Inflation Device Market by Display Type (Analog & Digital), Capacity (20ml, 30ml, 60ml), Application (Interventional Cardiology, Radiology, Peripheral Vascular, Urology), End User (Hospitals & Clinics, Ambulatory Surgery Centers) - Forecasts to 2024

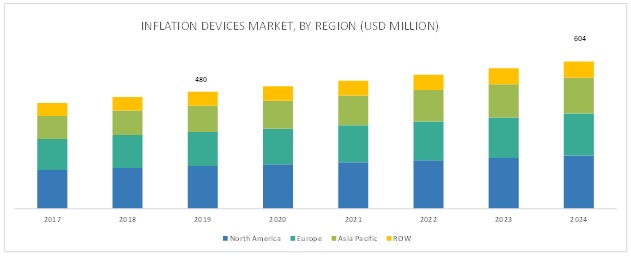

The inflation device market is projected to reach USD 600 Million by 2024, at a CAGR of 4.7%. The rising adoption of minimally invasive procedures, the presence of developed healthcare infrastructure in a majority of developed countries, the growing incidence of CVD, and the less-stringent approval procedures are contributing to the growth of the market. With the growth of the geriatric population, the prevalence of coronary artery disease is also expected to increase, which is a major target indication for interventional cardiology procedures that utilizes inflation device to inflate and deflate the balloon. Aforementioned key factors are likely to fuel growth of market over the forecast period.

By capacity, the 60ml inflation device segment is expected to grow at the highest rate during the forecast period

Based on display type, the inflation device market is segmented into 20ml, 30ml, and 60ml inflation devices. The 60ml inflation devices segment is expected to grow at fastest CAGR during forecast period. These devices feature quick-latch mechanisms (enables one-handed deflation) and are designed to be easy to use, which has driven their adoption in pulmonary, gastroenterology, and otolaryngology procedures, as these procedures utilize comparatively larger-sized balloons and require more amounts of liquid for inflation.

The interventional cardiology segment was the largest contributor to the inflation devices market, by application in 2018

Based on application, the inflation device market is segmented interventional cardiology, intervention radiology, peripheral vascular procedures, urological procedures, gastroenterological procedures, and other applications. Among these, the interventional cardiology segment accounted for the largest share of the inflation device market in 2018. The rising geriatric population more prone to develop CVD, which is a major factor driving the adoption of interventional cardiology procedures that utilizes inflation devices. Moreover, growth in the number of new multi-specialty hospitals in developing countries offering advanced minimally invasive procedures, favourable reimbursement scenario for angioplasty procedures will further drive growth of segment over the forecast period.

By end user, the hospitals and clinics segment was the largest contributor to the inflation devices market in 2018

Based on end users, the global inflation device industry is segmented into hospitals and clinics; and ambulatory care centers. In 2018, the hospitals and clinics segment accounted for the largest market share majorly due to the growing number of hospitals and specialty clinics in emerging countries; increasing prevalence of target diseases; and large number of surgical and diagnostic procedures performed across these facilities.

Asia Pacific is expected to grow at the highest CAGR in the inflation device market during the forecast period

North America is expected to account for largest share in the global inflation device market in 2018. However, APAC is expected to grow at the highest CAGR during the forecast period. This regional segment comprises Japan, China, India, and the Rest of Asia Pacific. Market growth is driven by the rising number of minimally invasive surgical procedures, developing healthcare infrastructure, rising awareness about HAIs and the use of disposable devices, and the increasing adoption of minimally invasive procedures. Major market players are undertaking strategic initiatives to increase their presence in emerging APAC countries such as China and India in order to leverage the growth opportunities in these markets will further contribute to the market growth.

The major players operating in the inflation device market include Merit Medical Systems (US), Boston Scientific Corporation (US), Cardinal Health (US), CONMED Corporation (US), Medtronic Plc (Ireland), Acclarent Inc. (US), Cook medical (US), Atrion Corporation (US), Becton Dickinson and Company (US), Terumo Medical Corporation (Japan), B. Braun Melsungen AG (US), Olympus Corporation (Japan), Teleflex Incorporated (US), and US Endovascular (US), among others. An analysis of the market developments between 2015 and 2019 revealed that several growth strategies such as product launches and enhancements, partnerships, collaborations, and strategic acquisitions were adopted by market players to strengthen their product portfolios and maintain a competitive position in the inflation device market.

