Fiber Optic Components Market Size, Share and Trends, 2025 To 2030

Fiber Optic Components Market by Component (Transceivers, AOCs, Cables, Amplifiers, Splitters, Connectors, Circulators), Data Rate(Less than 10Gbps, 10Gbos to 40 Gbps, 41 Gbps to 100 Gbps, More than 100 Gbps) and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fiber optic components market is projected to grow from USD 36.69 billion in 2025 to USD 58.65 billion by 2030, growing at a CAGR of 9.8%. The growth of the fiber optic components market is driven by the increasing demand for high-speed and reliable internet connectivity, driving innovation and investment in fiber optic technologies.

KEY TAKEAWAYS

-

BY REGIONNorth America dominated the fiber optic components market, accounting for a 36.6% market share in 2024.

-

BY TYPEThe transceivers segment accounted for almost half the market in 2024.

-

BY DATA RATEThe data rates from 41 Gbps to 100 Gbps to grow with the highest CAGR of 15.8% from 2025 to 2030.

-

BY APPLICATIONThe communications application accounted for a significant market share of 90.9% in 2024.

-

COMPETITIVE LANDSCAPEShenzhen Nokoxin Technology Co., Ltd. (China) and Fiber Mountain (US) are among the major startup/SME players in the fiber optic components market.

The fiber optic components market is experiencing strong growth driven by escalating demand for high-speed, reliable internet connectivity and the widespread deployment of 5G networks. Increasing data traffic from cloud computing, AI, and IoT technologies fuels the need for advanced optical transceivers, connectors, and sensors across data centers and telecom infrastructure.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

A majority of fiber optics ecosystem players are currently focusing on leveraging new revenue sources such as FTTX, Data Center Interconnect (DCI), and subsea fiber optic cable networks. These revenue sources are generated from clients in telecom, premises, utility, CATV, military, industrial, sensors, and fiber optic lighting applications. Developments such as 5G connectivity, smart cities, IoT, cloud computation, big data, smart devices, and AI are expected to provide growth potential in the future once the penetration of fiber optics and the internet increases in the market. Rapidly developing and deploying hyperscale data centers, smart factories, IIoT, smart sensors, fiber optic-based military weapon systems, and security and surveillance solutions are expected to add opportunities for market players. These are the potential revenue sources that can notably impact the fiber optics connectors market in the future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing deployment of data centers

-

Growing internet penetration and data traffic

Level

-

Susceptibility of fiber optic components to physical damage and signal transmission loss

Level

-

Expansion of telecom infrastructure in developing economies

-

Rise in demand for fiber optics due to reliability

Level

-

Threat to optical network security

-

High cost of installation and difficulty in installing in different terrains

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing deployment of data centers

Data centers require high bandwidth, low power consumption, and wide area coverage. Consequently, fiber optic connectors play a crucial role in data centers, as they are in high demand for connecting servers, switches, and storage devices within these facilities.

Restraint: Susceptibility of fiber optic components to physical damage and signal transmission loss

Fiber optic connectors are essential for high-speed data transmission, but are fragile and prone to transmission losses that can impact network performance. Their small size makes them vulnerable to damage during renovations or rewiring, as even minor mishandling can disrupt signal integrity. To ensure reliable connectivity, it is crucial to handle them carefully and implement protective measures during installation and maintenance.

Opportunity: Expansion of telecom infrastructure in developing economies

Implementing a 5G network requires high-bandwidth fiber optical cables integrated with optical transceivers for secure and reliable data transfers. Subsequently, the expansion of telecommunication infrastructure across developing nations is expected to drive the fiber optic connectors market in the near future.

Challenge: Threat to optical network security

With the advancement of technology, fiber hacking is becoming increasingly common, and the belief that fiber optic cable networks are secure is proving to be incorrect. Data theft is becoming increasingly easier for hackers with these technologies, and it often goes undetected.

