LTE and 5G Broadcast Market Size, Share, Industry Growth, Trends & Analysis by Technology (LTE and 5G), End Use (Video on Demand, Emergency Alerts, Radio, Mobile TV, Connected Cars, Stadiums, Data Feeds & Notifications), and Region

LTE and 5G Broadcast Market Overview

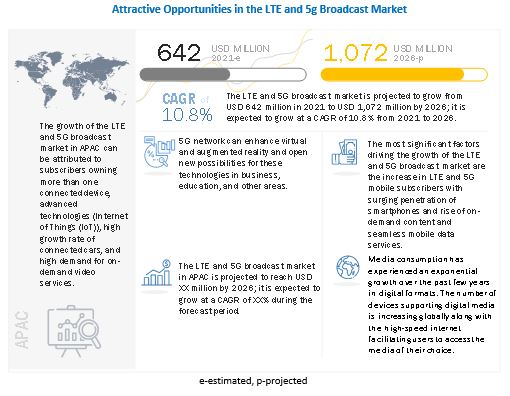

The LTE and 5G broadcast market Size, Share, Industry Growth, Trends & Analysis is estimated to be worth USD 642 million in 2021 and projected to reach USD 1,072 million by 2026, at a CAGR of 10.8%.

The increasing LTE and 5G mobile subscribers with surging penetration of smartphones growing popularity of on-demand content and seamless mobile data services and growing need for massive connectivity of devices due to evolution of IoT are some of the prominent factors for the growth of the LTE and 5G broadcast industry globally.

- The rapid increase in data consumption, driven by video streaming, online gaming, and real-time communication, has necessitated the deployment of advanced broadcasting technologies like LTE and 5G. These technologies provide the bandwidth and speed required to meet the growing demand for high-quality, uninterrupted content delivery.

- eMBB applications, such as high-definition video streaming, virtual reality (VR), and augmented reality (AR), are driving the demand for LTE and 5G broadcast technologies. These applications require high-speed, low-latency connectivity, which LTE and 5G networks can provide.

- LTE and 5G broadcast technologies are crucial for public safety and emergency services, enabling the efficient dissemination of critical information to large populations. They support applications such as real-time video streaming for situational awareness, emergency alerts, and disaster management.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Global LTE and 5G Broadcast Market

COVID-19 has led to severe health crisis across the world and several casualties. North America was one of the worst affected regions in the world, and the US was hit the most due to this pandemic. It caused ongoing challenges for the region’s healthcare system as the health systems were not designed to deal with such a crisis. The sudden rise in the infections led to lockdowns, quarantines, border closures, and halting of economic activities across the region. This led to disruptions in the supply chain which negatively affected the supply of raw materials to several countries. The region has faced several disruptions owing to the lockdowns, quarantine measures, border closures, etc., undertaken by various governments. The region has witnessed a decline in mobile revenue growth in the first half of 2020, which was largely due to the commitments by the operators to waive off the data overage and late payment fee because of the pandemic. The lockdowns have also resulted in the shutting of physical stores, with several stores shutting down permanently as the operators in the region anticipate the shift of the customers toward the digital channel to get several types of services. The Q3 of 2020 showed some type of recovery as network performance remained resilient with rising bandwidth pressure.

The COVID-19 pandemic has taken a toll on the European region, with countries such as Italy, France, and the UK suffering the most. The region witnessed a large number of fatalities due to the pandemic. This resulted in the economic disruption in the region, with several industries facing a fall in demand and inability to supply owing to lockdown measures.

Telecom networks have continued to do well during testing times, despite changes in consumption levels and peak hours. Residential broadband usage and video calls are up, and voice call volumes temporarily reversed in a downward trend. Several major telecom companies in Europe have followed a similar path during the pandemic. However, there still exists a sizeable gap between them, with Germany (Deutsche Telekom) and France (Orange) enduring less of a hit compared with southern countries, especially Italy. The financial outlook is uncertain with limited subscriber growth, and price competition in most developed markets could be compounded by lower consumer spending and the reintroduction of restrictions on movement and trading. Operators are looking for ways to foster new opportunities in connectivity, digital transformation, and adjacent services while helping their customers navigate a challenging macroeconomic climate. Europe has witnessed progress in getting back to 5G rollout and trials. Spectrum assignments in the region have somewhat recovered in Q3 following earlier postponements, which will support operator deployment plans.

LTE and 5G Broadcast Market Dynamics

Driver: Increasing LTE and 5G mobile subscribers with surging penetration of smartphones

According to a GSMA report, The Mobile Economy 2020, there were approximately 5.2 billion unique mobile subscribers in 2019 worldwide; this number is expected to reach 5.8 billion by 2025, at a CAGR of 1.9% between 2019 and 2025. The number of mobile internet users is expected to increase from 3.8 billion in 2019 to 5.0 billion in 2025, at a CAGR of 4.6%. Also, the adoption of smartphones is expected to grow by 15% globally between 2019 and 2025. 4G connections in 2019 accounted for approximately 52% of the world’s total connections and are likely to reach 56% of total connections by 2025, while 5G connections are expected to reach 1.8 billion by 2025. The main reason behind the increasing adoption of smartphones is the low cost of devices and the rise in income levels of consumers. The 5G network is commercially available in 61 countries, according to the data by Global Mobile Services Association (GSA); some of these include the US, China, the UK, Australia, and New Zealand.

