Nutraceutical Excipients Market

Nutraceutical Excipients Market by Source (Organic Chemicals, Inorganic Chemicals), Functionality (Binders, Fillers & Diluents, Disintegrants, Coating Agents), End Product, Formulation, Functionality Application and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The nutraceutical excipients market is projected to reach USD 7.12 billion by 2030, increasing from USD 4.98 billion in 2025, reflecting a strong CAGR of 7.4% during the forecast period. The rising use of excipients across dietary supplements, functional foods, and advanced nutraceutical formulations continues to be a key driver of market growth. Increasing demand for clean-label, stable, and bio-compatible ingredients is pushing manufacturers to develop innovative excipient solutions that support improved stability, taste, solubility, and bioavailability. The growing adoption of natural and plant-derived excipients across major regions, particularly in Asia Pacific, is accelerating the development of high-performance binders, fillers, coatings, and disintegrants designed for modern supplement delivery formats. These advancements are significantly enhancing product safety, efficacy, and consumer acceptance, thereby strengthening overall market expansion.

KEY TAKEAWAYS

-

BY REGIONThe North American nutraceutical excipients market accounted for a 32.2% revenue share in 2024.

-

BY SOURCEAmong sources, organic excipients are estimated lead.

-

BY FUNCTIONALITYBy functionality, the colorant segment is estimated to register the highest CAGR of 8.5%.

-

BY END PRODUCTBy end product, the probiotics segment is set to dominate the market.

-

BY FORMBy form, the dry segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY FUNCTIONALITY APPLICATIONBy functionality application, the taste masking segment is poised to register the highest CAGR of 7.9%.

-

COMPETITIVE LANDSCAPE (Key Players)Key players such as Kerry Group, BASF SE, Cargill Incorporated, Lubrizol Life Science, and DFE Pharma focus on capacity expansions, product innovations, and sustainable manufacturing technologies in the nutraceutical excipients market. Companies are also investing in research for bio-based and functional excipients and forming strategic partnerships to strengthen their regional presence and cater to a diverse range of dietary supplement and functional food applications.

-

COMPETITIVE LANDSCAPE (SME)Innophos, JRS PHARMA, Omya AG, Daicel Corporation, Alsiano A/S, and Colorcon have distinguished themselves within the SME landscape by building strong footholds in specialized excipient niches, underscoring their potential as emerging market leaders.

The nutraceutical excipients market is entering a dynamic growth phase as evolving consumer preferences, advanced supplement formulation needs, and the global shift toward natural, high-performance ingredients drive strong industry expansion. With rising demand for functional foods, dietary supplements, and innovative delivery formats such as gummies, soft gels, and effervescent tablets, manufacturers increasingly rely on specialized excipients to enhance stability, taste, solubility, and bioavailability. The move toward clean-label formulations and plant-derived alternatives is further reshaping the competitive landscape, encouraging continuous innovation in binders, fillers, coatings, disintegrants, and other functional components. As brands focus on improving shelf life, nutrient protection, and overall product efficacy, the demand for robust and scientifically optimized excipients is accelerating across both developed and emerging markets, positioning the sector for sustained long-term growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The nutraceutical excipients market is being shaped by a strong shift toward clean-label, natural, and plant-derived excipients, driven by rising consumer transparency demands. Manufacturers are increasingly adopting multifunctional excipients that improve compressibility, stability, and bioavailability while reducing formulation complexity. Advances in modified-release, nano-encapsulation, and protective coating technologies are disrupting traditional excipient use by enabling better delivery of sensitive ingredients like probiotics and omega-3s. The market is also witnessing rapid movement toward TiO2-free coatings and allergen-free alternatives due to regulatory pressures. Additionally, expansion of vegan softgel systems and plant-based polymers is accelerating the transition away from animal-derived excipients, reshaping product development strategies across nutraceutical brands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising global demand for dietary supplements & functional foods

-

Growing health-awareness and preventive healthcare trends

Level

-

Significant R&D and formulation development costs

-

High cost of specialty / clean-label excipient grades

Level

-

Development of plant-based/clean-label excipients

-

Expansion into personalized nutrition & targeted-release systems

Level

-

Regulatory uncertainty and differing regional requirement

-

High cost and lead time for validation/qualification

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising global demand for dietary supplements & functional foods

