Marine Battery Market Size, Share and Trends

Marine Battery Market by Type (Lithium, Sodium-ion, Nickel Cadmium, Lead-acid, Fuel-cell), Vessel Type (Commercial, Defense, Unmanned Maritime Vehicles) Function, Capacity, Propulsion, Power, Design, Form, Sales, Regions, Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The marine battery market is projected to grow to USD 1.51 billion by 2030, at a CAGR of 9.3 % from 2024 to 2030. The Volume of Lithium battery type is projected to grow from 5,43,635 (Units) in 2024 to 9,41,918 (Units) in 2030. The Marine Battery Market is supported by the global shift toward low-emission hybrid and electric propulsion, with rising public and private investment in sustainable vessel technologies. Growing emphasis on energy efficiency and improvements in battery management systems further reinforce adoption by enhancing operational safety and performance.

KEY TAKEAWAYS

-

By RegionThe Europe Marine Battery Market accounted for a 44.2% revenue share in 2024.

-

By FunctionBy Function type, the Dual-Purpose Batteries function segment is expected to register the highest CAGR of 12.6%.

-

By PowerBy Power type, the75–150 kw power segment is projected to grow at the fastest rate from 2024 to 2030.

-

By CapacityBy Capacity type, the >250 AH capacity segment is expected to dominate the market.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSCompany Siemens Energy, Leclanché SA, and Corvus Energy were identified as some of the star players in the Marine Battery Market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - START UPSCompanies EST-Floattech, US Battery, and EverExceed Industrial Co., Ltd, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The Marine Battery Market is witnessing steady growth, driven by the shift toward low-emission hybrid and electric vessels, supported by investments in sustainable technologies and advancements in battery management systems that improve efficiency and safety. The Marine Battery Market is expected to expand as regulatory pressure, fleet electrification, and technological improvements accelerate adoption across commercial and defense vessels.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business in the Marine Battery Market is shaped by evolving electrification requirements and shifts across the maritime sector. Ship manufacturers, service providers, and commercial, freight, and naval shipbuilders are key adopters, driven by priorities such as clean propulsion and fleet modernization. Increasing deployment of hybrid and electric vessels, growth in commercial shipping, and advancements in battery technologies are altering operational models and cost structures, reinforcing demand for marine battery systems and associated services.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising fuel costs and need for operational efficiency

-

Growth in demand for electric and hybrid marine vessels

Level

-

High initial capital requirements

-

Inadequate charging infrastructure

Level

-

Electrification of short-range vessels

-

Hybrid propulsion systems

Level

-

Energy density limitations

-

Supply chain constraints and raw material shortage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising fuel costs and need for operational efficiency

Escalating fuel prices and tightening environmental regulations are pushing operators toward electric and hybrid propulsion as a more cost-efficient alternative to conventional marine fuels. Battery-powered vessels reduce fuel dependence and offer lower operating costs, particularly for short-range and recreational segments. As the industry prioritizes efficiency and sustainability, battery adoption is rising across commercial and leisure fleets.

Restraint: High initial capital requirements

High upfront costs for advanced lithium-ion and solid-state batteries, along with the need for charging infrastructure and integrated propulsion systems, remain a barrier to adoption. These expenses are challenging for small operators and low-margin commercial segments. Although incentives and technological improvements are reducing costs, capital intensity continues to delay large-scale deployment and retrofitting activity.

Opportunity: Electrification of short-range vessels

Short-range vessels such as ferries, passenger boats, and coastal service fleets offer strong potential for electrification due to predictable routes and stricter emission regulations. Government incentives, port-level requirements, and advances in battery density and lifecycle performance are accelerating adoption. As demand for low-emission marine transport grows, manufacturers have a significant opportunity to expand battery deployment in high-utilization, near-shore segments.

Challenge: Energy density limitations

Current battery technologies still face constraints in delivering the energy density required for long-range voyages and high-power marine operations. Storage capacity relative to weight and volume restricts the practicality of fully electric solutions for heavy-duty vessels. Continued investment in infrastructure and advancements in next-generation chemistries are needed before adoption can extend to long-duration and deep-sea applications.

