LTE IoT Market by Technology (NB-IoT and LTE-M), Service (Professional Services and Managed Services), Industry (Manufacturing, Energy and Utilities, Transportation and Logistics, Healthcare, and Agriculture), and Region - Global Forecast to 2023

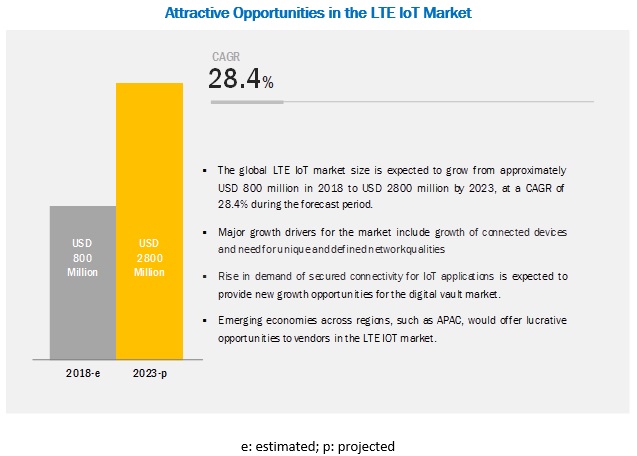

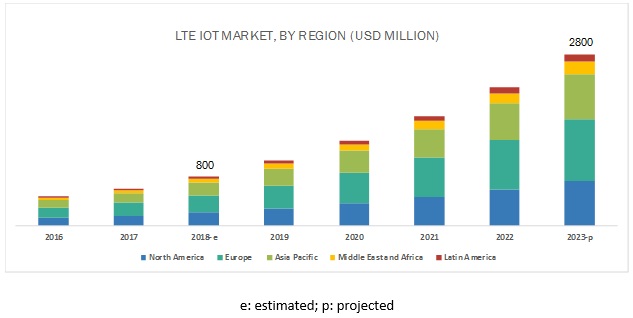

[109 Pages Report] The global LTE IoT Market size is expected to grow from USD 800 million in 2018 to USD 2800 million by 2023, at a Compound Annual Growth Rate (CAGR) of 28.4% during the forecast period. The major growth factors for the market include the growth of connected devices and the need for unique and defined network qualities.

The manufacturing industry to be the largest contributor to the LTE IoT market growth during the forecast period

The manufacturing industry has witnessed tremendous transformation, owing to advancements in technologies, such as robotics and automated production lines. Due to the delicate nature of manufacturing operations, manufacturers are adopting IoT solutions, sensors, and IoT wireless connectivity platforms to increase their productivity, thereby transforming their operations into smart manufacturing. Many software and solution providers are offering industries smart manufacturing applications that include proactive and automatic analytics capabilities, making industrial manufacturing an intelligent and self-manageable environment. The LTE technology is availed to establish stable connectivity among various devices in a factory for data transmission, to enable industries to tackle the issues related to predictive maintenance and autonomous production.

Professional services segment to hold a larger market size during the forecast period

Professional services are required during and after the implementation of LTE IoT technologies, such as LTE-M and NB-IoT. These services typically include planning, design and implementation, consulting services, support and maintenance services, and upgrades. The professional services segment is a growing market, where big firms rely on the players for consulting and implementation services. In the LTE IoT market, professional services play a very important role, as for customers it is very important to understand the feasibility of LTE IoT solutions. Therefore, the companies providing these services have consultants, security experts, and dedicated project management teams that specialize in the design and delivery of critical decision support software, tools, services, and expertise.

Europe to hold the largest market size during the forecast period

Europe is leading the LTE IoT market due to the widespread adoption of the LTE technology for enterprises IoT applications. The region is leading in terms of LTE IoT coverage area. Europe takes the credit that it coined the phrase IoT and has a major contribution to the promotion of IoT telecom and allied services across the globe. Moreover, the presence of telecom companies, such as Orange, Vodafone, and Deutsche Telekom, are playing an important role in bringing innovations to the telecom industry. This enables the region to adopt new technologies such as LTE-M and NB-IoT. Moreover, the government initiatives toward the adoption of such technologies are helping the vendors work on new advanced technologies. European Commission and European Union member states are committed to developing strategies to support experiments and the deployment of IoT telecom and allied services. Germany, UK, and France are the top 3 contributors to the LTE IoT market in Europe. The rising adoption of telco cloud, growing data consumption, increasing adoption of smart devices at a peak rate, and reduced cost of IoT components with the evolving wireless technology, such as 5G and NB-IoT, would drive the overall growth of LTE IoT.

