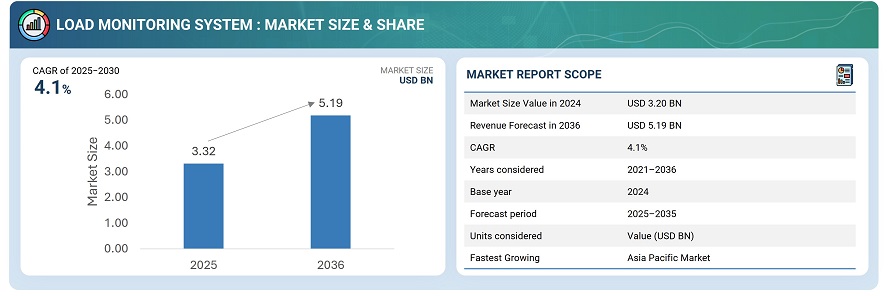

Load Monitoring System Market by Offering (Load Cell, Indicator & Controller, Data Logging Software), Technology (Analog, Digital), Industry (Automotive, Healthcare, Marine, Construction), and Geography - Global Forecast to 2025-2036

The global load monitoring system market was valued at USD 3.20 billion in 2024 and is estimated to reach USD 5.19 billion by 2036, at a CAGR of 4.1% between 2025 and 2036.

The Load Monitoring System market is experiencing significant growth, driven by increasing demand for efficient energy management, industrial automation, and safety monitoring across various sectors, including construction, manufacturing, and logistics. Load monitoring systems enable real-time measurement and analysis of mechanical loads, enhancing operational safety, reducing equipment downtime, and optimizing resource utilization. Key trends propelling this market include the adoption of smart sensors, IoT-based monitoring solutions, and predictive maintenance technologies. As industries prioritize automation and energy efficiency, load monitoring systems are emerging as a critical component for ensuring operational reliability and reducing maintenance costs.

The market growth is further reinforced by rising industrial automation, growing infrastructure projects, and stringent safety regulations that mandate precise load monitoring in critical applications. With advancements in wireless sensor technology and cloud-based monitoring solutions, the load monitoring system market is well-positioned for sustained expansion over the coming decade.

Market by Technology Type

Analog

Analog load monitoring systems currently hold the largest market share due to their simplicity, reliability, and cost-effectiveness. These systems measure mechanical loads through continuous electrical signals, providing real-time feedback for applications such as cranes, presses, and industrial machinery. Their proven performance, ease of integration, and low maintenance requirements make analog systems a preferred choice for traditional industrial environments. Additionally, their robust design allows them to operate effectively in harsh conditions, reinforcing their widespread adoption across multiple sectors.

Digital

Digital load monitoring systems are expected to register the highest CAGR during the forecast period, driven by advancements in sensor technology, microprocessors, and wireless communication. These systems convert load measurements into digital signals, enabling higher precision, data logging, and seamless integration with IoT platforms and predictive maintenance software. The growing demand for real-time analytics, remote monitoring, and smart manufacturing solutions is accelerating the adoption of digital LMS, particularly in industries seeking improved operational efficiency and automation.

Market by Industry

Manufacturing

The manufacturing sector holds the largest share of the load monitoring system market, driven by the need for precision, safety, and operational efficiency across diverse production processes. Load monitoring systems are widely deployed in various applications, including presses, conveyor systems, cranes, and heavy machinery, to prevent overloading, reduce equipment downtime, and ensure compliance with safety regulations. With the increasing adoption of automation and smart factory initiatives, manufacturing companies are leveraging real-time load data to optimize production efficiency, enhance equipment lifespan, and minimize operational risks.

Construction & Infrastructure

The construction and infrastructure monitoring segment is expected to register the highest CAGR during the forecast period, fueled by the rapid growth of infrastructure projects globally. Load monitoring systems are increasingly deployed in bridges, high-rise buildings, and large-scale construction equipment to ensure structural safety and real-time load management. The integration of IoT-based monitoring, wireless sensors, and predictive analytics is accelerating adoption, as construction companies seek to enhance efficiency, reduce downtime, and mitigate risks in complex projects.

