Low Intensity Sweeteners Market by Type (Sorbitol, Maltitol, Xylitol, D-Tagatose, Erythritol, Mannitol, Allulose), Application (Food, Beverages), Form (Dry, Liquid), and Region (North America, Europe, APAC, South America, & RoW)- Global Forecast to 2026

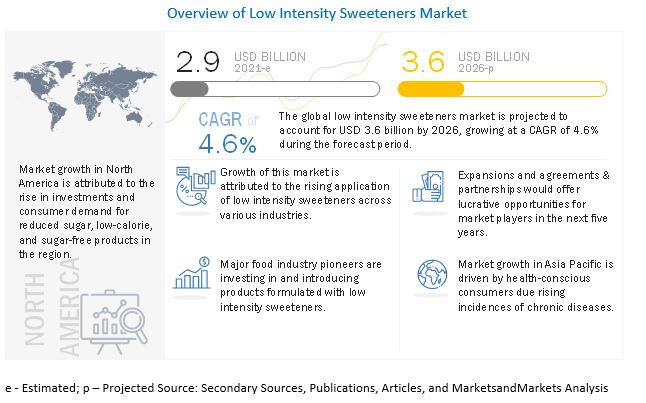

The low intensity sweeteners market surged significantly in 2021, reaching a valuation of US$2.9 billion. According to industry analysts, this growth will continue in the years to come, with a projected CAGR of 4.6% reaching a market size of US$3.6 billion by 2026. The low intensity sweeteners refers to the market for sweeteners that are low in calories and have a low glycemic index. These sweeteners are commonly used as alternatives to traditional sugar-based sweeteners in food and beverage products, as they offer a sweet taste without the negative health effects associated with high sugar consumption. Low intensity sweeteners can be derived from natural sources such as stevia, monk fruit, and honey, or can be chemically synthesized.

The market for low intensity sweeteners is growing due to increasing consumer demand for healthier food products and rising awareness about the health benefits of reducing sugar consumption. The North America region is expected to dominate the global market due to factors such as busy lifestyles, growing prevalence of chronic diseases, and rising awareness about the benefits of reduced sugar in food and beverage products.

To know about the assumptions considered for the study, Request for Free Sample Report

Consumers are becoming increasingly aware of the adverse effects of consuming sugar and the preventive measures that should be taken to avoid the diseases. This has resulted in an increasing inclination of consumers toward sugar substitute products. All these factors have led to a rise in consumption of low-calorie, sugar-free food, beverage, and healthcare products, giving rise to the trend of sugar reduction globally. The increasing demand for functional food & beverage products in developed countries is also leading to the growth of market. Food & beverage is one of the prominent sectors impacted by Covid-19 both positively and negatively. This situation accelerated the trend of sugar reduction as demand for low-calorie products surged in these pandemic times. COVID-19 forced the consumers and manufacturers to recognize the health hazards related to the consumption of sugar and shift to low intensity sweetener products.

Manufacturers are investing considerably in the R&D of new sugar substitute products to gain a larger share than their competitors. Researchers, on the other hand, are coming up with new ranges of sugar substitute products. Many food & beverage manufacturers are replacing regular sugars with sugar substitutes such as low intensity sweeteners to lower the calorie content of the final products. Easy access to near-infinite information is increasingly making consumers aware of their nutritional needs. Low intensity sweeteners are being adopted by various industrial food manufacturers wherein products are being commercialized at a rapid pace globally.

Impact of COVID-19

The outbreak of COVID-19 has brought serious medical, social, and economic challenges. Where the medical community is focused on developing successful diagnostic and medical treatment, the food & beverage industry is also focused on manufacturing healthy products to combat diseases by providing immune support.

Owing to the increasing COVID-19 pandemic outbreak in various regions/countries, the low intensity sweeteners market in 2020 was observed to witness a decline due to the lockdowns in various countries, closure of the international borders, and delay in cross border transit that has led to supply chain hindrances. The social distancing and the other measures taken by the regional governments limit the number of people who can work together in small areas. Thus, the decline in 2020 in the market growth was mainly due to the major impact of the COVID-19 pandemic. Gradually, as the restrictions of the government measures are likely to relax, the market for low intensity sweeteners would witness a slight increment in the upcoming years till 2026.

Market Dynamics

Drivers: Rise in demand for low intensity sweeteners in various food & beverage applications

Low intensity sweeteners contain a negligible amount of calories and hence are suitable alternatives to sugar. They are generally used in processed foods such as soft drinks, baked goods, candy, functional drink mixes, puddings, jams, jellies, canned foods, dairy products, and other food & beverages. Low intensity sweeteners have several physical properties that are important in food processing, including the level of sweetness, cooling effect, solubility, and molecular weight. They also exist in various forms, such as powder and liquid, serving several functional roles, including use as bulk sweeteners and as sugar-free carriers for flavors, colors, and enzymes. Due to the variety of crystallization properties, molecular weight, and solubility, they offer a wide range of applications in cold and frozen foods

Restraints: Higher cost of production of food & beverage products with low intensity sweeteners as compared to sugar

The rising cost of production by using low intensity sweeteners as a sugar substitute limits the adoption of low intensity sweeteners in the industry. The price of low intensity sweeteners is much higher as compared to sugar due to the expensive technology required for the extractions. The price is also elevated due to the higher cost of raw materials and labor. In various food industries, such as bakery, confectionery, and dairy, the sweeteners are used in bulk quantities, and as a sugar substitute, low intensity sweeteners tend to increase the cost of the end product significantly. This has been discouraging adopting these sweeteners, especially polyols such sorbitol, mannitol, and erythritol, in various food products consumed daily by consumers.

