Food Flavors Market by Labelling/ Regulation (Natural, Nature Identical/ Artificial), Form (Liquid & Gel, Dry), Type (Chocolate & Brown, Vanilla, Fruit & Nut, Spices & Savory, Dairy), Application (Food, Beverage) Region - Forecast 2027

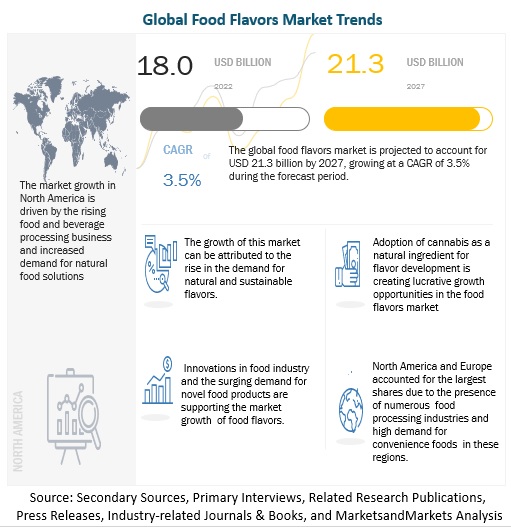

With a projected CAGR of 3.5% from 2022 to 2027, the global food flavors market is expected to grow from $18.0 billion to $21.3 billion.

Convenience is a prime concern for present-day consumers who frequently lack time to make wholesome food and beverages at home due to cultural upheavals and dynamic lifestyle changes. Hesitant to forgo nutrition, they seek ready-made substitutes that can save time without jeopardizing their health objectives.

However, there is much loss of natural food flavors as convenience foods undergo extensive processing. To compensate for this loss, manufacturers are widely employing food flavors, both natural and artificial, to improve the overall aroma of food and beverages, hence fueling the expansion of the food flavor market. At the same time, constant innovations, increased investment in R&D, and a surging demand for variety in foods and beverages have led to extensive use of flavors by producers. Flavors can be created synthetically or can be derived naturally from fruits, botanical extracts, meat, spices, herbs, and essential oils.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Flavors Market Trends & Dynamics

A shift in demand for natural and sustainable flavors

Sustainability is a multidimensional issue, where the food production system and diets play significant roles. It is essential to advance toward a sustainable food future with coordinated global initiatives. Household food consumption accounts for more than 60% of global greenhouse gas emissions and 50-80% of overall resource usage. As a result, customers are gradually implementing wholesome and environmentally friendly eating habits. Changing food consumption is a prerequisite for achieving global sustainability goals, especially in high-income countries. The demand for natural flavors is rising as customers increasingly prefer foods and beverages with natural tastes and environmentally ethical safe ingredients for health advantages, from blueberry-flavored protein drinks to rose-flavored teas driving the food flavor market size.

Harmful impacts of synthetic flavors

Synthetic flavors are artificial ingredients added to food to improve its flavor, shelf life, freshness, and nutritional value. They can be found in various foods, including yogurt, chips, bread, baked goods, salad dressings, and baked goods. However, data from a variety of scientific studies suggests that artificial food additives might be carcinogenic. Particularly, nitrites and nitrates, which are frequently present in processed meats, have been associated with an elevated risk of colorectal cancer, when consumed in increased amounts. Research is being conducted related to the impact of artificial food additives on children's behavioral problems or neurodevelopmental abnormalities. The detrimental effects of synthetic flavors may thus restrain the food flavors market growth.

Adoption of cannabis as a natural ingredient for flavor development

Terpenes and cannabinoids like tetrahydrocannabinol (THC) and cannabidiol (CBD) have enormous potential for applications in medicine and health. Additionally, cannabis-derived chemicals have unique characteristics that can impart distinctive flavors to meals and beverages. Studies are being conducted to prove that cannabis can improve taste response and increase food sensory attractiveness. Moreover, combining cannabis with botanicals, such as ginseng, ashwagandha, and citrus fruits, not only creates novel flavor profiles but also improves the effects of cannabis on focus, sleep, and stress relief. The adaptation of cannabis as a flavor ingredient may create opportunities for the food flavor industry to grow exponentially.

Compliance with quality and regulatory standards

The food flavor manufacturers are to abide by the various regulatory standards set by the national and international food safety bodies. However, the stringent regulations vary with every country, which may cause confusion, prevent the introduction of new products, increase product prices, and may lead to product recalls, thus challenging the food flavor market growth.

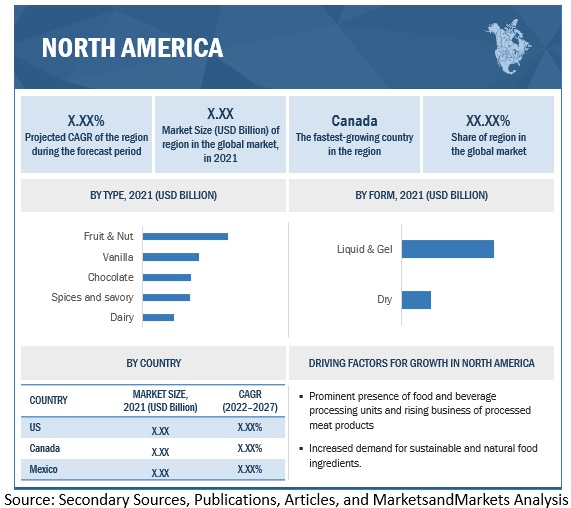

North America dominated the global food flavors market in 2021, and the flavor market is projected to grow with a CAGR of 3.39% during the forecast period (2022-2027)

North America provides many expansion opportunities to the food flavors industry owing to the presence of a large number of food processing units and increased demand for convenience and functional foods influenced by the dynamic lifestyle and changing eating habits of the region. The United States harbors the greatest number of food and beverage manufacturing plants on the continent. USDA reports imply that food and beverage processing facilities accounted for 15.8% of total shipments and 14.7% of all U.S. manufacturing plant employment, in 2019. With a share of shipments of 24% in 2019, the food processing sector was dominated by the meat processing industry.