Key LTE IoT Market Players

Major vendors in the LTE IoT market include Ericsson (Sweden), Vodafone (UK), Telstra (Australia), Sierra Wireless (Canada), PureSoftware (India), Sequans Communications (France), Orange (France), T-Mobile (US), Telus (US), MediaTek (Sweden), Athonet (Italy), NetNumber (US), Telensa (UK), Actility (France), and Link Labs (US).

Scope of the report:

|

Report Metrics |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Technology (LTE-M and NB-IoT), Service, Industry, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Ericsson (Sweden), Vodafone (UK), Telstra (Australia), Sierra Wireless (Canada), Sequans Communications (France), and 10 other players |

This research report categorizes the market based on technology, service, industry, and region.

By Technology, the LTE IoT market has been segmented as follows:

- LTE-M

- NB-IoT

By Service, the market has been segmented as follows:

- Professional services

- Managed services

By Industry, the LTE IoT market has been segmented as follows:

- Manufacturing

- Energy and utilities

- Transportation and logistics

- Healthcare

- Agriculture

By Region, the market has been segmented as follows:

- North America

- Europe

- APAC

- MEA

- Latin America

Key questions addressed by the report:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for the LTE IoT market?

- Which are the major factors expected to drive the market in near future?

- Which region would offer a higher growth for the vendors in the market?

- Which service would account for the highest market share in the market?

Frequently Asked Questions (FAQ):

What is LTE IoT?

What are the major industries that deploy LTE IoT?

Which are the top industry players in LTE IoT market?

What are the top trends in LTE IoT market?

Trends that are impacting the LTE IoT market includes:

- Growth in the Number of Connected Devices

- Need for Unique and Defined Network Qualities

- Rise in Need for Long-Range Connectivity Between IoT Applications

Opportunities for the LTE IoT market:

- Rise in Demand of Secured Connectivity for IoT Applications

- Growing Adoption of Smart Technologies and Distributed Applications

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 LTE IoT: Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Forecast

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the LTE IoT Market

4.2 Market Top 3 Industries and Regions

4.3 Market By Region

4.4 Market Investment Scenario

5 Market Overview (Page No. - 29)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Growth in the Number of Connected Devices

5.1.1.2 Need for Unique and Defined Network Qualities

5.1.1.3 Rise in Need for Long-Range Connectivity Between IoT Applications

5.1.2 Restraints

5.1.2.1 Operational Downtime Due to Upgradation of Network Infrastructure

5.1.3 Opportunities

5.1.3.1 Rise in Demand of Secured Connectivity for IoT Applications

5.1.4 Challenges

5.1.4.1 Additional Requirements for Deployment of LTE IoT Technology

5.1.4.2 High Initial Cost of Deployment

5.2 Use Cases

5.2.1 China Mobile

5.2.2 Telefonica

5.2.3 T-Mobile

5.2.4 Cosmote

5.2.5 Telia

6 LTE IoT Market, By Technology (Page No. - 33)

6.1 Introduction

6.2 LTE-M

6.2.1 Growing Need for Managing High-Level IoT Applications in Real Time to Drive the Growth of LTE-M Technology

6.3 NB-IoT

6.3.1 Need for Managing Higher Number of Applications at A Lower Cost to Drive the Growth of NB-IoT Technology

7 LTE IoT Market, By Service (Page No. - 37)

7.1 Introduction

7.2 Professional Services

7.2.1 Increasing Demand for LTE IoT Technologies Expected to Fuel the Growth of Professional Services

7.3 Managed Services

7.3.1 Need for Expertise During Integration of Two Different Technologies on the Same Platform to Generate the Demand for Managed Services

