Hand Tools & Woodworking Tools Market By Type (Chisels, Hammers, Saws, Pliers, Wrenches, Screwdrivers), Distribution Channel (Online, Offline), End User, and Region (2021-2026)

Hand Tools & Woodworking Tools Market

Hand Tools and Woodworking Tools Market and Top Companies

Stanley Black & Decker, Inc.

Stanley Black & Decker, Inc is a globally leading manufacturing company that delivers a diversified product portfolio of hand tools, power tools, engineered fastening systems, electronic security systems, oil & gas and infrastructure services, healthcare solutions, among others. The company operates under three business segments: Tools and Storage, Industrial, and Security. The tools and storage segment comprises the subsegments, such as Power Tools and Equipment (PTE) and Hand Tools and Accessories & Storage (HTAS). Under this business segment, the company delivers innovative hand tools, power tools, storage solutions, and other related accessories under the umbrella of its various acquired brands, which include Stanley, DeWalt, Back & Decker, Craftsman, Irwin, Facom, Mac Tools, Lenox, and Powers. The company is known as a worldwide leader in hand tools because of its innovative, tough, and strong properties. These tools find applications for professionals from various industries, including construction, manufacturing, electrification, and plumbing.

Apex Tool Group

The company is known as the globally leading manufacturer and supplier of professional and industrial hand and power tools, tool storage, drill chucks, chain, and electronic soldering products. It manufactures and offers hand tools through its various acquired hand tool brands, such as SATA, Campbell, GEARWRENCH, Cresent, Jacobs, and Weller. These hand tools stand for quality, innovation, and value that make sure the end users are able to solve their problems efficiently. The end-use markets that the company serves include automotive, aerospace, electronics, energy, hardware, industrial, construction, consumer retail, and residential/DIY. The company has established its operations in over 30 countries and its manufacturing facilities in over 20 locations across the world.

Snap-on Incorporated

Snap-on is a globally leading company that manufactures and markets tools, equipment, diagnostics, repair information, and system solutions. The products offered by the company include hand tools, power tools, tool storage solutions, diagnostics software, information and management systems, and shop equipment, and related services. The company operates under four business segments: Commercial & Industrial Group, Snap-on Tools Group, Repair Systems & Information Group, and Financial Services. The business segment, Snap-on Tools Group, is primarily known for providing vehicle and repair services. These hand tools claim to offer quality, durability, performance, and reliability to the experts and are well-known in the market for providing longer service, greater productivity, and higher income. The industries that the company serves majorly include aerospace, agriculture, construction, mining, and power generation.

Hand Tools and Woodworking Tools Market and Top DISTRIBUTION CHANNEL

OFFLINE/RETAIL

The retail/offline distribution channel dominated the hand tools market in 2020 and is expected to continue dominating the market during the forecast period. This channel comprises several players that include distributors, suppliers, wholesalers, dealers. This channel also comprises many transportations and logistical operations where hand tools are carried from the manufacturer to the final retailer. From offline stores, such as hardware shops and tools and machinery stores in the market, customers can see the products they want to buy and also can check the quality of their purchase and compare it with other products.

OnLINE

Online distribution channel is growing and is expected to grow at the highest growth rate in the market during the forecast period. This channel can be seen changing the way customers shop. They are providing customers with numerous additional benefits such as door-to-door delivery of products and provide an online display of an extensive variety of products and brands to choose from through their online e-commerce platforms. Various third-party distributors sell hand tools on the online platforms. This helps the customers compare, evaluate, study, and select the best suitable hand tool. These online platforms has enabled many hand tool manufacturers to sell their products directly to the end customers. Large manufacturing organizations can be seen launching their online distribution channels with their e-commerce platforms.

Hand Tools and Woodworking Tools Market and Top END-USER

Professional

The professional end-usage of hand tools dominated the hand tools market in 2020 and is expected to continue dominating the market during the forecast period. With the rising population and infrastructural development worldwide, professional applications such as plumbing, electrification, and carpentry have registered strong growth. Additionally, growth in other industries, such as oil & gas, electronics, automotive, aerospace, energy, mining, and shipbuilding, also contribute to the growth of the professional usage of hand tools & woodworking tools with the increasing application areas.

Residential/DIY

The market for the residential end-user segment is expected to grow at the highest CAGR during the forecast period. The consumer is evolving and trying to be experimental, self-reliant and independent. Hence, DIY activities have gained popularity owing to which consumers prefer to carry their household activities by their own. This has induced the demand for hand tools for residential/Diy applications. Additionally the factors such as high labor costs to the easy availability and low cost of hand tools, promote the usage of hand tools for DIY purposes. These consumers have employed hand tools for residential refurbishment and improvement projects, to remodel and renovate their house on their own instead of opting for construction projects

Hand tools and woodworking tools market by top TYPE

Wrenches

Wrenches are hand tools that owned highest market share in hand tools market in 2020 and are expected to dominate the market during the forecast period as well. These wrenches are used to hold standard bolts and nuts firmly and for gripping and turning objects. Wrenches are greatly needed for repairs and maintenance operations in automotive industry and in plumbing and electrification operations, where they are used to turn pipes or for fitting operations. Depending upon the size and specifications of the application areas, wrenches with various dimensions are designed and manufactured. With the rapid development and expansion of the automotive industry globally, the demand for wrenches can be seen growing effectively.

Pliers

Pliers are one of the most common hand tools that find application in almost every industry or household. They are designed for holding, bending or gripping objects firmly so that they can be handled more easily. These pliers find their applications in numerous operations in households and industries. Some common activities include bending or straightening wires, cutting or splicing wires, removing nails or tiny needles. Due to their variable shapes, sizes, features, they have been used in many industrial applications.

Chisels

Chisels are hand tools and woodworking tools that owned the highest market share in woodworking tools market in 2020 and are expected to dominate the market during the forecast period as well. A chisel has a sharp blade at one end used for carving or cutting wood. Chisels are designed and constructed with different dimensions and blade specifications. Chisels used in the woodworking industry are known as woodworking chisels. The demand for chisels in the industrial market is driven by their increasing applications across woodworking industry along with various industries.

Updated on : October 22, 2024

[222 Pages Report] The Global hand tools and woodworking tools market size is expected to grow from USD 8.4 billion in 2021 to USD 10.3 billion by 2026, growing at a CAGR of 4.0%. The growth of the market is attributed to the increasing commercial as well as residential construction and infrastructure projects, adoption of hand tools in households for residential/DIY purposes as well as growing manufacturing setups and increasing repair and maintenance operations across the world.

