Mechanical Control Cables Market for Military and Aerospace, by Application (Aerial, Land, Marine), Type (Push-Pull, Pull-Pull), Platform, Material, End-Use (Commercial, Defense, Non-Aero Military) and Region - Global Forecast to 2027

[153 Pages Report] The mechanical control cables market for military and aerospace sectors is projected to grow from USD 10.23 Billion in 2022 to USD 12.98 Billion by 2027 at a CAGR of 4.9% during the forecast period. Mechanical control cables, also known as push-pull control cables, are used to transmit signals from the cockpit of a platform to various critical subsystems and components which determine the operational parameters of the platform. The demand for mechanical control cables is driven by the demand of aerospace and military platforms as part of the ongoing modernization initiatives undertaken by the defense forces.

Mechanical Control Cables Market Dynamics:

Driver: Increasing demand for military platforms

The increasing geopolitical rift that has escalated into serious altercations, as evident from the ongoing Russian-Ukraine war and the Syrian crisis, has led to the mobilization of military and peacekeeping forces of powerful nations, such as the US, UK, and France. This has resulted in a gradual but consistent increase in global defense spending on the procurement and modernization of military platforms across all domains of warfare. For instance, in September 2022, the US expedited its plans for procuring new armored vehicles due to the ongoing Russia-Ukraine conflict. The US Army plans to expend USD 867 million in Ukraine emergency funding to facilitate the transfer of 200 M113 armored vehicle to Ukraine as a war aid. Several contracts are either underway or in pipeline during the forecast period, which is envisioned to drive the demand for mechanical control cables for integration into the different subsystems of military platforms.

Restraint: Program delays and existing order backlog

Any aerospace or defense platform is the culmination of years of R&D, incurring millions of financial and resources for the involved firms. Since the supply chains have become too complex, any delay in production or any sort of supply chain disruption can result in cascading effect for every firm involved at any level with the program. For instance, the production delay in the ARJ21 and C919 aircraft program, which was scheduled to start in 2016 but was delayed due to several issues with the aircraft, resulted in losses worth millions for the entire supply chain as the involved firms were required to adjust their production plans as per the changes in the aircraft schedule. Currently, the order backlog for new commercial aircraft stands at more than 12,000, a staggering number that would require years for major OEMs to deliver. Inadvertent production disruption, as in the case of B737, may prove disastrous for the suppliers of mechanical control cables and other systems and deleteriously affect the growth of the market.

Opportunity: Emergence of a robust aviation infrastructure in Asia Pacific

Previously, the major aircraft OEMs and their facilities were limited to developed economies based in North America and Europe, however, a rapid boom has been recorded in the development of new facilities for both aerospace manufacturing and maintenance in Asia Pacific. The emergence of Commercial Aircraft Corporation of China Ltd. (COMAC) and Mitsubishi Aircraft Corporation (Japan) as one of the leading aircraft OEMs on the global front has led to several opportunities for the regional players. Meanwhile, the demand for MRO from the regional airlines and other aircraft operators also creates a plethora of opportunities for component suppliers based in the region, as with a globalized supply chain, they can access a larger segment of the global aerospace and defense sector.

Challenge: Complexities associated with manufacturing and installing wire harness

The increased adoption of technologies such as fly-by-wire, modern inflight entertainment systems, and glass cockpits has increased the volume of wires and cables used in aircraft. Aircraft with high total wire length include the Airbus A380 (530 km), Airbus A340 (300 km), and the Boeing 747-400 (274 km). Aircraft wiring is structurally complex due to multiple interconnected systems and components. Stringent regulatory requirements on reliability and redundancy increase the level of complexity. Wiring harnesses are produced on flat tables called formboards, through a 1:1 scale production drawing. Flat harnesses assembled on formboards need to be bent during installation in the aircraft. The bending of the wire bundle or damage to wires and pins during installation acts as a major challenge to the market.

Mechanical Control Cables Market for Aerospace & Defense Segment Insights

Compound Semiconductor Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Based on type, the push-pull segment dominated market share throughout the forecast period

Based on type, the mechanical control cables market for military and aerospace is segmented into push-pull and pull-pull. The increasing demand for commercial air travel especially from emerging economies of Asia Pacific is fueling the demand for new commercial aircraft, which in turn, is driving the requirement for mechanical cable controls for integration into the aircraft to facilitate flight control and other operational input transmission.

