Natural Sweeteners Market by Type (Stevia, Sorbitol, Xylitol, Mannitol, Erythritol, Sweet Proteins, and Others), End-use Sector (Food & Beverage, Pharmaceutical, Direct Sales, and Others), Application, and Region - Global Forecast to 2025

[219 Pages Report] The natural sweeteners market size estimated to be valued at USD 2.8 billion in 2020 and projected to reach USD 3.8 billion by 2025, recording a CAGR of 6.1% during the forecast period. The global natural sweeteners industry has witnessed growing trends in the past years. The growth of this industry is majorly driven by increase in health consciousness among consumers to encourage the demand for healthier food choices, increase in demand for natural sweeteners due to the rise in consumer inclination toward natural products, and growing demand for sugar alternatives in various applications in the food & beverage industry. Other factors driving the demand for these natural sweeteners include the growing applications of sweeteners, especially in food & beverage industry in developing and underdeveloped countries, owing to its low-calorie and naturally sweetening properties. However, the growth of the natural sweeteners market is inhibited by factors, such as ambiguity related to health problems caused due to over consumption of natural sweeteners.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Analysis

The global natural sweeteners market is impacted highly due to the uncertain pandemic circumstances that occurred across the globe. The effects of COVID-19 impact the supply chain of the final products, as well as raw material ingredients. The North American region, followed by the Europe and Asia Pacific region, plays a vital role in the natural sweeteners market due to the concentration of several key players operating from these regions. Hence, the market in terms of supply is projected to witness hindrances, as natural sweeteners produced by many key players in these regions cater to the end-users across the world. However, regional consumption is projected to witness a surge in the respective market itself, as consumers are increasingly concentrating on maintaining weight and following different diets for maintaining good health. This, altogether, is projected to drive the demand for natural sweeteners.

Natural Sweeteners Market Dynamics

Drivers: Growing awareness regarding healthy foods and rising health-consciousness leading to consumers opting for preventive healthcare measures

Over the last few years, owing to the new product launches and growing awareness regarding preventive healthcare alternatives, consumers are increasingly getting aware of their nutritional needs. Hence, with growing health consciousness, consumers are now shifting towards healthier choices with respect to the consumption of various food & beverage products. Recent consumer trends involve a demand for low-calorie, reduced sugar, and all-natural & organic ingredient-based products, owing to the various health benefits offered and rising incidences of chronic diseases across the globe as a result of unhealthier dietary lifestyles.

One of the major diseases witnessing an increase and is equally chronic to humans is diabetes. It is a result of excessive consumption of sugar, which contains a large number of calories as well, further leading to obesity. According to a National Diabetes Statistics Report published by the US. Department of Health & Human Services in 2020, 10.5% of the US population had diabetes in 2018, 13.0% of all US adults had diabetes, 2.8% of all US adults met laboratory criteria for diabetes were not aware of or did not report having diabetes and 21.4% of all US adults were diagnosed with diabetes. Furthermore, according to the US. Department of Health & Human Services, the prevalence of obesity was 40.0% among young adults aged 20 to 39 years, 44.8% among middle-aged adults aged 40 to 59 years, and 42.8% among adults aged 60 and older.

Owing to the rising prevalence of obesity and diabetes among consumers across the globe, there is an increased demand for low-calorie, sugarless or sweetener-based food and beverage products to help consumers maintain a healthy diet. Among that, too, the majority of the health-conscious consumers are preferring products containing natural sweeteners because they contain fewer calories than conventional sugar and also is less prone to side effects on human health as compared to artificial sweeteners. Consumption of natural sweeteners helps in providing various health benefits for consumers opting to lead a healthier lifestyle. For instance, the consumption of natural sweeteners helps in weight control and diabetes. These sweeteners do not comprise carbohydrates, owing to which they generally do not raise blood sugar levels. Natural sweeteners have virtually no calories, whereas a teaspoon of sugar has over 16 calories.

Restraints: Ambiguity in the minds of consumers associated with the consumption of natural sweeteners and their ill-effects on human health

International

In the case of natural sweeteners, overconsumption can lead to health problems, such as tooth decay, weight gain, poor nutrition, and increased triglycerides. Stevia is a non-nutritive or zero-calorie sweetener made of steviol glycosides. The United States Food and Drug Administration (FDA) only consider high-purity steviol glycosides to be safe for human consumption currently. Because the FDA has not approved crude stevia extracts and stevia leaves as a food additive, companies are not allowed to market them as sweetening products. According to the FDA, the acceptable daily intake for stevia glycosides is 4 milligrams (mg) per kilogram of body weight. When used as a sweetener or to flavor foods, experts do not consider highly purified stevia to cause adverse side effects. While several studies have identified potential side effects of stevia over the last few decades, most were done using laboratory animals, and many have since been disproved. Potential side effects linked to stevia consumption include:

- Kidney damage: Stevia is considered a diuretic—it increases the speed at which the body expels water and electrolytes from the body in urine. Because the kidney is responsible for filtering and creating urine, researchers initially thought that long-term consumption of stevia could damage the organ.

- Gastrointestinal symptoms: Some stevia products contain added sugar alcohols that may cause unpleasant symptoms in individuals that are very sensitive to the chemicals, including nausea, indigestion, vomiting, bloating, and cramping.

- Hypoglycemia or low blood sugar: Although stevia may help control blood sugar in people with diabetes, it was also once thought that long-term or heavy stevia consumption might cause hypoglycemia or low blood sugar.

