Food Encapsulation Market

Food Encapsulation Market by Shell Material (Lipids, Polysaccharides, Emulsifiers, Proteins), Technology (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation), Application, Method, Core Phase and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

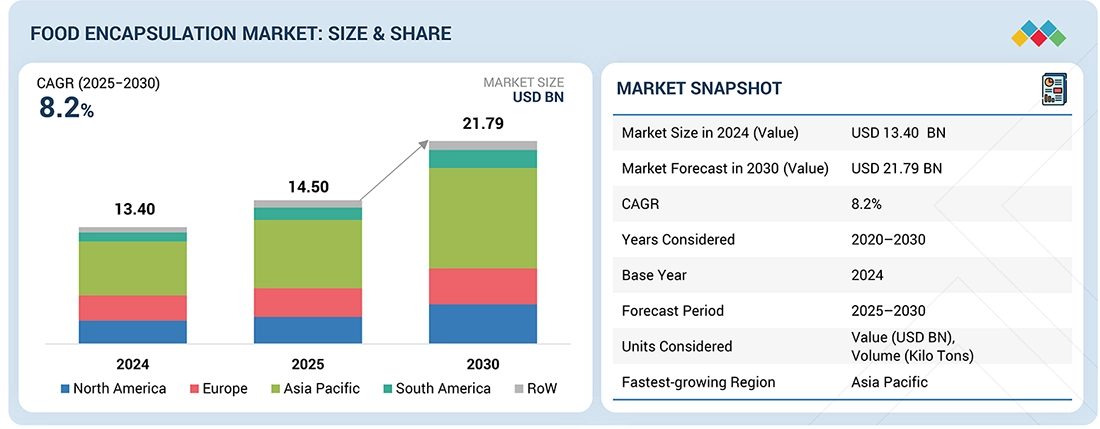

The Global Food Encapsulation Market is estimated to be valued at USD 14.50 billion in 2025 and is projected to reach USD 21.79 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. Food encapsulation is a rapidly growing market, with the food and nutrition industry increasingly adopting this technology to ensure stability of ingredients, enhance shelf-life, and enhance functional performances. Encapsulation makes it possible to save active ingredients that are sensitive to heat, moisture, oxygen, and other process stress, ensuring delivery as well as consistency throughout the lifecycle of a product. This gives significant support for functional foods, fortified foods, dietary supplements, infant nutrition, and pet food, where monotony and nutritional efficacy are of utmost centrality. Additionally, the market thrives due to the increased consumer hunger for clean-label, health-oriented, and preventive food products. Mostly, flavor matching, controlled release, and highly; consistent distribution makes encapsulation desirable for manufacturers to fulfill regulatory requirements with undiminished feasibility of their products. Through technologies such as spray-drying, fluid-bed coating, coacervation, and lipid-based encapsulation that are constantly improving by providing scalability and cost effectiveness.

KEY TAKEAWAYS

-

By RegionNorth America accounted for 32.4% market share in 2024.

-

By Core MaterialBy Core Material, the Nutraceuticals segment is expected to register the highest CAGR of 8.9% during the forecast period.

-

By ApplicationBy application, the Sports & clinical nutrition segment will grow the fastest during the forecast period.

-

By Shell MaterialShell Polysaccharides accounted for 48.5% market share in 2024.

-

Competitive Landscape – Key PlayersKey players include DSM-Firmenich, Kerry Group, ADM, Givaudan, and Ingredion, supported by strong formulation capabilities and global manufacturing presence.

-

Competitive Landscape – StartupsEmerging players such as Balchem, TasteTech, Lycored, and Microcaps are gaining traction through targeted, clean-label, and application-specific encapsulation solutions.