However, factors such as an increase in safety risks and concerns due to improper use of hand tools are restraining the market growth. On the flip side, the development of variable-size/multi-tasking single tools that cater to multiple operations might increase demand for hand tools, and increase in hand tool automation to reduce physical work might boost hand tool usage and are expected to create opportunities for the adoption of hand tools and woodworking tools in the coming years. Moreover, the lack of all-specification/dimension hand tools for end-users to be prepared for every possible area of application acts as a challenge for the hand tools and woodworking tools market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the hand tools and woodworking tools market

COVID-19 has severely impacted the global economy and all the industries throughout the globe. Governments of various countries have imposed lockdowns to contain the spread of the epidemic. The complete global lockdown in the initial stage of the pandemic in various countries severely impacted the livelihoods of people and quality of life. This has resulted into disruptions in the supply chain across the globe. The economies across the world have declined as there is a major decline in the demand for products. The production of hand tools along with other industries has been limited due to the pandemic resulting in the shortage of raw material, decline in exports, and disruptions in supply chain. Along with industrial disruptions, the commercial, construction, and infrastructure projects across the world were either cancelled or put on hold owing to the lockdown impositions. On the other hand, as the homeowners spent most of their time at homes during pandemic, there was a noticeable shift in focus towards home improvements, interiors, home decoration activities at residential/DIY level which in turn called for a slight demand for hand tools. Thus, the hand tools and woodworking tools market is getting affected by COVID-19. This has resulted in a lower estimated year-on-year growth rate for 2020 as compared with 2019.

Market Dynamics

DRIVERS: Increasing commercial as well as residential construction and infrastructure projects

Across the world, the demand for infrastructural development and quick urbanization can be seen increasing rapidly. To promote such developments, governments from all major countries can be seen taking efforts toward the infrastructural development and making necessary investments in the sector. These infrastructural development projects include projects dealing with the development of roads, railways, airports, energy, utilities, and commercial and residential buildings. Countries such as the US, China, Japan, and India are investing heavily in construction projects, shaping their infrastructural development and are expected to make huge growth in the coming years. With the increasing projects and rapidly changing demands from construction and other infrastructure industries, the demand for hand tools is growing and the hand tool manufacturers can be seen focusing on innovating their products to cater to the latest and changing market demands. The upsurge in construction and infrastructure activities, coupled with the evolving hand tool ecosystem, will fuel the growth of the hand tools & woodworking tools market during the forecast period.

RESTRAINT: Increase in safety risks and concerns due to improper use of hand tools

Hand tools include some sharp-edged, heavy weight, hazardous equipment that can be unsafe and risky to use at times that are usually used in drilling, fitting, cutting, shaping, repairing, operations. The use of such equipment can lead to human safety concerns due to improper usage or improper handling. These mishaps usually result either from a lack of knowledge, experience, or professionalism, and hence these tools should be used under necessary guidance with necessary precautions. Also, necessary precautions should be taken while carrying them and should be carried in sheath or holsters or specific toolboxes. Additionally, with the higher adoption of hand tools by households for residential DIY applications, the safety risks are increasing due to improper or limited knowledge about usage.

OPPORTUNITIES: Increase in hand tool automation to reduce physical work might boost hand tool usage

The entire global countries are now moving towards automation. This evolution is necessary for all industries to overcome the upcoming challenging period and fulfill the ever-increasing market demands. Additionally, automation helps manufacturers in numerous ways of including reducing operation costs, reducing human efforts, improving worker safety, increasing production output, and improving quality of output. Similarly, hand tools can be replaced by automated hand tools where they can include self-acting tools that displace hand dexterity with automated functioning and provide smart solutions. automated hand tools can be a smart solution for replacing tedious and tiring work and provide productivity and quality within less time.

CHALLENGES: Lack of all-specification/dimension hand tools to be prepared for every possible area of application

The application of every hand tool varies according to its designed size, shape, material, intensity, and also specifications of the application area. This generates a need to own and use hand tools only with specific requirements for the desired application. Whereas practically, it is almost impossible to own and carry all hand tools of all dimensions by the household users or professionals to carry out the specific application.

“Online distribution channel to grow at the fastest rate during the forecast period”

Online distribution channels can be seen changing the way customers shop. They are providing customers with numerous additional benefits such as door-to-door delivery of products and provide an online display of an extensive variety of products and brands to choose from through their online e-commerce platforms. Various third-party distributors sell hand tools on the online platforms. This helps the customers compare, evaluate, study, and select the best suitable hand tool. These online platforms has enabled many hand tool manufacturers to sell their products directly to the end customers. Large manufacturing organizations can be seen launching their online distribution channels with their e-commerce platforms.

“Professional end-users to hold the largest share of hand tools and woodworking tools market by 2026”

The market for the professional end-user segment is expected to hold the largest share during the forecast period. With the rising population and infrastructural development worldwide, professional applications such as plumbing, electrification, and carpentry have registered strong growth. Additionally, growth in other industries, such as oil & gas, electronics, automotive, aerospace, energy, mining, and shipbuilding, also contribute to the growth of the professional usage of hand tools & woodworking tools with the increasing application areas.

To know about the assumptions considered for the study, download the pdf brochure

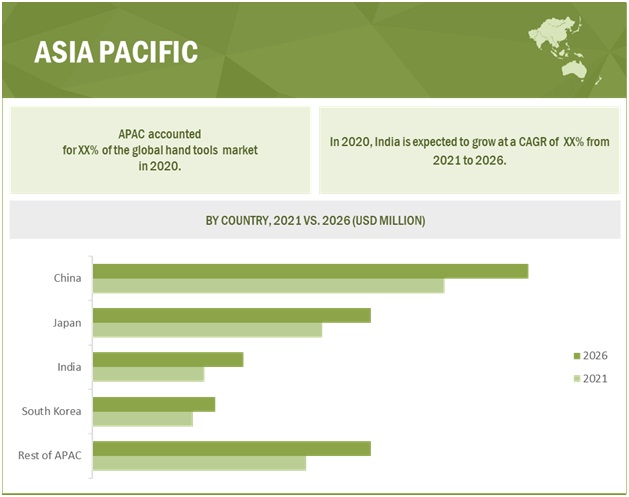

“Hand tools and woodworking tools market in APAC to grow at the highest CAGR”

The growth of the hand tools and woodworking tools market in APAC can be attributed to the rapid industrialization and surging construction activities in the countries such as India, China, Australia, and Japan. Hand tools are highly used in both construction and industrial activities. Even governments from the leading countries are taking initiatives towards developing infrastructural and construction plans, and to bring industrial development with the increasing number of industrial plants and manufacturing units. However, the pandemic has resulted in disruptions in supply chain activities, revenue losses, and slowdown in production activities which have somehow impacted the growth of the market, eventually impacting the economy.

