High Density Interconnect Market by Product (4–6 Layers HDI, 8–10 Layers HDI, and 10+ Layers HDI), End User (Automotive, Consumer Electronics, Telecommunications, Medical), Application, and Geography - Global Forecast to 2025-2036

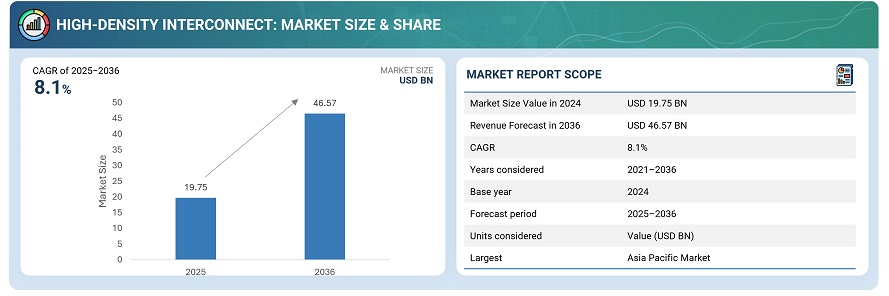

The global high-density interconnect market was valued at USD 18.11 billion in 2024 and is estimated to reach USD 46.57 billion by 2036, at a CAGR of 8.1% between 2025 and 2036.

The global high-density interconnect (HDI) market is driven by the growing demand for miniaturized, high-performance electronic devices across sectors such as consumer electronics, automotive, telecommunications, and industrial systems. Advances in PCB fabrication technologies, via-in-pad design, and laser drilling are enabling higher wiring density, faster signal transmission, and improved reliability in compact form factors. The rise of 5G infrastructure, electric vehicles, and advanced computing applications is further accelerating HDI adoption to support complex circuitry and high-speed data processing. Overall, the market is becoming increasingly competitive, with manufacturers focusing on material innovation, multilayer board design, and regional production expansion to meet performance, cost, and sustainability requirements.

High-Density Interconnect (HDI) is a PCB technology that enables much denser board construction by allowing smaller components to be placed in closer proximity, resulting in shorter electrical paths and enhanced signal performance. HDI goes beyond simple miniaturization, offering improvements in electrical characteristics, weight, and space efficiency. HDI PCBs are manufactured using techniques such as microvias, buried vias, and sequential lamination with advanced insulation and conductor materials to achieve higher routing density and superior reliability.

Market by Product Type

4–6 Layers

The 4–6 Layers HDI segment currently holds the largest market share, primarily driven by its extensive use in smartphones, tablets, wearables, and consumer electronics. These products require compact designs with moderate interconnect density, and 4–6 layer HDI boards offer an optimal balance of performance, cost, and manufacturability. High production volumes in Asia Pacific, combined with stable demand from mobile and connected device manufacturers, sustain this segment’s dominance in the market.

10+ Layers

The 10+ Layers HDI segment is expected to witness the fastest growth over the forecast period, fueled by rising adoption in automotive electronics, networking infrastructure, data centers, and advanced computing systems. These applications demand complex, high-density interconnects to support greater signal integrity, higher data rates, and miniaturized high-performance modules. As technologies like AI servers, 5G base stations, and EV platforms scale, the need for multilayer, high-reliability HDI PCBs is accelerating rapidly, driving premium growth in this category.

Market by Application

Communication Devices & Equipment

The communication devices & equipment segment is expected to account for the largest share of the high-density interconnect market in 2024, driven by several key factors. The communication devices & equipment demand extreme miniaturization, high I/O density, and multi-layer routing to pack advanced SoCs, RF subsystems, and power management into thin form factors. Volume production, frequent product refresh cycles, and strong consumer demand drive steady, high-volume HDI consumption. In addition, manufacturers’ ongoing moves to 5G, higher-bandwidth radios, and more camera/sensor integrations reinforce HDI requirements across successive device generations, keeping this segment the largest revenue contributor.

Automotive Electronics

Automotive electronics is poised for the fastest HDI growth as vehicles incorporate more advanced functionality such as EV powertrains, ADAS, in-vehicle infotainment, and domain controllers, all of which require higher routing density, thermal robustness, and reliability. Regulatory safety demands and long product lifecycles are pushing automakers toward multi-layer, high-density boards and qualified materials, while the electrification and autonomous-feature roadmaps are accelerating HDI adoption.

