GPS Tracking Device Market Size, Share, Trends, Statistics and Industry Growth Analysis by Type (Standalone Trackers, OBD Devices, Advance Trackers), Deployment (Commercial Vehicles, Cargo and Containers), Communication Technologies (Satellite, Cellular), Industry and Region - Global Forecast to 2028

Updated on : July 11, 2025

GPS Tracking Device Market Summary

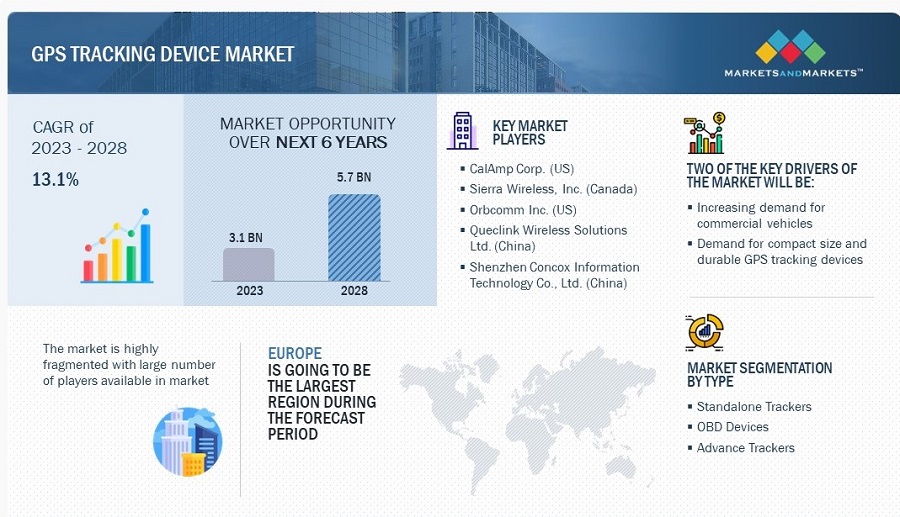

The global GPS tracking device market size in terms of revenue was estimated to be worth USD 3.1 billion in 2023 and is poised to reach USD 5.7 billion by 2028, growing at a CAGR of 13.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market.

GPS Tracking Device Market Key Takeaways

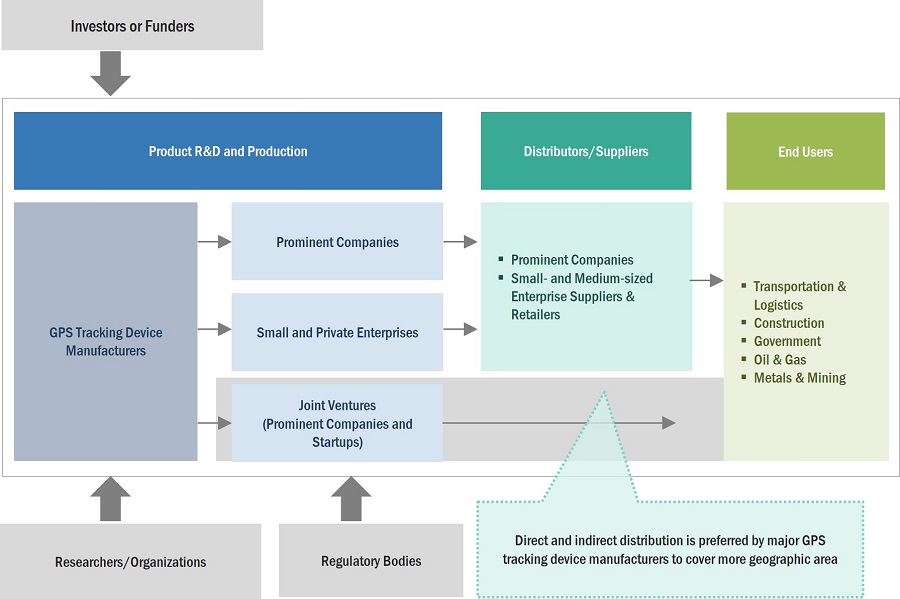

-

By witnessing the growing demand for real-time location services, GPS tracking devices are seeing increased adoption across diverse industries such as transportation, defense, and construction.

-

By riding on the back of advanced telematics and increasing mobile device penetration, North America continues to lead the market, with the U.S. being a hub for innovation and large-scale deployments.

