Freight Management System Market by Solution (Freight Tracking & Monitoring, Cargo Routing & Scheduling, Security, EDI, TMS, Order Management), End-user (3PLs, Forwarders, Brokers, Shippers), Transportation Mode, and Region - Global Forecast to 2023

[182 Pages Report] The freight management system market is expected to grow from USD 10.76 Billion in 2018 to USD 17.45 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast period. The increase in global trade, need to control time-in-transit, growth in freight visibility solutions and technologies, advancements in freight security, safety, and transportation solutions, and growth in communications technologies and IoT adoption worldwide are expected to be the major factors driving the growth of the market. The objective of the report is to define, describe, and forecast the freight management system market size based on solution (planning, execution and operations, and control and monitoring), service, end-user, transportation mode, and region.

Attractive Opportunities in the Freight Management System Market

Market Dynamics

Driver: Increased supply chain visibility

Companies are increasingly leaning toward technologies that help track, trace, secure, and control their in-transit cargo. Be it inbound logistics or outbound logistics, visibility is increasingly playing a vital role in supply chain and logistics strategies. This has been achieved by using specific identification numbers that describe the nature of the products. Visibility helps improve inventory management, reduce CAPEX, and minimize supply chain errors by making data available at a click to any stakeholder. It overcomes the limitation of most enterprise resource planners, who struggle to ingest external organizational information, providing only an inside view of the organization. Visibility gives the ability to unify the organizational supply chain information to support concurrent planning.

Restraint: Congested trade routes

The world is entering the early stage of freight transportation capacity crisis. The last decades have witnessed steady growth in the demand for freight transportation in North America and Europe, driven by economic expansions and global trade. This has caused freight congestion in specific areas on highways, which are not designed to handle large volumes of freight traffic. According to Government Accountability Office (GAO), truck, rail, water, and intermodal volumes of freight are projected to grow by 98%, 88%, 49%, and 101%, respectively, by 2035. This can have detrimental effects on the cargo being transported and can add to the costs; for instance, as the number of trains per mile on the track increases, the average speed declines, and the amount of goods in freight yards increases, leading to further reduction in travel time along with increased potential of routing errors and damage to shipments.

Opportunity: Cloud and big data analytics

Big data analytics is arguably the biggest opportunity in the generation of freight management transportation. Speed, efficiency, and reliability are the factors that determine the success of freight business. With technology advances and increasing digitization, organizations today generate huge amounts of data, but struggle to gain maximum benefits from it. Big data analytics can bring the real value of data to improve freight operational efficiencies and customer satisfaction at reduced costs.

The rapid increase in big data applications has led to the need for developing newer technologies to optimize cost efficiency. Thus, these factors are expected to be the cause of increasing the growth of new analytics platforms and new data storage centers in the freight management system market.

Challenge: Cost sensitivity

The huge cost of technological setups and sophisticated equipment is not affordable for many SMEs. The small and medium freight companies tend to avoid investments related to the installation of such technologies, software, and services because of their cost-sensitive attitude and lack of awareness regarding the benefits of the freight management system. Hence, cost sensitivity is acting as a negative force to the freight management system market.

Among solutions, control and monitoring solutions to have the highest size

Under the solutions segment, the control and monitoring solutions segment is expected to dominate the market, due to the higher demand for visibility, track and trace, and security and monitoring applications and technologies. Asia Pacific (APAC) has the highest volumes in terms of freight movement, hence users in this region would adopt freight management system tools rapidly, which in turn, is expected to boost the growth of the overall market within the next 5 years.

3PLs segment to hold the largest market share among end users

Among end-users, the Third-Party Logistics (3PLs) segment is expected to hold the largest market share in the freight management system market. Globalization and the growth in world trade volumes are expected to provide opportunities to logistics service providers.

North America to account for the largest market size during the forecast period

As per the geographic analysis, North America is expected to hold the largest market share during the forecast period. This can be attributed to freight management solutions and services, which are adopted by many users in this region. North America is expected to be the most mature region for the growth of the freight management system market, due to the high technological adoption and presence of leading solutions providers in the market. The North American region comprises the US and Canada, which are also witnessing the significant adoption of freight management systems. In fact, the US is expected to have a major dominance in the market, due to its sustainable and well-established economy, which empower it to make huge investments in R&D activities, thereby contributing to the development of new technologies and use cases.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component (Solutions & Services), End-User, Transportation Mode, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Descartes (Canada), Oracle (US), Werner Enterprises (US), MercuryGate (US), SAP (Germany), Accenture (Republic of Ireland), JDA Software (US), Ceva Logistics (Spain), UPS (US), DB Schenker (Germany), C.H. Robinson TMC (US), Riege Software (Germany), Retrans (US), BluJay Solutions (UK), McLeod Software (US), FreightView (US), Freight Management (US), Linbis (US), Logisuite (US), DreamOrbit (India), Manhattan Associates (US), Magaya Corporation (US), Kuebix (US), ImageSoft (Australia), and 3GTMS (US) |

