Usage-based Insurance Market Size, Share & Analysis

Usage-Based Insurance Market Strategic Trends and Opportunities, by Type (Pay-As-You-Drive, Pay-How-You-Drive, and Manage-How-You-Drive), Hardware (smartphones and Telematics), and Region (North America, Europe and Asia Pacific) - Global Forecast 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The usage-based insurance market is projected to grow from USD 46.95 billion in 2024 to USD 70.46 billion by 2030, at a CAGR of 7.0%. The key factors driving the usage-based insurance market are consumer willingness to share personal data with UBI insurer companies, the increase in connected cars, and the affordability of the UBI premium compared to traditional insurance.

KEY TAKEAWAYS

-

BY TYPEPay-As-You-Drive (PAYD) is the dominant UBI type, accounting for the largest share of adoption among usage-based models. Its growth is supported by telematics data showing that drivers using PAYD models reduce annual mileage by an average of 12–15%, directly lowering risk exposure and enabling insurers to price premiums more accurately.

-

BY HARDWAREEmbedded Telematics Box is the dominant segment in the Usage-Based Insurance (UBI) market, driven by integration of advanced driver assistance systems and real-time data analytics. Over three-quarters of new vehicles globally are equipped with OEM-installed telematics systems, and the number of connected cars with embedded telematics is projected to surpass half a billion in the coming years.

-

BY REGIONNorth America dominates the Usage-Based Insurance market, accounting for 67–75% of the global UBI market. In the US, insurers like Allstate and Progressive leverage PAYD models to offer mileage-based premiums, using telematics to track speed, braking, and distance. High insurance costs and widespread connected-vehicle penetration enable precise risk-based pricing and measurable reductions in claim frequency.

-

COMPETITIVE LANDSCAPEThe Usage-Based Insurance market is dominated by globally established players such as Octo Group S.p.A (Italy), Cambridge Mobile Telematics (US), Lexis Nexis (US), The Floow (UK), Allianz (Germany), AXA (France), Zurich (Switzerland), Libert Mutual Insurance (US), Allstate Insurance Company (US), and Farmers Insurance (US), and Tesla (US).

The usage-based insurance (UBI) market is witnessing robust growth, driven by increasing adoption of connected vehicles, telematics, and smartphone-based monitoring to offer personalized, data-driven premiums. Strategic developments, including partnerships between insurers and OEMs, regulatory support for telematics, and innovations in driver behavior analytics, are accelerating market expansion and transforming the insurance landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on insurers’ business in the Usage-based insurance market emerges from customer trends and technological disruptions. Policyholders are the end consumers, and connected vehicles or telematics providers are the target applications. Shifts in driving behavior, regulatory changes, or adoption of new telematics technologies will affect policyholder premiums and claims, which in turn influence insurer revenues, ultimately shaping the growth and strategies of UBI providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High premium rates for electric vehicles

-

Increased connected car penetration

Level

-

Regulatory Challenges

-

Low Consumer Awareness in Developing Countries for UBI

Level

Level

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High insurance premium rates for EVs are driving the market

Initially, the UBI premiums were high for EVs due to a lack of parc data and vehicle performance in the long term, due to which the insurers were charging more to protect the risks. Whereas, in recent years, there has been a rise in EV sales and access to EV’s parc data and its performance in calculating UBI premiums.

Restraint: Regulatory Challenges

Varying privacy laws, data protection, and insurance standards hinder the ability to offer consistent UBI services globally, limiting market expansion and increasing operational complexities.

usage-based-insurance-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides telematics for commercial fleets to monitor driver behavior and optimize routes. | Reduces accidents, lowers insurance costs, and improves fleet utilization. |

|

Offers Pay-As-You-Drive insurance where premiums are calculated based on mileage. | Low-mileage drivers save money and are encouraged to drive safely. |

|

Uses telematics to score driver behavior including speed, braking, and acceleration. | Supports risk-based pricing and reduces claims frequency. |

|

Provides mobile apps that give drivers feedback and gamified scoring. | Increases customer engagement, retention, and brand differentiation. |

|

Monitors both fleet and individual driver behavior across Europe. | Supports ESG initiatives, reduces emissions, and improves road safety. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Usage-Based Insurance (UBI) market ecosystem comprises four key segments. Telematics service providers (e.g., Octo, Cambridge Mobile Telematics, Geotab) enable data collection from vehicles, while insurance companies (e.g., State Farm, Allianz, AXA) leverage this data to offer personalized premiums. Data analytics and risk solution firms (e.g., Verisk, SAS, IBM) provide insights for underwriting and claims optimization, and OEMs (e.g., Toyota, Ford, Tesla) integrate connected vehicle technology to support UBI programs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Usage-based Insurance Market, By Type

PAYD, or “pay less, when drive less,” offers personalized premiums based on actual kilometres driven, making insurance cost-efficient and customer-centric. Its flexibility allows vehicle owners to pay only for the days or months the vehicle is in use, enhancing affordability. Leading insurers, such as Reliance General Insurance, promote PAYD with incentives like carrying forward unused kilometres, driving adoption and market growth.

