Hybrid Fiber Coaxial Market by Technology (DOCSIS 3.0 & Below and DOCSIS 3.1), Component (CMTS/CCAP, Fiber Optic Cable, Amplifier, Optical Node, Optical Transceiver, Splitter, and CPE), and Geography - Global Forecast to 2023

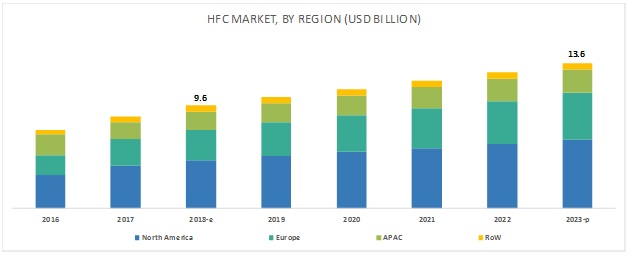

The hybrid fiber coaxial market report share is estimated to be USD 9.6 billion in 2018 and expected to reach USD 13.6 billion by 2023, at a CAGR of 8.8% from 2018 to 2023.

Major factors driving the markets growth include high bandwidth and cost efficiency compared to other technologies. In line with this, the use of HFC has gained remarkable consideration for data transfer in IoT applications. However, factors such as troubleshooting and maintenance issues after deployment are restraining the markets growth.

Hybrid Fiber Coaxial Market Segment Overview

By technology, DOCSIS 3.1 expected to grow at fast rate during forecast period

DOCSIS is expected to be a fast-growing technology for hybrid fiber coaxial market during the forecast period. DOCSIS 3.1 is the latest version of DOCSIS, and its adoption is expected to rise as it provides greater capacity and speed as compared to the previous versions. Majority of the service providers are already deploying DOCSIS 3.1 in their HFC networks and experiencing a better change in delivering services to their customers.

CMTS/CCAP accounts for largest market size during forecast period

CMTS/CCAP is expected to hold the largest share of the hybrid fiber coaxial market throughout the forecast period. CMTS/CCAP systems are located in the headends of multiple service operators (MSOs). Generally, these systems are used to exchange digital signals on a cable network with cable modems. They enable services such as video streaming, voice over internet protocol (VoIP), and high-speed internet. CMTS is used for managing cable modems in HFC networks. Thus, CMTS/CCAP play an important role in the complete HFC network.

North America is expected to account for largest market share during forecast period

North America accounted for the largest share of the overall hybrid fiber coaxial market in 2018, with the US being one of the major contributors in terms of market size. North America is a major revenue generating region in the global HFC market. Majority of the HFC equipment/solutions providers across the region are constantly involved in product innovation and deployment of HFC network in this region.

The major players in the hybrid fiber coaxial market are Arris (US), Huawei (China), Nokia (Finland), Technicolor (France), Cisco (US), Corning, (US), Ciena (US), Comcast (US), CommScope (US), Teleste Corp. (Finland), Telstra Corp. (Australia), PCT International (US), ZTE (China), Comba (China), Skyworks (US), Vodafone (England), Vecima Networks (Canada), Technetix (UK), Infinera (US), Finisar (US), Bentley Systems (US), Bktel (Germany), C-COR Broadband (Australia), Verizon (US), Charter Communications (US), Cox Communications (US), Singtel Optus (China), Com Hem (Sweden), TDC (Denmark), Telecom Italia (Italy), and Telefonica (Spain).

Hybrid Fiber Coaxial Market Report Scope :

|

Report Metric |

Details |

| Estimated Value | USD 9.6 Billion |

| Revenue Forecast in 2023 | USD 13.6 Billion |

| Growth Rate | 8.8% |

|

Forecast period |

2018-2023 |

|

Market sizes available for years |

2016-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Largest Market Share Segment | CMTS/CCAP |

| Largest Growing Region | North America |

This report categorizes the HFC market based on technology, component, and region.

