Fruit & Vegetable Ingredients Market by Category (Fruits and Vegetables), Nature (Organic, Conventional), Type (Concentrates, Pastes & Purees, NFC Juices, and Pieces & Powders), Application, and Region - Global Forecast to 2027

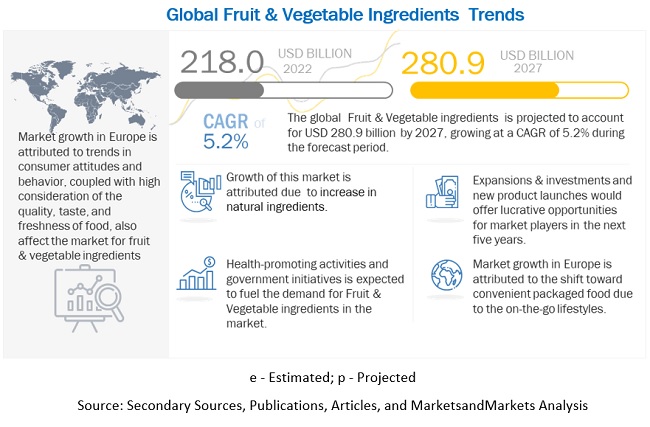

The global fruit & vegetable ingredients market was valued at USD 218.0 billion in 2022 and is expected to grow at a CAGR of 5.2% during the forecast period.

The market has been growing in accordance with the processed food industry. Fruits and vegetables ingredients are used as a thickening agent, stabilizer, or emulsifier. Apart from food & beverage products, fruits and vegetables ingredients also finds use in paper manufacturing, medicine & pharmaceuticals, and various other industrial applications.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Fruit & vegetable ingredients market

The effect of COVID-19 had a significant impact on the processed food & beverage industry. The impact was also onserved in the ingredients market, thereby affecting the fruit & vegetable ingredients market. The market experienced a significant dip in 2020 due to trade barriers in different regions and limited usage of food ingredient for their varied applications. With the relaxed restrictions in the late 2021 and early 2022, business are expected to recover slowly.

Fruit & vegetable ingredients Market Dynamics

Drivers: Growing demand for food preservatives

The fruit & vegetable ingredients market has a positive outlook due to high growth in the processed food & beverage industry. The rise in per capita income and increase in the trend of snacking between meals are propelling the demand for R.T.E. cereals, nutrition bars, and beverages (especially those that are derived from natural sources). Consumer preferences in emerging economies such as China, India, Brazil, and countries of the Middle East have gradually transitioned from traditional homemade breakfast and snacks to processed foods & meals over the last couple of decades.

Restraints: Stringent food safety regulations

A number of legislations authorized by different regional regulatory bodies are prevailing in the fruit & vegetable ingredients market. To easily understand different regulations, these have been segmented into three types that cover the possible aspects of the fruit & vegetable ingredients industry. Regulations pertaining to the definitions, labeling, composition, and other areas concerning the production, marketing, and trade of fruit & vegetable ingredients

Opportunities: Inclination of consumers towards healthier alternatives

Consumers are now more concerned about the food they are consuming. They want to be more educated about the ingredients used and the nutritional content of the processed food & beverage products they have paid for. The rise in health-related problems has increased the focus on consuming healthier food & beverage products in order to overcome health issues. Consumers are focusing on non-GMO, organic, chemical-free, and clean-label products for better health. These factors have developed a wider scope for fruit & vegetable-based natural ingredients to be used in the place of artificial colors & flavors.

Challenges: Infrastructural challenges in developing countries

The saturated markets of developed economies compel the manufacturers of fruit & vegetable ingredients to expand into untapped markets and find a new consumer base. This requires substantial investment in many aspects of business expansion, especially when it comes to the establishment of new facilities in developing countries. Other than internal investments in manufacturing facilities, manufacturers need to spend heavily on the development of an efficient supply chain management and storage of raw materials & finished goods. Though low raw material prices and labor costs benefit fruit & vegetable ingredient companies, the investment costs of infrastructural development pose a bigger challenge.

