Lactase Market by Source (Yeast, Fungi, and Bacteria), Form (Liquid and Dry), Application (Food & Beverages and Pharmaceutical products & Dietary Supplements), Region (North America, Europe, Asia Pacific, South America and RoW) - Global Forecast to 2027

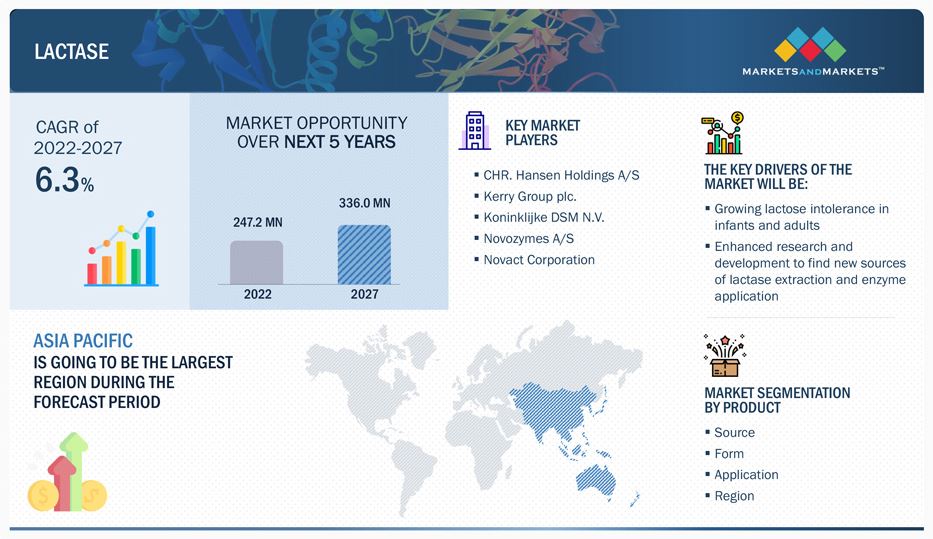

The global lactase market is projected to reach USD 336 million by 2027, at a CAGR of 6.3%, in terms of value, between 2022 and 2027. It is estimated to be valued at USD 247 million in 2022.

Lactose is a type of sugar found in milk and other dairy products, lactase is an enzyme that helps in breaking down the milk sugar lactose into simple sugars, namely glucose and galactose. Factors, such as increasing demand for lactose-free and rising product development & innovations in other application areas like pharmaceutical, dietary supplements, and infant nutrition are expected to boost the demand for lactase on a global level. Key players in the market are introducing new food products like lactose-free cream, ice cream, and milk alternatives to address the growing lactase-deficient population.

To know about the assumptions considered for the study, Request for Free Sample Report

Lactase Market Dynamics

Drivers: Growing lactose intolerance in infants and adults

The development of primary lactose intolerance is temporary and found in premature infants before their small intestine is fully developed. Secondary intolerance is seen in adults when they have a digestive issue in the small intestine. Secondary lactose intolerance is triggered by conditions such as Crohn’s disease or gastroenteritis. According to the National Center for Biotechnology Information (NCBI), nearly 65% of the global population is prone to lactase deficiency. Thus, this has led to an increase in the production of lactose-free dairy products, which helps the lactose-intolerant population to avoid gastrointestinal problems.

Restraints: Rising preference for dairy-free alternatives and vegan diets

The major requirements by consumers recently have been the need for dairy alternatives for removing the problems of cow milk allergy, calorie concerns, lactose intolerance, and the prevalence of hypercholesterolemia. There are other factors such as price, taste exploration, and environmental concerns due to which the shift is seen. Plant-based products are cheaper as compared to meat and dairy products. The manufacturing of lactose-free products is on the higher side due to the usage of the enzyme. Dairy alternatives and vegan products offer different ingredients, tastes, and textures to consumers.

Lactase Market Opportunities: Enhanced research and development to find new sources of lactase extraction and enzyme application

There are different sources from which the lactase enzyme is extracted. However, recent research and development are mainly focused on finding newer alternatives like bacteria and fungi as a source to extract the enzyme. Enzymes are also used to improve the nutritional value of food and feed products. In addition, enzymes reduce water consumption and chemical waste and decrease by-product generation, posing negligible risks to humans and the ecosystem. Lactase enzymes obtained from fungal sources have acidic pH and are stable which may have wide application in the food and beverages industry, as it has to undergo different production processes.

