Industrial Radiography Market by Imaging Technique (Film-based Radiography, Digital Radiography), End User (Petrochemicals & Gas, Power Generation, Manufacturing, Aerospace, and Automotive & Transportation), and Geography - Global Forecast to 2025

Industrial Radiography Market

Industrial Radiography Market and Top Companies

General Electric:

General Electric (US) is one of the world’s largest multinational conglomerates, operating as an infrastructure company worldwide. The company develops and manufactures products that are used in the generation, transmission, distribution, utilization, and control of electricity. GE operates through 8 business segments: Aviation, Power, Healthcare, Oil & Gas, Capital, Lighting, Transportation, and Renewable Energy. The company provides industrial radiography solutions under the Oil & Gas business segment.

Comet Group:

Comet Group (Switzerland) is a globally leading technology firm developing and producing innovative high-tech components and systems based on x-ray, radiofrequency, and e-beam technology. The company markets its components, systems, and services under the COMET, YXLON, and ebeam brands. The company operates through four business segments, which include Plasma Control Technologies, X-Ray Systems, Industrial X-Ray Modules, and e-beam Technologies. The e-beam Technologies segment develops, manufactures, and markets metal-ceramic X-ray sources and portable X-ray modules for non-destructive testing and security inspection, as well as e-beam sets for the eco-friendly sterilization of surfaces. COMET, YXLON, and e-beam are the company’s three strong brands, which serve different markets. Its products are used in automotive, aerospace, electronics, energy, semiconductors, and solar industries, as well as in airport security applications.

Fujifilm Holdings Corporation:

FUJIFILM Holdings (Japan) is a holding company of two operating companies Fujifilm and Fuji Xerox. The company is constantly transforming itself to cope up with the changes in the business environment where the market for photographic materials is rapidly shrinking with the rise of digitalization. Fujifilm operates through three segments, Imaging Solutions, Document Solutions, and Healthcare and Material Solutions. The Healthcare and Materials Solutions segment develops, manufactures, markets, and services equipment and materials for medical systems, life science products, pharmaceutical products, graphic art products, flat panel display materials, recording media, electronic materials, and related products, primarily for commercial enterprises. The company operated through 279 consolidated subsidiaries globally as of 2019.

Nikon Corporation (Japan)

Nikon Corporation is one of the players in the field of advanced optoelectronics and precision technologies. The company operates through four business segments, namely, Imaging Products Business, Precision Equipment Business, Industrial Metrology and Others, and Healthcare Business. It provides industrial radiography-related products and solutions through the Industrial Metrology and Others segment. The products and solutions from the Industrial Metrology segment are used for applications in industries such as automotive, aerospace, and electronics manufacturing.

Shimadzu Corporation (Japan)

Shimadzu Corporation is a major manufacturer of precision tools and equipment. The company also specializes in developing, manufacturing, and selling analytical and measuring instruments, medical systems, and aircraft and industrial equipment. The company operates through 5 business segments, namely, Analytical & Measuring Instruments, Medical Systems, Industrial Machinery, Aircraft Equipment, and Other Products. The products and solutions related to industrial radiography are offered under the Analytical & Measuring Instruments segment. This segment is divided into several sub-segments. General analytical instruments are mainly used for pharmaceutical, chemical, and life science purposes. Surface analyzers are mainly used for electronics, metals, and nonferrous metals. Drain and exhaust gas monitors are primarily used for factories and thermal power stations. Moreover, testing and non-destructive inspection machines are used for various materials.

Industrial Radiography Market and Top End-user Industries

Automotive & Transportation

The automotive sector is developing rapidly and is focusing more on high-value proposition along with cost reductions. Industrial radiography tools have become invaluable in these efforts as they provide manufacturers the ability to engineer products of higher quality with tighter tolerances, while also providing them a way to inspect the products during the production process. Industrial radiography is used for the measurement of the internal and external geometry of critical parts to compare with the original CAD model. Industrial radiography techniques have the following applications, resistance spot weld inspection, MAG weld inspection, inspection overlapped laser welds, and the inspection of glued joints. Industrial radiography is very valuable during the development phase. It involves inspection that is generally performed on casting components, plastic components, cast wheels, engine components, tires, fuel injectors, and the components of braking assembly among others.

