Lutein Market by Form (Powder & Crystalline, Oil Suspension, Beadlet, Emulsion), Source (Synthetic, Natural), Application (Dietary Supplements, Animal Feed, Food, Beverages,), Production Process and Region - Global Forecast to 2028

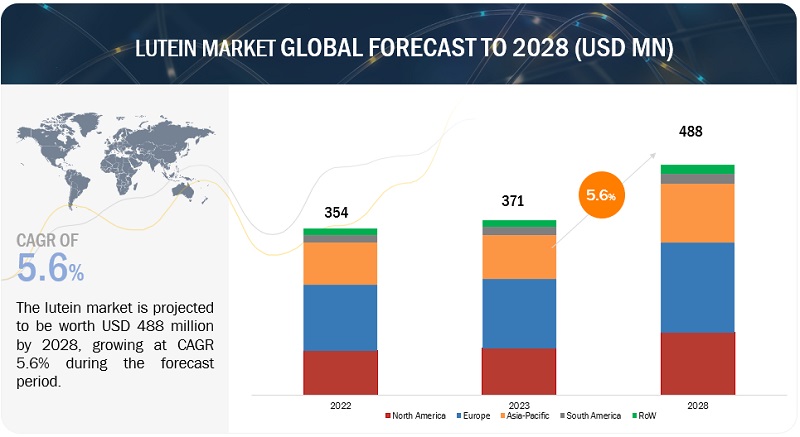

[241 Pages Report] The global lutein market was valued at USD 371 million in 2023 and is projected to reach USD 488 million by 2028, at a CAGR of 5.6% during the forecast period.

Lutein is a naturally occurring pigment found in various fruits and vegetables, particularly in leafy greens like spinach and kale. It is also present in high concentrations in marigold flowers. Lutein is widely known for its beneficial effects on eye health, particularly in reducing the risk of age-related macular degeneration (AMD) and cataracts. The demand for lutein has been increasing due to several factors, including a growing aging population, rising awareness about eye health, and increasing prevalence of eye-related disorders. Additionally, lutein is also used in the food and beverage industry as a natural colorant and in dietary supplements for its antioxidant properties. The market for lutein is driven by both the pharmaceutical and nutraceutical industries. In the pharmaceutical sector, lutein is used in the production of eye health supplements and medications. In the nutraceutical sector, lutein is included in various dietary supplements and functional foods that promote eye health.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Increase in scope of application

Lutein is a naturally occurring pigment and antioxidant that belongs to the carotenoid family. Carotenoids are a group of pigments found in plants that are responsible for the vibrant colors seen in fruits, vegetables, and flowers. Lutein, along with its isomer zeaxanthin, is specifically concentrated in the macula of the human eye, which is why it is often associated with eye health. In nature, lutein is found in various sources, including dark green leafy vegetables such as spinach, kale, and broccoli, as well as in fruits like oranges, kiwi, and grapes. However, one of the richest sources of lutein is marigold flowers (Tagetes erecta). Marigold extracts are commonly used as a natural source of lutein for commercial applications.

The potential health benefits of lutein have garnered significant attention from researchers and the general public. Lutein acts as a potent antioxidant, meaning it helps neutralize harmful free radicals in the body. Free radicals are unstable molecules that can cause damage to cells and contribute to various health issues, including aging, inflammation, and chronic diseases.

The wide range of potential health benefits associated with lutein has led to its incorporation into various industries. The pharmaceutical industry utilizes lutein as an ingredient in dietary supplements and eye health formulations. Lutein is often combined with other vitamins, minerals, and antioxidants to create comprehensive eye health supplements. The food and beverage industry incorporates lutein into functional foods and beverages targeting eye health, as well as products focused on overall well-being. Lutein-fortified juices, nutritional bars, cereals, and dairy products are examples of how lutein is used to enhance the nutritional profile of everyday foods. Lutein also plays a role in the animal feed industry, particularly in poultry and aquaculture. By adding lutein to animal feed formulations, producers can enhance the coloration of egg yolks, poultry skin, and fish flesh, making them more visually appealing to consumers. Furthermore, lutein has found applications in the cosmetics and personal care industry. Its antioxidant properties make it an attractive ingredient for skincare products targeting anti-aging and protection against environmental stressors. Lutein is incorporated into creams, lotions, serums, and other cosmetic formulations to promote skin health and radiance.

Restraints: Harmful effects of high doses of lutein

According to "Oxidants and Antioxidants in Medical Science, 2022," a publication that focuses on the role of antioxidants in healthcare. Suggests on consulting healthcare providers before taking any dietary supplements, including lutein, highlights the potential risks and side effects associated with lutein supplementation, particularly for individuals with specific medical conditions or those taking medications. This cautious approach can instill a sense of uncertainty and hesitation among consumers, making them more reluctant to consider lutein supplements as a viable option. Moreover, the mention of the lack of regulation in the dietary supplement industry raises serious concerns about the quality and safety of lutein supplements. The fact that these supplements have not undergone rigorous testing for safety and efficacy can erode consumer trust in the market. The potential for variations in dosage and the risk of contamination with other substances further exacerbate these concerns. Consumers may be skeptical about the accuracy of dosage claims and worry about potential health risks associated with using lutein supplements. This lack of trust and confidence in the quality of lutein supplements can deter consumers from purchasing these products and steer them towards seeking lutein from natural food sources instead.

Additionally, the caution against self-medication and the need to avoid or delay standard medical treatment can act as a significant restraint on the lutein market. The mention of potential misuse and the recommendation for healthcare provider consultation imply that some individuals may be tempted to rely solely on lutein supplements for treating or preventing health problems, which may not be advisable. This cautionary advice may discourage consumers from considering lutein supplementation altogether, as they may prefer to rely on conventional medical treatments instead.