Hybrid Fiber Coaxial Market , By Technology

- DOCSIS 3.0 & Below

- DOCSIS 3.1

Hybrid Fiber Coaxial Market , By Component

- CMTS/CCAP

- Fiber Optic Cable

- Amplifier

- Optical Node

- Optical Transceiver

- Splitter

- CPE

Hybrid Fiber Coaxial Market , By Geography

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- Japan

- Australia

- Korea

- Singapore

- Rest of APAC

- Rest of the World (RoW)

- South America

- Africa

- Middle East

Recent Developments in Hybrid Fiber Coaxial Market

- In October 2018, Teleste introduced a remote PHY ready node called ICON9000. In addition to meeting the standards and requirements of distributed network architectures, the node can offer cable subscribers with symmetrical, 10-Gigabit-grade speeds over HFC networks.

- In October 2018, Cisco introduced the Full Duplex-Ready GS7000 FDXi neighborhood node. This equipment divides broadband service distribution to a number of households in a neighborhood.

- In June 2018, Corning Inc. acquired the Communication Markets Division of 3M Company. This acquisition extended Corning Optical Communications market reach and access to customers, particularly in key growth areas in Europe, the Middle East and Asia; and Central and Latin America.

- In June 2017, Ciena implemented DOCSIS 3.0 into its networks to increase upstream and downstream speeds.

Key Questions addressed by the report

- What are the significant components of an HFC network?

- What is the size of the global HFC market?

- Who are the major HFC equipment/solution and service providers globally?

- Which regions can be expected to present the largest and fastest-growing markets?

- What are the major strategies adopted by leading companies?

- What is the dominating technology for HFC?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews With Experts

2.1.3.2 Breakdown of Primaries

2.1.3.3 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Approach (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Approach (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities for Hybrid Fiber Coaxial (HFC) Market

4.2 HFC Market, By Component

4.3 HFC Market, By Technology

4.4 HFC Market in North America, By Component & Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Cost Efficiency of HFC Cables

5.2.1.2 Increasing Demand for Higher Bandwidth

5.2.1.3 IoT Gaining Global Foothold

5.2.2 Restraints

5.2.2.1 Proactive Monitoring, Troubleshooting, and Maintenance Issues

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Video-Focused Data

5.2.3.2 Docsis 3.1 Technology Upgrade Cycle

5.2.4 Challenges

5.2.4.1 Signal Interference in Return Paths

6 HFC Market, By Technology (Page No. - 35)

6.1 Introduction

6.2 Docsis 3.1

6.3 Docsis 3.0 & Below

7 HFC Market, By Deployment (Page No. - 35)

7.1 Introduction

7.2 Interconnections

7.3 On-Premises

8 HFC Market, By Application (Page No. - 35)

8.1 Introduction

8.2 Broadcasting

8.2.1 Analog

8.2.2 Digital

8.3 Broadband

8.4 Telephone Network

8.5 Others

9 HFC Market, By Component (Page No. - 38)

9.1 Introduction

9.2 CMTS/CCAP

9.3 Fiber Optic Cable

9.4 Amplifier

9.5 Optical Node

9.6 Optical Transceiver

9.7 Splitter

9.8 Customer Premises Equipment

10 Geographic Analysis (Page No. - 56)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 Italy

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 Korea

10.4.6 Singapore

10.4.7 Rest of APAC

10.5 RoW

10.5.1 South America

10.5.2 Africa

10.5.3 Middle East

11 Competitive Landscape (Page No. - 72)

11.1 Overview

11.2 Competitive Situations and Trends

11.2.1 Product Launches

11.2.2 Partnerships, Agreements, and Contracts

11.2.3 Others

12 Company Profiles (Page No. - 75)

12.1 Overview

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Equipment/Solution Providers

12.2.1 Arris

12.2.2 Huawei

12.2.3 Nokia

12.2.4 Technicolor

12.2.5 Cisco

12.2.6 Corning

12.2.7 Ciena

12.2.8 Commscope

12.2.9 PCT International

12.2.10 ZTE

12.2.11 Comba

12.2.12 Skyworks

12.2.13 Vecima Networks

12.2.14 Technetix

12.2.15 Infinera

12.2.16 Finisar

12.2.17 Bentley Systems

12.2.18 Bktel

12.2.19 C-Cor Broadband

12.3 Service Providers

12.3.1 Comcast

12.3.2 Teleste Corporation

12.3.3 Telstra

12.3.4 Vodafone

12.3.5 Verizon

12.3.6 Charter Communications

12.3.7 COX Communications

12.3.8 Singtel Optus

12.3.9 Com Hem

12.3.10 TDC

12.3.11 Telecom Italia

12.3.12 Telefonica

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 107)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (132 Tables)