Market by Geography

Geographically, the load monitoring system market is experiencing widespread adoption across North America, Europe, the Asia Pacific, and the Middle East & Africa. The Asia Pacific region is expected to witness the fastest growth in the load monitoring system market during the forecast period. Rapid industrialization, increasing infrastructure investments, and the expansion of manufacturing and logistics sectors in countries such as China, India, and Japan are driving demand for load monitoring solutions. Additionally, the growing adoption of smart construction practices, renewable energy projects, and heavy machinery in the region is creating substantial opportunities for LMS deployment. With increasing government initiatives aimed at enhancing industrial safety and operational efficiency, the Asia Pacific is emerging as a key hub for the adoption of load monitoring systems.

Market Dynamics

Driver: Growing Industrial Automation and Safety Requirements

The rising adoption of industrial automation and stringent workplace safety regulations is driving the demand for load monitoring systems. Industries such as construction, manufacturing, and logistics increasingly rely on real-time load data to prevent equipment failures, optimize operations, and ensure regulatory compliance. This growing emphasis on operational efficiency and safety continues to propel market expansion. Additionally, the increasing complexity of machinery and heavy equipment has intensified the need for precise load measurement to avoid costly accidents and downtime.

Restraint: High Initial Investment and Installation Costs

Despite the benefits, the high upfront cost of advanced load monitoring systems and the complexity of installation remain key restraints. Many small- and medium-sized enterprises face budgetary constraints that limit large-scale deployment, especially in regions with lower industrial automation penetration. Furthermore, ongoing maintenance and calibration requirements add to the total cost of ownership, slowing adoption among cost-sensitive industries.

Opportunity: Integration with IoT and Predictive Maintenance Solutions

The convergence of load monitoring systems with IoT platforms and predictive maintenance technologies presents significant growth opportunities. Real-time monitoring, cloud-based analytics, and wireless sensor integration enable proactive maintenance, reduce downtime, and enhance operational efficiency. Such technological advancements are expanding LMS adoption across multiple sectors, including those involving smart infrastructure and heavy machinery. Moreover, the rising adoption of digital twins and AI-based analytics is expected to enhance further the value proposition of load monitoring solutions in optimizing asset performance.

Challenge: Standardization and Data Interoperability Issues

Lack of standardization across load monitoring devices and challenges in integrating diverse data streams into a unified platform pose significant market challenges. Ensuring compatibility between sensors, control systems, and analytics software is crucial for achieving reliable performance and widespread adoption across various industries. Addressing these interoperability issues will require collaboration between manufacturers, software providers, and regulatory bodies to establish common standards and protocols.

Future Outlook

Between 2025 and 2036, the load monitoring system market is anticipated to expand steadily as industries increasingly adopt smart and automated operations. Advancements in sensor technology, wireless communications, and IoT integration are transforming traditional load monitoring systems into intelligent solutions capable of predictive maintenance and real-time performance analytics. Growing focus on workplace safety, operational efficiency, and regulatory compliance will further drive market adoption. As the market matures, load monitoring systems are expected to play a pivotal role in enhancing operational reliability, reducing downtime, and enabling data-driven decision-making across industrial and commercial applications.

Key Market Players

Top companies in the Load Monitoring System Market are Flintec (Sweden), METTLER TOLEDO (US), Precia Molen (France), Spectris (UK), and JCM Load Monitoring Ltd. (UK)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Scope of the Study

1.3.1 Market Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary & Primary Research

2.1.3.1 Key Industry Insights

2.1.3.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Load Monitoring System Market, 2018–2024 (USD Billion)

4.2 Market, By Offering

4.3 Market, By Technology

4.4 Market, By Industry

4.5 Market, By Geography

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Demand for LMS in Healthcare

