Healthcare BPO Market Size, Share & Trends by Outsourcing Models, Provider (Patient Care, RCM), Payer (Claims Management, Billing & Accounts), Life Science (R&D, Manufacturing, Sales & Marketing (Analytics, Research)), & Region (Source, Destination) - Global Forecast to 2029

Healthcare BPO Market Size, Share & Trends

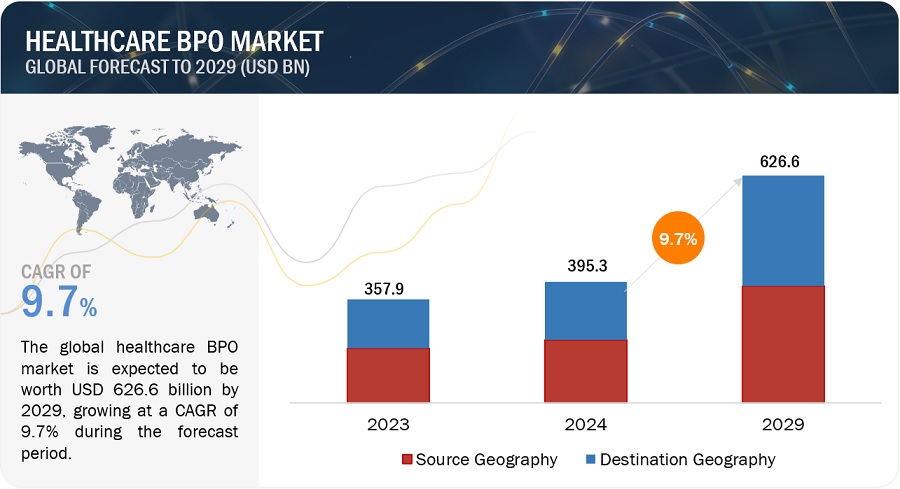

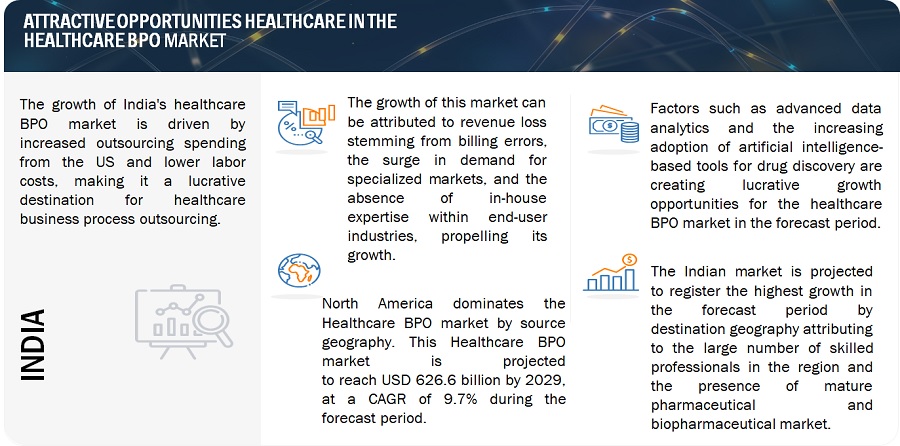

The global Healthcare BPO market is expected to grow from $395.3 billion in 2024 to $626.6 billion by 2029, at a CAGR of 9.7%. This growth is driven by the increasing outsourcing in pharma and biopharma industries and the pressure to reduce healthcare costs. Key trends include the utilization of advanced data analytics, though hidden outsourcing costs pose significant challenges. The market is segmented into various services such as medical transcription, which holds the largest share in patient care, and claims adjudication, dominating the claims management sector. The sales and marketing segment leads in non-clinical life science services. North America is the largest source geography due to the widespread adoption of electronic health records and stringent regulatory requirements. Prominent players include Accenture, Cognizant, Tata Consultancy Services, Xerox, WNS, Omega Healthcare, R1 RCM, Invensis Technologies, and others from the US, India, Japan, and Europe. The market's comprehensive ecosystem involves leveraging technological advancements like AI and automation to enhance efficiency and cost-effectiveness, allowing healthcare providers to focus more on patient care.

