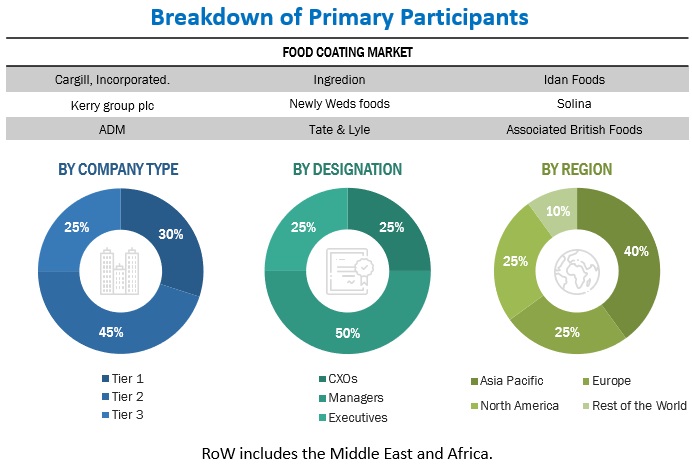

Archer Daniels Midland (US),Kerry Group (Ireland), Cargill (US), Ingredion Incorporated (US), and DSM (The Netherland) are among the key players in the global food coating market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the food coating market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Ingredient Type, By Application, By Equipment Type, By Form, By Mode of Operation and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Key Companies Profiled |

|

Food Coating Market Segmentation:

By Ingredient Type

- Batter

- Flours

By Application

- Bakery

- Snacks

By Equipment Type

- Coaters & Applicators

- Enrobers

By form

- Dry

- Liquid

By Mode of operation

- Automatic

- Semi-automatic

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Other ingredient type includes starches, proteins, and colors.

Other equipment type includes panning systems, fluid applicators, and sugar applicators.

RoW includes the Middle East & Africa.

Food Coating Industry News

- In July 2021, Kerry has officially opened a new 21,500-square-foot state of the art facility at its Jeddah operation in the Kingdom of Saudi Arabia. This will meet the growing consumer demand in the region for healthier, tastier, and more sustainable food and beverages, particularly in snack, meat and bakery sectors.

- In September 2021, Ingredion signed a new strategic distribution agreement with a US-based company, Batory Foods, which is one of the leading suppliers of high-quality food ingredients, such as food emulsifiers. This agreement with Batory Foods aimed to expand its distribution all over the US. Batory Foods will be responsible for the distribution of food ingredients manufactured by Ingredion in 15 states of the US, including Arizona, California, Illinois, etc. This will help Ingredion strengthen its position and gain more market share for food emulsifiers in the US.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the food coating ingredients and food coating equipment market?

The North America region accounted for the largest share, in terms of value, of USD 1.4 billion, of the global food coating ingredients market in 2022 and is expected to grow at a CAGR of 5.9% and Asia Pacific region accounted the largest share, in terms of value, of USD 1.8 billion , of the global food coating equipment market in 2022 and is expected to grow at a CAGR of 6.5%. The growing consumer base and rising demand for processed foods are expected to drive the growth of the food coating market in emerging counties such as China, India, and Thailand, to name a few.

What is the current size of the global food coating ingredients and global food coating equipment market?

The food coating ingredients market is estimated at USD 3.6 billion in 2023 and is projected to reach USD 4.9 billion by 2028, at a CAGR of 6.2% from 2023 to 2028. The global food coating equipment market is estimated at USD 5.7 billion in 2023 and is projected to reach USD 7.7 billion by 2028, at a CAGR of 6.3% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include Cargill, Incorporated. (US), Kerry Group plc. (Ireland), ADM (US), Ingredion (US), Newly Weds Foods (US), Associated British Foods plc (UK), Tate & Lyle (UK), Solina (France), Idan Foods (US), POPLA International INC. (US), Marel (Iceland), GEA Group Aktiengesellschaft (Germany), JBT (US), Buhler AG (Switzerland), TNA Australia Pty Limited (Australia).

What are the factors driving the food coating market?

Rising consumption of processed food and rising demand for processed, prepared and convenience food.

Which segment by application accounted for the largest food coating market share?

The meat & seafood products dominated the market for food coating ingredient market as well as food coating equipment market and was valued at USD 1.0 billion and USD 1.5 billion respectively in 2022. The global increase in meat consumption and the related food products is what is fueling the expansion. Humans need a variety of protein sources in their diets, and meat and poultry are regarded as excellent sources. Human bodies receive a necessary amount of protein from eating meat and poultry products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISING DEMAND FOR FUNCTIONAL FOODSINCREASING HEALTH AWARENESS AND GROWING HEALTH CONCERNS

-

5.3 MARKET DYNAMICSDRIVERS- Rising consumption of processed food- Rising demand for processed, prepared, and convenience food- Increased focus on production efficiency, processing time, and quality of food productsRESTRAINTS- Rising cost of production due to fluctuating price of ingredients- Shift in consumer preference toward fresh foodOPPORTUNITIES- Growing investment opportunities to develop new food coating technologiesCHALLENGES- Infrastructural and regulatory challenges in emerging economies