The overdose of lutein can be considered harmless; however, an allergic person should avoid any lutein supplement source that contains the allergen. It is always recommended to avoid lutein supplements in times of pregnancy or breast-feeding. Scientists are unclear about the interactions of lutein with prescription and over-the-counter medications. Therefore, taking supplements that mix lutein with vitamins carries a risk of negative interactions with medications and can have adverse effects. For instance, toxic levels of vitamin C and E have shown an association with health problems, while vitamin A overdose can lead to liver toxicity and weak bones.

To avoid the harmful effects of consuming synthetic lutein, it is suggested that lutein should be taken with high-fat meals. If an excessive amount of lutein is taken over a period of time, one may experience a yellowing of the skin which is also known as carotenodermia. Refraining from lutein overdose is also suggested to any person is suffering from liver or kidney problems.

Opportunities: Awareness about the medical applications of lutein

Lutein has multiple uses and applications in the fields of animal feed, human food, pharmaceuticals, cosmetics, and supplements. The uses of lutein for medicinal purposes are still not very well-known to many people. The developing countries of Asia Pacific and Africa are still unaware of the multiple uses of lutein in the medical field, combating the most prominent fatal diseases across the world—for different heart diseases, cancer prevention, and diabetes reduction. The leading players are now entering the untapped markets in the Asian, African, and the Middle Eastern countries to create awareness about the uses of lutein as well as market their products. Thus, there are immense opportunities in the pharmaceutical industry for lutein. Growth in awareness about medicinal benefits of lutein will lead to an increase in the overall market of lutein.

Cognitive Health

Lutein's potential benefits for brain health and cognitive function have gained attention in recent years. Several studies have found a positive association between higher lutein levels in the brain and better cognitive performance, including memory, attention, and processing speed. Lutein's antioxidant properties help protect against oxidative stress and inflammation, which are implicated in age-related cognitive decline and neurodegenerative diseases such as Alzheimer's disease. The exploration of lutein supplements for cognitive enhancement has led to increased interest in the pharmaceutical market. Consumers are seeking natural and effective solutions to support brain health and improve cognitive function, especially as the aging population grows. Lutein-based supplements and formulations targeting cognitive health provide an opportunity for the pharmaceutical industry to develop products that meet this demand.

According to a report from the U.S. Department of Health & Human Services in 2021, it was found that approximately 83% of individuals with subjective cognitive decline (SDC) also have at least one chronic condition. The presence of SDC alongside these chronic conditions can make it more challenging to effectively manage overall health. This influences the growing demand for interventions and solutions that can address cognitive health issues and assist in the management of these coexisting chronic conditions. The increased prevalence of chronic conditions in individuals with SDC highlights the need for comprehensive healthcare strategies that address both cognitive health and the management of underlying chronic conditions. Lutein, with its potential cognitive benefits and positive effects on chronic conditions like cardiovascular diseases, can play a role in meeting this demand. Lutein-based pharmaceutical formulations or supplements may offer a natural and effective approach to support cognitive health while simultaneously addressing the challenges associated with managing chronic conditions.

Cardiovascular Health

Lutein's antioxidant and anti-inflammatory properties are also believed to have positive effects on cardiovascular health. Oxidative stress and inflammation contribute to the development and progression of cardiovascular diseases, including heart disease and stroke. Lutein acts as a scavenger of free radicals and helps reduce oxidative damage to cells and tissues, including those in the cardiovascular system.

Several studies have shown an inverse relationship between lutein intake and the risk of developing cardiovascular diseases. Higher dietary lutein intake or lutein supplementation has been associated with a reduced risk of coronary artery disease, atherosclerosis, and stroke. Lutein's ability to improve endothelial function, reduce inflammation, and enhance antioxidant defense mechanisms in the blood vessels contributes to its potential cardiovascular benefits. As cardiovascular diseases remain a significant global health concern, the pharmaceutical market has an opportunity to develop lutein-based formulations or combination products that promote cardiovascular health. Lutein supplements or pharmaceutical formulations could be targeted towards individuals at risk of or diagnosed with cardiovascular conditions, as well as those seeking preventive measures to maintain a healthy cardiovascular system.

Challenges: Low cost-competitiveness from Asian countries

Asian countries often benefit from economies of scale due to their large population, abundant resources, and well-established supply chains. These economies of scale allow Asian companies to achieve cost advantages in production, distribution, and procurement, which leads to lower overall costs. Companies in other countries may struggle to compete on price due to the lack of similar scale advantages. Labor costs in Asian countries, particularly in Southeast Asia, are generally lower compared to Western countries. This cost advantage allows Asian companies to offer lutein at a lower price while maintaining reasonable profit margins. In contrast, companies in other countries with higher labor costs may face difficulties in matching the competitive prices offered by their Asian counterparts.

Many Asian governments actively support their domestic industries, including the lutein market, by providing incentives, subsidies, and favorable policies. This support helps Asian companies reduce their costs, invest in research and development, and expand their market presence. Companies in other countries may find it challenging to compete against Asian rivals benefiting from such government support. The following are examples of government schemes and support in India and China that have aided the lutein market:

India

- Make in India Initiative: Launched in 2014, this initiative aims to promote manufacturing in India by providing various incentives and support to domestic industries. It offers benefits such as tax incentives, infrastructure development, and easier access to credit, which can help companies in the lutein market reduce their costs and expand their operations.

- National Horticulture Mission (NHM): The NHM focuses on promoting horticulture cultivation, including the production of medicinal plants like marigold, which is a significant source of lutein. The mission provides financial assistance, technical guidance, and infrastructure development support to farmers and entrepreneurs engaged in horticulture, boosting the availability of raw materials for lutein production.