Aerospace

Industrial radiography plays a critical role in the aerospace industry as any fault in the equipment can put lives at risk every day; therefore, high precision is important in this sector. The aerospace industry involves the extensive use of industrial radiography techniques. The complex technology and structural characteristics of aerospace components are critical with respect to both safety and performance. Sometimes it becomes very difficult to detect flaws and defects in these components, which can result in huge failures causing consequences far beyond commercial loss.

Petrochemical & gas

The petrochemicals and gas industry is one of the major end users in the industrial radiography market in terms of market share. Workplace safety is of utmost importance in this industry hence, radiographic techniques are used to keep constant checks on the equipment. In the petrochemicals and gas industry, industrial radiography is mainly used for inspecting the welds of pipelines and pressure vessels. Industrial radiography testing in this end user includes monitoring pipelines, storage tanks, and refining equipment for measuring internal corrosions without externally damaging the material. The monitoring is carried out according to safety and environmental regulations to extend the life and productivity of assets, minimize repair costs, manage risks, and avoid catastrophic disasters.

Power Generation

The power generation sector has seen a worldwide increase in the use and demand for energy production, which has increased the number of power plants worldwide and boosted the demand for industrial radiography testing equipment in the market. The industrial radiography market in this sector is driven by service providers who continuously inspect the power plants of both conventional and nuclear sites. A few of the main parts for inspection are boilers, heaters, turbines, generators, feedwater heaters, reactor vessels, and condensers. Industrial radiography provides inspection solutions for fossil fuel, nuclear, wind, and solar applications. It helps in maximizing efficiency, minimizing downtime, and enhancing productivity.

Manufacturing

Industrial radiographic inspection and testing are important in manufacturing plants. Further, consumer durable goods, non-durable goods, electronic components, and equipment have to undergo regulatory standard testing before being launched. There is a huge demand for industrial radiography inspection equipment and services from industries such as mining, iron foundry, piping, tube manufacturing, heavy engineering, shipbuilding, and metal. To monitor and regulate the equipment according to standard values, industrial radiography techniques are frequently used in all manufacturing plants. The different segments that the manufacturing end user can be divided into are mining industry, metal industry, foundry, shipbuilding, and pipe & tube manufacturing.

Industrial Radiography Market by Imaging techniques

Film-Based Radiography

In film-based radiography, a film is exposed to radiations such as x-rays and gamma rays that are bombarded on the item being inspected. The development time of the image in this technique is longer compared with other techniques. However, the technology is better understood and known by people. The process control is simpler in comparison to other forms of radiography. Film-based radiography measures defects using a transparent base and an emulsion layer. Further film-based radiography is a volumetric testing method. The film used in it is lightweight, flexible, and suitable for various applications. All films such as spot films, laser films, video films, are direct exposure films are used with the transparent base and emulsion layer.

Digital Radiography

Digital radiography is the latest development, A digital image-capturing device is used in digital radiography instead of X-ray films. The image quality can be enhanced using computer processing. The image gets stored in a digital format; hence, a database can be maintained for future referrals. Digital radiography is used in various industries: petrochemicals & gas, power generation, manufacturing, aerospace, automotive & transportation, and others. The advantage of this technique is that the images can be made more precise at every stage. An ideal imaging system should develop a high-quality image with minimal radiation exposure, which can be achieved in digital radiography.