Market by Geography

Geographically, the high-density interconnect market is witnessing strong adoption across Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Asia Pacific leads the market, driven by large-scale consumer electronics manufacturing, rapid adoption of smartphones, wearables, and tablets, and high-volume PCB production in countries such as China, Taiwan, and South Korea. The region’s established electronics supply chain and cost-competitive manufacturing further reinforce its dominance. North America follows, supported by demand from automotive electronics, data centers, and networking equipment, along with strong R&D capabilities and advanced manufacturing technologies. Europe is also significant, fueled by automotive electronics, industrial applications, and stringent quality and reliability standards. Meanwhile, South America and the Middle East & Africa are emerging markets, with growing industrialization, increasing adoption of smart devices, and expansion of electronics manufacturing infrastructure driving gradual HDI adoption.

Market Dynamics

Driver: Growing Demand for Miniaturized Consumer Electronics

The rising demand for smartphones, tablets, wearables, and laptops is driving HDI adoption, as these devices require compact boards with high routing density and superior electrical performance. Manufacturers are leveraging microvias, sequential lamination, and fine-line routing to integrate advanced SoCs, cameras, sensors, and power-management ICs in limited space. Frequent product refresh cycles, high production volumes, and consumer preference for thinner, lighter devices further sustain growth in HDI deployment.

Restraint: High Manufacturing Complexity and Cost

HDI PCBs are more expensive to design and manufacture compared to standard PCBs due to multi-layer lamination, microvia drilling, and stringent quality control requirements. Small production errors can result in high rejection rates, increasing costs and limiting adoption in low-cost applications. Additionally, the need for advanced equipment and skilled labor can constrain small-scale manufacturers from entering the high-density interconnect market.

Opportunity: Rapid Adoption in Automotive and EV Electronics

The automotive sector, particularly electric vehicles (EVs) and ADAS systems, presents significant growth potential for HDI PCBs. EVs require high-layer, thermally robust boards to manage complex electronics, infotainment, sensors, and powertrain control modules. Rising automotive electrification, autonomous driving technologies, and connected car initiatives are expanding HDI content per vehicle, creating a high-value opportunity for PCB suppliers.

Challenge: Supply Chain and Material Constraints

HDI production relies on specialty materials, high-precision laminates, and microvia drilling equipment, making it sensitive to supply chain disruptions. Fluctuations in the availability of advanced resins, copper foils, and high-grade substrates can delay production and increase costs. Maintaining consistent quality and on-time delivery in a globalized supply chain remains a critical challenge for manufacturers.

Future Outlook

Between 2025 and 2036, the high-density interconnect market is expected to expand significantly as electronic devices across consumer, automotive, telecom, and industrial sectors demand higher performance in smaller form factors. Advances in microvia technology, sequential lamination, fine-line routing, and high-speed signal integrity solutions will enable more compact, reliable, and high-density boards for smartphones, EVs, data centers, and networking equipment. Rising adoption of electric vehicles, autonomous driving systems, 5G infrastructure, and advanced computing applications will drive increased HDI content per device and higher-layer PCB requirements. Continuous investment in advanced materials, fabrication facilities, and automation technologies will further accelerate growth. As the market evolves, HDI technology will play a pivotal role in miniaturization, high-speed data processing, and the development of next-generation electronic systems, supporting both consumer convenience and industrial innovation.

Key Market Players

Top high-density interconnect companies include TTM Technologies Inc. (US), Compeq Co., Ltd. (Taiwan), AT&S (Austria), Unimicron (Taiwan), and Meiko Electronics Co., Ltd. (Japan).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 11 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.2.3 Market Share Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in HDI Market

4.2 HDI Market, By Product Type

4.3 HDI Market in APAC, By Application and Country

4.4 HDI Market, By Region

4.5 Country-Wise Analysis of HDI Market

4.6 HDI Market, By End User

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Smart Consumer Electronics and Wearable Devices

