IoT in Healthcare Market by Component (Medical Device, Systems & Software, Services, and Connectivity Technology), Application (Telemedicine, Connected Imaging, and Inpatient Monitoring), End User and Region - Global Forecast to 2028

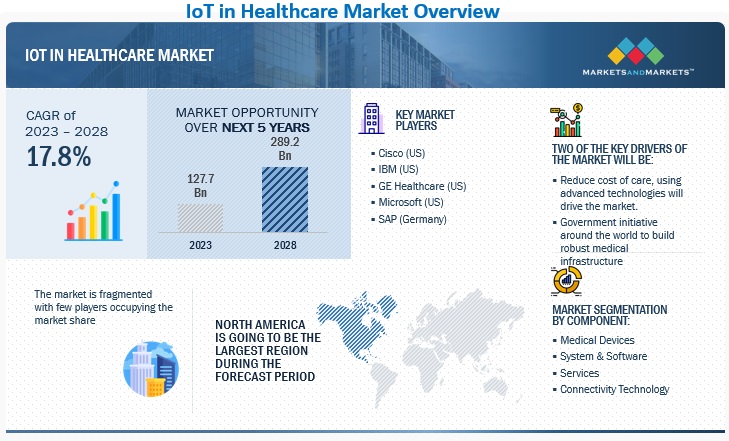

The global IoT in Healthcare Market size is expected to grow from USD 127.7 billion in 2023 to USD 289.2 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 17.8% over the forecast period. Major factors such advancements in healthcare infrastructure, medical devices and digital transformation across healthcare industry will drive the market.

To know about the assumptions considered for the study, Request for Free Sample Report

IoT in Healthcare Market Dynamics

Driver: Rising adoption of IoMT in healthcare industry

The Internet of Things has inevitably penetrated the healthcare industry. As connected technology becomes more intertwined into the daily lives, the healthcare industry is witnessing an increase in health-connected devices and the growth of the connected medical device market. IoMT connects data (patient information or performance data), people (patients, clinicians, and caregivers) and processes (healthcare delivery and patient support) with the help of connected medical devices and medical mobile applications. Patients and providers within the healthcare industry are adopting connected devices and IoMT as they offer several benefits such as real-time patient monitoring, more personalized care, and increased safety.

Restraints: Internet disruptions leading to rugged IoT device performance

The poor internet access and the use of internet among populations that are considered vulnerable, such as the elderly, those with low education levels, lower-income populations, rural residents, and minorities, pose the biggest restraint in implementing IoT solutions in the healthcare industry. The major drawback of IoT solutions is that there are ongoing advancements for which the workforce handling the technology requires adequate knowledge which the above-mentioned population lacks. Moreover, providing education to these individuals is a difficult task, posing a threat to the growth of the IoT in healthcare market.

Opportunity: Health insurers with IoT-connected intelligent devices

There are multiple opportunities for health insurers with IoT-connected intelligent devices. Health monitoring device data can be used by insurance firms for underwriting and claims processing. This data will allow them to detect fraud claims and identify candidates for underwriting. IoT devices provide transparency between insurers and customers in the underwriting, pricing, claims management, and risk assessment processes. Customers will have appropriate insight into the underlying logic behind every choice taken and process outcomes as a result of IoT-captured data-driven decisions in all operating processes.

Challenge: Increase in attack surfaces with rise in IoT devices due to data security constrictions

Technology’s growing role in healthcare is a double-edged sword: Alongside countless benefits are countless opportunities for bad actors to steal the most sensitive information. With the rising implementation of IoT, a significant threat that IoT poses is of data security and privacy, which further increases the healthcare industry’s vulnerability to cyberattacks. This is supplemented by the vast amount of sensitive data captured by IoT devices and transmitted in real-time. These attacks enable cybercriminals to hack healthcare systems, which compromise Personal Health Information (PHI) of both patients and doctors. With more advancements, the graph of cyberattacks also increases.

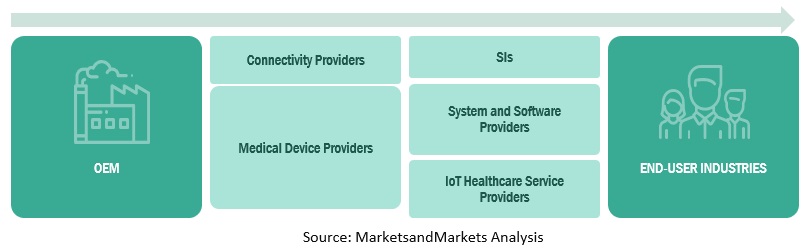

IoT in Healthcare Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on Application, Telemedicine segment to hold the highest market share during the forecast period

Various factors, such as organizational efforts toward moving to paperless EHR, government models and policy changes aimed at improving reimbursement models, and availability of high-speed internet connections and high-definition video cameras drive the growth of telemedicine adoption.

Based on Systems & Software, Remote Device Management segment to hold the highest market share during the forecast period

Remote device management solutions in healthcare typically involve the use of specialized software or platforms that enable healthcare providers to remotely monitor and manage medical devices. The need to monitor the status of medical devices in real-time will drive the market. Also, the increased adoption of cloud-based platform across healthcare verticals will drive the market.

Based on Service, Deployment and Integration segment to hold the highest market share during the forecast period

The increasing demand for software and solutions is pushing the demand for deployment & integration services, specifically in developing economies. Deployment & integration services add functionality and improve the performance of the existing operational systems to gain process efficiency, environmental benefits, and save on investment and operational expenditures. These service providers help organizations develop a connected environment by integrating IoT devices and solutions with their existing IT infrastructure.