- 6.1 INTRODUCTION

-

6.2 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

-

6.3 REGULATORY FRAMEWORKPERMISSIBLE LIMITS FOR USE OF FOOD ADDITIVES- PreservativesANTI-CAKING- FDA regulations- European regulations- Sweeteners- ColorsNORTH AMERICA- US- Canada- MexicoEUROPE- France- ItalyASIA PACIFIC- Australia- Japan- Australia & New ZealandSOUTH AMERICA- Brazil- Argentina- Rest of South AmericaMIDDLE EAST- UAE

-

6.4 PATENT ANALYSIS

- 6.5 SUPPLY CHAIN ANALYSIS

-

6.6 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGLOGISTICS & DISTRIBUTIONMARKETING & SALES

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

-

6.8 ECOSYSTEM ANALYSIS

- 6.9 TRADE ANALYSIS

- 6.10 AVERAGE PRICE ANALYSIS

-

6.11 TECHNOLOGY ANALYSISNANOCOMPOSITESEDIBLE BIOPOLYMER FOOD COATING WITH NANOCURCUMIN AND HONEY

-

6.12 CASE STUDIESKERRY’S TEAM IDENTIFIED MOST UP-TO-DATE ARTISAN BAKERY TRENDS AND EXPLORED MARKET AND CONSUMER INSIGHTSKERRY TRENDSPOTTER HELPED SNACK MANUFACTURER CREATE NEW SNACK FLAVORS WITH ARTIFICIAL INTELLIGENCE

-

6.13 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.15 KEY CONFERENCES & EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 FOOD COATING INGREDIENTS MARKET, BY APPLICATIONMEAT & SEAFOOD PRODUCTS- Rising preference for flavorful and aromatic meat and seafood to drive market for food coating ingredientsCONFECTIONERY PRODUCTS- Growing preference for healthy snacking to drive growth of food coating ingredients market for confectionery productsBAKERY PRODUCTS- Popularity of chocolate-coated confectionery to drive adoption of food coating ingredients in bakery productsBREAKFAST CEREALS- Rising preference for healthy products to boost consumption of sugar-coated cerealsSNACKS- Demand for convenient and ultra-processed food products to fuel market for coating ingredients for snacks

-

7.3 FOOD COATING EQUIPMENT MARKET, BY APPLICATIONMEAT & SEAFOOD PRODUCTS- Increasing consumption of processed and frozen meat & seafood meal products to drive food coating equipment marketCONFECTIONERY PRODUCTS- Demand for processed and premium bakery products to propel market for food coating equipment for confectionery productsBAKERY PRODUCTS- Growing need for bakeries to gain control over liquid flow to drive adoption of food coating equipment in bakery industryBREAKFAST CEREALS- Automated processing lines curated by dairy and breakfast cereal product manufacturers to drive market for food coating equipment for breakfast cerealsSNACKS- Rapid shift in consumer demand toward convenience food products to drive market for food coating equipment for snacks

- 8.1 INTRODUCTION

-

8.2 COATERS & APPLICATORSINCREASE IN DEMAND FOR HEALTHIER SNACKS AND PREMIUM-COATED CONFECTIONERY PRODUCTS TO DRIVE MARKETBREADING APPLICATORS- Increasing demand for crunchy products to drive growth of breaded applicatorsFLOUR APPLICATORS- Rising demand for flexible flour applicators to drive marketBATTER APPLICATORS- Popularity of sophisticated foods and diverse fried foods to drive demand for battering applicatorsSEASONING APPLICATORS- Growing demand for different types of snacks to drive use of seasoning applicatorsOTHER COATERS & APPLICATORS

-

8.3 ENROBERSNEED FOR EVENLY COATED BUTTER TO DRIVE USE OF ENROBERS IN CONFECTIONERY

- 9.1 INTRODUCTION

-

9.2 DRYGROWING CONSUMPTION OF PROCESSED FOODS TO DRIVE MARKET FOR DRY COATING INGREDIENTS

-

9.3 LIQUIDUNIFORMITY AND ACCURATE DOSING OF LIQUID FOOD COATING INGREDIENTS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 COCOA & CHOCOLATERISING PREFERENCE FOR ASSORTED CHOCOLATE TO DRIVE USE OF COCOA AND CHOCOLATE AS COATING INGREDIENTS

-

10.3 FATS & OILSLOW COST OF FATS & OILS TO DRIVE THEIR USE AS COATING INGREDIENTS IN BISCUITS AND COOKIES

-

10.4 FLOURSRISING CASES OF GLUTEN-INTOLERANCE TO DRIVE USE OF GLUTEN-FREE FLOURS AS COATING AGENTS

-

10.5 BREADERSDEMAND FOR IMPROVED TEXTURE OF BREADERS TO DRIVE THEIR USE AS COATING AGENTS IN BURGER PATTIES

-

10.6 BATTERPOPULARITY OF HEALTHY FRIED FOOD TO DRIVE MARKET FOR BATTER AS COATING AGENT

-

10.7 SUGARS & SYRUPSPOPULARITY OF AESTHETICS IN BAKERY AND CONFECTIONERY TO DRIVE USE OF SUGARS & SYRUPS AS COATING AGENTS

