Energy Harvesting System Market Size, Share & Trends, 2025 To 2030

Energy Harvesting System Market by Light Energy Harvesting, Vibration Energy Harvesting, RF Energy Harvesting, Thermal Energy Harvesting, Transducers, Power Management Integrated Circuits, Building & Home Automation - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global energy harvesting system market is projected to grow from USD 0.61 billion in 2025 to USD 0.95 billion by 2030, at a CAGR of around 9.1% during the forecast period. Growth is fueled by the increasing demand for self-powered IoT devices, wireless sensor networks, and low-power electronics across industrial, consumer, and building automation applications. Advancements in transducer technologies, power management circuits, and energy storage components are enhancing efficiency and reliability, enabling broader deployment in smart infrastructure, wearable electronics, environmental monitoring, and predictive maintenance systems.

KEY TAKEAWAYS

- Light energy harvesting leads due to widespread photovoltaic adoption and its high efficiency, scalability, and easy integration across IoT and smart devices.

- Transducers dominate as they convert ambient energy into usable power and offer high efficiency, scalability, and improved output across applications.

- Building and home automation leads due to rising use of self-powered smart sensors that enhance energy efficiency and reduce maintenance needs.

- North America holds the largest marke share of 39.3% owing to strong IoT adoption, advanced automation, and major investments in smart infrastructure and sustainability.

- Major players/Stars in the energy harvesting system market are STMicroelectronics (Switzerland), Microchip Technology Inc. (US), Texas Instruments Incorporated (US), Analog Devices, Inc. (US), and Infineon Technologies AG (Germany) SME/Startups in the energy harvesting system market are Everactive, Inc. (US) and Wiliot (Israel), Ambri Incorporated (US) and VoltStorage (Germany), ENGOPLANET ENERGY SOLUTIONS LLC (US), and Enervibe labs (Israel)

Energy harvesting systems are innovative technologies that capture and convert ambient energy sources such as light, heat, vibration, and radio frequency into electrical energy to power low-consumption electronic devices. These systems eliminate the need for external power or frequent battery replacement, making them ideal for wireless sensor networks, IoT devices, wearable electronics, and building automation systems. With the rising adoption of smart and sustainable electronics, the energy harvesting system market is set for strong growth, driven by advancements in transducer efficiency, power management circuits, and miniaturized energy storage solutions, supporting reliable, maintenance-free, and eco-friendly energy generation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the energy harvesting system market is driven by evolving demand for self-powered electronics and advancements in ultra-low power technologies. Over the next 4–5 years, companies’ revenue mix will shift from standalone energy harvesting components to integrated energy harvesting modules and smart power management solutions. Two key trends shaping this transition include the integration of AI-enabled energy optimization for autonomous operation in IoT networks, and advancements in micro-scale transducers and energy storage technologies, enabling compact, efficient, and maintenance-free power solutions across industrial automation, healthcare wearables, and smart infrastructure applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for energy-efficient and sustainable solutions

-

Integration of IoT devices in building & home automation

Level

-

High initial cost of energy harvesting system

-

Limited Power Output and Storage Challenges

Level

-

Expansion of Smart Cities and Infrastructure Projects

-

Adoption of sensors in wearable electronics

Level

-

Lack of Standardization and Compatibility Issues

-

Slow Adoption in Large-Scale Industrial Applications

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for energy-efficient and sustainable solutions

The rising demand for energy-efficient and sustainable solutions is a significant factor driving the growth of the energy harvesting system market. As industries and consumers focus on reducing energy waste and minimizing dependence on traditional power sources, energy harvesting technologies are gaining traction for their ability to convert ambient energy into usable power. These systems utilize solar, thermal, kinetic, and radio frequency (RF) energy to generate electricity for various applications, including industrial automation, IoT devices, and wearable electronics.

Restraint: High initial cost of energy harvesting system

The high initial cost of energy harvesting systems is a significant challenge in the market. These systems, which capture and convert energy from solar, thermal, and vibration sources, require specialized materials, advanced components, and complex integration, leading to significant upfront expenses. Costs include developing and deploying energy harvesting modules, investing in energy storage solutions, and customization for specific applications such as IoT, industrial automation, and smart buildings.