Opportunities: Growth and diversification opportunities in other application sectors

Low intensity sweeteners such as sorbitol, mannitol, xylitol, and erythritol have functional properties that can be utilized in many industries. Consumption of many low intensity sweeteners does not contribute to tooth decay, as they do not leave behind the enamel-destroying acid as much as sugar. Xylitol is a tooth-friendly, non-fermentable low intensity sweetener. It has more dental health benefits as compared to other low intensity sweeteners. It is actively beneficial for dental health by reducing cavities to a third in regular use and is also helpful in remineralization. Xylitol stimulates the production of salivary enzymes, which prevent bacterial growth along with preventing dental decay. All these factors create a great opportunity for low intensity manufacturers to cater to the health and oral care industries.

Challenges: Stringent regulations and international quality standards for low intensity sweeteners

Various international bodies and organizations have control over the usage of different low intensity sweeteners in food processing. Low intensity sweetener products are subjected to rigorous health and safety checks. Various studies have been conducted by regulatory bodies to measure and assess the impact of these products on humans. Based on the results, products are classified, and the daily intake allowance (DIA) has been set. Standards established by agencies for classification and usage levels differ with respective authoritative bodies and pose a serious problem to companies for streamlining product developments.

By type, the allulose segment is projected to grow with the highest CAGR in the market during the forecast period

The allulose segment is expected to grow at the highest CAGR over the forecast period. The demand for allulose has increased as it is a low-calorie sugar, which has same clean and sweet taste as tabletop sugar. As in 2019, FDA officially allowed allulose to be excluded from total sugar and added sugar counts on processed food nutrition label, the market is expected to grow tremendously as it clears the path for innovation for manufacturers.

By application, the pharmaceutical and personal care products segment is projected to grow with the highest CAGR in the low intensity sweeteners market during the forecast period

Based on application, the pharmaceutical and personal care products segment is projected to be the fastest-growing segment in the market. Functional properties possessed by low intensity sweeteners, such as spreading capacity, workability, and good compressibility, is leading to their increasing demand in pharmaceutical and personal care product applications.

By food application, confectioneries segment is projected to grow fastest in the market during the forecast period

By food applications, the confectioneries segment is anticipated to grow fastest over the forecast period. Low intensity sweeteners are widely used in confectionery products for imparting a blend of sweetness and extending its shelf-life. They are also used as a humectant and efficient plasticizer.

By form, dry segment is projected to account for a larger share in the market during the forecast period

By form, the low intensity sweeteners market is segmented into dry and liquid. The dry form has higher demand among food & beverage manufacturers, as they are easier to use, and manufacturers are accustomed to using the powdered form of raw materials in food manufacturing processes as compared to the liquid form.

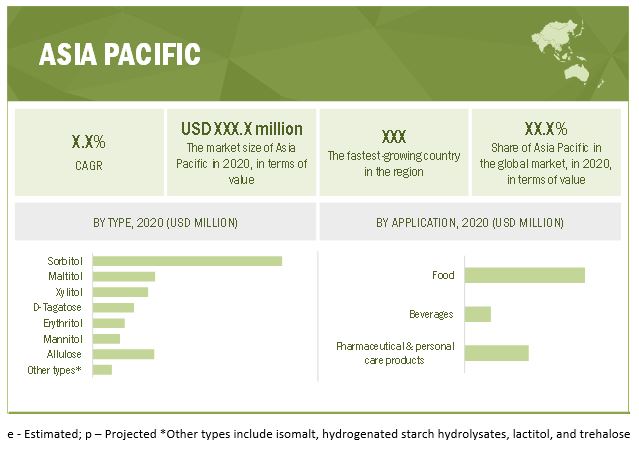

The Asia Pacific region is projected to grow with the highest CAGR in the global market, in terms of value. The market in this region is witnessing a drastic transformation regarding diet diversification, rapid urbanization, and liberal trade policies in the food sector. Furthermore, a rise in consumer awareness about health issues, an increase in the inclination of consumers toward health-benefiting food products, and a surge in income and purchasing power are the major factors offering growth opportunities for low intensity sweeteners manufacturers in the region. China contributes significantly to the region’s leading position, with India and Japan being the emerging market in the region.

Key Market Players:

Key players in this market include Ingredion Incorporated (US), ADM (US), Anderson Advanced Ingredients (US), Tate & Lyle (UK), Roquette Frères (France), Matsutani Chemical Industry Co., Ltd (Japan), Whole Earth Brands (US), CJ CheilJedang (South Korea), Samyang Corporation (South Korea), Daesang Corporation (South Korea), Van Wankum Ingredients (Netherlands), Hylen Co., Ltd (China), Sweeteners Plus (US), Fooding Group Limited (China), Savanna Ingredients (Germany), Foodchem International Corporation (China), Apura Ingredients (US), Shandong Saigo Group Corporation (China), Icon Foods (US), and Bonumose Inc. (US).