MARINE BATTERY MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Lithium-ion battery–based hybrid propulsion for Japan’s first hybrid freight coaster (Utashima) | Lower fuel use, reduced emissions, battery-only port operations |

|

Hybrid energy storage system with lithium-ion batteries for a hybrid tugboat | Lower fuel consumption, reduced emissions, improved power distribution |

|

SCiB battery system integration for electric ferry Damen Ferry 2306E3 | Reliable electric propulsion, reduced fuel costs, zero exhaust emissions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The marine battery ecosystem is structured around OEMs, aftermarket suppliers, and service providers that collectively enable battery deployment and lifecycle support across the maritime sector. OEMs such as Siemens Energy, EnerSys, Leclanché, Corvus Energy, and Toshiba develop core battery systems used in electric and hybrid vessels. Aftermarket players including Sensata, PowerTech, Furukawa Battery, and East Penn supply replacement units, components, and monitoring solutions that ensure continued operability. Service providers like Clarios, Manly, EverExceed, Exide, and KSB support maintenance, charging, and performance optimization, completing the value chain for reliable marine energy storage.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Marine Battery Market , By Type

Lithium batteries dominate due to their superior energy density, extended cycle life, rapid charging capability, and low maintenance profile. Their ability to support both hybrid and fully electric propulsion makes them the preferred chemistry for modern marine electrification initiatives.

Marine Battery Market , By Power

The 150–745 kW range dominates because it aligns with the power requirements of mid-size commercial vessels, tugs, and ferries that are rapidly adopting hybrid and electric systems. This segment balances performance and energy efficiency, making it the preferred choice for operational and regulatory compliance.

Marine Battery Market , By Propulsion

Dual-purpose batteries lead the market as they support both starting and deep-cycle energy needs, enabling vessel operators to use a single system for multiple functions. This versatility reduces system complexity, lowers installation and maintenance costs, and improves overall operational efficiency.

Marine Battery Market , By Capacity

Batteries below 100 AH dominate because they are widely used in auxiliary systems, backup power, and smaller vessels, which represent the largest volume of installations. Their lower cost and ease of integration further expand their adoption.

Marine Battery Market , By Form

Prismatic cells hold the largest share because they provide higher energy density within a compact and stable form factor, which is critical for space-constrained marine installations. Their structural stability and improved thermal performance make them well-aligned with maritime safety and operational requirements.

Marine Battery Market , By Design

Liquid/gel-based batteries dominate because they provide stable performance, enhanced safety, and lower maintenance compared to traditional flooded designs. Their suitability for harsh marine conditions makes them widely preferred.

Marine Battery Market , By Sales

The aftermarket dominates because vessels require frequent battery replacements, upgrades, and maintenance throughout their lifecycle. Continuous demand for replacement units, monitoring systems, and system servicing drives recurring revenue.

Marine Battery Market , By Function

Starting batteries remain dominant as every vessel, regardless of propulsion type, requires reliable engine ignition power. Their consistent demand across commercial, industrial, and leisure segments drives market volume.

Marine Battery Market , By Vessel Type

Commercial vessels lead the segment due to rising electrification across ferries, cargo vessels, workboats, and offshore service fleets. Higher operational hours and stricter emissions requirements accelerate battery adoption in this category.

REGION

North America to be fastest-growing region in global Marine Battery Market during forecast period

The North American Marine Battery Market is expected to register the highest CAGR during the forecast period, driven by strong decarbonization policies, rising adoption of sustainable maritime solutions, and rapid technological advances in marine battery systems. The region’s expanding naval fleet, growth in coastal shipping, and increasing ship deliveries further accelerate demand. Additionally, early assessment and uptake of hybrid and fully electric vessel technologies support sustained market expansion.

MARINE BATTERY MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

In the Marine Battery Market matrix, Siemens Energy (Star) holds a leading position supported by a broad technology portfolio and proven energy storage solutions, with its high-performance battery systems widely deployed across commercial, passenger, and hybrid-electric vessels. US Battery (Emerging Leader) is strengthening its position through specialized deep-cycle marine batteries and targeted innovation that supports commercial and recreational vessel requirements. As demand for durable, high-capacity systems grows, the company is well-placed to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens Energy (German)

- Leclanché SA (Switzerland)

- Corvus Energy (Norway)

- Toshiba Corporation (japan)

- EnerSys (US)

- Saft (France)

- Shift (Canada)

- Sensata Technologies, Inc. (US)

- PowerTech Systems (India)

- The Furukawa Battery Co, Ltd. (Japan)

- East Penn Manufacturing Company (US)

- Korea Special Battery Co., Ltd. (South Korea)

- Clarios (US)

- Exide Technologies (US)

- Shenzhen Manly Battery Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.88 Billion |

| Market Forecast in 2030 (Value) | USD 1.51 Billion |

| Growth Rate | CAGR of 9.3% from 2024-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: MARINE BATTERY MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Whats clarity on whether aftermarket data is included | Needs current kWh-basis prices for Corvus Blue Whale and Corvus Orca |Wants forecast of kWh-basis price transition through 2030 | Requires broader market-level kWh price forecast to support multi-vendor sourcing |

|

|

RECENT DEVELOPMENTS

- September 2024 : Leclanché SA (Switzerland) launched the XN50, which is the world’s first lithium-ion battery cell utilizing Echion Technologies’ XNO a niobium-based anode material. The product XN50 boasts an impressive cycle life of over 10,000 cycles, making it well-suited for demanding, heavy-duty applications across the rail, marine, and mining industries. This new technology helps to enhance battery durability and performance in sectors requiring long-lasting energy storage solutions.