5.2.1.2 Increase in Use of LMS for Testing and Monitoring Aircraft Parts

5.2.1.3 Decline in Instrumental Errors Owing to Technological Innovations in Load Cells

5.2.1.4 Increase in Demand for Remote Load Monitoring

5.2.2 Restraints

5.2.2.1 Compliance With Various Standards

5.2.2.2 Complex Manufacturing Process

5.2.3 Opportunities

5.2.3.1 Rise in Demand for Digital Load Cells

5.2.3.2 Increase in Demand for Customized Load Monitoring System

5.2.4 Challenges

5.2.4.1 Entry Barriers for New Vendors From International Players

5.2.4.2 Volatility in Demand for LMS

5.3 Value Chain Analysis

6 Load Monitoring System Market, By Offering (Page No. - 44)

6.1 Introduction

6.2 Load Cell

6.2.1 Single Beam Load Cell

6.2.1.1 Single Beam Load Cell Holds Largest Share of Market

6.2.2 S-Type Load Cell

6.2.2.1 S-Type Load Cell to Grow at Highest Rate During Forecast Period

6.2.3 Dual Shear Load Cell

6.2.3.1 Dual Shear Load Cells are Mainly Used for Heavy-Load Industrial Applications

6.2.4 Bending Beam Load Cell

6.2.4.1 Bending Beam Load Cell is Popularly Used in Commercial Weighing Applications

6.2.5 Others

6.2.5.1 Compression Load Cell

6.2.5.2 Load Link

6.2.5.3 Load Pin

6.2.5.4 Load Shackle

6.3 Indicator and Controller

6.3.1 Indicators and Controllers to Grow at Highest CAGR From 2018 to 2024

6.4 Data Logging Software

6.4.1 Software Helps in Easy Analysis and Monitoring of Load

7 Load Monitoring System Market, By Technology (Page No. - 55)

7.1 Introduction

7.2 Analog

7.2.1 Analog Technology to Hold Larger Share of market in 2018

7.3 Digital

7.3.1 Digital Technology to Grow at Higher CAGR From 2018 to 2024

7.4 Difference Between Analog and Digital Load Cell

8 Load Monitoring System Market, By Industry (Page No. - 60)

8.1 Introduction

8.2 Automotive

8.2.1 Increasing Competition in Automotive Industry Compelling Players to Follow Safety and Quality Standards

8.3 Marine

8.3.1 Increasing Globalization Led to Shipbuilding Industry Growth

8.4 Construction

8.4.1 Construction Industry Growth Fuelled By Ever-Increasing Population

8.5 Food & Beverages

8.5.1 Increase in Automation in F&B Industry Propelling LMS Market Growth

8.6 Aerospace

8.6.1 Globalization Led to Increase in Airline Passengers Fuelling Demand for Aircrafts

8.7 Oil & Gas

8.7.1 Harsh Environmental Conditions at Oil & Gas Exploration Sites Fuelling Demand for LMS

8.8 Healthcare

8.8.1 Development in Medical Technology Supporting LMS Market Growth

8.9 Agriculture

8.9.1 Increasing Adoption of Automation in Agriculture Industry Fuelling Demand for LMS

9 Geographic Analysis (Page No. - 75)

9.1 Introduction

9.2 North America

9.2.1 Us

9.2.1.1 Presence of Heavy Industries Supports LMS Market Growth in Us

9.2.2 Canada

9.2.2.1 Manufacturing Industry in Canada Propels LMS Market Growth

9.2.3 Mexico

9.2.3.1 Increasing Medical Device Manufacturing Supports LMS Market Growth

9.3 Europe

9.3.1 Germany

9.3.1.1 Automotive and Shipbuilding Industry in Germany is Among Major End Users of LMS

9.3.2 UK

9.3.2.1 F&B and Oil & Gas Industries Drive LMS Market Growth in UK

9.3.3 France

9.3.3.1 Industrial Manufacturing Sector Propels LMS Market Growth in France

9.3.4 Rest of Europe

9.3.4.1 Rising Number of Manufacturing Facilities and High Safety Standards Propel LMS Market Growth in Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Rapidly Growing Industrial Manufacturing Along With Agriculture Industry Propels LMS Market Growth in China

9.4.2 Japan

9.4.2.1 Highly Advanced Automotive Industry Keeps Steady Demand for LMS in Japan

9.4.3 India

9.4.3.1 Rising Investments in Automotive Industry Propel Demand for LMS in India

9.4.4 Rest of APAC

9.4.4.1 Increasing Automation in Industrial Manufacturing Supports LMS Market Growth in Rest of APAC

9.5 RoW

9.5.1 South America

9.5.1.1 Developing Economies of South America Drive Demand for LMS in Manufacturing Sector

9.5.2 Middle East

9.5.2.1 Oil & Gas and Marine Industries are Major Drivers of LMS Market in Middle East

9.5.3 Africa

9.5.3.1 Agriculture and Automotive Markets Drive LMS Market Growth in Africa

10 Competitive Landscape (Page No. - 91)

10.1 Overview

10.2 Ranking of Players in market

10.3 Competitive Leadership Mapping

10.3.1 Visionaries

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Strength of Product Portfolio