Low Intensity Sweeteners Market Report Scope

|

Report Metric |

Details |

|

Market volume in 2021 |

USD 2.9 billion |

|

Revenue estimate in 2026 |

USD 3.6 billion |

|

Growth rate |

CAGR of 4.6% |

|

Market size available for years |

2021-2026 |

|

Base year for estimation |

2020 |

|

Forecast period |

2021-2026 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Top players analyzed |

ADM (US), Anderson Advanced Ingredients (US), Tate & Lyle (UK), Roquette Frères (France), Matsutani Chemical Industry Co., Ltd (Japan), Whole Earth Brands (US), CJ CheilJedang (South Korea), Samyang Corporation (South Korea), Daesang Corporation (South Korea), Van Wankum Ingredients (Netherlands), Hylen Co., Ltd (China), Sweeteners Plus (US), Fooding Group Limited (China), Savanna Ingredients (Germany), Foodchem International Corporation (China), Apura Ingredients (US), Shandong Saigo Group Corporation (China), Icon Foods (US) |

|

Research coverage |

This report segments the low intensity sweeteners market on the basis of type, application, form, and region. In terms of insights, this research report focuses on various levels of analyses—competitive landscape, pricing insights, end-use analysis, and company profiles—which together comprise and discuss the basic views on the emerging & high-growth segments of the feed additives market, high-growth regions, countries, industry trends, drivers, restraints, opportunities, and challenges. |

Target Audience:

- Processed food & beverage manufacturers

- Pharma and personal care products manufacturers

- Government and research organizations

- Sweetener manufacturers

- Sugar substitute distributors

- Marketing directors

- Key executives from various key companies and organizations in the market

This research report categorizes the low intensity sweeteners market based on type, application, form, and region.

By Type

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Erythritol

- Allulose

Other types (isomalt, hydrogenated starch hydrolysates, lactitol, and trehalose)

By Application

-

Food

- Bakery products

- Confectioneries

- Dairy & frozen desserts

- Other food applications (processed meat, fruit preparation, snacks, soups, sauces, and dressings)

- Beverages

- Pharmaceutical & personal care products

By Form

- Dry

- Liquid

By Region:

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- In January 2021, Tate & Lyle announced the expansion of its DOLCIA PRIMA Allulose portfolio with a crystalline form certified as non-GMO Project Verified. This expansion will provide manufacturers with a great opportunity to increase the number of retail products bearing NON-GMO Project Verified label and certification.

- In July 2020, Tate & Lyle launched SWEETENER VANTAGE Expert Systems, a set of new and innovative sweetener solution design tools, together with an education program. This will help formulators to create sugar-reduced food and drink using low-calorie sweeteners.

- In January 2021, Tate & Lyle extended and deepened its partnership with Codexis (US), a leading protein engineering company. This strategic move is taken to enhance the production of Tate & Lyle’s newest sweeteners, DOLCIA PRIMA Allulose and TASTEVA M Stevia Sweetener. Codexis’ latest novel enzyme products, generated in close collaboration with Tate & Lyle’s experts, would enable additional production efficiencies.

- In June 2020, Samyang Corporation’s Allulose is expanding its market position as more consumers are looking for healthy and safe food options during the COVID-19 pandemic. The company aims to expand the applicability of its specialty sweetener product, Allulose, according to the latest guilt-free product trend in the market.

Frequently Asked Questions (FAQ):

What is the expected market size for the global low intensity sweeteners market in the coming years?

The low intensity sweeteners market is anticipated to grow at a CAGR of 4.6% and reach a valuation of US$3.6 billion by 2026, up from its valuation of US$2.9 billion in 2021.

What is the estimated growth rate (CAGR) of the global low intensity sweeteners market for the next five years?

The low intensity sweeteners market is expected to grow significantly over the next five years, with a projected CAGR of 4.6% during 2021-2026, driven by rising consumer demand for sugar substitutes and increased awareness of the health benefits of low calorie products.

What are the major revenue pockets in the low intensity sweeteners market currently?

The Asia Pacific region is projected to grow with the highest CAGR in the global market, in terms of value. The market in this region is witnessing a drastic transformation regarding diet diversification, rapid urbanization, and liberal trade policies in the food sector. Furthermore, a rise in consumer awareness about health issues, an increase in the inclination of consumers toward health-benefiting food products, and a surge in income and purchasing power are the major factors offering growth opportunities for low intensity sweeteners manufacturers in the region. China contributes significantly to the region’s leading position, with India and Japan being the emerging market in the region.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom up approach

- Top down approach (Based on global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below mentioned players, company profiles provide insights such as business overview covering information on the company’s business segments, financials, geographic presence and revenue mix and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis and MnM view to elaborate analyst view on the company. Some of the key players in the market include ADM (US), Ingredion Incorporated (US), Anderson Advanced Ingredients (US), Tate & Lyle (UK), and Roquette Frères (France). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON TYPES, BY REGION)