Merit Medical Systems (US) is one of the leading players in the global inflation device market. Its broad portfolio of analog and digital inflation device are some key factors accounting for its large share in this market. The company focuses on both organic and inorganic growth strategies to enhance its footprint in the global market. Merit medical is a leading provider of digital inflation technology worldwide. In addition, the company is one of the market leaders in the US for analog inflation devices. With its strong product portfolio and wide geographic presence, the company is expected to grow at a high rate in the market during the forecast period.

Inflation Device Market : Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

20172024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

20192024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Display type, Capacity, Application, End User, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, France, UK, and RoE), APAC (Japan, China, India, and RoAPAC), and ROW (LATAM and MEA). |

|

Companies Covered |

The major players in the market include Merit Medical Systems (US), Boston Scientific Corporation (US), Cardinal Health (US), CONMED Corporation (US), Medtronic plc (Ireland), Acclarent Inc. (US), Cook Medical (US), Atrion Corporation (US), Becton, Dickinson and Company (US), Terumo Medical Corporation (Japan), B. Braun Melsungen AG (US), Olympus Corporation (Japan), Teleflex Incorporated (US), US Endovascular (US), among others. |

This research report categorizes the market based on Display type, Capacity, Application, End User, and Region.

market, by Display Type

- Analog

- Digital

market, by Capacity

- 20ml

- 30ml

- 60ml

market, by Application

- Interventional Cardiology

- Interventional Radiology

- Peripheral Vascular Procedures

- Gastroenterology Procedures

- Urology Procedures

- Other Application

market, by End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

market, by Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- RoE

- Asia Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World

Inflation Device Market : Recent Developments:

- In 2018, Acclarent, Inc. (US) received the FDA clearance for the expanded use of its AERA Eustachian Tube Balloon Dilation System to include its use in young patients, who are young as 18 years of age

- In 2017, Becton, Dickson and Company (US) has acquired C. R. Bard, Inc. that manufactures medical devices in the fields of urology, vascular, surgical specialty, and oncology. This acquisition expanded BDs offering in the inflation devices market by the addition of the EAGLE inflation device product.

- In 2017, Boston Scientific (US) established its new manufacturing facility in Penang, Malaysia. This helped the company expand its presence in the Asia Pacific region and also support local R&D activities.

- In 2016, Acclarent, Inc. (US) launched the ACCLARENT AERA Eustachian Tube Balloon Dilation System in the US after receiving the US FDA approval for Eustachian Tube Dysfunction (ETD) disorder

Key Questions Addressed by the Inflation Device Market Report:

- Emerging countries have immense opportunities for the growth and adoption of inflation devices procedures. Will this scenario continue in the next five years?

- What will be the impact of rising number of local entrants on the market in the coming years?

- What are the major application areas of inflation devices? What are the potential applications offering growth to inflation devices manufacturers?

Frequently Asked Questions (FAQ):

What is the expected addressable market value of inflation devices over a 5-year period?

Based on the prevailing trends and estimated market value data as of 2018, the total market value of inflation devices is estimated to be about USD 604.2 million as of 2024.

Which display type categories are expected to garner highest traction within the inflation devices market?

Based on display type, the inflation devices market is segmented into analog and digital inflation devices. Analog inflation devices accounted for the largest share of the inflation devices market in 2018. The large share of this segment is mainly attributed to the low cost and portability of analog devices in comparison to the digital devices. Moreover, reluctance among users (specifically from emerging economies) for adopting advanced display technologies is expected to further contribute to the growth of the segment.

What are the major end use applications of inflation devices globally?

Key application areas of inflation devices includes interventional cardiology, interventional radiology, peripheral vascular procedures, urological procedures, and gastroenterological procedures, among others. The interventional cardiology is the major end use application of the inflation devices globally. The large share of this segment is attributed to the rising geriatric population, increasing prevalence of cardiovascular diseases, and the growing preference for minimally invasive surgeries.