Restraint: Reluctance in transitioning from legacy infrastructure

Legacy telecom environments are considered to be a major restraint to new commercial telecom spending on LTE and 5G broadcast. Many telecom operators continue to maintain and operate legacy systems, which are very complex and inefficient for business needs. Due to legacy systems, telecom operators often face various challenges, such as high maintenance costs, unsupported hardware and software, skill shortage, and lack of compatibility on different platforms, including servers, hypervisors, and cloud. New commercial hardware and solutions must be heavily customized to support old services. There is always a risk that the conversion will be incomplete. This conversion carries a substantial upgrade cost with it. When deploying systems to support new services, operators are thus reluctant to convert old services to new systems. Some operators continue to implement legacy systems incapable of supporting new services for the growing subscriber base, which could ultimately result in the fallout of services and hamper the customer experience. Big operators have already deployed traditional EPC solutions for LTE networks worldwide. Traditional EPC solutions, however, are very costly and involves a lot of maintenance activities. The installation lifecycle of network components ranges from 2 to 5 years. Therefore, mobile operators are reluctant to add new solutions to their networks that are already deployed.

Opportunity: Monetizing network bandwidth through new business models

LTE and 5G broadcast offer new business opportunities to mobile network operators. Once deployed, LTE and 5G broadcast can be used for multiple use cases, such as digital signage, emergency alerts, displays in stadiums, and content delivery to automobile screens. The technologies allow mobile network operators to offer new products and services directly to consumers. Mobile network operators can also utilize off-peak capacity to deliver new service offerings, such as rich media caching and managed software updates.

LTE and 5G broadcast offer significant revenue generation and cost-saving opportunities to mobile network operators. Operators can use and monetize their media and network assets, and make a deal with content and me

dia partners for new services. The technologies also enable mobile network operators to charge premium rates for premium content and monetize network bandwidth through new business models, such as timeslot auctions.

Challenge: High upfront deployment costs related to core network and radio network

LTE broadcast, which is also referred to as evolved Multimedia Broadcast and Multicast Services (eMBMS), is a mobile wireless technology that is capable of broadcasting multimedia content over a 4G/LTE spectrum. Further, the 5G broadcast has been enhanced via the 3GPP group with Release-14 and Release-15 as Further enhanced Multimedia Broadcast Multicast Service or FeMBMS. Significant upfront investments are required for building and maintaining a dedicated network. The high upfront costs relating to the core network and the radio network are a challenge for overlaying LTE broadcast on the existing 4G core network. The reason for the high initial investment is the complexity of synchronizing the existing radio network infrastructure with the new infrastructure of LTE broadcast. This poses a challenge for the growth of the market.

LTE technology held the major market share in the LTE and 5G broadcast market in 2020

LTE broadcast is transforming the types of services mobile customers receive, their quality, and the way they are delivered. It is equipped with eMBMS, a 3GPP standardized technology. The technology allows mobile operators to use a proportion of their network capacity for broadcasting popular content or data. LTE broadcast serves multiple customers within a single cell with the same video, TV, or other data services instead of unicasting delivery. LTE broadcast has significantly impacted the capacity needed to deliver popular content, and the technology is opening up new business opportunities for mobile operators. Users expect low latency in mobile devices while watching videos and TV content, leading to an increase in demand for LTE and 5G broadcast services.

LTE and 5G broadcast technology for connected cars end use to grow at the highest CAGR during forecast period

The market is coming up with new LTE broadcast services, including the trial by Japanese operator KDDI. The trial involved using eMBMS in two connected car applications – the first involved broadcasting a status alert from one car to the network and back through eMBMS to many other cars and users. The other application was to enable real-time mapping and navigation information. It is expected that potential applications for LTE broadcast and 5G broadcast will continue to grow with the technology leading to high market growth for connected cars.

Key Market Players

The major players in the LTE and 5G broadcast companies such as Qualcomm (US), Huawei (China), Cisco (US), Ericsson (Sweden), and ZTE (China).

Scope of the report

|

Report Metric |

Details |

| Estimated Value | USD 642 million in 2021 |

| Projected Value | USD 1,072 million by 2026 |

| Growth Rate | CAGR of 10.8% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million), and Volume (Million Units) |

|

Segments covered |

By Technology and By End Use |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the LTE and 5G broadcast market are Qualcomm (US), Samsung Electronics (South Korea), Huawei (China), Cisco (US), Ericsson (Sweden), ZTE (China), Nokia (Finland), NEC (Japan), Enensys Technologies (France) and Rohde Y& Schwarz (Germany) |

The study categorizes the LTE and 5G broadcast market based on technology, end use at the regional and global level.

By Technology

- LTE

- 5G

By End Use

- Video on Demand

- Fixed LTE Quadruple Play

- e-Newspapers and e-Magazines

- Last Mile CDN

- Emergency Alerts

- Radio

- Mobile TV

- Connected Cars

- Stadiums

- Data Feeds & Notifications

- Others

By Region

- North America

- Europe

- Asia Pacific

- Rest of World

Recent Developments

- In February 2021 ,Qualcomm announced the second-generation 5G Fixed Wireless Access Platform with 10 Gigabit 5G connectivity for homes and businesses. The new platform, powered by the fourth-generation Qualcomm® Snapdragon™ X65 5G Modem-RF System, will enable new business opportunities for mobile operators by allowing them to offer fixed internet broadband services to homes and businesses using their 5G network infrastructure.

- In November 2020, Huawei unveiled an innovative 5G microwave long-reach E-band solution that combines intelligent beam tracking (IBT) antenna with high-power E-band. This combination increases the distance of E-band transmission from 3 km to 5 km while providing a 20 Gb/s capacity and loosening the requirements of site deployment, which further accelerates the deployment of 5G.

- In March 2020, Cisco in March 2020 launched a new converged SDN transport solution. The new converged SDN transport solution by Cisco enables PLDT (Philippines) to unleash the full potential of 5G for a superior customer experience

- In Septemeber 2020 .ZTE a major international provider of telecommunications, enterprise, and consumer technology solutions for the mobile internet, launched the industry's first broadcast demonstration based on 5G NR physical layer technology at Ultra-High Definition Video (Beijing) Production Technology Collaboration Center, realizing end-to-end 5G HD video broadcast service on 700 MHz spectrum.