The Global Food Encapsulation Market is estimated to be valued at USD 14.50 billion in 2025 and is projected to reach USD 21.79 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. Demand for encapsulated food is increasing globally, as food manufacturers are adopting encapsulation technologies to ensure the stability, shelf life, and functionality of ingredients being used in food processing exponentially. Food encapsulation also helps in protecting heat-transparent, most often sensitive, components such as vitamins, minerals, flavors, omega-3 fatty acids, probiotics, enzymes, and bioactive compounds from heat, moisture, oxygen, and processing stress. This, in turn, leads to the controlled release systems, taste masking, and the standardized nutritional delivery in a vast assortment of processed and packaged food products.

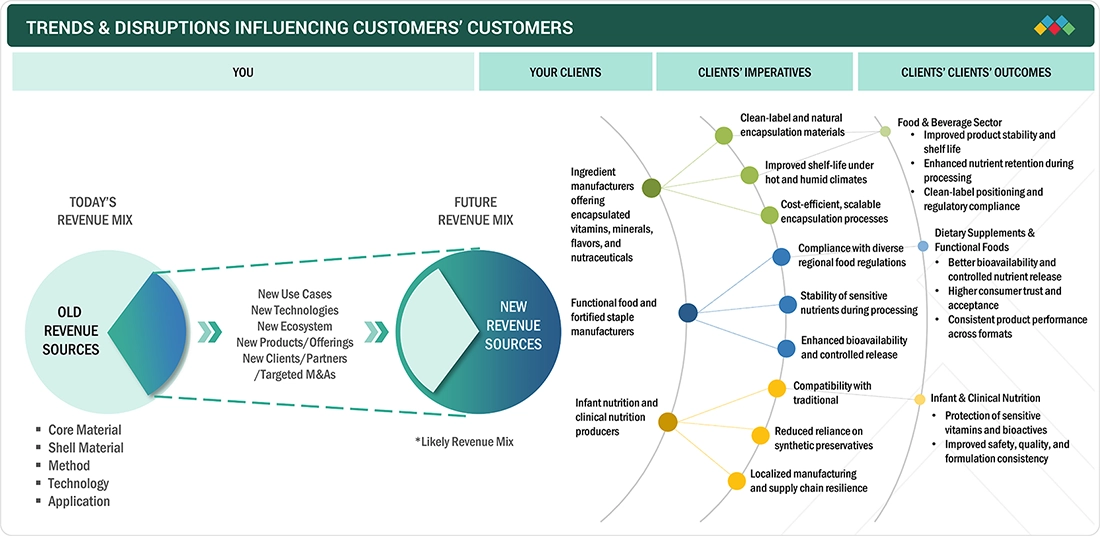

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The food encapsulation market is increasingly shaped by downstream demand for stable, clean-label, and performance-driven food products, leading to a clear shift in revenue mix toward advanced encapsulated ingredients. Ingredient manufacturers are expanding offerings of encapsulated vitamins, minerals, flavors, and nutraceuticals to support functional foods, dietary supplements, and infant and clinical nutrition products. Clients’ imperatives focus on improving shelf life under heat and humidity, ensuring stability during processing, achieving cost-efficient scalability, and meeting evolving food safety and regulatory standards. Encapsulation technologies enable controlled release, enhanced bioavailability, and reduced reliance on synthetic preservatives, directly influencing customers’ customers across food and nutrition categories. For food and beverage manufacturers, this translates into improved product consistency, longer shelf life, and stronger clean-label positioning. In dietary supplements and functional foods, encapsulation supports consumer trust through consistent nutrient delivery, while in infant and clinical nutrition it ensures protection of sensitive actives and formulation reliability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Rising demand for functional and fortified food products

-

•Expanding processed food consumption across emerging Asian economies

Level

-

§High cost of advanced encapsulation technologies and materials

-

§Limited technical expertise among small and mid-scale food manufacturers

Level

-

§Growing adoption of encapsulated probiotics in dairy and beverages

-

§Increasing government focus on food fortification programs

Level

-

§Regulatory complexity across diverse Asia Pacific food markets

-

§Ensuring stability of encapsulated ingredients under tropical climates

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for functional and fortified food products

The food encapsulation market is primarily driven by the growing demand for functional and fortified food products that deliver targeted health benefits. Increasing consumer focus on immunity, digestive health, micronutrient adequacy, and preventive nutrition has accelerated the incorporation of vitamins, minerals, probiotics, and bioactive compounds into everyday food products. Encapsulation enables food manufacturers to protect these sensitive ingredients from heat, moisture, and oxidation during processing and storage, while ensuring consistent nutrient delivery. As clean-label and health-oriented food consumption expands across developed and emerging markets, encapsulation has become a key enabling technology supporting product differentiation, quality consistency, and regulatory compliance.