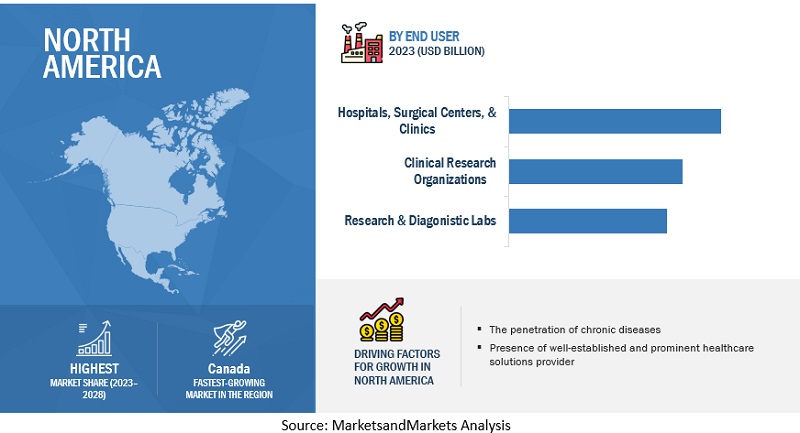

North America to account for the highest market share during the forecast period

The presence of leading healthcare solution providers that have established themselves globally is a major factor leading to the rapid growth of the IoT in Healthcare market in North America. The other factors such governments taking appropriate initiatives to promote digital health and a robust health infrastructure will drive the IoT in healthcare market in this region.

Key Market Players

This research study outlines the market potential, market dynamics, and major vendors operating in the IoT in Healthcare market. Key and innovative vendors in the the IoT in Healthcare market include Cisco (US), IBM (US), GE Healthcare (US), Microsoft (US), SAP (Germany), Medtronic (Ireland), Royal Philips (Netherlands), Resideo Technologies (US), Securitas (Sweden), Bosch (Germany), Armis (US), Oracle (US), PTC (US), Huawei (Japan), Seimens ( Germany), R-Style Lab (US), HQSoftware (Estonia), Oxagile (US), Softweb Solutions (US), OSP Labs (US), Comarch SA (Poland), Telit (UK), Kore Wireless (US), ScienceSoft (US), Intel (US), AgaMatrix (US), Welch Allyn (US), AliveCor (US), Sensely (US), Clover Health (US).

The study includes an in-depth competitive analysis of these key players in the IoT in Healthcare market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 127.7 Billion |

|

Market size value in 2028 |

USD 289.2 Billion |

|

Growth rate |

CAGR of 17.8% |

|

Segments covered |

Component, Application, End-User and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Cisco (US), IBM (US), GE Healthcare (US), Microsoft (US), SAP (Germany), Medtronic (Ireland), Royal Philips (Netherlands), Resideo Technologies (US), Securitas (Sweden), Bosch (Germany), Armis (US), Oracle (US), PTC (US), Huawei (China), Seimens ( Germany), R-Style Lab (US), HQSoftware (Estonia), Oxagile (US), Softweb Solutions (US), OSP Labs (US), Comarch SA (Poland), Telit (UK), Kore Wireless (US), ScienceSoft (US), Intel (US), AgaMatrix (US), Welch Allyn (US), AliveCor (US), Sensely (US), Clover Health (US). |

This research report categorizes the IoT in Healthcare market to forecast revenue and analyze trends in each of the following submarkets:

Based on Component:

-

Medical Devices

- Wearable External Medical Devices

- Implanted Medical Devices

- Stationary Medical Devices

-

System & Software

- Remote Device Management

- Network Bandwidth Management

- Data Analytics

- Application Security

- Network Security

-

Services

- Deployment & Integration

- Consulting

- Support & Maintenance

- Connectivity Technology

Based on Application:

- Telemedicine

- Clinical Operations and Workflow Management

- Connected Imaging

- Inpatient Monitoring

- Medication Management

- Others

Based on End-Users:

- Hospitals, Surgical Centers, and Clinics

- Clinical Research Organizations

- Government and Defense Institutions

- Research and Diagnostic Laboratories

Based on regions:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Recent Developments:

- In October 2022, GE Healthcare partnered with AMC Health in remote health monitoring to provide patients with chronic and post-acute care.

- In July 2022, Securitas announced the acquisition of Stanley Security and Healthcare. This acquisition will help Securitas to become a global security solutions partner.

- In June 2022, GE Healthcare launched a new remote patient monitoring technology, Portrait Mobile, which uses wearable wireless sensors to help clinicians detect patient deterioration earlier than traditional methods.

- In March 2022, Microsoft announced advancements in cloud technologies for healthcare and life sciences with the general availability of Azure Health Data Services and updates to Microsoft Cloud for Healthcare.

Frequently Asked Questions (FAQ):

What is the projected market value of the global IoT in Healthcare market?

The global IoT in Healthcare market size is projected to grow from USD 127.7 billion in 2023 to USD 289.2 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 17.8% during the forecast period.

Which region has the highest market share in the IoT in Healthcare market?

North America followed is expected to hold the largest market share in the IoT in Healthcare market.

Which application is expected to witness a higher market share in the coming years?

The telemedicine segment is expected to hold the highest market share during the forecast period.

Who are the major vendors in the IoT in Healthcare market?