Key Market Players

Stanley Black & Decker (US), Apex Tool Group(US), Snap-On Incorporated(US), Techtronic Industries Co. Ltd (China), Klein Tools (US), Husqvarna (Sweden), Akar Auto Industries Ltd. (India), and Hangzhou Great Star Industrial Co. Ltd. (China) are a few major players in hand tools and woodworking tools market.

Hand Tools and Woodworking Tools Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 8.4 Billion |

| Revenue Forecast in 2026 | USD 10.3 Billion |

| Growth Rate | 4.0% |

|

Market Size Available for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Increasing commercial as well as residential construction and infrastructure projects |

| Key Market Opportunity | Increase in hand tool automation to reduce physical work might boost hand tool usage |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Professional end-users |

| Highest CAGR Segment | Ultrasonic fingerprint sensors |

| Largest Application Market Share | Consumer Electronics |

This research report categorizes the Hand tools and woodworking tools market by frequency type, type, industry, and region.

By Type:

- Wrenches

- Chisels

- Hammers

- Saws

- Screwdrivers

- Pliers

- Others

By End-User:

- Professional

- Residential/DIY

By Distribution Channel:

- Online

- Retail/Offline

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In March 2021, Klein Tools, Inc. launched the Fallen Lineman Tribute Knife, a limited-edition knife honoring the lives of fallen electrical line workers.

- In February 2021, Klein Tools, Inc. introduced the Klein-Kurve Wire Stripper/Cutter, a durable stamped wire stripper with six stripping holes and shear blades for cutting, plus a comfortable grip and updated lock.

- In November 2020, Klein Tools, Inc. introduced two new adjustable length screwdrivers that function as both impact driver attachments and multi-bit screwdrivers, with on-board storage of bits and optimum control.

- In February 2020, Apex Tool Group LLC, under its GEARWRENCH brand, introduced 90 tooth ratchet, which is stronger and provides better access to being more comfortable on the professional mechanics' hands.

Key Questions Addressed by the Report:

- Which hand tools and woodworking tools distribution channel would have the highest demand in the future?

- What are the opportunities and challenges pertaining to the hand tools and woodworking tools market?

- What are the key industry trends in the hand tools and woodworking tools market?

- What would be the impact of COVID on hand tools and woodworking tools companies and industries?

- What are key players and their key strategies in hand tools and woodworking tools market?

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the hand tools and woodworking tools market during 2021-2026?

The hand tools and woodworking tools market is expected to record a CAGR of 4.0% from 2021–2026.

Does this report include the impact of COVID-19 on the hand tools and woodworking tools market?

Yes, the report includes the impact of COVID-19 on the hand tools and woodworking tools market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the hand tools and woodworking tools market?

The increasing commercial as well as residential construction and infrastructure projects, adoption of hand tools in households for residential/DIY purposes as well as growing manufacturing setups and increasing repair and maintenance operations across the world

Which are the significant players operating in the hand tools and woodworking tools market?

Stanley Black & Decker (US), Apex Tool Group(US), Snap-On Incorporated(US), Techtronic Industries Co. Ltd (China), Klein Tools (US), Husqvarna (Sweden), Akar Auto Industries Ltd. (India), and Hangzhou Great Star Industrial Co. Ltd. (China) are a few major players in hand tools and woodworking tools market.

Which region will lead the hand tools and woodworking tools market in the future?

APAC is expected to grow at the highest growth rate, yet North America is expected to keep leading the hand tools and woodworking tools market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 HAND TOOLS & WOODWORKING TOOLS MARKET: INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 SEGMENTS COVERED

FIGURE 1 HAND TOOLS & WOODWORKING TOOLS MARKET SEGMENTATION

FIGURE 2 HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 3 HAND TOOLS & WOODWORKING TOOLS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: (SUPPLY SIDE): REVENUE OF PRODUCTS OF HAND TOOLS & WOODWORKING TOOLS MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 5 HAND TOOLS & WOODWORKING TOOLS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 6 HAND TOOLS & WOODWORKING TOOLS MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RESULTS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 COVID-19 IMPACT ANALYSIS ON THE HAND TOOLS & WOODWORKING TOOLS MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 9 WRENCHES TO ACCOUNT FOR THE LARGEST HAND TOOLS SHARE IN 2021

FIGURE 10 RESIDENTIAL/DIY USAGE EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 11 OFFLINE DISTRIBUTION CHANNEL WAS LARGELY ADOPTED FOR HAND TOOLS IN 2021

FIGURE 12 NORTH AMERICA TO HOLD THE LARGEST SHARE OF THE HAND TOOLS & WOODWORKING TOOLS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR THE HAND TOOLS & WOODWORKING TOOLS MARKET

FIGURE 13 HAND TOOLS & WOODWORKING TOOLS MARKET TO EXPERIENCE HUGE GROWTH OPPORTUNITIES IN APAC

4.2 HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER

FIGURE 14 MARKET FOR RESIDENTIAL/DIY USES IS EXPECTED TO GROW AT A HIGHER CAGR BETWEEN 2021 AND 2026

4.3 HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE

FIGURE 15 WRENCHES TO ACCOUNT FOR THE LARGEST SHARE OF THE HAND TOOLS & WOODWORKING TOOLS MARKET BY 2026

4.4 HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 16 ONLINE DISTRIBUTION CHANNEL TO GROW AT A HIGHER CAGR BETWEEN 2021 AND 2026

4.5 HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION

FIGURE 17 NORTH AMERICA TO BE THE LARGEST HAND TOOLS & WOODWORKING TOOLS MARKET BY 2026

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 GLOBAL HAND TOOLS & WOODWORKING TOOLS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing commercial as well as residential construction and infrastructure projects

5.2.1.2 Growing adoption of hand tools in households for residential/DIY purposes

5.2.1.3 Growing manufacturing setups and increasing repair and maintenance operations

FIGURE 19 DRIVERS OF GLOBAL HAND TOOLS & WOODWORKING TOOLS MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Increase in safety risks and concerns due to improper use of hand tools

FIGURE 20 RESTRAINTS OF GLOBAL HAND TOOLS & WOODWORKING TOOLS MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Variable-size/Multitasking single tools that cater to multiple operations might increase the demand for hand tools

