The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the cable modem termination system (CMTS) and converged cable access platform (CCAP) market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the CMTS and CCAP market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the CMTS and CCAP market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the CMTS and CCAP market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

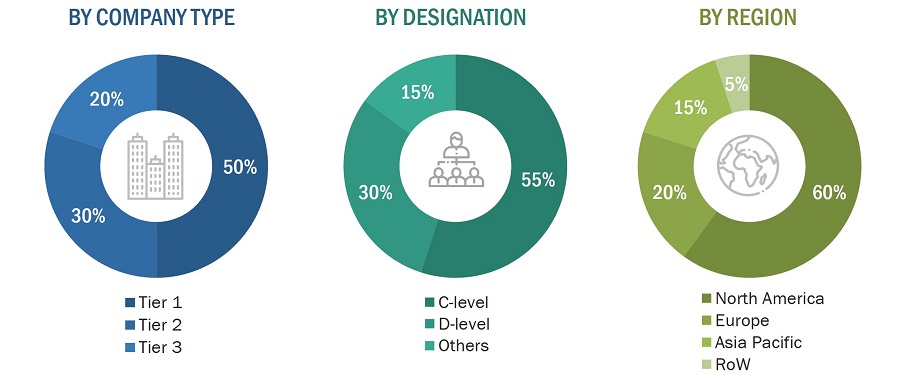

Extensive primary research has been conducted after acquiring knowledge about the CMTS and CCAP market scenarios through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (CMTS and CCAP manufacturers/providers) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews were conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

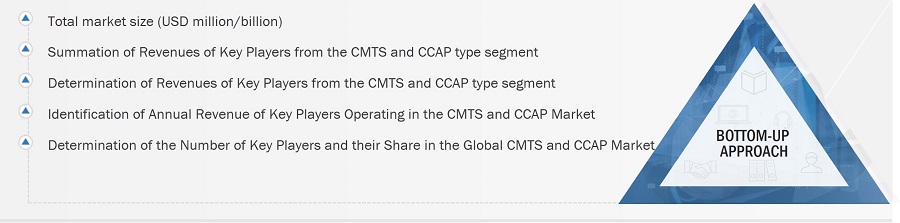

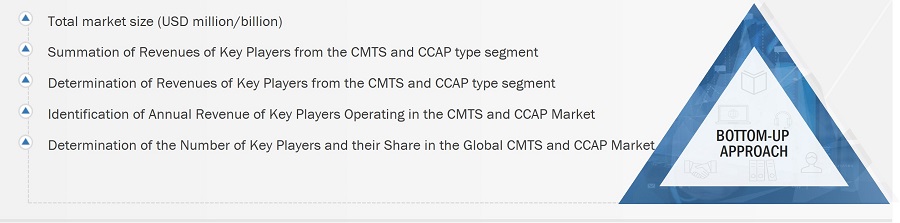

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the CMTS and CCAP market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

CMTS and CCAP Market: Bottom-Up Approach

CMTS and CCAP Market: Top-down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

Cable modem termination system (CMTS) and converged cable access platform (CCAP) are systems located in headends or hub sites to provide high-speed internet and video streaming services to cable subscribers. Headends with CMTS systems have been traditionally used in several countries. CMTS mainly focuses on providing high-speed internet; however, for video streaming, it requires Edge QAM. CCAP is more advantageous over CMTS as it can provide high-speed internet and video-streaming services without the requirement of Edge QAM. Edge QAM is a system used by multiple-system operator (MSO) for video streaming functions.

Key Stakeholders

-

Suppliers of raw materials and manufacturing equipment

-

Providers and manufacturers of components

-

Network infrastructure suppliers

-

Network infrastructure manufacturer

-

CMTS suppliers

-

CMTS manufacturer

-

CCAP suppliers

-

CCAP manufacturer

-

CMTS and CCAP vendors

-

Raw material suppliers

-

Multiple system operator (MSO)

-

Consumer premises equipment manufacturer

-

End-users

Report Objectives

-

To describe, segment, and forecast the CMTS and CCAP market, in terms of value, based on type and DOCSIS Standards

-

To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the CMTS and CCAP market

-

To provide a detailed overview of the supply chain and ecosystem pertaining to the CMTS and CCAP market.

-

To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

-

To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

-

To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, and acquisitions in the CMTS and CCAP market

-

To strategically profile the key players in the CMTS and CCAP market and comprehensively analyze their market ranking and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Cable Modem Termination System (CTMS) and Converged Cable Access Platform (CCAP) Market