Cisco (US), IBM (US), GE Healthcare (US), Microsoft (US), SAP (Germany), Medtronic (Ireland), Royal Philips (Netherlands), Resideo Technologies (US), Securitas (Sweden), Bosch (Germany), Armis (US), Oracle (US), PTC (US), Huawei (China), Seimens ( Germany), R-Style Lab (US), HQSoftware (Estonia), Oxagile (US), Softweb Solutions (US), OSP Labs (US), Comarch SA (Poland), Telit (UK), Kore Wireless (US), ScienceSoft (US), Intel (US), AgaMatrix (US), Welch Allyn (US), AliveCor (US), Sensely (US), Clover Health (US).

Which end-user is expected to witness a higher market share in the IoT in Healthcare market?

The Clinical Research Organizations segment is expected to hold the highest market share during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of IoMT in healthcare industry- Rising focus on active patient engagement and patient-centric care- Growing need for cost control measures in healthcare- Increased adoption of high-speed network technologies for IoT connectivity- Evolution of complementing technologies such as artificial intelligence and big data- Need for healthcare in remote locationsRESTRAINTS- Outdated infrastructure hindering digital growth of medical industry- Internet disruptions leading to IoT device issuesOPPORTUNITIES- Low doctor-to-patient ratio leading to increased dependency on self-operated eHealth platforms- Government initiatives for promoting digital health- IoT for COVID-19 patient monitoring- Health insurers with IoT-connected intelligent devicesCHALLENGES- Increase in cyberattacks due to data security constrictions- Integration of multiple devices and protocols leading to data overload- High cost of technology implementation

-

5.3 USE CASESUSE CASE 1: CONNECTED HEALTHCAREUSE CASE 2: ASSET TRACKINGUSE CASE 3: REMOTE PATIENT MONITORING

-

5.4 INDUSTRY TRENDSEVOLUTIONREGULATORY IMPLICATIONS- ISO STANDARDS - ISO 27799:2008 and ISO/TR 27809:2007- Internet of Medical Things Resilience Partnership Act (2017)- Health Insurance Portability and Accountability Act- HIPAA Privacy Rule- HIPAA Security Rule- CEN ISO/IEEE 11073- CEN/CENELEC

-

5.5 TECHNOLOGICAL ANALYSISARTIFICIAL INTELLIGENCEMACHINE LEARNINGNATURAL LANGUAGE PROCESSINGBIG DATASPEECH RECOGNITION5G

- 5.6 PRICING ANALYSIS

- 5.7 PATENT ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY CONFERENCES AND EVENTS, 2023

- 5.10 VALUE CHAIN ANALYSIS

- 6.1 INTRODUCTION

-

6.2 MEDICAL DEVICESMEDICAL DEVICES: MARKET DRIVERSSTATIONARY MEDICAL DEVICES- Technological advancements in medical technologyIMPLANTED MEDICAL DEVICES- Increasing demand for minimally invasive proceduresWEARABLE EXTERNAL MEDICAL DEVICES- Increasing focus on preventative healthcare

-

6.3 SYSTEMS & SOFTWARESYSTEMS & SOFTWARE: IOT IN HEALTHCARE MARKET DRIVERSREMOTE DEVICE MANAGEMENT- Need to improve patient outcomesNETWORK BANDWIDTH MANAGEMENT- Need for timely transmission of dataDATA ANALYTICS- Need to analyze large datasets and gain insightsAPPLICATION SECURITY- Security breaches in IoT healthcareNETWORK SECURITY- Increasing cyber threats

-

6.4 SERVICESSERVICES: MARKET DRIVERSDEPLOYMENT & INTEGRATION- Integrating operational and enterprise environments for secured IoT experienceCONSULTING- Need to implement data management processes and systemsSUPPORT & MAINTENANCE- Need for healthcare organizations to ensure optimal performance and prevent downtime

- 7.1 INTRODUCTION

-

7.2 TELEMEDICINETELEMEDICINE: MARKET DRIVERSSTORE-AND-FORWARD TELEMEDICINE- Need to improve diagnostic accuracyREMOTE PATIENT MONITORING- Need to improve patient outcome and convenienceINTERACTIVE TELEMEDICINE- Need to provide real-time communication

-

7.3 CLINICAL OPERATIONS & WORKFLOW MANAGEMENTCLINICAL OPERATIONS & WORKFLOW MANAGEMENT: MARKET DRIVERS

-

7.4 CONNECTED IMAGINGCONNECTED IMAGING: MARKET DRIVERS

-

7.5 IN-PATIENT MONITORINGIN-PATIENT MONITORING: MARKET DRIVERS

-

7.6 MEDICATION MANAGEMENTMEDICATION MANAGEMENT: MARKET DRIVERS

- 7.7 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 WI-FIIMPROVED DATA TRANSMISSION SPEED

-

8.3 BLUETOOTH LOW ENERGYINCREASED RANGE AND EASY INTEGRATION

-

8.4 ZIGBEELOW COST AND LOW POWER CONSUMPTION

-

8.5 NEAR-FIELD COMMUNICATIONINCREASING EFFICIENCY OF HEALTHCARE DELIVERY

-

8.6 CELLULARWIDE COVERAGE OFFERED BY CELLULAR NETWORKS

- 8.7 SATELLITE

- 9.1 INTRODUCTION

-

9.2 HOSPITALS, SURGICAL CENTERS, AND CLINICSHOSPITALS, SURGICAL CENTERS, AND CLINICS: MARKET DRIVERS

-

9.3 CLINICAL RESEARCH ORGANIZATIONSCLINICAL RESEARCH ORGANIZATIONS: MARKET DRIVERS

-

9.4 GOVERNMENT AND DEFENSE INSTITUTIONSGOVERNMENT AND DEFENSE INSTITUTIONS: MARKET DRIVERS

-

9.5 RESEARCH AND DIAGNOSTIC LABORATORIESRESEARCH AND DIAGNOSTIC LABORATORIES: MARKET DRIVERS

-

10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: MARKET DRIVERSUS- Rising prevalence of chronic diseases and growing aging populationCANADA- Need to curtail escalating healthcare costs and implementation of favorable government initiatives