- In February 2021, Ericsson launched three new radios in its industry-leading massive MIMO portfolio and expanded its RAN compute portfolio with six RAN compute products to accelerate 5G mid-band rollouts.

Frequently Asked Questions (FAQ):

What is the current size of the global LTE and 5G broadcast market?

The LTE and 5G broadcast market is estimated to be worth USD 642 million in 2021 and projected to reach USD 1,072 million by 2026, at a CAGR of 10.8%. The increasing LTE and 5G mobile subscribers with surging penetration of smartphones, growing popularity of on-demand content and seamless mobile data services and growing need for massive connectivity of devices due to evolution of IoT are some of the prominent factors for the growth of the LTE and 5G broadcast market globally.

Who are the winners in the global LTE and 5G broadcast market?

Companies such as Qualcomm (US), Verizon (US), KT Corporation (South Korea), MediaTek (Taiwan), Telstra (Australia), and Sequans Communication (France)

What is the COVID-19 impact on LTE and 5G broadcast solution providers?

The key manufacturers in the LTE and 5G broadcast market, including Qualcomm (US), Verizon (US), KT Corporation (South Korea), MediaTek (Taiwan), Telstra (Australia), and Sequans Communication (France)have been impacted severely during the first and second quarters of 2020 owing to the outbreak and spread of COVID-19 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LTE AND 5G BROADCAST MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SEGMENTATION

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 INCLUSIONS AND EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 LTE AND 5G BROADCAST MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 LTE AND 5G BROADCAST MARKET: RESEARCH APPROACH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.1.3.3 Primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size by bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 LTE AND 5G BROADCAST MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND SIDE APPROACH

2.2.3 TOP-DOWN APPROACH

2.2.3.1 Estimating market size by top-down analysis (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

TABLE 2 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

3.1 POST-COVID-19: REALISTIC SCENARIO

3.2 POST-COVID-19: OPTIMISTIC SCENARIO

3.3 POST-COVID-19: PESSIMISTIC SCENARIO

FIGURE 8 PRE- AND POST-COVID-19 SCENARIO ANALYSIS FOR LTE AND 5G BROADCAST MARKET, 2017–2026 (USD MILLION)

FIGURE 9 5G BROADCAST TECHNOLOGY IS EXPECTED TO HOLD LARGER SHARE OF LTE AND 5G BROADCAST MARKET DURING FORECAST PERIOD

FIGURE 10 LTE AND 5G BROADCAST MARKET FOR CONNECTED CARS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 11 APAC TO HOLD LARGEST SHARE OF LTE AND 5G BROADCAST MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 OPPORTUNITIES IN LTE AND 5G BROADCAST MARKET

FIGURE 12 NEED FOR OFF LOADING NETWORK CAPACITY CONGESTION LEADING TO INCREASING DEMAND FOR LTE AND 5G BROADCAST SERVICES

4.2 LTE AND 5G BROADCAST MARKET IN APAC, BY COUNTRY AND END USE

FIGURE 13 CHINA TO HOLD LARGEST SHARE OF LTE AND 5G BROADCAST MARKET IN APAC

4.3 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY

FIGURE 14 5G BROADCAST TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.4 LTE AND 5G BROADCAST MARKET, BY END USE

FIGURE 15 VIDEO ON DEMAND IS EXPECTED TO HOLD LARGEST SHARE OF MARKET BY 2026

4.5 LTE AND 5G BROADCAST MARKET, BY GEOGRAPHY

FIGURE 16 LTE AND 5G BROADCAST MARKET IN FRANCE TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 INCREASING LTE MOBILE SUBSCRIBERS AND GROWING VIDEO TRAFFIC ARE MAJOR DRIVING FACTORS FOR LTE AND 5G BROADCAST MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing LTE and 5G mobile subscribers with surging penetration of smartphones

5.2.1.2 Growing popularity of on-demand content and seamless mobile data services

FIGURE 18 OVER THE TOP (OTT) VIDEO VIEWERS, 2017–2025 (MILLIONS)

FIGURE 19 CONSUMER INTERNET TRAFFIC, 2017–2022

5.2.1.3 Growing need for massive connectivity of devices due to evolution of IoT

FIGURE 20 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Reluctance in transitioning from legacy infrastructure

5.2.2.2 Shortage of compatible 5G broadcast and reception devices

FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Need for reliable and high-quality public safety communication systems

5.2.3.2 Monetizing network bandwidth through new business models

5.2.3.3 Need for minimizing network capacity congestion

FIGURE 22 INTERNET SPEED IN SELECT COUNTRIES FROM APRIL 2019–JUNE 2019

FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Correct bandwidth allocation for LTE broadcast

5.2.4.2 High upfront deployment costs related to core network and radio network

5.2.4.3 Lack of skilled workforce

FIGURE 24 IMPACT ANALYSIS: CHALLENGES

5.3 ARCHITECTURE OF LTE BROADCAST/EMBMS DEPLOYMENT IN LTE NETWORK

FIGURE 25 DEPLOYMENT OF EMBMS IN A NETWORK

5.4 LTE BROADCAST ALLIANCE

5.4.1 ADVANTAGES OF LTE AND 5G BROADCASTING

TABLE 3 ADVANTAGES OF LTE AND 5G BROADCAST

6 INDUSTRY TRENDS (Page No. - 58)

6.1 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED AT MULTIPLEXING, CONTENT DISTRIBUTION, AND NETWORK TRANSMISSION STAGES