-

10.8 SALTS, SPICES, AND SEASONINGSDEMAND FOR APPEALING FLAVORS IN FOOD PRODUCTS TO BOOST MARKET FOR SALTS, SPICES, AND SEASONINGS

- 10.9 OTHER INGREDIENT TYPES

- 11.1 INTRODUCTION

-

11.2 AUTOMATICACCURACY AND EFFICIENCY OF AUTOMATIC FOOD COATING EQUIPMENT TO DRIVE MARKET

-

11.3 SEMI-AUTOMATICNEED FOR LOW INSTALLATION AND MAINTENANCE COSTS TO FUEL MARKET FOR SEMI-AUTOMATIC FOOD COATING EQUIPMENT

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTFOOD COATING INGREDIENTS MARKET- US- Canada- MexicoFOOD COATING EQUIPMENT MARKET- US- Canada- Mexico

-

12.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTFOOD COATING INGREDIENTS MARKET- China- Japan- Australia & New Zealand- India- Rest of Asia PacificFOOD COATING EQUIPMENT MARKET- China- Japan- Australia & New Zealand- India- Rest of Asia Pacific

-

12.4 EUROPEEUROPE: RECESSION IMPACTFOOD COATING INGREDIENTS MARKET- UK- Germany- France- Netherlands- Italy- Rest of EuropeFOOD COATING EQUIPMENT MARKET- Germany- UK- France- Netherlands- Italy- Rest of Europe

-

12.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTFOOD COATING INGREDIENTS MARKET- Brazil- Argentina- Rest of South AmericaFOOD COATING EQUIPMENT MARKET- Brazil- Argentina- Rest of South America

-

12.6 REST OF THE WORLDROW: RECESSION IMPACTFOOD COATING INGREDIENTS MARKET- Middle East- AfricaFOOD COATING EQUIPMENT MARKET- Middle East- Africa

- 13.1 OVERVIEW

- 13.2 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS

- 13.3 COMPARISON BETWEEN ANNUAL REVENUE AND GROWTH RATES OF KEY FOOD COATING INGREDIENT MARKET PLAYERS

- 13.4 EBITDA ANALYSIS FOR KEY MANUFACTURERS OF FOOD COATING INGREDIENTS, 2022 (USD BILLION)

- 13.5 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS (FOOD COATING INGREDIENT MANUFACTURERS)

- 13.7 MARKET SHARE ANALYSIS, 2022

-

13.8 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS (FOOD COATING INGREDIENT MANUFACTURERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT (KEY FOOD COATING INGREDIENT MANUFACTURERS)

- 13.9 COMPARISON BETWEEN ANNUAL REVENUE AND GROWTH RATES OF KEY FOOD COATING EQUIPMENT MANUFACTURERS

- 13.10 EBITDA ANALYSIS FOR KEY MANUFACTURERS OF FOOD COATING EQUIPMENT, 2022 (USD BILLION)

- 13.11 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS (FOOD COATING EQUIPMENT MANUFACTURERS)

-

13.12 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS (FOOD COATING EQUIPMENT MANUFACTURERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT (FOOD COATING EQUIPMENT MANUFACTURERS)

-

13.13 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERS (FOOD COATING INGREDIENT COMPANIES)CARGILL, INCORPORATED- Business overview- Products/Solutions offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products/Solutions offered- MnM viewADM- Business overview- Products/Solutions offered- MnM viewINGREDION- Business overview- Products/Solutions offered- Recent developments- MnM viewNEWLY WEDS FOODS- Business overview- Products/Solutions offered- MnM viewASSOCIATED BRITISH FOODS PLC- Business overview- Products/Solutions offered- MnM viewTATE & LYLE- Business overview- Products/Solutions offered- MnM viewSOLINA- Business overview- Products/Solutions offered- Recent developments- MnM viewIDAN FOODS- Business overview- Products/Solutions offered- MnM viewPOPLA INTERNATIONAL, INC.- Business overview- Products/Solutions offered- MnM viewHOLLY POWDER

-

14.2 KEY PLAYERS (FOOD COATING EQUIPMENT COMPANIES)MAREL- Business overview- Products/Solutions offered- MnM viewGEA GROUP AKTIENGESELLSCHAFT- Business overview- Products/Solutions offered- Recent developments- MnM viewBÜHLER AG- Business overview- Products/Solutions offered- MnM viewJBT- Business overview- Products/Solutions offered- MnM viewTNA AUSTRALIA PTY LIMITED- Business overview- Products/Solutions offered- MnM viewSPICE APPLICATIONS LIMITED- Business overview- Products/Solutions offered- MnM viewCLEXTRAL- Business overview- Products/Solutions offered- MnM viewBESTMACHINERY- Business overview- Products/Solutions offered- MnM viewBETTCHER INDUSTRIES, INC.- Business overview- Products/Solutions offered- MnM viewDING-HAN MACHINERY CO., LTD.- Business overview- Products/Solutions offered- MnM view