-

10.3 EUROPEEUROPE: PESTLE ANALYSISEUROPE: RECESSION IMPACTEUROPE: IOT IN HEALTHCARE MARKET DRIVERSUK- Rising adoption of Real-Time Healthcare Systems (RTHS) and other Healthcare Information Systems (HCIS)GERMANY- Growing demand for effective self-health management and home-care solutionsFRANCE- Huge demand for innovative healthcare solutions driving market for IoT in healthcareREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: IMARKET DRIVERSCHINA- Strong telecommunications network creating influx of IoT deploymentsJAPAN- Rising overall healthcare expenditure and growing geriatric populationINDIA- Government initiatives driving marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: PESTLE ANALYSISMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET DRIVERSMIDDLE EAST- National Transformation Plan and aims of Saudi Vision 2030 driving marketAFRICA- Rapid growth in access to ICT, particularly mobile phones and network connectivity

-

10.6 LATIN AMERICALATIN AMERICA: PESTLE ANALYSISLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: IOT IN HEALTHCARE MARKET DRIVERSBRAZIL- Increasing adoption of smartphone technology driving marketMEXICO- Government efforts toward healthcare digitalization fueling market growthREST OF LATIN AMERICA

-

11.1 OVERVIEW

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 REVENUE ANALYSIS

-

11.4 COMPANY MARKET RANKING ANALYSIS

-

11.5 MARKET SHARE ANALYSIS OF TOP PLAYERS

-

11.6 COMPANY EVALUATION QUADRANTSDEFINITIONS AND METHODOLOGY- Stars- Emerging leaders- Pervasive players- Participants

-

11.7 COMPANY PRODUCT FOOTPRINT ANALYSISEND-USER FOOTPRINTCOMPONENT FOOTPRINTREGIONAL FOOTPRINT

-

11.8 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

-

11.9 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.10 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 MAJOR PLAYERSCISCO- Business overview- Products offered- Recent developments- MnM viewIBM- Business overview- Products offered- Recent developments- MnM viewGE HEALTHCARE- Business overview- Products offered- Recent developments- MnM viewMICROSOFT- Business overview- Products offered- Recent developments- MnM viewSAP- Business overview- Products offered- Recent developments- MnM viewMEDTRONIC- Business overview- Products offered- Recent developmentsROYAL PHILIPS- Business overview- Products offered- Recent developmentsRESIDEO TECHNOLOGIES- Business overview- Products offeredSECURITAS- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSBOSCHARMISORACLEPTCHUAWEISIEMENSR-STYLE LABHQSOFTWAREOXAGILESOFTWEB SOLUTIONSOSP LABSCOMARCH SATELITKORE WIRELESSSCIENCESOFTINTELAGAMATRIXWELCH ALLYNALIVECORSENSELYCLOVER HEALTH

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 IOT INTEGRATION MARKETMARKET OVERVIEWIOT INTEGRATION MARKET, BY SERVICEIOT INTEGRATION MARKET, BY ORGANIZATION SIZEIOT INTEGRATION MARKET, BY REGION- Europe

-

13.4 INCIDENT AND EMERGENCY MARKETMARKET OVERVIEWINCIDENT AND EMERGENCY MARKET, BY COMMUNICATION TOOL AND DEVICEINCIDENT AND EMERGENCY MARKET, BY REGION- Asia Pacific