- Horticulture Mission for Northeast and Himalayan States (HMNEH): The HMNEH initiative provides subsidies and support for horticulture cultivation, including marigold farming, in the northeastern states of India and the Himalayan region. The scheme offers assistance for activities like land development, plant material distribution, irrigation, and infrastructure development, aiming to boost marigold production in these regions.

China

- Made in China 2025: Launched in 2015, this strategic plan aims to transform China into a high-tech manufacturing powerhouse. It provides support to industries, including the pharmaceutical and nutraceutical sectors, through initiatives such as funding for technological innovation, infrastructure development, and preferential policies. Companies in the lutein market can benefit from these policies to enhance their manufacturing capabilities and improve competitiveness.

- Government Subsidies: The Chinese government provides subsidies to domestic companies in various industries, including the pharmaceutical sector. These subsidies can cover aspects such as research and development, production equipment, and raw material procurement, helping companies in the lutein market reduce costs and invest in innovation.

These examples illustrate how the governments of India and China actively support their domestic lutein industries through a combination of incentives, subsidies, infrastructure development, and favorable policies. Such support enables Asian companies to reduce costs, invest in R&D, and expand their market presence, giving them a competitive edge over companies from other countries that may not have access to similar government support.

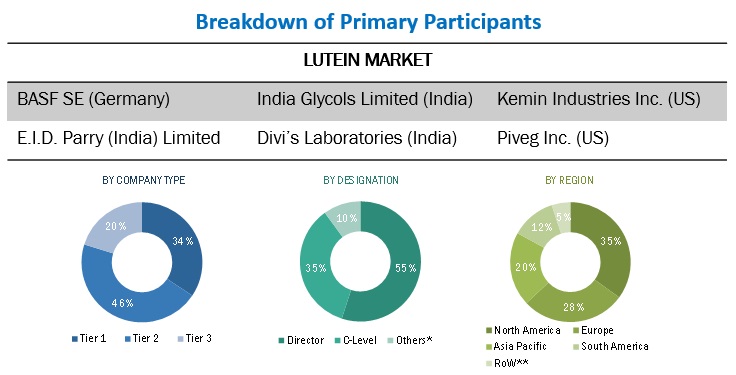

Lutein Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of lutein ingredients. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art facilites, and strong global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), India Glycols Limited. (India), Kemin Industries, Inc. (US), E.I.D. Parry (India) Limited (India), Divi’s Laboratories (India), Merck KGaA (Germany), Piveg, Inc. (US), Omniactive Health Technologies (India), Synthite Industries Ltd. (India), Zhejiang Medicine Co., Ltd. (China), Döhler (Germany), Lycored (Israel), Allied Biotech Corporation (Taiwan), Sabinsa (India) and FENCHEM (China).

Based on application, the beverage is witnessing the highest CAGR during the forecast period.

As consumers become more health-conscious, there is a growing demand for functional and fortified beverages. Lutein, with its eye health benefits, appeals to this consumer trend, driving the demand for lutein-fortified beverages. Nutraceuticals are beverages that bridge the gap between nutrition and pharmaceuticals, offering health benefits beyond basic nutrition. Lutein is used as a key ingredient in nutraceutical drinks due to its potential role in preventing age-related macular degeneration (AMD) and reducing the risk of cataracts. These beverages cater to health-conscious consumers seeking preventive measures against eye diseases. Consumers are increasingly seeking clean-label products with natural ingredients. Lutein, being a natural pigment, serves as a clean label option for manufacturers looking to meet consumer demands for transparency and healthier choices.

Based on form, The powder & crystalline form of lutein are anticipated to dominate the market.

powder & crystalline lutein is relatively easy to formulate compared to other forms. It can be readily mixed and encapsulated, allowing for convenient production processes. This ease of formulation can contribute to its higher demand as it reduces manufacturing complexities and costs. The powder & crystalline form of lutein provides flexibility in its usage as it can be conveniently mixed with various ingredients. This adaptability makes it highly suitable for a diverse range of products, including dietary supplements, functional foods, and beverages. Manufacturers seeking to include lutein in their formulations find the versatility of powdered lutein appealing

Natural segment of the lutein market by source is projected to witness the highest CAGR during the forecast period.

Many consumers prefer products that are derived from natural sources rather than synthetic alternatives. Natural lutein, sourced from plants like marigold flowers, may be perceived as a more desirable option for individuals seeking natural and plant-based supplements. As the demand for clean-label products increases, consumers are seeking transparency in product ingredients. Natural lutein may align with these preferences, as it can be marketed as a clean, natural ingredient without any chemical modifications.

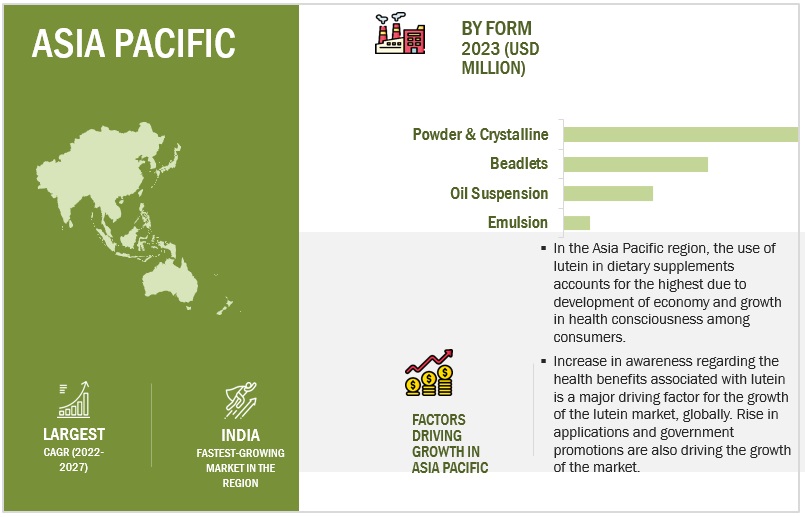

The Asia Pacific market is projected to contribute the largest share for the lutein market.