Table 1 Research Study Assumptions

Table 2 Docsis Technology Evolution (1990 2018)

Table 3 Hybrid Fiber Coaxial Market, By Technology, 20162023 (USD Million)

Table 4 DCOSIS 3.0 Market for Hybrid Fiber Coaxial Market, By Region, 20162023 (USD Million)

Table 5 DCOSIS 3.0 Market for Hybrid Fiber Coaxial Market in North America, By Country, 20162023 (USD Million)

Table 6 DCOSIS 3.0 Market for Hybrid Fiber Coaxial Market in Europe, By Country, 20162023 (USD Million)

Table 7 DCOSIS 3.0 Market for Hybrid Fiber Coaxial Market in APAC, By Country, 20162023 (USD Million)

Table 8 DCOSIS 3.0 Market for Hybrid Fiber Coaxial Market in RoW, By Country, 20162023 (USD Million)

Table 9 DCOSIS 3.1 Market for Hybrid Fibers Coaxial Market, By Region, 20162023 (USD Million)

Table 10 DCOSIS 3.1 Market for Hybrid Fibers Coaxial Market in North America, By Country, 20162023 (USD Million)

Table 11 DCOSIS 3.1 Market for Hybrid Fibers Coaxial Market in Europe, By Country, 20162023 (USD Million)

Table 12 DCOSIS 3.1 Market for Hybrid Fibers Coaxial Market in APAC, By Country, 20162023 (USD Million)

Table 13 DCOSIS 3.1 Market for Hybrid Fibers Coaxial Market in RoW, By Country, 20162023 (USD Million)

Table 14 Hybrid Fiber Coaxial (HFC) Market, By Component, 20162023 (USD Million)

Table 15 HFC Market for CMTS/CCAP, By Region, 20162023 (USD Million)

Table 16 HFC Market for CMTS/CCAP in North America, By Country, 20162023 (USD Million)

Table 17 Market for CMTS/CCAP in Europe, By Country, 20162023 (USD Million)

Table 18 Hybrid Fiber Coaxial Market for CMTS/CCAP in Asia Pacific, By Country, 20162023 (USD Million)

Table 19 Market for CMTS/CCAP in RoW, By Region, 20162023 (USD Million)

Table 20 Market for Fiber Optic Cable, By Region, 20162023 (USD Million)

Table 21 Market for Fiber Optic Cable in North America, By Country, 20162023 (USD Million)

Table 22 Market for Fiber Optic Cable in Europe, By Country, 20162023 (USD Million)

Table 23 Market for Fiber Optic Cable in Asia Pacific, By Country, 20162023 (USD Million)

Table 24 Hybrid Fiber Coaxial Market for Fiber Optic Cable in RoW, By Region, 20162023 (USD Million)

Table 25 Market for Amplifier, By Region, 20162023 (USD Million)

Table 26 Market for Amplifier in North America, By Country, 20162023 (USD Million)

Table 27 Market for Amplifier in Europe, By Country, 20162023 (USD Million)

Table 28 Market for Amplifier in Asia Pacific, By Country, 20162023 (USD Million)

Table 29 Market for Amplifier in RoW, By Country, 20162023 (USD Million)

Table 30 Market for Optical Node, By Region, 20162023 (USD Million)

Table 31 Market for Optical Node in North America, By Country, 20162023 (USD Million)

Table 32 Market for Optical Node in Europe, By Country, 20162023 (USD Million)

Table 33 Market for Optical Node in Asia Pacific, By Country, 20162023 (USD Million)

Table 34 Market for Optical Node in RoW, By Region, 20162023 (USD Million)

Table 35 Market for Optical Transceiver, By Region, 20162023 (USD Million)

Table 36 Hybrid Fiber Coaxial Market for Optical Transceiver in North America, By Country, 20162023 (USD Million)

Table 37 Market for Optical Transceiver in Europe, By Country, 20162023 (USD Million)

Table 38 Market for Optical Transceiver in Asia Pacific, By Country, 20162023 (USD Million)

Table 39 Market for Optical Transceiver in RoW, By Country, 20162023 (USD Million)