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 FACTOR ANALYSIS

- TABLE 2 KEY USE CASES

- TABLE 3 AVERAGE SELLING PRICE, BY KEY PLAYER

- TABLE 4 TOP TWENTY PATENT OWNERS

- TABLE 5 IOT IN HEALTHCARE MARKET: PORTER’S FIVE FORCES MODEL

- TABLE 6 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 7 MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 8 MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 9 MEDICAL DEVICES: MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 10 MEDICAL DEVICES: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 11 MEDICAL DEVICES: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 12 MEDICAL DEVICES: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 13 MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 14 MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 15 STATIONARY MEDICAL DEVICES MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 16 STATIONARY MEDICAL DEVICES MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 17 STATIONARY MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 18 STATIONARY MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 19 IMPLANTED MEDICAL DEVICES MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 20 IMPLANTED MEDICAL DEVICES MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 21 IMPLANTED MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 22 IMPLANTED MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 23 WEARABLE EXTERNAL MEDICAL DEVICES MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 24 WEARABLE EXTERNAL MEDICAL DEVICES MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 25 WEARABLE EXTERNAL MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 26 WEARABLE EXTERNAL MEDICAL DEVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 27 SYSTEMS & SOFTWARE: IOT IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 28 SYSTEMS & SOFTWARE: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 29 SYSTEMS & SOFTWARE: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 30 SYSTEMS & SOFTWARE: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 31 SYSTEMS & SOFTWARE: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 32 SYSTEMS & SOFTWARE: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 33 REMOTE DEVICE MANAGEMENT MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 34 REMOTE DEVICE MANAGEMENT MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 35 REMOTE DEVICE MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 36 REMOTE DEVICE MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 37 NETWORK BANDWIDTH MANAGEMENT MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 38 NETWORK BANDWIDTH MANAGEMENT MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 39 NETWORK BANDWIDTH MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 40 NETWORK BANDWIDTH MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 41 DATA ANALYTICS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 42 DATA ANALYTICS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 43 DATA ANALYTICS: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 44 DATA ANALYTICS: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 45 APPLICATION SECURITY MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 46 APPLICATION SECURITY MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 47 APPLICATION SECURITY: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 48 APPLICATION SECURITY: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 49 NETWORK SECURITY MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 50 NETWORK SECURITY MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 51 NETWORK SECURITY: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 52 NETWORK SECURITY: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 53 SERVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 54 SERVICES: MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 55 SERVICES: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 56 SERVICES: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 57 SERVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 58 SERVICES: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 59 DEPLOYMENT & INTEGRATION MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 60 DEPLOYMENT & INTEGRATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 61 DEPLOYMENT & INTEGRATION: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 62 DEPLOYMENT & INTEGRATION: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 63 CONSULTING MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 64 CONSULTING MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 65 CONSULTING: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 66 CONSULTING: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 67 SUPPORT & MAINTENANCE MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 68 SUPPORT & MAINTENANCE MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 69 SUPPORT & MAINTENANCE: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 70 SUPPORT & MAINTENANCE: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 71 MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 72 MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 73 TELEMEDICINE: IOT IN HEALTHCARE MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 74 TELEMEDICINE: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 75 TELEMEDICINE: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 76 TELEMEDICINE: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 77 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 78 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 79 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 80 CLINICAL OPERATIONS & WORKFLOW MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 81 CONNECTED IMAGING: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 82 CONNECTED IMAGING: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 83 CONNECTED IMAGING: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 84 CONNECTED IMAGING: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 85 IN-PATIENT MONITORING: IOT IN HEALTHCARE MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 86 IN-PATIENT MONITORING: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 87 IN-PATIENT MONITORING: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 88 IN-PATIENT MONITORING: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 89 MEDICATION MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 90 MEDICATION MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 91 MEDICATION MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 92 MEDICATION MANAGEMENT: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 93 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 94 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 95 OTHER APPLICATIONS: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 96 OTHER APPLICATIONS: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 97 MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 98 MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 99 HOSPITALS, SURGICAL CENTERS, AND CLINICS: IOT IN HEALTHCARE MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 100 HOSPITALS, SURGICAL CENTERS, AND CLINICS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 101 HOSPITALS, SURGICAL CENTERS, AND CLINICS: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 102 HOSPITALS, SURGICAL CENTERS, AND CLINICS: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 103 CLINICAL RESEARCH ORGANIZATIONS: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 104 CLINICAL RESEARCH ORGANIZATIONS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 105 CLINICAL RESEARCH ORGANIZATION: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 106 CLINICAL RESEARCH ORGANIZATION: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 107 GOVERNMENT AND DEFENSE INSTITUTIONS: IOT IN HEALTHCARE MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 108 GOVERNMENT AND DEFENSE INSTITUTIONS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 109 GOVERNMENT AND DEFENSE INSTITUTIONS: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 110 GOVERNMENT AND DEFENSE INSTITUTIONS: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 111 RESEARCH AND DIAGNOSTIC LABORATORIES: MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 112 RESEARCH AND DIAGNOSTIC LABORATORIES: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 113 RESEARCH AND DIAGNOSTIC LABORATORIES: NORTH AMERICAN MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 114 RESEARCH AND DIAGNOSTIC LABORATORIES: NORTH AMERICAN MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 115 MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 116 MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 117 NORTH AMERICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 118 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 119 NORTH AMERICA: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 120 NORTH AMERICA: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 121 NORTH AMERICA: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 122 NORTH AMERICA: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 123 NORTH AMERICA: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 124 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 125 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 126 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 127 NORTH AMERICA: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 128 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 129 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 130 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 131 US: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 132 US: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 133 US: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 134 US: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 135 US: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 136 US: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 137 US: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 138 US: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 139 US: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 140 US: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 141 US: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 142 US: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 143 CANADA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 144 CANADA: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 145 CANADA: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 146 CANADA: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 147 CANADA: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 148 CANADA: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 149 CANADA: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 150 CANADA: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 151 CANADA: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 152 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 153 CANADA: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 154 CANADA: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 155 EUROPE: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 156 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 157 EUROPE: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 158 EUROPE: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 159 EUROPE: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 160 EUROPE: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 161 EUROPE: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 162 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 163 EUROPE: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 164 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 165 EUROPE: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 166 EUROPE: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 167 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 168 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 169 UK: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 170 UK: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 171 UK: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 172 UK: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 173 UK: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 174 UK: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 175 UK: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 176 UK: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 177 UK: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 178 UK: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 179 UK: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 180 UK: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 181 GERMANY: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 182 GERMANY: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 183 GERMANY: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 184 GERMANY: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 185 GERMANY: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 186 GERMANY: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 187 GERMANY: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 188 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 189 GERMANY: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 190 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 191 GERMANY: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 192 GERMANY: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 193 FRANCE: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 194 FRANCE: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 195 FRANCE: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 196 FRANCE: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 197 FRANCE: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 198 FRANCE: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 199 FRANCE: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 200 FRANCE: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 201 FRANCE: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 202 FRANCE: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 203 FRANCE: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 204 FRANCE: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 205 ASIA PACIFIC: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 206 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 207 ASIA PACIFIC: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 208 ASIA PACIFIC: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 209 ASIA PACIFIC: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 210 ASIA PACIFIC: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 211 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 212 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 213 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 214 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 215 ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 216 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 217 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 218 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 219 CHINA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 220 CHINA: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 221 CHINA: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 222 CHINA: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 223 CHINA: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 224 CHINA: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 225 CHINA: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 226 CHINA: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 227 CHINA: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 228 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 229 CHINA: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 230 CHINA: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 231 JAPAN: MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 232 JAPAN: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 233 JAPAN: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 234 JAPAN: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 235 JAPAN: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 236 JAPAN: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 237 JAPAN: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 238 JAPAN: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 239 JAPAN: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 240 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 241 JAPAN: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 242 JAPAN: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 243 MIDDLE EAST & AFRICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 244 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 245 MIDDLE EAST & AFRICA: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 246 MIDDLE EAST & AFRICA: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 247 MIDDLE EAST & AFRICA: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 248 MIDDLE EAST & AFRICA: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 249 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 250 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 251 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 252 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 253 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 254 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 255 MIDDLE EAST & AFRICA: MARKET, BY SUB-REGION, 2018–2022 (USD BILLION)