-

By addressing the rising concerns over vehicle and asset safety, the automotive sector is emerging as a major end user, using GPS tracking for fleet management, theft prevention, and route optimization.

-

By tapping into the explosive growth in e-commerce and logistics, GPS tracking systems are becoming vital tools for improving delivery accuracy and supply chain transparency.

-

By embracing stricter government regulations related to driver safety and vehicle monitoring, regions like Europe are seeing increased installation of GPS trackers in commercial vehicles.

-

By responding to the need for efficient field operations, GPS technology is being increasingly integrated into handheld and portable devices used in agriculture, mining, and utilities.

-

By benefiting from the expanding IoT ecosystem, GPS trackers are now being used in wearables and personal safety devices, supporting use cases ranging from child monitoring to elderly care.

-

By leveraging cost reductions in GPS chipsets and increased satellite infrastructure, Asia-Pacific is witnessing rapid growth, especially in countries like China and India where urban mobility and public transport systems are evolving fast.

Market Size & Forecast Report

-

2023 Market Size: USD 3.1 Billion

-

2028 Projected Market Size: USD 5.7 Billion

-

CAGR (2023-2028): 13.1%

-

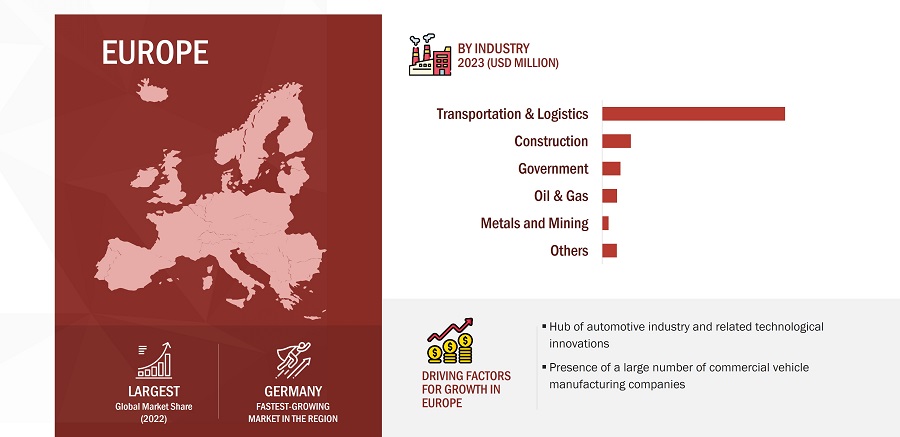

Europe: Largest market share

The market growth is driven by factors including increasing demand for commercial vehicles, demand for compact size and durable GPS tracking devices, and increasing popularity of cloud computing and IoT. Additionally, factors such as demand for GPS tracking devices for usage-based insurance and development of real-time monitoring features are expected to create high growth opportunities for the market. However, increasing adoption of hardware-agnostic tracking solutions may restrain the growth of GPS tracking device industry .

GPS Tracking Device Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

GPS Tracking Device Market Trends :

DRIVERS : Increasing demand for commercial vehicles

The growing number of commercial vehicles, such as trucks, buses, and vans, drive the market for GPS tracking devices. Vehicles that are engaged in the transportation of men, material, or machinery-where on-time delivery can make a significant difference in cost and productivity-are prompting players to adopt GPS-tracking devices. School buses, city, and state transport buses, cash vans, cargo vans, police petrol vans, radio taxis, courier pickup, and delivery vans, and others are prospects for vehicle tracking systems. The increasing demand for commercial vehicles is likely to increase the sales of GPS tracking devices owing to the usage of GPS tracking devices for multiple benefits such as theft protection, usage-based insurance (UBI), and prevention of unauthorized usage. As commercial vehicle sales increase, the demand for GPS tracking devices also rises. These devices are used to track and manage vehicles in real-time. The owners or enterprises efficiently utilize their resources, which helps them ensure vehicle safety.

RESTRAINT: Impact of nonstandard products leads to poor user experience

GPS tracking technology is widely adopted by users owing to its uniformity in performance and low costs. Thus, to fulfill the demand for GPS tracking devices, various companies are involved in the manufacturing of these devices, resulting in increased competition. To gain a competitive advantage, some manufacturers are introducing low-cost GPS tracking devices in the market. These devices may lead to poor user experience because of poor GPS tracking device quality. A low-cost GPS module has a low-quality GPS receiver antenna and poor position algorithm, which may hamper the performance of GPS tracking devices.