Table 40 Market for Splitter, By Region, 20162023 (USD Million)

Table 41 Market for Splitter in North America, By Country, 20162023 (USD Million)

Table 42 Market for Splitter in Europe, By Country, 20162023 (USD Million)

Table 43 Market for Splitter in Asia Pacific, By Country, 20162023 (USD Million)

Table 44 Market for Splitter in RoW, By Country, 20162023 (USD Million)

Table 45 Market for CPE, By Region, 20162023 (USD Million)

Table 46 Market for CPE in North America, By Country, 20162023 (USD Million)

Table 47 Hybrid Fiber Coaxial Market for CPE in Europe, By Country, 20162023 (USD Million)

Table 48 Market for CPE in Asia Pacific, By Country, 20162023 (USD Million)

Table 49 Market for CPE in RoW, By Country, 20162023 (USD Million)

Table 50 Market, By Deployment Type, 20162023 (USD Million)

Table 51 Interconnection HFC Market, By Region, 20162023 (USD Million)

Table 52 Interconnection HFC Market in North America, By Country, 20162023 (USD Million)

Table 53 Interconnection HFC Market in Europe, By Country, 20162023 (USD Million)

Table 54 Interconnection HFC Market in APAC, By Country, 20162023 (USD Million)

Table 55 Interconnection HFC Market in RoW, By Country, 20162023 (USD Million)

Table 56 On Premise HFC Market, By Region, 20162023 (USD Million)

Table 57 On Premise HFC Market in North America, By Country, 20162023 (USD Million)

Table 58 On Premise HFC Market in Europe, By Country, 20162023 (USD Million)

Table 59 On Premise HFC Market in APAC, By Country, 20162023 (USD Million)

Table 60 On Premise HFC Market in RoW, By Country, 20162023 (USD Million)

Table 61 Hybrid Fiber Coaxial (HFC) Market, By Application, 20162023 (USD Million)

Table 62 Broadcasting Market for Hybrid Fiber Coaxial Market, By Type, 20162023 (USD Million)

Table 63 Broadcasting Market for HFC Market, By Region, 20162023 (USD Million)

Table 64 Broadcasting Market for HFC Market in North America, By Country, 20162023 (USD Million)

Table 65 Broadcasting Market for HFC Market in Europe, By Country, 20162023 (USD Million)

Table 66 Broadcasting Market for HFC Market in APAC, By Country, 20162023 (USD Million)

Table 67 Broadcasting Market for HFC Market in RoW, By Country, 20162023 (USD Million)

Table 68 Broadband Market for HFC Market, By Region, 20162023 (USD Million)

Table 69 Broadband Market for HFC Market in North America, By Country, 20162023 (USD Million)

Table 70 Broadband Market for HFC Market in Europe, By Country, 20162023 (USD Million)

Table 71 Broadband Market for HFC Market in APAC, By Country, 20162023 (USD Million)

Table 72 Broadband Market for HFC Market in RoW, By Country, 20162023 (USD Million)

Table 73 Telephone Network Market for HFC Market, By Region, 20162023 (USD Million)

Table 74 Telephone Network Market for HFC Market in North America, By Country, 20162023 (USD Million)

Table 75 Telephone Network for HFC Market in Europe, By Country, 20162023 (USD Million)

Table 76 Telephone Network Market for HFC Market in APAC, By Country, 20162023 (USD Million)

Table 77 Telephone Network Market for HFC Market in RoW, By Country, 20162023 (USD Million)

Table 78 Other Application Market for HFC Market, By Region, 20162023 (USD Million)

Table 79 Other Application Market for HFC Market in North America, By Country, 20162023 (USD Million)

Table 80 Other Application for Hybrid Fiber Coaxial Marketin Europe, By Country, 20162023 (USD Million)

Table 81 Other Application Market for HFC Market in APAC, By Country, 20162023 (USD Million)

Table 82 Other Application Market for HFC Market in RoW, By Country, 20162023 (USD Million)

Table 83 Hybrid Fiber Coaxial (HFC) Market, By Region, 20162023 (USD Million)

Table 84 HFC Market in North America, By Technology, 20162023 (USD Million)

Table 85 HFC Market in North America, By Component, 20162023 (USD Million)

Table 86 HFC Market in North America, By Country, 20162023 (USD Million)