- Endocrine disruption: As a type of steroid, steviol glycosides can interfere with hormones controlled by the endocrine system. A 2016 study found that human sperm cells exposed to steviol experienced an increase in progesterone production.

Thus, several research and clinical trials are required to prove the safety of these sweeteners used in various products. All such factors lead to hampering growth prospects

Opportunities: Rising R&D activities to develop and formulate newer and advanced natural sweetening products.

Researchers are coming with new ranges of natural sweetener products to meet the growing need of consumers for health-promoting products. For instance, monk fruit sweeteners are introduced by the major players in the food & beverage industry, owing to its numerous health benefits and higher safety levels. ADM provides three ranges of monk fruit sweeteners under the brand name SweetRight. ADM launched these monk fruit sweeteners in 2017 through its partnership with GLG Life Tech Corporation (Canada). Monk fruit sweetener is extracted from monk fruit. The monk fruit is also known as luo han guo or “Buddha fruit.” Monk fruit sweeteners are 150-200 times sweeter than sugar and provide sweetness to food and beverage products without adding calories. Monk fruit sweeteners have numerous food and beverage applications, including juices, soft drinks, dairy products, candies, desserts, and condiments. Monk fruits are stable at high temperatures, owing to which they can be used in baked goods. The successful research and developments in the sweetener market for the production of safer and better products to cater to the increasing demand of consumers for safe, health-benefiting products would create a huge growth opportunity for the sweeteners market, and, in turn, for the natural sweeteners market, in the coming years.

Challenges: Premium pricing of natural sweeteners owing to the higher costs of production

Sweeteners that are available in the global market are majorly available in two forms; artificial and natural. Artificial sweeteners may be derived through the manufacturing of plant extracts or processed by chemical synthesis. Various synthetic chemical pathways are undertaken to manufacture an artificial sweetener, which is modified by a reaction with certain chemicals and then combined. However, natural sweeteners are carbohydrates obtained from vegetables, trees, seeds, roots, and nuts. The commonly obtained natural sweeteners are honey, molasses, maple syrup, coconut sugar, agave nectar, date sugar, and xylitol.

It is easy to procure raw materials for the production of artificial sweeteners as compared to that of natural sweeteners. The costs of these natural raw materials are generally higher than the chemicals required to manufacture artificial sweeteners. Also, the processing of artificial sweeteners consumes lesser effort and time than that of natural sweeteners. Natural sweeteners have to undergo various tests and trials and labeling norms & regulations to be labeled as a natural sweetener. All these factors accumulatively add up to the costs of production, ultimately leading to adding up in the cost price. Thus, natural sweeteners are premium priced as compared to artificial sweeteners. This may possess a challenge in the growth of the natural sweeteners market during the forecast period.

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 2.8 billion |

|

Market size value in 2025 |

USD 3.8 billion |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Upcoming Trend |

Vegan and Calorie Free Products |

|

Units considered |

Value (USD) and Volume (KT) |

|

Segments covered |

Type, application, end-use sector, and region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

By type, the stevia segment is projected to experience the fastest growth in the natural sweeteners market during the forecast period

The stevia segment is expected to experience the fastest growth in the global natural sweeteners market, on the basis of type, in 2019. The sweet-tasting components of stevia are called steviol glycosides, which are naturally present in the stevia leaf. There are eleven major steviol glycosides present in stevia. These are the sweet components isolated and purified from the leaves of stevia. Out of these eleven steviol glycosides, stevioside and rebaudioside A are the most abundant steviol glycosides. China is one of the leading exporters of stevia products across the globe. Moreover, stevia sweeteners do not contribute carbohydrates or calories to the food and beverage it is added to. It also does not affect blood glucose or insulin response. Owing to this, people with diabetes can consume a wider variety of foods and comply with a healthy meal plan by substituting sugar with stevia. Also, stevia comprises several sterols and antioxidant compounds, including kaempferol. Kaempferol can reduce the risk of pancreatic cancer by 23%. Thus, with such widespread acceptability and availability of stevia, it is expected to substantially grow in the coming years as well.

By end-user, the food & beverage segment is projected to account for the fastest growing segment in the natural sweeteners market during the forecast period

The food & beverage segment accounted for the fastest growing segment in the global natural sweeteners market, in 2019, in terms of value. High sugar consumption worldwide is a result of its usage over a wide spectrum of food and beverage products. Sugar imparts a sweetening taste to them. Thus, consumption of natural sweeteners is witnessed in the food and beverage industry as well which are constantly innovating and developing newer products including various natural sweeteners along with other products to cater the growing demand for new products. Food and beverage industry is projected to witness major investment developments worldwide from key players in the coming years. Thus, natural sweeteners manufacturers are trying to focus mainly on this sector to make full use of demand and investment opportunities.