Restraint: High Cost of Advanced Encapsulation Technologies and Materials

The adoption of food encapsulation technologies is constrained by the relatively high cost of advanced encapsulation processes and specialized coating materials. Techniques such as fluid-bed coating, lipid-based encapsulation, and multilayer systems require capital-intensive equipment, skilled technical expertise, and higher-quality raw materials. These cost factors can limit adoption, particularly among small and mid-sized food manufacturers operating in price-sensitive markets. In addition, formulation development, stability testing, and scale-up validation further increase overall production costs. As a result, cost considerations remain a key restraint affecting wider penetration of encapsulated ingredients across mass-market food applications.

Opportunity: Growing Adoption of Encapsulated Probiotics in Dairy and Foods

Encapsulated probiotics present a significant growth opportunity within the food encapsulation market, particularly in dairy and fermented food applications. Encapsulation improves probiotic stability during processing, storage, and distribution, enabling consistent viable counts at the point of consumption. This has expanded probiotic usage beyond traditional refrigerated products into shelf-stable dairy, powdered foods, and fortified nutrition formats. Rising consumer awareness of gut health and immunity is further supporting demand for probiotic-enriched foods. As food manufacturers seek scalable solutions to maintain probiotic efficacy while extending shelf life, encapsulation technologies are expected to see increased adoption.

Challenge: Regulatory and Compliance Complexity

Regulatory complexity remains a significant challenge for the global food encapsulation market due to varying food safety standards, approval pathways, and labeling requirements across regions. Encapsulated ingredients must comply with regulations governing food additives, novel ingredients, carrier materials, and health claims. Regulatory authorities require detailed safety, stability, and bioavailability data to validate encapsulated formulations, particularly for probiotics, bioactives, and nanostructured systems. Differences in regulatory interpretation between regions such as North America, Europe, and Asia further increase compliance complexity for multinational manufacturers. Navigating these regulatory frameworks adds time and cost to product development and commercialization, influencing innovation timelines and market entry strategies.

FOOD ENCAPSULATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of encapsulation technologies to protect sensitive bioactive components in fermented food products, ensuring stability of functional ingredients during processing, storage, and distribution under varied temperature conditions. | Improved ingredient stability, consistent functional performance, extended shelf life, and reliable quality in mass-consumption functional foods. |

|

Encapsulation of vitamins, minerals, and functional lipids in dairy and plant-based food products to enable fortification without affecting taste, texture, or product appearance. | Enhanced nutrient protection, uniform dispersion in food matrices, clean-label fortification, and improved consumer acceptance. |

|

Application of encapsulated micronutrients, flavors, and bioactive ingredients in fortified foods, infant nutrition, and ready-to-consume products to maintain nutritional value throughout product shelf life. | Better nutrient retention, controlled release, sensory consistency, and compliance with stringent food safety and nutrition standards. |