Challenges: High processing cost and lack of technical expertise

Many consumers are unable to consume milk and milk products due to lactose intolerance. Lactose-free milk is available, but they are costlier as compared to the cost of regular milk. The reduction of lactose in milk and dairy products has been explored using many different methods. The high cost of lactose-free products is due to the added cost of the lactose hydrolysis process. Small & medium-sized enterprises have efficient cost management due to limited capital and resources and lack of knowledge and resources for implementation

By source, the bacteria segment is projected to grow at the highest CAGR in terms of value, in the lactase market during the forecast period

Based on the source, the bacteria segment is estimated to grow at the highest CAGR, in terms of value, during the forecast period in the lactase market. The lactase gene from bacterial sources is obtained from three major bacteria namely Lactobacillus acidophilus, Bifidobacterium longum, and Enterococcus faecalis. These are non-pathogenic in nature and possess higher enzymatic activity during the production of lactose-free products. Since these are not pathogens the lactase enzyme sourced from the bacterial source find its application in human nutrition and medicinal purpose.

By form, the dry segment occupies a significant market share during the forecast period

Based on form, the dry segment occupies a significant share in the lactase market during the forecast period. The dry form is more concentrated and easier to use. Enzymes are very sensitive to pH and temperature changes; hence it is important to provide optimum storage conditions. Pharmaceutical manufacturers majorly use the dry form due to ease of use in the required formulations. Most of the companies provide lactase in dry form for import and export purposes.

By application, the food & beverages segment is estimated to occupy the largest market share in terms of value

By application, the food & beverages segment is estimated to occupy the largest market share in the lactase market. The lactase enzyme is an enzyme that some people are unable to produce in their small intestines. Without it, lactase-deficient people cannot break down the natural disaccharide in milk. Adding lactase to milk hydrolyzes the lactose naturally found in milk, leaving it slightly sweet but digestible. This property of the enzyme increases its wider application in the food & beverages industry.

To know about the assumptions considered for the study, download the pdf brochure

North America is the largest region with a significant CAGR in the lactase market. A huge lactose-intolerant consumer base in the region creates a growth opportunity for the lactase market in North America. American Academy of Pediatrics (AAP) recommends that people with lactose intolerance must not be encouraged to avoid milk or any dairy product as it provides necessary nutrients like calcium to the body. This creates a lucrative opportunity for marketing different lactose-free products to cater to the growing lactose-intolerant population in North America.

With the increasing health awareness among consumers, the willingness to pay for supplements and food & beverage products has witnessed tremendous growth in recent years. Additionally, growing vegan and flexitarian diet also contributes to the rising demand for lactose-free products in the region, impacting the need for lactase enzyme.

Top Companies in the Lactase Market:

Key players in this market include CHR. Hansen Holdings A/S (Denmark), Kerry Group plc. (Ireland), Koninklijke DSM N.V. (the Netherlands), Novozymes A/S (Denmark), Merck KGaA (Denmark), IFF (US), Amano Enzyme (Japan), Advanced Enzyme Technologies (India), Novact Corporation (US), Antozyme Biotech Pvt. Ltd (India), Nature Biosciences Pvt. Ltd (India), Aumgene Biosciences (India), Creative Enzymes (US), Biolaxi Enzymes Pvt. Ltd (India), Enzyme Biosciences Pvt. Ltd (India), Infinita Biotech (India), Mitushi Biopharma (India), Oenon Holdings Inc. (Japan), Ultreze Enzymes (India), and Senson (Finland)

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 247 million |

|

Revenue forecast in 2027 |

USD 336 million |

|

Growth Rate |

CAGR of 6.3% from 2022 to 2027 |

|

Base year for estimation |

2021 |

|

Historical data |

2019-2027 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) / Volume (tons) |

|

Segments covered |

Source, form, application and region |

|

Regional scope |

North America, Europe, Asia Pacific, South America, RoW |

|

Dominant Geography |

North America |

|

Key companies profiled |

|

This research report categorizes the lactase market based on source, form, application, and region.

Lactase Market By Source

- Yeast

- Fungi

- Bacteria

By Form

- Liquid

- Dry

Lactase Market By Application

-

Food & Beverages

- Milk

- Cheese

- Yogurt

- Ice cream

- Others

- Pharmaceutical Products & Dietary Supplements

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

Recent Developments

- In June 2022, Koninklijke DSM N.V (Netherlands) announced its merger with Firmenich (Denmark). Firmenich is among the major leaders in fragrance and flavors. This merger will help the company to strengthen its market position in the nutrition, wellness, and beauty space. As per company sources, the merger will be completed by 2023.

- In February 2022, Kerry Group plc. (Ireland) acquired the German biotechnology innovation company c-LEcta (Germany), which manufactures enzymes. c-LEcta specializes in precision fermentation and bioprocessing of enzymes. This acquisition will help Kerry to break through in the lactase enzymes market.