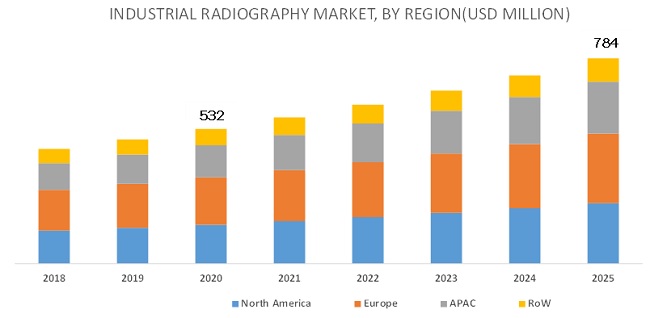

[149 Pages Report] The industrial radiography market is estimated to grow from USD 532 million in 2020 to USD 784 million by 2025; growing at a CAGR of 8.1%. The market growth is propelled by stringent regulations by various governments regarding industrial safety and product quality, increasing demand for NDT services in automotive and aerospace industries, advancements in software that are integrated into radiography systems, and the preventive maintenance of industrial equipment.

Market for direct radiography to grow at higher CAGR from 2020 to 2025

The market for direct radiography is expected to grow at the highest CAGR during the forecast period. Direct radiography is also known as real-time radiography as this technique is capable of generating real-time images of objects being tested, which is the ultimate need of the time. This is expected to drive the demand for direct radiography technique in the near future.

Petrochemicals & gas end user to exhibit high growth in industrial radiogrpahy market during forecast period

The market for the petrochemicals & gas end user is expected to register the highest CAGR during the forecast period. Industrial radiography testing in this end user includes monitoring pipelines, storage tanks, and refining equipment for measuring internal corrosions without externally damaging the material. Industrial radiography is extremely important for the deep-sea oil and natural gas industry. In this industry, oil leaks or spills can occur over a period of time if the infrastructure of the refineries is not monitored carefully, which leads to extremely high costs of cleanup.

Industrial radiography market in APAC to grow at highest CAGR during forecast period

The industrial radiography market in APAC is expected to grow at the highest CAGR during the forecast period. Stringent government regulations regarding safety have created a huge demand for industrial radiography equipment in this region. Further, the consumer electronics sector is also expanding rapidly due to the globally increasing demand for various consumer electronic devices, which leads to the rise in the adoption of radiography equipment to reduce failures and maintenance costs. Further, rapid technological advancements and the increased focus of manufacturers on R&D are expected to create a significant opportunity for the growth of the industrial radiography market.

Key Market Players

As of 2019, General Electric (U.S.), FujiFilm Holdings Corporation (Japan), and COMET Group (Switzerland) dominated the industrial radiography market.

General Electric

General Electric (US) is one of the world’s largest multinational conglomerates, operating as an infrastructure company worldwide. The company develops and manufactures products that are used in the generation, transmission, distribution, and utilization, and control of electricity. GE operates through eight business segments: Aviation, Power, Healthcare, Oil & Gas, Capital, Lighting, Transportation, and Renewable Energy. The company provides industrial radiography solutions under the Oil & Gas business segment. In July 2017, GE merged its Oil & Gas business segment with Baker Hughes and currently Baker Hughes operates as the forefront company for GE’s Oil & Gas segment. Baker Hughes supplies products related to industrial radiography to more than 120 countries across the world. The company’s industrial radiography solutions fulfill critical requirements for distinctive applications and deliver productivity, quality, and safety. GE is primarily focusing on merging with strategic companies.

Comet Group

Comet Group (Switzerland) is a global leading technology firm developing and producing innovative high-tech components and systems based on x-ray, radiofrequency, and e-beam technology. The company markets its components, systems, and services under the COMET, YXLON, and ebeam brands. The company operates through four business segments, which include Plasma Control Technologies, X-Ray Systems, Industrial X-Ray Modules, and e-beam Technologies. The e-beam Technologies segment develops, manufactures, and markets metal-ceramic X-ray sources and portable X-ray modules for non-destructive testing and security inspection, as well as e-beam sets for the eco-friendly sterilization of surfaces. COMET, YXLON, and e-beam are the company’s three strong brands, which serve different markets. Its products are used in automotive, aerospace, electronics, energy, semiconductors, and solar industries, as well as in airport security applications.