Rising global demand for dietary supplements and functional foods is becoming a key driver for the nutraceutical excipients market, supported by recent government-backed data and consumption trends. According to the US CDC’s NHANES survey (August 2021–August 2023), dietary supplement use remains widespread, with over 57% of adults reporting supplement intake, while multi-supplement usage among adults aged 20–59 increased to 30.8% in the 2021–2023 cycle. This steady rise in supplement consumption directly accelerates the need for high-performance excipients that enhance stability, bioavailability, solubility, and taste. In parallel, the Ministry of Food Processing Industries (India) reported in 2023 that functional foods and beverages account for over one-third of the country’s nutraceutical market, reflecting strong consumer adoption of fortified and value-added foods. As governments continue to highlight nutrition, wellness, and preventive health, this expanding consumption base strengthens demand for innovative nutraceutical excipients, positioning them as crucial enablers of product performance and market growth.

Restraint: Significant R&D and formulation development costs

Significant R&D and formulation development costs act as a major restraint for the nutraceutical excipients market, particularly as companies increasingly pursue advanced delivery systems, clean-label solutions, and multifunctional excipients. Developing high-performance excipients such as those supporting modified release, taste masking, enhanced solubility, or stability requires substantial investment in scientific research, pilot-scale testing, regulatory documentation, and compatibility studies with diverse nutraceutical actives. Smaller manufacturers often struggle to absorb these costs, limiting their ability to innovate or adopt next-generation excipients. Additionally, the need for continuous reformulation to meet evolving regulatory standards, regional compliance requirements, and consumer expectations further increases development expenses. High costs associated with specialized equipment, analytical testing, and quality assurance also contribute to slower market entry and reduced product affordability. As a result, these financial barriers may constrain innovation, delay commercialization timelines, and limit wider adoption of advanced excipient technologies across the nutraceutical industry.

Opportunity: Development of plant-based/clean-label excipients

The growing development of plant-based and clean-label excipients presents a significant opportunity for the nutraceutical excipients market, reinforced by rising global demand for natural, sustainable, and transparent formulations. The systematic review published on November 19, 2024, highlights how plant-derived materials such as cellulose, starch, carrageenan, guar gum, and plant oils are increasingly preferred for their biocompatibility, safety, and alignment with green chemistry principles. As consumers move toward chemical-free, vegan, and eco-friendly supplements, manufacturers are accelerating the adoption of these clean-label excipients to improve stability, solubility, texture, and controlled-release performance in nutraceutical products. This trend opens strong innovation pathways in allergen-free, non-GMO, and biodegradable excipient solutions. Additionally, advancements in extraction and purification technologies are making plant-based excipients more scalable and cost-efficient. With sustainability now central to product development strategies, plant-based excipients represent a high-growth opportunity for companies aiming to meet evolving regulatory and consumer expectations.

Challenge: Regulatory uncertainty and differing regional requirement

Regulatory uncertainty and differing regional requirements pose a significant challenge for the nutraceutical excipients market, primarily because excipient standards are not harmonized across major markets. Nutraceuticals often fall between food and pharmaceutical regulations, and each region, such as the US, EU, India, and Asia Pacific, applies different rules for safety, purity, permitted additives, and labeling. This inconsistency makes it difficult for manufacturers to develop formulations that meet all regional compliance expectations without extensive reformulation or multiple approval cycles. Moreover, several countries lack clear frameworks for novel or functional excipients, creating delays in market entry and increasing the cost of product development. Frequent regulatory updates and unclear classification of excipients further add to compliance risks, especially for innovative or plant-based materials. As a result, companies face higher documentation burdens, complex quality-control requirements, and increased R&D costs, slowing down innovation and limiting the ability to launch standardized global products in the nutraceutical excipients market.