By application, the beverage segment is projected to experience the fastest growth in the natural sweeteners market during the forecast period

The beverage segment accounted for a major share in the global natural sweeteners market, in 2019, in terms of value. natural sweeteners are currently preferred in beverages, such as diet carbonated drinks, flavored water, and other beverages. Stevia is a key natural sweeteners used in beverages. It is a preferred natural sweeteners with reduced-calorie and zero glycemic indexes, which is used to produce numerous versions of energy drinks, soft drinks, ready-to-drink teas, flavored water, and fruit juices. Other natural sweeteners, such as erythritol and xylitol, are also preferred among key players in the beverage industry. Thus, the expansion of the consumer base for beverage products provides an incentive for developing new natural sweeteners and products, thereby driving the market growth during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

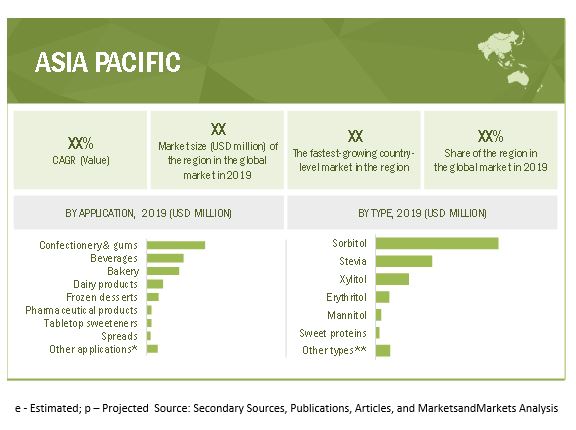

Asia Pacific is projected to grow at the highest growth rate during the forecast period

During the forecast period, the Asia Pacific market is projected to grow at the fastest rate in the natural sweeteners market. Lifestyle changes and increase in health consciousness among customers are contributing to the growth of the market. The Asia Pacific market is very dynamic in terms of rapid urbanization, diet diversification, attractive and liberal trade policies in the food sector. Furthermore, a surge in per capita income and purchasing power are the major factors offering growth opportunities for natural sweeteners manufacturers in the market in the region. Developing countries like India and China are seeing increase in urbanization, rapid rise in household incomes, and lifestyle and dietary changes in the consumers. Thus, the demand is high and is expected to increase rapidly in the coming years.

Key Market Players:

DuPont (US), ADM (US), Tate & Lyle PLC (UK), Cargill (US), Ingredion Incorporated (US), Roquette Frères (France), FoodChem International Corporation (China), PureCircle Ltd (US), MacAndrews & Forbes Holdings Inc (Merisant) (US), Ecogreen Oleochemicals Pvt Ltd (Indonesia), Pyure Brands LLC (US), Stevia Hub India (India), Suminter India Organics (India), Stevia Biotech Pvt Ltd (India), The Real Stevia Company (Sweden), Sweetly Stevia USA (UK), XiliNat (Mexico), Fooditive B.V. (Netherlands), Saganà Association (Switzerland), and Hearthside Food Solutions LLC (US)

Target Audience:

- Raw material suppliers

- Natural sweeteners manufacturers and suppliers

- Natural sweeteners-based product manufacturing and marketing companies

- Contract manufacturers

- Traders, distributors, and retailers of natural sweeteners ingredients

- Service providing company officials

- Research officers

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the market

- Government and research organizations

- Associations, regulatory bodies, food safety agencies, and other industry-related bodies:

- Food and Drug Association (FDA)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

This natural sweeteners market report is categorized based on type, end-use sector, application, and region.

By Type

- Stevia

- Sorbitol

- Xylitol

- Mannitol

- Erythritol

- Sweet proteins

- Other types

By Application

- Bakery products

- Confectioneries & gums

- Spreads

- Beverages

- Dairy products

- Frozen desserts

- Tabletop sweeteners

- Pharmaceutical products

- Other applications

By End-use sector

- Food & beverages

- Pharmaceutical

- Direct sales

- Other end-use sectors

By Region:

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- In July 2020, Tate & Lyle launched the VANTAGE sweetener solution design tools. It is a set of new and innovative sweetener solution design tools along with an education program, which is designed for creating sugar-reduced food and drinks using low-calorie sweeteners.

- In July 2018, ADM and Aston Foods (Russia) entered into a joint venture of sweeteners and starches in Russia. This helped the company in expanding its footprint in the Russian natural sweeteners market.

Frequently Asked Questions (FAQ):

What are the upcoming trends or opportunities that a start-up company can look at, in the natural sweeteners market?

Start-up companies can invest in R&D activities to innovate vegan and calorie free products. This is cause the consumers are now shifting towards these options in the global market.

Which region witnesses to have a lucrative market?

Asia Pacific regional market exhibits lucrative opportunities. A number manufacturers have started investing in the region, owing to the market been at a nascent stage and the potential of high growth due to a rise in awareness and consumption.

Does the report provide bifurcation of the region into countries and provide insights?

Yes, the report provides further bifurcation of regions into countries. The data and insights have been provided for individual countries, that will help the companies or manufacturers understand country-level insights.

Can you provide company profiling for additional or customized companies?

Yes, we can provide additional profiling of companies.

Does the report provide COVID-19 impact analysis?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2016–2020

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from secondary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 NATURAL SWEETENERS MARKET SIZE ESTIMATION: METHOD 1

2.2.2 MARKET SIZE ESTIMATION: METHOD 2

2.2.3 MARKET SIZE ESTIMATION NOTES

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 2 NATURAL SWEETENERS MARKET SNAPSHOT, 2020 VS. 2020

FIGURE 4 MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 5 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 6 MARKET SIZE, BY END-USE SECTOR, 2020 VS. 2025 (USD MILLION)

FIGURE 7 MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 8 NATURAL SWEETENERS: AN EMERGING MARKET WITH IMMENSE GROWTH POTENTIAL

4.2 NATURAL SWEETENERS MARKET, BY REGION

FIGURE 9 ASIA PACIFIC TO GROW AT THE HIGHEST RATE IN THE MARKET FROM 2020 TO 2025

4.3 NATURAL SWEETENERS MARKET, BY APPLICATION

FIGURE 10 CONFECTIONERIES & GUMS TO DOMINATE THE MARKET FROM 2020 TO 2025 (VALUE)