-

14.3 STARTUPS/SMES (FOOD COATING EQUIPMENT COMPANIES)ABM COMPANY SRLAC HORN MANUFACTURINGMIA FOOD TECHNEMCO MACHINERY A/S

- 15.1 INTRODUCTION

- 15.2 RESEARCH LIMITATIONS

-

15.3 FOOD & BEVERAGES PROCESSING EQUIPMENT MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 PREPARED FOOD EQUIPMENT MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2018–2022

- TABLE 2 GLOBAL FOOD COATING MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 USAGE LIMITATIONS FOR BHA AS AN ANTIOXIDANT IN FOOD (ALONE OR IN COMBINATION WITH BHT)

- TABLE 9 USAGE LIMITATIONS FOR BHT AS AN ANTIOXIDANT IN FOOD (ALONE OR IN COMBINATION WITH BHA)

- TABLE 10 ADDITIVES AND THEIR PERMITTED USE IN VARIOUS FOOD APPLICATIONS IN CANADA

- TABLE 11 ADDITIVES AND THEIR PERMITTED USE IN VARIOUS FOOD APPLICATIONS IN EUROPE

- TABLE 12 PERMISSIBLE ADDITIVE LEVELS IN FOOD

- TABLE 13 STANDARDS REGARDING USE OF ADDITIVES IN FOOD

- TABLE 14 MAJOR PATENTS PERTAINING TO FOOD COATING MARKET, 2016–2023

- TABLE 15 ROLE OF FOOD COATING MANUFACTURERS IN MARKET ECOSYSTEM

- TABLE 16 IMPORT VALUE OF COCOA BEANS, WHOLE OR BROKEN, RAW OR ROASTED, BY KEY COUNTRY, 2022 (USD THOUSAND)

- TABLE 17 EXPORT VALUE OF COCOA BEANS, WHOLE OR BROKEN, RAW OR ROASTED, BY KEY COUNTRY, 2022 (USD THOUSAND)

- TABLE 18 IMPORT VALUE OF SUGARS AND SUGAR CONFECTIONERY, BY KEY COUNTRY, 2022 (USD THOUSAND)

- TABLE 19 EXPORT VALUE OF SUGARS AND SUGAR CONFECTIONERY, BY KEY COUNTRY, 2022 (USD THOUSAND)

- TABLE 20 PORTER’S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD COATING, BY TYPE

- TABLE 22 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 23 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 24 FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 25 FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 MEAT & SEAFOOD PRODUCTS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 MEAT & SEAFOOD PRODUCTS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 CONFECTIONERY PRODUCTS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 CONFECTIONERY PRODUCTS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 BAKERY PRODUCTS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 BAKERY PRODUCTS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 BREAKFAST CEREALS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 BREAKFAST CEREALS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 SNACKS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 SNACKS: FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 MEAT & SEAFOOD PRODUCTS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 MEAT & SEAFOOD PRODUCTS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CONFECTIONERY PRODUCTS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 CONFECTIONERY PRODUCTS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 BAKERY PRODUCTS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 BAKERY PRODUCTS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 BREAKFAST CEREALS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 BREAKFAST CEREALS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 SNACKS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 SNACKS: FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 FOOD COATING MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 49 FOOD COATING MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 50 COATERS & APPLICATORS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 COATERS & APPLICATORS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 COATERS & APPLICATORS: FOOD COATING MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 53 COATERS & APPLICATORS: FOOD COATING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 54 BREADING APPLICATORS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 BREADING APPLICATORS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 FLOUR APPLICATORS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 FLOUR APPLICATORS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 BATTER APPLICATORS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 BATTER APPLICATORS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 SEASONING APPLICATORS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 SEASONING APPLICATORS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 OTHER COATERS & APPLICATORS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 OTHER COATERS & APPLICATORS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 ENROBERS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 ENROBERS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 FOOD COATING MARKET, BY INGREDIENT FORM, 2019–2022 (USD MILLION)

- TABLE 67 FOOD COATING MARKET, BY INGREDIENT FORM, 2023–2028 (USD MILLION)

- TABLE 68 DRY: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 DRY: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 LIQUID: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 LIQUID: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 FOOD COATING MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 73 FOOD COATING MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 74 FOOD COATING MARKET, BY INGREDIENT TYPE, 2019–2022 (KT)

- TABLE 75 FOOD COATING MARKET, BY INGREDIENT TYPE, 2023–2028 (KT)