What are the major revenue pockets in the inflation devices market currently?

The highest market share of inflation devices is estimated to belong to the North America; owing to the significant presence of key global market players, favorable reimbursement scenario, increasing patient preference for minimally invasive surgical procedures, and the large target patient population base. Furthermore, emerging economies such as India, China, and South Korea, along with developed markets such as Japan and Australia, are also offering high-growth opportunities for market players in the field of interventional cardiology.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Estimation Methodology

2.2.1 Product-Based Market Estimation

2.2.2 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Research Limitations and Assumptions

2.4.1 Limitations

2.4.2 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Market Overview

4.2 Geographic Analysis: Inflation Device Market, By Display Type and Region

4.3 Geographic Analysis: Market, By Capacity and Region

4.4 Market, By Application

4.5 Geographic Snapshot of the Inflation Device Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Geriatric Population

5.2.1.2 Increasing Preference for Minimally Invasive Surgeries

5.2.1.3 Favorable Reimbursement Scenario for Cardiovascular Procedures

5.2.2 Restraints

5.2.2.1 Availability of Effective Alternative Treatments

5.2.2.2 High Rate of Reprocessing Inflation Devices

5.2.3 Opportunities

5.2.3.1 Emerging Economies Offer High-Growth Potential

5.2.3.2 Rising Awareness About Hospital-Acquired Infections and the Rising Adoption of Disposable Accessories

5.2.4 Challenges

5.2.4.1 Product Recalls

5.2.4.2 Presence of Local Manufacturers and Pricing Pressure

6 Inflation Device Market, By Capacity (Page No. - 42)

6.1 Introduction

6.2 20ml Inflation Devices

6.2.1 Easy Availability of 20ml Inflation Devices and Wide Range of Offerings are Driving the Growth of This Market Segment

6.3 30ml Inflation Devices

6.3.1 30ml Inflation Devices Offer Digital Or Analog Displays

6.4 60ml Inflation Devices

6.4.1 60ml Inflation Devices to Witness Highest Growth During the Forecast Period

7 Inflation Device Market, By Display Type (Page No. - 47)

7.1 Introduction

7.2 Analog Inflation Devices

7.2.1 Analog Inflation Devices Accounted for the Larger Market Share Primarily Due to the Low Cost and Portability Associated With These Devices

7.3 Digital Inflation Devices

7.3.1 High Growth of the Digital Inflation Devices Segment is Attributed to the Advanced Display Patterns and Ease of Use Associated With These Devices

8 Inflation Device Market, By Application (Page No. - 51)

8.1 Introduction

8.2 Interventional Cardiology

8.2.1 Interventional Cardiology Forms the Largest Application Segment of the Inflation Devices Market

8.3 Interventional Radiology

8.3.1 Increasing Prevalence of Cancer to Drive the Adoption of Inflation Devices for This Application Segment

8.4 Peripheral Vascular Procedures

8.4.1 Increasing Prevalence of Target Diseases to Drive the Market for This Application Segment

8.5 Gastroenterological Procedures

8.5.1 Gastroenterological Procedures Segment to Witness the Highest Growth Primarily Due to the Increasing Incidence of Gastrointestinal Diseases Across the Globe

8.6 Urological Procedures

8.6.1 Growing Prevalence of Urological Disorders & Ongoing Technical Advancements in the Field of Minimally Invasive Urological Treatments to Drive Market Growth

8.7 Other Applications

9 Inflation Device Market, By End User (Page No. - 60)

9.1 Introduction

9.2 Hospitals and Clinics

9.2.1 Hospitals Hold the Largest Share of the Market, By End User

9.3 Ambulatory Surgery Centers

9.3.1 Advantages of Ambulatory Care Have Boosted Patient Preference for These Centers

10 Inflation Device Market, By Region (Page No. - 64)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US Accounts for the Largest Share of the North American Market

10.2.2 Canada

10.2.2.1 Nearly One-Fifth of the Population Suffers From High Blood Pressure

10.3 Europe

10.3.1 Germany

10.3.1.1 Germany Had Among the Highest Obesity Rates in 2017

10.3.2 UK

10.3.2.1 Rising Geriatric Population and Well-Developed Healthcare Infrastructure Account for Market Growth

10.3.3 France

10.3.3.1 Favorable Government Support has Expanded Healthcare Access and Medical Tourism in France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Chinas Aging Population is Growing at A High Rate