Fujifilm Holdings Corporation

FUJIFILM Holdings (Japan) is a holding company of two operating companies Fujifilm and Fuji Xerox. The company is constantly transforming itself to cope up with the changes in the business environment where the market for photographic materials is rapidly shrinking with the rise of digitalization. Fujifilm operates through three segments, Imaging Solutions, Document Solutions, and Healthcare and Material Solutions. The Healthcare and Materials Solutions segment develops, manufactures, markets, and services equipment and materials for medical systems, life sciences products, pharmaceuticals, graphic art products, flat panel display materials, recording media, electronic materials, and related products, primarily for commercial enterprises. The company operated through 279 consolidated subsidiaries globally as of 2019.

Report Scope:

|

Report Metric |

Details |

|

Years considered |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) in million |

|

Segments covered |

Imaging technique and end user |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Emerson (US), Honeywell (US), Rockwell (US), ABB (Switzerland), Schneider (France), Yokogawa (Japan), General Electric (US), Siemens (Germany), Etc. |

In this report, the overall industrial radiography market is segmented based on imaging technique, end user, and region.

By Imaging Technique:

- Film-based Radiography

- Digital Radiography

By End User:

- Petrochemicals & Gas

- LNG

- Refining

- Transmission Pipelines

- Subsea Pipelines

- Storage Tanks

- Power Generation

- Nuclear Power

- Wind Power

- Solar Power

- Fossil Fuel

- Manufacturing

- Mining Industry

- Metal Industry

- Foundry

- Shipbuilding

- Pipe and Tube Manufacturing

- Aerospace

- Engine Part Production

- Composite Airframe Manufacturing

- Material and Component Analysis

- Maintenance

- Automotive & Transportation

- Wheel and Axle Manufacturing

- Metal Casting

- Critical Component Manufacturing

- Others

Geographic Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

- Rest of the World (RoW)

- South America

- Middle East & Africa

Critical Questions:

- Which industrial radiography imaging technique is expected to have the highest demand in the future?

- Who are the top 5 players in the industrial radiography market?

- What would be the growth opportunities for manufacturers in various industries?

- What are the key industry trends in the market?

- How can digital radiogrpahy providers tap high-growth opportunities in the industrial radiography market?

Frequently Asked Questions (FAQ):

What are the key factors driving industrial radiography market?

Stringent regulations by various governments regarding industrial safety and product quality, increasing demand for NDT services in automotive and aerospace industries are the driving factors in the industrial radiography market.

Which is the potential market for industrial radiography market in terms of region?

The APAC region is growing at the fastest rate during the forecast period.

What are the major companies dealing in industrial radiography market?

The major companies dealing in the industrial radiography market are: General Electric, FujiFilm Holdings Corporation, and COMET Group, Nikon, Shimadzu, Anritsu, Mettler-Toledo, PerkinElmer.

Which type of imaging technology will be widely used in the industrial radiography market?

In industrial radiography market digital radiography is most widely used imaging technology.

Which are the major end users of industrial radiography market? How huge is the opportunity for their growth in the next five years?

The major end users of industrial radiography includes petrochemicals & gas, power generation, manufacturing, aerospace, and automotive & transportation . which will lead to market opportunity of USD 784 million by 2025

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Objective of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years considered for the study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary and Primary Research