- August 2024 : Corvus Energy and Wärtsilä(Finland) collaborated to develop the world’s largest battery electric ship a 130-meter ferry which is designed to accommodate 2,100 passengers and crew, along with 225 cars. This marine vessel will be powered by an impressive 40 MWh battery system and the delivery of this vessels is scheduled for the end of 2024.

- March 2024 : Corvus Energy (Canada) secured a contract to supply a battery energy storage system for the Magellan Discoverer. It will be the first hybrid diesel-electric vessel to be built in South America. Corvus Energy is contracted to provide its Orca Energy Storage system, enabling zero-emission operation for the vessel. This battery system will be used into ABB’s comprehensive power plant delivery for the ship for enhancement of its environmental performance and operational efficiency.

- November 2023 : Shift (Canada) and Garden Reach Shipbuilders & Engineers Ltd (GRSE)(Kolkata) collaborated together with Seatech Solutions International (Singapore) and the American Bureau of Shipping (ABS) stating that they will be developing the innovative E-VOLT 50, a 50-ton bollard pull electric tug. This project will significantly help reduce carbon emissions, enhancing operational efficiency in marine vessels.

- January 2024 : Furukawa Electric Co., Ltd. (Japan) announced a new share subscription agreement which have involved investment of approx. 10 million pounds in Tokamak Energy Ltd. (UK). The aim of this agreement is to accelerate the advancement of commercial fusion energy.