5.2.1.2 Increasing Adoption of Advanced Electronics and Safety Measures in Automotive Vertical

5.2.2 Restraints

5.2.2.1 Complex Manufacturing Process

5.2.3 Opportunities

5.2.3.1 Rising Demand for Connected Devices

5.2.3.2 Evolution of 5g Technology

5.2.4 Challenges

5.2.4.1 Rapid Changes in Technology and Increasing Functionality of Electronic Devices

5.3 Value Chain Analysis

6 HDI Market, By Product (Page No. - 44)

6.1 Introduction

6.2 4–6 Layers HDI

6.2.1 Communications Devices and Equipment Likely to Be Major Consumer of 4-6 Layers HDI

6.3 8–10 Layers HDI

6.3.1 HDI Market for 8–10 Layers HDI to Witness Second-Highest CAGR During Forecast Period

6.4 10+ Layers HDI

6.4.1 10+ Layers HDI to Occupy Largest Share of HDI Market During Forecast Period

7 HDI Market, By End User (Page No. - 51)

7.1 Introduction

7.2 Automotive

7.2.1 Automotive Segment to Witness Second-Highest CAGR in HDI Market During Forecast Period

7.3 Consumer Electronics

7.3.1 Computer and Display Application to Account for Largest Share of HDI Market for Consumer Electronics During Forecast Period

7.4 Telecommunication

7.4.1 Telecommunication to Hold Largest Share of HDI Market During Forecast Period

7.5 Medical

7.5.1 HDI Market for Medical to Register Highest CAGR During Forecast Period

7.6 Others

7.6.1 10+ Layers to Witness Highest CAGR in HDI Market for Other End Users During Forecast Period

8 HDI Market, By Application (Page No. - 61)

8.1 Introduction

8.2 Automotive Electronics

8.2.1 Increasing Number of Applications, Such as Autonomous Driving and Infotainment, to Propel Demand for HDI Pcbs in Automotive Electronics

8.3 Computer and Display

8.3.1 Consumer Electronics Segment to Account for Largest Share of HDI Market for Computer and Display During Forecast Period

8.4 Communication Devices and Equipment

8.4.1 Communication Devices and Equipment to Account for the Largest Share of the HDI Market During Forecast Period

8.5 Audio/Audiovisual (AV) Devices

8.5.1 RoW to Witness Second-Highest CAGR in HDI Market for Audio/AV Devices

8.6 Connected Devices

8.6.1 Connected Devices to Exhibit Second-Highest CAGR in HDI Market During Forecast Period

8.7 Wearable Devices

8.7.1 Market for Wearable Devices to Grow at Highest CAGR During Forecast Period

8.8 Others

8.8.1 Medical Segment to Register Highest CAGR in HDI Market for Other Applications During Forecast Period

9 HDI Market, By Geography (Page No. - 73)

9.1 Introduction

9.2 Americas

9.2.1 US

9.2.1.1 US to Account for Largest Market Share During Forecast Period

9.2.2 Canada

9.2.2.1 Canadian HDI Market’s Growth Mainly Attributed to Demand for Communication and Entertainment Products

9.2.3 Mexico

9.2.3.1 Growing Demand for Smartphones to Aid Market Growth in Mexico

9.2.4 Rest of the Americas

9.2.4.1 Growing Market for Consumer Electronics and Communication Products to Drive HDI Market in Rest of the Americas

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Expected to Capture Largest Share of HDI Market in Europe During Forecast Period

9.3.2 France

9.3.2.1 Connected Car Technology and 5g Connectivity to Drive HDI Market in France

9.3.3 UK

9.3.3.1 HDI Market in UK to Witness Highest CAGR in Europe

9.3.4 Italy

9.3.4.1 Consumer Electronics to Drive HDI Market in Italy

9.3.5 Rest of Europe

9.3.5.1 Rising Demand From Automotive and Telecommunication End-User Industries to Drive HDI Market in Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 China to Continue Holding Largest Share of HDI Market in APAC During Forecast Period