Nutraceutical Excipients Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced coating systems, controlled-release polymers, and film-forming excipients for nutraceutical tablets and capsules | Improved product stability, enhanced swallowing experience, uniform appearance, and better release control for active ingredients |

|

Taste-masking excipients, functional binders, and delivery matrix systems for powders, gummies, and functional beverages | Superior palatability, consistent texture, improved consumer acceptance, and enhanced dispersion in liquid formats |

|

Pharma-grade binders, disintegrants, and solubilizers for high-potency nutraceutical formulations | Enhanced bioavailability, faster disintegration, improved shelf-life, and reliable performance in complex formulations |

|

Plant-based excipients such as pea starches, polyols, and natural binders for a clean-label nutraceutical product | Clean-label positioning, improved compressibility, better formulation flexibility, and strong alignment with vegan and natural trends |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The nutraceutical excipients market ecosystem comprises interconnected relationships among key stakeholders, including raw material suppliers, excipient manufacturers, distributors, and end users across various industries such as dietary supplements, functional foods, beverages, and personal care. Raw material suppliers provide plant-based, organic chemical, mineral, or bio-derived ingredients used in the production of functional excipients. Manufacturers convert these raw materials into excipients such as binders, stabilizers, emulsifiers, flavoring agents, and taste-masking agents, which are further processed for incorporation into vitamins, protein powders, herbal formulations, and nutraceutical products. Distributors and suppliers act as intermediaries, connecting producers with end users such as supplement manufacturers, functional food companies, and beverage formulators, thereby optimizing the supply chain to enhance product availability, quality, and operational efficiency across global markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Nutraceutical Excipients Market, By End Product

Probiotics represent the largest sub-segment within the end-product segment of the nutraceutical excipients market, driven by increasing consumer demand for digestive health and immunity-supporting supplements. The growing popularity of probiotic supplements has encouraged manufacturers to develop excipients that enhance the stability, shelf life, and organoleptic properties of these sensitive bioactive ingredients. A recent example is Roquette’s launch of PEARLITOL ProTec on May 18, 2023, a plant-based co-processed excipient combining mannitol and maize starch, designed specifically to protect moisture-sensitive probiotics and maintain product consistency. This innovation addresses key formulation challenges, allowing manufacturers to offer diverse, consumer-friendly dosage formats while meeting stringent regulatory standards across major markets.

Nutraceutical Excipients Market, By Functionality

Coating agents continue to dominate the functionality segment of the nutraceutical excipients market, driven by their critical role in enhancing product stability, appearance, and consumer appeal across tablets and capsules. These excipients not only protect active ingredients from environmental stressors such as moisture and light but also improve swallowability and mask unpleasant tastes, ensuring better patient and consumer compliance. A recent example of innovation in this segment is Colorcon’s launch of Nutracore on April 18, 2023, a range of label-friendly coating excipients designed specifically for nutritional and dietary supplements. Nutracore materials are formulated from natural ingredients, combining flowability, compressibility, and lubricity to simplify manufacturing while meeting clean-label and sustainability demands. By offering consistent performance, ease of application, and cost-effectiveness, coating agents like Nutracore enable supplement manufacturers to create high-quality, consumer-friendly products without compromising on functional efficiency. The launch underscores the strategic importance of coating excipients in the nutraceutical sector, highlighting how innovations in this space are key to addressing evolving consumer preferences and driving the growth of the functionality sub-segment.

Nutraceutical Excipients Market, By Functionality Application

Stabilizers have emerged as the dominating sub-segment within the functionality application segment of the nutraceutical excipients market, owing to their essential role in maintaining the integrity, efficacy, and shelf life of sensitive bioactive compounds. These excipients are particularly critical in probiotic and other moisture-sensitive formulations, where environmental factors such as temperature, humidity, and processing conditions can compromise product stability. A notable example is Balchem’s launch of StabiliPro on October 15, 2025, a new portfolio of excipients designed specifically to stabilize probiotics and extend their shelf life. StabiliPro minimizes the need for overages, ensuring that functional food, beverage, and dietary supplement innovators can deliver cost-effective formulations that meet consumer expectations for quality and clean-label solutions. By preserving probiotic viability and overcoming processing challenges, stabilizers like StabiliPro are pivotal in addressing formulation hurdles, regulatory compliance, and consumer demand for effective, reliable supplements. This launch underscores the strategic importance of stabilizers, highlighting their central role in driving growth and innovation within the functionality segment of the nutraceutical excipients market.