|

Integration of encapsulated nutrients in dairy-based functional foods to preserve efficacy during heat processing and long-term storage, particularly for products targeting digestive and immune health. | Improved product stability, enhanced bioavailability, longer shelf life, and reduced degradation of sensitive ingredients. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The food encapsulation market ecosystem comprises a well-integrated network of ingredient and technology suppliers, food and nutrition manufacturers, regulatory authorities, and distribution channels that collectively support large-scale adoption across global food systems. Core ingredient and technology suppliers provide encapsulation materials, processing know-how, and delivery systems that enable the stabilization and controlled release of sensitive nutrients. Food and nutrition manufacturers leverage these solutions to develop fortified foods, functional products, and specialized nutrition offerings with improved shelf life, safety, and consistency. Regulatory and standards authorities play a central role in defining compliance requirements for encapsulated ingredients, ensuring food safety, labeling accuracy, and quality assurance across regions. On the demand side, modern retail, pharmacy chains, and e-commerce platforms facilitate widespread market access and consumer reach. The interaction among these stakeholders enables continuous innovation, efficient scale-up, and regulatory alignment, positioning food encapsulation as a foundational technology supporting functional food development, clean-label positioning, and long-term growth in the global food and nutrition industry.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Food Encapsulation Market, By Core Material

In the food encapsulation market, core materials include vitamins, minerals, probiotics, enzymes, nutraceuticals, flavors, and organic acids that require protection during processing and storage. Vitamins and minerals account for the largest share due to their extensive use in food fortification and their high sensitivity to heat, oxygen, moisture, and light. Encapsulation ensures stability, uniform dispersion, and improved bioavailability, enabling consistent nutritional delivery in functional foods, dietary supplements, infant nutrition, and clinical products. At the same time, probiotics and nutraceutical bioactives are emerging as faster-growing core materials, driven by rising interest in gut health, immunity, and preventive nutrition.

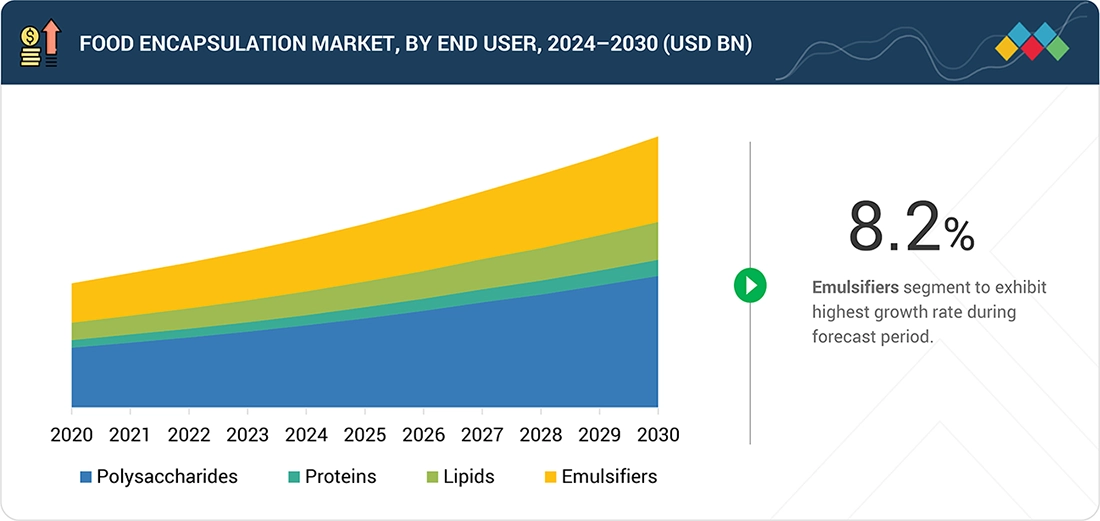

Food Encapsulation Market, By Shell Material

Shell materials play a critical role in determining the performance of encapsulated food ingredients. Polysaccharides such as starches, maltodextrin, alginates, and gums are widely used due to their food-grade status, cost efficiency, and compatibility with clean-label requirements. Lipids and proteins are also used where controlled release, moisture protection, or fat-soluble ingredient delivery is required. The selection of shell material directly influences encapsulation efficiency, release behavior, shelf stability, and sensory impact, making it a key formulation decision for food manufacturers targeting different applications and processing conditions.