6.2 LTE AND 5G BROADCAST MARKET ECOSYSTEM

FIGURE 27 LTE AND 5G BROADCAST MARKET: ECOSYSTEM

TABLE 4 LTE AND 5G BROADCAST MARKET: ECOSYSTEM

6.3 TECHNOLOGY ANALYSIS

6.3.1 ULTRA-HIGH FREQUENCY BANDS FOR 5G

FIGURE 28 LTE AND 5G BROADCAST MARKET: ULTRA-HIGH BANDS FOR 5G TECHNOLOGY

6.3.2 3GPP RELEASE FOR 5G BROADCAST

6.3.2.1 SA2 Release-17 study on architectural enhancements for 5G multicast-broadcast services (5MBS)

FIGURE 29 ENTV IS EVOLVING IN RELEASE-16 TO BECOME 5G BROADCAST

6.3.2.2 LTE evolution in Release-17

6.3.3 ROLE OF 3GPP IN LTE

6.4 AVERAGE SELLING PRICE TRENDS

FIGURE 30 AVERAGE SUBSCRIPTION COST PER USER FOR LTE BROADCAST (USD)

FIGURE 31 AVERAGE SUBSCRIPTION COST PER USER FOR 5G BROADCAST (USD)

6.5 REVENUE SHIFT AND NEW REVENUE POCKETS FOR LTE AND 5G BROADCAST MARKET

FIGURE 32 REVENUE SHIFT IN LTE AND 5G BROADCAST MARKET

6.6 PATENTS ANALYSIS

TABLE 5 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS, 2015–2020

FIGURE 33 NUMBER OF PATENTS GRANTED FROM 2011 TO 2020 FOR EMBMS

6.7 TRADE DATA

TABLE 6 IMPORTS DATA FOR KEY COUNTRIES FOR HS CODE 851761, 2016–2020 (USD THOUSAND)

TABLE 7 EXPORTS DATA FOR KEY COUNTRIES FOR HS CODE 851761, 2016–2020 (USD THOUSAND)

6.8 CASE STUDIES

6.8.1 ORS GROUP USED SOLUTIONS BY ENENSYS TO TEST 5G BROADCAST

6.8.2 EE LTE BROADCAST DEMONSTRATION

6.9 REGULATORY LANDSCAPE

6.9.1 NORTH AMERICA

6.9.1.1 US

6.9.1.2 Canada

6.9.2 EUROPE

6.9.3 APAC

6.9.3.1 China

6.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 LTE AND 5G BROADCAST MARKET: IMPACT OF FORCES ON LTE AND 5G BROADCAST MARKET

TABLE 8 LTE AND 5G BROADCAST MARKET: PORTER’S FIVE FORCES ANALYSIS

7 LTE BROADCAST AND 5G BROADCAST MARKET, BY TECHNOLOGY (Page No. - 78)

7.1 INTRODUCTION

TABLE 9 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 35 5G TECHNOLOGY TO HOLD LARGEST SHARE OF LTE AND 5G BROADCAST MARKET DURING FORECAST PERIOD

TABLE 10 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 11 LTE AND 5G BROADCAST MARKET, GLOBAL SUBSCRIBER BASE, 2017–2020 (MILLION)

TABLE 12 LTE AND 5G BROADCAST MARKET, GLOBAL SUBSCRIBER BASE, 2021–2026 (MILLION)

7.2 LTE BROADCAST

7.2.1 LTE BROADCAST RESULTS IN SUBSTANTIAL REDUCTION IN AMOUNT OF NETWORK RESOURCES USED TO DELIVER CONTENT

TABLE13 LTE BROADCAST MARKET, BY REGION, 2017–2020 (USD MILLION)

FIGURE 36 APAC LTE TECHNOLOGY MARKET TO HOLD LARGEST SHARE OF LTE AND 5G BROADCAST MARKET DURING FORECAST PERIOD

TABLE14 LTE BROADCAST MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE15 LTE BROADCAST MARKET, BY END USE, 2017–2020 (USD MILLION)

TABLE16 LTE BROADCAST MARKET, BY END USE, 2021–2026 (USD MILLION)

7.3 5G BROADCAST

7.3.1 5G BROADCAST OFFERS CONSUMERS LIMITLESS MEDIA CONSUMPTION AND ENHANCES MOBILE EXPERIENCE

TABLE17 5G BROADCAST MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 37 CONNECTED CAR SEGMENT TO WITNESS HIGH GROWTH IN LTE AND 5G BROADCAST MARKET FOR 5G TECHNOLOGY DURING FORECAST PERIOD

TABLE18 5G BROADCAST MARKET, BY END USE, 2021–2026 (USD MILLION)

8 LTE BROADCAST AND 5G BROADCAST MARKET, BY END USE (Page No. - 87)

8.1 INTRODUCTION

TABLE 19 LTE AND 5G BROADCAST MARKET, BY END USE, 2017–2020 (USD MILLION)

FIGURE 38 VIDEO ON DEMAND TO HOLD LARGEST SHARE OF LTE AND 5G BROADCAST MARKET DURING FORECAST PERIOD

TABLE 20 LTE AND 5G BROADCAST MARKET, BY END USE, 2021–2026 (USD MILLION)

8.2 VIDEO ON DEMAND (VOD)

8.2.1 LTE BROADCAST PROVIDES HD QUALITY VIDEOS DESPITE CONGESTIONS IN NETWORK

TABLE21 LTE AND 5G BROADCAST MARKET FOR VIDEO ON DEMAND, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE22 LTE AND 5G BROADCAST MARKET FOR VIDEO ON DEMAND, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE23 LTE BROADCAST MARKET FOR VIDEO ON DEMAND, BY REGION, 2017–2020 (USD MILLION)

TABLE24 LTE BROADCAST MARKET FOR VIDEO ON DEMAND, BY REGION, 2021–2026 (USD MILLION)