4.4 NATURAL SWEETENERS MARKET, BY TYPE

FIGURE 11 SORBITOL IS PROJECTED TO DOMINATE THE MARKET FROM 2020 TO 2025 (USD MILLION)

4.5 NATURAL SWEETENERS MARKET, BY END-USE SECTOR

FIGURE 12 FOOD & BEVERAGE SECTOR TO DOMINATE THE MARKET FROM 2020 TO 2025 (USD MILLION)

4.6 NORTH AMERICA: NATURAL SWEETENERS MARKET, BY KEY TYPE & COUNTRY

FIGURE 13 SORBITOL ACCOUNTED FOR THE LARGEST SHARE IN THE NORTH AMERICAN NATURAL SWEETENERS MARKET IN 2019

4.7 NATURAL SWEETENERS MARKET SHARE (VALUE), BY KEY SUBREGIONAL MARKETS

FIGURE 14 THE US, FOLLOWED BY CHINA, OCCUPIED A MAJOR SHARE IN THE GLOBAL MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MARKET DYNAMICS: NATURAL SWEETENERS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing awareness regarding healthy foods and rising health-consciousness leading to consumers opting for preventive healthcare alternatives

5.2.1.2 Rising demand for natural sweeteners owing to increasing consumer inclination towards natural products

5.2.1.3 Fluctuations in the prices and supply of conventional sugar drive demand for natural sweeteners

FIGURE 16 THE FRP OF SUGARCANE PAYABLE BY SUGAR FACTORIES IN INDIA, 2013–2018 (INR/QUINTAL)

5.2.2 RESTRAINTS

5.2.2.1 Ambiguity in the minds of consumers associated with the consumption of natural sweeteners and their ill-effects on human health

5.2.2.2 Adherence to international quality standards and regulations for sweeteners and sweetener-based products

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in developments in the field of application of natural sweeteners across various industries, especially the food & beverage industry

5.2.3.2 Rising R&D activities to develop and formulate newer and advanced natural sweetening products

5.2.4 CHALLENGES

5.2.4.1 Premium pricing of natural sweeteners owing to the higher costs of production

5.2.4.2 Product labeling and claims issues

5.3 IMPACT OF COVID-19 ON THE SUPPLY CHAIN OF NATURAL SWEETENERS

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: DEVELOPMENT AND LAUNCH OF NEW PRODUCTS HAVE INTENSIFIED INDUSTRIAL RIVALRY

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 VALUE CHAIN

FIGURE 18 NATURAL SWEETENER DEVELOPMENT AND QUALITY ANALYSIS CONTRIBUTE MAXIMUM VALUE TO THE FINAL PRODUCT

5.6 YC-YCC SHIFT

FIGURE 19 YC-YCC SHIFT FOR THE NATURAL SWEETENERS MARKET

5.7 MARKET ECOSYSTEM

FIGURE 20 MARKET ECOSYSTEM FOR FOOD INGREDIENTS

5.8 TRADING AND QUALITY PRACTICES FOR NATURAL SWEETENERS

5.9 PRICING ANALYSIS OF NATURAL SWEETENERS

6 REGULATIONS (Page No. - 61)

6.1 STRINGENT INTERNATIONAL REGULATIONS OVER NATURAL SWEETENERS

6.1.1 EUROPE

6.1.2 US

6.1.3 CHINA

6.1.4 INDIA

7 CASE STUDY ANALYSIS (Page No. - 67)

7.1 CASE STUDIES ON TOP INDUSTRY INNOVATIONS AND BEST PRACTICES

7.1.1 MANUFACTURERS INVESTING IN NEW PRODUCT LAUNCHES, JOINT VENTURES, AND EXPANSIONS IN ORDER TO CATER TO THE GLOBAL RISE IN DEMAND

7.1.2 INCREASE IN THE NUMBER OF CAMPAIGN LAUNCHES AND INITIATIVES IN ORDER TO INFORM CONSUMERS REGARDING SUGAR REDUCTION

7.1.3 NEWER PRODUCTS IN THE NATURAL SWEETENERS MARKET SUCH AS YACON SYRUPS ARE GAINING TRACTION

8 NATURAL SWEETENERS MARKET, BY TYPE (Page No. - 69)

8.1 INTRODUCTION

FIGURE 21 NATURAL SWEETENERS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 3 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 MARKET SIZE, BY TYPE, 2018–2025 (KT)

8.2 COVID-19 IMPACT ANALYSIS, BY TYPE

TABLE 5 OPTIMISTIC SCENARIO: NATURAL SWEETENERS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 6 REALISTIC SCENARIO: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 7 PESSIMISTIC SCENARIO: NATURAL SWEETENERS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.3 STEVIA

8.3.1 WIDESPREAD APPLICATION AND ACCEPTANCE OF STEVIA ACROSS VARIOUS APPLICATIONS AND INDUSTRY PLAYERS

TABLE 8 STEVIA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 STEVIA MARKET SIZE, BY REGION, 2018–2025 (KT)

8.4 SORBITOL

8.4.1 OFFERING VARIOUS FUNCTIONALITIES ACROSS LINE OF PRODUCTS DRIVE THE GROWTH FOR SORBITOL

TABLE 10 SORBITOL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 SORBITOL MARKET SIZE, BY REGION, 2018–2025 (KT)

8.5 XYLITOL

8.5.1 AIDING IN DENTAL CARE APPLICATION ALONG WITH OFFERING NATURALLY SWEETENING CHARACTERISTICS

TABLE 12 XYLITOL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 XYLITOL MARKET SIZE, BY REGION, 2018–2025 (KT)