The organic segment, by nature is the fastest growing market in terms of value

The market for organic fruit & vegetable ingredients is projected to register the highest CAGR of 6.1% during the forecast period. The increasing demand for organic foods & beverages from the established economies is boosting the market for organic fruit & vegetable ingredients across the globe.

The fruit ingredients segment, by category dominates the market in terms of value

The fruit ingredients segment will dominate the fruit & vegetable ingredients market in 2022. Fruit ingredients are more widely used, as they can be easily incorporated into various kinds of products, such as fruit salads, fruit juices, fruit shakes, etc. Fruit ingredients are easily available with favorable taste in the form of dry powder along with easy packaging and transportation to the required locations, as they do not require specialized equipment. Also, manufacturers find them easy to handle. Therefore, this segment is projected to grow at a higher CAGR of 5.6% during the forecast period.

South America is the second fastest growing region

Innovations, consumer health, and the busy lifestyles of people are the main drivers for the fruit & vegetable ingredients industry in South America. Factors for the high growth rates are the rapid expansion of modern retail outlets providing easy access to natural and healthy food & beverage products, along with increasing disposable income levels of consumers, rapid urbanization, the need for convenience, and busier urban households.

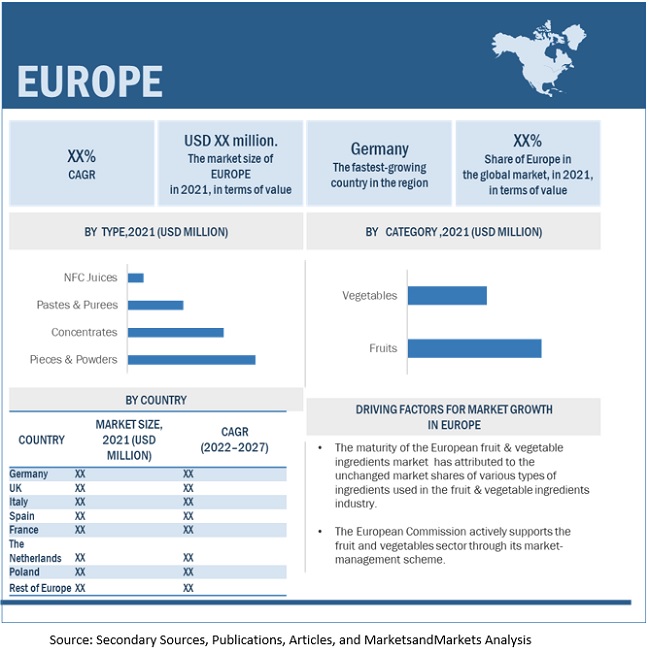

Europe Fruit & Vegetable Ingredients Trends

To know about the assumptions considered for the study, download the pdf brochure

The European commission actively supports fruit & vegetable sector through its market management scheme. The food industry in Europe is highly fragmented and consist of large number of small-scale players. Europe food industry focuses on new product development and innovation as strategies to sustain the competition and demand.

Key Players in Fruit & vegetable ingredients Market

The key players in this market include Cargill Incorporated (US), ADM (US), Ingredion, Tate & Lyle(U.K), DöhlerGmbH(Germany), Kerry(Ireland), Sensient Technologies(U.S), AGRANA Beteiligungs-AG(Austria), and SunOpta(Canada), etc.

Fruit & vegetable ingredients Market Report Scope

|

Report Metric |

Details |

| Market valuation in 2022 | USD 218.0 Billion |

| Revenue prediction in 2027 | USD 280.9 Billion |

| Market Growth Rate | CAGR of 5.2% |

|

Number of Pages |

197 Pages Report |

|

Forecast period |

2022–2027 |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Segments covered |

By Type, Category, Nature, Application and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and Rest of the World |

|

Companies studied |

|

This research report categorizes the fruit & vegetable ingredients market., based on type, category, nature, application and region

Target Audience

- Fruit & vegetable ingredients raw material suppliers

- Fruit & vegetable ingredients manufacturers

- Intermediate suppliers, such as traders and distributors of fruit & vegetable ingredients

- Manufacturers of food & beverages.