- TABLE 76 COCOA & CHOCOLATE: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 COCOA & CHOCOLATE: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 COCOA & CHOCOLATE: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 79 COCOA & CHOCOLATE: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 80 FATS & OILS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 FATS & OILS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 FATS & OILS: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 83 FATS & OILS: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 84 FLOURS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 FLOURS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 FLOURS: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 87 FLOURS: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 88 BREADERS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 BREADERS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 BREADERS: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 91 BREADERS: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 92 BATTER: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 BATTER: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 BATTER: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 95 BATTER: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 96 SUGARS & SYRUPS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 97 SUGARS & SYRUPS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 SUGARS & SYRUPS: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 99 SUGARS & SYRUPS: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 100 SALTS, SPICES, AND SEASONINGS: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 101 SALTS, SPICES, AND SEASONINGS: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 SALTS, SPICES, AND SEASONINGS: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 103 SALTS, SPICES, AND SEASONINGS: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 104 OTHER INGREDIENT TYPES: FOOD COATING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 OTHER INGREDIENT TYPES: FOOD COATING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 OTHER INGREDIENT TYPES: FOOD COATING MARKET, BY REGION, 2019–2022 (KT)

- TABLE 107 OTHER INGREDIENT TYPES: FOOD COATING MARKET, BY REGION, 2023–2028 (KT)

- TABLE 108 FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2019–2022 (USD MILLION)

- TABLE 109 FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 110 AUTOMATIC: FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 AUTOMATIC: FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 SEMI-AUTOMATIC: FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 SEMI-AUTOMATIC: FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 117 FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 118 FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 119 FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 120 FOOD COATING EQUIPMENT MARKET, BY REGION, 2019–2022 (KT)

- TABLE 121 FOOD COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (KT)

- TABLE 122 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 123 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (KT)

- TABLE 125 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (KT)

- TABLE 126 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 127 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2019–2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2023–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 US: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 133 US: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 134 CANADA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 135 CANADA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 136 MEXICO: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 137 MEXICO: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2019–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2019–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 US: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 149 US: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 150 CANADA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 151 CANADA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 152 MEXICO: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 153 MEXICO: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (KT)

- TABLE 157 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (KT)

- TABLE 158 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2019–2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2023–2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 CHINA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 165 CHINA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 166 JAPAN: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 167 JAPAN: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 168 AUSTRALIA & NEW ZEALAND: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 169 AUSTRALIA & NEW ZEALAND: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 170 INDIA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 171 INDIA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2019–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2019–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 184 CHINA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 185 CHINA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 186 JAPAN: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 187 JAPAN: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 188 AUSTRALIA & NEW ZEALAND: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 189 AUSTRALIA & NEW ZEALAND: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 190 INDIA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 191 INDIA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 194 EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 195 EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 196 EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (KT)

- TABLE 197 EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (KT)

- TABLE 198 EUROPE: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 199 EUROPE: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 200 EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2019–2022 (USD MILLION)

- TABLE 201 EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2023–2028 (USD MILLION)

- TABLE 202 EUROPE: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 203 EUROPE: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 204 UK: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 205 UK: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 206 GERMANY: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 207 GERMANY: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 208 FRANCE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 209 FRANCE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 210 NETHERLANDS: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 211 NETHERLANDS: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 212 ITALY: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 213 ITALY: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 214 REST OF EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 215 REST OF EUROPE: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 216 EUROPE: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 217 EUROPE: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 218 EUROPE: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2019–2022 (USD MILLION)

- TABLE 219 EUROPE: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2023–2028 (USD MILLION)

- TABLE 220 EUROPE: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2019–2022 (USD MILLION)

- TABLE 221 EUROPE: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 222 EUROPE: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 223 EUROPE: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 224 EUROPE: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 225 EUROPE: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 226 GERMANY: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 227 GERMANY: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 228 UK: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 229 UK: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 230 FRANCE: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 231 FRANCE: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 232 NETHERLANDS: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 233 NETHERLANDS: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 234 ITALY: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 235 ITALY: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 236 REST OF EUROPE: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 237 REST OF EUROPE: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 238 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 239 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 240 SOUTH AMERICA: FOOD COATING MARKET, BY INGREDIENT TYPE, 2019–2022 (KT)

- TABLE 241 SOUTH AMERICA: FOOD COATING MARKET, BY INGREDIENT TYPE, 2023–2028 (KT)

- TABLE 242 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 243 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 244 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2019–2022 (USD MILLION)

- TABLE 245 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2023–2028 (USD MILLION)

- TABLE 246 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 247 SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 248 BRAZIL: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 249 BRAZIL: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 250 ARGENTINA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 251 ARGENTINA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 253 REST OF SOUTH AMERICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 254 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 255 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 256 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2019–2022 (USD MILLION)

- TABLE 257 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2023–2028 (USD MILLION)

- TABLE 258 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2019–2022 (USD MILLION)

- TABLE 259 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 260 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 261 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 262 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 263 SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 264 BRAZIL: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 265 BRAZIL: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 266 ARGENTINA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 267 ARGENTINA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 268 REST OF SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 269 REST OF SOUTH AMERICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 270 ROW: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 271 ROW: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 272 ROW: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (KT)