Table of Contents

Methodology

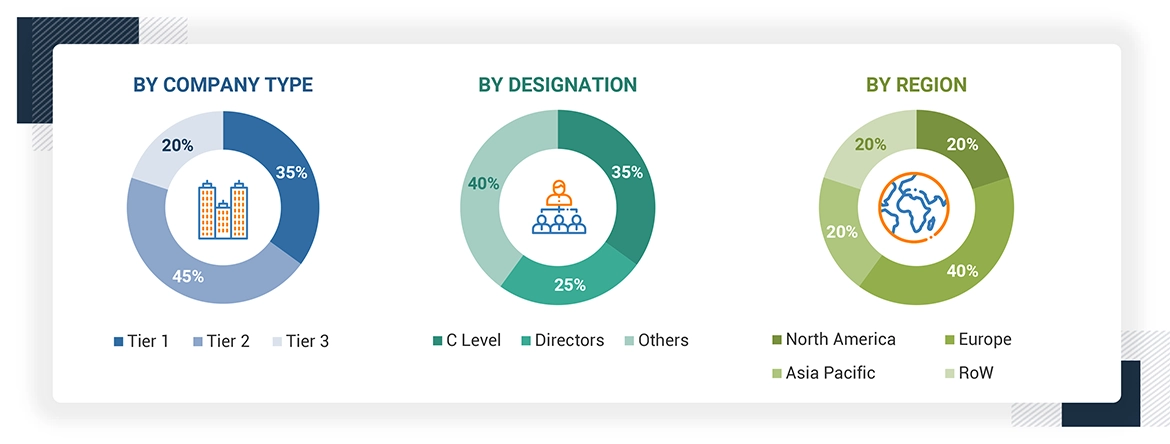

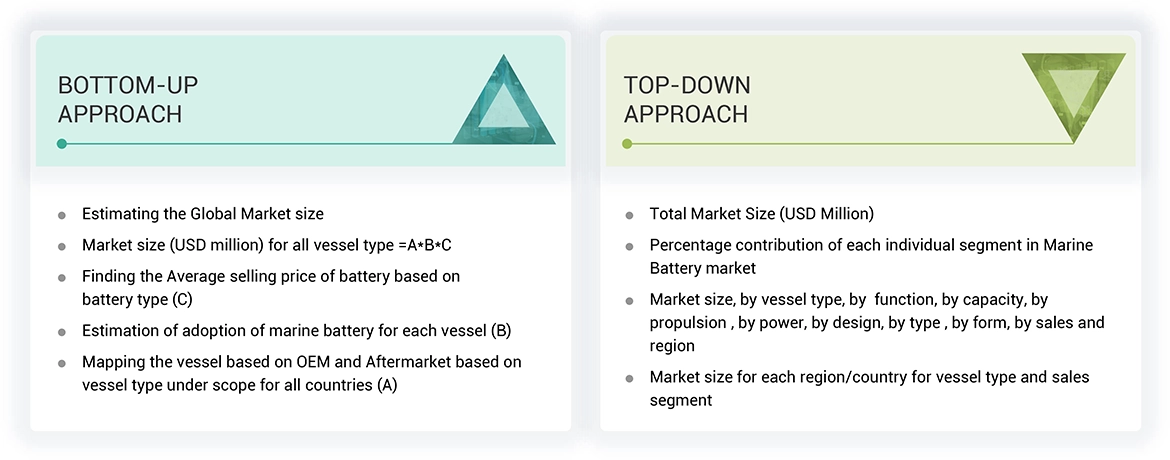

The research study conducted on the marine battery market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market as well as assess the growth prospects of the market. A deductive approach, also known as the bottom-up approach combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the marine battery market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the marine battery market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Tiers of companies are based on their revenue in 2023. Tier 1: company revenue greater than USD 1 billion; tier 2: company revenue between USD 100 million and USD 1 billion; and tier 3: company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the marine battery market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, marine vessel maintenance professionals, and SMEs of leading companies operating in the marine battery market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the marine battery market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Marine Battery Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the marine battery market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the marine battery market size was validated using the top-down and bottom-up approaches.

Market Definition

The marine battery market refers to the development of batteries specifically designed for use in marine environments. A marine battery is an energy device that converts chemical energy into electrical energy through electrochemical reactions. It consists of one or more electrochemical cells with terminals that provide power to various systems on vessels, including propulsion, navigation, and auxiliary equipment. Available in chemistry like lithium-ion, lead-acid, and fuel cells, marine batteries are built to withstand harsh marine conditions, offering different capacities to match vessel sizes and requirements, which is important in supporting sustainable maritime operations, with applications in fully electric ships such as deep-cycle batteries mainly used for propulsion, hybrid ships use dual-purpose batteries in the auxiliary system such as starting, lighting, etc. and fuel-powered vessels adoption of starter batteries to assist during engine ignition.

Key Stakeholders

- Marine Battery Suppliers

- Marine Battery Component Manufacturers

- Marine Battery Manufacturers

- Technology Support Providers

- Marine Battery Solution Providers

- Regulatory Bodies

- Defense Forces

- Ship Operators

- System Integrators

Report Objectives

- To define, describe, segment, and forecast the size of the marine battery Market based on vessel type, function, capacity, propulsion, power, design, type, sales, form and region.

- To forecast sizes of various segments of the market with respect to six major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with major countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe.

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market.

- To provide an overview of the regulatory landscape with respect to drone regulations across regions.

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders by identifying key market trends.

- To profile key market players and comprehensively analyze their market shares and core competencies.

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market.

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

- Next Generation Solid-state Battery Technology: Next Generation Solid-state Battery Technology is a revolutionary innovation in the maritime energy industry, pertaining to high safety, efficiency, and energy density. Solid electrolytes replace liquids, thus preventing leakage risks, fire hazards, and thermal runaway. Next Generation Solid-state battery technology batteries are more compact and durable, and they are also very suitable for marine environments that place enormous demands on products. This batteries have a greater energy capacity which is useful for longer voyages and supporting hybrid as well as pure battery propulsion systems, which align with the industry's step toward emissionless operation. As research and development advance, such batteries are slated to dramatically alter maritime energy storage, providing sustainable and reliable power solutions for modern vessels.

- Advanced Battery Management Systems: Advanced Battery Management Systems are utilized in marine vessels for enhancing the performance, safety, and lifespan of all the marine batteries. This Advanced Battery Management System monitor all parameters like voltage, temperature, current, and state of charge in real-time when it comes to the operation of battery packs. Overcharging, overheating, and deep discharging could cause quite a number of faults to arise in the battery. Advanced BMS controls and optimizes the hybrid or electrical vessels' energy supply and demand, allowing the reduction of operational costs and improving reliability in hybrid and electrical vessels. Advanced BMS technology can support the maritime industry's shift towards sustainable and high-performance energy solutions through predictive maintenance, faults detection, and seamless integration with onboard systems.

- Growth in Electric and Hybrid Marine Vessels

- Advances in Battery Technology

- Stringent Environmental Regulations

- Increasing Trend Towards Decarbonization and Renewable Energy Integration

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Marine Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Marine Battery Market

Nick

Sep, 2022

Writing my bachelors degree within valuation. The company I am valuing is Corvus Energy, this report would to huge help. .