The research report categorizes the freight management system market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Component

- Solution

- Services

By Solution

- Planning

- Supplier and Vendor Management

- Freight Order Management

- Revenue Management

- Dispatch Management

- Claims Management

- Execution and Operations

- Electronic Data Interchange

- Load Optimization

- Brokerage Operational Management

- Freight Visibility

- Freight Audit and Payment

- Transportation Management System

- Control and Monitoring

- Freight Tracking and Monitoring Solution

- Cargo Routing and Scheduling Solution

- Cargo Security

By Services

- Consulting

- System Integration and Deployment

- Support and Maintenance

By End-User

- 3PLs

- Forwarders

- Brokers

- Shippers

- Carriers

By Mode

- Rail Freight

- Road Freight

- Ocean Freight

- Air Freight

By Region

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- Australia and New Zealand

- Singapore

- Rest of Asia Pacific

- Middle East and Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- Qatar

- South Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

KEY MARKET PLAYERS

Descartes (Canada), Oracle (US), Werner Enterprises (US), MercuryGate (US), SAP (Germany), Accenture (Republic of Ireland), JDA Software (US), Ceva Logistics (Spain), UPS (US), DB Schenker (Germany), C.H. Robinson TMC (US), Riege Software (Germany), Retrans (US), BluJay Solutions (UK), McLeod Software (US), FreightView (US), Freight Management (US), Linbis (US), Logisuite (US), DreamOrbit (India), Manhattan Associates (US), Magaya Corporation (US), Kuebix (US), ImageSoft (Australia), and 3GTMS (US).

Descartes is among the most crucial players in freight management market. The companys solutions include routing, mobile, and telematics; transportation management; customs and regulatory compliance; logistics network services; and broker and forwarder enterprise systems. The solutions of the company fulfill the needs of its customers, across different modes, such as airways, roadways, and waterways. The company also offers a logistics technology platform, which is a multimodal logistics community that enables companies to quickly and cost-effectively connect and collaborate with each other. It has local offices and resellers located in North America, Europe, APAC, MEA, and South America.

Recent Developments

- In February 2018, Descartes acquired Aljex, a cloud-based logistics provider, to provide Aljexs back-office transportation management solutions to freight brokers and transportation providers. Descartes acquired Aljex for USD 32.4 million in cash.

- In December 2017, Werner Enterprises announced the opening of its new office in Texas, US. Werner Enterprises includes intermodal, brokerage, freight management, and global portfolio service offerings.

- In December 2017, JDA Software partnered with SATO, a Japan-based global barcode and RFID technology company, to inculcate SATOs visual warehouse solutions associated with digitalization technologies, such as the Internet of Things (IoT) and big data, to improve JDA Softwares warehouse management and warehouse labor management solutions.

- In October 2017, MercuryGate launched MercuryMaestro. This solution is designed to provide an advanced BI platform to enhance the value and visual presentation of data, captured within MercuryGates TMS solutions.

- In August 2017, Descartes acquired MacroPoint, an electronic transportation network provider, to provide location-based truck tracking and predictive freight capacity data content to become a market leader in truckload shipment visibility. The deal was closed at USD 107 million.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the freight management system market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Freight Management System Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Freight Management System Market Size, 2018 vs 2023

4.2 Market, By Transportation Mode, 2018 vs 2023

4.3 Market, By Component, 2018 vs 2023

4.4 Market, By Solution, 2018 vs 2023

4.5 Freight Management System Market, By Solution Type, 2018 vs 2023

4.6 Market, Market Share Across Various Regions

4.7 Market Investment Scenario

5 Freight Management System Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapidly Increasing Global Trade and the Need to Control the Time-In-Transit