Usage-based Insurance Market, By Hardware

Embedded telematics from OEMs enable real-time vehicle data sharing for accurate risk assessment and personalized premiums, enhancing operational efficiency and driver safety. Regulatory mandates, such as Europe’s eCall system, accelerate adoption by requiring built-in telematics in all new vehicles. Increasing vehicle connectivity and OEM-driven offerings position embedded telematics as the fastest-growing segment in usage-based insurance.

REGION

Asia Pacific to be fastest-growing region in usage-based insurance market during forecast period

Asia Pacific is emerging as the fastest-growing market for Usage-Based Insurance (UBI), driven by widespread smartphone adoption and built-in telematics. Insurers are aligning with country-specific data privacy and transparency regulations to ensure compliance. China leads the region in UBI penetration, supported by high EV sales and a growing connected vehicle ecosystem. Strategic partnerships, such as Citroen India and ICICI Lombard’s PAYD program for the eC3, are promoting safe driving and personalized premiums, further accelerating UBI adoption in the region.

usage-based-insurance-market: COMPANY EVALUATION MATRIX

In the Usage-Based Insurance market matrix, Octo Group SPA (Star) leads with a strong market share and extensive product offerings, driven by its advanced telematics solutions and PAYD/PHYD programs widely adopted across North America and Europe. AXA (Emerging Leader) is gaining visibility with innovative mileage- and behavior-based insurance products, strengthening its position through digital platforms and targeted consumer programs. While Octo Group SPA dominates through scale and integrated solutions, AXA shows significant potential to move toward the leaders' quadrant as demand for personalized, risk-based insurance continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 46.95 Billion |

| Market Forecast in 2030 (Value) | USD 70.46 Billion |

| Growth Rate | CAGR of 7.0% from 2024-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By type, by hardware, and by region |

| Regions Covered | Asia Pacific, North America, and Europe |

WHAT IS IN IT FOR YOU: usage-based-insurance-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Auto OEM | Competitive profiling of UBI solution providers (financials, platform features, partnerships) |

|

| Telematics Device Manufacturer |

|

|

| Insurance Carrier |

|

|

| Mobility Platform / Fleet Operator |

|

|

| Data Analytics Provider |

|

|

RECENT DEVELOPMENTS

- Nov 2024 : LexisNexis Risk Solutions partnered with TransUnion UK to integrate affordability data into pricing workflows, merging telematics behavior with credit analytics.

- Oct 2024 : OCTO Group was selected by ABAX Group in Norway as the new risk-scoring partner for its Nordic UBI business “Fair,” strengthening its European footprint.

- Sep 2024 : Cambridge Mobile Telematics (CMT) expanded global rollout of DriveWell Fusion across more than 25 countries, combining smartphone, IoT, and dashcam data for advanced crash detection.

- Jul 2024 : LexisNexis Risk Solutions reported strong consumer UBI adoption trends via its U.S. Insurance Demand Meter, signaling growing appetite for behavior-based auto policies.

Table of Contents

Methodology

The study involved analyzing the UBI market trend, regualtions, and the recent development by the TSP and insurer and automakers to determin the UBI market for 2023 with a forecast projection till 2030. The study is also based on data collected by OEMs from connected cars. Subsequently, these findings, along with assumptions, were corroborated and validated through primary research involving industry experts across the value chain. Employing bottom-up methodology, the complete market size was estimated. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The secondary sources referred for this research study include automotive OEMs, Tier I/II companies, and publication from government sources, automotive associations & databases: [such as country level automotive associations and organizations, International Energy Agency (IEA), MarkLines and others] trade, business, and automotive associations. Secondary data has been collected and analysed to arrive at the overall sales volume.

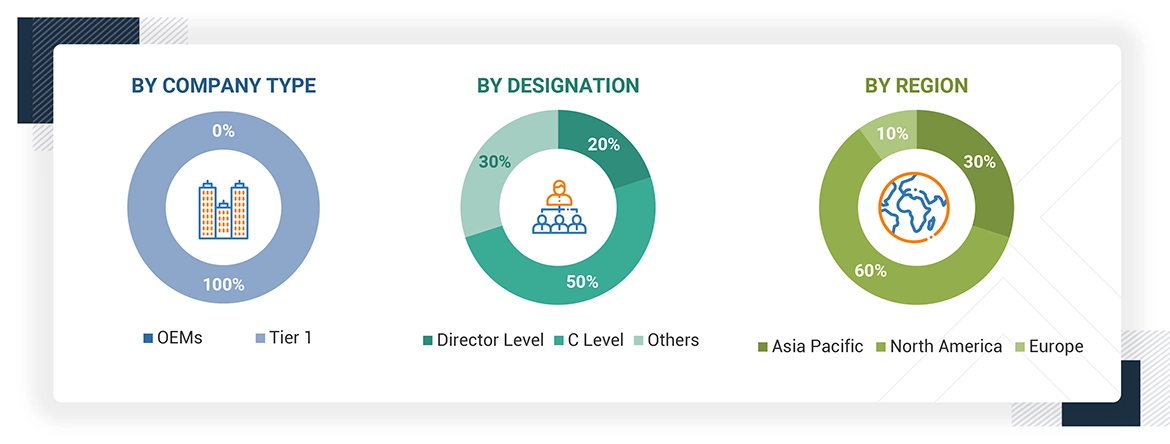

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as Usage-Based Insurance market sizing estimation and forecast.