Asia Pacific, particularly countries like China and India, boasts a strong agricultural sector and favorable climatic conditions for cultivating lutein-rich sources like marigold flowers. This enables a steady supply of lutein, supporting Asia Pacific position as a major producer and ensuring a reliable source of the ingredient. Asia Pacific has experienced significant investments in the nutraceutical and dietary supplement industries. Companies in the region are actively focusing on research, development, product innovation, and marketing to meet the rising demand for lutein and related products. These investments in infrastructure and manufacturing capabilities further boost the Asia Pacific market position

Key Market Players

BASF SE (Germany), India Glycols Limited. (India), Kemin Industries, Inc. (US), E.I.D. Parry (India) Limited (India), and Divi’s Laboratories (India) are among the key players in the global lutein market. Companies are focusing on expanding their production facilities by entering into partnerships and agreements as well as by launching new products to grow their businesses and their market shares. New product launches as a result of extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the lutein market.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (Tons) |

|

Segments covered |

By Form, By Application, By Production Process, By Source, By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

Lutein Market Segmentation:

By source

- Natural

- synthetic

By Form

- powder & crystalline

- oil suspension

- beadlet

- emulsion

By application

- food

- beverage

- dietary supplements

- animal feed

- other applications*

By production process

- Chemical synthesis

- Extraction from botanical materials

- Fermentation

- Algae route

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)**

*pharmaceutical and personal care

**Rest of the World (RoW) includes the Middle East and Africa.

Recent Developments in the Lutein Market

- In April 2021, Kemin Industries has expanded its distribution agreement with Diethelm Keller Siber Hegner (DKSH) to include distribution for Kemin Food Technologies - Asia in the Philippines and Indonesia. This partnership builds upon their successful collaboration in Vietnam, Myanmar, Cambodia, and Singapore. The expanded collaboration with DKSH benefits the lutein market by ensuring greater accessibility and reliability of Kemin's products in Asia.

- In June 2020, Kemin Industries has formed a partnership with Diethelm Keller Siber Hegner (DKSH) to serve as the distributor for Kemin Food Technologies in Vietnam, Myanmar, and Cambodia. This collaboration enables Kemin to strengthen its market presence and expand its reach in these emerging countries. By leveraging DKSH's distribution services, Kemin Food Technologies can optimize its distribution network and enhance its customer service. The partnership between Kemin Food Technologies – Asia and DKSH benefits the lutein market by offering technically competent local salespeople from DKSH, supported by Kemin's expertise and high-quality products. This collaboration ensures that customers in Vietnam, Myanmar, and Cambodia have access to reliable distribution channels and the necessary support to meet their lutein-related needs.

- In September 2021, OmniActive Health Technologies has announced the official commercial launch of Nutritears in the US. Nutritears is a product that is developed using OmniActive's Integrative Actives platform, which enables the delivery of multiple active ingredients in concentrated, smaller doses. It is specifically designed to address the issues related to occasional dry eyes. Nutritears features a unique and patent-pending combination of ingredients, including lutein and zeaxanthin isomers, curcuminoids, and vitamin D3. This formulation may attract new customers who are looking for comprehensive eye health solutions containing lutein supplements.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the lutein market?

The Asia Pacific region accounted for the largest share and fastest-growing market, in terms of value. Asia Pacific dominates the global lutein market due to its robust production base and favorable agricultural conditions, particularly in countries like China and India. The region attracts significant investments in the nutraceutical and dietary supplement industries, fostering research, innovation, and manufacturing capabilities. Governments in the Asia Pacific actively support eye health and nutritional supplementation through policies, awareness campaigns, subsidies, and regulations. This government support, combined with a strong production base and rising investments, contributes to Asia Pacific leadership in the lutein market.

What is the current size of the global lutein market?

The global market for lutein was valued at USD 371 million in 2023 and is projected to reach USD 488 million by 2028.

Which are the key players in the market?

Key players operating in this market include BASF SE (Germany), India Glycols Limited. (India), Kemin Industries, Inc. (US), E.I.D. Parry (India) Limited (India), Divi’s Laboratories (India), Merck KGaA (Germany), Piveg, Inc. (US), Omniactive Health Technologies (India), Synthite Industries Ltd. (India), Zhejiang Medicine Co., Ltd. (China), Döhler (Germany), Lycored (Israel), Allied Biotech Corporation (Taiwan), Sabinsa (India) and FENCHEM (China).

What are the factors driving the lutein market?

- Growing awareness of eye health

- Rising demand for natural and plant-based ingredients

- Expansion of the nutraceutical industry

- Ongoing research and development highlighting lutein's health benefits

- Increasing consumer spending on wellness products.

What is the CAGR of Lutein Market?