- In November 2021, CHR. Hansen Holdings A/S (Denmark) launched its next-gen enzyme solution Sweety Y-3. Through this, added sugar content of yogurt can be reduced and natural sugar can be enhanced. It helps maintain the quality of dairy products without added sugar. This launch will help the company to increase its market share in the lactase market.

- In May 2022, Kerry Group plc. (Ireland) expanded its presence by opening an advanced taste manufacturing facility in Africa. This will help the group produce sustainable nutrition solutions and expand its food, beverage, and pharmaceutical operations in Africa. It will also help the company expand its lactase enzyme portfolio in newer geographies.

Frequently Asked Questions (FAQ):

What is the projected market value of the global lactase market?

The global lactase market is projected to reach USD 336 million by 2027, and it is estimated to be valued at USD 247 million in 2022.

What is the estimated growth rate (CAGR) of the global lactase market for the next five years?

The global lactase market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2027

What are the major revenue pockets in the lactase market currently?

North America is the largest region with a significant CAGR in the lactase market. A huge lactose-intolerant consumer base in the region creates a growth opportunity for the lactase market in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

1.9 LIMITATIONS AND RISK ASSESSMENT

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 LACTASE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Key data from primary sources

2.1.2.4 Breakdown of primary interviews

2.1.2.5 Key primary insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 APPROACH ONE: BOTTOM-UP

FIGURE 4 APPROACH TWO: TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 2 LACTASE MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 6 LACTASE MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 LACTASE MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 8 LACTASE MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 9 LACTASE MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN LACTASE MARKET

FIGURE 10 HIGH ADOPTION OF LACTOSE-FREE PRODUCTS TO OFFER STEADY GROWTH POTENTIAL

4.2 ASIA PACIFIC: LACTASE MARKET, BY APPLICATION AND COUNTRY

FIGURE 11 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC IN 2021

4.3 LACTASE MARKET, BY SOURCE

FIGURE 12 YEAST-BASED LACTASE TO DOMINATE DURING FORECAST PERIOD

4.4 LACTASE MARKET, BY FORM

FIGURE 13 LIQUID FORM TO DOMINATE DURING FORECAST PERIOD

4.5 LACTASE MARKET, BY APPLICATION

FIGURE 14 FOOD & BEVERAGE APPLICATIONS TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 LACTASE MARKET, BY SOURCE AND REGION

FIGURE 15 NORTH AMERICA TO DOMINATE DURING FORECAST PERIOD

5 LACTASE MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.1.1 MACROECONOMIC FACTOR

5.1.1.1 Increase in incidences of lactase deficiency

FIGURE 16 COUNTRY-WISE PREVALENCE OF LACTOSE INTOLERANCE, 2020

5.2 LACTASE MARKET DYNAMICS

FIGURE 17 LACTASE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing lactose intolerance in infants and adults

5.2.1.2 Growth in technological advancements in end-user applications

5.2.1.3 Increasing awareness among people about food allergies

5.2.2 RESTRAINTS

5.2.2.1 Rising preference for dairy-free alternatives and vegan diets

5.2.2.2 Differences in regulatory framework across regions

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for lactase for producing lactose-free products

5.2.3.2 Enhanced research and development to find new sources of lactase extraction and enzyme application

5.2.4 CHALLENGES

5.2.4.1 High processing cost and lack of technical expertise

5.2.4.2 Concerns over adulteration and quality of enzymes used

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 DISTRIBUTION

6.2.5 MARKETING AND SALES

FIGURE 18 LACTASE MARKET: VALUE CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 LACTASE MARKET MAPPING AND ECOSYSTEM ANALYSIS

6.4.1 DEMAND SIDE

6.4.2 SUPPLY SIDE

FIGURE 19 LACTASE MARKET MAP

FIGURE 20 LACTASE MARKET: ECOSYSTEM MAPPING

TABLE 3 LACTASE MARKET: SUPPLY CHAIN ANALYSIS (ROLE IN ECOSYSTEM)

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 21 REVENUE SHIFT FOR LACTASE MARKET

6.6 PATENT ANALYSIS

FIGURE 22 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

TABLE 4 PATENTS PERTAINING TO LACTASE, 2020–2022

6.7 TRADE DATA

TABLE 5 IMPORT DATA OF ENZYMES, BY COUNTRY, 2019–2020 (USD MILLION)

TABLE 6 EXPORT DATA OF ENZYMES, BY COUNTRY, 2019–2020 (USD MILLION)

6.8 KEY CONFERENCES AND EVENTS

TABLE 7 KEY CONFERENCES AND EVENTS, 2022–2023

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 LACTASE MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT FROM SUBSTITUTES