5.2.3.2 Increase in hand tool automation to reduce physical work might boost hand tool usage

FIGURE 21 OPPORTUNITIES OF GLOBAL HAND TOOLS & WOODWORKING TOOLS MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of all-specification/dimension hand tools to be prepared for every possible area of application

FIGURE 22 CHALLENGES OF GLOBAL HAND TOOLS & WOODWORKING TOOLS MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 HAND TOOLS & WOODWORKING TOOLS MARKET: VALUE CHAIN

5.3.1 RAW MATERIAL SUPPLIERS

5.3.2 HAND TOOL MANUFACTURERS & ASSEMBLERS

5.3.3 HAND TOOL RETAILERS/DISTRIBUTORS

5.3.4 END USERS

5.4 ECOSYSTEM

FIGURE 24 GLOBAL HAND TOOLS & WOODWORKING TOOLS MARKET: ECOSYSTEM

TABLE 3 HAND TOOLS & WOODWORKING TOOLS MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

5.5.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR HAND & WOODWORKING TOOL MANUFACTURERS

FIGURE 25 REVENUE SHIFT FOR HAND TOOLS AND WOODWORKING TOOLS MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S 5 FORCES IMPACT ON THE HAND TOOLS & WOODWORKING TOOLS MARKET

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS: HAND TOOLS & WOODWORKING TOOLS MARKET

5.6.1 THREAT FROM NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITION RIVALRY

5.7 CASE STUDY ANALYSIS

5.7.1 MILLENNIUM CONTROL SYSTEMS USED RIDGID RE 6 ELECTRICAL TOOL BY EMERSON ELECTRIC FOR DRILLING QUICK AND EFFICIENT HOLES

5.7.2 E.M. DUGGAN USED RIDGID B-500 BEVELLER BY EMERSON ELECTRIC FOR CUTTING BEVELS

5.8 TECHNOLOGY TRENDS

5.8.1 BRUSHLESS DC MOTORS

5.8.2 CONNECTED ASSEMBLY POWER TOOLS

5.8.3 WIRELESS CHARGING

5.8.4 PNEUMATIC TOOLS

5.8.5 HYDRAULIC TOOLS

5.8.6 POWER-ACTUATED TOOLS

5.9 PRICING ANALYSIS

5.10 PATENT ANALYSIS

FIGURE 27 ANALYSIS OF PATENTS GRANTED FOR HAND TOOLS & WOODWORKING TOOLS MARKET

5.10.1 LIST OF FEW PATENTS IN THE HAND TOOLS & WOODWORKING TOOLS MARKET, 2019-20

5.11 TRADE ANALYSIS

5.11.1 EXPORT SCENARIO OF HAND TOOLS

FIGURE 28 HAND TOOLS EXPORT, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.11.2 IMPORT SCENARIO OF HAND TOOLS

FIGURE 29 HAND TOOLS IMPORT, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.12 MARKET STANDARDS

5.12.1 ANSI (AMERICAN NATIONAL STANDARDS INSTITUTE) STANDARDS FOR HAND TOOLS

5.12.2 JIS (JAPANESE INDUSTRIAL STANDARDS) FOR HAND TOOLS

5.12.3 DIN (DEUTSCHES INSTITUT FÜR NORMUNG) STANDARDS FOR HAND TOOLS

5.12.4 OSHA

6 HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE (QUALITATIVE) (Page No. - 75)

6.1 INTRODUCTION

FIGURE 30 HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE

6.2 FASTENING TOOLS

6.2.1 RIVETS

6.2.2 CLAMPS

6.2.3 STAPLE GUNS

6.2.4 HAMMER TACKERS

6.3 SNIPS

6.4 HEX KEYS AND NUT DRIVERS

6.4.1 HEX KEYS

6.4.2 NUT DRIVERS

6.5 DEMOLITION TOOLS

6.5.1 WRECKING BARS/CROWBARS/PRY BARS

6.6 KNIVES AND BLADES

6.6.1 KNIVES

6.6.2 BLADES

6.7 MEASURING AND LAYOUT TOOLS

6.7.1 TAPES

6.7.2 LASER DISTANCE METERS

6.7.3 SQUARES

6.8 RATCHETS

7 HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 78)

7.1 INTRODUCTION

FIGURE 31 HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 32 THE ONLINE SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE IN 2021

TABLE 5 HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2017–2020 (USD MILLION)

TABLE 6 HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2021–2026 (USD MILLION)

7.2 OFFLINE/RETAIL

7.2.1 OFFLINE/RETAIL CHANNEL ACCOUNTING FOR A LARGER MARKET SHARE

TABLE 7 OFFLINE/RETAIL: HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 8 OFFLINE/RETAIL: HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.2.2 COVID-19 IMPACT ON THE RETAIL CHANNEL

7.3 ONLINE

7.3.1 ONLINE CHANNEL EXPECTED TO ACHIEVE A HIGHER GROWTH RATE

TABLE 9 ONLINE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 10 ONLINE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3.2 COVID-19 IMPACT ON THE ONLINE CHANNEL

8 HAND TOOLS MARKET, BY TYPE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 33 HAND TOOLS MARKET, BY TYPE

FIGURE 34 THE WRENCHES MARKET TO ACCOUNT FOR THE LARGEST SHARE IN 2021

TABLE 11 HAND TOOLS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 12 HAND TOOLS MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2 CHISELS

8.2.1 PRECISION IN CUTTING OPERATIONS

TABLE 13 HAND TOOLS MARKET FOR CHISELS, BY END USER, 2017–2020 (USD MILLION)

TABLE 14 HAND TOOLS MARKET FOR CHISELS, BY END USER, 2021–2026 (USD MILLION)

TABLE 15 HAND TOOLS MARKET FOR CHISELS, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 HAND TOOLS MARKET FOR CHISELS, BY REGION, 2021–2026 (USD MILLION)

8.3 HAMMERS

8.3.1 EXPLICIT GROWTH IN THE CONSTRUCTION INDUSTRY DRIVING THE DEMAND

TABLE 17 HAND TOOLS MARKET FOR HAMMERS, BY END USER, 2017–2020 (USD MILLION)

TABLE 18 HAND TOOLS MARKET FOR HAMMERS, BY END USER, 2021–2026 (USD MILLION)

TABLE 19 HAND TOOLS MARKET FOR HAMMERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 HAND TOOLS MARKET FOR HAMMERS, BY REGION, 2021–2026 (USD MILLION)