REGION

North America to be dominating region in global nutraceutical excipients market during forecast period

North America continues to dominate the nutraceutical excipients market, supported by a strong pace of product innovation and launches across the US. In April 2023, Colorcon introduced its Nutracore™ range of label-friendly excipients specifically formulated for nutritional tablets and capsules, reflecting the region’s push toward clean-label formulations. This was followed by the launch of Colorcon’s Nutrafinish® TiO2-free high-productivity coating in October 2023, designed to meet growing regulatory and consumer demands for titanium-dioxide-free supplements. More recently, in May 2025, Roquette strengthened its North American footprint by expanding its excipient and drug-delivery capabilities through the completion of its acquisition of IFF Pharma Solutions, enhancing access to advanced plant-based and modified-release excipient technologies. These timely advancements highlight how continuous innovations and rapid adoption of new excipient systems in the US reinforce North America’s position as the leading and most dynamic region in the nutraceutical excipients market.

Nutraceutical Excipients Market: COMPANY EVALUATION MATRIX

In the nutraceutical excipients market, key companies profiled include Colorcon, Inc., Roquette Frères, BASF SE, Ashland Global Holdings, Kerry Group plc, Ingredion Incorporated, DuPont Nutrition & Biosciences, ADM, DFE Pharma, Sensient Technologies Corporation, Gattefossé, Meggle Group, JRS Pharma, FMC Corporation, and Evonik Industries AG.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- International Flavors & Fragrances Inc. (US)

- Kerry Group plc (Ireland)

- Ingredion (US)

- Sensient Technologies Corporation (US)

- Associated British Foods plc (UK)

- BASF SE (Germany)

- Roquette Frères (France)

- MEGGLE GmbH & Co. KG (Germany)

- Cargill, Incorporated (US)

- Ashland (US)

- IMCD (Netherlands)

- Hilmar Cheese Company, Inc. (US)

- SEPPIC (US)

- Azelis Group (Luxembourg)

- Biogrund GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 4.63 Billion |

| Market Forecast, 2030 (Value) | USD 7.12 Billion |

| Growth Rate | CAGR of 7.4% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Thousand), Volume (Metric Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Rest of the World |

WHAT IS IN IT FOR YOU: Nutraceutical Excipients Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global nutraceutical manufacturer needed detailed excipient demand projections across dosage forms | Forecasting of binders, fillers, disintegrants, lubricants, coating agents, solubilizers, and taste-masking systems across tablets, capsules, softgels, gummies, and powders | Enabled precise sourcing, efficient production planning, and better alignment with global supplement trends |

| Plant-based nutrition brand required evaluation of natural and vegan excipients | Functional assessment of plant-derived starches, gums, fibers, and natural polymers for clean-label and allergen-free formulations | Improved texture and stability, strengthened clean-label claims, and reduced reliance on synthetic additives |

| Sports nutrition & beverage company needed a performance analysis of excipients in RTDs and powders | Mapping of excipients enhancing instantization, dispersibility, emulsification, and mouthfeel | Delivered superior product performance, enhanced solubility, and improved consumer experience |

| Pharma-nutrition hybrid company required advanced excipient application insights | Evaluation of pharma-grade excipients such as microencapsulation agents, controlled-release polymers, and solubility enhancers for nutraceutical use | Increased bioavailability, extended shelf stability, and ensured compliance with regulatory expectations |

| Contract manufacturing organization (CMO) needed supplier benchmarking to expand capacity | Analysis of global excipient suppliers, production capacity mapping, pricing trends, and quality certifications | Supported cost optimization, secure supplier selection, and expansion into high-growth supplement formats |

| Functional food company needed guidance on excipient performance in fortified foods | Assessment of stabilizers, emulsifiers, and anti-caking agents for bars, beverages, and powdered mixes | Enhanced product uniformity, reduced formulation failures, and improved shelf consistency |

| Herbal supplement brand required optimization of moisture-sensitive formulations | Screening of low-moisture binders, protective coating systems, and desiccation-friendly fillers | Reduced degradation of botanical actives, improved shelf life, and ensured potency retention |

| Gummy supplement manufacturer needed insights on texture & stability enhancers | Evaluation of pectin, gelatin alternatives, starch systems, and natural sweetener-compatible excipients | Delivered consistent chewiness, minimized sticking, and improved heat stability during transport |

| Softgel manufacturer required excipient support for challenging lipid-based actives | Profiling solubilizers, antioxidants, and shell-stability enhancers for lipid systems | Improved encapsulation efficiency, greater active retention, and enhanced oxidative stability |

| Start-up brand needed regulatory alignment for excipients used in new supplement formats | Mapping of FDA, EFSA, and FSSAI regulatory approvals, allowable limits, and clean-label compliance | Ensured faster go-to-market, reduced regulatory risk, and improved label transparency |