5.2.1.2 Increased Supply Chain Visibility

5.2.1.3 Emergence of Advanced Solutions in Cargo Security, Safety, and Transportation

5.2.1.4 Rapidly Growing Communication Technologies and IoT

5.2.2 Restraints

5.2.2.1 Congested Trade Routes

5.2.2.2 Cross-Border Trade Risks

5.2.2.3 Environmental Concerns

5.2.3 Opportunities

5.2.3.1 Green Freight

5.2.3.2 Autonomous Trucking and Smart Freight Transport

5.2.3.3 Blockchain in Freight Management

5.2.3.4 Cloud and Big Data Analytics

5.2.4 Challenges

5.2.4.1 Operational Evolution of Small Players

5.2.4.2 Cost Sensitivity

5.3 Freight Life Cycle

5.4 Freight Value Chain

6 Freight Management System Market, By Component (Page No. - 45)

6.1 Introduction

7 Market By Solution (Page No. - 47)

7.1 Introduction

7.2 Planning

7.2.1 Supplier and Vendor Management

7.2.2 Freight Order Management

7.2.3 Revenue Management

7.2.4 Dispatch Management

7.2.5 Claims Management

7.3 Execution and Operations

7.3.1 Electronic Data Interchange

7.3.2 Load Optimization

7.3.3 Brokerage Operational Management

7.3.4 Freight Visibility

7.3.5 Freight Audit and Payment

7.3.6 Transportation Management System

7.4 Control and Monitoring

7.4.1 Freight Tracking and Monitoring Solution

7.4.2 Cargo Routing and Scheduling Solution

7.4.3 Cargo Security

8 Freight Management System Market, By Service (Page No. - 65)

8.1 Introduction

8.2 Consulting

8.3 System Integration and Deployment

8.4 Support and Maintenance

9 Market By End-User (Page No. - 70)

9.1 Introduction

9.2 Third-Party Logistics

9.3 Forwarders

9.4 Brokers

9.5 Shippers

9.6 Carriers

10 Market By Transportation Mode (Page No. - 76)

10.1 Introduction

10.2 Rail Freight

10.3 Road Freight

10.4 Ocean Freight

10.5 Air Freight

11 Freight Management System Market, By Region (Page No. - 82)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 United Kingdom

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 Japan

11.4.3 Australia and New Zealand

11.4.4 Singapore

11.4.5 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Kingdom of Saudi Arabia

11.5.2 United Arab Emirates

11.5.3 Qatar

11.5.4 South Africa

11.5.5 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.2 Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 115)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 Partnerships/Collaborations

12.3.2 New Product Launches

12.3.3 Business Expansions

12.3.4 Mergers and Acquisitions

13 Company Profiles (Page No. - 121)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 Descartes

13.2 Oracle

13.3 Werner Enterprises

13.4 Mercurygate

13.5 SAP

13.6 Accenture

13.7 JDA Software

13.8 Ceva Logistics

13.9 UPS

13.10 Db Schenker

13.11 C.H. Robinson (TMC)

13.12 Riege Software

13.13 Retrans

13.14 Blujay Solutions

13.15 Mcleod Software

13.16 Freightview

13.17 Freight Management (FMI)

13.18 Linbis

13.19 Logisuite

13.20 Dreamorbit

13.21 Key Innovators

13.21.1 Manhattan Associates

13.21.2 Magaya Corporation

13.21.3 Kuebix

13.21.4 Imagesoft

13.21.5 3gtms

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 173)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (115 Tables)

Table 1 Freight Management System Market Size, By Component, 20162023 (USD Million)

Table 2 Solutions: Market Size By Stage, 20162023 (USD Million)

Table 3 Solutions: Market Size By Region, 20162023 (USD Million)

Table 4 Planning: Market Size By Solution Type, 20162023 (USD Million)

Table 5 Planning: Market Size By Region, 20162023 (USD Million)

Table 6 Supplier and Vendor Management Market Size, By Region, 20162023 (USD Million)

Table 7 Freight Order Management Market Size, By Region, 20162023 (USD Million)

Table 8 Revenue Management Market Size, By Region, 20162023 (USD Million)

Table 9 Dispatch Management Market Size, By Region, 20162023 (USD Million)

Table 10 Claims Management Market Size, By Region, 20162023 (USD Million)

Table 11 Execution and Operations: Freight Management System Market Size By Solution Type, 20162023 (USD Million)

Table 12 Execution and Operations: Market Size By Region, 20162023 (USD Million)

Table 13 Electronic Data Interchange Market Size, By Region, 20162023 (USD Million)

Table 14 Load Optimization Market Size, By Region, 20162023 (USD Million)

Table 15 Brokerage Operational Management Market Size, By Region, 20162023 (USD Million)