Opportunity: Expansion of Smart Cities and Infrastructure Projects

The rapid growth of smart cities and infrastructure projects creates significant opportunities in the energy harvesting system market. These technologies enable self-powered and sustainable solutions for urban infrastructure, IoT devices, and smart transportation systems. By utilizing energy sources such as solar, thermal, piezoelectric, and RF, energy harvesting reduces reliance on traditional power grids, making it essential for the expanding smart city landscape.

Challenge: Lack of Standardization and Compatibility Issues

The energy harvesting system market faces a key challenge due to the lack of standardization and compatibility, making integration across different applications difficult. Technologies like piezoelectric, thermoelectric, and RF energy harvesting must work smoothly with power management and IoT systems. However, without universal standards, differences in communication protocols, hardware connections, and power conversion methods create inefficiencies. This lack of uniformity complicates business adoption, requiring extra effort and cost to ensure systems work together effectively. Standardized frameworks and industry-wide collaboration will improve compatibility and drive wider adoption of energy harvesting solutions.

Energy Harvesting System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops ultra-low power energy harvesting ICs and power management modules supporting multiple sources such as vibration, light, and thermal energy. | Extended battery life for IoT devices | Seamless energy conversion | Compact and efficient design for sensor networks. |

|

Offers energy harvesting solutions integrated with wireless microcontrollers and low-power sensor interfaces for autonomous operation. | Simplified IoT integration | Maintenance-free operation | Enhanced performance for industrial and smart building applications. |

|

Provides complete energy harvesting reference designs with advanced power management ICs for solar, vibration, and RF-based harvesting. | Reliable power for remote sensors | Scalable design | High conversion efficiency and load adaptability. |

|

Specializes in precision analog and mixed-signal energy harvesting circuits with integrated battery charging and power conditioning. | Optimized for healthcare wearables | Stable operation under low-energy input | Reduced energy losses and extended device lifespan. |

|

Focuses on semiconductor-based energy harvesting transducers and ultra-low leakage power management components for industrial IoT. | High reliability in harsh environments | Improved energy autonomy | Sustainable power solutions for smart infrastructure. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The energy harvesting system ecosystem involves a collaborative network of manufacturers, distributors, system integrators, and end users working together to enable self-powered electronic systems. Manufacturers such as Texas Instruments, STMicroelectronics, and EnOcean focus on developing advanced transducers, power management ICs, and ultra-low power semiconductors that efficiently capture ambient energy from light, vibration, and thermal sources. System integrators like ABB, Schneider Electric, and Honeywell play a key role in incorporating these technologies into industrial automation, smart buildings, and IoT-enabled systems by integrating energy harvesting modules with monitoring and control platforms. Distributors such as Avnet, Arrow Electronics, and Mouser Electronics ensure efficient global supply and accessibility of energy harvesting components. End users, including companies like Tesla, Legrand, and Apple, utilize these solutions to power smart devices, sensors, and building systems, supporting energy efficiency, sustainability, and reduced maintenance across diverse applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Energy Harvesting System Market, By Technology

Light energy harvesting holds the largest market size during the forecast period due to its widespread adoption in powering sensors, wearables, and building automation systems. The availability of efficient photovoltaic materials, abundant light sources (both indoor and outdoor), and declining solar cell costs make it the most reliable and scalable energy harvesting technology.

Energy Harvesting System Market, By Application

Building & Home Automation holds the largest market size in the energy harvesting system market due to the rising adoption of wireless sensors and IoT-based control systems for lighting, temperature, and security management. Energy harvesting enables maintenance-free, batteryless operation, reducing installation costs and enhancing sustainability in smart and energy-efficient buildings.

Energy Harvesting System Market, By Component

Transducers hold the largest market size in the energy harvesting system market as they serve as the core component that converts ambient energy sources such as light, vibration, or thermal energy into electrical power. Their widespread use across multiple energy types and advancements in material efficiency drive their dominance and broad applicability across industries.

REGION

Asia Pacific is expected to be fastest-growing segment in the energy harvesting system market during the forecast period

Asia Pacific is expected to witness the highest CAGR in the energy harvesting system market due to rapid industrialization, expansion of smart cities, and increasing adoption of IoT-based technologies. Government initiatives promoting renewable energy, coupled with growing demand for energy-efficient electronics in countries like China, Japan, and India, further accelerate market growth.