Fiber Optic Components Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Optical fibers and cables for high-speed data transmission | Ultra-low loss, high durability, wide deployment in telecom and data centers |

|

Fiber optic cable solutions for telecom and energy sectors | Comprehensive product range supporting broadband and power grids |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The fiber optic component market ecosystem showcases the interconnection between key stakeholders across the value chain. Manufacturers such as TE Connectivity, Molex, Broadcom, and Coherent focus on producing essential fiber optic components. Integrators such as Corning, CommScope, and 3M play a crucial role in assembling and optimizing these components into comprehensive network solutions. End users, including major cloud and technology companies such as AWS, Google, Meta, and Microsoft, utilize these fiber optic systems to support high-speed data transmission, cloud computing, and large-scale digital infrastructure. This ecosystem highlights the collaborative nature of the industry, driving advancements in connectivity and data communication.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fiber Optic Component Market, by Type

Transceivers accounted for the largest market share in 2024. The rising demand for higher data transmission drives the growing demand for 100G, 200G, and 400G transceivers. With the advent of advanced technologies such as artificial intelligence (AI) and 5G, there is an increased requirement for higher bandwidth, which is eventually necessary for data center applications.

Fiber Optic Component Market, by Data Rates

Optical transceivers supporting data rates of 41 Gbps to 100 Gbps are projected to grow at the highest CAGR during the forecast period. The rising demand for higher data transmission drives the growing demand for 100G, 200G, and 400G transceivers. With the advent of advanced technologies such as AI and 5G, there is an increased requirement for higher bandwidth, which is eventually necessary for data center applications.

Fiber Optic Component Market, by Application

Optical fiber components are crucial components for communications and networking. Fiber optic components allow the core networking hardware, such as switches and routers, as well as data centers, enterprise, and telecommunication networking systems, to function effectively. The increasing adoption of connected devices generates data traffic across networks that require components supporting high-speed communications; hence, high-data-rate optical components are gaining traction in the market.

REGION

Asia Pacific to be fastest-growing region in global fiber optic components market during forecast period

The Asia Pacific is projected to have the highest growth rate in the fiber optic components industry during the forecast period, driven by rapid urbanization, expanding digital economies, and significant government investments in broadband infrastructure. Countries such as China, India, and Japan are aggressively deploying fiber optic networks to meet the growing demand for high-speed internet, driven by the proliferation of cloud computing, IoT, and data centers. Additionally, strong initiatives for smart cities and the increasing adoption of advanced telecommunication technologies further propel market growth in the region.

Fiber Optic Components Market: COMPANY EVALUATION MATRIX

The star players generally receive high scores on most of the evaluation criteria. They have a strong product portfolio, a robust market presence, and effective business strategies. These are the leading market players in new developments, including product launches, innovative technologies, and strategic growth plans. Coherent Corporation (US) comes under his category. Emerging leaders demonstrate more substantial product innovations than their competitors; they have a highly focused product portfolio. However, they lack effective growth strategies for their overall businesses. New players can make profits even if there is an increased demand for innovative fiber optic components offered by established players. TE Connectivity (Ireland) comes under this category.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 32.69 Billion |

| Market Forecast, 2030 (Value) | USD 58.65 Billion |

| Growth Rate | CAGR of 9.8% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Fiber Optic Components Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Telecom Operator | Competitive profiling of fiber optic component suppliers (financials, certifications, technology portfolios) | Identify qualified component partners |

| Optical Transceiver Manufacturer | Benchmarking fiber optic module adoption across telecom, data center, and 5G sectors | Switching cost analysis between suppliers |

RECENT DEVELOPMENTS

- October 2024 : Lumentum launched the Lumentum 800G ZR+ and 0dBm 400G ZR+ transceivers to facilitate seamless connectivity between data centers. These devices had data rates of up to 800 Gbps on a single wavelength. Available in QSFP-DD and OSFP form factors, these transceivers provided high output power and extended reach capabilities, specifically addressing the increasing demands of AI and ML applications.