- TABLE 273 ROW: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (KT)

- TABLE 274 ROW: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 275 ROW: FOOD COATING INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 276 ROW: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2019–2022 (USD MILLION)

- TABLE 277 ROW: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2023–2028 (USD MILLION)

- TABLE 278 ROW: FOOD COATING INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 279 ROW: FOOD COATING INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 280 MIDDLE EAST: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 281 MIDDLE EAST: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 282 AFRICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 283 AFRICA: FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 284 ROW: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 285 ROW: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 286 ROW: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2019–2022 (USD MILLION)

- TABLE 287 ROW: FOOD COATING EQUIPMENT MARKET, BY COATER & APPLICATOR, 2023–2028 (USD MILLION)

- TABLE 288 ROW: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2019–2022 (USD MILLION)

- TABLE 289 ROW: FOOD COATING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 290 ROW: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 291 ROW: FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 292 ROW: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 293 ROW: FOOD COATING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 294 MIDDLE EAST: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 295 MIDDLE EAST: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 296 AFRICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 297 AFRICA: FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 298 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 299 FOOD COATING MARKET: INTENSITY OF COMPETITIVE RIVALRY (FOOD COATING EQUIPMENT MANUFACTURERS), 2022

- TABLE 300 COMPANY FOOTPRINT, BY INGREDIENT TYPE

- TABLE 301 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 302 COMPANY REGIONAL FOOTPRINT

- TABLE 303 OVERALL COMPANY FOOTPRINT

- TABLE 304 COMPANY FOOTPRINT, BY EQUIPMENT TYPE

- TABLE 305 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 306 COMPANY REGIONAL FOOTPRINT

- TABLE 307 OVERALL COMPANY FOOTPRINT

- TABLE 308 PRODUCT LAUNCHES, 2020–2023

- TABLE 309 DEALS, 2020–2023

- TABLE 310 OTHERS, 2021–2023

- TABLE 311 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 312 CARGILL, INCORPORATED: DEALS

- TABLE 313 CARGILL, INCORPORATED: OTHERS

- TABLE 314 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 315 KERRY GROUP PLC: OTHERS

- TABLE 316 ADM: BUSINESS OVERVIEW

- TABLE 317 INGREDION: BUSINESS OVERVIEW

- TABLE 318 INGREDION: PRODUCT LAUNCHES

- TABLE 319 INGREDION: DEALS

- TABLE 320 INGREDION: OTHERS

- TABLE 321 NEWLY WEDS FOODS: BUSINESS OVERVIEW

- TABLE 322 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- TABLE 323 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 324 SOLINA: BUSINESS OVERVIEW

- TABLE 325 SOLINA: DEALS

- TABLE 326 IDAN FOODS: BUSINESS OVERVIEW

- TABLE 327 POPLA INTERNATIONAL, INC.: BUSINESS OVERVIEW

- TABLE 328 HOLLY POWDER: BUSINESS OVERVIEW

- TABLE 329 MAREL: BUSINESS OVERVIEW

- TABLE 330 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- TABLE 331 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 332 BÜHLER AG: BUSINESS OVERVIEW

- TABLE 333 JBT: BUSINESS OVERVIEW

- TABLE 334 JBT: OTHERS

- TABLE 335 TNA AUSTRALIA PTY LIMITED: BUSINESS OVERVIEW

- TABLE 336 SPICE APPLICATIONS LIMITED: BUSINESS OVERVIEW

- TABLE 337 CLEXTRAL: BUSINESS OVERVIEW

- TABLE 338 BESTMACHINERY: BUSINESS OVERVIEW

- TABLE 339 BETTCHER INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 340 DING-HAN MACHINERY CO., LTD.: BUSINESS OVERVIEW

- TABLE 341 ADJACENT MARKETS

- TABLE 342 FOOD & BEVERAGES PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 343 FOOD & BEVERAGES PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 344 PREPARED FOOD EQUIPMENT MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023 VS. 2028

- FIGURE 4 FOOD COATING INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023 VS. 2028

- FIGURE 5 FOOD COATING INGREDIENTS MARKET, BY INGREDIENT FORM, 2023 VS. 2028

- FIGURE 6 FOOD COATING INGREDIENTS MARKET, BY INGREDIENT APPLICATION, 2023 VS. 2028

- FIGURE 7 FOOD COATING EQUIPMENT MARKET, BY EQUIPMENT APPLICATION, 2023 VS. 2028

- FIGURE 8 FOOD COATING INGREDIENTS MARKET: REGIONAL ANALYSIS

- FIGURE 9 FOOD COATING EQUIPMENT MARKET: REGIONAL ANALYSIS

- FIGURE 10 HIGH DEMAND FOR READY-TO-EAT MEALS TO DRIVE MARKET GROWTH

- FIGURE 11 RISING DEMAND FOR PROCESSED FOODS TO PROPEL MARKET GROWTH

- FIGURE 12 COATERS & APPLICATORS SEGMENT AND CHINA TO ACHIEVE SIGNIFICANT SHARE IN 2023

- FIGURE 13 COCOA & CHOCOLATE SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 14 COCOA & CHOCOLATE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 15 US TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 16 US TO LEAD MARKET IN 2023