FIGURE 39 APAC TO HOLD LARGEST SHARE OF 5G BROADCAST MARKET FOR VIDEO ON DEMAND DURING FORECAST PERIOD

TABLE25 5G BROADCAST MARKET FOR VIDEO ON DEMAND, BY REGION, 2021–2026 (USD MILLION)

8.3 FIXED LTE QUADRUPLE PLAY

8.3.1 5G BROADCAST TO WITNESS HIGH ADOPTION FOR FIXED LTE QUADRUPLE PLAY

TABLE26 LTE AND 5G BROADCAST MARKET FOR FIXED LTE QUADRUPLE PLAY, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE27 LTE AND 5G BROADCAST MARKET FOR FIXED LTE QUADRUPLE PLAY, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE28 LTE BROADCAST MARKET FOR FIXED LTE QUADRUPLE PLAY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE29 LTE BROADCAST MARKET FOR FIXED LTE QUADRUPLE PLAY, BY REGION, 2021–2026 (USD THOUSAND)

TABLE30 5G BROADCAST MARKET FOR FIXED LTE QUADRUPLE PLAY, BY REGION, 2021–2026 (USD THOUSAND)

8.4 E-NEWSPAPERS AND E-MAGAZINES

8.4.1 5G TECHNOLOGY COULD BE A DRIVING FACTOR FOR GROWTH OF E-NEWSPAPERS AND E-MAGAZINES

TABLE31 LTE AND 5G BROADCAST MARKET FOR E-NEWSPAPERS AND E-MAGAZINES, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 40 5G TECHNOLOGY TO WITNESS HIGHER GROWTH FOR E-NEWSPAPERS AND E-MAGAZINES END USE

TABLE32 LTE AND 5G BROADCAST MARKET FOR E-NEWSPAPERS AND E-MAGAZINES, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE33 LTE BROADCAST MARKET FOR E-NEWSPAPERS AND E-MAGAZINES, BY REGION, 2017–2020 (USD MILLION)

TABLE34 LTE BROADCAST MARKET FOR E-NEWSPAPERS AND E-MAGAZINES, BY REGION, 2021–2026 (USD MILLION)

TABLE35 5G BROADCAST MARKET FOR E-NEWSPAPERS AND E-MAGAZINES, BY REGION, 2021–2026 (USD MILLION)

8.5 LAST-MILE CONTENT DELIVERY NETWORK (CDN)

8.5.1 CDN CAN PROVIDE POPULAR CONTENT USING SMART MANAGEMENT FOR VIDEO STREAMING USING LTE OR 5G BROADCAST

TABLE36 LTE AND 5G BROADCAST MARKET FOR LAST-MILE CDN, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE37 LTE AND 5G BROADCAST MARKET FOR LAST-MILE CDN, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE38 LTE BROADCAST MARKET FOR LAST-MILE CDN, BY REGION, 2017–2020 (USD MILLION)

TABLE39 LTE BROADCAST MARKET FOR LAST-MILE CDN, BY REGION, 2021–2026 (USD MILLION)

TABLE40 5G BROADCAST MARKET FOR LAST-MILE CDN, BY REGION, 2021–2026 (USD MILLION)

8.6 EMERGENCY ALERTS

8.6.1 LTE BROADCAST PROVIDES AN ADDITIONAL MEANS OF COMMUNICATING VIA MOBILE DATA NETWORK

TABLE41 LTE AND 5G BROADCAST MARKET FOR EMERGENCY ALERTS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE42 LTE AND 5G BROADCAST MARKET FOR EMERGENCY ALERTS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE43 LTE BROADCAST MARKET FOR EMERGENCY ALERTS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 41 APAC TO HOLD LARGEST MARKET SHARE FOR EMERGENCY ALERTS END USE DURING FORECAST PERIOD

TABLE44 LTE BROADCAST MARKET FOR EMERGENCY ALERTS, BY REGION, 2021–2026 (USD MILLION)

TABLE45 5G BROADCAST MARKET FOR EMERGENCY ALERTS, BY REGION, 2021–2026 (USD MILLION)

8.7 RADIO

8.7.1 RADIO COULD BE MAJOR APPLICATION OF LTE AND 5G BROADCAST OWING TO POPULARITY OF RADIO SERVICES

TABLE46 LTE AND 5G BROADCAST MARKET FOR RADIO, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE47 LTE AND 5G BROADCAST MARKET FOR RADIO, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE48 LTE BROADCAST MARKET FOR RADIO, BY REGION, 2017–2020 (USD MILLION)

TABLE49 LTE BROADCAST MARKET FOR RADIO, BY REGION, 2021–2026 (USD MILLION)

FIGURE 42 ROW TO WITNESS HIGHEST GROWTH FOR RADIO END USE IN LTE AND 5G BROADCAST MARKET

TABLE50 5G BROADCAST MARKET FOR RADIO, BY REGION, 2021–2026 (USD MILLION)

8.8 MOBILE TV

8.8.1 LIVE TV STREAMING USES BROADCAST TECHNOLOGY FOR STREAMING LIVE CONTENT SUCH AS NEWS AND SPORTS EVENTS

TABLE51 LTE AND 5G BROADCAST MARKET FOR MOBILE TV, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE52 LTE AND 5G BROADCAST MARKET FOR MOBILE TV, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE53 LTE BROADCAST MARKET FOR MOBILE TV, BY REGION, 2017–2020 (USD MILLION)

TABLE54 LTE BROADCAST MARKET FOR MOBILE TV, BY REGION, 2021–2026 (USD MILLION)

TABLE55 5G BROADCAST MARKET FOR MOBILE TV, BY REGION, 2021–2026 (USD MILLION)