RECENT DEVELOPMENTS

- October 2025 : Balchem launched its StabiliPro™ excipient portfolio focused on enhancing probiotic stability in supplements and functional foods. The range helped maintain probiotic viability during processing and storage, minimizing the need for overages. It would align with clean-label expectations and support long-term shelf-life requirements. This launch strengthened Balchem’s position in specialized stabilization excipients for nutraceuticals.

- May 2024 : Roquette introduced LYCAGEL® Flex, a plant-based softgel capsule excipient based on hydroxypropyl pea starch. The system enabled manufacturers to choose tailored plasticizer combinations, improving capsule flexibility, stability, and performance. It also supported cleaner processing with faster degassing and easier equipment cleaning. The innovation expanded Roquette’s offerings for vegan and allergen-free nutraceutical capsules.

- April 2023 : Colorcon launched its NutraCore™ range of label-friendly binders, fillers, and lubricants designed for nutritional products. These excipients used natural, consumer-preferred ingredients while ensuring excellent tableting and encapsulation performance. The platform helped manufacturers meet clean-label demands without compromising manufacturability. This expansion reinforced Colorcon’s leadership in natural excipient solutions.

- April 2023 : Colorcon introduced a TiO2-free Nutrafinish® moisture-protection coating for humidity-sensitive nutraceutical tablets. The coating delivered strong moisture resistance while avoiding titanium dioxide, aligning with global regulatory shifts. It supported brands transitioning to cleaner label formats without sacrificing stability. The product enhanced both tablet protection and consumer acceptance.

- October 2023 : Colorcon launched a high-productivity, TiO2-free Nutrafinish® coating designed for large-scale supplement manufacturing. The system provided high opacity and fast processing, improving efficiency on high-speed coating lines. It allowed manufacturers to eliminate titanium dioxide while preserving tablet appearance and performance. This development further expanded Colorcon’s clean-label coating portfolio.