Hence, there is a potential for the growth of the savory flavor market in this country. Besides, the rising concern among consumers regarding the health and environmental impacts of synthetic food ingredients has resulted in an increased demand for natural ingredients, which is further boosting the growth of the food flavor market. Additionally, Mexico has a wide consumer base for soft drinks and is widely employing fruit and botanical extracts to provide more flavor varieties to customers.

North America (Flavor US Market): Food Flavors Market Snapshot

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in the Global Food Flavors Market

The key players in the food flavors industry include Givaudan (Switzerland), International Flavors and Fragrances (IFF) (US), Symrise (Germany), Firmenich (Switzerland), and Mane (France).

Food Flavors Market Report Scope

|

Report Metrics |

Details |

| Market valuation in 2022 |

USD 18.0 billion |

| Revenue forecast in 2027 |

USD 21.3 billion |

| Growth rate |

CAGR of 3.5% between 2022-2027 |

| Market driving factor |

A shift in demand for natural and sustainable flavors |

| Largest growing region in flavors market |

North America |

| Segments covered |

By Labelling/Regulation, Type, Form, Application, and Region. |

| Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

| Companies studied |

|

Target Audience of the Global Food Flavors Market Report:

- Food flavor manufacturers, suppliers, and dealers

- Flavor blends and emulsion processors

- Natural flavor and essential oil-extracting organizations

- Flavor carrier suppliers

- Government bodies

- Food & beverage retailers, suppliers, and wholesalers

- Raw material suppliers

- Food & beverage processing industry

- Associations, regulatory bodies, and other industry-related bodies

Food Flavors Market Report Segmentation:

|

Aspect |

Details |

| Market, By Labelling/Regulation | |

| Market, By Type |

|

| Food Flavors Market Size, By Form |

|

| Flavors Market, By Application |

|

| By Region |

|

Recent Developments in the Global Food Flavors Market

- In August 2021, Taiyo International partnered with ITO EN, a supplier of authentic, flavorful, and highly nutritious tea, intending to supply high-quality matcha to the food, beverage, and supplement industries in North America.

- In July 2021, Symrise acquired Giraffe Foods Inc, a leading manufacturer of custom taste solutions for various food industries. This acquisition facilitated the expansion of the flavor & nutrition segment in North America.

- In June 2019, Kerry Group opened its production facility in India as an investment in the expansion of taste and nutrition profiles.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the food flavors market?

North America accounted for the largest share of about 31.13% of the overall food flavors market in 2021 and is projected to sustain its leading position by 2027.

What is the forecasted size of the global food flavors market?

The global food flavors market is projected to reach USD 21.3 billion by 2027 growing at a CAGR of 3.5% from 2022 to 2027.

Which food flavor types are considered in the study and which segments are projected to have promising growth rates in the future?

All the major types include chocolate & brown, vanilla, dairy, fruit and nut, spices and savory, mint, and others.

Which are the key players in the food flavors market?

The key players in the food flavors market include Givaudan (Switzerland), International Flavors and Fragrances (IFF) (US), Symrise (Germany), Firmenich (Switzerland), and MANE SA (France).

What kind of information is provided in the competitive landscape section?

For the list of players mentioned above, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, and MnM view to elaborate analyst view on the company. .

What is the food flavors market?

The food flavors market encompasses the production and distribution of natural and synthetic ingredients used to enhance the taste, aroma, and overall sensory experience of food and beverages.

What are the types of food flavors?

There are three primary types of food flavors:

- Natural Flavors: Extracted from plants, fruits, or animals.

- Artificial Flavors: Chemically synthesized compounds mimicking natural flavors.

- Nature-Identical Flavors: Synthetically produced but chemically identical to natural flavors.

What trends are shaping the food flavors market?

Emerging trends include:

- Increased demand for plant-based and vegan flavors

- Innovation in ethnic and exotic flavors

- Growing focus on sustainable and clean-label ingredients

- Technological advancements in flavor extraction

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 100)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 FOOD FLAVORS MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 108)

2.1 RESEARCH DATA

FIGURE 3 FOOD FLAVORS INDUSTRY: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

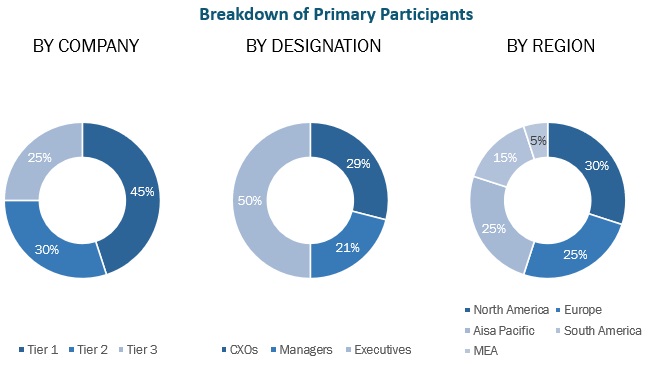

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.5 Primary sources

2.2 FOOD FLAVOR MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 FOOD FLAVORS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 1

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

FIGURE 9 ASSUMPTIONS CONSIDERED

2.5 LIMITATIONS

FIGURE 10 STUDY LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 117)

TABLE 3 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 11 MARKET, BY LABELING/REGULATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 15 FOOD FLAVORS MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 122)

4.1 ATTRACTIVE OPPORTUNITIES FOR GLOBAL FOOD FLAVORS MARKET PLAYERS

FIGURE 16 INCREASE IN DEMAND FOR CONVENIENCE FOODS TO SUPPORT GROWTH OF THE MARKET

4.2 FLAVOR MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 17 BRAZIL TO BE FASTEST-GROWING MARKET FOR FOOD FLAVORS DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY KEY TYPE & COUNTRY