8.9 CONNECTED CARS

8.9.1 LTE AND 5G BROADCAST ARE CAPABLE OF DELIVERING VOLUMINOUS CONTENT, LIVE TV, AND FILES TO DEVICES IN VEHICLES

TABLE56 LTE AND 5G BROADCAST MARKET FOR CONNECTED CARS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 43 5G TECHNOLOGY FOR CONNECTED CARS TO SHOW A HIGH GROWTH DURING THE FORECAST PERIOD IN THE LTE AND 5G BROADCAST MARKET

TABLE57 LTE AND 5G BROADCAST MARKET FOR CONNECTED CARS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE58 LTE BROADCAST MARKET FOR CONNECTED CARS, BY REGION, 2017–2020 (USD THOUSAND)

TABLE59 LTE BROADCAST MARKET FOR CONNECTED CARS, BY REGION, 2021–2026 (USD THOUSAND)

TABLE60 5G BROADCAST MARKET FOR CONNECTED CARS, BY REGION, 2021–2026 (USD MILLION)

8.1 STADIUMS

8.10.1 OPERATORS NEED TO UPGRADE BASE STATIONS IN STADIUMS TO DEPLOY LTE BROADCAST EFFICIENTLY

TABLE61 LTE AND 5G BROADCAST MARKET FOR STADIUMS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE62 LTE AND 5G BROADCAST MARKET FOR STADIUMS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE63 LTE BROADCAST MARKET FOR STADIUMS, BY REGION, 2017–2020 (USD MILLION)

TABLE64 LTE BROADCAST MARKET FOR STADIUMS, BY REGION, 2021–2026 (USD MILLION)

TABLE65 5G BROADCAST MARKET FOR STADIUMS, BY REGION, 2021–2026 (USD MILLION)

8.11 DATA FEEDS & NOTIFICATIONS

8.11.1 DATA FEEDS AND NOTIFICATIONS CAN BE EFFICIENTLY DELIVERED USING LTE AND 5G BROADCAST

TABLE66 LTE AND 5G BROADCAST MARKET FOR DATA FEEDS & NOTIFICATIONS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE67 LTE AND 5G BROADCAST MARKET FOR DATA FEEDS & NOTIFICATIONS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE68 LTE BROADCAST MARKET FOR DATA FEEDS & NOTIFICATIONS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 44 APAC TO HOLD LARGEST SIZE OF LTE AND 5G BROADCAST MARKET FOR DATA FEEDS & NOTIFICATIONS DURING 2021–2026

TABLE69 LTE BROADCAST MARKET FOR DATA FEEDS & NOTIFICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE70 5G BROADCAST MARKET FOR DATA FEEDS & NOTIFICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.12 OTHERS

TABLE71 LTE AND 5G BROADCAST MARKET FOR OTHERS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE72 LTE AND 5G BROADCAST MARKET FOR OTHERS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE73 LTE BROADCAST MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE74 LTE BROADCAST MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

TABLE75 5G BROADCAST MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 116)

9.1 INTRODUCTION

FIGURE 45 GEOGRAPHIC SNAPSHOT OF LTE AND 5G BROADCAST MARKET

TABLE76 LTE AND 5G BROADCAST MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE77 LTE AND 5G BROADCAST MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 46 SNAPSHOT: LTE AND 5G BROADCAST MARKET IN NORTH AMERICA

TABLE78 LTE AND 5G BROADCAST MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE79 LTE AND 5G BROADCAST MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE80 LTE AND 5G BROADCAST MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE81 LTE AND 5G BROADCAST MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE82 LTE BROADCAST MARKET IN NORTH AMERICA, BY END USE, 2017–2020 (USD MILLION)

TABLE83 LTE BROADCAST MARKET IN NORTH AMERICA, BY END USE, 2021–2026 (USD MILLION)

TABLE84 5G BROADCAST MARKET IN NORTH AMERICA, BY END USE, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 US has highest number of 5G subscribers in North America

9.2.2 CANADA

9.2.2.1 Major national telecommunications companies are testing LTE broadcast and 5G broadcast in large cities

9.2.3 MEXICO

9.2.3.1 Mexico has taken step toward launching 5G in a band that enables high coverage at relatively low cost

9.3 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

9.4 EUROPE

FIGURE 47 SNAPSHOT: LTE AND 5G BROADCAST MARKET IN EUROPE

TABLE85 LTE AND 5G BROADCAST MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE86 LTE AND 5G BROADCAST MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE87 LTE AND 5G BROADCAST MARKET IN EUROPE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE88 LTE AND 5G BROADCAST MARKET IN EUROPE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE89 LTE BROADCAST MARKET IN EUROPE, BY END USE, 2017–2020 (USD MILLION)

TABLE90 LTE BROADCAST MARKET IN EUROPE, BY END USE, 2021–2026 (USD MILLION)

TABLE91 5G BROADCAST MARKET IN EUROPE, BY END USE, 2021–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Germany is in process of moving its free-to-air broadcasting services to DVB-T2

9.4.2 UK

9.4.2.1 Companies are demonstrating live broadcast with remote production over 5G in UK

9.4.3 FRANCE

9.4.3.1 Testing and trialing of 5G network is constantly going on in France

9.4.4 REST OF EUROPE (ROE)

9.5 IMPACT OF COVID-19 ON EUROPEAN MARKET

9.6 ASIA PACIFIC (APAC)

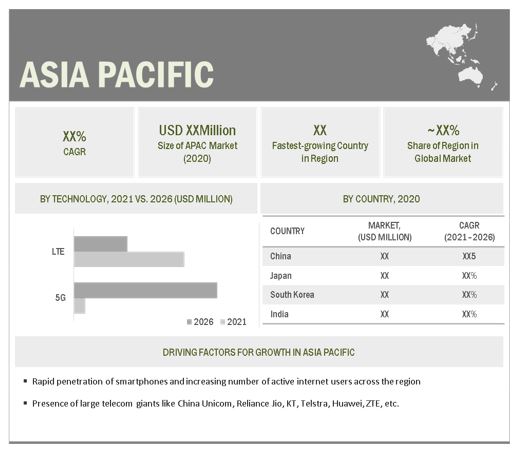

FIGURE 48 APAC: SNAPSHOT OF LTE AND 5G BROADCAST MARKET

TABLE92 LTE AND 5G BROADCAST MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE93 LTE AND 5G BROADCAST MARKET IN APAC, BY COUNTRY 2021–2026 (USD MILLION)