Energy Harvesting System Market: COMPANY EVALUATION MATRIX

In the energy harvesting system market matrix, STMicroelectronics (Star) leads with a strong market presence and an extensive portfolio of energy harvesting ICs, transducers, and power management solutions that enable efficient energy conversion for IoT devices, industrial automation, and smart infrastructure. ABB (Emerging Leader) is gaining momentum with its integration of energy harvesting technologies into industrial and building automation systems, focusing on smart energy management and self-powered sensor networks, positioning itself as a key innovator in scalable, energy-efficient industrial solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.55 Billion |

| Market Forecast in 2030 (Value) | USD 0.95 Billion |

| Growth Rate | CAGR of 9.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Energy Harvesting System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Energy Harvesting Component Manufacturer / OEM |

|

|

| System Integrator / IoT Solution Provider |

|

|

| Government / Energy Agency |

|

|

| Industrial / Commercial End User |

|

|

RECENT DEVELOPMENTS

- July 2024 : STMicroelectronics (Switzerland) and Dracula Technologies (France) collaborated to integrate Dracula’s LAYER organic photovoltaic (OPV) technology with STMicroelectronics’ STM32U0 microcontroller.

- March 2024 : STMicroelectronics introduced the STM32U0, a new ultra-low-power microcontroller (MCU) designed for industrial, medical, smart metering, and consumer applications. It reduces energy consumption by up to 50%, enabling devices to run longer on batteries or operate solely on energy-harvesting systems like small solar cells.

- October 2023 : Microchip Technology (US) introduced the PIC32CZ CA MCU family, which includes models with integrated hardware security modules (HSM) to enhance security in industrial and consumer applications.

- May 2021 : Analog Devices, Inc. (US) introduced an expanded portfolio of battery management systems (BMS) featuring ASIL-D functional safety and low-power capabilities.

Table of Contents

Methodology

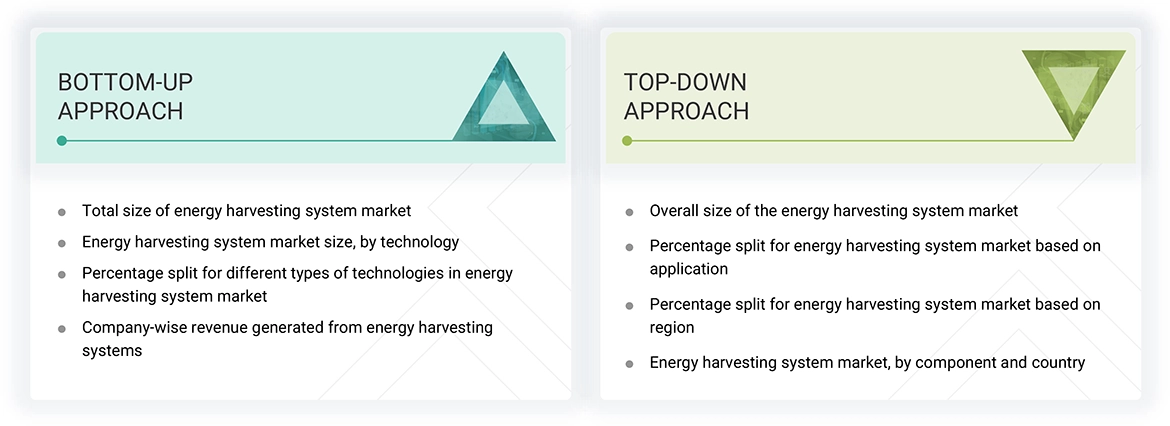

The research study involved 4 major activities in estimating the size of the energy harvesting system market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