Table 16 Freight Visibility Market Size, By Region, 20162023 (USD Million)

Table 17 Freight Audit and Payment Market Size, By Region, 20162023 (USD Million)

Table 18 Transportation Management System Market Size, By Region, 20162023 (USD Million)

Table 19 Control and Monitoring: Freight Management System Market Size, By Component, 20162023 (USD Million)

Table 20 Software: Control and Monitoring Market Size, By Type, 20162023 (USD Million)

Table 21 Hardware: Control and Monitoring Market Size, By Type, 20162023 (USD Million)

Table 22 Control and Monitoring: Freight Management System Market Size By Region, 20162023 (USD Million)

Table 23 Freight Tracking and Monitoring Solution Market Size, By Region, 20162023 (USD Million)

Table 24 Cargo Routing and Scheduling Solution Market Size, By Region, 20162023 (USD Million)

Table 25 Cargo Security Market Size, By Region, 20162023 (USD Million)

Table 26 Freight Management System Market Size, By Service, 20162023 (USD Million)

Table 27 Services: Freight Management Systems Market Size, By Region, 20162023 (USD Million)

Table 28 Consulting: Market Size By Region, 20162023 (USD Million)

Table 29 System Integration and Deployment: Market Size By Region, 20162023 (USD Million)

Table 30 Support and Maintenance: Market Size By Region, 20162023 (USD Million)

Table 31 Freight Management System Market Size, By End-User, 20162023 (USD Million)

Table 32 End-User: Freight Management Systems Market Size, By Region, 20162023 (USD Million)

Table 33 Third-Party Logistics: Market Size By Region, 20162023 (USD Million)

Table 34 Forwarders: Market Size By Region, 20162023 (USD Million)

Table 35 Brokers: Market Size By Region, 20162023 (USD Million)

Table 36 Shippers: Market Size By Region, 20162023 (USD Million)

Table 37 Carriers: Market Size By Region, 20162023 (USD Million)

Table 38 Freight Management System Market Size, By Transportation Mode, 20162023 (USD Million)

Table 39 Rail Freight: Market Size By Region, 20162023 (USD Million)

Table 40 Road Freight: Market Size By Region, 20162023 (USD Million)

Table 41 Ocean Freight: Market Size By Region, 20162023 (USD Million)

Table 42 Air Freight: Freight Management System Market Size By Region, 20162023 (USD Million)

Table 43 North America: Market Size By Component, 20162023 (USD Million)

Table 44 North America: Freight Management System Solution Market Size, By Stage, 20162023 (USD Million)

Table 45 North America: Planning Market Size, By Solution Type, 20162023 (USD Million)

Table 46 North America: Execution and Operations Market Size, By Solution Type, 20162023 (USD Million)

Table 47 North America: Control and Monitoring Market Size, By Component, 20162023 (USD Million)

Table 48 North America: Control and Monitoring Software Market Size, By Type, 20162023 (USD Million)

Table 49 North America: Control and Monitoring Hardware Market Size, By Type, 20162023 (USD Million)

Table 50 North America: Market Size By Service, 20162023 (USD Million)

Table 51 North America: Market Size By Transportation Mode, 20162023 (USD Million)

Table 52 North America: Market Size By End-User, 20162023 (USD Million)

Table 53 US: Freight Management System Solution Market Size, By Stage, 20162023 (USD Million)

Table 54 US: Planning Market Size, By Solution Type, 20162023 (USD Million)

Table 55 US: Execution and Operations Market Size, By Solution Type, 20162023 (USD Million)

Table 56 US: Control and Monitoring Market Size, By Component, 20162023 (USD Million)

Table 57 US: Control and Monitoring Software Market Size, By Type, 20162023 (USD Million)

Table 58 US: Control and Monitoring Hardware Market Size, By Type, 20162023 (USD Million)

Table 59 US: Market Size By Service, 20162023 (USD Million)

Table 60 US: Market Size By Transportation Mode, 20162023 (USD Million)

Table 61 US: Market Size By End-User, 20162023 (USD Million)

Table 62 Canada: Freight Management System Solution Market Size, By Stage, 20162023 (USD Million)

Table 63 Canada: Planning Market Size, By Solution Type, 20162023 (USD Million)

Table 64 Canada: Execution and Operations Market Size, By Solution Type, 20162023 (USD Million)

Table 65 Canada: Control and Monitoring Market Size, By Component, 20162023 (USD Million)