- TABLE 256 MIDDLE EAST & AFRICA: MARKET, BY SUB-REGION, 2023–2028 (USD BILLION)

- TABLE 257 MIDDLE EAST: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 258 MIDDLE EAST: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 259 MIDDLE EAST: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 260 MIDDLE EAST: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 261 MIDDLE EAST: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 262 MIDDLE EAST: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 263 MIDDLE EAST: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 264 MIDDLE EAST: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 265 MIDDLE EAST: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 266 MIDDLE EAST: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 267 MIDDLE EAST: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 268 MIDDLE EAST: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 269 LATIN AMERICA: IOT IN HEALTHCARE MARKET, BY COMPONENT, 2018–2022 (USD BILLION)

- TABLE 270 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD BILLION)

- TABLE 271 LATIN AMERICA: MARKET, BY MEDICAL DEVICE, 2018–2022 (USD BILLION)

- TABLE 272 LATIN AMERICA: MARKET, BY MEDICAL DEVICE, 2023–2028 (USD BILLION)

- TABLE 273 LATIN AMERICA: MARKET, BY SYSTEMS & SOFTWARE, 2018–2022 (USD BILLION)

- TABLE 274 LATIN AMERICA: MARKET, BY SYSTEMS & SOFTWARE, 2023–2028 (USD BILLION)

- TABLE 275 LATIN AMERICA: MARKET, BY SERVICE, 2018–2022 (USD BILLION)

- TABLE 276 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD BILLION)

- TABLE 277 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 278 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 279 LATIN AMERICA: MARKET, BY END USER, 2018–2022 (USD BILLION)

- TABLE 280 LATIN AMERICA: MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 281 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 282 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 283 IOT IN HEALTHCARE MARKET: DEGREE OF COMPETITION

- TABLE 284 COMPANY PRODUCT FOOTPRINT

- TABLE 285 COMPANY END-USER FOOTPRINT

- TABLE 286 COMPANY COMPONENT FOOTPRINT

- TABLE 287 COMPANY REGION FOOTPRINT

- TABLE 288 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 289 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- TABLE 290 MARKET: PRODUCT LAUNCHES, 2020–2022

- TABLE 291 IOT IN HEALTHCARE MARKET: DEALS, 2019–2022

- TABLE 292 CISCO: BUSINESS OVERVIEW

- TABLE 293 CISCO: PRODUCTS OFFERED

- TABLE 294 CISCO: DEALS

- TABLE 295 IBM: BUSINESS OVERVIEW

- TABLE 296 IBM: PRODUCTS OFFERED

- TABLE 297 IBM: PRODUCT LAUNCHES

- TABLE 298 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 299 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 300 GE HEALTHCARE: PRODUCT LAUNCHES

- TABLE 301 GE HEALTHCARE: DEALS

- TABLE 302 MICROSOFT: BUSINESS OVERVIEW

- TABLE 303 MICROSOFT: PRODUCTS OFFERED

- TABLE 304 MICROSOFT: PRODUCT LAUNCHES

- TABLE 305 SAP: BUSINESS OVERVIEW

- TABLE 306 SAP: PRODUCTS OFFERED

- TABLE 307 SAP: PRODUCT LAUNCHES

- TABLE 308 MEDTRONIC: BUSINESS OVERVIEW

- TABLE 309 MEDTRONIC: PRODUCTS OFFERED

- TABLE 310 MEDTRONIC: PRODUCT LAUNCHES

- TABLE 311 ROYAL PHILIPS: BUSINESS OVERVIEW

- TABLE 312 ROYAL PHILIPS: PRODUCTS OFFERED

- TABLE 313 ROYAL PHILIPS: PRODUCT LAUNCHES

- TABLE 314 ROYAL PHILIPS: DEALS

- TABLE 315 RESIDEO TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 316 RESIDEO TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 317 SECURITAS: BUSINESS OVERVIEW

- TABLE 318 SECURITAS: PRODUCTS OFFERED

- TABLE 319 SECURITAS: DEALS

- TABLE 320 IOT INTEGRATION MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 321 IOT INTEGRATION MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 322 IOT INTEGRATION MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 323 IOT INTEGRATION MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 324 EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 325 EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 326 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 327 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 328 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMMUNICATION TOOL AND DEVICE, 2016–2021 (USD MILLION)

