Molded Interconnect Device (MID) Market by Product Type (Antennae & Connectivity, Sensor),by Process (Laser Direct Structuring, Two-shot Molding), by Industry (Consumer Electronics, Telecommunication, Medical) and Geography - Global Forecast to 2027

Updated on : October 22, 2024

The Molded Interconnect Device (MID) Market is witnessing robust growth, driven by escalating demand for compact and efficient electronic components across various industries, including automotive, consumer electronics, and medical devices. As manufacturers increasingly seek to minimize space and weight in their designs, MIDs offer an innovative solution by integrating multiple functions into a single component, reducing assembly time and enhancing reliability. Key trends shaping the market include advancements in 3D printing technologies and the growing adoption of automation in production processes, which facilitate the customization and scalability of MID applications. Looking to the future, the Molded Interconnect Device Market is poised for further expansion, fueled by increasing investments in research and development, as well as the rising trend of smart devices that require advanced interconnect solutions. As technology evolves, MIDs are expected to play a pivotal role in enabling the next generation of miniaturized, multifunctional electronic systems.

Molded Interconnect Device (MID) Market Size

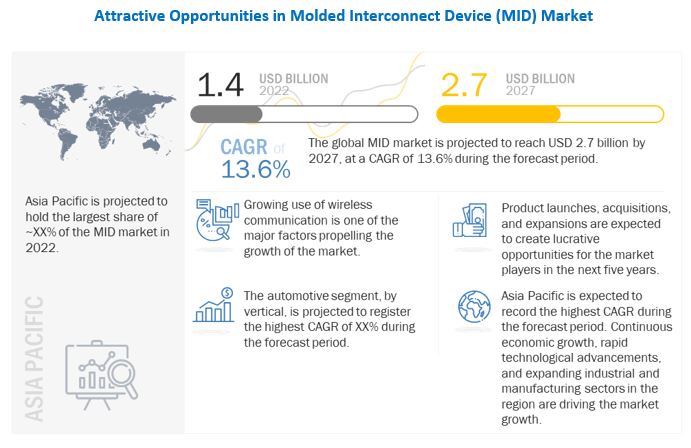

The molded interconnect device (MID) market size is expected to grow from USD 1.4 billion in 2022 to USD 2.7 billion by 2027; it is expected to grow at a CAGR of 13.6 % during the forecast period.

Key factors driving the demand for MIDs included the growing use of LDS process for the production of 5G antennas, which increases the speed and efficiency of wireless communication. Growing demand for IoT devices is bringing huge opportunities for MID providers.

To know about the assumptions considered for the study, Request for Free Sample Report

Molded Interconnect Device (MID) Market Segment Overview

Sensors to account for the highest CAGR of the molded interconnect device (MID) market by 2027

MID sensor have applications in industrial and automotive vertical. In industrial application MID is used in temperature sensor, pressure sensor among others.

With increase in technology in automotive, sensor have applications in adaptive scruise control systems and climate control related applications. The increasing use of MIDs in these application is improving the demand of MID sensors during forecast period.

Laser direct structuring (LDS) to account for largest market share of the molded interconnect device (MID) market by 2027

Laser direct structuring (LDS) is expected to account of molded interconnect device (MID) industry in 2027. LDS equipment is used to manufacture MIDs.

LDS consists of various steps, such as injection molding, laser activation, metallization, and assembly. LPKF Laser & Electronics is the sole manufacturer of LDS equipment.LDS is a three-step process. First, the antenna is molded in a standard single-shot mold by using one of the LDS resins.

The second step includes forming the desired pattern directly onto the antenna by 3D laser system. Finally, the pattern is plated using industry-standard methods where the pattern adheres to the plastic only in the area where plastic has been activated by laser, hence creating a conductive pattern. The key benefits of this process include 3D design capabilities, improved performance, and cost-saving.