2.2.2 APPROACH TWO: TOP DOWN (BASED ON THE GLOBAL MARKET)

2.2.3 APPROACH TWO: TOP DOWN

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 2 LOW INTENSITY SWEETENERS MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 9 IMPACT OF COVID-19 ON LOW INTENSITY SWEETENERS MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 10 LOW INTENSITY SWEETENERS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 MARKET SIZE, BY FOOD APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 13 MARKET SIZE, BY FORM, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE LOW INTENSITY SWEETENERS MARKET

FIGURE 15 INCREASING HEALTH-CONSCIOUSNESS AMONG CONSUMERS AND RISING DEMAND FOR HEALTHY FOOD & BEVERAGE PRODUCTS TO PROPEL THE MARKET

4.2 NORTH AMERICA: MARKET FOR LOW INTENSITY SWEETENERS, BY KEY TYPE & COUNTRY

FIGURE 16 SORBITOL AND THE US SEGMENT TO ACCOUNT FOR THE LARGE SHARES IN THE NORTH AMERICAN MARKET IN 2020

4.3 MARKET FOR LOW INTENSITY SWEETENERS, BY TYPE

FIGURE 17 SORBITOL SEGMENT TO DOMINATE THE LOW INTENSITY SWEETENERS MARKET DURING THE FORECAST PERIOD

4.4 MARKET FOR LOW INTENSITY SWEETENERS, BY APPLICATION & REGION

FIGURE 18 NORTH AMERICA TO DOMINATE THE MARKET FOR LOW INTENSITY SWEETENERS DURING THE FORECAST PERIOD

4.5 LOW INTENSITY SWEETENERS MARKET IN FOOD, BY APPLICATION

FIGURE 19 CONFECTIONERIES TO DOMINATE THE AMONG THE FOOD APPLICATIONS OF LOW INTENSITY SWEETENERS DURING THE FORECAST PERIOD

4.6 MARKET FOR LOW INTENSITY SWEETENERS, BY FORM

FIGURE 20 DRY SWEETENERS TO DOMINATE THE LOW INTENSITY SWEETENERS MARKET DURING THE FORECAST PERIOD

FIGURE 21 COVID-19 IMPACT ON THE LOW INTENSITY SWEETENERS MARKET: COMPARISON OF PRE AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in awareness among consumers regarding health and wellness to encourage the demand for healthier food products

TABLE 3 GLOBAL ESTIMATED NUMBER OF ADULTS WITH DIABETES (MILLIONS)

TABLE 4 TOP 10 COUNTRIES OR TERRITORIES FOR NUMBER OF ADULTS (AGED 20–79) WITH DIABETES

FIGURE 23 OBESITY RATES (PERCENTAGE OF TOTAL ADULT POPULATIONS)

5.2.1.2 Rise in demand for low-calorie sweeteners in various food & beverage applications

5.2.1.3 Rise in awareness about the functionalities of low intensity sweeteners in the pharmaceutical industry

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of production of food & beverage products with low intensity sweeteners as compared to sugar

5.2.2.2 Ambiguity related to health problems due to the consumption of low intensity sweeteners

TABLE 5 CALORIC VALUES OF LOW INTENSITY SWEETENERS

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in investment in R&D activities by manufacturers to develop innovative and safer low intensity sweeteners

5.2.3.2 Growth and diversification opportunities in other application sectors

5.2.4 CHALLENGES

5.2.4.1 Stringent regulations and international quality standards for low intensity sweeteners

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4 EFFECTS ON RAW MATERIAL AVAILABILITY AND SUPPLY CHAIN DISTRIBUTION

5.5 EFFECT ON LOW INTENSITY SWEETENERS CONSUMPTION

6 INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RAW MATERIAL SOURCING

6.2.2 MANUFACTURING OF LOW INTENSITY SWEETENERS

6.2.3 QUALITY AND SAFETY CONTROLLERS

6.2.4 PACKAGING

6.2.5 MARKETING & DISTRIBUTION

6.2.6 END-USE INDUSTRY

FIGURE 24 VALUE CHAIN ANALYSIS OF THE MARKET: MANUFACTURING AND QUALITY & SAFETY CONTROLLERS KEY CONTRIBUTORS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 25 SUPPLY CHAIN ANALYSIS OF THE MARKET

6.4 TECHNOLOGY ANALYSIS

6.4.1 MICROBIAL PRODUCTION

6.4.2 BIOLOGICAL PRODUCTION OF ERYTHRITOL

6.5 PRICING ANALYSIS: LOW INTENSITY SWEETENERS MARKET

TABLE 6 LOW INTENSITY SWEETENERS AVERAGE SELLING PRICE (ASP), BY TYPE, 2019–2021 (USD/TON)

TABLE 7 LOW INTENSITY SWEETENERS AVERAGE SELLING PRICE (ASP), BY REGION, 2019–2021 (USD/TON)

6.6 MARKET MAP AND ECOSYSTEM LOW INTENSITY SWEETENERS MARKET

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

6.6.3 FOOD INGREDIENTS: ECOSYSTEM VIEW

6.6.4 LOW INTENSITY SWEETENERS: MARKET MAP

TABLE 8 MARKET FOR LOW INTENSITY SWEETENERS: SUPPLY CHAIN (ECOSYSTEM)