6.9.5 THREAT FROM NEW ENTRANTS

6.10 PRICING ANALYSIS

6.10.1 AVERAGE SELLING PRICE TRENDS

TABLE 9 LACTASE MARKET: AVERAGE SELLING PRICE, BY SOURCE TYPE, 2019–2022 (USD/KG)

TABLE 10 LACTASE MARKET: AVERAGE SELLING PRICE, BY FORM, 2019–2022 (USD/KG)

TABLE 11 LACTASE MARKET: AVERAGE SELLING PRICE, BY APPLICATION, 2019–2022 (USD/KG)

6.11 CASE STUDIES

6.11.1 NEED FOR LACTOSE-FREE AND HIGH-FIBER SOLUTIONS IN DAIRY INDUSTRY

6.11.2 NEED FOR LACTOSE-FREE AND REDUCED-SUGAR YOGURT

6.12 REGULATORY FRAMEWORK

TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.1 US

TABLE 16 ENZYME PREPARATION AFFIRMED AS GRAS LISTED IN 21 CFR 184

6.12.2 EUROPE

6.12.3 CHINA

6.12.4 INDIA

6.12.5 AUSTRALIA & NEW ZEALAND

6.12.6 SOUTH AMERICA

6.12.7 BRAZIL

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR LACTASE APPLICATIONS

TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR LACTASE APPLICATIONS

FIGURE 24 KEY BUYING CRITERIA FOR LACTASE APPLICATIONS

TABLE 18 KEY BUYING CRITERIA FOR LACTASE APPLICATIONS

7 LACTASE MARKET, BY SOURCE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 25 LACTASE MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 19 LACTASE MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 20 LACTASE MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 21 LACTASE MARKET, BY SOURCE, 2019–2021 (TON)

TABLE 22 LACTASE MARKET, BY SOURCE, 2022–2027 (TON)

7.2 YEAST

7.2.1 EASE OF EXTRACTION AND ENZYME STABILITY TO DRIVE MARKET FOR YEAST-BASED LACTASE

TABLE 23 YEAST MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 YEAST MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 YEAST MARKET, BY REGION, 2019–2021 (TON)

TABLE 26 YEAST MARKET, BY REGION, 2022–2027 (TON)

7.3 FUNGI

7.3.1 INCREASING USE OF FUNGAL LACTASE IN DAIRY AND PHARMACEUTICAL INDUSTRIES

TABLE 27 FUNGI MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 FUNGI MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 FUNGI MARKET, BY REGION, 2019–2021 (TON)

TABLE 30 FUNGI MARKET, BY REGION, 2022–2027 (TON)

7.4 BACTERIA

7.4.1 HIGH ENZYME ACTIVITY OF BACTERIAL LACTASE TO DRIVE DEMAND

TABLE 31 BACTERIA MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 BACTERIA MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 BACTERIA MARKET, BY REGION, 2019–2021 (TON)

TABLE 34 BACTERIA MARKET, BY REGION, 2022–2027 (TON)

8 LACTASE MARKET, BY FORM (Page No. - 94)

8.1 INTRODUCTION

FIGURE 26 LACTASE MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

TABLE 35 MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 36 MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 37 MARKET, BY FORM, 2019–2021 (TON)

TABLE 38 MARKET, BY FORM, 2022–2027 (TON)

8.2 LIQUID

8.2.1 HIGH ACTIVITY AND BETTER FUNCTIONALITY TO MAKE LIQUID LACTASE MORE PREFERRED

TABLE 39 LIQUID LACTASE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 LIQUID MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 LIQUID MARKET, BY REGION, 2019–2021 (TON)

TABLE 42 LIQUID MARKET, BY REGION, 2022–2027 (TON)

8.3 DRY

8.3.1 EASE OF STORAGE AND BULK HANDLING TO DRIVE USE OF DRY LACTASE IN FOOD AND PHARMACEUTICALS

TABLE 43 DRY LACTASE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 44 DRY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 DRY MARKET, BY REGION, 2019–2021 (TON)

TABLE 46 DRY MARKET, BY REGION, 2022–2027 (TON)

9 LACTASE MARKET, BY APPLICATION (Page No. - 100)

9.1 INTRODUCTION

FIGURE 27 LACTASE MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 47 MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 48 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 49 MARKET, BY APPLICATION, 2019–2021 (TON)

TABLE 50 MARKET, BY APPLICATION, 2022–2027 (TON)

9.2 FOOD & BEVERAGES

9.2.1 DEMAND FOR LACTOSE-FREE FOOD & BEVERAGES TO DRIVE LACTASE APPLICATION

TABLE 51 FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 52 FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (TON)