Food Encapsulation Market, By Method

Encapsulation methods in the food market include physical, chemical, and physicochemical approaches, with physical methods accounting for the largest share. Techniques such as spray drying, fluid-bed coating, and extrusion are preferred due to their scalability, cost effectiveness, and compatibility with existing food processing infrastructure. These methods enable high-volume production while maintaining ingredient stability and consistent quality. Physical encapsulation methods are particularly suitable for vitamins, minerals, flavors, and probiotics, supporting their widespread adoption across fortified foods, bakery, dairy, and nutrition products.

Food Encapsulation Market, By Technology

By technology, microencapsulation dominates the food encapsulation market owing to its proven industrial applicability and regulatory acceptance. Spray drying and fluid-bed coating are extensively used to encapsulate sensitive food ingredients at commercial scale. These technologies offer reliable protection, controlled release, and ease of handling while balancing performance and production costs. Although advanced technologies such as nanoencapsulation are gaining attention for enhanced bioavailability, microencapsulation remains the preferred choice for most food applications due to its maturity, scalability, and alignment with food safety and labeling regulations.

Food Encapsulation Market, By Application

Food encapsulation finds extensive application across functional foods, dietary supplements, infant nutrition, bakery, dairy, confectionery, and clinical nutrition, where stability and performance of active ingredients are critical. In functional and fortified foods, encapsulation enables the effective incorporation of vitamins, minerals, probiotics, omega-3 fatty acids, and bioactive compounds without compromising taste, texture, or appearance. In dietary supplements, it supports precise dosage control, improved bioavailability, and extended shelf life, especially for sensitive ingredients prone to degradation. Infant nutrition and clinical nutrition applications rely heavily on encapsulation to ensure safety, consistent nutrient delivery, and protection of heat- and moisture-sensitive micronutrients during processing and storage. In bakery and dairy products, encapsulation helps ingredients withstand high temperatures and harsh processing conditions while ensuring controlled release during consumption. Overall, application-driven demand is a key factor shaping the food encapsulation market, as manufacturers increasingly use encapsulation to meet clean-label expectations, regulatory requirements, and rising consumer demand for health-focused, stable, and high-quality food products.