8.6 MANNITOL

8.6.1 RISE IN DEMAND FROM THE CONFECTIONERY AND PHARMACEUTICAL INDUSTRIES FOR MANNITOL

TABLE 14 MANNITOL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 MANNITOL MARKET SIZE, BY REGION, 2018–2025 (KT)

8.7 ERYTHRITOL

8.7.1 ADDITIONAL FUNCTIONALITIES OFFERED APART FROM SWEETENING

TABLE 16 ERYTHRITOL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 ERYTHRITOL MARKET SIZE, BY REGION, 2018–2025 (KT)

8.8 SWEET PROTEINS

8.8.1 POTENTIAL REPLACEMENT TO AN ARRAY OF ARTIFICIAL SWEETENERS ALONG WITH HEALTH ENHANCING CHARACTERISTICS

TABLE 18 SWEET PROTEINS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 SWEET PROTEINS MARKET SIZE, BY REGION, 2018–2025 (KT)

8.8.2 CURCULIN

8.8.3 THAUMATIN

8.8.4 OTHER SWEET PROTEINS

TABLE 20 SWEET PROTEINS MARKET SIZE, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 21 SWEET PROTEINS MARKET SIZE, BY SUBTYPE, 2018–2025 (KT)

8.9 OTHER TYPES

8.9.1 INCREASE IN R&D ACTIVITIES BY KEY PLAYERS AND DEMAND FROM VARIOUS INDUSTRY PLAYERS

TABLE 22 OTHER TYPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 OTHER TYPES MARKET SIZE, BY REGION, 2018–2025 (KT)

9 NATURAL SWEETENERS MARKET, BY APPLICATION (Page No. - 84)

9.1 INTRODUCTION

FIGURE 22 NATURAL SWEETENERS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 24 MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 25 MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

9.2 COVID-19 IMPACT ANALYSIS, BY APPLICATION

TABLE 26 OPTIMISTIC SCENARIO: NATURAL SWEETENERS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 27 REALISTIC SCENARIO: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 28 PESSIMISTIC SCENARIO: NATURAL SWEETENERS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

9.3 BAKERY PRODUCTS

9.3.1 INCREASE IN DEMAND FOR BAKERY PRODUCTS WITH HEALTHIER ALTERNATIVES

TABLE 29 MARKET SIZE IN BAKERY PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 MARKET SIZE IN BAKERY PRODUCTS, BY REGION, 2018–2025 (KT)

9.4 CONFECTIONERIES & GUMS

9.4.1 RISE IN HEALTH CONCERNS REGARDING CONSUMING SUGAR-BASED CONFECTIONERY PRODUCTS AND ADOPTION OF NEWER INGREDIENTS IN CONFECTIONERIES

TABLE 31 NATURAL SWEETENERS MARKET SIZE IN CONFECTIONERIES & GUMS, BY REGION, 2018–2025 (USD MILLION)

TABLE 32 NATURAL SWEETENERS MARKET SIZE IN CONFECTIONERIES & GUMS, BY REGION, 2018–2025 (KT)

9.5 SPREADS

9.5.1 INCREASE IN CONSUMPTION OF SPREADS AND AWARENESS FOR HEALTHIER AND NATURAL BREAKFAST OPTIONS

TABLE 33 MARKET SIZE IN SPREADS, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 MARKET SIZE IN SPREADS, BY REGION, 2018–2025 (KT)

9.6 BEVERAGES

9.6.1 LARGER BASE OF AUDIENCE SHIFTING TOWARD LOW-CALORIE AND REDUCED SUGAR BEVERAGE OPTION

TABLE 35 MARKET SIZE IN BEVERAGES, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 MARKET SIZE IN BEVERAGES, BY REGION, 2018–2025 (KT)

9.7 DAIRY PRODUCTS

9.7.1 RISE IN FAVORABLE REGULATIONS FOR THE USE OF VARIOUS SWEETENERS IN AN ARRAY OF DAIRY PRODUCTS

TABLE 37 MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2018–2025 (KT)

9.8 FROZEN DESSERTS

9.8.1 FROZEN DESSERTS BENEFIT CONSUMERS AS WELL AS THE INDUSTRY PLAYERS BY HELPING THEM EXPAND THEIR PROFIT MARGINS

TABLE 39 NATURAL SWEETENERS MARKET SIZE IN FROZEN DESSERTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 MARKET SIZE IN FROZEN DESSERTS, BY REGION, 2018–2025 (KT)

9.9 TABLETOP SWEETENERS

9.9.1 INCREASE IN HEALTH CONSCIOUSNESS AND FREQUENT CONSUMPTION OF TABLETOP SWEETENING PRODUCTS

TABLE 41 NATURAL SWEETENERS MARKET SIZE IN TABLETOP SWEETENERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 MARKET SIZE IN TABLETOP SWEETENERS, BY REGION, 2018–2025 (KT)

9.1 PHARMACEUTICAL PRODUCTS

9.10.1 NATURAL SWEETENERS COMPLEMENT THE HEALTH PROMOTING CHARACTERISTIC OF PHARMA PRODUCTS

TABLE 43 REGULATORY STATUS OF COMMON SWEETENERS IN THE PHARMACEUTICAL INDUSTRY

TABLE 44 NATURAL SWEETENERS MARKET SIZE IN PHARMACEUTICAL PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 45 NATURAL SWEETENERS MARKET SIZE IN PHARMACEUTICAL PRODUCTS, BY REGION, 2018–2025 (KT)