Table 87 HFC Market in US, By Technology, 20162023 (USD Million)

Table 88 HFC Market in Canada, By Technology, 20162023 (USD Million)

Table 89 Hybrid Fiber Coaxial Market in Mexico, By Technology, 20162023 (USD Million)

Table 90 HFC Market in US, By Application, 20162023 (USD Million)

Table 91 HFC Market in Canada, By Application, 20162023 (USD Million)

Table 92 HFC Market in Mexico, By Application, 20162023 (USD Million)

Table 93 HFC Market in Europe, By Technology, 20162023 (USD Million)

Table 94 HFC Market in Europe, By Country, 20162023 (USD Million)

Table 95 HFC Market in Europe, By Component, 20162023 (USD Million)

Table 96 Hybrid Fiber Coaxial Market in UK, By Technology, 20162023 (USD Million)

Table 97 HFC Market in Germany, By Technology, 20162023 (USD Million)

Table 98 HFC Market in Italy, By Technology, 20162023 (USD Million)

Table 99 HFC Market in Rest of Europe, By Technology, 20162023 (USD Million)

Table 100 HFC Market in UK, By Application, 20162023 (USD Million)

Table 101 HFC Market in Germany, By Application, 20162023 (USD Million)

Table 102 HFC Market in Italy, By Application, 20162023 (USD Million)

Table 103 HFC Market in Rest of Europe, By Application, 20162023 (USD Million)

Table 104 HFC Market in APAC, By Technology, 20162023 (USD Million)

Table 105 HFC Market in Asia Pacific, By Country, 20162023 (USD Million)

Table 106 HFC Market in APAC, By Component, 20162023 (USD Million)

Table 107 HFC Market in China, By Technology, 20162023 (USD Million)

Table 108 HFC Market in Japan, By Technology, 20162023 (USD Million)

Table 109 HFC Market in India, By Technology, 20162023 (USD Million)

Table 110 Hybrid Fiber Coaxial Market in Australia, By Technology, 20162023 (USD Million)

Table 111 HFC Market in Korea, By Technology, 20162023 (USD Million)

Table 112 HFC Market in Singapore, By Technology, 20162023 (USD Million)

Table 113 HFC Market in Rest of APAC, By Technology, 20162023 (USD Million)

Table 114 HFC Market in China, By Application, 20162023 (USD Million)

Table 115 HFC Market in Japan, By Application, 20162023 (USD Million)

Table 116 HFC Market in India, By Application, 20162023 (USD Million)

Table 117 Hybrid Fiber Coaxial Market in Australia, By Application, 20162023 (USD Million)

Table 118 HFC Market in Korea, By Application, 20162023 (USD Million)

Table 119 HFC Market in Singapore, By Application, 20162023 (USD Million)

Table 120 HFC Market in Rest of APAC, By Application, 20162023 (USD Million)

Table 121 HFC Market in RoW, By Technology, 20162023 (USD Million)

Table 122 HFC Market in RoW, By Region, 20162023 (USD Million)

Table 123 HFC Market in RoW, By Component, 20162023 (USD Million)

Table 124 HFC Market in South America, By Technology, 20162023 (USD Million)

Table 125 HFC Market in Africa, By Technology, 20162023 (USD Million)

Table 126 HFC Market in Middle East, By Technology, 20162023 (USD Million)

Table 127 HFC Market in South America, By Application, 20162023 (USD Million)

Table 128 Hybrid Fiber Coaxial Market in Africa, By Application, 20162023 (USD Million)

Table 129 HFC Market in Middle East, By Application, 20162023 (USD Million)

Table 130 Product Launches (20152018)

Table 131 Partnerships, Agreements, and Contracts (20152018)

Table 132 Mergers & Acquisitions, Expansions, and Collaborations (20152018)

List of Figures (34 Figures)

Figure 1 Hybrid Fiber Coaxial Market Segmentation

Figure 2 Hybrid Fiber Coaxial Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Hybrid Fibers Coaxial Market Snapshot (20162023)

Figure 7 Hybrid Fibers Coaxial Market, By Component, 20162023

Figure 8 Hybrid Fibers Coaxial Market, By Application, 20162023 (USD Million)

Figure 9 Hybrid Fibers Coaxial Market, By Region (2018 2023)