FIGURE 18 CHINA TO ACCOUNT FOR LARGEST FOOD FLAVORS MARKET SHARE IN ASIA PACIFIC MARKET IN 2022

4.4 MARKET, BY LABELING/REGULATION

FIGURE 19 NATURE IDENTICAL FLAVORS TO BE LARGER SEGMENT THROUGHOUT FORECAST PERIOD

4.5 MARKET, BY FORM

FIGURE 20 LIQUID & GEL FLAVORS TO DOMINATE MARKET IN 2022

4.6 MARKET, BY TYPE

FIGURE 21 FRUIT & NUT FOOD FLAVORS TO BE LARGEST MARKET DURING FORECAST PERIOD

4.7 MARKET, BY APPLICATION

FIGURE 22 FOOD APPLICATION TO BE LARGER MARKET DURING FORECAST PERIOD

4.8 FOOD FLAVOR MARKET, BY REGION

FIGURE 23 NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

5 GLOBAL FOOD FLAVORS MARKET TRENDS & OVERVIEW (Page No. - 128)

5.1 INTRODUCTION

5.2 FLAVOR MARKET DYNAMICS

FIGURE 24 FOOD FLAVORS INDUSTRY DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in demand for plant-based foods

5.2.1.2 Shift in demand toward natural and sustainable flavors

5.2.1.3 Innovations in food industry to cater to surging demand for novel food products

5.2.1.4 Growth in research & development investments

5.2.2 RESTRAINTS

5.2.2.1 Harmful health impacts of synthetic flavors

5.2.2.2 High-cost of natural flavors

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging popularity of functional foods

5.2.3.2 Adoption of cannabis as natural ingredient for flavor development

5.2.3.3 Nascent trend of extracting flavors from flowers

5.2.4 CHALLENGES

5.2.4.1 Compliance with quality and regulatory standards

6 FOOD FLAVORS INDUSTRY TRENDS (Page No. - 134)

6.1 INTRODUCTION

6.2 TRENDS IMPACTING CUSTOMER BUSINESSES

6.3 PRICING ANALYSIS

6.3.1 AVERAGE SELLING PRICE OF FOOD FLAVORS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

TABLE 4 AVERAGE SELLING PRICES OF FOOD FLAVORS, BY TYPE, 2018–2022 (USD/KG)

6.3.2 AVERAGE SELLING PRICE TRENDS, BY REGION

TABLE 5 AVERAGE SELLING PRICES OF FOOD FLAVORS, BY REGION, 2018–2022 (USD/KG)

6.4 VALUE CHAIN

6.4.1 RESEARCH AND PRODUCT DEVELOPMENT

6.4.2 RAW MATERIAL SOURCING

6.4.3 PRODUCTION & PROCESSING

6.4.4 CERTIFICATIONS/REGULATORY BODIES

6.4.5 MARKETING & SALES

FIGURE 25 FOOD FLAVORS MARKET: VALUE CHAIN ANALYSIS

6.5 ECOSYSTEM/MARKET MAP

TABLE 6 FOOD FLAVOR MARKET: ECOSYSTEM

FIGURE 26 FLAVOR MARKET: ECOSYSTEM MAP

6.6 TECHNOLOGY ANALYSIS

6.6.1 USE OF ARTIFICIAL INTELLIGENCE TO PROPEL MARKET GROWTH

6.6.2 SUPER CRITICAL FLUID EXTRACTION (SCFE) TECHNIQUE

6.7 TARIFF AND REGULATORY LANDSCAPE

6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.7.2 NORTH AMERICA

6.7.2.1 US

6.7.2.2 Canada

6.7.2.3 Mexico

6.7.2.4 Europe

6.7.2.5 Italy

6.7.3 ASIA PACIFIC

6.7.3.1 India

6.7.3.2 China

6.7.3.3 Japan

6.7.3.4 Australia & New Zealand

6.7.4 SOUTH AMERICA

6.7.4.1 Argentina

6.7.5 MIDDLE EAST & AFRICA

6.7.5.1 Saudi Arabia

6.7.5.2 UAE

6.8 PATENT ANALYSIS

FIGURE 27 ANNUAL NUMBER OF PATENTS IN FOOD FLAVORS MARKET, 2018–2022

FIGURE 28 PATENT ANALYSIS: MARKET, BY REGION, 2018–2022

TABLE 8 LIST OF IMPORTANT PATENTS FOR FOOD FLAVORS, 2018–2022

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 FOOD FLAVORS INDUSTRY: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT FROM NEW ENTRANTS

6.9.2 THREAT FROM SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 KEY CONFERENCES AND EVENTS

TABLE 10 FOOD FLAVOR MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING FOOD FLAVOR FOR VARIOUS TYPES OF FLAVORS

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD FLAVORS

6.12 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR FOOD FLAVORS IN VARIOUS APPLICATIONS

TABLE 12 KEY BUYING CRITERIA FOR TOP APPLICATIONS OF FOOD FLAVORS

7 FOOD FLAVORS MARKET SHARE, BY LABELING/REGULATION (Page No. - 167)

7.1 INTRODUCTION

FIGURE 32 MARKET, BY LABELING/REGULATION, 2022 VS. 2027 (METRIC TON)

TABLE 13 MARKET, BY LABELING/REGULATION, 2019–2021 (USD MILLION)

TABLE 14 MARKET, BY LABELING/REGULATION, 2022–2027 (USD MILLION)

TABLE 15 MARKET, BY LABELING/REGULATION, 2019–2021 (METRIC TON)

TABLE 16 FLAVOR MARKET, BY LABELING/REGULATION, 2022–2027 (METRIC TON)

7.2 NATURAL

7.2.1 RISE IN TREND OF NATURE-DERIVED SUSTAINABLE PRODUCTS TO DRIVE GROWTH

TABLE 17 NATURAL FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 18 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 19 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 20 MARKET, BY REGION, 2022–2027 (METRIC TON)