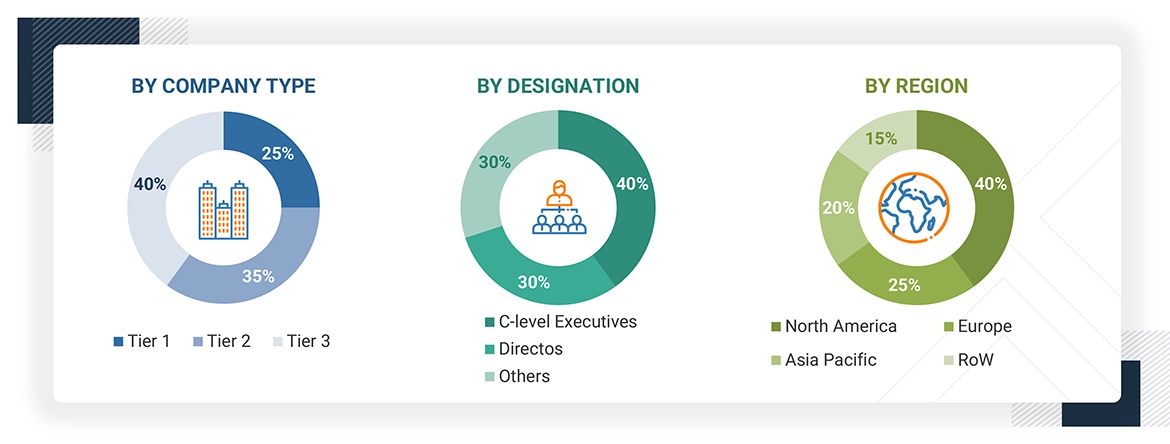

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the energy harvesting system market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the energy harvesting system market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the energy harvesting system market.

- Identifying various key players offering energy harvesting systems

- Identification of key segments within the energy harvesting system market across different geographical regions

- Analyzing the penetration of each type of technology in various applications through secondary and primary research

- Estimation of the market size in various regions by analyzing the adoption of energy harvesting technologies across different applications

- Tracking ongoing and upcoming developments in energy harvesting systems

- Compilation of regional market size data for each segment to derive regional market estimates

- Conducting multiple discussion sessions with key opinion leaders to understand the implementation of energy harvesting systems in multiple applications, which would help in analyzing the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, and operation managers, and the MarketsandMarkets domain experts

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the energy harvesting system market

- Focusing on the top-line investments and expenditures made in the energy harvesting system market ecosystem and splitting into the market segments

- Identifying major players in the energy harvesting system market by technology and component offering through secondary research and dully verified with a brief discussion with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth pockets across all key segments

- Estimating the geographic split using secondary sources based on factors such as the number of players in a specific country and region, types of offerings, and applications catered

- Breaking down the total market based on verified splits and key growth pockets across all segments and subsegments

Energy Harvesting System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides of the energy harvesting system market.

Market Definition

Energy harvesting systems consist of advanced technologies and techniques that aim at the harvesting, storage, and conversion of ambient energy sources into useful electrical power. These systems enhance the sustainability, efficiency, and longevity of electronic devices and minimize the reliance on conventional power sources and batteries in different industries. The fundamental components of energy harvesting systems include energy transducers (photovoltaic cells, thermoelectric generators, piezoelectric materials, and RF energy harvesters), power management circuits, and energy storage devices such as supercapacitors and micro-batteries. Some of the well-known technologies and tools in this field include thermoelectric energy harvesters, piezoelectric vibration energy harvesters, and hybrid energy harvesting systems with multiple sources to provide high efficiency. The applications of energy harvesting systems include building & home automation, consumer electronics, industrial automation, transportation, security, and agriculture & smart farming. The applications include smart buildings' wireless sensors powered by themselves, battery-less wearable products in consumer electronics, transportation regenerative braking systems, and self-powered monitoring solutions in precision farming. These systems provide reliable, maintenance-free power solutions utilizing renewable energy sources and are hence appropriate for commercial and industrial applications in energy efficiency and sustainability.

An SSE solution requires four fundamental security capabilities: zero trust access network (ZTNA), cloud access security broker (CASB), secure web gateway (SWG), and firewall-as-a-service (FWaaS).

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Integrated device manufacturers (IDMs)

- Energy harvesting system component manufacturers

- Original device manufacturers (ODMs)

- Original equipment manufacturers (OEMs) of energy harvesting systems

- Distributors and traders

- Research organizations

- Organizations, forums, alliances, and associations related to energy harvesting systems

Report Objectives

- To define, describe, segment, and forecast the energy harvesting system market size by technology, component, application, and region, in terms of value

- To describe and forecast the energy harvesting system market size in four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the energy harvesting system value chain and ecosystem, along with the average selling price by component and region

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze the impact of AI/Gen AI on the energy harvesting system market

- To analyze the macroeconomic outlook for regions such as North America, Europe, Asia Pacific, and RoW

- To analyze strategies such as product launches, collaborations, acquisitions, and partnerships adopted by players in the energy harvesting system market

- To profile key energy harvesting system market players and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Energy Harvesting System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Energy Harvesting System Market