TABLE 54 FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (TON)

TABLE 55 FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 56 FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 57 FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (TON)

TABLE 58 FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (TON)

9.2.1.1 Milk

TABLE 59 MILK APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 60 MILK APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 MILK APPLICATIONS MARKET, BY REGION, 2019–2021 (TON)

TABLE 62 MILK APPLICATIONS MARKET, BY REGION, 2022–2027 (TON)

9.2.1.2 Yogurt

TABLE 63 YOGURT APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 64 YOGURT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 YOGURT APPLICATIONS MARKET, BY REGION, 2019–2021 (TON)

TABLE 66 YOGURT APPLICATIONS MARKET, BY REGION, 2022–2027 (TON)

9.2.1.3 Cheese

TABLE 67 CHEESE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 68 CHEESE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 CHEESE APPLICATIONS MARKET, BY REGION, 2019–2021 (TON)

TABLE 70 CHEESE APPLICATIONS MARKET, BY REGION, 2022–2027 (TON)

9.2.1.4 Ice cream

TABLE 71 ICE CREAM APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 72 ICE CREAM APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 73 ICE CREAM APPLICATIONS MARKET, BY REGION, 2019–2021 (TON)

TABLE 74 ICE CREAM APPLICATIONS MARKET, BY REGION, 2022–2027 (TON)

9.2.1.5 Other food & beverages

TABLE 75 OTHER FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 76 OTHER FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 77 OTHER FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2021 (TON)

TABLE 78 OTHER FOOD & BEVERAGE APPLICATIONS MARKET, BY REGION, 2022–2027 (TON)

9.3 PHARMACEUTICAL PRODUCTS & DIETARY SUPPLEMENTS

9.3.1 HIGHER USE OF LACTASE IN PHARMA AND DIETARY SUPPLEMENTS TO TREAT LACTOSE-INTOLERANCE

TABLE 79 PHARMACEUTICAL PRODUCT & DIETARY SUPPLEMENT APPLICATIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 80 PHARMACEUTICAL PRODUCT & DIETARY SUPPLEMENT APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 PHARMACEUTICAL PRODUCT & DIETARY SUPPLEMENT APPLICATIONS MARKET, BY REGION, 2019–2021 (TON)

TABLE 82 PHARMACEUTICAL PRODUCT & DIETARY SUPPLEMENT APPLICATIONS MARKET, BY REGION, 2022–2027 (TON)

10 LACTASE MARKET, BY REGION (Page No. - 117)

10.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

TABLE 83 LACTASE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 84 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 MARKET, BY REGION, 2019–2021 (TON)

TABLE 86 MARKET, BY REGION, 2022–2027 (TON)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: HEALTH SPENDING, BY KEY COUNTRY, 2017–2021 (USD/CAPITA)

FIGURE 30 NORTH AMERICA: LACTASE MARKET SNAPSHOT

TABLE 87 NORTH AMERICA: LACTASE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (TON)

TABLE 90 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (TON)

TABLE 91 NORTH AMERICA: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY FORM, 2019–2021 (TON)

TABLE 94 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (TON)

TABLE 95 NORTH AMERICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY SOURCE, 2019–2021 (TON)

TABLE 98 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (TON)

TABLE 99 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (TON)

TABLE 102 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (TON)

TABLE 103 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (TON)

TABLE 106 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (TON)

10.2.1 US

10.2.1.1 High spending on health products to create growth opportunities

TABLE 107 US: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 108 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rise in awareness among consumers about health concerns

TABLE 109 CANADA: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 110 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Rising preference for healthy alternatives to dairy products

TABLE 111 MEXICO: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 112 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 31 EUROPE: COUNTRY-WISE FREQUENCY OF LACTASE DEFICIENCY, 2017

TABLE 113 EUROPE: LACTASE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY COUNTRY, 2019–2021 (TON)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2022–2027 (TON)

TABLE 117 EUROPE: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY FORM, 2019–2021 (TON)

TABLE 120 EUROPE: MARKET, BY FORM, 2022–2027 (TON)

TABLE 121 EUROPE: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY SOURCE, 2019–2021 (TON)

TABLE 124 EUROPE: MARKET, BY SOURCE, 2022–2027 (TON)

TABLE 125 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY APPLICATION, 2019–2021 (TON)

TABLE 128 EUROPE: MARKET, BY APPLICATION, 2022–2027 (TON)

TABLE 129 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 130 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 131 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (TON)

TABLE 132 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (TON)

10.3.1 GERMANY

10.3.1.1 Rising popularity of bakery and confectionery products using lactase

TABLE 133 GERMANY: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 134 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Growing lactase-deficient population