Asia Pacific to have the largest market share in the molded interconnect device (MID) market during the forecast period

Asia Pacific is expected to witness the highest CAGR during the forecast period. The Asia Pacific region has the largest market share in the molded interconnect device (MID) industry.

This is mainly attributed to several OEMs as well as semiconductor devices and product manufacturers based out of Asia Pacific. The region has excelled offering of the most advanced semiconductor fabrication services as well as assembling services for electronic systems, especially from countries such as Taiwan, South Korea, and China. Moreover, semiconductor electronics companies gain considerable cost advantage by getting their products manufactured in countries such as China and Taiwan.

To know about the assumptions considered for the study, download the pdf brochure

Top Key Market Players in Molded Interconnect Device (MID) Industry

- Molex (US),

- TE Connectivity (Switzerland),

- Amphenol Corporation (US),

- LPKF Laser & Electronics (Germany),

- Taoglas (Dublin),

- Harting (Germany),

- Arlington Plating Company (US),

- MID Solutions (Germany),

- 2E Mechatronic (Germany),

- KYOCERA AVX (US) and

- Johnan (Japan), are among the molded interconnect device (MID) companies operating .

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Molded Interconnect Device (MID) Market Scope

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 1.4 Billion |

| Revenue Forecast in 2027 | USD 2.7 Billion |

| Growth Rate | 13.6 % |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

|

|

Regions covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Growing use of LDS in production of 5G antenna |

| Key Market Opportunity | Rising use of MIDs in automotive industry |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Laser direct structuring (LDS) |

| Highest CAGR Segment | Sensors Segment |

Molded Interconnect Device (MID) Market Dynamics:

Driver: Growing use of LDS in production of 5G antenna

The demand for superior voice and data services has led to the rollout of 4G-LTE or 5G services in different parts of the world. North American countries are the first adopters of the latest 5G technology.

Europe and Asia Pacific are gradually adapting to 5G technology. Most of the industries that use communication are deploying 5G antennas for improving the speed of communication. The production of antennas or any other electronic component that requires the generation of 5G is one of the major challenges for manufacturers. The aim to achieve higher frequency and higher data throughput is challenging for manufacturers. Laser direct structuring (LDS) process is ideal for the production of antennas.

Companies are using LDS process to develop antennas for 5G communications. LDS process helps to generate high-frequency antennas, easily and directly on 3D plastic components of any shape. This process reduces the need for cost-intensive and loss-prone connectors. The constant deployment of LDS process to develop 5G antennas is one of the major drivers of the molded interconnect device market.

Restraint: Technological monopoly of LDS equipment manufacturers

The molded interconnect device (MID) market is highly consolidated, with LPKF being a single player holding patent for LDS equipment (equipment used to manufacture MIDs), along with a few LDS equipment players based in China.

MID manufacturers outside China are reluctant to buy equipment from these players. Hence, all the MID manufacturers across the world are dependent on a single player for the equipment. This technological monopoly of a player hampers innovation activities and discourages competition, resulting in the high cost of MIDs.

Opportunity: Rising use of MIDs in automotive industry

With advancements in conventional car design and the evolution of EVs and HEVs, electronic components in vehicles have increased tremendously.

Modern vehicles require sensors and assistive electronics that increase passenger comfort and safety. Also, manufacturers are trying to reduce the number of electronic components used in vehicles to reduce manufacturing costs. This is expected to increase MID consumption in the automotive industry.

Challenge: Incompatibility with electronic packages

MID technology is incompatible with modern area-array-based packages. New electronic packages have multi layer structures for high count I/O devices and it’s a limitation with MID. MID consists of only one electric layer hence it is one of the major challenge for MIDs.