7.2.2 CHOCOLATE & BROWN

7.2.2.1 Application of chocolate flavor in various foods & beverages to boost market exponentially

7.2.3 VANILLA

7.2.3.1 Increased popularity and consumption of natural vanilla extracts in North America to create growth opportunities

7.2.4 FRUIT & NUT

7.2.4.1 Growth in use of fruit and nuts in dairy and chocolate products to propel market growth

7.2.5 DAIRY

7.2.5.1 Surge in demand for dairy products in emerging markets to fuel growth

7.2.6 SPICES & SAVORY

7.2.6.1 Globalization of food systems to increase application of spices & savory flavors

7.2.7 MINT

7.2.7.1 Increase in popularity and varied applications of mint in food industry to drive market expansion

7.2.8 OTHER NATURAL FLAVORS

7.3 NATURE IDENTICAL/ARTIFICIAL

7.3.1 ADVANCEMENTS IN FOOD TECHNOLOGY TO DRIVE GROWTH OF NATURE IDENTICAL/ARTIFICIAL FOOD FLAVORS

TABLE 21 NATURE IDENTICAL/ARTIFICIAL FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 22 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 23 NATURE IDENTICAL/ARTIFICIAL FOOD FLAVORS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 24 MARKET, BY REGION, 2022–2027 (METRIC TON)

7.3.2 CHOCOLATE & BROWN

7.3.2.1 Innovation in bakery and confectionery to augment growth of artificial chocolate flavors market

7.3.3 VANILLA

7.3.3.1 Increased popularity of baked products to create demand for artificial vanilla

7.3.4 FRUIT & NUT

7.3.4.1 High demand for processed sweet foods to drive segment

7.3.5 DAIRY

7.3.5.1 Artificial milk flavors to gain much popularity among lactose-intolerant and vegan consumers

7.3.6 SPICES & SAVORY

7.3.6.1 Detrimental health effects of artificial spices and seasonings to deter market growth

7.3.7 MINT

7.3.7.1 Increased application of mint in food and nutraceuticals to drive market

7.3.8 OTHER NATURE IDENTICAL/ARTIFICIAL FLAVORS

8 FOOD FLAVORS MARKET SHARE, BY FORM (Page No. - 180)

8.1 INTRODUCTION

FIGURE 33 GLOBAL FOOD FLAVOR MARKET, BY FORM, 2022 VS 2027 (USD MILLION)

TABLE 25 FOOD FLAVORS INDUSTRY, BY FORM, 2019–2021 (USD MILLION)

TABLE 26 MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 27 MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 28 FLAVOR MARKET, BY FORM, 2022–2027 (METRIC TON)

8.2 LIQUID & GEL

8.2.1 INCREASED PRODUCTION OF ALCOHOLIC AND NON-ALCOHOLIC BEVERAGES TO PROPEL DEMAND FOR LIQUID FLAVORS

TABLE 29 LIQUID & GEL FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 30 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 31 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 32 MARKET, BY REGION, 2022–2027 (METRIC TON)

8.3 DRY

8.3.1 SURGE IN POPULARITY OF BAKED AND CONFECTIONERY FOODS TO AUGMENT GROWTH OF DRY FLAVORS MARKET

TABLE 33 DRY FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 34 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 35 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 36 MARKET, BY REGION, 2022–2027 (METRIC TON)

9 FOOD FLAVORS MARKET, BY TYPE (Page No. - 187)

9.1 INTRODUCTION

TABLE 37 CHEMICAL ADDITIVES USED AS FLAVORS

FIGURE 34 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 38 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 39 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 40 MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 41 MARKET, BY TYPE, 2022–2027 (METRIC TON)

9.2 CHOCOLATE & BROWN

TABLE 42 CHOCOLATE & BROWN FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 43 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 45 MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 46 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 47 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 48 MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 49 CHOCOLATE & BROWN FOOD FLAVOR MARKET, BY TYPE, 2022–2027 (METRIC TON)

9.2.1 DARK CHOCOLATE

TABLE 50 DARK CHOCOLATE FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 53 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.2.2 MILK CHOCOLATE

TABLE 54 MILK CHOCOLATE FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 55 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 57 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.2.3 WHITE CHOCOLATE

TABLE 58 WHITE CHOCOLATE FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 59 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 61 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.2.4 CARAMEL

TABLE 62 CARAMEL FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 63 FLAVOR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 65 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.3 VANILLA

TABLE 66 VANILLA FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 67 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 68 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 69 MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 70 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 71 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 72 MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 73 VANILLA FOOD FLAVORS MARKET, BY TYPE, 2022–2027 (METRIC TON)

9.3.1 BOURBON-MADAGASCAR VANILLA

TABLE 74 BOURBON-MADAGASCAR VANILLA FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 75 FOOD FLAVORS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 77 BOURBON-MADAGASCAR VANILLA FOOD FLAVOR MARKET, BY REGION, 2022–2027 (METRIC TON)

9.3.2 MEXICAN VANILLA

TABLE 78 MEXICAN VANILLA FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 79 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 80 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 81 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.3.3 TAHITIAN VANILLA

TABLE 82 TAHITIAN VANILLA FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 83 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 84 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 85 TAHITIAN VANILLA FOOD FLAVORS: MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4 FRUIT & NUT

TABLE 86 FRUIT & NUT FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 87 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 89 MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 90 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 91 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 93 FRUIT & NUT FOOD FLAVORS: MARKET, BY TYPE, 2022–2027 (METRIC TON)

9.4.1 CITRUS

TABLE 94 CITRUS FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 96 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 97 MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 98 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 99 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 101 MARKET, BY TYPE, 2022–2027 (METRIC TON)

9.4.1.1 Orange

TABLE 102 ORANGE FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 103 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 104 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 105 ORANGE FOOD FLAVOR MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4.1.2 Lime

TABLE 106 LIME FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 107 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 108 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 109 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4.1.3 Lemon

TABLE 110 LEMON FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 111 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 112 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 113 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4.1.4 Other Citrus Flavors