TABLE 135 FRANCE: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 136 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Country’s diverse dairy sector to drive market for lactose-free dairy products

TABLE 137 UK: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 138 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Increasing customer awareness about lactose intolerance

TABLE 139 SPAIN: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 140 SPAIN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Growing popularity of ready-to-eat low-sugar dairy products

TABLE 141 ITALY: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 142 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 143 REST OF EUROPE: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 144 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: LACTASE MARKET SNAPSHOT

TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (TON)

TABLE 148 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (TON)

TABLE 149 ASIA PACIFIC: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY FORM, 2019–2021 (TON)

TABLE 152 ASIA PACIFIC: MARKET, BY FORM, 2022–2027 (TON)

TABLE 153 ASIA PACIFIC: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY SOURCE, 2019–2021 (TON)

TABLE 156 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (TON)

TABLE 157 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (TON)

TABLE 160 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (TON)

TABLE 161 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (TON)

TABLE 164 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (TON)

10.4.1 CHINA

10.4.1.1 Rising consumption of dairy products

TABLE 165 CHINA: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 166 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Growing demand for functional, low-lactose beverages

TABLE 167 INDIA: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 168 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Concerns related to diabetes and obesity to drive use of lactase in food and beverages

TABLE 169 JAPAN: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 170 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.4.1 Growing consumption of low-sugar products

TABLE 171 AUSTRALIA & NEW ZEALAND: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 172 AUSTRALIA & NEW ZEALAND: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 173 REST OF ASIA PACIFIC: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 175 SOUTH AMERICA: LACTASE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 176 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 177 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (TON)

TABLE 178 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (TON)

TABLE 179 SOUTH AMERICA: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 180 SOUTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 181 SOUTH AMERICA: MARKET, BY FORM, 2019–2021 (TON)

TABLE 182 SOUTH AMERICA: MARKET, BY FORM, 2022–2027 (TON)

TABLE 183 SOUTH AMERICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 184 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 185 SOUTH AMERICA: MARKET, BY SOURCE, 2019–2021 (TON)

TABLE 186 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (TON)

TABLE 187 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 188 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 189 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (TON)

TABLE 190 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (TON)

TABLE 191 SOUTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 192 SOUTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 193 SOUTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (TON)

TABLE 194 SOUTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (TON)

10.5.1 BRAZIL

10.5.1.1 Expansion of R&D activities to produce lactase

TABLE 195 BRAZIL: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 196 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Inability of people to consume regular dairy products to drive use of lactase in dairy

TABLE 197 ARGENTINA: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 198 ARGENTINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 199 REST OF SOUTH AMERICA: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 200 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.6 ROW

TABLE 201 ROW: LACTASE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 202 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 203 ROW: MARKET, BY REGION, 2019–2021 (TON)

TABLE 204 ROW: MARKET, BY REGION, 2022–2027 (TON)

TABLE 205 ROW: MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 206 ROW: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 207 ROW: MARKET, BY FORM, 2019–2021 (TON)

TABLE 208 ROW: MARKET, BY FORM, 2022–2027 (TON)

TABLE 209 ROW: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 210 ROW: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 211 ROW: MARKET, BY SOURCE, 2019–2021 (TON)

TABLE 212 ROW: MARKET, BY SOURCE, 2022–2027 (TON)

TABLE 213 ROW: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 214 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 215 ROW: MARKET, BY APPLICATION, 2019–2021 (TON)

TABLE 216 ROW: MARKET, BY APPLICATION, 2022–2027 (TON)

TABLE 217 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (USD MILLION)

TABLE 218 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (USD MILLION)

TABLE 219 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2021 (TON)

TABLE 220 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2022–2027 (TON)

10.6.1 MIDDLE EAST

10.6.1.1 Increasing health concerns and availability of healthy alternatives

TABLE 221 MIDDLE EAST: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 222 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.6.2 AFRICA

10.6.2.1 High consumption of milk and dairy products to offer growth opportunities

FIGURE 33 AFRICA: DAIRY CONSUMPTION, 2019–2021 (THOUSAND TONNES)

TABLE 223 AFRICA: LACTASE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 224 AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 172)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 225 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

11.3 MARKET SHARE ANALYSIS

TABLE 226 MARKET SHARE ANALYSIS OF LACTASE, 2021

11.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS, 2019–2021 (USD BILLION)

11.5 LACTASE MARKET: COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 35 LACTASE MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.5.5 LACTASE PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 227 COMPANY FOOTPRINT, BY SOURCE (KEY PLAYERS)

TABLE 228 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

TABLE 229 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

TABLE 230 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

TABLE 231 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

11.6 LACTASE MARKET: EVALUATION QUADRANT (STARTUPS/SMES)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 36 LACTASE MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