Note: *Others include sales managers, marketing managers, and product managers.

UBI policy providers are companies that provide UBI packages/programs, while UBI technology providers are companies that provide UBI apps/hardware to UBI providers and OEMs.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As mentioned below, a detailed market estimation approach was followed to estimate and validate the value and volume of the usage-based insurance market and other dependent submarkets

- The bottom-up approach was used to estimate and validate the light duty vehicles unit market size. The country-level sales for light duty vehicles (Car, SUVs, Pickup Trucks, Vans, MPVs and Minivans) were referred from country-level manufacturing associations and secondary sources (company publications, articles, etc.).

- The sales forecast for this vehicle type is based on factors such as country-wise macroeconomic indicators, emission regulations, growth in the automotive industry, GDP growth, and government spending.

- The UBI premiums for new and VIO was calculated by reducing certain percentage from the traditional insurance form each country and forecasted accordingly.

- The UBI policy adoption rate for each country was referred to from the secondary sources and then validated through primary interviews and industry experts.

- The UBI adoption rate was then multiplied with the unit sales of light duty vehicles by country to get the unit shipment at the country level.

- The country level UBI shipment was then multiplied by the country-level average selling price (ASP) of UBI policy to get the revenue for each country .

- The summation of the country-level market would give the global unit shipment for UBI in terms of million and revenue in terms of billion .

Market Definition

As per the National Association of Insurance Commissioners (NAIC), usage-based insurance (UBI) is a type of auto insurance that tracks mileage and driving behavior. UBI is often powered by in-vehicle telecommunication devices (telematics)—technology that is available in a vehicle and is self-installed using a plug-in device or already integrated into the original equipment installed by car manufacturers. It can also be available through mobile applications. The basic idea of UBI is that a driver's behavior is monitored in real time, allowing insurers to align driving behavior more closely with premium rates.

Stakeholders

- Automotive OEMs

- Technology Service Providers

- Automotive insurance providers

- Telematics Technology Providers (TTP)

- Aftermarket Telematics Providers

- Technology investors

- National and Regional Environmental Regulatory Agencies or Organizations

- Technology standards organization, forum, alliances, and associations

- Agents and brokers of usage usage-based insurance market

- Regional Automobile Associations

- Telematics device suppliers for OEMs and Automotive Tier

- Traders, distributors, and suppliers of telematics components and raw material suppliers

- Organized and unorganized aftermarket suppliers of telematics devices

Report Objectives

-

To define, describe, and forecast the usage-based insurance market, in terms of unit shipment (Million) and revenue (USD billion), based on the following segments:

- By type [Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD)]

- By hardware [OBD-II, smartphones, and embedded telematics box].

- By region {Asia Pacific, North America, and Europe}

- To understand the market dynamics (drivers and restraints), regulatory analysis, and ecosystem analysis.

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

- To understand how data is tracked from the connected cars.

- Company profiling of TSP, OEMs and Insurance providers with details to what hardware they use for tracking and what parameters do they track.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Usage-Based Insurance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Usage-Based Insurance Market

Genelia

Jul, 2022

We are reviewing different Usage-Based Insurance scenarios, as part of the strategy for this topic we are looking for a strategic partner to help us understand how to introduce UBI solutions in the Mexican market. We would like to know and understand the needs of the Mexican market to enter with UBI solutions, here are a couple of points that we would like to know: 1. Evaluate the Mexican UBI market opportunity 2. Understand the Mexican personal auto insurance market 3. Understand Mexican personal line insurance companiesí key needs and challenges 4. Identify opportunities for telematics in the personal line market 5. Understand the Mexican commercial auto insurance market 6. Understand Mexican commercial line insurance companiesí key needs and challenges 7. Identify opportunities for telematics in the commercial line market.

Laura

Jul, 2022

Usage-Based Insurance Market report was published and updated early last month and is the most updated market report available with us on the Usage-Based Insurance Market. The report breaks-down the market size and growth forecast for ICE vehicles and for Battery Electric Vehicle (BEV), Plug-in Hybrid Vehicle (PHEV) and Fuel-cell Electric Vehicle (FCEV), further broken down by 1) By Package Type: Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD) 2) By Technology: OBD-II, Smartphone, Black Box, Embedded, Other technologies 3) By Vehicle Type: Light-duty Vehicle (LDV), Heavy-duty Vehicle (HDV) 4 By Vehicle Age: New Vehicle, Old Vehicle 5) By Device Offering: Bring Your Own Device (BYOD), Company Provided Market share analysis of top players, including their business and service portfolio, last three year financials, contracts awarded, organic and in-organic growth strategies, SWOT analysis, key investments, and MnM view point of each company, is covered for all global and regional players..