- TABLE 329 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMMUNICATION TOOL AND DEVICE, 2022–2027 (USD MILLION)

- TABLE 330 ASIA PACIFIC: INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 331 ASIA PACIFIC: INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- FIGURE 1 IOT IN HEALTHCARE MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

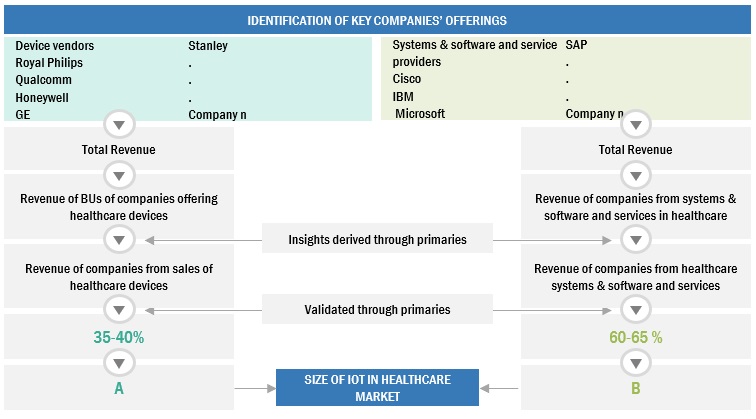

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE OF IOT IN HEALTHCARE DEVICES, SYSTEMS & SOFTWARE, AND SERVICES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL MEDICAL DEVICES, SYSTEMS AND SOFTWARE, AND SERVICES OF IOT IN HEALTHCARE

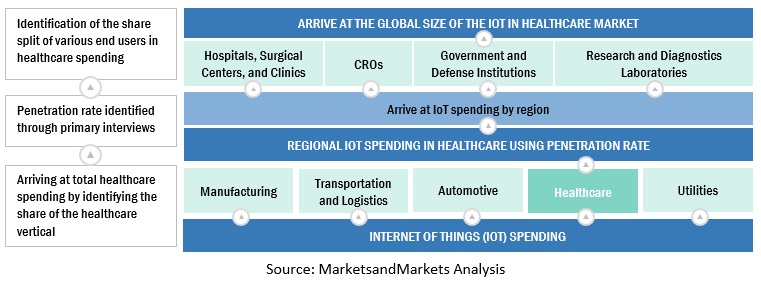

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—TOP-DOWN (DEMAND SIDE): SHARE OF HEALTHCARE THROUGH OVERALL IOT SPENDING

- FIGURE 6 MARKET: TO WITNESS SLIGHT DIP IN Y-O-Y IN 2023

- FIGURE 7 MARKET: REGIONAL SNAPSHOT

- FIGURE 8 REDUCED COST OF CARE AND EVOLUTION OF ARTIFICIAL INTELLIGENCE TECHNOLOGY TO DRIVE GROWTH

- FIGURE 9 MEDICAL DEVICES SEGMENT AND NORTH AMERICA TO DOMINATE IN 2023

- FIGURE 10 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

- FIGURE 12 HEALTHCARE SPENDING, BY COUNTRY, 2021 (% OF GDP)

- FIGURE 13 EVOLUTION OF IOT IN HEALTHCARE

- FIGURE 14 TOP TEN PATENT APPLICANTS (GLOBAL)

- FIGURE 15 IOT IN HEALTHCARE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 16 SYSTEMS & SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 17 IMPLANTED MEDICAL DEVICES SEGMENT TO BE LARGEST SUBSEGMENT BY 2028

- FIGURE 18 APPLICATION SECURITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DEPLOYMENT & INTEGRATION SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 20 IN-PATIENT MONITORING SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 21 CLINICAL RESEARCH ORGANIZATIONS SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 22 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING 2023–2028

- FIGURE 23 GEOGRAPHIC SNAPSHOT OF GLOBAL MARKET

- FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 26 HISTORICAL REVENUE ANALYSIS, 2018–2022

- FIGURE 27 RANKING OF KEY PLAYERS IN MARKET, 2022

- FIGURE 28 MARKET SHARE ANALYSIS OF COMPANIES IN MARKET

- FIGURE 29 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 30 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 31 IOT IN HEALTHCARE MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 32 CISCO: COMPANY SNAPSHOT

- FIGURE 33 IBM: COMPANY SNAPSHOT

- FIGURE 34 GE HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 35 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 36 SAP: COMPANY SNAPSHOT

- FIGURE 37 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 38 ROYAL PHILIPS: COMPANY SNAPSHOT