8.4 SAWS

8.4.1 EASE AND PRECISION IN CUTTING OPERATIONS

TABLE 21 HAND TOOLS MARKET FOR SAWS, BY END USER, 2017–2020 (USD MILLION)

TABLE 22 HAND TOOLS MARKET FOR SAWS, BY END USER, 2021–2026 (USD MILLION)

TABLE 23 HAND TOOLS MARKET FOR SAWS, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 HAND TOOLS MARKET FOR SAWS, BY REGION, 2021–2026 (USD MILLION)

8.5 PLIERS

8.5.1 INCREASING USE OF PLIERS FOR ELECTRIFICATION WORKS

TABLE 25 HAND TOOLS MARKET FOR PLIERS, BY END USER, 2017–2020 (USD MILLION)

TABLE 26 HAND TOOLS MARKET FOR PLIERS, BY END USER, 2021–2026 (USD MILLION)

TABLE 27 HAND TOOLS MARKET FOR PLIERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 HAND TOOLS MARKET FOR PLIERS, BY REGION, 2021–2026 (USD MILLION)

8.6 WRENCHES

8.6.1 RAPIDLY DEVELOPING AUTOMOTIVE INDUSTRY

TABLE 29 HAND TOOLS MARKET FOR WRENCHES, BY END USER, 2017–2020 (USD MILLION)

TABLE 30 HAND TOOLS MARKET FOR WRENCHES, BY END USER, 2021–2026 (USD MILLION)

TABLE 31 HAND TOOLS MARKET FOR WRENCHES, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 HAND TOOLS MARKET FOR WRENCHES, BY REGION, 2021–2026 (USD MILLION)

8.7 SCREWDRIVERS

8.7.1 RISING INDUSTRIAL REPAIR AND MAINTENANCE OPERATIONS DEMANDING NEED FOR SPECIFIC SCREWDRIVERS

TABLE 33 HAND TOOLS MARKET FOR SCREWDRIVERS, BY END USER, 2017–2020 (USD MILLION)

TABLE 34 HAND TOOLS MARKET FOR SCREWDRIVERS, BY END USER, 2021–2026 (USD MILLION)

TABLE 35 HAND TOOLS MARKET FOR SCREWDRIVERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 HAND TOOLS MARKET FOR SCREWDRIVERS, BY REGION, 2021–2026 (USD MILLION)

8.8 OTHERS

TABLE 37 HAND TOOLS MARKET FOR OTHERS, BY END USER, 2017–2020 (USD MILLION)

TABLE 38 HAND TOOLS MARKET FOR OTHERS, BY END USER, 2021–2026 (USD MILLION)

TABLE 39 HAND TOOLS MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 HAND TOOLS MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

8.8.1 BLOCK PLANE

8.8.2 HAND DRILL

8.8.3 LEVEL

8.8.4 SCRAPPERS/GRINDERS/SANDERS

8.8.5 SOCKETS

8.8.6 NAIL SETS

9 WOODWORKING TOOLS & EQUIPMENT, BY TYPE (Page No. - 98)

9.1 INTRODUCTION

FIGURE 35 WOODWORKING TOOLS MARKET, BY TYPE

FIGURE 36 CHISELS SEGMENT TO ACCOUNTED FOR THE LARGEST SHARE IN THE MARKET IN 2021

TABLE 41 WOODWORKING TOOLS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 42 WOODWORKING TOOLS MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2 WOODWORKING TOOLS

9.2.1 CHISELS

9.2.1.1 Optimal use of chisels for cutting, dressing, and shaping, in woodworking operations

9.2.2 HAMMERS

9.2.2.1 Claw hammers - The most used hammers by woodworkers/carpenters

9.2.3 SAWS

9.2.3.1 Most traditional wood-cutting tools that deliver clean cuts and notches dominate the woodcutting tools market

9.2.4 PLIERS

9.2.4.1 Pliers - The most dependent gripping, cutting, and bending tool

9.2.5 SCREWDRIVERS

9.2.5.1 Rising demand for woodworking operations driving the demand for screwdrivers

9.2.6 OTHERS

9.2.6.1 Block plane

9.2.6.2 Hand drill

9.2.6.3 Level

9.2.6.4 Scrappers/Grinders/Sanders

9.2.6.5 Nail sets

9.3 WOODWORKING EQUIPMENT

9.3.1 CNC ROUTER

9.3.2 CUTTING MACHINE

9.3.3 DUST COLLECTOR

9.3.4 PLANERS

9.3.5 SANDERS

TABLE 43 WOODWORKING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 44 WOODWORKING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

10 HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER (Page No. - 106)

10.1 INTRODUCTION

FIGURE 37 HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER

FIGURE 38 PROFESSIONAL APPLICATIONS TO HOLD THE LARGEST SHARE OF THE HAND TOOLS & WOODWORKING TOOLS MARKET IN 2021

TABLE 45 HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 46 HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2 PROFESSIONAL USERS

TABLE 47 HAND TOOLS & WOODWORKING TOOLS MARKET FOR PROFESSIONAL USERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 48 HAND TOOLS & WOODWORKING TOOLS MARKET FOR PROFESSIONAL USERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 49 HAND TOOLS & WOODWORKING TOOLS MARKET FOR PROFESSIONAL USERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 HAND TOOLS & WOODWORKING TOOLS MARKET FOR PROFESSIONAL USERS, BY REGION, 2021–2026 (USD MILLION)

10.2.1 COVID-19 IMPACT ON PROFESSIONAL USERS

10.3 RESIDENTIAL/DIY USERS

10.3.1 RISING TREND OF SELF-RELIANCE HAS SUPPORTED THE MARKET FOR HAND TOOLS AMONG RESIDENTIAL/DIY END USERS

TABLE 51 HAND TOOLS & WOODWORKING TOOLS MARKET FOR RESIDENTIAL/DIY USERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 52 HAND TOOLS & WOODWORKING TOOLS MARKET FOR RESIDENTIAL/DIY USERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 53 HAND TOOLS & WOODWORKING TOOLS MARKET FOR RESIDENTIAL/DIY USERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 HAND TOOLS & WOODWORKING TOOLS MARKET FOR RESIDENTIAL/DIY USERS, BY REGION, 2021–2026 (USD MILLION)

10.3.1.1 COVID-19 impact on residential/DIY users

11 HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION (Page No. - 113)

11.1 INTRODUCTION

FIGURE 39 HAND TOOLS & WOODWORKING TOOLS MARKET, BY REGION

TABLE 55 HAND TOOLS & WOODWORKING TOOLS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 HAND TOOLS & WOODWORKING TOOLS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