TABLE 114 OTHER CITRUS FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 115 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 116 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 117 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4.2 TREE FRUITS

TABLE 118 TREE FRUITS FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 119 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 120 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 121 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4.3 TROPICAL & EXOTIC FRUITS

TABLE 122 TROPICAL & EXOTIC FRUITS FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 123 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 124 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 125 TROPICAL & EXOTIC FRUITS FOOD FLAVORS: MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4.4 BERRIES

TABLE 126 BERRY FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 127 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 128 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 129 BERRY FOOD FLAVOR MARKET, BY REGION, 2022–2027 (METRIC TON)

9.4.5 OTHER FRUITS

TABLE 130 OTHER FRUIT FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 131 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 132 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 133 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.5 DAIRY

TABLE 134 DAIRY FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 135 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 136 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 137 MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 138 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 139 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 141 MARKET, BY TYPE, 2022–2027 (METRIC TON)

9.5.1 MILK

TABLE 142 MILK FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 143 FLAVOR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 144 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 145 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.5.2 BUTTER

TABLE 146 BUTTER FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 147 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 148 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 149 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.5.3 CREAM

TABLE 150 CREAM FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 151 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 152 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 153 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.5.4 YOGURT

TABLE 154 YOGURT FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 155 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 156 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 157 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.5.5 CHEESE

TABLE 158 CHEESE FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 159 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 160 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 161 CHEESE FOOD FLAVOR MARKET, BY REGION, 2022–2027 (METRIC TON)

9.5.6 OTHER DAIRY FLAVORS

TABLE 162 OTHER DAIRY FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 163 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 164 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 165 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.6 SPICES & SAVORY

TABLE 166 SPICE & SAVORY FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 167 FOOD FLAVORS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 168 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 169 MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 170 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 171 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 172 MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 173 MARKET, BY TYPE, 2022–2027 (METRIC TON)

9.6.1 ESSENTIAL OILS & OLEORESINS

TABLE 174 ESSENTIAL OIL & OLEORESIN FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 175 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 176 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 177 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.6.2 VEGETABLE FLAVORS

TABLE 178 VEGETABLE FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 179 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 180 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 181 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.6.3 MEAT FLAVORS

TABLE 182 MEAT FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 183 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 184 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 185 MEAT FOOD FLAVOR MARKET, BY REGION, 2022–2027 (METRIC TON)

9.6.4 OTHER SPICES & SAVORY

TABLE 186 LIST OF FLAVOR COMPOUNDS THAT IMPART SPICY OR SAVORY FLAVOR TO FOOD & BEVERAGE PRODUCTS

TABLE 187 LIST OF FLAVOR COMPOUNDS USED AS HERBAL SPICES

TABLE 188 OTHER SPICE & SAVORY FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 189 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 190 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 191 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.7 MINT

TABLE 192 MINT FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 193 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 194 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 195 MARKET, BY REGION, 2022–2027 (METRIC TON)

9.8 OTHER FLAVORS

TABLE 196 OTHER FOOD FLAVORS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 197 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 198 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 199 MARKET, BY REGION, 2022–2027 (METRIC TON)

10 GLOBAL FOOD FLAVORS MARKET SHARE, BY APPLICATION (Page No. - 257)

10.1 INTRODUCTION

FIGURE 35 FLAVOR MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 200 FOOD FLAVORS INDUSTRY, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 201 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 203 FOOD FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

10.2 FOOD

10.2.1 DEMAND FOR FAST FOOD & READY-TO-EAT MEALS TO DRIVE SEGMENT

TABLE 204 FOOD FLAVORS APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 205 FOOD FLAVORS APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 206 FOOD FLAVORS APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 207 FOOD FLAVORS APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 208 FOOD FLAVORS APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 209 FOOD FLAVORS APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 210 FOOD FLAVORS APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 211 FOOD FLAVORS APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

10.2.2 DAIRY PRODUCTS

10.2.2.1 Rise in popularity of plant-based food culture to urge dairy industries to introduce experimental flavors driving global food flavors market growth

TABLE 212 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 213 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 214 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 215 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.3 CONFECTIONERY PRODUCTS

10.2.3.1 Shift toward healthier snacking along with taste and sensory benefits to increase among customers

TABLE 216 CONFECTIONERY PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 217 CONFECTIONERY PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 218 CONFECTIONERY PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 219 CONFECTIONERY PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.4 SUPPLEMENTS & SPORTS NUTRITION

10.2.4.1 Healthy and exotic flavors to dominate sports nutrition market

TABLE 220 SUPPLEMENTS & SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 221 SUPPLEMENTS & SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 222 SUPPLEMENTS & SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 223 SUPPLEMENTS & SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.5 BAKERY PRODUCTS

10.2.5.1 Fusion flavors to dominate bakery products market

TABLE 224 BAKERY PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 225 BAKERY PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 226 BAKERY PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 227 BAKERY PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.6 MEAT & SEAFOOD PRODUCTS

10.2.6.1 Proliferation in flavor and aroma of meat & seafood to drive market

TABLE 228 MEAT & SEAFOOD PRODUCTS FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 229 MEAT & SEAFOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 230 MEAT & SEAFOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 231 MEAT & SEAFOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.7 SAVORY & SNACKS

10.2.7.1 Changing consumer snacking patterns and behaviors to encourage new food categories

TABLE 232 SAVORY & SNACKS APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 233 SAVORY & SNACKS APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 234 SAVORY & SNACKS APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 235 SAVORY & SNACKS APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.8 PET FOODS

10.2.8.1 Pet palatability and humanization to drive segment

TABLE 236 PET FOODS APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 237 PET FOODS APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 238 PET FOODS APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 239 PET FOODS APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.9 CEREAL

10.2.9.1 American breakfast cereal flavors to gain popularity globally

TABLE 240 CEREAL APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 241 CEREAL APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 242 CEREAL APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 243 CEREAL APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.10 SOUPS