9.11 OTHER APPLICATIONS

9.11.1 RISE IN R&D ACTIVITIES BY KEY PLAYERS IN ORDER TO WIDEN APPLICATION AREAS

TABLE 46 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 47 NATURAL SWEETENERS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (KT)

10 NATURAL SWEETENERS MARKET, BY END-USE SECTOR (Page No. - 102)

10.1 INTRODUCTION

FIGURE 23 MARKET SIZE, BY END-USE SECTOR, 2020 VS. 2025 (USD MILLION)

TABLE 48 MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 49 NATURAL SWEETENERS MARKET SIZE, BY END-USE SECTOR, 2018–2025 (KT)

10.2 COVID-19 IMPACT ANALYSIS, BY END-USE SECTOR

TABLE 50 OPTIMISTIC SCENARIO: NATURAL SWEETENERS MARKET SIZE, BY END-USE SECTOR, 2018–2021 (USD MILLION)

TABLE 51 REALISTIC SCENARIO: MARKET SIZE, BY END-USE SECTOR, 2018–2021 (USD MILLION)

TABLE 52 PESSIMISTIC SCENARIO: MARKET SIZE, BY END-USE SECTOR, 2018–2021 (USD MILLION)

10.3 FOOD & BEVERAGE

10.3.1 NATURAL SWEETENERS HELP MANUFACTURERS CUT ON ADDITIONAL COSTS FOR RAW MATERIAL AND ITS PROCUREMENT

TABLE 53 MARKET SIZE IN FOOD & BEVERAGE SECTOR, BY REGION, 2018–2025 (USD MILLION)

TABLE 54 MARKET SIZE IN FOOD & BEVERAGE SECTOR, BY REGION, 2018–2025 (KT)

10.4 PHARMACEUTICAL

10.4.1 FAVORABLE REGULATORY FRAMEWORK ENCOURAGING PHARMACEUTICAL PLAYERS TO ADOPT NATURAL SWEETENERS FOR FURTHER PROCESSING

TABLE 55 MARKET SIZE IN PHARMACEUTICAL SECTOR, BY REGION, 2018–2025 (USD MILLION)

TABLE 56 MARKET SIZE IN PHARMACEUTICAL SECTOR, BY REGION, 2018–2025 (KT)

10.5 DIRECT SALES

10.5.1 RISE IN CONSUMPTION AND AWARENESS ABOUT HEALTHIER AND NATURAL BREAKFAST OPTIONS AMONG CONSUMERS

TABLE 57 NATURAL SWEETENERS MARKET SIZE IN DIRECT SALES SECTOR, BY REGION, 2018–2025 (USD MILLION)

TABLE 58 MARKET SIZE IN DIRECT SALES SECTOR, BY REGION, 2018–2025 (KT)

10.6 OTHER END-USE SECTORS

10.6.1 INCREASE IN POTENTIAL APPLICATION SECTORS AND CONTINUOUS INVESTMENTS BY KEY MANUFACTURERS

TABLE 59 NATURAL SWEETENERS MARKET SIZE IN OTHER END-USE SECTORS, BY REGION, 2018–2025 (USD MILLION)

TABLE 60 MARKET SIZE IN OTHER END-USE SECTORS, BY REGION, 2018–2025 (KT)

11 NATURAL SWEETENERS MARKET, BY REGION (Page No. - 112)

11.1 INTRODUCTION

FIGURE 24 CHINA AND INDIA TO ACCOUNT FOR THE HIGHEST GROWTH RATE IN THE NATURAL SWEETENERS MARKET

TABLE 61 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 62 MARKET SIZE, BY REGION, 2018–2025 (KT)

11.2 COVID-19 IMPACT ANALYSIS, BY REGION

TABLE 63 OPTIMISTIC SCENARIO: NATURAL SWEETENERS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 PESSIMISTIC SCENARIO: NATURAL SWEETENERS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.3 NORTH AMERICA

TABLE 66 NORTH AMERICA: NATURAL SWEETENERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (KT)

FIGURE 25 NORTH AMERICA: NATURAL SWEETENERS MARKET SNAPSHOT

11.3.1 US

11.3.1.1 Increase in awareness and consumption of sweetener ingredient-based products

FIGURE 26 US: SURVEY OF CONSUMERS REGARDING READING OF PRODUCT INFORMATION ON THE PACKING OF FOOD PRODUCTS, 2017

11.3.2 CANADA

11.3.2.1 Increased potential usage in food & beverage and pharmaceutical applications in Canada

FIGURE 27 CANADA: COMMONLY CONSUMED BEVERAGES BETWEEN AGES 18 & 79, 2019

11.3.3 MEXICO

11.3.3.1 Increase in support from government initiatives and public healthcare campaigns

11.4 EUROPE

TABLE 74 EUROPE: NATURAL SWEETENERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 76 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 78 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 80 EUROPE: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (KT)

11.4.1 UK

11.4.1.1 Growth in the trend of buying natural ingredient-based products in the UK

11.4.2 GERMANY

11.4.2.1 Rise in prevalence of diabetes and population inclining toward natural ingredient-based foods

11.4.3 FRANCE

11.4.3.1 Growth of the beverage industry and consumption among the consumers in the country

11.4.4 ITALY

11.4.4.1 Significant rise in demand among consumers for health-enriching beverages in Italy

11.4.5 SPAIN

11.4.5.1 Rise in consumer awareness toward consumption of organic ingredients in Spain

11.4.6 RUSSIA

11.4.6.1 Increase in health-consciousness among the consumers in the country

11.4.7 NETHERLANDS

11.4.7.1 Rising prevalence of obesity and diabetes in the Netherlands

11.4.8 NORWAY

11.4.8.1 Government policies and awareness among the consumers regarding the consumption of natural sweeteners

11.4.9 REST OF EUROPE

11.4.9.1 Rise in demand from confectionery and other food application industry players

11.5 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: NATURAL SWEETENERS MARKET SNAPSHOT