10.4.2 Japan

10.4.2.1 Universal Healthcare Coverage has Allowed for Easy Access to Healthcare in Japan

10.4.3 India

10.4.3.1 High Target Patient Population in India Will Drive Market Growth

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 99)

11.1 Introduction

11.2 Market Ranking

11.3 Competitive Scenario

11.3.1 Product Launches and Approvals

11.3.2 Acquisitions

11.3.3 Expansions

11.3.4 Partnerships, Agreements, and Collaborations

11.4 Competitive Leadership Mapping: Major Market Players (2018)

11.4.1 Visionary Leaders

11.4.2 Innovators

11.4.3 Dynamic Differentiators

11.4.4 Emerging Companies

12 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 Advanced Lifesciences Pvt. Ltd.

12.2 Acclarent, Inc. (Subsidiary of Johnson & Johnson)

12.3 Atrion Corporation

12.4 B. Braun Melsungen AG

12.5 Becton, Dickinson and Company

12.6 Boston Scientific Corporation

12.7 Cardinal Health

12.8 Conmed Corporation

12.9 Cook Medical

12.10 Medtronic PLC

12.11 Merit Medical Systems

12.12 Olympus Corporation

12.13 Teleflex Incorporated

12.14 Terumo Medical Corporation

12.15 US Endovascular

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 130)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (78 Tables)

Table 1 Comparison of Cardiac Surgical Procedure Prices (Us vs Major Medical Tourism Countries)

Table 2 Inflation Device Market Size, By Capacity, 20172024 (USD Million)

Table 3 20ml Market, By Region, 20172024 (USD Million)

Table 4 30ml Market, By Region, 20172024 (USD Million)

Table 5 60ml Market, By Region, 20172024 (USD Million)

Table 6 Market, By Display Type, 20172024 (USD Million)

Table 7 Analog Inflation Devices: Market, By Region, 20172024 (USD Million)

Table 8 Digital Inflation Devices: Market, By Region, 20172024 (USD Million)

Table 9 Market, By Application, 20172024 (USD Million)

Table 10 Market for Interventional Cardiology, By Region, 20172024 (USD Million)

Table 11 Market for Interventional Radiology, By Region, 20172024 (USD Million)

Table 12 Market for Peripheral Vascular Procedures, By Region, 20172024 (USD Million)

Table 13 Market for Gastroenterological Procedures, By Region, 20172024 (USD Million)

Table 14 Market for Urological Procedures, By Region, 20172024 (USD Million)

Table 15 Market for Other Applications, By Region, 20172024 (USD Million)

Table 16 Market, By End User, 20172024 (USD Million)

Table 17 Market for Hospitals and Clinics, By Region, 20172024 (USD Million)

Table 18 Market for Ambulatory Surgery Centers, By Region, 20172024 (USD Million)

Table 19 Market, By Region, 20172024 (USD Million)

Table 20 North America: Market , By Country, 20172024 (USD Million)

Table 21 North America: Market, By Capacity, 20172024 (USD Million)

Table 22 North America: Market, By Display Type, 20172024 (USD Million)

Table 23 North America: Market, By Application, 20172024 (USD Million)

Table 24 North America: Market, By End User, 20172024 (USD Million)

Table 25 US: Market, By Capacity, 20172024 (USD Million)

Table 26 US: Market, By Display Type, 20172024 (USD Million)

Table 27 US: Market, By Application, 20172024 (USD Million)

Table 28 US: Market, By End User, 20172024 (USD Million)

Table 29 Canada: Market, By Capacity, 20172024 (USD Million)

Table 30 Canada: Market, By Display Type, 20172024 (USD Million)

Table 31 Canada: Market, By Application, 20172024 (USD Million)

Table 32 Canada: Market, By End User, 20172024 (USD Million)

Table 33 Europe: Market , By Country, 20172024 (USD Million)

Table 34 Europe: Market, By Capacity, 20172024 (USD Million)