6.7 YC-YCC SHIFT

FIGURE 26 YC-YCC SHIFT FOR THE LOW INTENSITY SWEETENERS MARKET

6.8 PATENT ANALYSIS

FIGURE 27 NUMBER OF PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 28 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 29 TOP 10 APPLICANTS WITH HIGHEST NO. OF PATENT DOCUMENTS

TABLE 9 SOME OF THE PATENTS PERTAINING TO SUGAR SUBSTITUTE, 2020–2021

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET FOR LOW INTENSITY SWEETENERS: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

6.10.1 GROWTH IN DEMAND FOR REDUCED SUGAR OR SUGAR-FREE FORMULATIONS

6.10.2 INCREASE IN CONCERN REGARDING HUMAN HEALTH AND WELLNESS

7 REGULATORY FRAMEWORK (Page No. - 79)

7.1 INTRODUCTION

7.2 US

7.2.1 POLYOLS

7.2.2 ALLULOSE

7.3 EUROPE

7.3.1 LABELING OF SWEETENERS

7.3.2 BULK SWEETENERS: POLYOLS

7.3.3 ERYTHRITOL (E968)

7.3.4 ISOMALT (E953)

7.3.5 LACTITOL (E966)

7.3.6 MALTITOL (E965)

7.3.7 MANNITOL (E421)

7.3.8 SORBITOL (E420)

7.3.9 XYLITOL (E967)

7.3.10 ALLULOSE

8 LOW INTENSITY SWEETENERS MARKET, BY TYPE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 30 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 11 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (KT)

8.2 COVID-19 IMPACT ON THE LOW INTENSITY SWEETENERS MARKET, BY TYPE

8.2.1 OPTIMISTIC SCENARIO

TABLE 13 OPTIMISTIC SCENARIO: LOW INTENSITY SWEETENERS MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 14 REALISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2022 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 15 PESSIMISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2022 (USD MILLION)

8.3 SORBITOL

8.3.1 FUNCTIONAL PROPERTIES OF SORBITOL MAKE IT A PREFERRED SUGAR SUBSTITUTE

TABLE 16 SORBITOL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 SORBITOL MARKET SIZE, BY REGION, 2019–2026 (KT)

8.4 MALTITOL

8.4.1 SEVERAL GLOBAL HEALTH AUTHORITIES CONFIRMED THE SAFE CONSUMPTION OF MALTITOL

TABLE 18 MALTITOL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 MALTITOL MARKET SIZE, BY REGION, 2019–2026 (KT)

8.5 XYLITOL

8.5.1 RISE IN DIABETIC POPULATION TO DRIVE THE MARKET FOR XYLITOL

TABLE 20 XYLITOL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 XYLITOL MARKET SIZE, BY REGION, 2019–2026 (KT)

8.6 D-TAGATOSE

8.6.1 D-TAGATOSE IS SIMILAR TO SUGAR IN TERMS OF TASTE AND TEXTURE

TABLE 22 D-TAGATOSE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 D-TAGATOSE MARKET SIZE, BY REGION, 2019–2026 (KT)

8.7 ERYTHRITOL

8.7.1 CERTAIN SIDE EFFECTS ASSOCIATED WITH THE USE OF ERYTHRITOL HINDERS ITS MARKET GROWTH

TABLE 24 ERYTHRITOL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 ERYTHRITOL MARKET SIZE, BY REGION, 2019–2026 (KT)

8.8 MANNITOL

8.8.1 MANNITOL FINDS ITS APPLICATION IN THE PHARMACEUTICAL AND FOOD INDUSTRIES

TABLE 26 MANNITOL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 27 MANNITOL MARKET SIZE, BY REGION, 2019–2026 (KT)

8.9 ALLULOSE

8.9.1 EXCLUSION OF ALLULOSE FROM TOTAL AND ADDED SUGAR COUNTS BY FDA TO DRIVE INNOVATION AND GROWTH

TABLE 28 ALLULOSE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 ALLULOSE MARKET SIZE, BY REGION, 2019–2026 (KT)

8.10 OTHER TYPES

TABLE 30 OTHER LOW INTENSITY SWEETENER TYPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 OTHER LOW INTENSITY SWEETENER TYPES MARKET SIZE, BY REGION, 2019–2026 (KT)

9 LOW INTENSITY SWEETENERS MARKET, BY APPLICATION (Page No. - 99)

9.1 INTRODUCTION

FIGURE 31 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 32 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2026 (USD MILLION)

9.2 COVID-19 IMPACT ON THE LOW INTENSITY SWEETENERS MARKET, BY APPLICATION

9.2.1 OPTIMISTIC SCENARIO

TABLE 33 OPTIMISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2022 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 34 REALISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2022 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 35 PESSIMISTIC SCENARIO: LOW INTENSITY SWEETENERS MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

9.3 FOOD

TABLE 36 LOW INTENSITY SWEETENERS MARKET SIZE IN FOOD, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 37 MARKET SIZE IN FOOD, BY REGION, 2019–2026 (USD MILLION)

9.3.1 CONFECTIONERIES

9.3.1.1 Confectionery manufacturers need to cater to the rising demand for healthy confectionery products

TABLE 38 MARKET SIZE IN CONFECTIONERIES, BY REGION, 2019–2026 (USD MILLION)