Healthcare BPO Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare BPO Market Dynamics

DRIVER: Pressure to reduce the rising healthcare cost

The pressure to reduce rising healthcare costs is a significant driving factor in the growth of the healthcare BPO market. As healthcare expenses continue to escalate, organizations are under increasing pressure to find ways to manage and reduce these costs. Outsourcing various non-core functions, such as medical billing, claims processing, and other administrative tasks, to specialized BPO providers has emerged as an effective solution. By outsourcing, healthcare companies can achieve substantial cost savings by reducing expenditures on resource management, labor, and physical space. BPO providers offer scalable and efficient services that streamline operations and enhance productivity, allowing healthcare organizations to focus more on core activities like patient care and clinical innovation. Moreover, offshore outsourcing can further amplify these cost savings due to lower labor costs in other regions. This strategic move not only helps in managing rising healthcare costs but also ensures that healthcare providers can maintain high standards of service and compliance. As a result, the imperative to reduce healthcare expenses significantly boosts the demand for BPO services, driving market growth by enabling organizations to operate more efficiently and cost-effectively in an increasingly competitive and financially constrained environment.

RESTRAINT: Hidden outsourcing costs

Hidden outsourcing costs are a major restraining factor in the healthcare BPO market. Many companies enter outsourcing agreements with the expectation of significant cost savings, but improper planning and financial allocation often undermine these benefits. Unforeseen expenses can arise at various stages of the outsourcing process, starting with the evaluation and selection of a vendor. This phase involves substantial time and resources to identify a suitable partner, which many companies fail to fully anticipate. Additionally, managing offshore contracts and transitioning processes to an external provider can incur unexpected costs, particularly if the transition is not smooth or requires extensive training and support. Enhancing security measures to protect sensitive healthcare data and addressing severance pay for displaced employees further add to these hidden costs. Without meticulous financial planning and a comprehensive understanding of all potential expenses, companies might find that the actual costs of outsourcing outweigh the anticipated savings. These hidden costs can erode the business value derived from outsourcing, making it a less attractive option for some healthcare organizations. Consequently, the challenge of managing these unanticipated expenses acts as a significant barrier to the growth of the healthcare BPO market, as companies become wary of the true financial implications of outsourcing.

OPPORTUNITY: Advanced Data analytics

Advanced data analytics presents a significant opportunity for the growth of the healthcare BPO market. Service providers that leverage sophisticated data analytics tools can offer enhanced value to their clients by improving service efficiency and customer retention. By utilizing advanced analytics, BPO providers can gain deeper insights into operational workflows, patient outcomes, and financial performance. These insights enable them to optimize processes, identify cost-saving opportunities, and proactively address potential issues before they escalate. Additionally, data analytics facilitates personalized service offerings tailored to the specific needs of healthcare organizations, enhancing client satisfaction and loyalty. The ability to predict trends, measure key performance indicators accurately, and ensure regulatory compliance through data-driven strategies makes BPO services more attractive to healthcare providers. As healthcare organizations increasingly recognize the value of data in driving decision-making and improving patient care, the demand for BPO services that incorporate advanced analytics is likely to rise. This creates a substantial growth opportunity for BPO providers who can effectively harness and apply data analytics to deliver superior services. Consequently, the integration of advanced data analytics into healthcare BPO operations not only boosts efficiency and cost-effectiveness but also serves as a critical differentiator in a competitive market.

CHALLENGE: Safety of blood transfusion in developing countries

Data security concerns pose a significant challenge to the healthcare BPO market, primarily due to the heightened risk of data breaches and the potential consequences for patient confidentiality. With the proliferation of digital healthcare records and the outsourcing of critical processes to third-party service providers, the risk of unauthorized access to sensitive patient information increases. Factors such as inadequate internal controls, lack of top management support, outdated policies and procedures, and insufficient personnel training further exacerbate these risks. Data breaches not only compromise patient confidentiality but also undermine trust in healthcare providers and BPO vendors, leading to reputational damage and legal repercussions. The stringent regulatory landscape, including laws like HIPAA (Health Insurance Portability and Accountability Act) in the United States, imposes strict requirements for safeguarding patient data, making compliance a complex and challenging endeavor for both healthcare organizations and BPO providers. Consequently, addressing data security concerns requires a multifaceted approach encompassing robust cybersecurity measures, ongoing risk assessments, comprehensive training programs, and proactive collaboration between stakeholders to mitigate risks and uphold patient confidentiality in the healthcare BPO market.

Healthcare BPO Industry Ecosystem

The healthcare BPO market ecosystem involves outsourcing administrative and medical services to third-party providers. BPO services range from medical billing, claims processing, and data management to telehealth support and patient care services. Technological advancements like AI and automation enhance efficiency and accuracy. This ecosystem aims to reduce operational costs, improve service quality, and allow healthcare providers to focus more on patient care.

The medical transcription segment has accounted for the largest share of Healthcare BPO industry.