TABLE 232 COMPETITIVE BENCHMARKING (STARTUPS/SMES)

11.7 COMPETITIVE SCENARIO

11.7.1 PRODUCT LAUNCHES

TABLE 233 LACTASE MARKET: PRODUCT LAUNCHES, 2019–2022

11.7.2 DEALS

TABLE 234 LACTASE MARKET: DEALS, 2019–2022

11.7.3 OTHER DEVELOPMENTS

TABLE 235 LACTASE MARKET: OTHERS, 2019–2022

12 COMPANY PROFILES (Page No. - 187)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

12.1 KEY PLAYERS

12.1.1 CHR. HANSEN HOLDINGS A/S

TABLE 236 CHR. HANSEN HOLDINGS A/S: BUSINESS OVERVIEW

FIGURE 37 CHR. HANSEN HOLDINGS A/S: COMPANY SNAPSHOT

TABLE 237 CHR. HANSEN HOLDINGS A/S: PRODUCTS OFFERED

TABLE 238 CHR. HANSEN HOLDINGS A/S: PRODUCT LAUNCHES

12.1.2 KERRY GROUP PLC

TABLE 239 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 38 KERRY GROUP PLC: COMPANY SNAPSHOT

TABLE 240 KERRY GROUP PLC: PRODUCTS OFFERED

TABLE 241 KERRY GROUP PLC: DEALS

TABLE 242 KERRY GROUP PLC: OTHERS

12.1.3 KONINKLIJKE DSM N.V.

TABLE 243 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

FIGURE 39 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

TABLE 244 KONINKLIJKE DSM N.V.: PRODUCTS OFFERED

TABLE 245 KONINKLIJKE DSM N.V.: DEALS

12.1.4 NOVOZYMES A/S

TABLE 246 NOVOZYMES A/S : BUSINESS OVERVIEW

FIGURE 40 NOVOZYMES A/S: COMPANY SNAPSHOT

TABLE 247 NOVOZYMES A/S: PRODUCTS OFFERED

TABLE 248 NOVOZYMES A/S: PRODUCT LAUNCHES

TABLE 249 NOVOZYMES A/S : DEALS

12.1.5 MERCK KGAA

TABLE 250 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 41 MERCK KGAA: COMPANY SNAPSHOT

TABLE 251 MERCK KGAA: PRODUCTS OFFERED

12.1.6 INTERNATIONAL FLAVORS & FRAGRANCES INC. (IFF)

TABLE 252 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

FIGURE 42 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

TABLE 253 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

TABLE 254 INTERNATIONAL FLAVORS AND FRAGRANCES INC.: DEALS

12.1.7 AMANO ENZYME INC.

TABLE 255 AMANO ENZYME INC.: BUSINESS OVERVIEW

TABLE 256 AMANO ENZYME INC.: PRODUCTS OFFERED

TABLE 257 AMANO ENZYME INC.: OTHERS

12.1.8 ADVANCED ENZYME TECHNOLOGIES

TABLE 258 ADVANCED ENZYME TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 43 ADVANCED ENZYME TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 259 ADVANCED ENZYME TECHNOLOGIES: PRODUCTS OFFERED