FIGURE 40 GEOGRAPHIC SNAPSHOT: HAND TOOLS & WOODWORKING TOOLS MARKET

11.2 NORTH AMERICA

11.2.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 41 SNAPSHOT OF HAND TOOLS & WOODWORKING TOOLS MARKET IN NORTH AMERICA

TABLE 57 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2017–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2021–2026 (USD MILLION)

11.2.2 UNITED STATES

11.2.2.1 United States to hold the largest share in North America due to rapid industrial development

11.2.3 CANADA

11.2.3.1 Growth of Canadian market to be driven by expanding of the infrastructure industry

11.2.4 MEXICO

11.2.4.1 Widespread adoption of hand tools in the construction industry is driving market growth in Mexico

11.3 EUROPE

FIGURE 42 SNAPSHOT OF HAND TOOLS & WOODWORKING TOOLS MARKET IN EUROPE

TABLE 65 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 66 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 67 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 68 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 69 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 70 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 71 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2017–2020 (USD MILLION)

TABLE 72 EUROPE: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2021–2026 (USD MILLION)

11.3.1 IMPACT OF COVID-19 ON EUROPE

11.3.2 GERMANY

11.3.2.1 Strong and rapidly developing automotive industry driving the demand for hand tools in Germany

11.3.3 FRANCE

11.3.3.1 Home improvement activities, along with the highly developing aerospace industry, drive the demand for hand tools in France

11.3.4 UNITED KINGDOM

11.3.4.1 Construction industry to drive the demand for hand tools in the United Kingdom

11.3.5 ITALY

11.3.5.1 Furniture industry majorly driving the demand for hand tools in Italy

11.3.6 REST OF EUROPE

11.4 APAC

FIGURE 43 SNAPSHOT OF HAND TOOLS & WOODWORKING TOOLS MARKET IN APAC

TABLE 73 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 74 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 75 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 76 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 77 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 78 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 79 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2017–2020 (USD MILLION)

TABLE 80 APAC: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2021–2026 (USD MILLION)

11.4.1 IMPACT OF COVID-19 ON APAC

11.4.2 CHINA

11.4.2.1 Woodworking industry to drive the hand tools & woodworking tools market in China

11.4.3 JAPAN

11.4.3.1 Rapidly developing infrastructure industry driving the demand for hand tools in Japan

11.4.4 INDIA

11.4.4.1 Rapid expansion of the construction industry in India to drive the demand for hand tools

11.4.5 SOUTH KOREA

11.4.5.1 Shipbuilding industry is a key driver of hand tools in South Korea

11.4.6 REST OF APAC

11.5 REST OF THE WORLD

11.5.1 IMPACT OF COVID-19 ON ROW

TABLE 81 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 82 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 83 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 85 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 86 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 87 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2017–2020 (USD MILLION)

TABLE 88 ROW: HAND TOOLS & WOODWORKING TOOLS MARKET, BY DISTRIBUTION CHANNEL, 2021–2026 (USD MILLION)

11.5.2 SOUTH AMERICA

11.5.2.1 Industrial development in Brazil, Argentina, Chile, and Peru to drive the demand for hand tools in South America

11.5.3 MIDDLE EAST & AFRICA

11.5.3.1 UAE, Saudi Arabia, and South Africa are key driving countries in Middle East & Africa

12 COMPETITIVE LANDSCAPE (Page No. - 138)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

12.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE HAND TOOLS AND WOODWORKING TOOLS MARKET

12.3 HAND TOOLS AND WOODWORKING TOOLS MARKET REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 44 REVENUE ANALYSIS OF KEY MARKET PLAYERS IN LAST FIVE YEARS

12.4 MARKET SHARE ANALYSIS

TABLE 89 HAND TOOLS AND WOODWORKING TOOLS MARKET:DEGREE OF COMPETITION

TABLE 90 WOODWORKING TOOLS MARKET: DEGREE OF COMPETITION

12.5 COMPETITIVE EVALUATION QUADRANT, 2020

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANTS

FIGURE 45 HAND TOOLS AND WOODWORKING TOOLS MARKET (GLOBAL):COMPANY EVALUATION QUADRANT, 2020

12.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2020

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 46 HAND TOOLS AND WOODWORKING TOOLS MARKET (GLOBAL):SME EVALUATION QUADRANT, 2020

12.6.5 HAND TOOLS AND WOODWORKING TOOLS MARKET: COMPANY FOOTPRINT

TABLE 91 COMPANY PRODUCT FOOTPRINT

TABLE 92 COMPANY REGION FOOTPRINT

TABLE 93 COMPANY FOOTPRINT

12.7 COMPETITIVE SITUATIONS AND TRENDS

12.7.1 PRODUCT LAUNCHES

TABLE 94 HAND TOOLS AND WOODWORKING TOOLS MARKET: PRODUCT LAUNCHES, FEB 2020–MARCH 2021

12.7.2 DEALS

TABLE 95 HAND TOOLS AND WOODWORKING TOOLS MARKET: DEALS, JANUARY 2019–MARCH 2021

13 COMPANY PROFILES (Page No. - 152)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

13.1.1 STANLEY BLACK & DECKER, INC.

TABLE 96 STANLEY BLACK & DECKER, INC.: BUSINESS OVERVIEW

FIGURE 47 STANLEY BLACK & DECKER, INC.: COMPANY SNAPSHOT

TABLE 97 STANLEY BLACK & DECKER: PRODUCT OFFERINGS

TABLE 98 STANLEY BLACK & DECKER: EXPANSION

13.1.2 APEX TOOL GROUP LLC.

TABLE 99 APEX TOOL GROUP LLC.: BUSINESS OVERVIEW

TABLE 100 APEX TOOL GROUP LLC.: PRODUCT OFFERINGS

TABLE 101 APEX TOOL GROUP LLC.: PRODUCT LAUNCHES

13.1.3 SNAP-ON INCORPORATED

TABLE 102 SNAP-ON INCORPORATED: BUSINESS OVERVIEW

FIGURE 48 SNAP-ON INCORPORATED: COMPANY SNAPSHOT

TABLE 103 SNAP-ON INCORPORATED: PRODUCT OFFERINGS

13.1.4 TECHTRONIC INDUSTRIES CO. LTD.

TABLE 104 TECHTRONIC INDUSTRIES CO. LTD.: BUSINESS OVERVIEW

FIGURE 49 TECHTRONIC INDUSTRIES CO. LTD.: COMPANY SNAPSHOT

TABLE 105 TECHTRONIC INDUSTRIES CO. LTD.: PRODUCT OFFERINGS

13.1.5 KLEIN TOOLS, INC.

TABLE 106 KLEIN TOOLS, INC.: BUSINESS OVERVIEW

TABLE 107 KLEIN TOOLS, INC.: PRODUCT OFFERINGS

TABLE 108 KLEIN TOOLS, INC.: PRODUCT LAUNCHES

13.1.6 HUSQVARNA GROUP

TABLE 109 HUSQVARNA GROUP: BUSINESS OVERVIEW

FIGURE 50 HUSQVARNA GROUP: COMPANY SNAPSHOT

TABLE 110 HUSQVARNA GROUP: PRODUCT OFFERINGS

13.1.7 AKAR AUTO INDUSTRIES LTD.

TABLE 111 AKAR AUTO INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 51 AKAR AUTO INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 112 AKAR AUTO INDUSTRIES LTD.: PRODUCT OFFERINGS