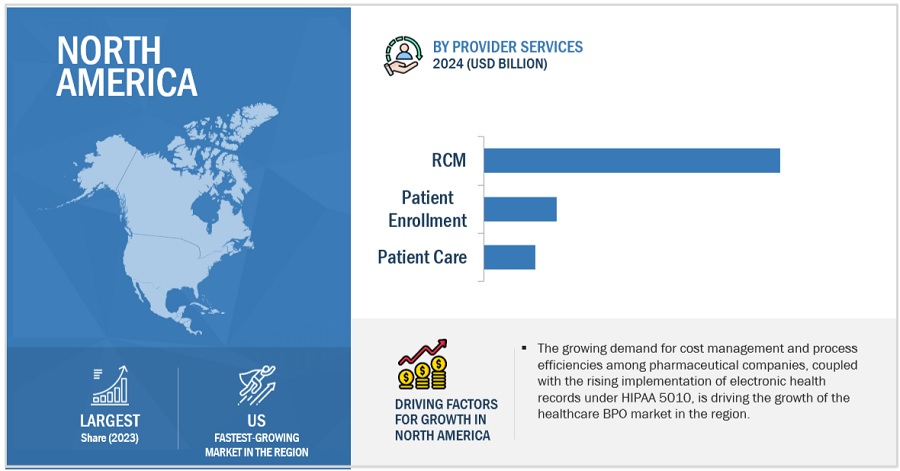

Based on provider services, the Healthcare BPO market is segmented into revenue cycle management, patient enrolment, patient care. The patient care segment is further divided into medical transcription, device monitoring and medical imaging. Among these the medical transcription segment has accounted for the largest share in healthcare BPO market by patient care type. This is attributed to its ability to offer quicker, efficient, and streamlined transcription processes. Medical transcription outsourcing provides healthcare organizations with a solution to meet the stringent quality requirements of transcribed reports while efficiently managing workload and costs. Medical transcription companies specialize in transcribing various medical records, including reports, referrals, diagnostic tests, patient history, laboratory results, and radiology test results. To ensure accuracy and quality, these documents undergo meticulous multi-level checks by transcriptionists and proofreaders. Outsourcing medical transcription allows healthcare providers to focus on core patient care activities while offloading the time-consuming and labor-intensive task of transcription to specialized BPO providers. This strategic move not only enhances operational efficiency but also ensures compliance with industry standards and regulations. By leveraging the expertise and resources of BPO providers, healthcare organizations can achieve significant cost savings without compromising on the quality or timeliness of medical transcription services, thus driving the dominance of the medical transcription segment in the patient care segment of the healthcare BPO market.

The Claims adjudication services accounted for the largest share of the Healthcare BPO industry by claims management service types.

By payer service, the Healthcare BPO market is segmented into claims management services, member management services, provider management services, Human Resources (HR) services, integrated front-end services and back-office operations, analytics and fraud management services, product development & business acquisition (PDBA), and billing & accounts services. The claims management services are again divided into claims adjudication, claims settlement, information management, claims repricing, claims investigation, claims indexing, and fraud detection & management. Among these, claims adjudication service segment accounted for the largest market share by claims management service types in healthcare BPO market. This is attributed to its critical role in ensuring proper processing and resolution of healthcare claims. Healthcare payers rely on efficient claims adjudication processes to accurately assess claims, determine coverage eligibility, and facilitate timely reimbursement. Improper adjudication can not only impact the revenue of payers but also result in litigation and customer dissatisfaction if genuine claims are inaccurately processed or denied. To mitigate these risks and achieve cost savings, healthcare payers increasingly prefer to outsource their claims adjudication services to specialized BPO providers. Outsourcing allows payers to leverage the expertise and resources of BPO firms to streamline adjudication processes, improve accuracy, and enhance overall operational efficiency. By offloading this complex and labor-intensive task to external providers, payers can focus on core business functions while ensuring compliance with regulatory requirements and maintaining high levels of customer satisfaction. Consequently, the dominance of the claims adjudication segment underscores its pivotal role in the claims management services segment of the healthcare BPO market, driven by the imperative for accuracy, efficiency, and cost-effectiveness in claims processing.

Sales and marketing segment accounted for the largest share of the Healthcare BPO industry.