Figure 10 Continuously Increasing Demand for Higher Bandwidth for Various Data-Rich and Video-Centric Services Driving HFC Market

Figure 11 CMTS/CCAP to Continue Holding Largest Share of Hybrid Fibers Coaxial Market

Figure 12 Hybrid Fiber Coaxial Market for Docsis 3.1 to Grow at Higher CAGR During Forecast Period

Figure 13 US to Account for Largest Share of Hybrid Fibers Coaxial Market in North America By 2023

Figure 14 Cost-Efficiency of Hybrid Fiber Coaxial Cables to Drive the Market

Figure 15 Global Internet Users, By Region (20052016)

Figure 16 Hybrid Fibers Coaxial Market: By Geography

Figure 17 Hybrid Fibers Coaxial Market: Geographic Snapshot

Figure 18 North America: Hybrid Fibers Coaxial Market Snapshot

Figure 19 Europe: Hybrid Fibers Coaxial Market Snapshot

Figure 20 Asia Pacific: Hybrid Fiber Coaxial Market Snapshot

Figure 21 RoW: Hybrid Fibers Coaxial Market Snapshot

Figure 22 Organic and Inorganic Strategies Adopted By Companies Operating in Hybrid Fibers Coaxial Market

Figure 23 Arris: Company Snapshot

Figure 24 Huawei: Company Snapshot

Figure 25 Nokia: Company Snapshot

Figure 26 Technicolor: Company Snapshot

Figure 27 Cisco: Company Snapshot

Figure 28 Corning: Company Snapshot

Figure 29 Ciena: Company Snapshot

Figure 30 Commscope: Company Snapshot

Figure 31 ZTE: Company Snapshot

Figure 32 Comcast: Company Snapshot

Figure 33 Teleste: Company Snapshot

Figure 34 Telstra: Company Snapshot

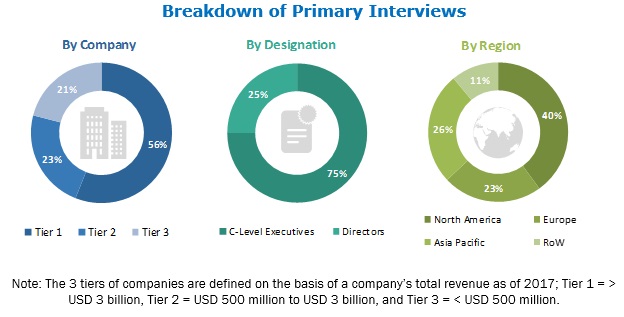

The study involved 4 major activities in estimating the current size of the hybrid fiber coaxial (HFC) market. Exhaustive secondary research was done to collect information on the market, the peer market, and parent market. The next step was to validate findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments

Secondary Search

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases (such as Factiva, Hoovers, and Bloomberg). Secondary research has been mainly done to obtain key information about the industrys supply chain, the markets value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Search

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the HFC market. After complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers.

The following figure shows the breakdown of primaries based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the HFC market, and various other dependent submarkets. Key players in the HFC market have been identified through secondary research, and their market shares in respective regions were determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative as well as qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the overall market was split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the HFC market has been validated using both top-down and bottom-up approaches.

Report Objective

- To define, describe, and forecast the overall hybrid fiber coaxial market based on component, technology, and geography

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the hybrid fiber coaxial market for stakeholders and detail the competitive landscape for market players

- To forecast the market size for various segments with respect to 4 regionsNorth America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze market rankings and core competencies

- To provide detailed information regarding major factors influencing the growth of the hybrid fiber coaxial market (drivers, restraints, opportunities, and challenges)

- To analyze competitive developments, such as product developments/launches, partnerships, agreements, collaborations, and R&D, in the hybrid fiber coaxial market

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product developments, collaborations, and acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

Application Analysis

- Further breakdown of the communication and component segments

Growth opportunities and latent adjacency in Hybrid Fiber Coaxial Market

Hello, we are a design house with a solution for HFC and I need to know how this solution fits in the market.

Im interested in benchmarking our HFC network performance with other carriers to determine targets and expectations for optimal performance .

I'm being interviewed for a Product Line Manager position with one of the big companies and I want to orient to the market.