OPPORTUNITIES : Demand for GPS tracking devices for usage-based insurance

Insurance companies are adopting GPS tracking technology to calculate car insurance premiums. The driving patterns, such as speeding and rash driving, monitored by the insurance companies using GPS tracking device, helps to quote the appropriate premium rate. For instance, a driver who frequently exceeds the speed limit and brakes harshly may be deemed a higher risk and pay a higher premium. This helps the company finalize the affordable insurance premium for the user and the company. The GPS tracking device will help insurance companies to lower the car insurance premium. Insurance companies are looking forward to this technology, and thus in the near future, the installation of GPS tracking devices in cars may become a mandate to avail car insurance. Thus, the GPS tracking device market share finds significant opportunities in the calculation of insurance premiums.

CHALLENGES: Increasing adoption of hardware-agnostic tracking solutions

The technological revolution helps manufacturers introduce a variety of smartphones at lower prices. Advancements in technology and different software applications allow smartphone users to access GPS signals to track vehicles, etc. These software applications are easy to install, provide a user-friendly graphical user interface (GUI), and are affordable. Thus, the adoption of smartphones as tracking devices is increasing rapidly. Many cab service providers, such as Uber Technologies Inc. (US) and transportation companies, use smartphones as vehicle tracking devices.

GPS Tracking Device Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers and providers of GPS tracking devices. These companies have been operating in the market growth for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include CalAmp Corp. (US), Orbcomm Inc. (US), Sierra Wireless, Inc. (Canada), Queclink Wireless Solutions Co., Ltd. (China), and Shenzhen Concox Information Technology Co., Ltd. (China).

Commercial vehicles segment is expected to account for largest market share during the forecast period

In vehicle tracking, a GPS receiver is installed in the vehicle, which is either self-powered with its own battery or takes power from the vehicle. Vehicle tracking is used for fleet tracking, routing, dispatching, onboard information, and security. It also includes monitoring driving patterns and theft protection. Advance trackers are more popular with commercial vehicle owners as they offer advanced vehicle diagnostics data that can be further monetized to increase the fleet operational performance and usage-based insurance calculation, and maintenance schedule. Vehicle tracking is shifting from basic automatic vehicle location to a data-driven solution. Therefore, organizations are looking to get beyond location and are more interested in engine performance parameters.

Transportation & logistics industry is expected to dominate the market during the forecast period

The transportation & logistics industry uses GPS tracking solutions for vehicle tracking, route management, fuel efficiency monitoring, driver safety, minimizing the risk of theft, asset tracking, real-time vehicle tracking, and performance tracking. In the transportation industry, GPS tracking devices are used to track assets through GPS and other solutions. This helps to track the information related to the assets efficiently, make decisions to reduce the speed, divert the vehicle to an alternate route, and take other actions to improve the reliability and safety of the overall operations. With GPS tracking devices’ adoption is expected to be significant in commercial vehicles used for transportation & logistics such as trucks, trailers, buses, and light commercial vehicles for tracking purposes, the market in this industry is expected to grow at highest CAGR during the forecast period.

GPS Tracking Device Market Size Regional Analysis

Europe to account for largest market share between 2023 and 2028

Europe is the hub of automotive industry and related technological innovations. The region has presence of a large number of commercial vehicles manufacturing companies. Germany, the UK, and France are the major countries for GPS tracking device market size in the region. In the UK, the main factor driving the industry is the adoption of telematics technology, where most enterprises are already integrating telematics in fleet operations, is the main factor driving the industry. Germany has already adopted the GPS tracking device technology, and it is a mature market with the presence of many telematics service providers. Commercial vehicles also play a significant role in the ecosystem of Germany. The French GPS tracking device market, similar to that in other countries, is dominated by commercial vehicles. There are many innovative uses of GPS trackers in France across various industries, for example, GPS trackers are used in precision farming to optimize crop management and increase efficiency.

GPS Tracking Device Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top GPS Tracking Device Companies - Key Market Players

- CalAmp Corp. (US),

- Orbcomm Inc. (US),

- Sierra Wireless, Inc. (Canada),

- Shenzhen Concox Information Technology Co., Ltd. (China),

- Queclink Wireless Solutions Co., Ltd. (China),

- TomTom International BV (Netherlands),

- Teltonika UAB (Lithuania),

- ATrack Technology Inc. (Taiwan),

- Ruptela (Lithuania), and

- Sensata Technologies, Inc. (US).