Molded Interconnect Device (MID) Market Categorization

This research report categorizes the molded interconnect device (MID) market based on Components, Type, Vertical and Region

Molded Interconnect Device (MID) Market, by Product Type

- Antennae & Connectivity Modules

- Sensors

- Connectors & Switches

- Lighting Systems

- Others

Molded Interconnect Device (MID) Market, by Process

- Laser Direct Structuring (LDS)

- Two-Shot Molding

- Film Techniques

Molded Interconnect Device (MID) Market, by Vertical

- Telecommunications

- Consumer Electronics

- Automotive

- Medical

- Industrial

- Military & Aerospace

Molded Interconnect Device (MID) Market, by Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments in Molded Interconnect Device (MID) Industry

- In May 2022, Taoglas has signed a partnership agreement with Dejerao. The company will help Dejerao’s customers by providing best-in-class RF antennas for cellular bonding devices used in mobile applications.

- In April 2022, Phillips-Medisize, a Molex company, has collaborated with SOTECH Health to develop a breath sensor system that detects COVID-19 in less than 30 seconds. Phillips-Medisize will help with its human-centric product design, rapid prototyping, and end-to-end manufacturing expertise.

- In March 2022, Amphenol Corporation has expanded its SURLOK Plus Series to include 8 mm and 10.3 mm right-angle connectors, with a voltage range of 1500 VDC to meet energy storage and high-power connection and transfer requirements.

- In November 2021, LPKF Laser & Electronics developed a new technology by combining LDS and laser plastic welding. LDS process places electrical circuits directly on parts with fine resolution in 2D and 3D design. Laser plastic welding provides visually and functionally welds for permeant and reliable joints.

Frequently Asked Questions (FAQs):

What are the key strategies adopted by key companies in the molded interconnect device (MID) market?

The product launch, acquisition and collaboration has been and continues to be some of the major strategies adopted by the key players to grow in the molded interconnect device (MID) market.

What region dominates molded interconnect device (MID) market?

Asia Pacific region will dominate molded interconnect device (MID) market.

Who are the major companies in the molded interconnect device (MID) market?

Molex (US), TE Connectivity (Switzerland), Amphenol Corporation (US), LPKF Laser & Electronics (Germany), and Taoglas (Dublin).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MOLDED INTERCONNECT DEVICE (MID) MARKET: SEGMENTATION

FIGURE 2 GEOGRAPHIC SCOPE

FIGURE 3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 4 PROCESS FLOW: MOLDED INTERCONNECT DEVICE (MID) MARKET SIZE ESTIMATION

FIGURE 5 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 List of key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 List of key primary respondents

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 6 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for deriving market size by top-down analysis

FIGURE 7 MOLDED INTERCONNECT DEVICE (MID) MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 9 LASER DIRECT STRUCTURING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 ANTENNAE AND CONNECTIVITY MODULES TO HOLD LARGEST SHARE OF MARKET BY 2027

FIGURE 11 AUTOMOTIVE TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC LIKELY TO BE FASTEST-GROWING MARKET FOR MOLDED INTERCONNECT DEVICES DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

FIGURE 13 INCREASING USE OF MOLDED INTERCONNECT DEVICES IN AUTOMOTIVE INDUSTRY TO OFFER OPPORTUNITIES FOR MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET, BY TYPE

FIGURE 14 SENSORS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY VERTICAL

FIGURE 15 CONSUMER ELECTRONICS VERTICAL TO HOLD LARGEST SHARE OF MID MARKET DURING FORECAST PERIOD

4.4 MARKET, BY PROCESS AND REGION

FIGURE 16 LDS TO HAVE LARGEST MARKET SIZE FOR LDS PROCESS DURING FORECAST PERIOD

4.5 MARKET, BY GEOGRAPHY (2027)

FIGURE 17 MID MARKET TO RECORD HIGHEST CAGR IN CHINA IN 2027

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 RISING DEMAND FOR MINIATURIZATION IN CONSUMER ELECTRONICS VERTICAL DRIVING MID MARKET