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (KT)

11.5.1 CHINA

11.5.1.1 Rise in preference for low-sugar products and usage of sweeteners across the beverage industry

11.5.2 INDIA

11.5.2.1 Increase in endorsements by celebrities and culinary experts encouraging the Indian diabetic population to opt for natural sweeteners

11.5.3 JAPAN

11.5.3.1 Rise in healthcare costs and higher life expectancy due to preventive healthcare measures

11.5.4 AUSTRALIA

11.5.4.1 Government encouraging consumers to adopt low-calorie, sugar-free products

11.5.5 NEW ZEALAND

11.5.5.1 High spending capacity on nutritional products and increase in disposable incomes

11.5.6 REST OF ASIA PACIFIC

11.5.6.1 Changing consumer preferences for all-natural ingredient-based products

11.6 SOUTH AMERICA

TABLE 90 SOUTH AMERICA: NATURAL SWEETENERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 91 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 92 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 94 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 96 SOUTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 97 SOUTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (KT)

11.6.1 BRAZIL

11.6.1.1 Growth in awareness regarding functional and health food & beverages as preventive healthcare

11.6.2 ARGENTINA

11.6.2.1 Increasing urbanization and growing awareness among consumers in Argentina

FIGURE 29 ARGENTINA: PEOPLE WITH DIABETES, 2010–2045 (‘000)

FIGURE 30 ARGENTINA: HEALTH EXPENDITURE (SHARE OF GDP), 2012–2017

11.6.3 REST OF SOUTH AMERICA

11.6.3.1 Government initiatives promoting the adoption of healthier dietary lifestyles

11.7 REST OF THE WORLD

TABLE 98 ROW: NATURAL SWEETENERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 99 ROW: MARKET SIZE, BY REGION, 2018–2025 (KT)

TABLE 100 ROW: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 ROW: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 102 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 103 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 104 ROW: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 105 ROW: NATURAL SWEETENERS MARKET SIZE, BY END-USE SECTOR, 2018–2025 (KT)

11.7.1 MIDDLE EAST

11.7.1.1 Increase in spending on premium and health-benefiting foods & beverages

11.7.2 AFRICA

11.7.2.1 Rise in urbanization and demand for premium natural foods such as sugar-free foods & beverages

12 COMPETITIVE LANDSCAPE (Page No. - 154)

12.1 OVERVIEW

12.2 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE GLOBAL MARKET, 2017-2020

12.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 31 PRODUCT PORTFOLIO OF THE MAJOR COMPANIES

12.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 32 BUSINESS STRATEGIES OF THE MAJOR COMPANIES

12.5 MARKET SHARE OF KEY PLAYERS, 2019

FIGURE 33 TOP FIVE COMPANIES LEADING THE NATURAL SWEETENERS MARKET IN 2019

12.6 COMPETITIVE SCENARIO

12.6.1 NEW PRODUCT LAUNCHES

TABLE 106 NEW PRODUCT LAUNCHES, 2017–2020

12.6.2 EXPANSIONS & INVESTMENTS

TABLE 107 EXPANSIONS & INVESTMENTS, 2017–2020

12.6.3 ACQUISITIONS

TABLE 108 ACQUISITIONS, 2017–2020

12.6.4 AGREEMENTS, JOINT VENTURES, AND PARTNERSHIPS

TABLE 109 AGREEMENTS, JOINT VENTURES, AND PARTNERSHIPS, 2017–2020

13 COMPANY MICRO-QUADRANTS AND COMPANY PROFILES (Page No. - 163)

13.1 COMPETITIVE LEADERSHIP MAPPING

13.1.1 STARS

13.1.2 EMERGING LEADERS

13.1.3 PERVASIVE PLAYERS

13.1.4 EMERGING COMPANIES

FIGURE 34 GLOBAL NATURAL SWEETENERS MARKET, COMPETITIVE LEADERSHIP MAPPING, 2020

(Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

13.2 DUPONT

TABLE 110 DUPONT: BUSINESS OVERVIEW

FIGURE 35 DUPONT: COMPANY SNAPSHOT

TABLE 111 DUPONT: PRODUCTS OFFERED

13.3 ADM

TABLE 112 ADM: BUSINESS OVERVIEW

FIGURE 36 ADM: COMPANY SNAPSHOT

TABLE 113 ADM: PRODUCTS OFFERED

13.4 TATE & LYLE

TABLE 114 TATE & LYLE: BUSINESS OVERVIEW

FIGURE 37 TATE & LYLE: COMPANY SNAPSHOT

TABLE 115 TATE & LYLE: PRODUCTS OFFERED

13.5 INGREDION INCORPORATED

TABLE 116 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 38 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 117 INGREDION INCORPORATED: PRODUCTS OFFERED