GPS Tracking Device Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 3.1 Billion |

| Projected Market Size | USD 5.7 Billion |

| Growth Rate | CAGR of 13.1% |

|

Market Size Available for Years |

2019–2028 |

|

GPS Tracking Device Market Share , Base Year |

2022 |

|

GPS Tracking Device Market Size, Forecast Period |

2023–2028 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

Major Players: CalAmp Corp. (US), Orbcomm Inc. (US), Sierra Wireless, Inc. (Canada), Shenzhen Concox Information Technology Co., Ltd. (China), Queclink Wireless Solutions Co., Ltd. (China), TomTom International BV (Netherlands), Teltonika UAB (Lithuania), ATrack Technology Inc. (Taiwan), Ruptela (Lithuania), Sensata Technologies, Inc. (US) and Others- total 25 players have been covered |

| Key Market Driver | Increasing demand for commercial vehicles |

| Key Market Opportunity | Demand for GPS tracking devices for usage-based insurance |

| Largest Growing Region | Europe |

| Largest Market Share Segment | Commercial Vehicles |

GPS Tracking Device Market Size & Highlights

This research report categorizes the GPS tracking device market size by type, deployment, industry, Trends and region.

|

Segment |

Subsegment |

|

GPS Tracking Device Market Size, By Type: |

|

|

By Deployment: |

|

|

GPS Tracking Device Market Share, By Industry: |

|

|

By Region: |

|

Recent Developments in GPS Tracking Devices Industry :

- In September 2022, Concox launched LL303, which is a 4G solar tracker designed for tracking ships and construction vehicles. In LL303, by integrating GPS, BDS, LBS, and WiFi multiple positioning systems, the cloud platform provides vehicle location and trajectory information outside vehicle location and trajectory information outside the production site to ensure production safety and productivity.

- In July 2022, Geotab Inc. expanded its position as the top telematics supplier for governmental organizations in North America. The company has been chosen as the e State of Ohio's telematics provider of the State of Ohio to assist in meeting the State's requirement to improve its fleet management.

- In June 2022, CalAmp Corp. announced a new partnership with Assured Telematics. Together with its CalAmp's edge computing devices, the company would offer commercial and public fleet operators the assured apollo electronic logging device (ELD) solution.

- In January 2022, ATrack Technologies Inc. launched announced the launch of the AL300 LTE-M waterproof tracker with IP67 waterproof and dustproof functions, particularly designed for heavy machinery or transportation equipment that needs to be monitored for a long time and placed outdoors, such as refrigerated trucks, scooters, trailers, and agricultural and construction heavy machinery.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the GPS tracking device market during 2023-2028?

The global GPS tracking device market is expected to record a CAGR of 13.1% from 2023–2028.

What are the driving factors for the GPS tracking device market?

Increasing demand for commercial vehicles and demand for compact size and durable GPS tracking devices.

Which type of GPS tracking device to drive the growth of the overall market?

Advance trackers are likely to see significant adoption in commercial vehicles and drive the growth of the market.

Which end-user industries are likely to create high growth opportunities for GPS tracking device market?

GPS tracking device market is estimated to be majorly driven by transportation & logistics industry. As GPS tracking devices automates workflow process and ensures streamlined operations in industry applications like from material loading to final delivery. This is likely to generate more demand for GPS tracking devices. Additionally, industries including construction and government applications are expected to create ample growth opportunities for the market.

Which regions are expected to drive the GPS tracking device market in future?

Europe is expected to hold largest market share throughout the forecast period, while market in Asia Pacific is projected to grow at highest CAGR between 2023 and 2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for commercial vehicles- Demand for compact size and durable GPS tracking devices- Increasing popularity of cloud computing and IoTRESTRAINTS- Impact of nonstandard products leads to poor user experienceOPPORTUNITIES- Demand for GPS tracking devices for usage-based insurance- Development of real-time monitoring featuresCHALLENGES- Increasing adoption of hardware-agnostic tracking solutions and regular maintenance of GPS device

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 PRICING ANALYSIS

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.6 TRADE ANALYSIS

- 5.7 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 STANDALONE TRACKERSPROVIDE NEAR REAL-TIME LOCATION OF VEHICLES