The CAGR of Lutein Market is 5.6%

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACRO-ECONOMIC FACTORSBOOMING DEMAND FOR LUTEIN SUPPLEMENTS AMONG AGING POPULATION

-

5.3 MARKET DYNAMICSDRIVERS- Increase in scope of application- Growing demand for natural and functional ingredients- Rising demand for natural colorantsRESTRAINTS- Harmful effects of high doses of lutein- Stringent regulations for lutein ingredientsOPPORTUNITIES- Expanding market opportunities with versatile physicochemical functions- Awareness regarding medical applications of luteinCHALLENGES- Competition and product differentiation in lutein industry- Low cost-competitiveness from Asian countries- Supply constraints in lutein market: Cultivating sustainable growth and market stability

- 6.1 INTRODUCTION

-

6.2 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCOUNTRY-WISE REGULATORY AUTHORITIES FOR LUTEIN IN FOOD- North America- Europe- Asia Pacific- South America

-

6.3 PATENT ANALYSIS

-

6.4 VALUE CHAIN ANALYSISSOURCING OF RAW MATERIALSEXTRACTION, PURIFICATION, AND CONCENTRATIONFORMULATION & PRODUCT DEVELOPMENTMANUFACTURING, PACKAGING, AND LABELINGDISTRIBUTION & MARKETINGCONSUMER

-

6.5 TRENDS/DISRUPTIONS IMPACTING BUSINESSES OF CUSTOMERS

-

6.6 ECOSYSTEM

- 6.7 TRADE ANALYSIS

- 6.8 PRICING ANALYSIS

-

6.9 TECHNOLOGY ANALYSISENCAPSULATION OF LUTEIN VIA MICROFLUIDIC TECHNOLOGY

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 7.1 INTRODUCTION

-

7.2 POWDER & CRYSTALLINELUTEIN POWDER TO DRIVE MARKET BECAUSE OF ITS USE IN VARIOUS APPLICATIONS

-

7.3 OIL SUSPENSIONCHARACTERISTICS AND APPLICATIONS OF LUTEIN OIL SUSPENSIONS IN FOOD, FEED, AND PHARMACEUTICALS TO DRIVE MARKET

-

7.4 BEADLETGROWING CAROTENOID NEEDS IN HEALTHCARE AND PHARMACEUTICALS TO FUEL DEMAND FOR LUTEIN

-

7.5 EMULSIONNEED TO FORTIFY FOOD & BEVERAGE PRODUCTS TO FUEL DEMAND FOR LUTEIN EMULSIONS

- 8.1 INTRODUCTION

-

8.2 NATURALGROWING DEMAND FOR NATURAL LUTEIN AND ITS SOURCES TO DRIVE MARKET

-

8.3 SYNTHETICDEMAND FOR SYNTHETIC LUTEIN TO INCREASE DUE TO ITS LOW PRICE

- 9.1 INTRODUCTION

-

9.2 FOODEXTENSIVE USE OF LUTEIN IN FOOD TO FUEL MARKETBAKERY & CONFECTIONERY PRODUCTSINFANT FORMULA & FORMULATED SUPPLEMENTARY FOOD PRODUCTSDAIRY PRODUCTSOTHER FOOD APPLICATIONS

-

9.3 BEVERAGESRISING CONSUMER DEMAND FOR BEVERAGES TO DRIVE MARKET GROWTHAERATED & CARBONATED DRINKSRTD BEVERAGESSPORTS & ENERGY DRINKSJUICE CONCENTRATES & FRUIT JUICESOTHER BEVERAGE APPLICATIONS

-

9.4 DIETARY SUPPLEMENTSRISING DEMAND FOR HEALTH SUPPLEMENTS TO FUEL MARKET GROWTH

-

9.5 ANIMAL FEEDGROWING HEALTH AWARENESS AND RISING SPENDING CAPACITY TO BOOST MARKET

-

9.6 OTHER APPLICATIONSPHARMACEUTICALS- Diverse properties of lutein in pharmaceuticals to fuel market demandPERSONAL CARE PRODUCTS- Rising demand for lutein in personal care products to spur market growth

- 10.1 INTRODUCTION

-

10.2 CHEMICAL SYNTHESISADVANCING LUTEIN PRODUCTION TECHNIQUES TO DRIVE MARKET

-

10.3 EXTRACTION FROM BOTANICAL MATERIALDIVERSE BOTANICAL EXTRACTIONS EXPLORING LUTEIN RECOVERY METHODS TO FUEL MARKET

-

10.4 FERMENTATIONCOST-EFFECTIVE APPROACH FOR LUTEIN EXTRACTION TO DRIVE MARKET GROWTH

-

10.5 ALGAE ROUTEALGAE-DRIVEN INNOVATION AND ADVANCING LUTEIN PRODUCTION METHODS TO BE NEW REVENUE POCKETS

- 11.1 INTRODUCTION

- 11.2 MACRO INDICATORS OF RECESSION

-

11.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Lutein to find extensive applications in healthcareCANADA- Increased pharmaceutical utilization to drive lutein marketMEXICO- Rising popularity of lutein in Mexico to fuel market

-

11.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Surge in demand for plant-based food products to drive marketFRANCE- Growing demand for natural food colors to drive marketITALY- Consumer shift toward processed food products to drive marketSPAIN- Rising consumer inclination toward incorporating dietary supplements to drive marketNETHERLANDS- Increased consumer preferences for high-quality & visually appealing meat and seafood to drive marketREST OF EUROPE

-

11.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- China's commitment to public health and Healthy China 2030 initiative to fuel market growthINDIA- Increasing prevalence of age-related eye disorders, particularly AMD, to boost marketJAPAN- Emphasis on maintaining overall well-being in busy lifestyle to propel market growthAUSTRALIA & NEW ZEALAND- Lutein's rising popularity in Australia & New Zealand to fuel demand in multiple sectorsREST OF ASIA PACIFIC

-

11.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Increased consumption of processed & frozen foods to drive market growthARGENTINA- Increased demand for cancer prevention to drive market growthREST OF SOUTH AMERICA

-

11.7 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISAFRICA- Growing popularity of lutein to fuel market growthMIDDLE EAST- Rising demand for natural food products to drive market