Based on life science services, the Healthcare BPO market is segmented into manufacturing, research and development, and non-clinical services. The non-clinical services are again divided into sales and marketing services, supply chain management & logistics, and other non-clinical services. Among these, sales and marketing services segment accounted for the largest share of the Healthcare BPO market, attributing to the growing trend among pharmaceutical companies to outsource these functions. In an effort to enhance focus on core competencies such as research and development (R&D) and production, pharmaceutical companies are increasingly turning to specialized BPO providers to handle their sales and marketing activities. Outsourcing sales and marketing services allows pharmaceutical firms to access specialized expertise and resources that can effectively promote their products in a competitive market landscape. BPO providers bring industry-specific knowledge, advanced technologies, and proven strategies to the table, enabling pharmaceutical companies to optimize their marketing efforts and reach target audiences more efficiently. By leveraging external expertise in sales and marketing, pharmaceutical companies can streamline operations, reduce costs, and achieve greater flexibility in adapting to market dynamics. Additionally, outsourcing these services allows pharmaceutical firms to remain agile and responsive to changing market trends and regulatory requirements, ultimately driving growth and competitiveness in the healthcare BPO market. Therefore, the dominance of the sales and marketing services segment underscores its pivotal role in supporting the commercial success of pharmaceutical companies while enabling them to focus on innovation and product development.

North America accounted for the largest share of the Healthcare BPO industry by source geography in 2023.

To know about the assumptions considered for the study, download the pdf brochure

Based on the region, the Healthcare BPO market is segmented into source geography and destination geography. The source geography is divided into North America, Europe, and rest of world while the destination geography is divided into India, China, Kingdom of Saudi Arabia, US, Philippines, Brazil, Bulgaria and other EU countries, Brazil, rest of the world. Among these North America holds the largest share in healthcare BPO market by source geography. This is due to the widespread adoption of electronic health records (EHRs) facilitated by the implementation of HIPAA 5010 regulations. The Health Insurance Portability and Accountability Act (HIPAA) 5010 mandates the use of standardized electronic transactions for healthcare transactions, including billing and claims processing. This regulatory framework has accelerated the transition from paper-based to electronic health records across healthcare organizations in North America. As a result, there is a growing need for specialized support services to manage and optimize these electronic health records, driving the demand for healthcare business process outsourcing (BPO) services in the region. Outsourcing requirements are often concentrated in regions where healthcare organizations are headquartered or have a significant presence. Given that North America is home to numerous healthcare providers, payers, and pharmaceutical companies, the region emerges as a hub for outsourcing requirements. Moreover, the stringent regulatory environment and the complex nature of healthcare operations in North America necessitate external expertise and support, further fueling the demand for healthcare BPO services in the region. Consequently, the convergence of regulatory mandates, widespread EHR adoption, and the concentration of healthcare organizations positions North America as the leading source geography in the healthcare BPO market.

Prominent players in Healthcare BPO market, Accenture plc. (Ireland), Cognizant Technology Solutions Corporation (US), Tata Consultancy Services Limited (India), Xerox Corporation (US), WNS (Holdings) Limited (India), Omega Healthcare Management Services (India), R1 RCM (US), Invensis Technologies (India), UnitedHealth Group (US), HCL Technologies Limited (India), NTT Data Corporation (Japan), Iqvia Holdings, Inc (US), Mphasis (India), Genpact Limited (US), Wipro Limited (India), Infosys BPM (India), Firstsource (India), International Business Machines Corporation (US), GeBBS Healthcare Solutions (US), Capgemini SE (France), Parexel International (US), Access Healthcare (India), Sutherland Global (US), Akurate Management Solutions (US), AGS Health (US).

Scope of the Healthcare BPO Industry

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$395.3 billion |

|

Projected Revenue by 2029 |

$626.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 9.7% |

|

Market Driver |

Pressure to reduce the rising healthcare cost |

|

Market Opportunity |

Advanced Data analytics |

The study categorizes the Healthcare BPO Market to forecast revenue and analyze trends in each of the following submarkets:

By Provider Service

- Revenue cycle management

- Patient enrolment

-

Patient care

- Medical transcription

- Device monitoring

- Medical imaging

By Payer Service

-

Claims management Services

- Claims adjudication services

- Claims settlement services

- Information management services

- Claims repricing

- Claims investigation services

- Claims indexing services

- Fraud detection & management

- Integrated Front-end services and back-office operations

- Member management services

- Product development & business acquisition services (PDBA)

- Provider management services

- Care management services

- Billing and accounts management services

- Human Resource Services

By Life Science Services

- Manufacturing

- Research & Development

-

Non-clinical services

-

Sales and marketing services

- Analytics

- Marketing

- Research

- Forecasting

- Performance reporting

- Supply chain management & logistics.