-

6.3 OBD DEVICESOFFERS INFORMATION BY READING DTCS FROM VEHICLE COMPUTER SYSTEM

-

6.4 ADVANCE TRACKERSCONNECTED TO AUTOMOTIVE COMMUNICATION PORT TO PROVIDE VEHICLE-RELATED DATA

- 7.1 INTRODUCTION

-

7.2 COMMERCIAL VEHICLESADVANCE TRACKERS TO GAIN POPULARITY IN COMMERCIAL VEHICLES

-

7.3 CARGO AND CONTAINERSOFFERS SIMPLIFIED AND EFFECTIVE SOLUTIONS TO TRACK CARGO AND CONTAINERS

- 8.1 INTRODUCTION

- 8.2 SATELLITE

- 8.3 CELLULAR

- 9.1 INTRODUCTION

-

9.2 TRANSPORTATION & LOGISTICSAUTOMATES WORKFLOW PROCESS AND ENSURES STREAMLINED OPERATIONS

-

9.3 CONSTRUCTIONIMPORTANCE OF TRACKING HEAVY VEHICLES AND ASSETS

-

9.4 OIL & GASTRACKS MOVEMENT OF LARGE-SCALE GENERATORS AND HEAVY VEHICLES

-

9.5 METALS & MININGENABLES TRANSPARENCY AND ACCOUNTABILITY IN MINING OPERATIONS

-

9.6 GOVERNMENTMEETS COMMUNITY SAFETY DEMANDS, SAVES FUEL, AND PROVIDES QUICK RESPONSE IN EMERGENCIES

-

9.7 OTHERSEDUCATIONHOSPITALITYAGRICULTUREHEALTHCARE

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Introduction of 4G technology to boost market growthCANADA- Government as end-use segment to offer significant opportunitiesMEXICO- Automotive industry to offer growth opportunities

-

10.3 EUROPEUK- Fleet management offerings to drive growthGERMANY- Commercial vehicles play significant role in developing marketFRANCE- Agriculture likely to drive market for GPS tracking devicesREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- Lucrative global manufacturing hubJAPAN- Growing implementation of modern fleet solutions to drive growthSOUTH KOREA- Focus on advancement of GPS technology to create opportunitiesREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDMIDDLE EAST & AFRICA- Expanding transportation and logistics industrySOUTH AMERICA- Mainly driven by fleet management

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF KEY COMPANIES

- 11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

-

11.4 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 COMPETITIVE SCENARIOS AND TRENDSGPS TRACKING DEVICE MARKET: PRODUCT LAUNCHES, JANUARY 2021–NOVEMBER 2022GPS TRACKING DEVICE MARKET: DEALS, SEPTEMBER 2021– JULY 2022

-

12.1 KEY PLAYERSCALAMP CORPORATION- Business overview- Products offered- Recent developments- MnM viewORBCOMM INC.- Business overview- Products offered- Recent developments- MnM viewSIERRA WIRELESS, INC.- Business overview- Products offered- MnM viewSHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.- Business overview- Products offered- Recent developments- MnM viewQUECLINK WIRELESS SOLUTIONS CO., LTD.- Business overview- Products offered- Recent developments- MnM viewTOMTOM INTERNATIONAL BV- Business overview- Products offered- Recent developmentsMEITRACK GROUP- Business overview- Products offeredTELTONIKA UAB- Business overview- Products offeredATRACK TECHNOLOGY INC.- Business overview- Products offered- Recent developmentsGEOTAB INC.- Business overview- Products offered- Recent developmentsTRACKIMO- Business overview- Products offered

-

12.2 OTHER PLAYERSAZUGA INC.VERIZON WIRELESSSPYTEC GPST42 IOT TRACKING SOLUTIONS PLCTRACKINGFOX, INC.TKSTAR TECHNOLOGY CO., LIMITEDSKYPATROL LLCLAIPAC TECHNOLOGY, INC.ARKNAV INTERNATIONAL, INC.GEOFORCESENSATA TECHNOLOGIES, INC.BRICKHOUSE SECURITYRUPTELASUNTECH INTERNATIONAL LTD.