- April 2024 : Prysmian Group acquired Warren & Brown Technologies to strengthen its enterprise solutions for the telecommunications market.

- February 2024 : Cisco partnered with Microsoft to achieve 800 Gbps on the Amitié subsea cable, spanning 6,234 km. Utilizing Space Division Multiplexing (SDM) with 16 fiber pairs, the trial showcased its optical transceivers' role in high-speed transmission. This milestone supported Microsoft's global network, driving innovations for increased network capacity.

- January 2024 : DriveNets and Cisco's Acacia integrated their technologies to bring 400G ZR/ZR+ optical modules to DriveNets' Network Cloud platform. This collaboration aimed to speed up large-scale network deployments by offering a disaggregated networking solution that allows operators to mix hardware and software from different vendors.

Table of Contents

Methodology

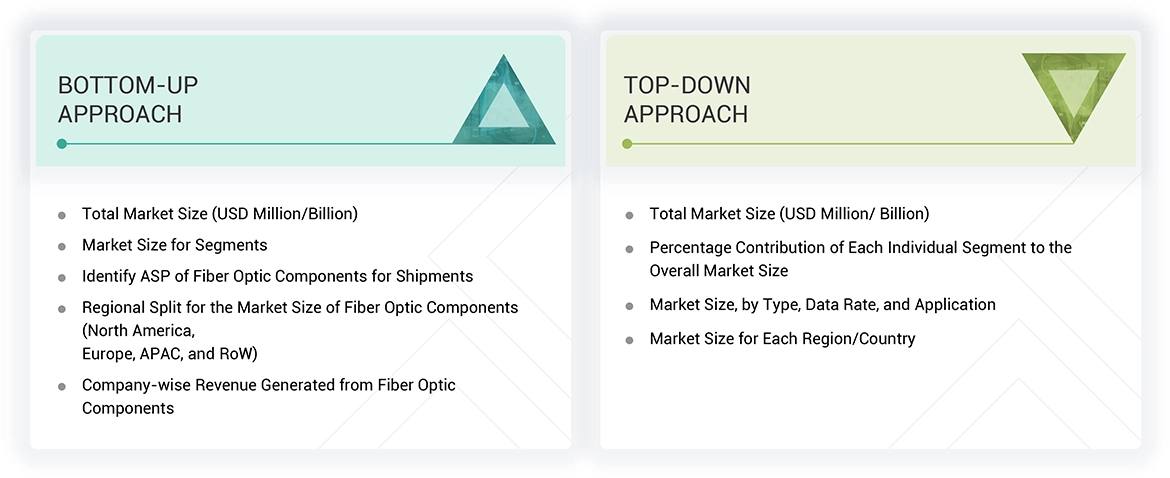

The study involved 4 major activities in estimating the current size of the fiber optic components market. Exhaustive secondary research has been done to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain important information about the industry’s supply chain, value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