13.1.8 TAPARIA TOOLS LTD.

TABLE 113 TAPARIA TOOLS LTD.: BUSINESS OVERVIEW

FIGURE 52 TAPARIA TOOLS LTD.: COMPANY SNAPSHOT

TABLE 114 TAPARIA TOOLS LTD.: PRODUCT OFFERINGS

13.1.9 HANGZHOU GREAT STAR INDUSTRIAL CO. LTD.

TABLE 115 HANGZHOU GREAT STAR INDUSTRIAL CO. LTD.: BUSINESS OVERVIEW

TABLE 116 HANGZHOU GREAT STAR INDUSTRIAL CO. LTD.: PRODUCT OFFERINGS

13.1.10 TOYA S.A.

TABLE 117 TOYA S.A.: BUSINESS OVERVIEW

FIGURE 53 TOYA S.A.: COMPANY SNAPSHOT

TABLE 118 TOYA S.A.: PRODUCT OFFERINGS

13.1.11 IDEAL INDUSTRIES

TABLE 119 IDEAL INDUSTRIES: BUSINESS OVERVIEW

TABLE 120 IDEAL INDUSTRIES: PRODUCT OFFERINGS

13.1.12 MARTIN SPROCKET & GEAR, INC.

TABLE 121 MARTIN SPROCKET & GEAR, INC.: BUSINESS OVERVIEW

TABLE 122 MARTIN SPROCKET & GEAR, INC.: PRODUCT OFFERINGS

13.1.13 ROBERT BOSCH

TABLE 123 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 54 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 124 ROBERT BOSCH: PRODUCT OFFERINGS

13.1.14 INGERSOLL RAND

TABLE 125 INGERSOLL RAND: BUSINESS OVERVIEW

FIGURE 55 INGERSOLL RAND: COMPANY SNAPSHOT

TABLE 126 INGERSOLL RAND: PRODUCT OFFERINGS

TABLE 127 INGERSOLL RAND: DEALS

13.1.15 JCBL LTD.

TABLE 128 JCBL LTD.: BUSINESS OVERVIEW

TABLE 129 JCBL LTD.: PRODUCT OFFERINGS

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 CHANNELLOCK, INC.

TABLE 130 CHANNELLOCK, INC.: COMPANY OVERVIEW

13.2.2 WRIGHT TOOL COMPANY

TABLE 131 WRIGHT TOOL COMPANY: COMPANY OVERVIEW

13.2.3 JETECH TOOL CO. LTD.

TABLE 132 JETECH TOOL CO. LTD.: COMPANY OVERVIEW

13.2.4 GRAY TOOLS CANADA INC.

TABLE 133 GRAY TOOLS CANADA INC.: COMPANY OVERVIEW

13.2.5 LIE-NIELSEN TOOLWORKS

TABLE 134 LIE-NIELSEN TOOLWORKS: COMPANY OVERVIEW

13.2.6 WERA TOOLS

TABLE 135 WERA TOOLS: COMPANY OVERVIEW

13.2.7 RIDGID TOOLS

TABLE 136 RIDGID TOOLS: COMPANY OVERVIEW

13.2.8 KIRCHHOFF GROUP

TABLE 137 KIRCHHOFF GROUP: COMPANY OVERVIEW

13.2.9 WINTEK TOOLS

TABLE 138 WINTEK TOOLS: COMPANY OVERVIEW

13.2.10 NINGBO GREAT WALL PRECISION INDUSTRIAL CO. LTD.

TABLE 139 NINGBO GREAT WALL PRECISION INDUSTRIAL CO. LTD.:COMPANY OVERVIEW

14 ADJACENT & RELATED MARKETS (Page No. - 195)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 OUTDOOR POWER EQUIPMENT, BY POWER SOURCE

14.3.1 INTRODUCTION

TABLE 140 OUTDOOR POWER EQUIPMENT MARKET, BY POWER SOURCE, 2016–2024 (USD MILLION)

14.3.2 FUEL-POWERED

14.3.2.1 Gas-powered equipment to hold a larger size of the market during the forecast period

TABLE 141 OUTDOOR POWER EQUIPMENT MARKET FOR FUEL-POWERED EQUIPMENT, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 142 OUTDOOR POWER EQUIPMENT MARKET FOR FUEL-POWERED EQUIPMENT, BY REGION, 2016–2024 (USD MILLION)

14.3.3 ELECTRIC-POWERED

TABLE 143 OUTDOOR POWER EQUIPMENT MARKET FOR ELECTRIC-POWERED EQUIPMENT, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 144 OUTDOOR POWER EQUIPMENT MARKET FOR ELECTRIC EQUIPMENT, BY REGION, 2016–2024 (USD MILLION)

TABLE 145 OUTDOOR POWER EQUIPMENT MARKET FOR ELECTRIC EQUIPMENT, BY TYPE, 2016–2024 (USD MILLION)

14.3.3.1 Corded

14.3.3.1.1 Environmental regulations to drive the growth of the corded equipment market in coming years

14.3.3.2 Cordless

14.3.3.2.1 Rising adoption of battery-powered handheld equipment to drive the demand for cordless equipment

14.4 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION

14.4.1 INTRODUCTION

TABLE 146 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION, 2016–2024 (USD MILLION)

14.4.2 COMMERCIAL

14.4.2.1 Increasing garden activities to propel the growth of the outdoor power equipment market for commercial applications

TABLE 147 OUTDOOR POWER EQUIPMENT MARKET FOR COMMERCIAL APPLICATIONS, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 148 OUTDOOR POWER EQUIPMENT MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2016–2024 (USD MILLION)