10.5 Business Strategy Excellence

10.6 Competitive Situations & Trends

10.6.1 Product Launches

10.6.2 Expansions

10.6.3 Contracts and Partnerships

10.6.4 Mergers and Acquisitions

11 Company Profiles (Page No. - 101)

11.1 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

11.1.1 Flintec

11.1.2 Mettler Toledo

11.1.3 Precia Molen

11.1.4 Spectris

11.1.5 Vishay Precision Group

11.1.6 Dynamic Load Monitoring

11.1.7 JCM Load Monitoring

11.1.8 LCM Systems

11.1.9 Load Monitoring Systems

11.1.10 Straightpoint

11.1.11 Wirop Industrial

11.2 Other Key Players

11.2.1 Eilersen Electric Digital Systems

11.2.2 Euroload

11.2.3 Futek Advanced Sensor Technology

11.2.4 Mantracourt Electronics

11.2.5 PCE Deutschland

11.2.6 Standard Loadcells

11.2.7 Strainsert

11.2.8 Tecsis

11.2.9 Thames Side Sensors

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 135)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (36 Tables)

Table 1 Load Monitoring System Market, By Offering, 2015–2024 (USD Million)

Table 2 Load Cell Market, By Type, 2015–2024 (USD Million)

Table 3 Market, By Technology, 2015–2024 (USD Million)

Table 4 Analog Market, By Region, 2015–2024 (USD Million)

Table 5 Digital Market, By Region, 2015–2024 (USD Million)

Table 6 Difference Between Analog and Digital Load Cell

Table 7 Load Monitoring Systems Market, By Industry, 2015–2024 (USD Million)

Table 8 Market for Automotive Industry, By Technology, 2015–2024 (USD Million)

Table 9 Market for Automotive Industry, By Region, 2015–2024 (USD Million)

Table 10 Market for Marine Industry, By Technology, 2015–2024 (USD Million)

Table 11 Market for Marine Industry, By Region, 2015–2024 (USD Million)

Table 12 Market for Construction Industry, By Technology, 2015–2024 (USD Million)

Table 13 Market for Construction Industry, By Region, 2015–2024 (USD Million)

Table 14 Market for Food & Beverages Industry, By Technology, 2015–2024 (USD Million)

Table 15 Load Monitoring Systems Market for Food & Beverages Industry, By Region, 2015–2024 (USD Million)

Table 16 Market for Aerospace Industry, By Technology, 2015–2024 (USD Million)

Table 17 Market for Aerospace Industry, By Region, 2015–2024 (USD Million)

Table 18 Market for Oil & Gas Industry, By Technology, 2015–2024 (USD Million)

Table 19 Market for Oil & Gas Industry, By Region, 2015–2024 (USD Million)

Table 20 Market for Healthcare Industry, By Technology, 2015–2024 (USD Million)

Table 21 Market for Healthcare Industry, By Region, 2015–2024 (USD Million)

Table 22 Market for Agriculture Industry, By Technology, 2015–2024 (USD Million)

Table 23 Market for Agriculture Industry, By Region, 2015–2024 (USD Million)

Table 24 Load Monitoring Systems Market, By Region, 2015–2024 (USD Million)

Table 25 Market in North America, By Country, 2015–2024 (USD Million)

Table 26 Market in North America, By Technology, 2015–2024 (USD Million)

Table 27 Market in Europe, By Country, 2015–2024 (USD Million)

Table 28 Market in Europe, By Technology, 2015–2024 (USD Million)

Table 29 Market in APAC, By Country, 2015–2024 (USD Million)

Table 30 Market in APAC, By Technology, 2015–2024 (USD Million)

Table 31 Market in RoW, By Country, 2015–2024 (USD Million)

Table 32 Load Monitoring Systems Market in RoW, By Technology, 2015–2024 (USD Million)

Table 33 Product Launches, 2018

Table 34 Expansions, 2017–2018

Table 35 Contract and Partnerships, 2017–2018

Table 36 Merger and Acquisition, 2016–2018

List of Figures (52 figures)

Figure 1 Market Segmentation

Figure 2 Load Monitoring System Market: Research Design

Figure 3 Bottom-Up Approach to Arrive at Market Size

Figure 4 Top-Down Approach to Arrive at Market Size

Figure 5 Data Triangulation

Figure 6 Assumptions of Research Study

Figure 7 Market Segmentation

Figure 8 Load Cell to Hold Largest Size of market in 2018

Figure 9 Analog Technology to Hold Larger Share of market in 2018

Figure 10 Market for Healthcare Industry to Grow at Highest CAGR During Forecast Period