10.2.10.1 Increase in consumption of vegetable-based soup to boost segment in the food flavors market

TABLE 244 SOUP APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 245 SOUP APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 246 SOUP APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 247 SOUP APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.11 SAUCES

10.2.11.1 Hot sauce to witness rise in demand among consumers

TABLE 248 SAUCE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 249 SAUCE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 250 SAUCE APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 251 SAUCE APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.2.12 DRESSINGS & CONDIMENTS

10.2.12.1 Healthy eating preferences to support flavor dressing market

TABLE 252 DRESSING & CONDIMENT APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 253 DRESSING & CONDIMENT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 254 DRESSING & CONDIMENT APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 255 DRESSING & CONDIMENT APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.3 BEVERAGES

10.3.1 HIGH DEMAND FOR VARIETY IN BOTTLED WATER TO FUEL SEGMENT

TABLE 256 BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 257 BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 258 BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 259 BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

TABLE 260 BEVERAGE APPLICATIONS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 261 BEVERAGE APPLICATIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 262 BEVERAGE APPLICATIONS MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 263 BEVERAGE APPLICATIONS MARKET, BY TYPE, 2022–2027 (METRIC TON)

10.3.2 JUICES & JUICE CONCENTRATES

10.3.2.1 Ready-to-drink beverages to gain attention in the global food flavors market

TABLE 264 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 265 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 266 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 267 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.3.3 FUNCTIONAL DRINKS

10.3.3.1 COVID-19 pandemic surged demand for functional drinks

TABLE 268 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 269 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 270 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 271 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.3.4 ALCOHOLIC DRINKS

10.3.4.1 Year-on-year rise in premium alcoholic beverages to drive segment

TABLE 272 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 273 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 274 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 275 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.3.5 CARBONATED SOFT DRINKS

10.3.5.1 Coca-Cola’s focus on flavor innovation to drive segment

TABLE 276 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 277 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 278 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 279 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.3.6 POWDERED DRINKS

10.3.6.1 Diversity in age groups consuming powdered drinks to drive market

TABLE 280 POWDERED BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 281 POWDERED BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 282 POWDERED BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 283 POWDERED BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

10.3.7 OTHER DRINKS

TABLE 284 OTHER DRINK APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 285 OTHER DRINK APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 286 OTHER DRINK APPLICATIONS MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 287 OTHER DRINK APPLICATIONS MARKET, BY REGION, 2022–2027 (METRIC TON)

11 FOOD FLAVORS MARKET SIZE, BY REGION (Page No. - 305)

11.1 INTRODUCTION

FIGURE 36 EUROPE LED MARKET IN 2021

TABLE 288 FOOD FLAVOR MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 289 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 290 MARKET, BY REGION, 2019–2021 (METRIC TON)

TABLE 291 FOOD FLAVORS INDUSTRY, BY REGION, 2022–2027 (METRIC TON)

11.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 292 NORTH AMERICA: GLOBAL FOOD FLAVORS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 293 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 294 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (METRIC TON)

TABLE 295 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

TABLE 296 NORTH AMERICA: MARKET, BY LABELING/REGULATION, 2019–2021 (USD MILLION)

TABLE 297 NORTH AMERICA: MARKET, BY LABELING/REGULATION, 2022–2027 (USD MILLION)

TABLE 298 NORTH AMERICA: MARKET, BY LABELING/REGULATION, 2019–2021 (METRIC TON)

TABLE 299 NORTH AMERICA: MARKET, BY LABELING/REGULATION, 2022–2027 (METRIC TON)

TABLE 300 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 301 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 302 NORTH AMERICA: FLAVOR US MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 303 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 304 NORTH AMERICA: CHOCOLATE & BROWN FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 305 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 306 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 307 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 308 NORTH AMERICA: VANILLA FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 309 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 310 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 311 NORTH AMERICA: FOOD FLAVORS INDUSTRY, BY TYPE, 2022–2027 (METRIC TON)

TABLE 312 NORTH AMERICA: FRUIT & NUT FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 313 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 314 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 315 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 316 NORTH AMERICA: CITRUS FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 317 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 318 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 319 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 320 NORTH AMERICA: DAIRY FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 321 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 322 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 323 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 324 NORTH AMERICA: SPICES & SAVORY FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 325 NORTH AMERICA: FLAVOR US MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 326 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 327 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 328 NORTH AMERICA: GLOBAL FOOD FLAVORS MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 329 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 330 NORTH AMERICA: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 331 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 332 NORTH AMERICA: FOOD FLAVOR MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 333 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 334 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 335 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 336 NORTH AMERICA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 337 NORTH AMERICA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 338 NORTH AMERICA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 339 NORTH AMERICA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 340 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 341 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 342 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 343 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.2.1 US

11.2.1.1 Expansion of meat processing industry to create growth opportunities for savory flavors in US

TABLE 344 US: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 345 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 346 US: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 347 US: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 348 US: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 349 US: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 350 US: FLAVOR MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 351 US: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 352 US: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 353 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 354 US: FLAVOR US MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 355 US: FOOD FLAVORS INDUSTRY, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 356 US: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 357 US: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 358 US: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 359 US: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 360 US: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 361 US: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 362 US: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 363 US: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.2.2 CANADA

11.2.2.1 Surge in demand for organic and natural food products to drive expansion of natural food flavors market in Canada

TABLE 364 CANADA: GLOBAL FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 365 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 366 CANADA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 367 CANADA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 368 CANADA: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 369 CANADA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 370 CANADA: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 371 CANADA: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 372 CANADA: FOOD FLAVOR MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 373 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 374 CANADA: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 375 CANADA: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 376 CANADA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 377 CANADA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 378 CANADA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 379 CANADA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 380 CANADA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 381 CANADA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 382 CANADA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 383 CANADA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.2.3 MEXICO