5.2.1 DRIVERS

5.2.1.1 Growing use of LDS in production of 5G antennas

5.2.1.2 Increasing use of MIDs in medical devices

5.2.1.3 Rising demand for miniaturization in consumer electronics industry

5.2.1.4 Intensifying need to reduce e-waste

5.2.2 RESTRAINTS

5.2.2.1 Technological monopoly of LDS equipment manufacturers

5.2.3 OPPORTUNITIES

5.2.3.1 Rising use of MIDs in automotive industry

5.2.3.2 Expanding IoT ecosystem

5.2.3.3 Opportunities for chip-level optical interconnects

5.2.4 CHALLENGES

5.2.4.1 Incompatibility with electronic packages

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 MID MARKET: VALUE CHAIN

5.3.1 RESEARCH AND DEVELOPMENT

5.3.2 MANUFACTURING

5.3.3 ASSEMBLY

5.3.4 MARKETING AND SALES

5.3.5 END-USERS

5.4 MID ECOSYSTEM ANALYSIS

FIGURE 20 MID ECOSYSTEM

TABLE 2 MID MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICE TRENDS FOR PRODUCTS

5.6 TRENDS AND DISTRIBUTION

FIGURE 21 REVENUE SHIFT FOR MID MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 3D MOLDED INTERCONNECT DEVICES

5.7.2 LASER PLASMA PATTERNING

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MID MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS (%)

5.9.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

TABLE 6 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

5.10 CASE STUDY ANALYSIS

5.10.1 MID SOLUTIONS

TABLE 7 SIEMENS COLLABORATED WITH LPKF LASER & ELECTRONICS FOR DEVELOPING MID-BASED HEARING AID

5.10.2 3D MID TECHNOLOGY

TABLE 8 3D MID COMPONENTS INSPECTION USING VISCOM S6056 MID

5.11 TRADE ANALYSIS

5.11.1 TRADE DATA FOR HS CODE 947330

FIGURE 24 IMPORT DATA FOR HS CODE 947330, BY COUNTRY, 2017−2021 (USD THOUSAND)

FIGURE 25 EXPORT DATA FOR HS CODE 947330, BY COUNTRY, 2017−2021 (USD THOUSAND)

5.12 TARIFF ANALYSIS

TABLE 9 TARIFFS DATA FOR HS 947330

5.13 PATENT ANALYSIS

FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 10 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

TABLE 11 LIST OF PATENTS

5.14 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 12 MID MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.15 REGULATORY LANDSCAPE

5.15.1 REGULATIONS PERTAINING TO ELECTRIC AND ELECTRONIC PRODUCTS

TABLE 13 REGULATIONS IN US

5.15.2 STANDARDS RELATED TO ELECTRICAL EQUIPMENT

TABLE 14 STANDARDS AND DESCRIPTION

5.15.3 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

6 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PRODUCT TYPE (Page No. - 67)

6.1 INTRODUCTION

FIGURE 28 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PRODUCT TYPE

FIGURE 29 ANTENNAE AND CONNECTIVITY MODULES TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 15 MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 16 MOLDED INTERCONNECT DEVICE MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

6.2 ANTENNAE AND CONNECTIVITY MODULES

6.2.1 EXTENSIVELY USED IN CONSUMER ELECTRONICS

TABLE 17 ANTENNAE AND CONNECTIVITY MODULES: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 18 ANTENNAE AND CONNECTIVITY MODULES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 19 ANTENNAE AND CONNECTIVITY MODULES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 ANTENNAE AND CONNECTIVITY MODULES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SENSORS

6.3.1 USED IN INDUSTRIAL APPLICATIONS

TABLE 21 SENSORS: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 22 SENSORS: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 23 SENSORS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 CONNECTORS AND SWITCHES

6.4.1 USED IN NAVIGATION DEVICES

TABLE 25 CONNECTORS AND SWITCHES: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 26 CONNECTORS AND SWITCHES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 27 CONNECTORS AND SWITCHES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 CONNECTORS AND SWITCHES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 LIGHTING SYSTEMS

6.5.1 MOLDED INTERCONNECT DEVICES MAKE LIGHTING SYSTEMS COST-EFFICIENT AND EFFECTIVE

TABLE 29 LIGHTING SYSTEMS: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 30 LIGHTING SYSTEMS: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 31 LIGHTING SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 LIGHTING SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 OTHERS