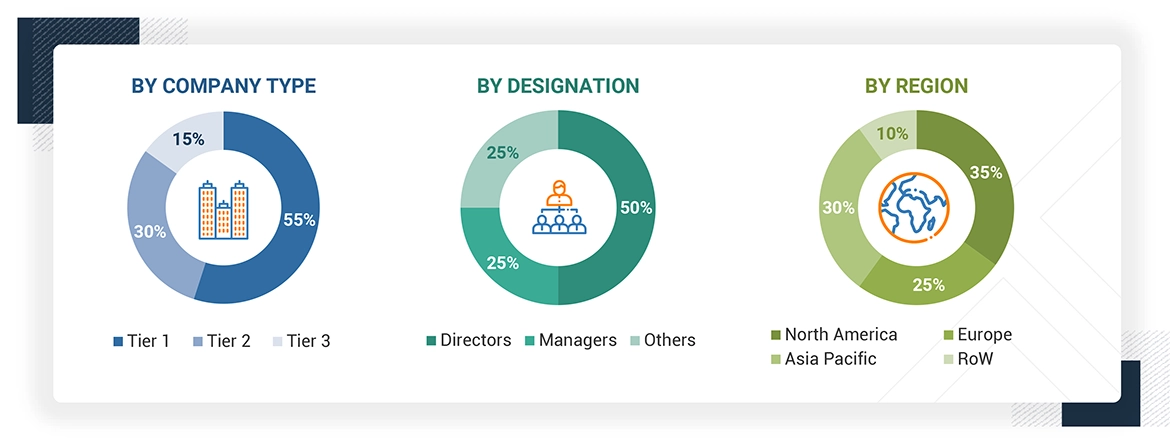

Primary Research

Extensive primary research has been conducted after gaining knowledge about the Fiber optic components market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (application providers) and supply (fiber optic components manufacturers and distributors) sides across four major regions: North America, Europe, APAC, and RoW. Approximately 20% and 80% of primary interviews have been conducted with parties from demand and supply sides, respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of companies have been defined based on their total revenue as of 2024; tier 1 = >USD 300 million, tier 2 = USD 100 million–USD 300 million, and tier 3 = USD 300 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the fiber optic components market and other dependent submarkets.

- The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) into the market.

Fiber Optic Components Market : Top-Down and Bottom-Up Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. For calculating specific market segments, the most appropriate parent market size has been used to implement the top-down approach. The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size obtained. The market share of each company has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the overall parent market size and individual market sizes have been determined and confirmed in this study. The data triangulation procedure used for this study has been explained in the next section.

The bottom-up approach has been employed to arrive at the overall size of the fiber optic components market from the calculations based on the revenues of key players and their shares in the market. For instance, key players in the market have been studied, and market estimations have been done considering the shipment and average selling prices (ASPs) of various applications.

Data Triangulation

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

Fiber optics is the technology used to transmit information as pulses of light through strands of fiber made of glass or plastic over long distances. Optical fibers are bundled into a fiber optic cable, capable of transmitting more data faster than any other medium. They are better than traditional electric cables as they are not subjected to electromagnetic interference that can reduce transmission speed. This technology provides homes and businesses with fiber optic internet, phone, and TV services. Fiber optic components are used in applications such as distributed sensing, analytical and measurement equipment, networking and communications, and lighting.

Key Stakeholders

- Raw material suppliers

- Component manufacturers

- System integrators

- Suppliers and distributors

- Market research and consulting firms

- Associations, organizations, forums, and alliances related to the fiber optic components industry

- Technology investors

- Governments and financial institutions

- Venture capitalists, private equity firms, and startups

- End users

Report Objectives

- To define, describe, and forecast the market, in terms of value, based on by type, data rate, application, and region

- To define, describe, segment, and forecast the overall fiber optic components market, in terms of volume, on the basis of component

- To forecast the market size, in terms of value, with regard to four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain of the fiber optic components market

- To analyze the opportunities for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape of the market

- To analyze competitive developments, such as product launches and developments, partnerships, acquisitions, contracts, expansions, and R&D in the fiber optic components market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical Questions

- What are new application areas fiber optic components providers exploring?

- Who are the key market players, and how intense is the competition?

- Which applications and geographies would be the biggest markets for fiber optic components?

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fiber Optic Components Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Fiber Optic Components Market

Mary

Aug, 2019

We are a connector company and fiber optics is one of the fastest growing of connector types. This is in support of our market expansion and growth and innovation strategy development..

miguel

Feb, 2018

We need executive summary of Fiber Optic Components Market by Component (Transceivers, AOCs, Cables, Amplifiers, Splitters, Connectors, Circulators), Data Rate (10G, 40G, 100G, above 500G), Application (Communications, Distributed Sensing) - Global Forecast to 2023..

Jennifer

Apr, 2019

I am looking for information on the growth of the DWDM market. Your report was the closest I could find. I would like to receive the full report..

stephen

May, 2019

I am assisting a Japanese Fiber Optic company to enter the USA market and am looking for resources to assist..