- FIGURE 17 NUMBER OF COUNTRIES MANDATING FOOD FORTIFICATION, 2011–2019

- FIGURE 18 FOOD COATING MARKET DYNAMICS

- FIGURE 19 GLOBAL SALES OF HEALTHY BAKED GOODS, BY KEY COUNTRY, 2017 VS. 2021 (USD MILLION)

- FIGURE 20 PRICE TREND FOR COCOA, 2018–2022 (USD PER TON)

- FIGURE 21 PRICE TREND FOR COCOA, 2018–2022 (USD PER LBS)

- FIGURE 22 NUMBER OF PATENTS GRANTED, 2016–2023

- FIGURE 23 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016–2023

- FIGURE 24 SUPPLY CHAIN INTEGRITY IN FOOD COATING MARKET

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 REVENUE SHIFT IN FOOD COATING MARKET

- FIGURE 27 ECOSYSTEM MAP

- FIGURE 28 IMPORT VALUE OF COCOA BEANS, WHOLE OR BROKEN, RAW OR ROASTED, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 29 EXPORT VALUE OF COCOA BEANS, WHOLE OR BROKEN, RAW OR ROASTED, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 30 IMPORT VALUE OF SUGARS AND SUGAR CONFECTIONERY, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 31 EXPORT VALUE OF SUGARS AND SUGAR CONFECTIONERY, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 32 AVERAGE SELLING PRICE TREND, BY INGREDIENT TYPE, 2019–2022 (USD PER TON)

- FIGURE 33 AVERAGE SELLING PRICE TREND, BY REGION, 2019–2022 (USD PER TON)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD COATING, BY TYPE

- FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 36 MEAT & SEAFOOD PRODUCTS SEGMENT TO DOMINATE FOOD COATING INGREDIENTS MARKET BY 2028

- FIGURE 37 FOOD COATING EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 COATERS & APPLICATORS SEGMENT TO DOMINATE MARKET BY 2028

- FIGURE 39 LIQUID SEGMENT TO DOMINATE MARKET BY 2028

- FIGURE 40 COCOA & CHOCOLATE SEGMENT TO LEAD MARKET BY 2028

- FIGURE 41 AUTOMATIC SEGMENT TO LEAD FOOD COATING EQUIPMENT MARKET BY 2028

- FIGURE 42 INDIA TO DOMINATE FOOD COATING INGREDIENTS MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: FOOD COATING INGREDIENTS MARKET SNAPSHOT

- FIGURE 44 INFLATION: COUNTRY-LEVEL DATA (2017–2021)

- FIGURE 45 NORTH AMERICAN FOOD COATING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 46 ASIA PACIFIC: FOOD COATING EQUIPMENT MARKET SNAPSHOT

- FIGURE 47 INFLATION: COUNTRY-LEVEL DATA (2017–2021)

- FIGURE 48 ASIA PACIFIC FOOD COATING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 49 EUROPE: INFLATION RATE, BY KEY COUNTRY, 2017–2021

- FIGURE 50 EUROPEAN FOOD COATING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 51 SOUTH AMERICA: INFLATION RATE, BY KEY COUNTRY, 2018–2021

- FIGURE 52 SOUTH AMERICAN FOOD COATING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 53 ROW: INFLATION RATE, BY KEY REGION, 2018–2021

- FIGURE 54 ROW FOOD COATING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 55 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS, 2018–2022 (USD MILLION)

- FIGURE 56 COMPARISON BETWEEN ANNUAL REVENUE AND GROWTH RATES OF KEY FOOD COATING INGREDIENT MARKET PLAYERS

- FIGURE 57 EBITA ANALYSIS FOR KEY MANUFACTURERS OF FOOD COATING INGREDIENTS, 2022 (USD BILLION)

- FIGURE 58 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS (FOOD COATING INGREDIENT MANUFACTURERS), 2022

- FIGURE 59 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2022 (FOOD COATING INGREDIENT MANUFACTURERS)

- FIGURE 60 COMPARISON BETWEEN ANNUAL REVENUE AND GROWTH RATES OF KEY FOOD COATING EQUIPMENT MANUFACTURERS

- FIGURE 61 EBITDA ANALYSIS FOR KEY MANUFACTURERS OF FOOD COATING EQUIPMENT, 2022 (USD BILLION)

- FIGURE 62 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS (FOOD COATING EQUIPMENT MANUFACTURERS), 2022

- FIGURE 63 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS (FOOD COATING EQUIPMENT MANUFACTURERS), 2022

- FIGURE 64 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 65 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 66 ADM: COMPANY SNAPSHOT

- FIGURE 67 INGREDION: COMPANY SNAPSHOT

- FIGURE 68 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- FIGURE 69 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 70 MAREL: COMPANY SNAPSHOT