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Value Chain Analysis

6 Basic Components Of Industrial Radiography

7 Industrial Radiography Imaging Process

8 Industrial Radiography Market, By Imaging Technology

8.1 Introduction

8.2 Film-Based Radiography

8.3 Digital Radiography

8.3.1 Computed Tomography

8.3.2 Computed Radiography

8.3.3 Direct Radiography

9 Industrial Radiography Market, By Radiation Type

9.1 Introduction

9.2 X-Rays

9.3 Gamma Rays

10 Industrial Radiography Market, By Industry

10.1 Introduction

10.2 Automotive

10.3 Oil & Gas

10.4 Aerospace & Defense

10.5 Manufacturing

10.6 Power Generation

10.7 Others

11 Industrial Radiography Market, By Geography

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Italy

11.3.5 Rest of Europe

11.4 APAC

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Rest of APAC

11.5 ROW

11.5.1 South America

11.5.1.1 Brazil

11.5.2 Middle East

11.5.3 Africa

12 Competitive Landscape

12.1 Introduction

12.2 Industrial radiography market rank analysis

12.3 Competitive leadership mapping

12.3.1 Visionary leaders

12.3.2 Dynamic differentiators

12.3.3 Innovators

12.3.4 Emerging companies

12.4 Competitive situation & trends

13 Company Profiles

13.1 Key Players

13.1.1 General Electric

13.1.2 Fujifilm

13.1.3 Nikon

13.1.4 Shimadzu

13.1.5 Comet Group

13.1.6 Anritsu

13.1.7 Mettler-Toledo

13.1.8 Perkinelmer

13.1.9 3DX-Ray

13.1.10 Bosello High Technology

13.2 Other Key Players

13.2.1 Mistras Group Inc.

13.2.2 American testing services

13.2.3 Ashtead technology Ltd.

13.2.4 Applied Technical Services Inc.

13.2.5 Nordson dage

13.2.6 TUV Rheinland AG

13.2.7 North Star Imaging

13.2.8 Thales Group

13.2.9 TWI

13.2.10 Teledyne DALSA

14 Appendix

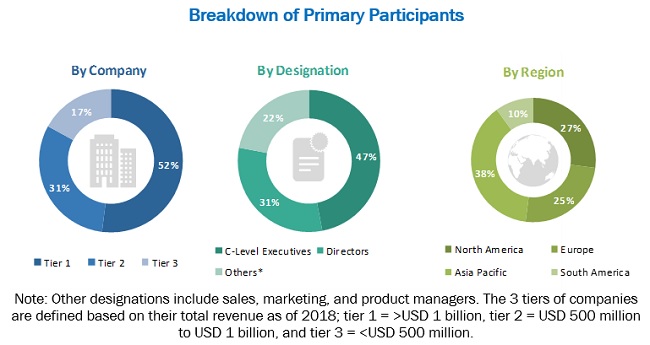

The study involved 4 major activities for estimating the size of the industrial radiography market. Exhaustive secondary research has been conducted to collect information on the market. The next step involved has been validating these findings, assumptions, with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall market size. Thereafter, market breakdown and data triangulation techniques have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, and databases, IEEE journals, International Atomic Energy Agency, National Academy of Sciences and leading players’ newsletters have been used to identify and collect information for an extensive technical and commercial study of the industrial radiography market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the industrial radiography market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research included studying annual reports of top market players and interviewing key opinion leaders such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the industrial radiography market and other dependent submarkets listed on this report.

- Key players in the industry and industrial radiography markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, market breakdown, and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the industrial radiography market, in terms of value, by imaging technique and end user

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the value chain of the industrial radiography ecosystem

- To analyze opportunities for stakeholders in the industrial radiography market by identifying its high-growth segments

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies, along with detailing the competitive leadership and analyzing growth strategies such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and the partnerships of leading players.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Industrial Radiography Market

I am looking for information on the phosphor storage plate market, does this report supply information on this segment of industrial radiography?

Dear Markets and Markets, I am currently writing my BSc Thesis on 'how to gain sustainable competitive advantage in the industrial radiography market' and I am therefore searching for information and characteristics of the market. In other words, I am very interested in your document, but unfortunately I do not have any budget to purchase it. I was wondering if you could please send me a sample of the document so that I can start from there.

Interested in understanding key drivers and key hurdles/pain points associated with the use of digital radiography in non destructive testing.

1. Do the reports have watermark on it? 2. How we get the report? Do you send the report to us directly or the download link

We would like to know about the current market size and volume of industrial digital x ray. Further, we would like to know about the growth opportunities and attractive segments in South East Asia region including Indonesia