Figure 11 Europe to Hold Largest Share of market in 2018

Figure 12 Growth in Healthcare Industry to Boost market

Figure 13 Load Cells to Account Highest Share of market From 2018 to 2024

Figure 14 Digital Technology to Grow at A Higher CAGR From 2018 to 2024

Figure 15 Automotive Industry to Hold Largest Share of Overall Market in 2018

Figure 16 US to Hold Largest Share of market in 2018

Figure 17 DROC: Market, 2018

Figure 18 Major Value Added During Manufacturing and Assembly Stage

Figure 19 Load Monitoring Systems Market Segmentation, By Offering

Figure 20 Load Cell to Hold Largest Size of market During Forecast Period

Figure 21 Single Beam Load Cell

Figure 22 S-Type Load Cell

Figure 23 Dual Shear Load Cell

Figure 24 Bending Beam Load Cell

Figure 25 Compression Load Cell

Figure 26 Load Link

Figure 27 Load Pin

Figure 28 Load Shackle

Figure 29 Market Segmentation, By Technology

Figure 30 Analog Technology to Hold Larger Size of market During Forecast Period

Figure 31 Market, By Industry

Figure 32 Analog Technology to Lead Market for Automotive Industry During Forecast Period

Figure 33 North America to Hold Largest Size of market for Food & Beverages Industry From 2018 to 2024

Figure 34 RoW to Hold Largest Size of market for Oil & Gas Industry From 2018 to 2024

Figure 35 APAC to Lead Market for Agriculture Industry From 2018 to 2024

Figure 36 Market in India to Grow at Highest CAGR During Forecast Period

Figure 37 North America: Snapshot of Load Monitoring System Market

Figure 38 US to Hold Largest Size of market in North America From 2018 to 2024

Figure 39 Europe: Snapshot of market

Figure 40 Renewable Energy Planned Capacity in France, By Source, 2023

Figure 41 APAC: Snapshot of market

Figure 42 China to Hold Largest Size of market in APAC During Forecast Period

Figure 43 RoW: Snapshot of Market

Figure 44 Product Launches Emerged as Key Growth Strategy Adopted By Players in market From 2016 to 2018

Figure 45 Ranking of Top 5 Players in market, 2017

Figure 46 Market (Global) Competitive Leadership Mapping, 2018

Figure 47 Market Evolution Framework: Product Launches Fueled Growth of market During 2016–2018

Figure 48 Product Launches Was the Key Strategy From 2016 to 2018

Figure 49 Mettler Toledo: Company Snapshot

Figure 50 Precia Molen: Company Snapshot

Figure 51 Spectris: Company Snapshot

Figure 52 Vishay Precision Group: Company Snapshot

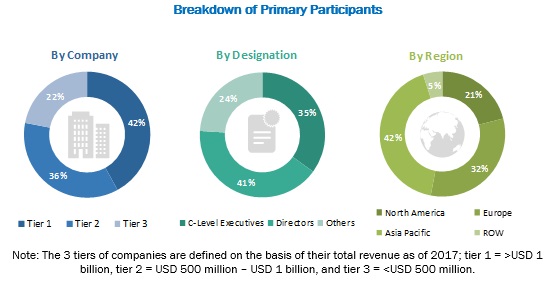

The study involved 4 major activities for estimating the current size of the load monitoring system market. An exhaustive secondary research was carried out to collect information on the market. The next step involved the validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, and databases [Lifting Equipment Engineers Association (LEEA), Association of Crane & Rigging Professionals (ACRP), American Shipbuilding Association (ASA), Mechanical Contractors Association of America (MCAA), OneSource, and Factiva] have been used to identify and collect information for an extensive technical and commercial study of the market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects. Key players in the market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

- To describe and forecast the load monitoring system (LMS) market, in terms of value, by offering, technology, and industry

- To forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of the load monitoring ecosystem

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific need. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Load Monitoring System Market

I would like to understand what kind of components are included in the revenue forecast of load monitoring system in each industry vertical.

Can you provide us the details in marine and construction with specific use cases.

Which is the leading application for load monitoring devices and who are the major players?

I would like to understand the data tables for market sizes and growth by offerings and by industry. My regions of interest are in the US, UK and Germany. Have you included these in your study?