- 13.1 INTRODUCTION

- 13.2 STUDY LIMITATIONS

-

13.3 ITS MARKET FOR ROADWAYS, BY SYSTEMADVANCED TRAFFIC MANAGEMENT SYSTEMSADVANCED TRAVELER INFORMATION SYSTEMSITS-ENABLED TRANSPORTATION PRICING SYSTEMSADVANCED PUBLIC TRANSPORTATION SYSTEMSCOMMERCIAL VEHICLE OPERATIONS SYSTEMS

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON GPS TRACKING DEVICE MARKET

- TABLE 2 INDICATIVE PRICING ANALYSIS OF GPS TRACKING DEVICES OFFERED BY COMPANIES

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 4 GPS TRACKING DEVICE MARKET: CONFERENCES AND EVENTS, 2023–2024

- TABLE 5 GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 6 GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 7 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 8 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 9 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 10 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 11 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2019–2022 (USD MILLION)

- TABLE 12 STANDALONE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 13 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 14 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 16 OBD DEVICES: GPS TRACKING DEVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 17 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 20 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 21 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2019–2022 (USD MILLION)

- TABLE 22 ADVANCE TRACKERS: GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 23 GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2019–2022 (USD MILLION)

- TABLE 24 GPS TRACKING DEVICE MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 25 COMMERCIAL VEHICLE: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 COMMERCIAL VEHICLE: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 CARGO AND CONTAINER: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 CARGO AND CONTAINER: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 30 GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 31 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 34 TRANSPORTATION & LOGISTICS: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 38 CONSTRUCTION: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 OIL & GAS: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 OIL & GAS: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 OIL & GAS: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 OIL & GAS: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 METALS & MINING: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 METALS & MINING: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 METALS & MINING: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 METALS & MINING: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 GOVERNMENT: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 OTHERS: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 OTHERS: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 OTHERS: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 OTHERS: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 EUROPE: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 EUROPE: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 EUROPE: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 EUROPE: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 EUROPE: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 68 EUROPE: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 ROW: GPS TRACKING DEVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 ROW: GPS TRACKING DEVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 ROW: GPS TRACKING DEVICE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 ROW: GPS TRACKING DEVICE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 ROW: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 80 ROW: GPS TRACKING DEVICE MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 81 MARKET SHARE OF TOP PLAYERS IN GPS TRACKING DEVICE MARKET, 2022

- TABLE 82 GPS TRACKING DEVICE MARKET: PRODUCT LAUNCHES JANUARY 2021–NOVEMBER 2022

- TABLE 83 GPS TRACKING DEVICE MARKET: DEALS, SEPTEMBER 2021–JULY 2022

- TABLE 84 CALAMP CORP.: BUSINESS OVERVIEW

- TABLE 85 CALAMP CORP.: PRODUCTS OFFERED

- TABLE 86 CALAMP CORP.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 87 CALAMP CORP.: DEALS

- TABLE 88 ORBCOMM INC.: BUSINESS OVERVIEW

- TABLE 89 ORBCOMM INC.: PRODUCTS OFFERED

- TABLE 90 ORBCOMM INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 91 ORBCOMM INC.: DEALS

- TABLE 92 SIERRA WIRELESS, INC.: BUSINESS OVERVIEW

- TABLE 93 SIERRA WIRELESS, INC.: PRODUCTS OFFERED

- TABLE 94 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 95 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 96 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 97 SHENZHEN CONCOX INFORMATION TECHNOLOGY CO., LTD.: DEALS

- TABLE 98 QUECLINK WIRELESS SOLUTIONS CO., LTD.: BUSINESS OVERVIEW

- TABLE 99 QUECLINK WIRELESS SOLUTIONS CO., LTD.: PRODUCTS OFFERED

- TABLE 100 QUECLINK WIRELESS SOLUTIONS CO., LTD: PRODUCT LAUNCHES

- TABLE 101 TOMTOM INTERNATIONAL BV: BUSINESS OVERVIEW

- TABLE 102 TOMTOM INTERNATIONAL BV: PRODUCTS OFFERED

- TABLE 103 TOMTOM INTERNATIONAL BV: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 104 TOMTOM INTERNATIONAL BV: DEALS

- TABLE 105 MEITRACK GROUP: BUSINESS OVERVIEW

- TABLE 106 MEITRACK GROUP: PRODUCTS OFFERED

- TABLE 107 TELTONIKA UAB: BUSINESS OVERVIEW

- TABLE 108 TELTONIKA UAB: PRODUCTS OFFERED

- TABLE 109 ATRACK TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 110 ATRACK TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 111 ATRACK TECHNOLOGIES INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 112 GEOTAB INC.: BUSINESS OVERVIEW