TABLE94 LTE AND 5G BROADCAST MARKET IN APAC, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE95 LTE AND 5G BROADCAST MARKET IN APAC, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE96 LTE BROADCAST MARKET IN APAC, BY END USE, 2017–2020 (USD MILLION)

TABLE97 LTE BROADCAST MARKET FOR LTE IN APAC, BY END USE, 2021–2026 (USD MILLION)

TABLE98 LTE AND 5G BROADCAST MARKET FOR 5G IN APAC, BY END USE, 2021–2026 (USD MILLION)

9.6.1 CHINA

9.6.1.1 China has started upgrading to 5G broadcasting

9.6.2 JAPAN

9.6.2.1 Japanese operators are using LTE broadcast in connected car applications

9.6.3 SOUTH KOREA

9.6.3.1 South Korea is among the leading countries to launch 5G services

9.6.4 INDIA

9.6.4.1 India is emerging as one of the technically strong and fast-growing economies

9.6.5 REST OF APAC (ROAPAC)

9.7 IMPACT OF COVID-19 ON APAC

9.8 REST OF THE WORLD (ROW)

TABLE99 LTE AND 5G BROADCAST MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE100 LTE AND 5G BROADCAST MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE101 LTE AND 5G BROADCAST MARKET FOR ROW, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE102 LTE AND 5G BROADCAST MARKET FOR ROW, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE103 LTE BROADCAST MARKET IN ROW, BY END USE, 2017–2020 (USD MILLION)

TABLE104 LTE BROADCAST MARKET IN ROW, BY END USE, 2021–2026 (USD MILLION)

TABLE105 5G BROADCAST MARKET IN ROW, BY END USE, 2021–2026 (USD THOUSAND)

9.8.1 SOUTH AMERICA

9.8.2 MIDDLE EAST AND AFRICA

10 COMPETITIVE LANDSCAPE (Page No. - 140)

10.1 OVERVIEW

FIGURE 49 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS AS KEY GROWTH STRATEGIES DURING 2017 TO 2020

10.2 MARKET SHARE ANALYSIS, 2020

FIGURE 50 MARKET SHARE OF KEY COMPANIES IN LTE AND 5G BROADCAST MARKET, 2021

TABLE 106 LTE AND 5G BROADCAST MARKET: DEGREE OF COMPETITION

10.3 LTE AND 5G BROADCAST MARKET: RANK ANALYSIS

FIGURE 51 LTE AND 5G BROADCAST MARKET RANKING 2020

10.4 MARKET EVALUATION FRAMEWORK

FIGURE 52 LTE AND 5G BROADCAST MARKET: MARKET EVALUATION FRAMEWORK

10.5 REVENUE ANALYSIS

FIGURE 53 REVENUE ANALYSIS: TOP 5 PLAYERS

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 EMERGING LEADER

10.6.4 PARTICIPANT

FIGURE 54 LTE AND 5G BROADCAST MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

10.7 COMPANY EVALUATION QUADRANT SME EVALUATION MATRIX FOR LTE AND 5G BROADCAST MARKET, 2020

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 55 LTE AND 5G BROADCAST MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, SME ECOSYSTEM, 2020

TABLE 107 COMPANY PRODUCT FOOTPRINT

TABLE 108 COMPANY APPLICATION FOOTPRINT

TABLE 109 COMPANY INDUSTRY FOOTPRINT

TABLE 110 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 111 LTE AND 5G BROADCAST MARKET: PRODUCT LAUNCHES, FEBRUARY 2018–FEBRUARY 2021