9.4.2 Japan

9.4.2.1 HDI Market in Japan to Get Boost From Automotive and Telecommunication End-User Industries

9.4.3 South Korea

9.4.3.1 Consumer Electronics and Telecommunication End-User Industries to Drive HDI Market in South Korea

9.4.4 India

9.4.4.1 HDI Market in India to Witness Highest CAGR Within APAC

9.4.5 Rest of APAC

9.4.5.1 HDI Market in Rest of APAC to Be Driven Majorly By Consumer Electronics End-User Industry

9.5 RoW

9.5.1 Middle East

9.5.1.1 Middle East to Hold Major Share of HDI Market in RoW During Forecast Period

9.5.2 Africa

9.5.2.1 Growing Smartphone Adoption to Drive HDI Market in Africa

10 Competitive Landscape (Page No. - 91)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Product Excellence

10.5 Business Excellence

10.6 Competitive Scenario

10.6.1 Acquisitions, Collaborations, and Partnerships

10.6.2 Expansions

11 Company Profiles (Page No. - 99)

11.1 Introduction

11.2 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2.1 Compeq Co.

11.2.2 TTM Technologies

11.2.3 Austria Technologie & Systemtechnik

11.2.4 Unimicron

11.2.5 Zhen Ding Tech.

11.2.6 Ncab Group

11.2.7 Fujitsu Interconnect Technologies

11.2.8 CMK

11.2.9 Sierra Circuits

11.2.10 EPEC

11.3 Other Key Players

11.3.1 Meiko Electronics Co.

11.3.2 Kingboard Holdings

11.3.3 Daeduck GDS Co.

11.3.4 Shenzhen Kinwong Electronic Co.

11.3.5 Multek

11.3.6 Rush Pcb

11.3.7 Bittele Electronics

11.3.8 Würth Elektronik Circuit Board Technology

11.3.9 Wuzhu Technology Co.

11.3.10 Nod Electronics

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 124)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (68 Tables)

Table 1 Various Government Regulations for Vehicular Safety

Table 2 HDI Market, By Product Type, 2015–2023 (USD Million)

Table 3 HDI Market for 4–6 Layers HDI, By Application, 2015–2023 (USD Million)

Table 4 HDI Market for 4–6 Layers HDI, By End-User Industry, 2015–2023 (USD Million)

Table 5 HDI Market for 4–6 Layers HDI, By Region, 2015–2023 (USD Million)

Table 6 HDI Market for 8–10 Layers HDI, By Application, 2015–2023 (USD Million)

Table 7 HDI Market for 8–10 Layers HDI, By End-User Industry, 2015–2023 (USD Million)

Table 8 HDI Market for 8–10 Layers HDI, By Region, 2015–2023 (USD Million)

Table 9 HDI Market for 10+ Layers HDI, By Application, 2015–2023 (USD Million)

Table 10 HDI Market for 10+ Layers HDI, By End-User Industry, 2015–2023 (USD Million)

Table 11 HDI Market for 10+ Layers HDI, By Region, 2015–2023 (USD Million)

Table 12 HDI Market, By End User, 2015–2023 (USD Million)

Table 13 HDI Market for Automotive, By Product Type, 2015–2023 (USD Million)

Table 14 HDI Market for Automotive, By Application, 2015–2023 (USD Million)

Table 15 HDI Market for Automotive, By Region, 2015–2023 (USD Million)

Table 16 HDI Market for Consumer Electronics, By Product Type, 2015–2023 (USD Million)

Table 17 HDI Market for Consumer Electronics, By Application, 2015–2023 (USD Million)

Table 18 HDI Market for Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 19 HDI Market for Telecommunication, By Product Type, 2015–2023 (USD Million)

Table 20 HDI Market for Telecommunication, By Application, 2015–2023 (USD Million)

Table 21 HDI Market for Telecommunication, By Region, 2015–2023 (USD Million)

Table 22 HDI Market for Medical, By Product Type, 2015–2023 (USD Million)

Table 23 HDI Market for Medical, By Application, 2015–2023 (USD Million)

Table 24 HDI Market for Medical, By Region, 2015–2023 (USD Million)

Table 25 HDI Market for Others, By Product Type, 2015–2023 (USD Million)

Table 26 HDI Market for Others, By Application, 2015–2023 (USD Million)

Table 27 HDI Market for Others, By Region, 2015–2023 (USD Million)

Table 28 HDI Market, By Application, 2015–2023 (USD Million)

Table 29 HDI Market for Automotive Electronics, By Product Type, 2015–2023 (USD Million)