13.6 CARGILL, INCORPORATED

TABLE 118 CARGILL, INCORPORATED: BUSINESS OVERVIEW

FIGURE 39 CARGILL, INCORPORATED: COMPANY SNAPSHOT

TABLE 119 CARGILL, INCORPORATED: PRODUCTS OFFERED

13.7 ROQUETTE FRÈRES

TABLE 120 ROQUETTE FRÈRES: BUSINESS OVERVIEW

FIGURE 40 ROQUETTE FRÈRES: COMPANY SNAPSHOT

TABLE 121 ROQUETTE FRÈRES: PRODUCTS OFFERED

13.8 PURECIRCLE LTD

TABLE 122 PURECIRCLE LTD: BUSINESS OVERVIEW

FIGURE 41 PURECIRCLE LTD: COMPANY SNAPSHOT

TABLE 123 PURECIRCLE LTD: PRODUCTS OFFERED

13.9 MACANDREWS & FORBES HOLDINGS INC

TABLE 124 MACANDREWS & FORBES HOLDINGS INC: BUSINESS OVERVIEW

TABLE 125 MACANDREWS & FORBES HOLDINGS INC: PRODUCTS OFFERED

13.10 FOODCHEM INTERNATIONAL CORPORATION

TABLE 126 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

TABLE 127 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS OFFERED

13.11 ECOGREEN OLEOCHEMICALS PVT LTD

TABLE 128 ECOGREEN OLEOCHEMICALS PVT LTD: BUSINESS OVERVIEW

TABLE 129 ECOGREEN OLEOCHEMICALS PVT LTD: PRODUCTS OFFERED

13.12 COMPANY PROFILES (OTHER PLAYERS)

13.12.1 STEVIA HUB INDIA

TABLE 130 STEVIA HUB INDIA: BUSINESS OVERVIEW

TABLE 131 STEVIA HUB INDIA: PRODUCTS OFFERED

13.12.2 SUMINTER INDIA ORGANICS

TABLE 132 SUMINTER INDIA ORGANICS: BUSINESS OVERVIEW

TABLE 133 SUMINTER INDIA ORGANICS: PRODUCTS OFFERED

13.12.3 STEVIA BIOTECH PVT LTD

TABLE 134 STEVIA BIOTECH PVT LTD: BUSINESS OVERVIEW

TABLE 135 STEVIA BIOTECH PVT LTD: PRODUCTS OFFERED

13.12.4 THE REAL STEVIA COMPANY

TABLE 136 THE REAL STEVIA COMPANY: BUSINESS OVERVIEW

TABLE 137 THE REAL STEVIA COMPANY: PRODUCTS OFFERED

13.12.5 SWEETLY STEVIA USA

TABLE 138 SWEETLY STEVIA USA: BUSINESS OVERVIEW

TABLE 139 SWEETLY STEVIA USA: PRODUCTS OFFERED

13.12.6 PYURE BRANDS LLC

TABLE 140 PYURE BRANDS LLC: BUSINESS OVERVIEW

TABLE 141 PYURE BRANDS LLC.: PRODUCTS OFFERED

13.12.7 XILINAT

TABLE 142 XILINAT: BUSINESS OVERVIEW

TABLE 143 XILINAT: PRODUCTS OFFERED

13.12.8 FOODITIVE B.V.

TABLE 144 FOODITIVE B.V.: BUSINESS OVERVIEW

TABLE 145 FOODITIVE B.V.: PRODUCTS OFFERED

13.12.9 SAGANÀ ASSOCIATION

TABLE 146 SAGANÀ ASSOCIATION: BUSINESS OVERVIEW

TABLE 147 SAGANÀ ASSOCIATION: PRODUCTS OFFERED

13.12.10 HEARTHSIDE FOOD SOLUTIONS LLC

TABLE 148 HEARTHSIDE FOOD SOLUTIONS LLC: BUSINESS OVERVIEW

TABLE 149 HEARTHSIDE FOOD SOLUTIONS LLC: PRODUCTS OFFERED

*Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 212)

14.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.2 AVAILABLE CUSTOMIZATIONS

14.3 RELATED REPORTS

14.4 AUTHOR DETAILS

The study involved four major activities in estimating the natural sweeteners market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

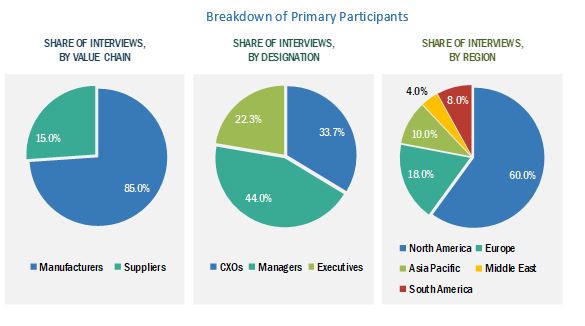

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of various application-industry manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the global market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted-top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the natural sweeteners market, in terms of type, application, end-use sector, and region

- To describe and forecast the natural sweeteners market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

To analyze strategic approaches, such as acquisitions & divestments, expansions, product launches & approvals, and agreements, in the natural sweeteners market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of the World natural sweeteners market into Middle East & Africa.

- Further breakdown of the Rest of European natural sweeteners market into Poland, Belgium, and Denmark, among other EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific includes Indonesia, Vietnam, South Korea, Thailand, and Malaysia.

- Further breakdown of the Rest of South America includes Chile, Colombia, and Paraguay.

Segment Analysis

- Further breakdown of the type segment into isomalt and trehalose.

- Further breakdown of the application segment into savory, cereal, and diet products.

- Further breakdown of the end-use sector segment into personal care & cosmetics and pet foods.

Company information

- Detailed analysis and profiling of additional market players (up to five).

Growth opportunities and latent adjacency in Natural Sweeteners Market