9.3.2 BAKERY PRODUCTS

9.3.2.1 Bakery product manufacturers are increasingly using low intensity sweeteners to maintain the freshness of products

TABLE 39 MARKET SIZE IN BAKERY PRODUCTS,BY REGION, 2019–2026 (USD MILLION)

9.3.3 DAIRY & FROZEN DESSERTS

9.3.3.1 Rising health concerns among consumers drive the demand for low intensity sweeteners in dairy & frozen desserts

TABLE 40 LOW INTENSITY SWEETENERS MARKET SIZE IN DAIRY & FROZEN DESSERTS, BY REGION, 2019–2026 (USD MILLION)

9.3.4 OTHER FOOD APPLICATIONS

TABLE 41 MARKET SIZE IN OTHER FOOD APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9.4 BEVERAGES

9.4.1 INCREASE IN DEMAND FOR LOW-CALORIE BEVERAGES AMONG CONSUMERS TO DRIVE MARKET GROWTH

TABLE 42 MARKET SIZE IN BEVERAGES, BY REGION, 2019–2026 (USD MILLION)

9.5 PHARMACEUTICAL & PERSONAL CARE PRODUCTS

9.5.1 FUNCTIONAL PROPERTIES OF LOW INTENSITY SWEETENERS DRIVE THEIR APPLICATION IN PHARMACEUTICAL AND PERSONAL CARE PRODUCTS

TABLE 43 MARKET SIZE IN PHARMACEUTICAL & PERSONAL CARE PRODUCTS, BY REGION, 2019–2026 (USD MILLION)

10 LOW INTENSITY SWEETENERS MARKET, BY FORM (Page No. - 109)

10.1 INTRODUCTION

FIGURE 32 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY FORM, 2021 VS 2026 (USD MILLION)

TABLE 44 LOW INTENSITY SWEETENERS MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

10.2 COVID-19 IMPACT ON THE LOW INTENSITY SWEETENERS MARKET, BY FORM

10.2.1 OPTIMISTIC SCENARIO

TABLE 45 OPTIMISTIC SCENARIO: LOW INTENSITY SWEETENERS MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 46 REALISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY FORM, 2019–2022 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 47 PESSIMISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY FORM, 2019–2022 (USD MILLION)

10.3 DRY

10.3.1 POWDER OR CRYSTAL FORMS ARE PREFERRED BY MANUFACTURERS DUE TO THEIR FUNCTIONAL BENEFITS

TABLE 48 DRY LOW INTENSITY SWEETENERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.4 LIQUID

10.4.1 LIQUID OR SYRUP FORMS OF LOW INTENSITY SWEETENERS ARE COST-EFFECTIVE COMPARED TO DRY FORMS

TABLE 49 LIQUID LOW INTENSITY SWEETENERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11 LOW INTENSITY SWEETENERS MARKET, BY REGION (Page No. - 114)

11.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2021–2026

TABLE 50 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY REGION, 2019–2026 (KT)

11.2 COVID-19 IMPACT ON THE LOW INTENSITY SWEETENERS MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIO

TABLE 52 OPTIMISTIC SCENARIO: LOW INTENSITY SWEETENERS MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 53 REALISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY REGION, 2019–2022 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 54 PESSIMISTIC SCENARIO: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY REGION, 2019–2022 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 34 NORTH AMERICA: LOW INTENSITY SWEETENERS MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (KT)

TABLE 58 NORTH AMERICA: SORBITOL MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MALTITOL MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: XYLITOL MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: D-TAGATOSE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: ERYTHRITOL MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MANNITOL MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: ALLULOSE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: OTHER LOW INTENSITY SWEETENER TYPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE IN FOOD, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.3.1 US

11.3.1.1 Increase in investment in R&D activities by the key players in the market to drive growth

TABLE 69 US: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Rise in incidences of health issues among the population to drive the demand for low intensity sweeteners

TABLE 70 CANADA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Government implemented taxes on sugar-sweetened drinks to drive the demand for low intensity sweeteners in Mexico

TABLE 71 MEXICO: LOW INTENSITY SWEETENERS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

11.4 EUROPE

TABLE 72 EUROPE: LOW INTENSITY SWEETENERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (KT)

TABLE 75 EUROPE: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 EUROPE: LOW INTENSITY SWEETENERS MARKET SIZE IN FOOD, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY FORM, 2019–2026 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Increase in demand for functional food products to drive the market

TABLE 78 GERMANY: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.4.2 FRANCE

11.4.2.1 Aging population in the country to drive the demand for low-calorie and healthy food & beverage products

TABLE 79 FRANCE: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.4.3 UK

11.4.3.1 Growth of the food & beverage industry to create opportunities for low intensity sweetener manufacturers

TABLE 80 UK: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.4.4 ITALY

11.4.4.1 The rising cases of chronic diseases in the country to drive the demand for low intensity sweeteners

TABLE 81 ITALY: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.4.5 SPAIN

11.4.5.1 Government initiatives to regulate the consumption of sugar to drive the demand for low intensity sweeteners in the country