TABLE 260 ADVANCED ENZYME TECHNOLOGIES: DEALS

12.1.9 NOVACT CORPORATION

TABLE 261 NOVACT CORPORATION: BUSINESS OVERVIEW

TABLE 262 NOVACT CORPORATION: PRODUCTS OFFERED

12.1.10 ANTOZYME BIOTECH PVT. LTD.

TABLE 263 ANTOZYME BIOTECH PVT. LTD.: BUSINESS OVERVIEW

TABLE 264 ANTOZYME BIOTECH PVT. LTD.: PRODUCTS OFFERED

12.2 OTHER PLAYERS

12.2.1 NATURE BIOSCIENCE PVT. LTD.

TABLE 265 NATURE BIOSCIENCE PVT. LTD.: BUSINESS OVERVIEW

TABLE 266 NATURE BIOSCIENCE PVT. LTD.: PRODUCTS OFFERED

12.2.2 AUMGENE BIOSCIENCES

TABLE 267 AUMGENE BIOSCIENCES: BUSINESS OVERVIEW

TABLE 268 AUMGENE BIOSCIENCES: PRODUCTS OFFERED

12.2.3 CREATIVE ENZYMES

TABLE 269 CREATIVE ENZYMES: BUSINESS OVERVIEW

TABLE 270 CREATIVE ENZYMES: PRODUCTS OFFERED

TABLE 271 CREATIVE ENZYMES: PRODUCT LAUNCHES

12.2.4 BIOLAXI ENZYMES PVT. LTD.

TABLE 272 BIOLAXI ENZYMES: BUSINESS OVERVIEW

TABLE 273 BIOLAXI ENZYMES PVT. LTD.: PRODUCTS OFFERED

12.2.5 ENZYME BIOSCIENCE PVT. LTD.

TABLE 274 ENZYME BIOSCIENCE: BUSINESS OVERVIEW

TABLE 275 ENZYME BIOSCIENCE: PRODUCTS OFFERED

12.2.6 INFINITA BIOTECH PVT. LTD.

TABLE 276 INFINITA BIOTECH: BUSINESS OVERVIEW

TABLE 277 INFINITA BIOTECH: PRODUCTS OFFERED

12.2.7 MITUSHI BIOPHARMA

TABLE 278 MITUSHI BIOPHARMA: BUSINESS OVERVIEW

TABLE 279 MITUSHI BIOPHARMA: PRODUCTS OFFERED

12.2.8 OENON HOLDINGS INC.

TABLE 280 OENON HOLDINGS INC.: BUSINESS OVERVIEW

FIGURE 44 OENON HOLDINGS INC.: COMPANY SNAPSHOT

TABLE 281 OENON HOLDINGS INC.: PRODUCTS OFFERED

12.2.9 ULTREZE ENZYMES

TABLE 282 ULTREZE ENZYMES: BUSINESS OVERVIEW

TABLE 283 ULTREZE ENZYMES: PRODUCTS OFFERED

12.2.10 SENSON

TABLE 284 SENSON: BUSINESS OVERVIEW

TABLE 285 SENSON: PRODUCTS OFFERED

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 227)

13.1 INTRODUCTION

TABLE 286 MARKETS ADJACENT TO LACTASE MARKET

13.2 LIMITATIONS

13.3 DAIRY INGREDIENTS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 287 DAIRY INGREDIENTS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 288 DAIRY INGREDIENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.4 FOOD ENZYMES MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 289 FOOD ENZYMES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 290 FOOD ENZYMES MARKET, BY TYPE, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 231)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

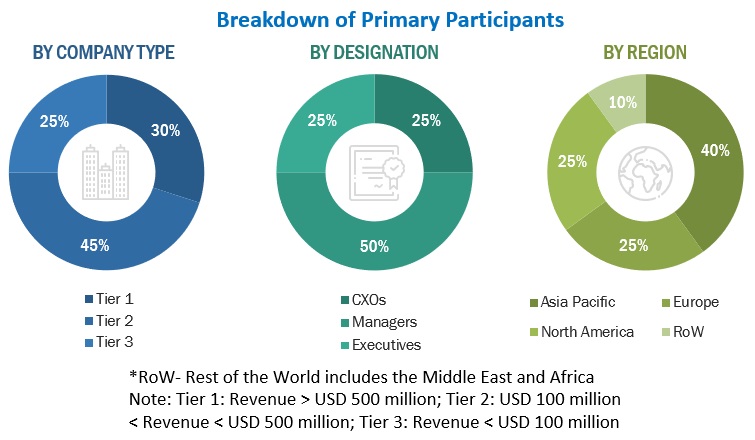

This research study involved the usage of extensive secondary sources (such as directories and databases)—Hoovers, Forbes, and Bloomberg Businessweek—to identify and collect information useful for the study of the lactase market. The primary sources mainly included industry experts from core and related industries and suppliers, dealers, manufacturers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents—including key industry participants, subject matter experts, C-level executives of the major market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the research design applied in drafting this report on the lactase market.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information relevant to this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. The secondary research was done to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Secondary sources for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research was conducted to gather information and verify and validate the critical market numbers. Various sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the smart agriculture market. The primary research was also conducted to identify segmentation types, industry trends, and key players, as well as to analyze the competitive landscape; key player strategies; key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Lactase Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the lactase market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the lactase market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall lactase market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points, match the data is assumed to be correct.

Report Objectives

- To describe and forecast the lactase market, in terms of source, form, application and region.

- To describe and forecast the lactase market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To study the complete value chain of the lactase market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the lactase market.

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders.

- To analyze strategic approaches, such as expansions, product launches, acquisitions, and partnerships in the lactase market.

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European lactase market by key countries Poland, the Netherlands, Denmark, Russia, and other EU and non-EU countries

- Further breakdown of the Rest of the Asia Pacific lactase market by key countries South Korea, Indonesia, Vietnam, the Philippines, Malaysia, Singapore, and Thailand

- Further breakdown of the Rest of South America’s lactase market by key countries Colombia, Peru, and Chile

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lactase Market