- Government and research organizations

- Associations, regulatory bodies, and other industry-related bodies:

- World Health Organization (WHO)

- Environmental Protection Agency (EPA)

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- Department of Environment, Food and Rural Affairs (DEFRA)

Fruit & vegetable ingredients Market Segmentation

Market By Type

- Concentrates

- NFC Juices

- Pastes & Purees

- Pieces & Powders

Market By Application

- Bakery Products

- Confectionery Products

- Dairy Products

- RTE Products

- Soups & Sauces

- Beverages

- Other Applications(Dips, spreads, dressings, toppings, and puddings.)

Market By Nature

- Organic

- Conventional

Market By Category

- Fruits

- Vegetables

Market By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In June 2021, Tate & Lyle, a leading global provider of food and beverage solutions and ingredients, announced a new long-term partnership in Brazil with AGRANA Fruit, a global leader in fruit preparations. The agreement establishes new manufacturing dynamics for Brazil’s fruit preparations segment, bringing more innovation to the sector

- In June 2021, Kerry announced the opening of its new taste facility in Latin America, which will serve mainly Mexico, Central America, the Caribbean, and the Andean region. Located in Irapuato, Mexico, the new state-of-the-art facility will significantly increase Kerry’s capacity in the region and further support customers in delivering local and sustainable taste solutions.

- In September-2021, Kerry acquired Niacet, which will now be integrated as part of Kerry’s global food protection and preservation platform

- In June 2019, Tate & Lyle took partnership with DKSH’s Business Unit Performance Materials, a leading food ingredients distributor, which will provide market expansion services for Tate & Lyle in Vietnam, including marketing, technical sales, distribution and logistics for Tate & Lyle’s product portfolio.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the fruit & vegetable ingredients market?

Europe dominated the fruit & vegetables ingredients market during the forecast period.

What is the current size of the global fruit & vegetable ingredients market?

The global fruit & vegetable ingredients market is estimated to be valued at of USD 207.8 billion in 2021; it is projected to reach USD 280.9 billion by 2027, at a CAGR of 5.2% during the forecast period.

Which are the key players in the market, and how intense is the competition?

The key players are ADM, Cargill, Ingredion, Tate & Lyle, Döhler GmbH, Kerry, Sensient Technologies, AGRANA Beteiligungs-AG, and SunOpta among other. The fruit & vegetable ingredients market can be classified as a fragmented market as it has a large number of organized players, accounting for a major part of the market share, present at the global level, and unorganized players present at the local level in several countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

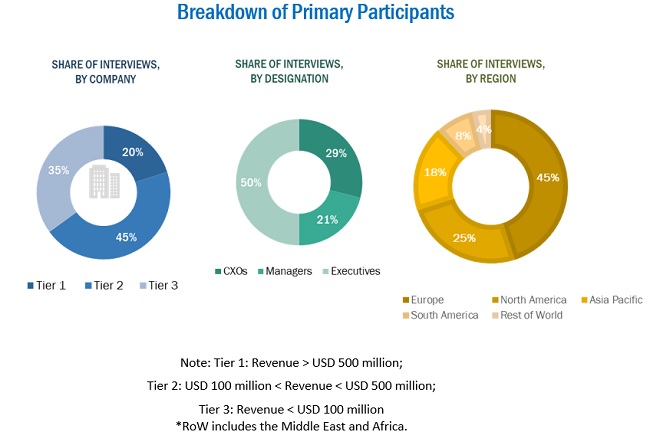

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of fruit & vegetable ingredients market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the fruit & vegetable ingredients market.

To know about the assumptions considered for the study, download the pdf brochure

Fruit & vegetable ingredients Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of fruit & vegetable ingredients market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All macroeconomic and microeconomic factors affecting the growth of the fruit & vegetable ingredients were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall fruit & vegetable ingredients market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global fruit & vegetable ingredients market on the basis of Type, Category, Nature, Application and Region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the fruit & vegetable ingredients market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Rest of Europe includes Belgium, Russia, Sweden, and other EU & non-EU countries.

- Rest of Asia Pacific includes Indonesia, the Philippines, Malaysia, Singapore, and Vietnam.

- Rest of South America includes Chile, Colombia, Paraguay, and other South American countries.

Company Information

- Detailed analyses and profiling of additional fruit & vegetable ingredients market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fruit & Vegetable Ingredients Market