8 Market, By Industry (Page No. - 41)

8.1 Introduction

8.2 Manufacturing

8.2.1 Asset Tracking and Management

8.2.1.1 Challenges Relate to Asset Management to Fuel the Adoption of LTE IoT Technology

8.2.2 Predictive Maintenance

8.2.2.1 Increasing Maintenance Cost Leading to Adoption of Predictive Maintenance

8.2.3 Inventory Management

8.2.3.1 Growing Need for Smart Inventory Management to Drive the Growth of LTE IoT Market

8.2.4 Emergency and Incident Management

8.2.4.1 Rising Concerns About Public Safety Driving the Growth of LTE IoT Technologies

8.2.5 Others

8.3 Energy and Utilities

8.3.1 Oil and Gas Management

8.3.1.1 Rising Concerns Related to Real-Time Application Management to Drive the Growth of LTE IoT Technologies

8.3.2 Electricity Grid Management

8.3.2.1 Need for Smart Application to Reduce Losses to Drive the Demand for Electricity Grid Management

8.3.3 Water and Wastewater Management

8.3.3.1 Increasing Adoption of Smart Water Metering Applications to Drive the Growth of LTE IoT Technologies

8.4 Transportation and Logistics

8.4.1 Remote Monitoring

8.4.1.1 Need for Real-Time Information to Monitor Vehicle and Material Condition Driving the Growth of LTE IoT Technologies

8.4.2 Security and Surveillance

8.4.2.1 Increasing Concerns About Safety to Drive the Adoption of IoT LTE Technology for Security and Surveillance

8.4.3 Smart Parking

8.4.3.1 Increasing Number of Connected Vehicles to Drive the Growth of Smart Parking Application

8.4.4 Supply Chain Management

8.4.4.1 Growing Adoption of RFID and Tracking Devices to Drive the Growth of LTE IoT for Supply Chain Management

8.5 Healthcare

8.5.1 Increasing Adoption of Monitoring Devices to Fuel the Demand for LTE IoT Technologies in Healthcare Industry

8.6 Agriculture

8.6.1 Increasing Adoption on Sensors and IoT Devices in Agriculture to Drive the Demand for LTE IoT Technologies

9 Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.1.1 Early Adoption of IoT Technologies to Increase the Need for LTE IoT Network to Manage Connected Devices

9.2.2 Canada

9.2.2.1 Increasing Availability of Telecom Infrastructure to Enable LTE Players to Deploy New Technologies in This Market

9.3 Europe

9.3.1 Germany

9.3.1.1 Growing Adoption of Connected Devices in Manufacturing Industry to Fuel the Need for LTE IoT Network

9.3.2 United Kingdom

9.3.2.1 Increasing Focus on Operational Excellence of Organizations to Enforce Enterprises to Adopt LTE IoT Technologies

9.3.3 France

9.3.3.1 Increasing Adoption of IoT Applications in Energy and Utilities Industry to Fuel the Growth of Market

9.4 Asia Pacific

9.4.1 Australia

9.4.1.1 Increasing Adoption of Industry 4.0 to Fuel the Growth of LTE IoT Market in Australia

9.4.2 China

9.4.2.1 Increasing Iiot and Government Initiatives Toward Adoption of Smart Applications in Various Industries to Fuel the Growth of LTE IoT Market in China

9.5 Middle East and Africa

9.5.1 United Arab Emirates

9.5.1.1 Increasing Smart City Initiatives to Fuel the Growth of the LTE IoT Market in the UAE

9.5.2 South Africa

9.5.2.1 Increasing Adoption of IoT Applications to Fuel the Growth of LTE IoT

9.6 Latin America

9.6.1 Brazil

9.6.1.1 Increasing Number of Smart Manufacturing Initiatives in Brazil to Fuel the Growth of LTE IoT

9.6.2 Mexico

9.6.2.1 Growing Telecom Infrastructure to Fuel the Growth of LTE IoT in Mexico

10 Competitive Landscape (Page No. - 76)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 New Product Launches and Enhancements

10.3.2 Partnerships, Collaborations, and Agreements

11 Company Profiles (Page No. - 79)

(Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Ericsson

11.2 Vodafone Group

11.3 Telstra

11.4 Sierra Wireless

11.5 Puresoftware

11.6 Sequans Communications

11.7 Orange

11.8 T Mobile

11.9 Telus

11.10 Mediatek

11.11 Athonet

11.12 Netnumber

11.13 Telensa

11.14 Actility

11.15 Link Labs

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 103)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (67 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 LTE IoT Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 3 Market Size By Technology, 20162023 (USD Million)