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 LUTEIN MARKET, EVALUATION QUADRANT FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTSPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINDIA GLYCOLS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKEMIN INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewE.I.D. - PARRY (INDIA) LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDIVI’S LABORATORIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPIVEG, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOMNIACTIVE HEALTH TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNTHITE INDUSTRIES LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZHEJIANG MEDICINE CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDÖHLER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLYCORED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALLIED BIOTECH CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSABINSA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFENCHEM- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 STARTUPS/SMESPANACEA PHYTOEXTRACTS PVT. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRAKRUTI PRODUCTS PVT. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOLIVE LIFESCIENCES PVT LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIOMED INGREDIENTS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKATRA PHYTOCHEM PVT LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

- 14.1 INTRODUCTION

- 14.2 RESEARCH LIMITATIONS

-

14.3 CAROTENOIDS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 FEED ADDITIVES MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2018–2022

- TABLE 2 GLOBAL LUTEIN MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LIST OF MAJOR PATENTS PERTAINING TO LUTEIN MARKET, 2013–2023

- TABLE 9 LUTEIN MARKET ECOSYSTEM

- TABLE 10 IMPORT VALUE OF COLORING MATTER OF VEGETABLE OR ANIMAL ORIGIN, INCL. DYE EXTRACTS (EXCLUDING ANIMAL BLACK) 2022 (USD THOUSAND)

- TABLE 11 EXPORT VALUE OF COLORING MATTER OF VEGETABLE OR ANIMAL ORIGIN, INCL. DYE EXTRACTS (EXCLUDING ANIMAL BLACK) 2022 (USD THOUSAND)

- TABLE 12 AVERAGE SELLING PRICE ANALYSIS: LUTEIN MARKET, BY FORM, 2019–2022 (USD/TON)

- TABLE 13 LUTEIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 15 MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 16 MARKET, BY FORM, 2019–2022 (TONS)

- TABLE 17 LUTEIN MARKET, BY FORM, 2023–2028 (TONS)

- TABLE 18 POWDER & CRYSTALLINE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 POWDER & CRYSTALLINE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 POWDER & CRYSTALLINE MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 21 POWDER & CRYSTALLINE MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 22 OIL SUSPENSION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 OIL SUSPENSION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 OIL SUSPENSION MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 25 OIL SUSPENSION MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 26 BEADLET MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 BEADLET MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 BEADLET MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 29 BEADLET MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 30 EMULSION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 EMULSION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 EMULSION MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 33 EMULSION MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 34 LUTEIN MARKET SIZE, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 35 LUTEIN MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 36 NATURAL LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 NATURAL LUTEIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SYNTHETIC LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 SYNTHETIC LUTEIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 LUTEIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 LUTEIN MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 FOOD: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 FOOD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 FOOD: MARKET, BY SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 45 FOOD: MARKET, BY SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 46 BAKERY & CONFECTIONERY PRODUCTS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 BAKERY & CONFECTIONERY PRODUCTS: LUTEIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 INFANT FORMULA & FORMULATED SUPPLEMENTARY FOOD PRODUCTS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 INFANT FORMULA & FORMULATED SUPPLEMENTARY FOOD PRODUCTS: LUTEIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 DAIRY PRODUCTS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 DAIRY PRODUCTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 OTHER FOOD APPLICATIONS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 OTHER FOOD APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 BEVERAGES: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 BEVERAGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 BEVERAGES: MARKET, BY SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 57 BEVERAGES: MARKET, BY SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 58 AERATED & CARBONATED DRINKS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 AERATED & CARBONATED DRINKS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 RTD BEVERAGES: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 RTD BEVERAGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 SPORTS & ENERGY DRINKS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 SPORTS & ENERGY DRINKS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 JUICE CONCENTRATES & FRUIT JUICES: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 JUICE CONCENTRATES & FRUIT JUICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 OTHER BEVERAGE APPLICATIONS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 OTHER BEVERAGE APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 DIETARY SUPPLEMENTS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 DIETARY SUPPLEMENTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 ANIMAL FEED: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 ANIMAL FEED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 OTHER APPLICATIONS: LUTEIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 SCIENTIFIC, FAMILY, AND COMMON NAME OF BOTANICAL SOURCES

- TABLE 75 LUTEIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 MARKET, BY REGION, 2019–2022 (KT)

- TABLE 78 MARKET, BY REGION, 2023–2028 (KT)

- TABLE 79 NORTH AMERICA: LUTEIN MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY FORM, 2019–2022 (TONS)

- TABLE 84 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (TONS)

- TABLE 85 NORTH AMERICA: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY FOOD SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY FOOD SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY BEVERAGES SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY BEVERAGES SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 93 US: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 94 US: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 95 CANADA: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 96 CANADA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 97 MEXICO: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 98 MEXICO: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: LUTEIN MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY FORM, 2019–2022 (TONS)

- TABLE 104 EUROPE: MARKET, BY FORM, 2023–2028 (TONS)

- TABLE 105 EUROPE: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY FOOD SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY FOOD SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY BEVERAGES SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY BEVERAGES SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 113 GERMANY: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 114 GERMANY: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 115 FRANCE: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 116 FRANCE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 117 ITALY: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 118 ITALY: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 119 SPAIN: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 120 SPAIN: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 121 NETHERLANDS: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 122 NETHERLANDS: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 124 REST OF EUROPE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: LUTEIN MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY FORM, 2019–2022 (TONS)

- TABLE 130 ASIA PACIFIC: MARKET, BY FORM, 2023–2028 (TONS)