- TABLE 113 GEOTAB INC.: PRODUCTS OFFERED

- TABLE 114 GEOTAB INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 115 GEOTAB INC.: DEALS

- TABLE 116 TRACKIMO: BUSINESS OVERVIEW

- TABLE 117 TRACKIMO: PRODUCTS OFFERED

- TABLE 118 AZUGA INC.: BUSINESS OVERVIEW

- TABLE 119 VERIZON WIRELESS: BUSINESS OVERVIEW

- TABLE 120 SPYTEC GPS: BUSINESS OVERVIEW

- TABLE 121 T42 IOT TRACKING SOLUTIONS PLC: BUSINESS OVERVIEW

- TABLE 122 TRACKINGFOX, INC.: BUSINESS OVERVIEW

- TABLE 123 TKSTAR TECHNOLOGY CO., LIMITED: BUSINESS OVERVIEW

- TABLE 124 SKYPATROL LLC: BUSINESS OVERVIEW

- TABLE 125 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2018–2022 (USD MILLION)

- TABLE 126 ITS MARKET FOR ROADWAYS, BY SYSTEM, 2023–2028 (USD MILLION)

- FIGURE 1 SEGMENTATION OF GPS TRACKING DEVICE MARKET

- FIGURE 2 GPS TRACKING DEVICE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 RESEARCH STUDY ASSUMPTIONS

- FIGURE 8 ADVANCE TRACKERS TO DOMINATE GPS TRACKING DEVICE MARKET DURING FORECAST PERIOD

- FIGURE 9 CARGO AND CONTAINERS PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 TRANSPORTATION & LOGISTICS TO DOMINATE GPS TRACKING DEVICE MARKET

- FIGURE 11 MARKET IN EUROPE HELD LARGEST MARKET SHARE IN 2022

- FIGURE 12 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

- FIGURE 13 INCREASE IN DEMAND FOR CLOUD TECHNOLOGY AND IOT TO DRIVE GROWTH OF GPS TRACKING DEVICE MARKET

- FIGURE 14 ADVANCE TRACKERS TO DOMINATE GPS TRACKING DEVICE MARKET BETWEEN 2023 AND 2O28

- FIGURE 15 COMMERCIAL VEHICLES TO CAPTURE HIGHEST MARKET SHARE IN 2028

- FIGURE 16 IN ASIA PACIFIC, TRANSPORTATION & LOGISTICS TO BE MOST LUCRATIVE INDUSTRY; CHINA LIKELY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 EUROPE HELD LARGEST SHARE OF GPS TRACKING DEVICE MARKET IN 2022

- FIGURE 18 GPS TRACKING DEVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 SUPPLY CHAIN ANALYSIS: GPS TRACKING DEVICE MARKET

- FIGURE 20 AVERAGE SELLING PRICE OF GPS TRACKING DEVICE

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 22 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8526, 2017–2021 (USD MILLION)

- FIGURE 23 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8526, 2017–2021 (USD MILLION)

- FIGURE 24 ADVANCE TRACKERS EXPECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 GPS TRACKING DEVICE MARKET FOR CARGO AND CONTAINERS TO EXPAND AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 TRANSPORTATION & LOGISTICS TO DOMINATE GPS TRACKING DEVICE MARKET FROM 2023 TO 2028

- FIGURE 27 GPS TRACKING DEVICE MARKET: REGIONAL SNAPSHOT (2023–2028)

- FIGURE 28 NORTH AMERICA: GPS TRACKING DEVICE MARKET SNAPSHOT

- FIGURE 29 EUROPE: GPS TRACKING DEVICE MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: GPS TRACKING DEVICE MARKET SNAPSHOT

- FIGURE 31 GPS TRACKING DEVICE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021

- FIGURE 32 SHARE OF MAJOR PLAYERS IN GPS TRACKING DEVICE MARKET, 2022

- FIGURE 33 GPS TRACKING DEVICE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 34 CALAMP CORP.: COMPANY SNAPSHOT

- FIGURE 35 QUECLINK WIRELESS SOLUTIONS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 36 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT

- FIGURE 37 ATRACK TECHNOLOGIES INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the GPS tracking device market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements, press releases); trade, business, and professional associations; white papers, tracking device journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