Table 30 HDI Market for Automotive Electronics, By End User, 2015–2023 (USD Million)

Table 31 HDI Market for Automotive Electronics, By Region, 2015–2023 (USD Million)

Table 32 HDI Market for Computer and Display, By Product Type, 2015–2023 (USD Million)

Table 33 HDI Market for Computer and Display, By End User, 2015–2023 (USD Million)

Table 34 HDI Market for Computer and Display, By Region, 2015–2023 (USD Million)

Table 35 HDI Market for Communication Devices and Equipment, By Product Type, 2015–2023 (USD Million)

Table 36 HDI Market for Communication Devices and Equipment, By End User, 2015–2023 (USD Million)

Table 37 HDI Market for Communication Devices and Equipment, By Region, 2015–2023 (USD Million)

Table 38 HDI Market for Audio/AV Devices, By Product Type, 2015–2023 (USD Million)

Table 39 HDI Market for Audio/AV Devices, By End User, 2015–2023 (USD Million)

Table 40 HDI Market for Audio/AV Devices, By Region, 2015–2023 (USD Million)

Table 41 HDI Market for Connected Devices, By Product Type, 2015–2023 (USD Million)

Table 42 HDI Market for Connected Devices, By End User, 2015–2023 (USD Million)

Table 43 HDI Market for Connected Devices, By Region, 2015–2023 (USD Million)

Table 44 HDI Market for Wearable Devices, By Product Type, 2015–2023 (USD Million)

Table 45 HDI Market for Wearable Devices, By End User, 2015–2023 (USD Million)

Table 46 HDI Market for Wearable Devices, By Region, 2015–2023 (USD Million)

Table 47 HDI Market for Others, By Product Type, 2015–2023 (USD Million)

Table 48 HDI Market for Others, By End User, 2015–2023 (USD Million)

Table 49 HDI Market for Others, By Region, 2015–2023 (USD Million)

Table 50 HDI Market, By Region, 2015–2023 (USD Million)

Table 51 HDI Market in Americas, By Country, 2015–2023 (USD Million)

Table 52 HDI Market in Americas, By Product Type, 2015–2023 (USD Million)

Table 53 HDI Market in Americas, By Application, 2015–2023 (USD Million)

Table 54 HDI Market in Americas, By End User, 2015–2023 (USD Million)

Table 55 HDI Market in Europe, By Country, 2015–2023 (USD Million)

Table 56 HDI Market in Europe, By Product Type, 2015–2023 (USD Million)

Table 57 HDI Market in Europe, By Application, 2015–2023 (USD Million)

Table 58 HDI Market in Europe, By End User, 2015–2023 (USD Million)

Table 59 HDI Market in APAC, By Country, 2015–2023 (USD Million)

Table 60 HDI Market in APAC, By Product Type, 2015–2023 (USD Million)

Table 61 HDI Market in APAC, By Application, 2015–2023 (USD Million)

Table 62 HDI Market in APAC, By End User, 2015–2023 (USD Million)

Table 63 HDI Market in RoW, By Region, 2015–2023 (USD Million)

Table 64 HDI Market in RoW, By Product Type, 2015–2023 (USD Million)

Table 65 HDI Market in RoW, By Application, 2015–2023 (USD Million)

Table 66 HDI Market in RoW, By End User, 2015–2023 (USD Million)

Table 67 5 Most Recent Acquisitions, Collaborations, and Partnerships in the HDI Market

Table 68 3 Most Recent Expansions in the HDI Market

List of Figures (39 Figures)

Figure 1 HDI Market: Research Design

Figure 2 Process Flow

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 HDI Market for 10+ Layers HDI to Grow at Highest CAGR During Forecast Period

Figure 6 Telecommunication to Hold the Largest Share of HDI Market During Forecast Period

Figure 7 HDI Market for Wearable Devices to Grow at Highest CAGR During Forecast Period

Figure 8 HDI Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 9 Growing Demand for Smart Consumer Electronics and Wearable Devices Driving Growth of HDI Market

Figure 10 HDI Market for 10+ Layers HDI Expected to Grow at Highest CAGR During Forecast Period