TABLE 33 OTHERS: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 34 OTHERS: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 35 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PROCESS (Page No. - 78)

7.1 INTRODUCTION

FIGURE 30 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY PROCESS

FIGURE 31 LASER DIRECT STRUCTURING (LDS) TO REGISTER HIGHEST CAGR IN MID MARKET DURING FORECAST PERIOD

TABLE 37 MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 38 MARKET, BY PROCESS, 2022–2027 (USD MILLION)

7.2 LASER DIRECT STRUCTURING (LDS)

7.2.1 CAN INTEGRATE MORE ELECTRONIC CIRCUITS INTO SMALLER SPACES

TABLE 39 LASER DIRECT STRUCTURING: MARKET, BY REGION 2018–2021 (USD MILLION)

TABLE 40 LASER DIRECT STRUCTURING: MARKET, BY REGION 2022–2027 (USD MILLION)

7.3 TWO-SHOT MOLDING

7.3.1 USED FOR HIGH-VOLUME PRODUCTION OF MOLDED INTERCONNECT DEVICES

TABLE 41 TWO-SHOT MOLDING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 TWO-SHOT MOLDING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 FILM TECHNIQUES

7.4.1 USED FOR PRODUCTION OF FLAT SURFACES

TABLE 43 FILM TECHNIQUES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 FILM TECHNIQUES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY VERTICAL (Page No. - 84)

8.1 INTRODUCTION

FIGURE 32 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY VERTICAL

FIGURE 33 AUTOMOTIVE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 45 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 46 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.2 TELECOMMUNICATIONS

8.2.1 USES MOLDED INTERCONNECT DEVICES FOR WIRELESS COMMUNICATIONS

TABLE 47 TELECOMMUNICATIONS: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 48 TELECOMMUNICATIONS: MARKET, BY PRODUCT TYPE, 2022–2027(USD MILLION)

TABLE 49 TELECOMMUNICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027(USD MILLION)

8.3 CONSUMER ELECTRONICS

8.3.1 USES MOLDED INTERCONNECT DEVICES IN ANTENNAS

TABLE 51 CONSUMER ELECTRONICS: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 52 CONSUMER ELECTRONICS: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 53 CONSUMER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 AUTOMOTIVE

8.4.1 DEPLOYS MOLDED INTERCONNECT DEVICES IN SMART VEHICLES

TABLE 55 AUTOMOTIVE: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 56 AUTOMOTIVE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 57 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 MEDICAL

8.5.1 NEED FOR MINIATURIZED MEDICAL DEVICES

TABLE 59 MEDICAL: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 60 MEDICAL: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 61 MEDICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MEDICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 INDUSTRIAL

8.6.1 MOLDED INTERCONNECT DEVICES ARE USED IN INDUSTRIAL SENSORS

TABLE 63 INDUSTRIAL: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 64 INDUSTRIAL: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 65 INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 MILITARY & AEROSPACE

8.7.1 GROWING DEMAND FOR RADAR AND ELECTRONIC WARFARE EQUIPMENT

TABLE 67 MILITARY & AEROSPACE: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 68 MILITARY & AEROSPACE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 69 MILITARY & AEROSPACE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MILITARY & AEROSPACE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MOLDED INTERCONNECT DEVICE (MID) MARKET, BY REGION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 34 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY PROCESS, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Increase in adoption of miniaturized packages

9.2.2 CANADA

9.2.2.1 Government initiatives and investments to support semiconductors manufacturing

9.3 EUROPE

FIGURE 36 EUROPE: MARKET SNAPSHOT

TABLE 81 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY PROCESS, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing demand for ADAS

9.3.2 FRANCE

9.3.2.1 Presence of developed communication network

9.3.3 UK

9.3.3.1 Heightened demand from medical vertical

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY PROCESS, 2022–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increase in medical equipment manufacturing