Table 66 Canada: Control and Monitoring Software Market Size, By Type, 20162023 (USD Million)

Table 67 Canada: Control and Monitoring Hardware Market Size, By Type, 20162023 (USD Million)

Table 68 Canada: Market Size By Service, 20162023 (USD Million)

Table 69 Canada: Market Size By Transportation Mode, 20162023 (USD Million)

Table 70 Canada: Market Size By End-User, 20162023 (USD Million)

Table 71 Europe: Freight Management System Market Size, By Component, 20182023 (USD Million)

Table 72 Europe: Freight Management System Solution Market Size, By Stage, 20182023 (USD Million)

Table 73 Europe: Planning Market Size, By Solution Type, 20182023 (USD Million)

Table 74 Europe: Execution and Operations Market Size, By Solution Type, 20162023 (USD Million)

Table 75 Europe: Control and Monitoring Market Size, By Component, 20162023 (USD Million)

Table 76 Europe: Control and Monitoring Software Market Size, By Type, 20162023 (USD Million)

Table 77 Europe: Control and Monitoring Hardware Market Size, By Type, 20162023 (USD Million)

Table 78 Europe: Freight Management System Market Size By Service, 20162023 (USD Million)

Table 79 Europe: Market Size By Transportation Mode, 20162023 (USD Million)

Table 80 Europe: Market Size By End-User, 20162023 (USD Million)

Table 81 Asia Pacific: Freight Management System Market Size, By Component, 20162023 (USD Million)

Table 82 Asia Pacific: Freight Management System Solution Market Size, By Stage, 20162023 (USD Million)

Table 83 Asia Pacific: Planning Market Size, By Solution Type, 20162023 (USD Million)

Table 84 Asia Pacific: Execution and Operations Market Size, By Solution Type, 20162023 (USD Million)

Table 85 Asia Pacific: Control and Monitoring Market Size, By Component, 20162023 (USD Million)

Table 86 Asia Pacific: Control and Monitoring Software Market Size, By Type, 20162023 (USD Million)

Table 87 Asia Pacific: Control and Monitoring Hardware Market Size, By Type, 20162023 (USD Million)

Table 88 Asia Pacific: Freight Management System Market Size By Service, 20162023 (USD Million)

Table 89 Asia Pacific: Market Size By Transportation Mode, 20162023 (USD Million)

Table 90 Asia Pacific: Market Size By End-User, 20162023 (USD Million)

Table 91 Middle East and Africa: Freight Management System Market Size, By Component, 20162023 (USD Million)

Table 92 Middle East and Africa: Freight Management System Solution Market Size, By Stage, 20162023 (USD Million)

Table 93 Middle East and Africa: Planning Market Size, By Solution Type, 20162023 (USD Million)

Table 94 Middle East and Africa: Execution and Operations Market Size, By Solution Type, 20162023 (USD Million)

Table 95 Middle East and Africa: Control and Monitoring Market Size, By Component, 20162023 (USD Million)

Table 96 Middle East and Africa: Control and Monitoring Software Market Size, By Type, 20162023 (USD Million)

Table 97 Middle East and Africa: Control and Monitoring Hardware Market Size, By Type, 20162023 (USD Million)

Table 98 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 99 Middle East and Africa: Market Size By Transportation Mode, 20162023 (USD Million)

Table 100 Middle East and Africa: Market Size By End-User, 20162023 (USD Million)

Table 101 Latin America: Freight Management System Market Size, By Component, 20162023 (USD Million)

Table 102 Latin America: Freight Management System Solution Market Size, By Stage, 20162023 (USD Million)

Table 103 Latin America: Planning Market Size, By Solution Type, 20162023 (USD Million)

Table 104 Latin America: Execution and Operations Market Size, By Solution Type, 20162023 (USD Million)

Table 105 Latin America: Control and Monitoring Market Size, By Component, 20162023 (USD Million)

Table 106 Latin America: Control and Monitoring Software Market Size, By Type, 20162023 (USD Million)

Table 107 Latin America: Control and Monitoring Hardware Market Size, By Type, 20162023 (USD Million)

Table 108 Latin America: Freight Management System Market Size By Service, 20162023 (USD Million)

Table 109 Latin America: Market Size By Transportation Mode, 20162023 (USD Million)

Table 110 Latin America: Market Size By End-User, 20162023 (USD Million)

Table 111 Market Ranking, 2018

Table 112 Partnerships/Collaborations, 20172018

Table 113 New Product Launches, 20152017

Table 114 Business Expansions, 20162018

Table 115 Mergers and Acquisitions, 20172018

List of Figures (42 Figures)