- TABLE 131 ASIA PACIFIC: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY FOOD SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY FOOD SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY BEVERAGES SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY BEVERAGES SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 139 CHINA: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 140 CHINA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 141 INDIA: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 142 INDIA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 143 JAPAN: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 144 JAPAN: LUTEIN MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 145 AUSTRALIA & NEW ZEALAND: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 146 AUSTRALIA & NEW ZEALAND: LUTEIN MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: LUTEIN MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 149 SOUTH AMERICA: LUTEIN MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 150 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 151 SOUTH AMERICA: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 152 SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 153 SOUTH AMERICA: MARKET, BY FORM, 2019–2022 (TONS)

- TABLE 154 SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (TONS)

- TABLE 155 SOUTH AMERICA: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 156 SOUTH AMERICA: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 158 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 SOUTH AMERICA: MARKET, BY FOOD SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 160 SOUTH AMERICA: MARKET, BY FOOD SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 161 SOUTH AMERICA: MARKET, BY BEVERAGES SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 162 SOUTH AMERICA: MARKET, BY BEVERAGES SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 163 BRAZIL: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 164 BRAZIL: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 165 ARGENTINA: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 166 ARGENTINA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 167 REST OF SOUTH AMERICA: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 168 REST OF SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 169 ROW: LUTEIN MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 170 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 171 ROW: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 172 ROW: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 173 ROW: MARKET, BY FORM, 2019–2022 (TONS)

- TABLE 174 ROW: MARKET, BY FORM, 2023–2028 (TONS)

- TABLE 175 ROW: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 176 ROW: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 177 ROW: LUTEIN MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 178 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 179 ROW: MARKET, BY FOOD SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 180 ROW: MARKET, BY FOOD SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 181 ROW: MARKET, BY BEVERAGES SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 182 ROW: MARKET, BY BEVERAGES SUB-TYPE, 2023–2028 (USD MILLION)

- TABLE 183 AFRICA: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 184 AFRICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST: LUTEIN MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST: LUTEIN MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 187 LUTEIN MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 188 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 189 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022 (USD BILLION)

- TABLE 190 COMPANY FOOTPRINT, BY FORM

- TABLE 191 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 192 COMPANY FOOTPRINT, BY REGION

- TABLE 193 OVERALL COMPANY FOOTPRINT

- TABLE 194 LUTEIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 195 LUTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 196 LUTEIN: PRODUCT LAUNCHES

- TABLE 197 LUTEIN: DEALS

- TABLE 198 LUTEIN: OTHERS

- TABLE 199 BASF SE: COMPANY OVERVIEW

- TABLE 200 INDIA GLYCOLS LIMITED: BUSINESS OVERVIEW

- TABLE 201 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 202 KEMIN INDUSTRIES, INC.: DEALS

- TABLE 203 KEMIN INDUSTRIES, INC.: OTHERS

- TABLE 204 E.I.D. - PARRY (INDIA) LIMITED: BUSINESS OVERVIEW

- TABLE 205 DIVI’S LABORATORIES: BUSINESS OVERVIEW

- TABLE 206 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 207 PIVEG, INC.: BUSINESS OVERVIEW

- TABLE 208 OMNIACTIVE HEALTH TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 209 OMNIACTIVE HEALTH TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 210 OMNIACTIVE HEALTH TECHNOLOGIES: DEALS

- TABLE 211 SYNTHITE INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 212 ZHEJIANG MEDICINE CO., LTD.: BUSINESS OVERVIEW

- TABLE 213 DÖHLER: BUSINESS OVERVIEW

- TABLE 214 LYCORED: BUSINESS OVERVIEW

- TABLE 215 ALLIED BIOTECH CORPORATION: BUSINESS OVERVIEW

- TABLE 216 SABINSA: BUSINESS OVERVIEW

- TABLE 217 SABINSA: OTHERS

- TABLE 218 FENCHEM: BUSINESS OVERVIEW

- TABLE 219 PANACEA PHYTOEXTRACTS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 220 PRAKRUTI PRODUCTS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 221 OLIVE LIFESCIENCES PVT LTD: BUSINESS OVERVIEW

- TABLE 222 BIO MED INGREDIENTS: BUSINESS OVERVIEW

- TABLE 223 KATRA PHYTOCHEM PVT LTD.: BUSINESS OVERVIEW

- TABLE 229 ADJACENT MARKETS

- TABLE 230 CAROTENOIDS MARKET, BY TYPE, 2017–2026 (USD MILLION)

- TABLE 231 FEED ADDITIVES MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 232 FEED ADDITIVES MARKET, BY TYPE, 2021–2026 (USD MILLION)

- FIGURE 1 LUTEIN MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- FIGURE 3 LUTEIN MARKET: RESEARCH DESIGN

- FIGURE 4 DATA TRIANGULATION METHODOLOGY

- FIGURE 5 LUTEIN MARKET, BY FORM, 2023 VS. 2028

- FIGURE 6 LUTEIN MARKET, BY SOURCE, 2023 VS. 2028

- FIGURE 7 LUTEIN MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 LUTEIN MARKET, BY REGION

- FIGURE 9 RISING DEMAND FOR HEALTHY FUNCTIONAL FOODS TO PROPEL MARKET GROWTH

- FIGURE 10 SYNTHETIC SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 11 DIETARY SUPPLEMENTS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 12 EUROPE TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 13 PERCENTAGE OF TOTAL ELDERLY POPULATION, 2000–2021