Table 35 Europe: Market, By Display Type, 20172024 (USD Million)

Table 36 Europe: Market, By Application, 20172024 (USD Million)

Table 37 Europe: Market, By End User, 20172024 (USD Million)

Table 38 Germany: Market, By Capacity, 20172024 (USD Million)

Table 39 Germany: Market, By Display Type, 20172024 (USD Million)

Table 40 Germany: Market, By Application, 20172024 (USD Million)

Table 41 Germany: Market, By End User, 20172024 (USD Million)

Table 42 UK: Market, By Capacity, 20172024 (USD Million)

Table 43 UK: Market, By Display Type, 20172024 (USD Million)

Table 44 UK: Market, By Application, 20172024 (USD Million)

Table 45 UK: Market, By End User, 20172024 (USD Million)

Table 46 France: Market, By Capacity, 20172024 (USD Million)

Table 47 France: Market, By Display Type, 20172024 (USD Million)

Table 48 France: Market, By Application, 20172024 (USD Million)

Table 49 France: Market, By End User, 20172024 (USD Million)

Table 50 Rest of Europe: Market, By Capacity, 20172024 (USD Million)

Table 51 Rest of Europe: Market, By Display Type, 20172024 (USD Million)

Table 52 Rest of Europe: Market, By Application, 20172024 (USD Million)

Table 53 Rest of Europe: Market, By End User, 20172024 (USD Million)

Table 54 Asia Pacific: Market , By Country, 20172024 (USD Million)

Table 55 Asia Pacific: Market, By Capacity, 20172024 (USD Million)

Table 56 Asia Pacific: Market, By Display Type, 20172024 (USD Million)

Table 57 Asia Pacific: Market, By Application, 20172024 (USD Million)

Table 58 Asia Pacific: Market, By End User, 20172024 (USD Million)

Table 59 China: Market, By Capacity, 20172024 (USD Million)

Table 60 China: Market, By Display Type, 20172024 (USD Million)

Table 61 China: Market, By Application, 20172024 (USD Million)

Table 62 China: Market, By End User, 20172024 (USD Million)

Table 63 Japan: Market, By Capacity, 20172024 (USD Million)

Table 64 Japan: Market, By Display Type, 20172024 (USD Million)

Table 65 Japan: Market, By Application, 20172024 (USD Million)

Table 66 Japan: Market, By End User, 20172024 (USD Million)

Table 67 India: Market, By Capacity, 20172024 (USD Million)

Table 68 India: Market, By Display Type, 20172024 (USD Million)

Table 69 India: Market, By Application, 20172024 (USD Million)

Table 70 India: Market, By End User, 20172024 (USD Million)

Table 71 RoAPAC: Market, By Capacity, 20172024 (USD Million)

Table 72 RoAPAC: Market, By Display Type, 20172024 (USD Million)

Table 73 RoAPAC: Market, By Application, 20172024 (USD Million)

Table 74 RoAPAC: Market, By End User, 20172024 (USD Million)

Table 75 RoW: Market, By Capacity, 20172024 (USD Million)

Table 76 RoW: Market, By Display Type, 20172024 (USD Million)

Table 77 RoW: Market, By Application, 20172024 (USD Million)

Table 78 RoW: Market, By End User, 20172024 (USD Million)

List of Figures (40 Figures)

Figure 1 Inflation Device Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Bottom-Up Approach Market Size Estimation: Market

Figure 4 Top-Down Approach Market Size Estimation: Inflation Devices

Figure 5 Data Triangulation Methodology

Figure 6 Market Share, By Display Type, 2018

Figure 7 Market Share, By Capacity, 2018

Figure 8 Market, By Application, 20192024 (USD Million)

Figure 9 Market Share, By End User, 2018

Figure 10 Market, By Region: Geographical Snapshot

Figure 11 Increasing Preference for Minimally Invasive Surgeries is Driving the Growth of Market Across the Globe

Figure 12 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 13 20ml Inflation Devices Segment Dominated the Asia Pacific Market in 2018

Figure 14 Interventional Cardiology to Hold the Largest Share of the Market During the Forecast Period