- Other non-clinical services

-

Sales and marketing services

By Region

-

Source Geography

- North America

- Europe

- Rest of world

-

Destination Geography

- India

- US

- China

- Bulgaria & other EU countries

- Philippines

- Brazil

- Kingdom of Saudi Arabia

- Rest of World

Recent Development of the Healthcare BPO Industry:

- In April 2024, Accenture Plc has finalised the acquisition of Health Unlimited, to expand its services and maximize generative AI potential. This acquisition brings specialized proficiency in behavioral scieence, customer strategy, and CRM activation.

- In March 2024, Cognizant technology solutions corporation collaborated with Microsoft to integrate advanced AI into healthcare administration, enhancing the productivity and efficiency for both payers and providers, prioritizing timely response and elevating patient care.

- In April 2023, Cognizant technology solutions corporation signed agreement with Horizon Healthcare services. Cognizant will oversee claims processing, provider configuration and enrollment services for Horizon.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global Healthcare BPO market?

The global Healthcare BPO market boasts a total revenue value of $626.6 billion by 2029.

What is the estimated growth rate (CAGR) of the global Healthcare BPO market?

The global Healthcare BPO market has an estimated compound annual growth rate (CAGR) of 9.7% and a revenue size in the region of $395.3 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities to estimate the current size of the Healthcare BPO market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of Healthcare BPO Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Healthcare BPO market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across source and destination geographies. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from manufacturers; distributors operating in the Healthcare BPO market.; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side customers/end users who are using infection control products were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage and the future outlook of their business, which will affect the overall market.

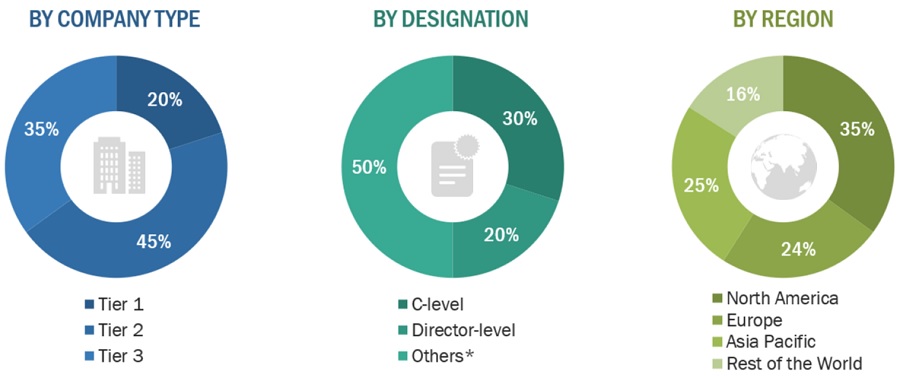

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue.

As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Healthcare BPO market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the Healthcare BPO market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall Healthcare BPO market was obtained from secondary data and validated by primary participants to arrive at the total Healthcare BPO market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall Healthcare BPO market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Healthcare BPO Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Healthcare BPO Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Healthcare BPO industry.

Market Definition:

The Healthcare BPO market encompasses the global business sphere surrounding the development, production, distribution, and use of Healthcare BPO equipment and related consumables. This specialized technology enables the separation and collection of specific blood components, such as plasma, platelets, or white blood cells, from a whole blood donation. These collected components are then used in various therapeutic applications, including treating blood disorders, autoimmune diseases, and neurological conditions.

Key Stakeholders

- Vendors/service providers

- Healthcare service providers

- Health insurance companies

- Business research and consulting service providers

- Technology partners

- Venture capitalists

- Research institutions

Report Objectives

- To define, describe, and forecast the healthcare BPO market based on provider service, payer service, life science service, and geography.

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall healthcare BPO market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments with respect to source geographies, namely, North America, Europe, and the Rest of the World (RoW); as well as destination geographies, namely, India, the US, China, the Philippines, Bulgaria and other EU countries, Brazil, the Kingdom of Saudi Arabia (KSA), and RoW

- To profile the key players and analyze their market shares and core competencies.

- To track and analyze competitive developments such as product/service launches & approvals, partnerships, agreements, collaborations, joint ventures, expansions, and acquisitions in the overall healthcare BPO market.

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product/service strategy.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the Latin American Healthcare BPO into specific countries and, the Middle East, and Africa Healthcare BPO into specific countries and further breakdown of the European Healthcare BPO into specific countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare BPO Market

Looking forward to gain more insights on the global Healthcare BPO Industry

What are the growth opportunities in Healthcare BPO Market?

Can you enlighten us on the end users in Healthcare BPO Market?