9.4.2 JAPAN

9.4.2.1 Increase in demand for consumer electronics and automobiles

9.4.3 SOUTH KOREA

9.4.3.1 Expansion of manufacturing sector

9.4.4 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD (ROW)

FIGURE 38 REST OF THE WORLD: MOLDED INTERCONNECT DEVICE MARKET SNAPSHOT

TABLE 97 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 99 ROW: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 100 ROW: MARKET, BY PROCESS, 2022–2027 (USD MILLION)

TABLE 101 ROW: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 102 ROW: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 103 ROW: MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 104 ROW: MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 High adoption of wireless communication

9.5.2 MIDDLE EAST AND AFRICA

9.5.2.1 Favorable government initiatives and high military investments

10 COMPETITIVE LANDSCAPE (Page No. - 121)

10.1 OVERVIEW

10.2 THREE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 39 REVENUE ANALYSIS, 2019–2021 (USD BILLION)

10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 105 KEY STRATEGIES OF TOP PLAYERS IN MID MARKET

10.4 MARKET SHARE ANALYSIS (2021)

TABLE 106 MID MARKET: MARKET SHARE ANALYSIS

FIGURE 40 MARKET SHARE ANALYSIS: MID MARKET, 2021

10.5 COMPANY EVALUATION QUADRANT, 2021

10.5.1 STARS

10.5.2 PERVASIVE PLAYERS

10.5.3 EMERGING LEADERS

10.5.4 PARTICIPANTS

FIGURE 41 MID MARKET: COMPANY EVALUATION QUADRANT, 2021

10.5.5 COMPANY FOOTPRINT

TABLE 107 COMPANY FOOTPRINT: MOLDED INTERCONNECT DEVICE (MID) MARKET

TABLE 108 COMPANY VERTICAL FOOTPRINT: MARKET

TABLE 109 COMPANY PROCESS FOOTPRINT: MARKET

TABLE 110 COMPANY REGIONAL FOOTPRINT: MARKET

10.6 SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 42 MARKET: SME EVALUATION QUADRANT, 2021

TABLE 111 MID MARKET: DETAILED LIST OF KEY STARTUPS/SMES

10.7 COMPETITIVE SCENARIO

TABLE 112 MARKET: PRODUCT LAUNCHES, JANUARY 2020–JANUARY 2022

TABLE 113 MARKET: DEALS, JANUARY 2020–JANUARY 2022

11 COMPANY PROFILES (Page No. - 136)

11.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

11.1.1 MOLEX

TABLE 114 MOLEX: BUSINESS OVERVIEW

TABLE 115 MOLEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 116 MOLEX: DEALS

11.1.2 LPKF LASER & ELECTRONICS

TABLE 117 LPKF LASER & ELECTRONICS: BUSINESS OVERVIEW

FIGURE 43 LPKF LASER & ELECTRONICS: COMPANY SNAPSHOT

TABLE 118 LPKF LASER & ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 119 LPKF LASER & ELECTRONICS: PRODUCT LAUNCHES

11.1.3 TE CONNECTIVITY

TABLE 120 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 44 TE CONNECTIVITY: COMPANY SNAPSHOT

TABLE 121 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 122 TE CONNECTIVITY: PRODUCT LAUNCHES

TABLE 123 TE CONNECTIVITY: DEALS

11.1.4 TAOGLAS

TABLE 124 TAOGLAS: BUSINESS OVERVIEW

TABLE 125 TAOGLAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 126 TAOGLAS: PRODUCT LAUNCHES

TABLE 127 TAOGLAS: DEALS

11.1.5 AMPHENOL CORPORATION

TABLE 128 AMPHENOL CORPORATION: BUSINESS OVERVIEW

FIGURE 45 AMPHENOL CORPORATION: COMPANY SNAPSHOT

TABLE 129 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 130 AMPHENOL CORPORATION: PRODUCT LAUNCHES

TABLE 131 AMPHENOL CORPORATION: DEALS

TABLE 132 AMPHENOL CORPORATION: OTHERS

11.1.6 HARTING

TABLE 133 HARTING: BUSINESS OVERVIEW

TABLE 134 HARTING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 135 HARTING: PRODUCT LAUNCHES