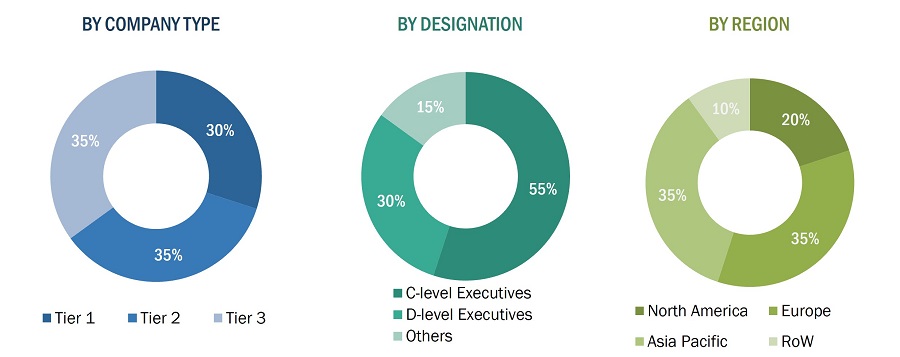

Primary Research

Extensive primary research has been conducted after understanding and analyzing the GPS tracking device market size through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast, and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to the GPS tracking device market. Major players in the GPS tracking device market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. The entire research methodology included the study of annual and financial reports of top players and interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

GPS Tracking Device Market: Bottom-Up Approach

- Identifying various segments currently using or expected to implement GPS tracking devices, along with the related technology.

- Identifying major companies across various sectors and their adoption of the GPS tracking device.

- Analyzing the ecosystem of start-up companies and their product portfolio to identify the impact of these developments on market growth.

- Tracking the ongoing and upcoming GPS tracking device solutions/products by companies and forecasting the market size on the basis of these developments and other critical parameters.

- Conducting multiple discussion sessions with key opinion leaders to understand the communication technology being used in GPS tracking devices, implementation, and applications in various industries, which would help in analyzing the break-up of the scope of work carried out by each major company.

- Verifying and crosschecking the estimates at every level with key opinion leaders, including CEOs, directors, and operation managers, and then finally with the MarketsandMarkets domain experts.

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

GPS Tracking Device Market: Top-Down Approach

- Focusing initially on the top-line investment and expenditures being made in the ecosystems of the GPS tracking market size . Further splitting into type, deployment type, and listing key developments in the key market areas.

- Identifying all major players in each category (personal tracking and commercial tracking) of the GPS tracking device market size through secondary research and dully verified with a brief discussion with the industry experts.

- Analyzing revenue, product mix, geographic presence, and key applications served by all the identified players to estimate and arrive at the percentage splits for all the key segments.

- Discussing these splits with many industry experts to validate the information and identify the key growth pockets across all the key segments.

- Breaking down the total market size based on the verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall size of the GPS tracking device market through the process explained above, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market size has also been validated using top-down and bottom-up approaches.

Market Definition

A GPS tracking device is hardware that can detect the precise location of moving objects such as vehicles or persons with the help of a global positioning system (GPS), and the detected location can be sent to the remote location database with the help of cellular (GPRS, HSPA, and LTE) or satellite modem embedded in it. Some of the devices can store the detected location in the same device.

Key Stakeholders

- Analysts and strategic business planners

- GNSS Module Supplier

- GNSS IC Supplier

- Governments, financial institutions, and investment communities

- Original equipment manufacturers (OEMs) of electronic components

- Product manufacturers

- Raw material and manufacturing equipment suppliers

- Research organizations

- Suppliers of chipsets and inductive components

- Technology investors and venture capital firms

- Technology standard organizations, forums, alliances, and associations

Report Objectives

- To define, describe, and forecast the global GPS tracking device market size in terms of value, segmented on the basis of type, deployment, and industry

- To define and describe the communication technology used in GPS tracking device

- To forecast the market size, in terms of value, for various segments with regard to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the value chain of the GPS tracking device market share

- To strategically analyze the micromarkets1 with respect to the individual growth trends, future prospects, and contribution to the overall GPS tracking device market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global GPS tracking device market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze the key vendors and their ecosystems in the global GPS tracking device market

- To analyze competitive developments such as joint ventures, mergers and acquisitions, product launches, and research and development in the global GPS tracking device market size

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in GPS Tracking Device Market