Figure 1 Freight Management System Market Segmentation

Figure 2 Market Research Design

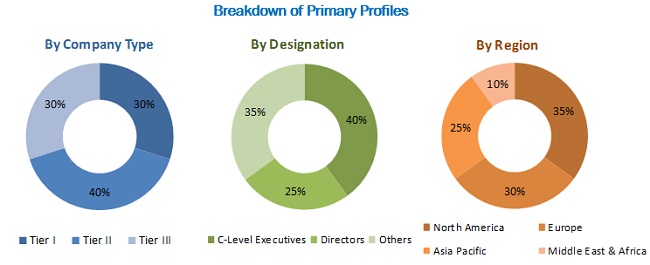

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Freight Management System Market: Assumptions

Figure 8 Regional Freight Volumes, Average Volume By Transportation Mode and CAGR, 20182023

Figure 9 Market Size 20162023

Figure 10 Market Analysis

Figure 11 Fastest-Growing Segments in the Market, 20182023

Figure 12 The Freight Management System Market is Expected to Exhibit A Slow Growth During the Forecast Period

Figure 13 Road Freight is Expected to Hold the Largest Market Share During the Forecast Period

Figure 14 Solutions Segment is Expected to Hold the Larger Market Share During the Forecast Period

Figure 15 Execution and Operations Stage is Expected to Hold the Largest Market Share During the Forecast Period

Figure 16 Transportation Management System Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 17 North America is Estimated to Hold the Largest Market Share in 2018

Figure 18 Market Investment Scenario

Figure 19 Market Drivers, Restraints, Opportunities, and Challenges

Figure 20 Market Freight Life Cycle

Figure 21 Market Value Chain Analysis

Figure 22 Solutions Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 23 Execution and Operations Stage is Expected to Have the Largest Market Size During the Forecast Period

Figure 24 System Integration and Deployment Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 25 Third-Party Logistics Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 26 Road Freight Transportation Mode is Expected to Have the Largest Market Size During the Forecast Period

Figure 27 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 28 North America: Market Snapshot

Figure 29 Asia Pacific: Market Snapshot

Figure 30 Key Developments By the Leading Players in the Freight Management System Market During 20152018

Figure 31 Market Evaluation Framework

Figure 32 Descartes: Company Snapshot

Figure 33 Oracle: Company Snapshot

Figure 34 Werner Enterprises: Company Snapshot

Figure 35 SAP: Company Snapshot

Figure 36 Accenture: Company Snapshot

Figure 37 Ceva Logistics: Company Snapshot

Figure 38 UPS: Company Snapshot

Figure 39 DB Schenker: Company Snapshot

Figure 40 C.H. Robinson (TMC): Company Snapshot

Figure 41 Dreamorbit: Company Snapshot

Figure 42 Manhattan Associates: Company Snapshot

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the freight management system market. In addition to this, a few other market-related reports and analysis published by various consortiums, communities, and industry associations, such as World Bank, International Transport Forum (ITF), Freight Management Association (FMA), Transportation Intermediaries Association (TIA), Transportation Management Association (TMA), and American Trucking Association (ATA) were also considered while conducting extensive secondary research. The primary sources were mainly industry experts from the core and related industries, and preferred freight and transportation management providers, project managers, partners, and standards and certification organizations related to the segments of this industrys value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess the markets prospects. The market has been forecasted by analyzing the driving factors, such as increasing global trade, growth in freight visibility solutions and technologies, advancements in freight security, safety and transportation solutions, and growth in communications technologies and IoT adoption worldwide. The break-up of the profiles of the primary participants have been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

SAP (Germany), Oracle (US), Manhattan Associates (US), JDA Software (US), Descartes (Canada), MercuryGate (US), Accenture (Ireland), C.H. Robinson TMC (US), DreamOrbit (India), 3Gtms (US), and Riege Software (Germany).

Key Target Audience

- Industries/shippers

- Freight carriers

- Logistics service providers/lead logistics

- Freight forwarders and brokers

- Independent Software Vendors (ISVs)

- Internet of Things (IoT) hardware and software vendors

- Government/regulatory agencies

- Industry associations

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North American freight management system market

- Further country-level breakdown of the European freight management system market

- Further country-level breakdown of the APAC freight management system market

- Further country-level breakdown of the MEA freight management system market

- Further country-level breakdown of the Latin American freight management system market

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Freight Management System Market