Table 4 LTE-M: Market Size By Region, 20162023 (USD Million)

Table 5 NB-IoT: Market Size By Region, 20162023 (USD Million)

Table 6 LTE IoT Market Size, By Service, 20162023 (USD Million)

Table 7 Professional Services: Market Size, By Region, 20162023 (USD Million)

Table 8 Managed Services: Market Size, By Region, 20162023 (USD Million)

Table 9 LTE IoT Market Size, By Industry, 20162023 (USD Million)

Table 10 Manufacturing: Market Size, By Region, 20162023 (USD Million)

Table 11 Manufacturing: Market Size, By Application, 20162023 (USD Million)

Table 12 Asset Tracking and Management Market Size, By Region, 20162023 (USD Million)

Table 13 Predictive Maintenance Market Size, By Region, 20162023 (USD Million)

Table 14 Inventory Management Market Size, By Region, 20162023 (USD Million)

Table 15 Emergency and Incident Management Market Size, By Region, 20162023 (USD Million)

Table 16 Others Market Size, By Region, 20162023 (USD Million)

Table 17 Energy and Utilities: LTE IoT Market Size, By Region, 20162023 (USD Million)

Table 18 Energy and Utilities: Market Size, By Application, 20162023 (USD Million)

Table 19 Oil and Gas Management Market Size, By Region, 20162023 (USD Million)

Table 20 Electricity Grid Management Market Size, By Region, 20162023 (USD Million)

Table 21 Water and Wastewater Management Market Size, By Region, 20162023 (USD Million)

Table 22 Transportation and Logistics: Market Size, By Region, 20162023 (USD Million)

Table 23 Transportation and Logistics: Market Size, By Application, 20162023 (USD Million)

Table 24 Remote Monitoring Market Size, By Region, 20162023 (USD Million)

Table 25 Security and Surveillance Market Size, By Region, 20162023 (USD Million)

Table 26 Smart Parking Market Size, By Region, 20162023 (USD Million)

Table 27 Supply Chain Management Market Size, By Region, 20162023 (USD Million)

Table 28 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 29 Agriculture: Market Size By Region, 20162023 (USD Million)

Table 30 LTE IoT Market Size, By Region, 20162023 (USD Million)

Table 31 North America: Market Size By Technology, 20162023 (USD Million)

Table 32 North America: Market Size By Service, 20162023 (USD Million)

Table 33 North America: Market Size By Industry, 20162023 (USD Million)

Table 34 North America: Market Size By Manufacturing Application, 20162023 (USD Million)

Table 35 North America: Market Size By Energy and Utilities Application, 20162023 (USD Million)

Table 36 North America: Market Size By Transportation and Logistics Application, 20162023 (USD Million)

Table 37 North America: Market Size By Country, 20162023 (USD Million)

Table 38 Europe: LTE IoT Market Size, By Technology, 20162023 (USD Million)

Table 39 Europe: Market Size By Service, 20162023 (USD Million)

Table 40 Europe: Market Size By Industry, 20162023 (USD Million)

Table 41 Europe: Market Size By Manufacturing Application, 20162023 (USD Million)

Table 42 Europe: Market Size By Energy and Utilities Application, 20162023 (USD Million)

Table 43 Europe: Market Size By Transportation and Logistics Application, 20162023 (USD Million)

Table 44 Europe: Market Size By Country, 20162023 (USD Million)

Table 45 Asia Pacific: LTE IoT Market Size, By Technology, 20162023 (USD Million)

Table 46 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size By Industry, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size By Manufacturing Application, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size By Energy and Utilities Application, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size By Transportation and Logistics Application, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 52 Middle East and Africa: LTE IoT Market Size, By Technology, 20162023 (USD Million)

Table 53 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size By Industry, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size By Manufacturing Application, 20162023 (USD Million)

Table 56 Middle East and Africa: Market Size By Energy and Utilities Application, 20162023 (USD Million)