REGION

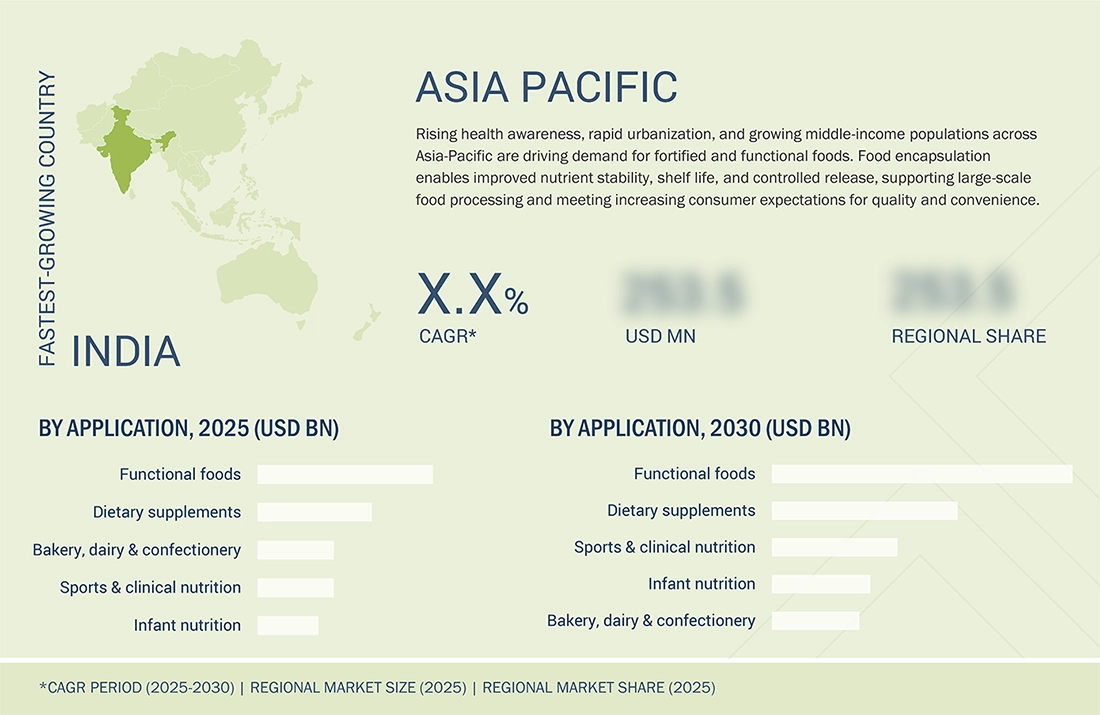

Asia Pacific is fastest-growing region Food Encapsulation market

The Asia Pacific region is considered the quickest expanding area in the Food Encapsulation market, mainly because of the dynamic changes in the eating habits, better health awareness, and the growth of the functional food and nutraceutical industries. Urbanization plus disposable income are increasing in countries like China, India, Japan, and South Korea, which are leading to higher consumption of fortified foods, dietary supplements, and infant nutrition products, where microencapsulation is applied to enhance the stability and bioavailability of sensitive ingredients. There is also a strong demand for powdered and capsule formats of probiotics, vitamins & minerals, and organic acids in the region because of their convenience and longer shelf life. Local producers are gradually incorporating spray drying and polysaccharide-based shell materials to satisfy the cost and scalability needs. Furthermore, the technology adoption is being sped up by regulatory transparency in important markets and the investment of global food and ingredient companies into the construction of regional production plants. Thus, all these factors combined make Asia Pacific the most vibrant growth market during the projected period.