TABLE 136 HARTING: OTHERS

11.1.7 ARLINGTON PLATING COMPANY

TABLE 137 ARLINGTON PLATING COMPANY: BUSINESS OVERVIEW

TABLE 138 ARLINGTON PLATING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 139 ARLINGTON PLATING COMPANY: DEALS

TABLE 140 ARLINGTON PLATING COMPANY: OTHERS

11.1.8 MID SOLUTIONS GMBH

TABLE 141 MID SOLUTIONS GMBH: BUSINESS OVERVIEW

TABLE 142 MID SOLUTIONS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 143 MID SOLUTIONS GMBH: OTHERS

11.1.9 2E MECHATRONIC

TABLE 144 2E MECHATRONIC: BUSINESS OVERVIEW

TABLE 145 2E MECHATRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 146 2E MECHATRONIC: OTHERS

11.1.10 KYOCERA AVX

TABLE 147 KYOCERA AVX: BUSINESS OVERVIEW

TABLE 148 KYOCERA AVX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 149 KYOCERA AVX: PRODUCT LAUNCHES

TABLE 150 KYOCERA AVX: DEALS

TABLE 151 KYOCERA AVX: OTHERS

11.1.11 JOHNAN

TABLE 152 JOHNAN: BUSINESS OVERVIEW

TABLE 153 JOHNAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 JOHNAN: DEALS

TABLE 155 JOHNAN: OTHERS

11.2 OTHER IMPORTANT PLAYERS

11.2.1 TEPROSA

11.2.2 SUNWAY COMMUNICATION

11.2.3 AXON CABLE

11.2.4 S2P

11.2.5 SUZHOU CICOR TECHNOLOGY CO. LTD

11.2.6 TACTOTEK

11.2.7 DURATECH INDUSTRIES

11.2.8 TEKRA

11.2.9 YOMURA TECHNOLOGIES

11.2.10 MACDERMID ALPHA ELECTRONICS

11.2.11 GALTRONICS

11.2.12 YAZAKI CORPORATION

11.2.13 CHOGORI TECHNOLOGY

11.2.14 SUZHOU ZEETEK ELECTRONICS

11.2.15 TOYO CONNECTORS

11.2.16 SINOPLAST

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 172)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the molded interconnect device (MID) market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include molded interconnect device (MID)market journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

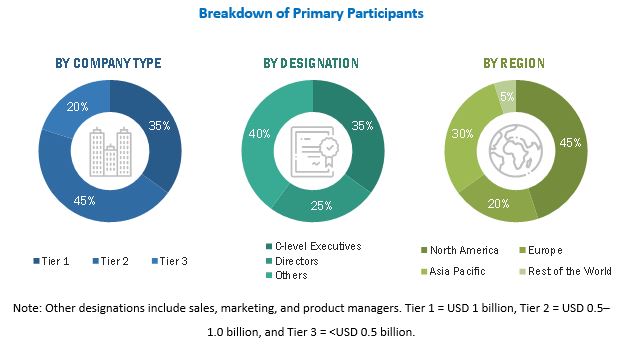

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the molded interconnect device (MID) market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the molded interconnect device (MID) market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Molded Interconnect Device (Mid) Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments.To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

The following are the primary objectives of the study.

- To define, describe, and forecast the molded interconnect device (MID) market, in terms of product type, process, vertical and region.

- To provide the market size estimation for North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth.

- To provide a detailed overview of the molded interconnect device (MID) market value chain

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies.

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market.

- To analyze competitive developments in the market, such as expansion, agreements, partnerships, contracts, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molded Interconnect Device (MID) Market