11.2.3.1 Ever-growing soft drink demand to augment rapid expansion of natural fruit flavors market in Mexico

TABLE 384 MEXICO: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 385 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 386 MEXICO: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 387 MEXICO: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 388 MEXICO: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 389 MEXICO: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 390 MEXICO: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 391 MEXICO: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 392 MEXICO: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 393 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 394 MEXICO: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 395 MEXICO: FLAVOR US MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 396 MEXICO: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 397 MEXICO: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 398 MEXICO: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 399 MEXICO: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 400 MEXICO: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 401 MEXICO: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 402 MEXICO: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 403 MEXICO: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3 EUROPE

TABLE 404 EUROPE: FOOD FLAVORS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 405 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 406 EUROPE: MARKET, BY COUNTRY, 2019–2021 (METRIC TON)

TABLE 407 EUROPE: MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

TABLE 408 EUROPE: MARKET, BY LABELING/REGULATION, 2019–2021 (USD MILLION)

TABLE 409 EUROPE: MARKET, BY LABELING/REGULATION, 2022–2027 (USD MILLION)

TABLE 410 EUROPE: MARKET, BY LABELING/REGULATION, 2019–2021 (METRIC TON)

TABLE 411 EUROPE: FOOD FLAVOR MARKET, BY LABELING/REGULATION, 2022–2027 (METRIC TON)

TABLE 412 EUROPE: FLAVOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 413 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 414 EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 415 EUROPE: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 416 EUROPE: CHOCOLATE & BROWN FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 417 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 418 EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 419 EUROPE: CHOCOLATE & BROWN FOOD FLAVORS MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 420 EUROPE: VANILLA FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 421 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 422 EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 423 EUROPE: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 424 EUROPE: FRUIT & NUT FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 425 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 426 EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 427 EUROPE: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 428 EUROPE: CITRUS FOOD FLAVOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 429 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 430 EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 431 EUROPE: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 432 EUROPE: DAIRY FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 433 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 434 EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 435 EUROPE: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 436 EUROPE: SPICES & SAVORY FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 437 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 438 EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 439 EUROPE: SPICES & SAVORY FOOD FLAVORS: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 440 EUROPE: GLOBAL FOOD FLAVORS MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 441 EUROPE: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 442 EUROPE: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 443 EUROPE: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 444 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 445 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 446 EUROPE: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 447 EUROPE: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 448 EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 449 EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 450 EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 451 EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 452 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 453 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 454 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 455 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.1 GERMANY

11.3.1.1 Bakery products to witness growth, resulting in higher demand for food flavors in bakery food applications

TABLE 456 GERMANY: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 457 GERMANY: FLAVOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 458 GERMANY: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 459 GERMANY: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 460 GERMANY: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 461 GERMANY: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 462 GERMANY: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 463 GERMANY: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 464 GERMANY: FOOD FLAVOR MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 465 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 466 GERMANY: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 467 GERMANY: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 468 GERMANY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 469 GERMANY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 470 GERMANY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 471 GERMANY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 472 GERMANY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 473 GERMANY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 474 GERMANY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 475 GERMANY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.2 UK

11.3.2.1 Fermented drinks to boost UK market

TABLE 476 UK: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 477 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 478 UK: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 479 UK: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 480 UK: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 481 UK: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 482 UK: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 483 UK: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 484 UK: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 485 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 486 UK: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 487 UK: FOOD FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 488 UK: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 489 UK: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 490 UK: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 491 UK: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 492 UK: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 493 UK: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 494 UK: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 495 UK: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.3 FRANCE

11.3.3.1 Bakery market to be highly favorable for growth in France

TABLE 496 FRANCE: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 497 FRANCE: FOOD FLAVORS INDUSTRY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 498 FRANCE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 499 FRANCE: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 500 FRANCE: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 501 FRANCE: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 502 FRANCE: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 503 FRANCE: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 504 FRANCE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 505 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 506 FRANCE: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 507 FRANCE: FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 508 FRANCE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 509 FRANCE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 510 FRANCE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 511 FRANCE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 512 FRANCE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 513 FRANCE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 514 FRANCE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 515 FRANCE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.4 SPAIN

11.3.4.1 Increased demand for processed food to boost food flavor market in Spain

TABLE 516 SPAIN: GLOBAL FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 517 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 518 SPAIN: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 519 SPAIN: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 520 SPAIN: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 521 SPAIN: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 522 SPAIN: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 523 SPAIN: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 524 SPAIN: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 525 SPAIN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 526 SPAIN: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 527 SPAIN: FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 528 SPAIN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 529 SPAIN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 530 SPAIN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 531 SPAIN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 532 SPAIN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 533 SPAIN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 534 SPAIN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 535 SPAIN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.5 ITALY

11.3.5.1 Gelato trend and launch of new sauces to drive flavors market in Italy

TABLE 536 ITALY: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 537 ITALY: FOOD FLAVORS INDUSTRY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 538 ITALY: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 539 ITALY: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 540 ITALY: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 541 ITALY: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 542 ITALY: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 543 ITALY: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 544 ITALY: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 545 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 546 ITALY: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 547 ITALY: FOOD FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 548 ITALY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 549 ITALY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 550 ITALY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 551 ITALY: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 552 ITALY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 553 ITALY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 554 ITALY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 555 ITALY: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.6 NETHERLANDS

11.3.6.1 Flavors in beverage industry to set trend with advanced technologies

TABLE 556 NETHERLANDS: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 557 NETHERLANDS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 558 NETHERLANDS: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 559 NETHERLANDS: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 560 NETHERLANDS: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 561 NETHERLANDS: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 562 NETHERLANDS: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 563 NETHERLANDS: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 564 NETHERLANDS: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 565 NETHERLANDS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 566 NETHERLANDS: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 567 NETHERLANDS: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 568 NETHERLANDS: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 569 NETHERLANDS: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 570 NETHERLANDS: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 571 NETHERLANDS: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 572 NETHERLANDS: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 573 NETHERLANDS: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 574 NETHERLANDS: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 575 NETHERLANDS: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.7 POLAND