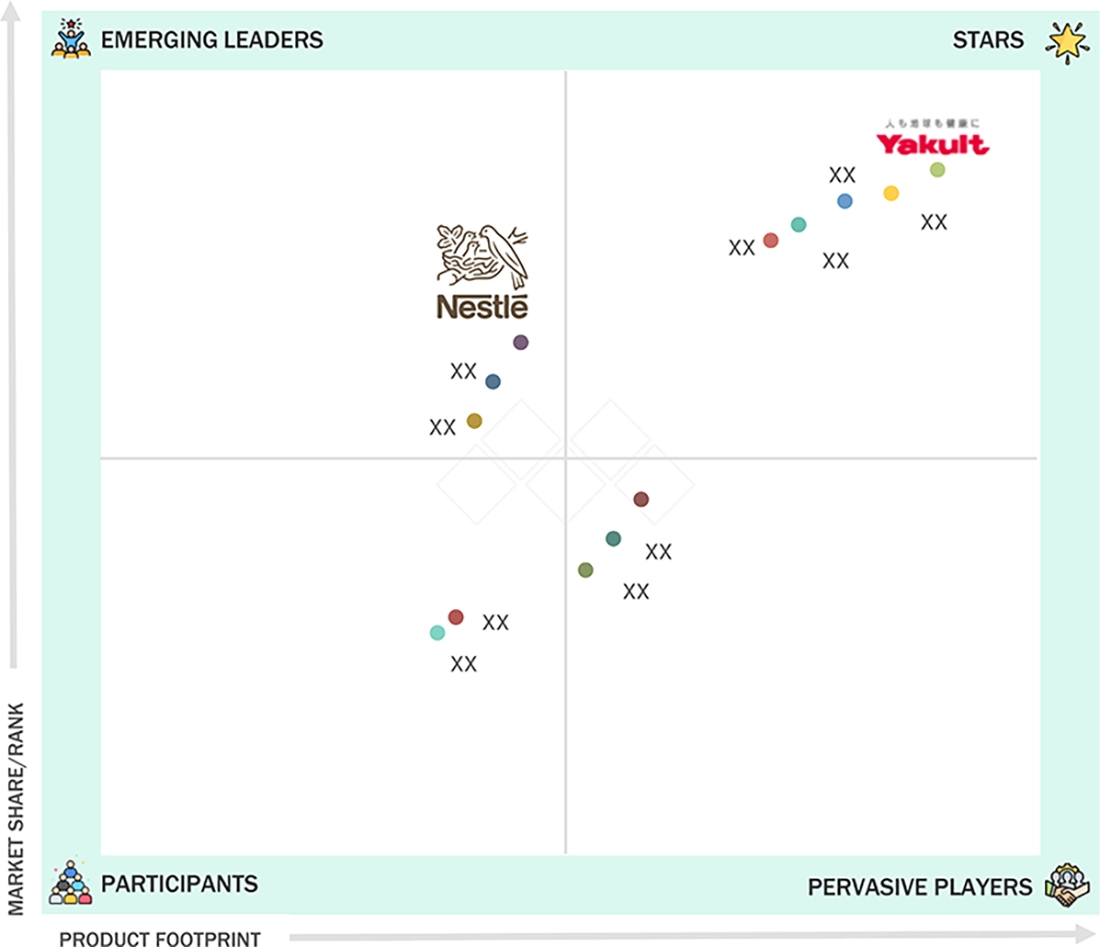

FOOD ENCAPSULATION MARKET: COMPANY EVALUATION MATRIX

The company evaluation matrix for the Food Encapsulation market classifies the companies according to the two factors that are most important: the product footprint and the share of the market or presence. The companies that are in the Stars category usually have a large range of microencapsulation technologies, excellent skills in the core materials and shell materials, and they are very much involved in the markets of functional foods, dietary supplements, and infant nutrition. Furthermore, these players are capable of reaping the rewards of effective customer relationships and worldwide manufacturing capacity. Emerging Leaders possess cutting-edge technology and are concentrating their innovations but they have a more limited geographical reach or scope of applications compared to the Stars. Pervasive Players are the ones who have a huge presence and sales network in the market but their products might be based on old technology and only slight changes are made to them. The participants in the market, who are mostly the smaller or niche-focused companies, cater to the specific applications, materials, or regions and sometimes compete on price or customization. In general, the matrix shows the technological depth, application diversity, regulatory compliance capabilities, and production scaling as the main sources of competitive differentiation. It also provides a clear framework to compare strategic positioning within the evolving Food Encapsulation landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- DSM-Firmenich (Switzerland)

- Givaudan (Switzerland)

- International Flavors & Fragrances (IFF) (US)

- Kerry Group (Ireland)

- ADM (US)

- BASF SE (Germany)

- Cargill, Incorporated (US)

- Ingredion Incorporated (US)

- Tate & Lyle PLC (UK)

- Sensient Technologies Corporation (US)

- Balchem Corporation (US)

- Lonza Group (Switzerland)

- Aveka Group (US)

- TasteTech (US)

- Microcaps (US/Global)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.40 BN |

| Market Forecast in 2030 (Value) | USD 21.79 BN |

| Growth Rate | CAGR of 8.2% from 2025–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kilo Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, South America, RoW |