TABLE 82 SPAIN: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.4.6 REST OF EUROPE

TABLE 83 REST OF EUROPE: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: LOW INTENSITY SWEETENERS MARKET SNAPSHOT

TABLE 84 ASIA PACIFIC: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (KT)

TABLE 87 ASIA PACIFIC: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE IN FOOD,BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY FORM, 2019–2026 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Rise in awareness regarding the health hazards associated with excess sugar consumption to drive the demand for low intensity sweeteners

TABLE 90 CHINA: LOW INTENSITY SWEETENERS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

11.5.2 JAPAN

11.5.2.1 Metabolic syndromes leading to health conditions to force the consumers to shift to health-benefiting products in Japan

TABLE 91 JAPAN: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.5.3 INDIA

11.5.3.1 Change in regulations on sugar substitutes to drive the demand for low intensity sweeteners among manufacturers and consumers in India

TABLE 92 INDIA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.5.4 AUSTRALIA & NEW ZEALAND

11.5.4.1 Government and non-government initiatives to promote a healthy lifestyle create growth opportunities for low intensity sweetener manufacturers

TABLE 93 AUSTRALIA & NEW ZEALAND: LOW INTENSITY SWEETENERS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

11.5.5 REST OF ASIA PACIFIC

TABLE 94 REST OF ASIA PACIFIC: LOW INTENSITY SWEETENERS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 95 SOUTH AMERICA: LOW INTENSITY SWEETENERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 SOUTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (KT)

TABLE 98 SOUTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 99 SOUTH AMERICA: MARKET SIZE IN FOOD,BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Strategic agreements formed by the Brazilian government to drive the market

TABLE 101 BRAZIL: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Growth in healthcare expenditure to force consumers and manufacturers to shift to low intensity sweeteners

TABLE 102 ARGENTINA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.6.3 REST OF SOUTH AMERICA

TABLE 103 REST OF SOUTH AMERICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.7 REST OF THE WORLD

TABLE 104 ROW: LOW INTENSITY SWEETENERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 105 ROW: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 ROW: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (KT)

TABLE 107 ROW: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 108 ROW: MARKET SIZE IN FOOD, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 109 ROW: MARKET SIZE, BY FORM, 2019–2026 (USD MILLION)

11.7.1 MIDDLE EAST

11.7.1.1 Rise in demand for herbal teas and functional beverages to drive the demand for low intensity sweeteners in the region

TABLE 110 MIDDLE EAST: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

11.7.2 AFRICA

11.7.2.1 Imposition of taxes on sugary beverages to drive the demand for low intensity sweeteners among beverage manufacturers

TABLE 111 AFRICA: MARKET SIZE FOR LOW INTENSITY SWEETENERS, BY TYPE, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 156)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2020

TABLE 112 MARKET SHARE ANALYSIS, 2020

12.3 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

12.4 COVID-19-SPECIFIC COMPANY RESPONSE

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 37 MARKET FOR LOW INTENSITY SWEETENERS, COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

12.5.5 PRODUCT FOOTPRINT

TABLE 113 COMPANY FOOTPRINT, BY TYPE

TABLE 114 COMPANY FOOTPRINT, BY APPLICATION

TABLE 115 COMPANY FOOTPRINT, BY FORM

TABLE 116 COMPANY REGIONAL, BY FOOTPRINT

TABLE 117 OVERALL COMPANY FOOTPRINT

12.6 LOW INTENSITY SWEETENERS MARKET, START-UP/SME EVALUATION QUADRANT, 2020

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 38 MARKET FOR LOW INTENSITY SWEETENERS: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SMES)

12.7 NEW PRODUCT LAUNCHES

12.7.1 NEW PRODUCT LAUNCHES

TABLE 118 LOW INTENSITY SWEETENERS MARKET: NEW PRODUCT LAUNCHES, 2020–2021

12.7.2 DEALS

TABLE 119 MARKET FOR LOW INTENSITY SWEETENERS: DEALS, 2018–2021

12.7.3 OTHERS

TABLE 120 MARKET FOR LOW INTENSITY SWEETENERS: OTHERS, 2019–2020

13 COMPANY PROFILES (Page No. - 168)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 INGREDION INCORPORATED

TABLE 121 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 39 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 122 INGREDION INCORPORATED: PRODUCTS OFFERED