Table of Contents

Methodology

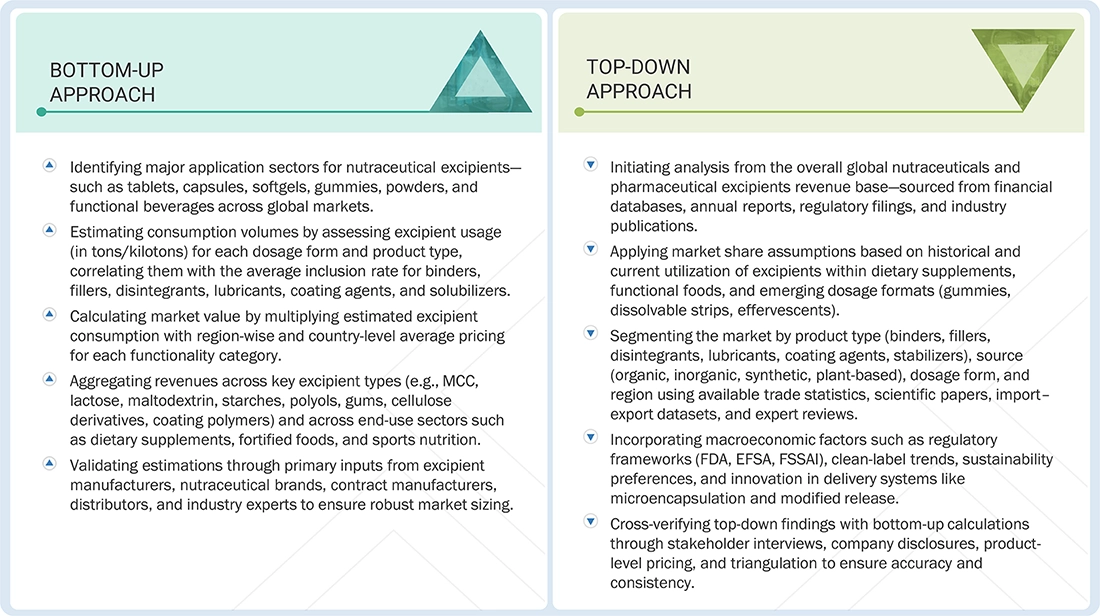

The study employed two primary approaches to estimate the current size of the nutraceutical excipients market. Exhaustive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources, directories, and databases such as Bloomberg Businessweek and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the nutraceutical excipients market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, the Middle East, and Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to source, end product, functionality, functionality application, formulation, and technology. Stakeholders from the demand side, such as research institutions and universities, and third-party vendors, were interviewed to understand the buyer’s perspective on the service, and their current usage of nutraceutical excipients and the outlook of their business, which will affect the overall market.

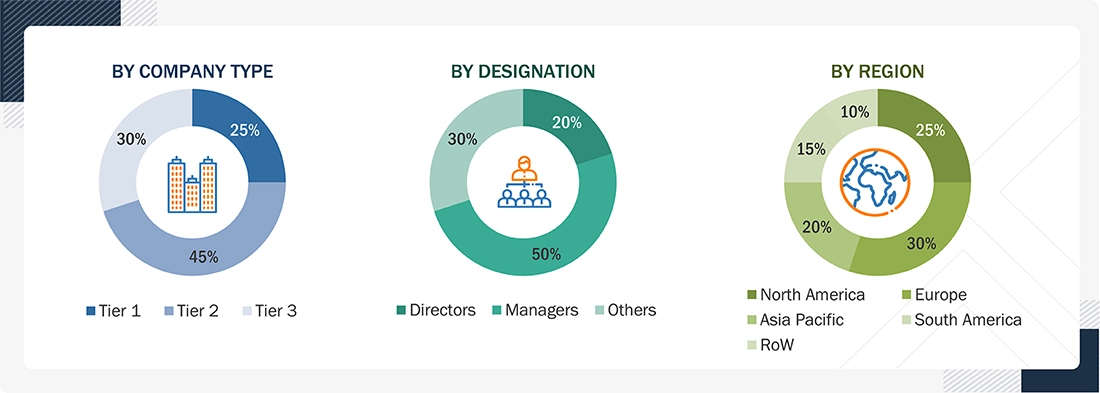

Breakdown of Primary Interviews

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100 million ≤ Revenue ≤ USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| BASF SE (Germany) | R&D Expert | |

| Cargill, Incorporated (US | Sales Manager | |

| ADM (US) | Manager | |

| Corbion (Netherlands) | Sales Manager | |

| Eastman Chemical Company (US) | Marketing Manager | |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the nutraceutical excipients market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Nutraceutical Excipients Market: Bottom-up & Top-down Approaches

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall nutraceutical excipients market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Nutraceutical excipients are inactive ingredients that are added to nutraceutical formulations. These excipients help to improve the effectiveness of active ingredients in the final product. Nutraceutical active ingredients are functional components that support the nutrition and health of the human body. They are often used to supplement the nutrients that we get from our regular diet. Excipients play an important role in delivering nutraceutical components accurately and on time. They also maintain the optimum levels of active ingredients in the nutraceutical products, such as vitamins and minerals.

Stakeholders

- Raw material supplier

- Commercial R&D institutions

- Manufacturers, dealers, and suppliers in the nutraceutical excipients market

- Government bodies

- Food & beverage manufacturers

- Nutraceutical manufacturers

- Cosmetic & skincare product manufacturers

- Food importers and exporters

- Associations and NGOs

- Logistics providers & transporters

- Regulatory bodies & institutions

- US Food and Drug Administration (US FDA)

- European Food Safety Authority (EFSA)

- Food Safety and Standards Authority of India (FSSAI)

- Food Safety Law of the People’s Republic of China

- Food Safety Commission of Japan

Report Objectives

- To determine, define, and project the size of the nutraceutical excipients market, with respect to source, end product, functionality, functionality application, formulation, technology, and regional markets, over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To strategically profile key market players and comprehensively analyze their core competencies in each segment

- To track and analyze competitive developments, such as alliances, joint ventures, new product developments, mergers, and acquisitions, in the nutraceutical excipients market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Nutraceutical Excipients Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Nutraceutical Excipients Market