- FIGURE 14 EXPANDING APPLICATIONS TO DRIVE MARKET GROWTH

- FIGURE 15 GLOBAL FEED MARKET, BY LIVESTOCK, 2021

- FIGURE 16 NUMBER OF PATENTS GRANTED FOR LUTEIN IN GLOBAL MARKET, 2013–2022

- FIGURE 17 REGIONAL ANALYSIS OF PATENTS GRANTED IN LUTEIN MARKET, 2013–2023

- FIGURE 18 LUTEIN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 REVENUE SHIFT FOR LUTEIN MARKET

- FIGURE 20 LUTEIN: MARKET MAP

- FIGURE 21 IMPORT VALUE OF COLORING MATTER OF VEGETABLE OR ANIMAL ORIGIN, INCL. DYE EXTRACTS (EXCLUDING ANIMAL BLACK) 2018-2022

- FIGURE 22 EXPORT VALUE OF COLORING MATTER OF VEGETABLE OR ANIMAL ORIGIN, INCL. DYE EXTRACTS (EXCLUDING ANIMAL BLACK) 2018-2022

- FIGURE 23 AVERAGE SELLING PRICE TREND, BY REGION, 2019-2022 (USD/TON)

- FIGURE 24 POWDER & CRYSTALLINE SEGMENT PROJECTED TO DOMINATE MARKET THROUGH 2028

- FIGURE 25 SYNTHETIC SEGMENT PROJECTED TO DOMINATE LUTEIN MARKET THROUGH 2028

- FIGURE 26 DIETARY SUPPLEMENTS SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 27 GEOGRAPHIC SNAPSHOT (2019–2022): MARKETS IN NORTH AMERICA PROJECTED TO REGISTER MODERATE GROWTH

- FIGURE 28 INDICATORS OF RECESSION

- FIGURE 29 WORLD INFLATION RATE: 2011-2021

- FIGURE 30 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 31 RECESSION INDICATORS AND THEIR IMPACT ON MARKET

- FIGURE 32 GLOBAL LUTEIN MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 33 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 34 NORTH AMERICAN LUTEIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 35 EUROPE: MARKET SNAPSHOT

- FIGURE 36 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 37 EUROPEAN LUTEIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 40 ASIA PACIFIC LUTEIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 41 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 42 SOUTH AMERICAN LUTEIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 43 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 44 ROW LUTEIN MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 45 LUTEIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 46 LUTEIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UP/SME)

- FIGURE 47 BASF SE: COMPANY SNAPSHOT

- FIGURE 48 INDIA GLYCOLS LIMITED: COMPANY SNAPSHOT

- FIGURE 49 E.I.D. - PARRY (INDIA) LIMITED: COMPANY SNAPSHOT

- FIGURE 50 DIVI’S LABORATORIES: COMPANY SNAPSHOT

- FIGURE 51 MERCK KGAA: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the lutein market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources were referred to to identify and collect information. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard & silver standard websites, agricultural organizations, regulatory bodies, trade directories, and databases. They were used to identify and collect information. The secondary research was used mainly to obtain key information about the industry’s supply chain, distribution channels, and total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from market perspectives.

Primary Research

Extensive primary research was conducted after acquiring information about the lutein market scenario through secondary research. Several primary interviews were conducted with market experts from the demand (lutein manufacturing companies and government organizations) and supply sides (manufacturers, suppliers, distributors, and exporters) across five major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (South Africa and others). Approximately 20% and 80% of the primary interviews were conducted with the demand and supply side, respectively. This primary data was collected through questionnaires, emails, and telephonic interview.

To know about the assumptions considered for the study, download the pdf brochure

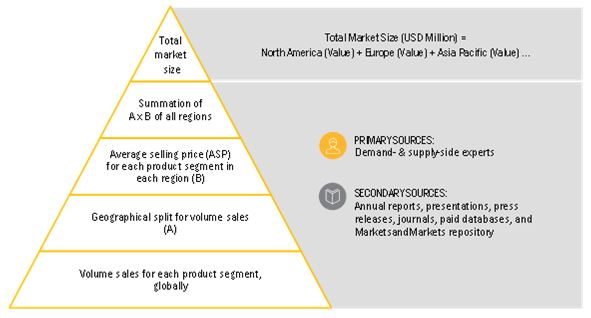

Lutein Market Size Estimation

Both “top-down” and “bottom-up” approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets in the overall lutein market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry value chain, market revenues, and sales/volumes were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following figures depict the complete market size estimation process implemented in this research study for an overall market size estimation of the lutein market, in a consolidated format.

Top-down approach:

Bottom-up approach:

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, there are three approaches: top-down approach, bottom-up approach, and the third involves expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Market Definition

Lutein is a yellow pigment which belongs to the carotenoids family. Largely extracted from the marigold flower petals, lutein can also be found in dark leafy vegetables, broccoli, and yellow carrot. It is used as a coloring agent in the food and beverages industry.

Lutein is an important carotenoid antioxidant that is used for protecting eye health. It is also used in animal feed to color the poultry skin and egg yolks to strengthen the immune system, reduce cellular aging, and protect against age-related eye diseases.

Stakeholdeers

- Raw material suppliers

- Lutein manufacturers and suppliers

- Regulatory bodies including government agencies and NGOs

- Commercial research & development (R&D) institutions and financial institutions

- Traders and distributors of lutein

- Government organizations and consulting firms

- Trade associations and industry bodies

Report Objectives

Market Intelligence

- Determining and projecting the size of the lutein market with respect to their application, production process, form, source, and key regions, over a five-year period ranging from 2017 to 2022

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling key market players in the lutein market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying major growth strategies adopted by the players across the key regions

- Providing insights on key innovations, such as expansions, new product launches, joint ventures, collaborations, and partnerships, and acquisitions in the lutein market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Lutein into the Czech Republic, The Netherlands, Belgium, Hungary, Romania, and Ireland

- Further breakdown of the Rest of South America market for lutein into Chile, Colombia, Paraguay, and Peru

- Further breakdown of other countries in the RoW market for lutein into the Middle East & Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Lutein Market