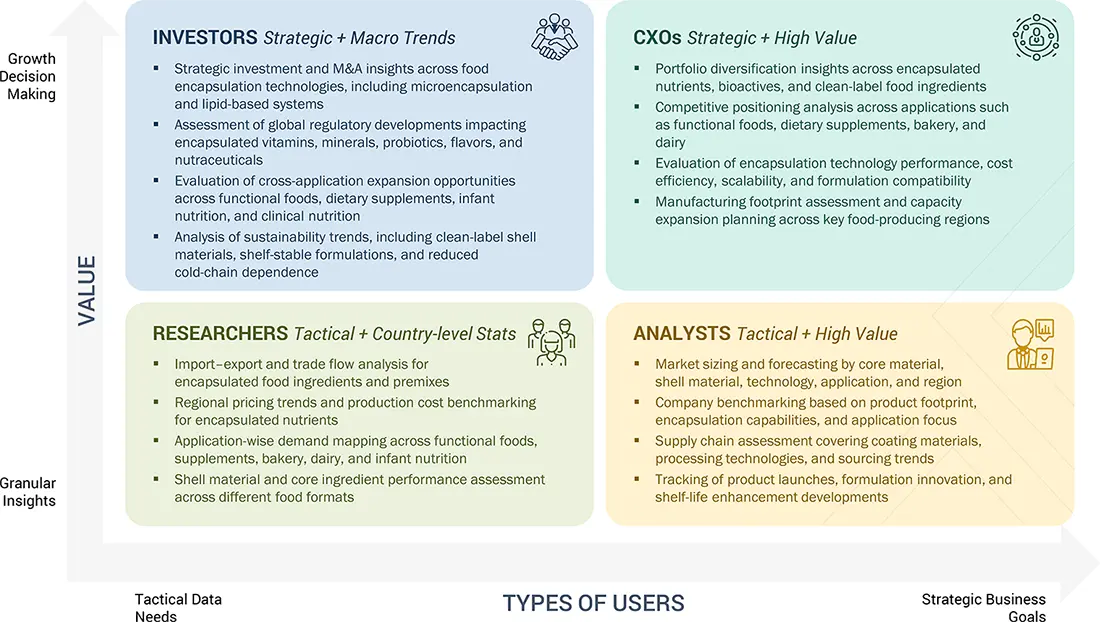

WHAT IS IN IT FOR YOU: FOOD ENCAPSULATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Food Encapsulation Ingredients Market |

|

|

| Functional Foods & Fortified Foods Market |

|

|

| Bakery, Dairy & Processed Foods Market |

|

|

RECENT DEVELOPMENTS

- January 2025 : DSM-Firmenich, Expanded Asia R&D hub launch, A dedicated research center to accelerate formulation and encapsulation technology development tailored for APAC functional food markets.

- October 2025 : Yakult Singapore, Launch of Y1000 concentrated probiotic drink APAC consumer product using encapsulation for enhanced viability and digestive health positioning.

- August 2025 : Ajinomoto Co., Inc., New encapsulation ingredient line Introduction of nanoemulsified carotenoid complexes designed for improved absorption in fortification applications.

- July 2025 : Kerry Group & FMC Corporation formed a strategic partnership for marine omega-3 encapsulation. Joint development of sustainable, heat-stable nanoencapsulated omega-3 oils for food fortification in Asia.

- May 2025 : Cargill, Inc. (Food Ingredients Division) Greenfield facility expansion (APAC). Increased production lines for encapsulated food ingredients to address rising functional food demand.

- April 2025 : Amul (Gujarat Cooperative, India) Brand-level encapsulated nutritional product launch. Functional nutrition product using encapsulated vitamins/minerals optimized for Asian diets.

- March 2025 : IFF (DuPont Nutrition & Biosciences) – India Partnership Regional technology co-creation program, collaborative research with universities on improved encapsulation carriers for plant-based protein applications.

- December 2024 : Lonza Group (APAC Functional Ingredients) Nanoencapsulated botanical ingredient launch. Specialty plant extracts delivered via nanocarrier systems for digestive wellness products.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources—directories and databases such as the Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the food encapsulation market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the food encapsulation market.

Secondary Research

In the secondary research process, various sources such as website information, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the food encapsulation market.

To know about the assumptions considered for the study, download the pdf brochure

Food Encapsulation Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food encapsulation market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All macroeconomic and microeconomic factors affecting the growth of the food encapsulation market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for food encapsulation on the basis of core phase, application, shell material, method, technology and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyse the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyse the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyse their market position and core competencies.

- To analyse the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the food encapsulation market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe for food encapsulation market includes the Sweden, Belgium, Greece, Switzerland, and other EU & Non-EU Countries

- Further breakdown of the Rest of South America for food encapsulation market includes Peru, Uruguay, and Venezuela.

- Further breakdown of the Rest of Asia Pacific for food encapsulation market includes Thailand, Indonesia, South Korea, Malaysia, Singapore, the Philippines, and Vietnam.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Food Encapsulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Food Encapsulation Market