14.4.3 RESIDENTIAL/DIY

14.4.3.1 Growing popularity of DIY gardening culture to drive outdoor power equipment market for residential/DIY applications

TABLE 149 OUTDOOR POWER EQUIPMENT MARKET FOR RESIDENTIAL/DIY APPLICATIONS, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 150 OUTDOOR POWER EQUIPMENT MARKET FOR RESIDENTIAL APPLICATIONS, BY REGION, 2016–2024 (USD MILLION)

14.5 GEOGRAPHIC ANALYSIS

14.5.1 INTRODUCTION

TABLE 151 OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2016–2024 (USD MILLION)

14.5.2 NORTH AMERICA

TABLE 152 OUTDOOR POWER EQUIPMENT MARKET IN NORTH AMERICA, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 153 OUTDOOR POWER EQUIPMENT MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2024 (USD MILLION)

TABLE 154 OUTDOOR POWER EQUIPMENT MARKET IN NORTH AMERICA, BY POWER SOURCE, 2016–2024 (USD MILLION)

TABLE 155 OUTDOOR POWER EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2024 (USD MILLION)

14.5.2.1 United States

14.5.2.1.1 US to hold the largest share of the outdoor power equipment market from 2019 to 2024

14.5.2.2 Canada

14.5.2.2.1 Rich gardening and lawn maintenance culture in Canada to help increase demand in the near future

14.5.2.3 Mexico

14.5.2.3.1 Growth in residential construction to drive the demand for outdoor power equipment in Mexico

14.5.3 EUROPE

TABLE 156 OUTDOOR POWER EQUIPMENT MARKET IN EUROPE, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 157 OUTDOOR POWER EQUIPMENT MARKET IN EUROPE, BY APPLICATION, 2016–2024 (USD MILLION)

TABLE 158 OUTDOOR POWER EQUIPMENT MARKET IN EUROPE, BY POWER SOURCE, 2016–2024 (USD MILLION)

TABLE 159 OUTDOOR POWER EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2016–2024 (USD MILLION)

14.5.3.1 Germany

14.5.3.1.1 Germany to remain a key market for outdoor power equipment in Europe during the forecast period

14.5.3.2 France

14.5.3.2.1 Presence of a large number of parks to drive the demand for outdoor power equipment in France

14.5.3.3 United Kingdom

14.5.3.3.1 Presence of parks and golf turfs continue to drive demand for outdoor power equipment

14.5.3.4 Rest of Europe

14.5.4 APAC

TABLE 160 OUTDOOR POWER EQUIPMENT MARKET IN APAC, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 161 OUTDOOR POWER EQUIPMENT MARKET IN APAC, BY APPLICATION, 2016–2024 (USD MILLION)

TABLE 162 OUTDOOR POWER EQUIPMENT MARKET IN APAC, BY POWER SOURCE, 2016–2024 (USD MILLION)

TABLE 163 OUTDOOR POWER EQUIPMENT MARKET IN APAC, BY COUNTRY, 2016–2024 (USD MILLION)

14.5.4.1 Japan

14.5.4.1.1 Japan held the largest share in the outdoor power equipment market in APAC

14.5.4.2 China

14.5.4.2.1 Growth in GDP and construction sector to offer opportunities for the outdoor power equipment market

14.5.4.3 South Korea

14.5.4.3.1 Well-established gardening and lawn culture to propel the demand for outdoor power equipment in South Korea

14.5.4.4 India

14.5.4.4.1 Indian outdoor power equipment market to grow at the highest CAGR during the forecast period

14.5.4.5 Rest of APAC

14.5.5 ROW

TABLE 164 OUTDOOR POWER EQUIPMENT MARKET IN ROW, BY EQUIPMENT TYPE, 2016–2024 (USD MILLION)

TABLE 165 OUTDOOR POWER EQUIPMENT MARKET IN ROW, BY APPLICATION, 2016–2024 (USD MILLION)

TABLE 166 OUTDOOR POWER EQUIPMENT MARKET IN ROW, BY POWER SOURCE, 2016–2024 (USD MILLION)

TABLE 167 OUTDOOR POWER EQUIPMENT MARKET IN ROW, BY COUNTRY, 2016–2024 (USD MILLION)

14.5.5.1 South America

14.5.5.1.1 Brazil and Argentina are major markets in South America

14.5.5.2 Middle East & Africa

14.5.5.2.1 UAE and South Africa are key markets in the Middle East and Africa

15 APPENDIX (Page No. - 216)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

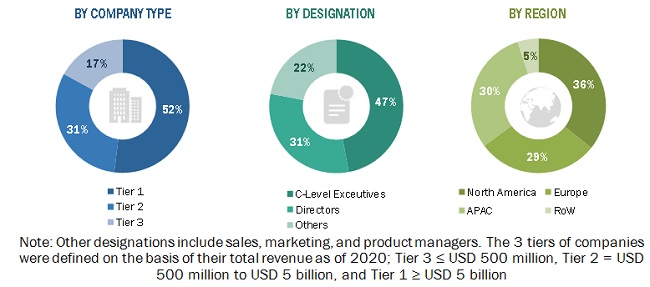

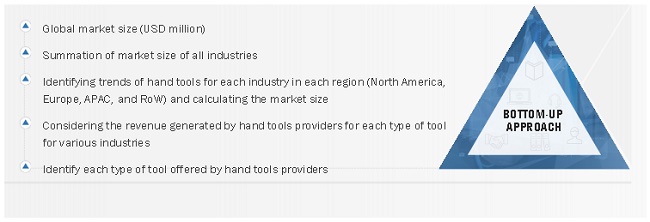

The study involved four major activities in estimating the current size of the Hand tools and woodworking tools market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the Hand tools and woodworking tools market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries as well as hand tools have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from hand tools and woodworking tools manufacturers, such as Stanley Black & Decker (US), Apex Tool Group(US), Snap-On Incorporated(US), Techtronic Industries Co. Ltd (China), Klein Tools (US), Husqvarna (Sweden), Akar Auto Industries Ltd. (India), and Hangzhou Great Star Industrial Co. Ltd. (China) and others; research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the Hand tools and woodworking tools market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Hand tools and woodworking tools market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global hand tools & woodworking tools market based on type, end user, distribution channel, and geography

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the process flow of the hand tools and woodworking tools market

- To analyze opportunities for stakeholders in the hand tools & woodworking tools market by identifying the high-growth segments

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies along with detailing the competitive leadership and analyzing growth strategies, such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and partnerships, of the leading players

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hand Tools & Woodworking Tools Market