Figure 15 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Projected Increase in the Geriatric Population, By Region, 2015 vs 2030

Figure 18 Percutaneous Transluminal Coronary Angioplasty (Ptca) Surgical Procedures Performed in Key European Countries, 2011 vs 2016 (Per 100,000 Inhabitants)

Figure 19 Cost of Angioplasty Across Major Countries, 2016

Figure 20 20ml Segment is Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 21 Analog Inflation Devices Segment Will Continue to Dominate the Market During the Forecast Period

Figure 22 Gastroenterological Procedures Segment to Witness the Highest Growth in the Inflation Devices Market During the Forecast Period

Figure 23 Hospitals & Clinics Segment to Hold the Largest Share of the Market During the Forecast Period

Figure 24 Geographic Snapshot of the Market

Figure 25 North America: Market Snapshot

Figure 26 Asia Pacific: Inflation Devices Market Snapshot

Figure 27 Inflation Devices Market Ranking, By Key Player, 2018

Figure 28 Vendor Dive: Evaluation Overview

Figure 29 Johnson & Johnson: Company Snapshot

Figure 30 Atrion Corporation: Company Snapshot

Figure 31 B. Braun Melsungen AG: Company Snapshot

Figure 32 BD: Company Snapshot

Figure 33 Boston Scientific Corporation: Company Snapshot

Figure 34 Cardinal Health: Company Snapshot

Figure 35 Conmed Corporation: Company Snapshot

Figure 36 Medtronic: Company Snapshot

Figure 37 Merit Medical Systems: Company Snapshot

Figure 38 Olympus Corporation: Company Snapshot

Figure 39 Teleflex Incorporated: Company Snapshot

Figure 40 Terumo Corporation: Company Snapshot

The study involved four major activities to estimate the current size of the market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments.

Inflation Device Market : Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

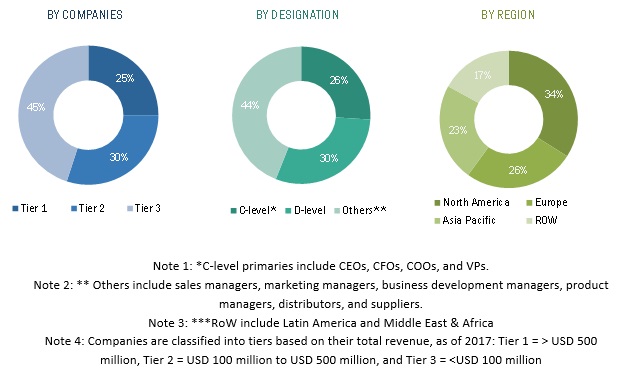

Inflation Device Market : Primary Research

Extensive primary research was conducted after acquiring knowledge about the market scenario through secondary research. A significant number of primary interviews were conducted from both the demand (healthcare providers, research institutes, physicians, and healthcare professionals) and supply sides (developers, manufacturers, and distributors of inflation devices). The primaries interviewed for this study include experts from the inflation devices and minimally invasive devices industry (such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1, 2, and 3 companies engaged in offering inflation devices across the globe) and administrators & purchase managers of hospitals, interventional cardiologist, ambulatory care centers, and healthcare service providers.

The following is the breakdown of primary respondents:

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the market and other dependent submarkets, as mentioned above. The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. Research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights (both quantitative and qualitative trends) on the market. All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size of the inflation devices industry from the market estimation approach explained above, the global market was split into several segments and sub-segments. To complete the overall market engineering process and to arrive at the exact market value data, data triangulation and market breakdown methodology methods were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply side analysis.

Inflation Device Market : Report Objectives

- To define, describe, and forecast the global market on the basis of display type, capacity, application, and end user, and region.

- To provide detailed information regarding major factors influencing the growth of the market (such as drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five main regions, namely, North America (US and Canada), Europe (Germany, France, the UK, and the Rest of Europe), Asia Pacific (China, Japan, India, and the Rest of Asia Pacific), Rest of World (Latin America, and the Middle East and Africa).

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as new product launches; agreements, partnerships; mergers & acquisitions; business expansions and research & development activities in the market.

Inflation Device Market : Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the present global market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Inflation Device Market