TABLE 123 INGREDION INCORPORATED: DEALS

TABLE 124 INGREDION INCORPORATED: OTHERS

13.1.2 ADM

TABLE 125 ADM: BUSINESS OVERVIEW

FIGURE 40 ADM: COMPANY SNAPSHOT

TABLE 126 ADM: PRODUCTS OFFERED

TABLE 127 ADM: DEALS

13.1.3 ANDERSON ADVANCED INGREDIENTS

TABLE 128 ANDERSON ADVANCED INGREDIENTS: BUSINESS OVERVIEW

TABLE 129 ANDERSON ADVANCED INGREDIENTS: PRODUCTS OFFERED

13.1.4 TATE & LYLE

TABLE 130 TATE & LYLE: BUSINESS OVERVIEW

FIGURE 41 TATE & LYLE: COMPANY SNAPSHOT

TABLE 131 TATE & LYLE: PRODUCTS OFFERED

TABLE 132 TATE & LYLE: NEW PRODUCT LAUNCHES

TABLE 133 TATE & LYLE: DEALS

13.1.5 ROQUETTE FRÈRES

TABLE 134 ROQUETTE FRÈRES: BUSINESS OVERVIEW

TABLE 135 ROQUETTE FRÈRES: PRODUCTS OFFERED

TABLE 136 ROQUETTE FRÈRES: NEW PRODUCT LAUNCHES

13.1.6 MATSUTANI CHEMICAL INDUSTRY CO., LTD

TABLE 137 MATSUTANI CHEMICAL INDUSTRY CO., LTD: BUSINESS OVERVIEW

TABLE 138 MATSUTANI CHEMICAL INDUSTRY CO., LTD: PRODUCTS OFFERED

TABLE 139 MATSUTANI CHEMICAL INDUSTRY CO., LTD: DEALS

13.1.7 WHOLE EARTH BRANDS

TABLE 140 WHOLE EARTH BRANDS: BUSINESS OVERVIEW

FIGURE 42 WHOLE EARTH BRANDS: COMPANY SNAPSHOT

TABLE 141 WHOLE EARTH BRANDS: PRODUCTS OFFERED

13.1.8 CJ CHEILJEDANG

TABLE 142 CJ CHEILJEDANG: BUSINESS OVERVIEW

FIGURE 43 CJ CHEILJEDANG: COMPANY SNAPSHOT

TABLE 143 CJ CHEILJEDANG: PRODUCTS OFFERED

13.1.9 SAMYANG CORPORATION

TABLE 144 SAMYANG CORPORATION: BUSINESS OVERVIEW

FIGURE 44 SAMYANG CORPORATION: COMPANY SNAPSHOT

TABLE 145 SAMYANG CORPORATION: PRODUCTS OFFERED

TABLE 146 SAMYANG CORPORATION: OTHERS

13.1.10 DAESANG CORPORATION

TABLE 147 DAESANG CORPORATION: BUSINESS OVERVIEW

FIGURE 45 DAESANG: COMPANY SNAPSHOT

TABLE 148 DAESANG CORPORATION: PRODUCTS OFFERED

13.2 START-UPS/SMES

13.2.1 VAN WANKUM INGREDIENTS

TABLE 149 VAN WANKUM INGREDIENTS: BUSINESS OVERVIEW

TABLE 150 VAN WANKUM INGREDIENTS: PRODUCTS OFFERED

13.2.2 HYLEN CO., LTD

TABLE 151 HYLEN CO., LTD: BUSINESS OVERVIEW

TABLE 152 HYLEN CO., LTD: PRODUCTS OFFERED

13.2.3 SWEETENERS PLUS

TABLE 153 SWEETENERS PLUS: BUSINESS OVERVIEW

TABLE 154 SWEETENERS PLUS: PRODUCTS OFFERED

13.2.4 FOODING GROUP LIMITED

TABLE 155 FOODING GROUP LIMITED: BUSINESS OVERVIEW

TABLE 156 FOODING GROUP LIMITED: PRODUCTS OFFERED

13.2.5 SAVANNA INGREDIENTS

13.2.6 FOODCHEM INTERNATIONAL CORPORATION

13.2.7 APURA INGREDIENTS

13.2.8 SHANDONG SAIGO GROUP CORPORATION

13.2.9 ICON FOODS

13.2.10 BONUMOSE, INC.

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 209)

14.1 INTRODUCTION

TABLE 157 ADJACENT MARKETS TO LOW INTENSITY SWEETENERS

14.2 LIMITATIONS

14.3 SUGAR SUBSTITUTES MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 158 SUGAR SUBSTITUTES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

14.4 NATURAL SWEETENERS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 159 NATURAL SWEETENERS MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

15 APPENDIX (Page No. - 212)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

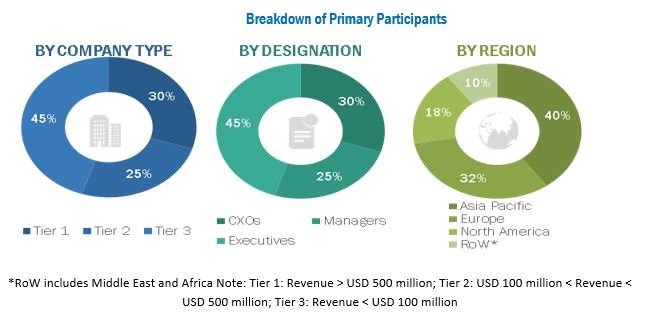

The study involved four major activities in estimating the low intensity sweeteners market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of processed food & beverage manufacturers, pharma and personal care products manufacturers, and government & research organizations. The supply side is characterized by the presence of sweetener manufacturer, sugar substitute distributor, marketing directors, research officers and quality control officers, and key executives from various key companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Low Intensity Sweeteners Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- To describe and forecast the low intensity sweeteners market, in terms of type, application, form, and region

- To describe and forecast the low intensity sweeteners market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements, in the global market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific low intensity sweeteners market, by key country

- Further breakdown of the Rest of European low intensity sweeteners market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Low Intensity Sweeteners Market