Table 57 Middle East and Africa: Market Size By Transportation and Logistics Application, 20162023 (USD Million)

Table 58 Middle East and Africa: Market Size By Country, 20162023 (USD Million)

Table 59 Latin America: LTE IoT Market Size, By Technology, 20162023 (USD Million)

Table 60 Latin America: Market Size By Service, 20162023 (USD Million)

Table 61 Latin America: Market Size By Industry, 20162023 (USD Million)

Table 62 Latin America: Market Size By Manufacturing Application, 20162023 (USD Million)

Table 63 Latin America: Market Size By Energy and Utilities Application, 20162023 (USD Million)

Table 64 Latin America: Market Size By Transportation and Logistics Application, 20162023 (USD Million)

Table 65 Latin America: Market Size By Country, 20162023 (USD Million)

Table 66 New Product Launches and Enhancements, 2018

Table 67 Partnerships, Collaborations, and Agreements, 20162018

List of Figures (25 Figures)

Figure 1 LTE IoT Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Market Top 3 Segments, 2018

Figure 4 Market By Technology, 2018

Figure 5 Rapidly Increasing Number of Connected Devices to Drive LTE IoT Market

Figure 6 Manufacturing and Europe to Hold the Highest Market Shares in 2018

Figure 7 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 8 Asia Pacific to Emerge as the Best Market for Investments Over the Next 5 Years

Figure 9 NB-IoT Segment to Account for A Larger Market Size During the Forecast Period

Figure 10 Professional Services Segment to Account for A Larger Market Size During the Forecast Period

Figure 11 Manufacturing Segment to Account for the Largest Market Size During the Forecast Period

Figure 12 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 13 Europe: Market Snapshot

Figure 14 Asia Pacific: Market Snapshot

Figure 15 Key Developments By the Leading Players in the LTE IoT Market During 20162018

Figure 16 Ranking of Key Players in the LTE IoT Market During 20172018

Figure 17 Ericsson: Company Snapshot

Figure 18 Vodafone Group: Company Snapshot

Figure 19 Telstra: Company Snapshot

Figure 20 Sierra Wireless: Company Snapshot

Figure 21 Sequans Communications: Company Snapshot

Figure 22 Orange: Company Snapshot

Figure 23 T-Mobile: Company Snapshot

Figure 24 Telus: Company Snapshot

Figure 25 Mediatek: Company Snapshot

The study involved 4 major steps that helped estimate the current market size of the LTE IoT Market. Exhaustive secondary research was done to collect information about the parent market and peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed for estimating the complete market size. Thereafter, market breakup and data triangulation methods were used for estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Businessweek, and Factiva have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; white papers; technology journals and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

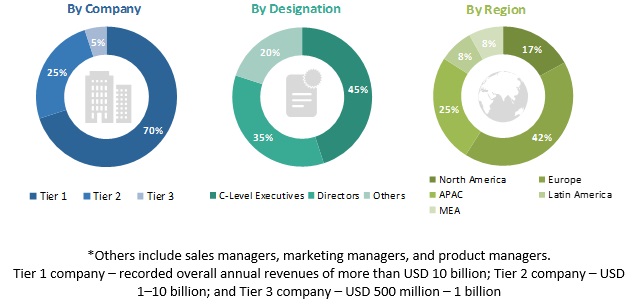

The LTE IoT market comprises several stakeholders, such as private enterprises, technology consultants, technology service vendors, IT and telecommunication enterprises, and IT solution managed service providers. The demand side of the market is characterized by the development of industries, such as manufacturing, energy and utilities, transportation and logistics, healthcare, and agriculture. The markets supply side is characterized by advancements in technologies and solutions for data and information security. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

LTE IoT Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The LTE IoT markets expenditure across regions and its geographic split in various segments have been considered to arrive at the overall market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation methods and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in all industry verticals.

Report Objectives:

- To define, describe, and forecast the LTE IoT market by technology (LTE-M and NB-IoT), service (professional services and managed services), industry, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze the competitive developments, such as mergers and acquisitions, new partnerships, product enhancements, and new product developments, in the LTE IoT market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the LTE IoT market in the US and Canada

- Further breakup of the market in the UK and Germany

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in LTE IoT Market