10.8.2 DEALS

TABLE 112 LTE AND 5G BROADCAST MARKET: DEALS, JANUARY 2018–FEBRUARY 2021

11 COMPANY PROFILES (Page No. - 172)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 QUALCOMM

TABLE 113 QUALCOMM: BUSINESS OVERVIEW

FIGURE 56 QUALCOMM: COMPANY SNAPSHOT

11.1.2 SAMSUNG

TABLE 114 SAMSUNG: BUSINESS OVERVIEW

FIGURE 57 SAMSUNG: COMPANY SNAPSHOT

11.1.3 HUAWEI

TABLE 115 HUAWEI: BUSINESS OVERVIEW

FIGURE 58 HUAWEI: COMPANY SNAPSHOT

11.1.4 CISCO

TABLE 116 CISCO: BUSINESS OVERVIEW

FIGURE 59 CISCO: COMPANY SNAPSHOT

11.1.5 ZTE

TABLE 117 ZTE: BUSINESS OVERVIEW

FIGURE 60 ZTE: COMPANY SNAPSHOT

11.1.6 ERICSSON

TABLE 118 ERICSSON: BUSINESS OVERVIEW

FIGURE 61 ERICSSON: COMPANY SNAPSHOT

11.1.7 NOKIA

TABLE 119 NOKIA: BUSINESS OVERVIEW

FIGURE 62 NOKIA: COMPANY SNAPSHOT

11.1.8 NEC

TABLE 120 NEC: BUSINESS OVERVIEW

FIGURE 63 NEC: COMPANY SNAPSHOT

11.1.9 ENENSYS TECHNOLOGIES

TABLE 121 ENENSYS TECHNOLOGIES: BUSINESS OVERVIEW

11.1.10 RHODE & SCHWARZ

TABLE 122 ROHDE & SCHWARZ: BUSINESS OVERVIEW

11.2 OTHER KEY PLAYERS

11.2.1 ATHONET

TABLE 123 ATHONET: BUSINESS OVERVIEW

11.2.2 AT&T

TABLE 124 AT&T: BUSINESS OVERVIEW

11.2.3 TELSTRA

TABLE 125 TELSTRA: BUSINESS OVERVIEW

11.2.4 INTEL

TABLE 126 INTEL: BUSINESS OVERVIEW

11.2.5 KT

TABLE 127 KT: BUSINESS OVERVIEW

11.2.6 VERIZON WIRELESS

TABLE 128 VERIZON: BUSINESS OVERVIEW

11.2.7 KDDI

TABLE 129 KDDI: BUSINESS OVERVIEW

11.2.8 SK TELECOM

TABLE 130 SK TELECOM: BUSINESS OVERVIEW

11.2.9 T-MOBILE

TABLE 131 T-MOBILE: BUSINESS OVERVIEW

11.2.10 NETGEAR

TABLE 132 NETGEAR: BUSINESS OVERVIEW

11.2.11 SAANKHYA LABS

TABLE 133 SAANKHYA LABS: BUSINESS OVERVIEW

11.2.12 ALTAIR SEMICONDUCTOR

TABLE 134 ALTAIR SEMICONDUCTOR: BUSINESS OVERVIEW

11.2.13 SPINNER GROUP

TABLE 135 SPINNER GROUP: BUSINESS OVERVIEW

11.2.14 UANGEL

TABLE 136 UANGEL: BUSINESS OVERVIEW

11.2.15 QUECTEL

TABLE 137 QUECTEL: BUSINESS OVERVIEW

11.2.16 SEQUANS COMMUNICATIONS

TABLE 138 SEQUANS COMMUNICATIONS: BUSINESS OVERVIEW

11.2.17 CHINA UNICOM

TABLE 139 CHINA UNICOM: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 229)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

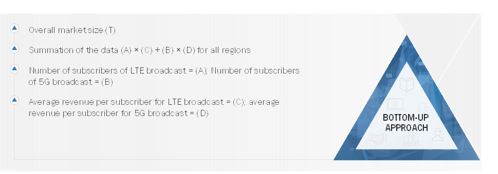

The research study involved 4 major activities in estimating the size of the LTE and 5G broadcast market. Exhaustive secondary research has been done to collect significant information on the LTE and 5G broadcast market, peer market, and parent market. The validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. Post which the market breakdown and data triangulation have been used to estimate the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred for this research study includes LTE Broadcast Alliance, Global Mobile Suppliers Association, World Semiconductor Trade Statistics (WSTS), Semiconductor Industry Association (SIA), European Broadcasting Union, International Telecommunication Union and International Telecommunication Society.

In the LTE and 5G broadcast market report, the top-down, as well as the bottom-up approaches, have been used for the estimation and validation of the size of the LTE and 5G broadcast market, along with several other dependent submarkets. The major players in the LTE and 5G broadcast market were identified using extensive secondary research and their presence using primary and secondary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

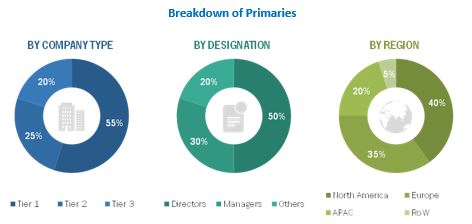

Primary Research

Extensive primary research has been conducted after understanding and analyzing the LTE and 5G broadcast market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific (APAC), and the Rest of the World (The South America, Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the LTE and 5G broadcast market, as well as that of various other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying the number of LTE and upcoming 5G subscribers globally

- Identifying the penetration of LTE broadcast among LTE subscribers and 5G broadcast among 5G subscribers based on product or solution launches/deployments/trials in the market

- Identifying the revenue generated per subscriber, excluding the normal revenue generated via voice services

- Multiplying the revenue generated per subscriber from LTE and 5G broadcast services with LTE and 5G broadcast subscribers to arrive at the global market size

- Identifying various end uses currently availing or expected to avail LTE and 5G broadcast services

- Analyzing each end use segment, along with the related major companies and LTE and 5G broadcast device/service providers, and identifying service providers for the implementation of the broadcast ecosystem

- Understanding the demand generated by companies providing services across different end use segments

- Tracking the ongoing and upcoming implementation of LTE and 5G broadcast projects across end-use segments and forecasting the market based on these developments and other parameters

- Conducting multiple discussions with key opinion leaders to understand the type of connectivity technology products and services, designed and developed for end-user segments; the discussions help analyze the breakdown of the scope of work carried out by each major company in the market

- Arriving at the market estimates through country-wise analysis of LTE and 5G broadcast companies; thereafter, combining country-wise data to arrive at the market estimates, by region

- Verifying and cross-checking the estimates at every level via discussions with key opinion leaders, including CXOs, directors, and operation managers; and, finally, with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, for this process

Market Size Estimation Methodology-Bottom-up Approach

After arriving at the overall market size from the estimation process explained above, the overall LTE and 5G broadcast market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the LTE and 5G broadcast market has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, and forecast the LTE and 5G broadcast market, in terms of value and volume, by technology, end use and region

- To forecast the market, for various segments with respect to 4 main regions— North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value and volume

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall LTE and 5G broadcast market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the LTE and 5G broadcast growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the LTE and 5G broadcast market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the LTE and 5G broadcast market landscape

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players, startups and comprehensively analyze their market ranking and core competencies2

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the LTE and 5G broadcast market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in LTE and 5G Broadcast Market