- FIGURE 39 RESIDEO TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 40 SECURITAS: COMPANY SNAPSHOT

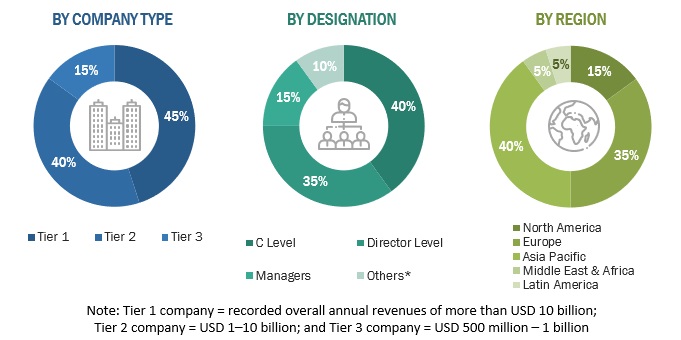

This research study involved the use of extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, and Bloomberg, to identify and collect information useful for the comprehensive market research study on the IoT in healthcare market. Additionally, sources such as the US Department of Health and Human Services, Integrated Healthcare Association (IHA), American Telemedicine Association, Health Level Seven International (HL7), Healthcare Information and Management Systems Society (HIMSS), Centers for Disease Control and Prevention (CDC), Centers for Medicare and Medicaid Services (CMS), Office of the National Coordinator for Healthcare Information Technology (ONC), National Health Service (NHS), Center for Devices and Radiological Health (CDRH), International Profiles of Health Care Systems, Continua Health Alliance, Economist Intelligence Unit, World Health Organization (WHO), and Organisation for Economic Co-operation and Development (OECD) were used to collect information specific to the IoT in healthcare market. The primary sources were mainly industry experts from core and related industries, preferred IoT medical device providers, connectivity/network providers, and service providers. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

The market size of companies offering IoT in healthcare devices, systems and solutions, and connectivity technologies and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from secondary sources, such as the US Department of Health and Human Services, IHA, American Telemedicine Association, HL7, HIMSS, CDC, CMS, ONC, NHS, CDRH, International Profiles of Health Care Systems, Continua Health Alliance, Economist Intelligence Unit, WHO, and OECD. Additionally, IoT investment and spending of various countries were extracted from the respective healthcare associations.

Secondary research was conducted to obtain key information about the industry’s value chain, the total pool of key players, market classification, and segmentation from market- and technology-oriented perspectives

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from IoT in healthcare solution vendors, system integrators, service providers, industry associations, healthcare consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and installation teams of governments/end users using IoT in healthcare solutions were interviewed to understand buyers’ perspective on the suppliers, products, service providers, and their current use of IoT healthcare solutions which would affect the overall IoT in healthcare market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

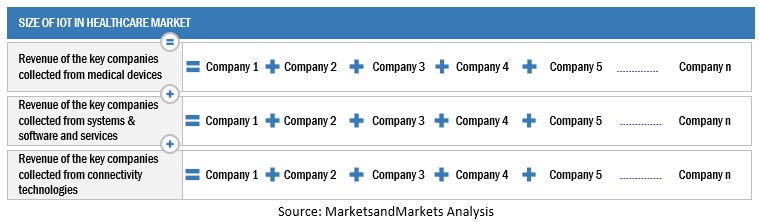

Multiple approaches were adopted for estimating and forecasting the IoT in healthcare market. The first approach involves the estimation of the market size by the summation of companies’ revenue generated through the sales of devices, systems and solutions, and associated services.

Market Size Estimation Methodology: Approach 1 (Supply Side) - Revenue of IoT in Healthcare Devices, Systems & Software, and Services

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology: Approach 1—Bottom Up (Supply Side): Collective Revenue of all Medical Devices, Systems and Software, and Services of IoT in Healthcare

In this market estimation approach, MarketsandMarkets identified key IoT healthcare device companies, such as Medtronic, Royal Philips, GE, Honeywell, and Healthcare Technology Services, which contribute almost 35-40% to the global IoT in healthcare market. After confirming these companies through primary interviews with industry experts, the companies’ total revenue was estimated through annual reports, SEC filings, and paid databases. These companies’ revenue pertaining to the Business Units (BUs) that offer IoT in healthcare systems and solutions, and associated services was identified through similar sources. Then through primaries, the data of revenue generated through specific IoT healthcare systems and solutions was collected. Collective revenue of key companies that offer IoT healthcare systems and solutions comprised 40-45% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed by connectivity technology players, the market size of connectivity technology players (20-25%) was assumed to be the size of the global IoT in healthcare market for Financial Year 2023.

Market Size Estimation Methodology: Approach 2—Top Down (Demand Side): Share of Healthcare Through Overall IoT Spending

In the demand-side approach, among the entire IoT spending, MarketsandMarkets has estimated the share of the healthcare vertical. IoT spending in various regions, such as North America, Europe, APAC, Latin America, and MEA, has been estimated and validated through primary research. Post arriving at the IoT spending by region, the demand by hospitals, surgical centers, and clinics; Clinical Research Organizations (CROs); government and defense institutions; and research and diagnostics laboratories was ascertained to arrive at the global size of the IoT in healthcare market.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

IoT is the networking of devices and buildings. The technology enables the collection and sharing of information directly via internet protocols. IoT in healthcare bridges the digital and physical worlds to monitor and modify patient behavior in real-time and manage conditions, such as asthma, diabetes, and high blood pressure, by streamlining various clinical processes and information flow. IoT can bring together people (patients, caregivers, and clinicians), data (patient or member data), processes (care delivery and wellness), and enablers (fitness and medical devices, and mobile applications) to efficiently deliver healthcare results. It helps deliver intelligent and measurable information to improve the overall efficiency in different healthcare aspects.

Key Stakeholders

- Sensor, location, and detection solution providers

- Wireless network operators and service providers

- Data management companies

- Embedded systems companies

- Application developers and aggregators

- Managed service and middleware companies

- System integrators

- Third-party providers

- Internet identity management, privacy, and security companies

- Semiconductor companies

- Machine-to-machine, IoT, and general telecommunication companies

- Support and maintenance service providers

- Wireless infrastructure providers

Report Objectives

- To define, describe, and forecast the Internet of Things (IoT) in healthcare market by component, application, end user, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze the competitive developments, such as mergers and acquisitions, product developments, and R&D activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT in Healthcare Market