Figure 11 China to Hold Largest Share of HDI Market in APAC in 2018

Figure 12 HDI Market in APAC Expected to Grow at Highest CAGR During Forecast Period

Figure 13 US Held Largest Share of HDI Market in 2018

Figure 14 Telecommunication to Hold Largest Share of HDI Market During Forecast Period

Figure 15 Growing Demand for Smart Consumer Electronics and Wearable Devices to Drive Growth of HDI Market

Figure 16 Total Smartphone Users Globally (2013–2020)

Figure 17 Number of Connected Devices By 2020: Cisco’s Perspective

Figure 18 Number of Connected Devices Worldwide (2015–2025)

Figure 19 Value Chain Analysis: Major Value Added During Raw Material Supply and Original Equipment Manufacturing Phases

Figure 20 HDI Market for 10+ Layers HDI to Grow at Highest CAGR During Forecast Period

Figure 21 HDI Market for Medical End-User Segment to Grow at Highest CAGR During Forecast Period

Figure 22 HDI Market for Connected Devices to Grow at Highest CAGR During Forecast Period

Figure 23 Geographic Snapshot: HDI Market

Figure 24 Americas: Snapshot of HDI Market

Figure 25 Europe: Snapshot of HDI Market

Figure 26 APAC: Snapshot of HDI Market

Figure 27 RoW: Snapshot of RoW Market

Figure 28 Inorganic Growth Strategies Majorly Adopted in HDI Market Between January 2016 and June 2018

Figure 29 Market Share of Top 5 Players in HDI Market, 2017

Figure 30 Global HDI Market Competitive Leadership Mapping, 2017

Figure 31 Evaluation Framework: HDI Market

Figure 32 Compeq Co.: Company Snapshot

Figure 33 TTM Technologies: Company Snapshot

Figure 34 Austria Technologie & Systemtechnik: Company Snapshot

Figure 35 Unimicron: Company Snapshot

Figure 36 Zhen Ding Tech.: Company Snapshot

Figure 37 Ncab Group: Company Snapshot

Figure 38 Fujitsu Interconnect Technologies: Company Snapshot

Figure 39 CMK: Company Snapshot

The study involved 4 major activities in estimating the size of the high density interconnect (HDI) market. Exhaustive secondary research has been done to collect information on the HDI market. Validation of these findings, assumptions, and sizing with industry experts across value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, PCB–related journals, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases. Few examples of secondary sources are the American National Standards Institute (ANSI), European Institute of Printed Circuits (EIPC), International Microelectronics and Packaging Society (IMAPS), Surface Mount Technology Association (SMTA), and The Institute of Electrical and Electronics Engineers (IEEE).

Primary Research

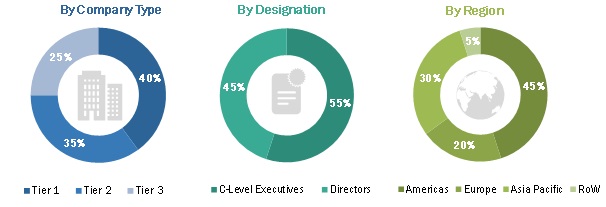

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the HDI market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the HDI market and its subsegments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size using the estimation processes explained above the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both demand and supply sides of the HDI market.

Report Objectives

- To define, describe, segment, and forecast the global HDI market, in terms of value, on the basis of product, application, end user, and geography

- To forecast the market size, in terms of value, segmented into 4 main regions—the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the HDI market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the HDI market

- To analyze opportunities in the market for stakeholders and the details of the competitive landscape for market leaders

- To provide a detailed overview of the HDI market value chain

- To analyze competitive developments such as expansions, acquisitions, collaborations, and partnerships, along with research and development (R&D) in the HDI market

- To strategically profile key players of the HDI market and comprehensively analyze their market shares and core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in High Density Interconnect Market

I am an IT engineer and a Ph.D. student as well, I am writing a report on PCB Industry and growth in HDI. Could you please showcase me the regional data for end use industry? I mean to say how much HDI PCBs are used in which segments? what are the percentages?

I am a Software Engineer and I am going to publish my 1st magazine on computer motherboard market as it is a HDI PCB. I just want to know the market size in terms of percentage in ASIA, EUROPE, and North America region. Please help me with this.