- FIGURE 71 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 72 BÜHLER AG: COMPANY SNAPSHOT

- FIGURE 73 JBT: COMPANY SNAPSHOT

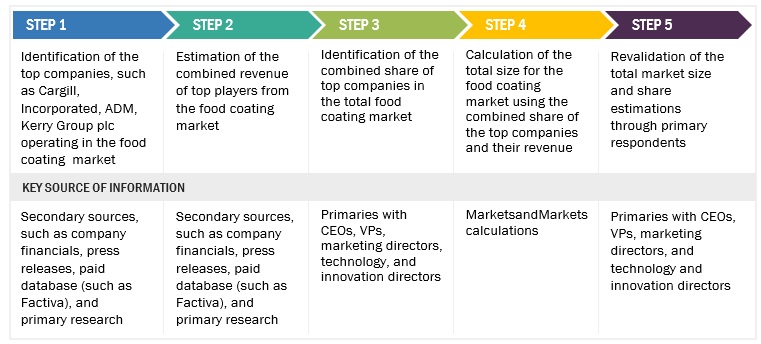

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the food coating market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, EU Commission, European Food Safety Authority, German Federal Institute of Risk Assessment, Food Safety and Standards Authority of India (FSSAI), and Japanese Ministry of Health, Labor and Welfare have been referred to, to identify and collect information for this study. The secondary sources also included food coating annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The Food coating market comprises of multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of food coating from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

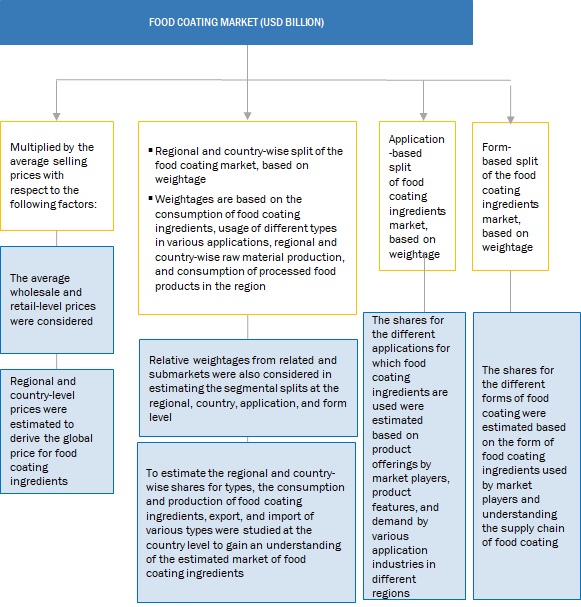

Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major food coating manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the food coating market has been arrived at.

Food Coating Market Size Estimation, By Type (Supply Side)

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up Approach:

- Based on the share of food coating for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for food coating was estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated.

- Other factors considered include the penetration rate of food coating, are the demand for health & wellness products, growth in immunity concerts, consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food coating market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Food Coating Market Size Estimation (Demand Side)

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the food coating market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to The National Agricultural Library Digital Collections (NALDC):

Any type of material used for enrobing (i.e., coating or wrapping) various food to extend the shelf life of the product that may be eaten together with food with or without further removal is considered an edible film or coating. Edible films provide replacement and/or fortification of natural layers to prevent moisture losses, while selectively allowing for controlled exchange of important gases, such as oxygen, carbon dioxide, and ethylene, which are involved in respiration processes. A film or coating can also provide surface sterility and prevent loss of other important components. Generally, its thickness is less than 0.3 mm.

Stakeholders

- Food & beverage processing equipment manufacturers

- Food & beverage processing equipment importers and exporters

- Food & beverage processing equipment traders, distributors, and suppliers

- Food product manufacturers, processors, distributors, and traders

- Beverage product manufacturers, processors, distributors, and traders

- Food ingredient manufacturers, processors, distributors, and traders

- Beverage ingredient manufacturers, processors, distributors, and traders

- Government and research organizations

-

Associations and industry bodies:

- Association for Packaging and Processing Technologies (PMMI)

- Food Processing Suppliers Association (FPSA)

- Center for Innovative Food Technology (CIFT)

- Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- Process Equipment Manufacturers' Association (PEMA)

- Food Manufacturing Machinery Manufacturers (PPMA)

- Agro & Food Processing Equipment & Technology Providers Association of India (AFTPAI)

- Canadian Produce Marketing Association (CPMA)

- The Association of Food Technology

- American Bakers Association (ABA)

- National Confectioners Association (NCA)

- American Association of Meat Processors (AAMP)

- British Confectioners' Association (BCA)

- Bakery Equipment Manufacturers & Allieds (BEMA)

- British Confectioners' Association (SPA)

- British Meat Processors Association (BMPA)

Report Objectives

Market Intelligence

- Determining and projecting the size of the food coating market with respect to its equipment type, ingredient form, ingredient type, mode of operation, application, and regional presence, over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the food coating market.

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the food coating market.

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global food coating market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis