Micromachining Market by Type (Traditional, Non-traditional, Hybrid), Process (Additive, Subtractive, Others), Axis (3 axes, 4 axes, 5 axes), Industry (Automotive, Aerospace & Defense), and Geography - Global Forecast to 2025

Micromachining Market

Micromachining Market and Top Companies

The Micromachining market is a highly competitive market, with many global and regional players operating in it. COHERENT, INC (US), Georg Fischer Ltd. (Switzerland), Makino Milling Machine Co., Ltd. (Japan), Lumentum Holdings Inc. (US), Mitsubishi Heavy Industries, Ltd (Japan), DATRON Dynamics, Inc. (US), Han’s Laser Technology Industry Group Co., Ltd (China), Electro Scientific Industries, Inc. (US), IPG Photonics Corporation (US), and Heraeus Holding GmbH (Germany).

COHERENT

COHERENT is one of the leading companies in the market. The company focuses on offering micromachining based on laser technology only and hence has a comprehensive product portfolio. Higher than 80% of the revenue is received outside of the US, suggesting that the company has a strong reach worldwide. It has operation centers in various countries, including the US, Germany, and China, among others, but is not present in other countries such as India, where the market is significant.

Georg Fischer

The company has a strong micromachining product portfolio and also has a strong presence in Europe. With more than 50% revenue from the Europe region, the company can now expand outside Europe by focusing on emerging countries such as India, Brazil, and China. Also, introducing micromachining tools other than laser-based can increase revenue sources.

Makino

The company offers high-quality metal cutting and EDM machines that include horizontal machining centers, vertical machining centers, 5 axes machining centers, graphite machining centers, and wire and sinker EDMs. The company has a presence in Asia, Americas, and Europe. The micromachining offerings by the company have features such as advanced spindle temperature control, rigid machine construction, and unique EDM advancements. The micromachining equipment is capable of high-speed machining and repeatability. The company offers a deeper product portfolio in wire EDM that makes it robust in the market.

Han’s Laser

The company offers laser marking machines, laser welding machines, laser cutting machines, 3D printers, collaborative robots, CNCs, and gap & step inspection machines. The industries catered by the company are automotive, metal, semiconductors & electronics, and packaging. The products offered by the company under micromachining are used for UV laser depaneling, laser marking, laser decoating, laser wire stripping, and wafer laser marking.

Lumentum

Lumentum has laser-based micromachining product offerings. The company has a limited number of products in its product portfolio, which can be increased. The company has a reach in the Asia Pacific region, where there is significant growth. It can expand its business to this region, especially in countries such as India, to stay competitive in the market. Acquisition of local players in India and China can boost the company’s position in the market.

Micromachining Market and Top Industries

Automotive

Micromachining in the automobile industry is widely used to increase the functionality of products and for miniaturization. Micromachined devices have applications in accelerometers, speed sensors, and temperature and pressure sensors. The demand for micromachining is also increasing due to recent advancements in micro electro mechanical system (MEMS) devices used in automobiles. Micromachining is widely used in the automotive industry. For example, fuel injector nozzles are used in the fuel injection technology of various automobiles. This fuel injection technology not only improves the mileage of the vehicle but also consumes less fuel. Fuel injector nozzles are normally micromachined by the electrical discharge machining (EDM) process. The laser technology in micromachining is widely used in seamless welding and joining in the automotive industry for various vehicle components. Electronic components used in automobiles and electro voltaic cells used in electric vehicles are driving the market

Medical & Aesthetics

The main goal of the medical industry is to reduce the cost of medicines, improve medical outcomes, and shorten recovery times. Medical procedures have to rely on tiny micromachined devices. Minimally invasive medical devices are used in electrophysiology, embolic protection, and stenting. Electrophysiology devices are used to treat cardiac disorders. In electrophysiology, cauterization and cryogenic catheters are used to kill tissue selectively, and this requires the use of micromachined devices. Laser machines are used in Lasik surgery, which requires micromachined precision.

Aerospace & Defence

Micromachined parts are widely used in engines, navigational systems, and heads-up displays, among others, in the aerospace industry. Micromachining in the aerospace industry includes micro milling and micro turning of various arrays of materials that possess the required high tolerances. The various aerospace micromachining applications include aircraft parts, auxiliary equipment of aircraft and others, engine parts, electronic assemblies, actuators, sensors, measurement systems, optical MEMS, and navigation displays, among others.

Telecommunications

There is an increasing demand for mobility, interconnectivity, and bandwidth, which is leading to the significant expansion of the telecommunication infrastructure worldwide. The introduction of the optical fiber-based telecommunication infrastructure has led to the high rise of the optically-related MEMS technology system, micro-opto-electro-mechanical systems (MOEMS). Micromachining plays a crucial role in the manufacture of MEMS sensors. Micromachining has enabled the low-cost manufacture of MEMS, and mass production of MEMS optical components and devices is made possible. MEMS are widely used in optical and radio frequency (RF) telecommunication applications owing to advantages in cost, performance, and integration.

Micromachining Market and Top Processes

Additive

Additive machining or manufacturing is also known as 3D printing. Additive micromachining comprises surface micromachining, which is further sub segmented into chemical vapor deposition (CVD), electro deposition, epitaxy, and physical vapor deposition (PVD). The additive process is widely used in industries such as automotive, aerospace, semiconductors & electronics, and healthcare. The layer by layer additive process makes additive micromachined equipment extremely adaptable to a wide range of products as compared to the subtractive micromachining process, which is required to be designed for each product. This advantage of additive micromachining is driving its market.

Subtractive

Unlike additive manufacturing, subtractive manufacturing removes thin films from surfaces through various processes, which include bulk micromachining, micro cutting, micro drilling, micro texturing, micro ablating, micro scribing, and micro engraving.

Others

Other processes include joining micro structures, which include micro welding and modifications in micro structures by micro marking and micro perforating. Generally, micro structures are joined by welding at the micro-level. Modifications in micro structures can be undertaken by micro marking on them or by perforating at the micro-level.

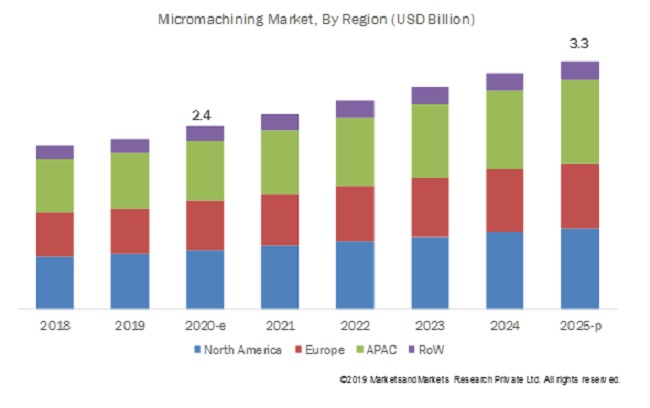

The global micromachining market size is expected to reach USD 3.3 billion by 2025 from USD 2.4 billion in 2020, growing at a CAGR of 6.2% during forecast period. Growth of this market is accelerated by growing demand for the miniaturization of electronic devices.

The Micromachining Market is witnessing robust growth driven by rising demand for precision manufacturing in sectors such as electronics, automotive, and medical devices. Key trends include the increasing adoption of advanced laser micromachining techniques and the integration of automation for enhanced efficiency and accuracy. As industries seek to miniaturize components while maintaining performance, the micromachining market is evolving to meet these needs, supported by technological advancements and a focus on cost-effective solutions. This dynamic environment positions micromachining as a critical player in the future of manufacturing processes.

The growth of this market is accelerated by the growing demand for the miniaturization of electronic devices and the rising preference of laser-based micromachining over the traditional approach.

Impact of AI Micromachining Market

The impact of artificial intelligence (AI) on the micromachining market is significantly enhancing precision, efficiency, and automation in manufacturing processes. AI-driven algorithms optimize micromachining techniques, such as laser, EDM, and micro milling, by enabling real-time monitoring, adaptive control, and predictive maintenance. This integration allows for greater accuracy in producing intricate microcomponents used in industries like electronics, aerospace, and medical devices. AI enhances the ability to analyze vast amounts of data, detect potential defects early, and reduce waste, leading to improved production timelines, lower costs, and higher-quality outcomes. As AI continues to evolve, it is driving the advancement of next-generation micromachining technologies.

Non-traditional micromachining segment to grow at the highest CAGR during the forecast period

Non-traditional micromachining consists of sub-types such as electrochemical micromachining, electrical discharge micromachining, ultrasonic micromachining, and laser micromachining. Laser micromachining and ultrasonic micromachining are some of the dominant sub-types of micromachining that offer ease of use, precision, and extensive usage in various industries. These advantages of laser and ultrasonic micromachining drives the market for non-traditional type micromachining.

Additive process of micromachining market to hold the highest growth rate during the forecast period

Additive machining or manufacturing is also known as 3D printing. The additive micromachining consists of surface micromachining which is further sub-segmented into chemical vapor deposition (CVD), electrodeposition, epitaxy, and physical vapor deposition (PVD).

With the increasing use of 3D printing for micromachining in industries such as medical & aesthetics, and semiconductor & electronics as it offers application flexibility and mass production of customized equipment heralds the highest growth rate of the additive process in micromachining market.

5-axes micromachining to witness the highest growth rate during the forecast period

5-axes micromachining is used in highly specialized industries for its precision. The application of the 5-axes is prominent in manufacturing medical components, automotive, military-grade products, petrochemical industry parts, and aerospace components. The addition of the 5th axis in the micromachining system increases the potential applications of the machine. Improved precision requires less movement of the material for micromachining, which drives the growth rate of the 5-axes micromachining market.

Automotive industry to hold the largest share of micromachining in 2019

Micromachining is used widely in the global automotive industry. For example, fuel injector nozzles are used in fuel injection technology of various automobiles. This fuel injection technology not only improves the mileage of the vehicle but also consumes less fuel.

Fuel injector nozzles are typically micromachined by the EDM process. The laser technology in micromachining is used widely in seamless welding and bonding in the automotive industry for various vehicle components. Electronic components used in automobiles and electro voltaic cells used in electric vehicles are driving the market for the automotive industry.

North America was the largest market for micromachining in 2019

North America accounted for a significant share of the global micromachining market in 2019. The region (for this study) includes the US, Canada, and Mexico. Leading companies in this region provide the most developed micromachining to various industries such as automotive and aerospace & defense. Some of the prominent companies from North America include General Motors, Ford, General Electric, Rockwell Automation, and Coherent, among others, that widely use micromachined products. The presence of all major companies, strong industrial demand, and steady supply-side drive the market in North America.

Key Market Players

Major players operating in the global micromachining market are Coherent, Inc. (US), Georg Fischer Ltd. (Switzerland), Makino Milling Machine Co., Ltd. (Japan), Lumentum Holdings Inc. (US), Mitsubishi Heavy Industries, Ltd (Japan), DATRON Dynamics, Inc. (US), Han’s Laser Technology Industry Group Co., Ltd (China), Electro Scientific Industries, Inc. (US), IPG Photonics Corporation (US), and Heraeus Holding GmbH (Germany), among others.

COHERENT is one of the leading companies in the micromachining market. The company has a laser technology-focused micromachining product portfolio for applications in microelectronics, materials processing, and OEM components and instrumentation. The laser solutions offered by the company are of various types such as diode-pumped solid-state lasers (DPSS), fiber lasers, gas lasers (CO, CO2, excimer, ion), optically pumped semiconductor lasers (OPSL), ultrafast (UF) lasers, and semiconductor lasers. The company has focused its micromachining offering based on laser technology only and hence has a comprehensive product portfolio based on it. Also, more than 80% of the revenue of the company comes from outside of the US, suggesting that the company has a substantial reach worldwide.

Makino is another major company in the micromachining market. The company offers high-quality metal cutting and EDM machines that include horizontal machining centers, vertical machining centers, 5-axis machining centers, graphite machining centers, and wire and sinker EDMs. The company is present in Asia, the Americas, and Europe. The micromachining offerings by the company have features such as advanced spindle temperature control, rigid machine construction, and unique EDM advancements. The micromachining equipment is capable of high-speed machining and repeatability. The company has a comprehensive product portfolio in wire EDM that makes it robust in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015–2025 |

|

Base year |

2019 |

|

Forecast period |

2020-2025 |

|

Market size units |

Value (USD) |

|

Segments covered |

Type, Process, Axis, Industry, and Region |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Coherent, Inc. (US), Georg Fischer Ltd. (Switzerland), Makino Milling Machine Co., Ltd. (Japan), Lumentum Holdings Inc. (US), Mitsubishi Heavy Industries, Ltd (Japan), DATRON Dynamics, Inc. (US), Han’s Laser Technology Industry Group Co., Ltd (China), Electro Scientific Industries, Inc. (US), IPG Photonics Corporation (US), and Heraeus Holding GmbH (Germany) |

In this report, the overall micromachining market has been segmented based on type, process, axis, industry, and geography.

By Type:

- Traditional

- Non-traditional

- Hybrid

By Process:

- Additive

- Subtractive

- Others

By Axis:

- 3-axes

- 4-axes

- 5-axes

- Others

By Industry:

- Automotive

- Semiconductor & Electronics

- Aerospace & Defense

- Medical & Aesthetics

- Telecommunications

- Power & Energy

- Plastics & Polymers

- Gems & Jewelry

- Others (Machine tools & Manufacturing, Watchmaking, Glass)

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Following are a few of the recent developments in the micromachining market:

- In September 2019, Georg Fischer opened a new production center in Biel (Switzerland) for machining solutions.

- In July 2019, Makino introduced the U6 H.E.A.T. Extreme wire EDM machine that uses 0.016" coated wire technology. This machine increases rough machining rates up to 300% as compared to traditional 0.010" brass wire while maintaining comparable wire consumption rate.

- In February 2019, Coherent launched ExactCut, a fine materials processing equipment. It is micromachining equipment that cuts metals, alloys, sapphire, polycrystalline diamond (PCD), and ceramics. This equipment is used in manufacturing applications for electronics, medical devices, horology, and automotive.

Key Questions Addressed by the Report:

- Which type of micromachining is most likely to have the highest demand in the near future?

- What are the opportunities and challenges for the players in the micromachining market?

- Which region will have the highest demand for micromachining?

- Which company is leading in the micromachining market at present?

- Which industry adopts micromachining at the highest rate?

Frequently Asked Questions (FAQ):

Which are the major types of Micromachining? How huge is the opportunity for their growth in the next five years?

The major types of micromachining includes traditional, non-traditional, and hybrid and it is expected that laser-based material micromachining will lead to huge opportunity till 2025.

Which are the major companies in the micromachining market?

The major companies in micromachining market includes Coherent, Inc. (US), Georg Fischer Ltd. (Switzerland), Makino Milling Machine Co., Ltd. (Japan), Lumentum Holdings Inc. (US), Mitsubishi Heavy Industries, Ltd (Japan), DATRON Dynamics, Inc. (US), Han’s Laser Technology Industry Group Co., Ltd (China), Electro Scientific Industries, Inc. (US), IPG Photonics Corporation (US), and Heraeus Holding GmbH (Germany), among others.

What is the fastest growing micromachining procedure?

The additive micromachining consists of surface micromachining which is further sub-segmented into chemical vapor deposition (CVD), electrodeposition, epitaxy, and physical vapor deposition (PVD). With the increasing use of 3D printing for micromachining in industries such as medical & aesthetics, and semiconductor & electronics as it offers application flexibility and mass production of customized equipment heralds the highest growth rate of the additive process in micromachining market.

What are the drivers and opportunities for the optoelectronic components market?

Factors such as risingin demand for miniaturization of microeletronic devices and preferrence of laser-based material micromachining over traditional micromaching is expected to drive the market. Moreover, regulatory compliances is expected to affect market growth.

Which end user industry is expected to drive the growth of the market in the next 5 years?

The market for the automotive vertical is expected to grow at the highest CAGR during the forecast period. The laser technology in micromachining is used widely in seamless welding and bonding in the automotive industry for various vehicle components. Electronic components used in automobiles and electro voltaic cells used in electric vehicles are driving the market for the automotive industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Inclusions/Exclusions

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at the Market Size Using the Bottom-Up Analysis

2.2.2 Top-Down Approach

2.2.2.1 Approach for Arriving at the Market Size Using the Bottom-Up Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Micromachining Market

4.2 Micromachining Market, By Type (2020–2025)

4.3 Micromachining Market, By Process (2020 and 2025)

4.4 Micromachining Market, By Axis (2020 and 2025)

4.5 Micromachining Market, By Industry (2020 and 2025)

4.6 Market, By Region (2020–2025)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for the Miniaturization of Microelectronic Devices

5.2.1.2 Laser-Based Material Micromachining Preferred Over the Traditional Approach

5.2.2 Restraints

5.2.2.1 Regulatory Compliances

5.2.3 Opportunities

5.2.3.1 Development of the Sensor Fusion Technology

5.2.4 Challenges

5.2.4.1 Requirement of Low-Cost Solutions

5.2.4.2 Environmental Concerns Over the Use of Rare Earth Elements

6 Micromachining Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Traditional

6.2.1 Traditional Type to Lead the Automotive Market

6.2.1.1 Mechanical

6.2.1.1.1 Micro Milling

6.2.1.1.2 Micro Turning

6.2.1.2 Lithographie, Galvanoformung & Abformung (LIGA)

6.3 Non-Traditional

6.3.1 Non-Traditional Type Micromachining to Lead the Market

6.3.1.1 Electro-Chemical Micromachining (ECM)

6.3.1.2 Electrical Discharge Micromachining (EDM)

6.3.1.3 Ultrasonic Micromachining

6.3.1.4 Laser Micromachining

6.4 Hybrid Micromachining

6.4.1 Subtractive Process Leads the Hybrid Micromachining Market

7 Micromachining Market, By Process (Page No. - 50)

7.1 Introduction

7.2 Additive

7.2.1 Additive Process to Grow at the Highest CAGR in the Micromachining Market

7.2.1.1 Surface Micromachining

7.2.1.1.1 Chemical Vapor Deposition (CVD)

7.2.1.1.1.1 Low Pressure CVD

7.2.1.1.1.2 Plasma Enhanced CVD

7.2.1.1.2 Electro Deposition

7.2.1.1.3 Epitaxy

7.2.1.1.4 Physical Vapor Deposition (Pvd)

7.3 Subtractive

7.3.1 Subtractive Process Projected to Lead the Market During the Forecast Period

7.3.1.1 Bulk Micromachining

7.3.1.1.1 Wet Etching

7.3.1.1.2 Dry Etching

7.3.1.2 Micro Cutting

7.3.1.3 Micro Drilling

7.3.1.4 Micro Texturing

7.3.1.5 Micro Ablating

7.3.1.6 Micro Scribing

7.3.1.7 Micro Engraving

7.4 Others

7.4.1 Joining

7.4.1.1 Micro Welding

7.4.2 Modifications

7.4.2.1 Micro Marking

7.4.2.2 Micro Perforating

8 Micromachining Market, By Axis (Page No. - 60)

8.1 Introduction

8.2 3 Axes

8.2.1 3 Axes Micromachining to Lead the Market During the Forecast Period

8.3 4 Axes

8.3.1 Non-Traditional Micromachining Projected to Lead the Market in 4 Axes Machines During the Forecast Period

8.4 5 Axes

8.4.1 5 Axes Micromachining to Grow at the Highest CAGR During the Forecast Period

8.5 Others

9 Micromachining Market, By Industry (Page No. - 68)

9.1 Introduction

9.2 Automotive

9.2.1 Non-Traditional Micromachining is Projected to Lead the Market in the Automotive Segment

9.3 Semiconductors & Electronics

9.3.1 Subtractive Process is Projected to Lead the Semiconductors & Electronics Industry

9.4 Aerospace & Defense

9.4.1 3 Axes and 5 Axes to Lead the Aerospace & Defense Market

9.5 Medical & Aesthetics

9.5.1 Europe Projected to Lead the Market in the Medical & Aesthetics Segment

9.6 Telecommunications

9.6.1 Additive Process in the Telecommunications Segment to Grow at the Highest CAGR

9.7 Power & Energy

9.7.1 The Hybrid Type is Projected to Grow at the Highest CAGR in the Power & Energy Segment

9.8 Plastics & Polymers

9.8.1 Additive Process to Grow at the Highest CAGR in the Plastics & Polymers Segment

9.9 Gems & Jewelry

9.9.1 Non-Traditional Segment to Lead in the Gems & Jewelery Industry

9.10 Others

10 Geographic Analysis (Page No. - 84)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Increasing Use of Micromachining in Automobile Industry

10.2.2 Canada

10.2.2.1 Promising Opportunities for Micromachining in Automotive Industry

10.2.3 Mexico

10.2.3.1 Consistent Growth in Automotive Industry to Boost Micromachining Market

10.3 Europe

10.3.1 UK

10.3.1.1 Presence of Prominent Automotive and Aerospace Companies Increases the Adoption of Micromachining in UK

10.3.2 France

10.3.2.1 Strong Aerospace Industry Boosts the Market for Micromachining in France

10.3.3 Germany

10.3.3.1 Significant Growth is Expected in Micromachining Market Due to Presence of Strong Automotive Industry

10.3.4 Rest of Europe

10.4 Asia Pacific (APAC)

10.4.1 China

10.4.1.1 Demand for Lasers is Rising Due to Increasing Manufacturing Activities in Automobile Industry

10.4.2 Japan

10.4.2.1 Rapid Industrialization and Modernization Makes Japan A Prominent Player in the Asia Pacific Region

10.4.3 South Korea

10.4.3.1 South Korea is One of the Most Industrialized Nations in Asia.

10.4.4 India

10.4.4.1 India is One of the Fastest-Growing Economies in the Asia Pacific.

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 98)

11.1 Overview

11.2 Ranking Analysis of Players in the Micromachining Market

11.3 Competitive Leadership Mapping, 2018

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

11.4 Competitive Scenario

11.4.1 Product Launches

11.4.2 Expansions

11.4.3 Partnerships

12 Company Profiles (Page No. - 102)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Key Players

12.1.1 Coherent

12.1.2 Georg Fischer

12.1.3 Makino

12.1.4 Lumentum

12.1.5 Mitsubishi

12.1.6 DATRON

12.1.7 Han’s Laser

12.1.8 Electro Scientific Industries

12.1.9 IPG Photonics

12.1.10 Heraeus

12.2 Right to Win

12.3 Other Key Players

12.3.1 Omax

12.3.2 3D Micromac

12.3.3 Lasea

12.3.4 Posalux

12.3.5 Scanlab

12.3.6 Tornos

12.3.7 Swisstec 3D

12.3.8 Kugler

12.3.9 GFH

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 125)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (101 Tables)

Table 1 Micromachining Market, By Type, 2017–2025 (USD Million)

Table 2 Micromachining Market for the Traditional Type, By Process, 2017–2025 (USD Million)

Table 3 Micromachining Market for the Traditional Type, By Axis, 2017–2025 (USD Million)

Table 4 Micromachining Market for the Traditional Type, By Industry, 2017–2025 (USD Million)

Table 5 Micromachining Market for the Traditional Type, By Geography, 2017–2025 (USD Million)

Table 6 Micromachining Market for the Non-Traditional Type, By Process, 2017–2025 (USD Million)

Table 7 Micromachining Market for the Non-Traditional Type, By Axis, 2017–2025 (USD Million)

Table 8 Micromachining Market for the Non-Traditional Type, By Industry, 2017–2025 (USD Million)

Table 9 Micromachining Market for the Non-Traditional Type, By Geography, 2017–2025 (USD Million)

Table 10 Market for the Hybrid Type, By Process, 2017–2025 (USD Million)

Table 11 Market for the Hybrid Type, By Axis, 2017–2025 (USD Million)

Table 12 Market for the Hybrid Type, By Industry, 2017–2025 (USD Thousand)

Table 13 Market for the Hybrid Type, By Geography, 2017–2025 (USD Million)

Table 14 Market, By Process, 2017–2025 (USD Million)

Table 15 Market for the Additive Process, By Type, 2017–2025 (USD Million)

Table 16 Market for the Additive Process, By Axis, 2017–2025 (USD Million)

Table 17 Market for the Additive Process, By Industry, 2017–2025 (USD Million)

Table 18 Market for the Additive Process, By Geography, 2017–2025 (USD Million)

Table 19 Market for the Subtractive Process, By Type, 2017–2025 (USD Million)

Table 20 Market for the Subtractive Process, By Axis, 2017–2025 (USD Million)

Table 21 Market for the Subtractive Process, By Industry, 2017–2025 (USD Million)

Table 22 Market for the Subtractive Process, By Geography, 2017–2025 (USD Million)

Table 23 Market for Other Processes, By Type, 2017–2025 (USD Million)

Table 24 Market for Other Processes, By Axis, 2017–2025 (USD Million)

Table 25 Market for Other Processes, By Industry, 2017–2025 (USD Million)

Table 26 Market for Other Processes, By Geography, 2017–2025 (USD Million)

Table 27 Market, By Axis, 2017–2025 (USD Million)

Table 28 Market for 3 Axes, By Process, 2017–2025 (USD Million)

Table 29 Market for 3 Axes, By Type, 2017–2025 (USD Million)

Table 30 Market for 3 Axes, By Industry, 2017–2025 (USD Million)

Table 31 Market for 3 Axes, By Geography, 2017–2025 (USD Million)

Table 32 Market for 4 Axes, By Process, 2017–2025 (USD Million)

Table 33 Market for 4 Axes, By Type, 2017–2025 (USD Million)

Table 34 Market for 4 Axes, By Industry, 2017–2025 (USD Million)

Table 35 Market for 4 Axes, By Geography, 2017–2025 (USD Million)

Table 36 Market for 5 Axes, By Process, 2017–2025 (USD Million)

Table 37 Market for 5 Axes, By Type, 2017–2025 (USD Million)

Table 38 Market for 5 Axes, By Industry, 2017–2025 (USD Million)

Table 39 Market for 5 Axes, By Geography, 2017–2025 (USD Million)

Table 40 Market for Other Axes, By Process, 2017–2025 (USD Million)

Table 41 Market for Other Axes, By Type, 2017–2025 (USD Million)

Table 42 Market for Other Axes, By Industry, 2017–2025 (USD Thousand)

Table 43 Market for Other Axes, By Geography, 2017–2025 (USD Million)

Table 44 Market, By Industry, 2017–2025 (USD Million)

Table 45 Market for the Automotive Industry, By Process, 2017–2025 (USD Million)

Table 46 Market for the Automotive Industry, By Type, 2017–2025 (USD Million)

Table 47 Market for the Automotive Industry, By Axis, 2017–2025 (USD Million)

Table 48 Market for the Automotive Industry, By Geography, 2017–2025 (USD Million)

Table 49 Market for the Semiconductors & Electronics Industry, By Process, 2017–2025 (USD Million)

Table 50 Market for the Semiconductors & Electronics Industry, By Type, 2017–2025 (USD Million)

Table 51 Market for the Semiconductors & Electronics Industry, By Axis, 2017–2025 (USD Million)

Table 52 Market for the Semiconductors & Electronics Industry, By Geography, 2017–2025 (USD Million)

Table 53 Market for the Aerospace & Defense Industry, By Process, 2017–2025 (USD Million)

Table 54 Market for the Aerospace & Defense Industry, By Type, 2017–2025 (USD Million)

Table 55 Market for the Aerospace & Defense Industry, By Axis, 2017–2025 (USD Million)

Table 56 Market for the Aerospace & Defense Industry, By Geography, 2017–2025 (USD Million)

Table 57 Market for the Medical & Aesthetics Industry, By Process, 2017–2025 (USD Million)

Table 58 Market for the Medical & Aesthetics Industry, By Type, 2017–2025 (USD Million)

Table 59 Market for the Medical & Aesthetics Industry, By Axis, 2017–2025 (USD Million)

Table 60 Market for the Medical & Aesthetics Industry, By Geography, 2017–2025 (USD Million)

Table 61 Market for the Telecommunications Industry, By Process, 2017–2025 (USD Million)

Table 62 Market for the Telecommunications Industry, By Type, 2017–2025 (USD Million)

Table 63 Market for the Telecommunications Industry, By Axis, 2017–2025 (USD Million)

Table 64 Market for the Telecommunications Industry, By Geography, 2017–2025 (USD Thousand)

Table 65 Market for the Power & Energy Industry, By Process, 2017–2025 (USD Thousand)

Table 66 Market for the Power & Energy Industry, By Type, 2017–2025 (USD Million)

Table 67 Market for the Power & Energy Industry, By Axis, 2017–2025 (USD Thousand)

Table 68 Market for the Power & Energy Industry, By Geography, 2017–2025 (USD Thousand)

Table 69 Market for the Plastics & Polymers Industry, By Process, 2017–2025 (USD Thousand)

Table 70 Market for the Plastics & Polymers Industry, By Type, 2017–2025 (USD Thousand)

Table 71 Market for the Plastics & Polymers Industry, By Axis, 2017–2025 (USD Thousand)

Table 72 Market for the Plastics & Polymers Industry, By Geography, 2017–2025 (USD Thousand)

Table 73 Market for the Gems & Jewelry Industry, By Process, 2017–2025 (USD Thousand)

Table 74 Market for the Gems & Jewelry Industry, By Type, 2017–2025 (USD Thousand)

Table 75 Market for the Gems & Jewelry Industry, By Axis, 2017–2025 (USD Thousand)

Table 76 Market for the Gems & Jewelry Industry, By Geography, 2017–2025 (USD Thousand)

Table 77 Market for Other Industries, By Process, 2017–2025 (USD Thousand)

Table 78 Market for Other Industries, By Type, 2017–2025 (USD Thousand)

Table 79 Market for Other Industries, By Axis, 2017–2025 (USD Thousand)

Table 80 Market for Other Industries, By Geography, 2017–2025 (USD Thousand)

Table 81 Market, By Geography, 2017–2025 (USD Million)

Table 82 Market for North America, By Process, 2017–2025 (USD Million)

Table 83 Market for North America, By Type, 2017–2025 (USD Million)

Table 84 Market for North America, By Axis, 2017–2025 (USD Million)

Table 85 Market for North America, By Industry, 2017–2025 (USD Million)

Table 86 Market for Europe, By Process, 2017–2025 (USD Million)

Table 87 Market for Europe, By Type, 2017–2025 (USD Million)

Table 88 Market for Europe, By Axis, 2017–2025 (USD Million)

Table 89 Market for Europe, By Industry, 2017–2025 (USD Million)

Table 90 Market for Asia Pacific, By Process, 2017–2025 (USD Million)

Table 91 Market for Asia Pacific, By Type, 2017–2025 (USD Million)

Table 92 Market for Asia Pacific, By Axis, 2017–2025 (USD Million)

Table 93 Market for Asia Pacific, By Industry, 2017–2025 (USD Million)

Table 94 Market for the Rest of the World, By Process, 2017–2025 (USD Thousand)

Table 95 Market for the Rest of the World, By Type, 2017–2025 (USD Million)

Table 96 Market for the Rest of the World, By Axis, 2017–2025 (USD Million)

Table 97 Market for the Rest of the World, By Industry, 2017–2025 (USD Thousand)

Table 98 Top Three Micromachining Market Players, 2018

Table 99 Product Launches, 2018–2019

Table 100 Expansions, 2018–2019

Table 101 Partnership, 2019

List of Figures (33 Figures)

Figure 1 Micromachining Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumptions for the Research Study

Figure 7 Market Segmentation

Figure 8 Global Micromachining Market, 2017 to 2025 (USD Million)

Figure 9 Market for Additive Micromachining Process to Grow at the Highest CAGR During the Forecast Period

Figure 10 Non-Traditional Type to Lead the Micromachining Market During the Forecast Period

Figure 11 5 Axes Micromachining System Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Automotive Industry to Lead the Market From 2020 to 2025

Figure 13 Asia Pacific to Grow at the Highest CAGR in the Market During the Forecast Period

Figure 14 Attractive Growth Opportunities for Players in the Market

Figure 15 Hybrid Micromachining to Grow at the Highest CAGR During the Forecast Period

Figure 16 Subtractive Micromachining to Lead the Market During the Forecast Period

Figure 17 3 Axes Micromachining to Lead the Market During the Forecast Period

Figure 18 Automotive Industry to Account for the Largest Share of the Market in 2025

Figure 19 Asia Pacific to Grow at the Highest CAGR in the Market During the Forecast Period

Figure 20 Micromachining Market Dynamics

Figure 21 Market, By Type

Figure 22 Market, By Process

Figure 23 Market, By Axis

Figure 24 Market, By Industry

Figure 25 North America: Micromachining Snapshot

Figure 26 Asia Pacific: Micromachining Market Snapshot

Figure 27 Market (Global) Competitive Leadership Mapping, 2018

Figure 28 Coherent: Company Snapshot

Figure 29 Georg Fischer: Company Snapshot

Figure 30 Makino: Company Snapshot

Figure 31 Lumentum: Company Snapshot

Figure 32 Mitsubishi: Company Snapshot

Figure 33 IPG Photonics: Company Snapshot

The study involved four major activities in estimating the current size of the global micromachining market. Exhaustive secondary research has been done to collect information on the market and the peer market. Validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation procedures have been carried out to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Factiva and Avention, have been referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, trade directories, and databases.

Primary Research

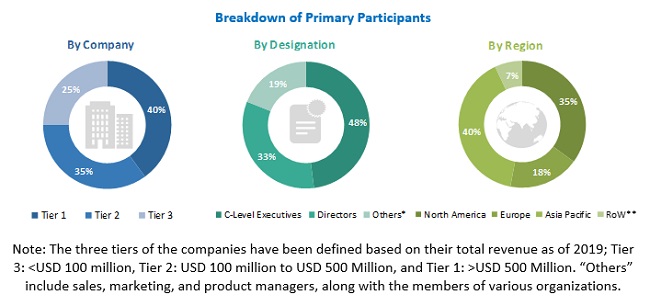

Extensive primary research has been conducted after gaining knowledge about the micromachining market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand and supply sides across four major regions—North America, Europe, APAC, and RoW. Approximately 30% and 70% of primary interviews have been conducted with parties from the demand and supply sides, respectively. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

The following figure shows the breakdown of primaries based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global micromachining market and other dependent submarkets. Key players in the market have been identified through secondary research, and their ranking in the respective regions has been determined through primary and secondary research. This entire research methodology involves the study of financial reports of top players and interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the micromachining market. All percentage share split and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall micromachining market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives Are as Follows:

- To define, describe, and forecast the micromachining market, in terms of value, based on type, process, axis, and industry

- To forecast the market size, in terms of value, for segments concerning four main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors, namely, drivers, restraints, opportunities, and challenges influencing the growth of the micromachining market

- To provide an overall view of the global micromachining market through illustrative segmentation, analyses, and market size estimations of crucial geographic segments

- To analyze the competitive intelligence of players based on company profiles and their strategies to sustain their position and grow in this market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2, along with detailing the competitive landscape for market leaders

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the micromachining market report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Micromachining Market