11.3.7.1 Tea flavors to fuel Polish market

TABLE 576 POLAND: GLOBAL FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 577 POLAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 578 POLAND: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 579 POLAND: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 580 POLAND: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 581 POLAND: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 582 POLAND: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 583 POLAND: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 584 POLAND: FOOD FLAVOR MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 585 POLAND: FLAVOR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 586 POLAND: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 587 POLAND: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 588 POLAND: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 589 POLAND: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 590 POLAND: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 591 POLAND: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 592 POLAND: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 593 POLAND: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 594 POLAND: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 595 POLAND: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.3.8 REST OF EUROPE

TABLE 596 REST OF EUROPE: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 597 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 598 REST OF EUROPE: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 599 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 600 REST OF EUROPE: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 601 REST OF EUROPE: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 602 REST OF EUROPE: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 603 REST OF EUROPE: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 604 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 605 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 606 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 607 REST OF EUROPE: FOOD FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 608 REST OF EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 609 REST OF EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 610 REST OF EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 611 REST OF EUROPE: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 612 REST OF EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 613 REST OF EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 614 REST OF EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 615 REST OF EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.4 ASIA PACIFIC

TABLE 616 ASIA PACIFIC: FOOD FLAVORS MARKET, BY COUNTRY/REGION, 2019–2021 (USD MILLION)

TABLE 617 ASIA PACIFIC: FOOD FLAVORS INDUSTRY, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 618 ASIA PACIFIC: FLAVOR MARKET, BY COUNTRY/REGION, 2019–2021 (METRIC TON)

TABLE 619 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2022–2027 (METRIC TON)

TABLE 620 ASIA PACIFIC: MARKET, BY LABELING/REGULATION, 2019–2021 (USD MILLION)

TABLE 621 ASIA PACIFIC: MARKET, BY LABELING/REGULATION, 2022–2027 (USD MILLION)

TABLE 622 ASIA PACIFIC: MARKET, BY LABELING/REGULATION, 2019–2021 (METRIC TON)

TABLE 623 ASIA PACIFIC: MARKET, BY LABELING/REGULATION, 2022–2027 (METRIC TON)

TABLE 624 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 625 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 626 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 627 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 628 ASIA PACIFIC: CHOCOLATE & BROWN FOOD FLAVOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 629 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 630 ASIA PACIFIC: CHOCOLATE & BROWN FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 631 ASIA PACIFIC: CHOCOLATE & BROWN FOOD FLAVOR MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 632 ASIA PACIFIC: VANILLA FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 633 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 634 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 635 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 636 ASIA PACIFIC: FRUIT & NUT FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 637 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 638 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 639 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 640 ASIA PACIFIC: CITRUS FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 641 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 642 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 643 ASIA PACIFIC: CITRUS FOOD FLAVORS: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 644 ASIA PACIFIC: DAIRY FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 645 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 646 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 647 ASIA PACIFIC: DAIRY FOOD FLAVORS: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 648 ASIA PACIFIC: SPICES & SAVORY FOOD FLAVORS: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 649 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 650 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 651 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 652 ASIA PACIFIC: GLOBAL FOOD FLAVORS MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 653 ASIA PACIFIC: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 654 ASIA PACIFIC: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 655 ASIA PACIFIC: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 656 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 657 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 658 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 659 ASIA PACIFIC: FOOD FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 660 ASIA PACIFIC: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 661 ASIA PACIFIC: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 662 ASIA PACIFIC: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 663 ASIA PACIFIC: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 664 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 665 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 666 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 667 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.4.1 CHINA

11.4.1.1 Diversity of cuisine to drive consumers toward Chinese food

TABLE 668 CHINA: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 669 CHINA: FOOD FLAVORS INDUSTRY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 670 CHINA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 671 CHINA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 672 CHINA: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 673 CHINA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 674 CHINA: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 675 CHINA: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 676 CHINA: FLAVOR MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 677 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 678 CHINA: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 679 CHINA: FLAVOR MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 680 CHINA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 681 CHINA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 682 CHINA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 683 CHINA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 684 CHINA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 685 CHINA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 686 CHINA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 687 CHINA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.4.2 JAPAN

11.4.2.1 Sweet and umami flavors to propel Japanese market

TABLE 688 JAPAN: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 689 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 690 JAPAN: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 691 JAPAN: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 692 JAPAN: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 693 JAPAN: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 694 JAPAN: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 695 JAPAN: FOOD FLAVOR MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 696 JAPAN: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 697 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 698 JAPAN: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 699 JAPAN: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 700 JAPAN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 701 JAPAN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 702 JAPAN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 703 JAPAN: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 704 JAPAN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 705 JAPAN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 706 JAPAN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 707 JAPAN: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.4.3 INDIA

11.4.3.1 Diversity in Indian cuisine to drive flavors market

TABLE 708 INDIA: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 709 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 710 INDIA: MARKET, BY TYPE, 2019–2021 (METRIC TON)

TABLE 711 INDIA: MARKET, BY TYPE, 2022–2027 (METRIC TON)

TABLE 712 INDIA: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 713 INDIA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 714 INDIA: MARKET, BY FORM, 2019–2021 (METRIC TON)

TABLE 715 INDIA: MARKET, BY FORM, 2022–2027 (METRIC TON)

TABLE 716 INDIA: FLAVOR MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 717 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 718 INDIA: MARKET, BY APPLICATION, 2019–2021 (METRIC TON)

TABLE 719 INDIA: MARKET, BY APPLICATION, 2022–2027 (METRIC TON)

TABLE 720 INDIA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 721 INDIA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 722 INDIA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 723 INDIA: FOOD APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

TABLE 724 INDIA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 725 INDIA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 726 INDIA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (METRIC TON)

TABLE 727 INDIA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (METRIC TON)

11.4.4 SOUTH KOREA

11.4.4.1 Vegetable & seafood consumption to be highest among South Korean population

TABLE 728 SOUTH KOREA: FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 729 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)