Based on platform, the aerial segment is projected to witness fastest growth by 2027

Based on platform, the mechanical control cables market for military and aerospace has been classified into aerial, land, and marine. The aerial segment is expected to register the highest CAGE as the increasing demand for aircraft replacements, increasing demand for wide body aircraft with large passenger-carrying capacity and low maintenance costs, increasing domestic air travel due to lower flight fares, are anticipated to drive the demand for mechanical control cables.

Based on application, the aerial segment held the leading share of market in 2022

Based on application, the mechanical control cables market for military and aerospace market is segmented into aerial, land, and marine. The aerial segment is projected to dominate market share throughout the forecast period. The aerial segment is further categorized into into flight control, engine control, auxiliary control, landing gear, and others. The increasing R&D efforts being undertaken by aircraft OEMs and supply chain players to design aircraft with enhanced performance parameters and integrated with advanced navigational technologies and flight control systems is driving the demand for mechanical cable controls as these cables are extensively used not only for the aforementioned systems but also for aircraft seating and cabin equipment, and landing gears.

Based on End-Use, the commercial segment is poised to witness strong growth in market during the forecast period

Based on end-use, the mechanical control cables market for military and aerospace has been segmented into commercial, defense, and non-aero military. The OEM and aftermarket aspects of commercial aircraft has been considered under the commercial segment and an increase in new aircraft demand and deliveries on account of a rapidly growing air passenger traffic is expected to be a major driver bolstering the growth of the demand for mechanical control cables during the forecast period.

Based on Material, the wire material segment is forecasted to dominate market share during the forecast period

Based on material, the mechanical control cables market for military and aerospace has been segmented into wire material and jacket material. Wires used in aircraft contain stranded conductors for flexibility and consist of several materials and layers of insulation for thermal protection, abrasion resistance, moisture resistance, and fluid resistance. They are widely used in flight control, engine control, auxiliary control, and landing gear applications. Hence, with evolution of sophisticated aircraft systems requiring precise controls and signal transference is anticipated to drive the demand for mechanical control cables.

Regional Insights:

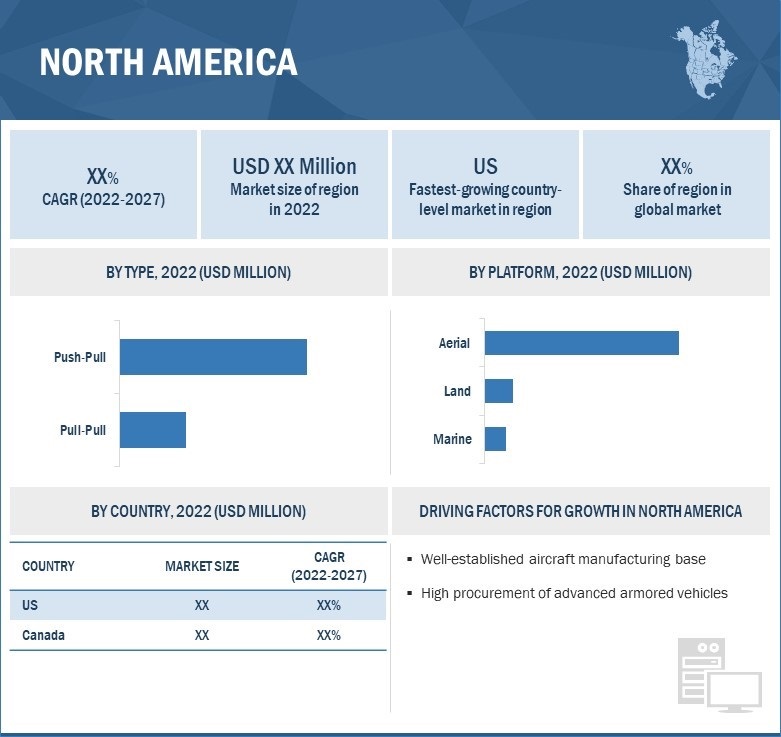

The North American region is projected to dominate market share during the forecast period

According to the World Bank, the North American region contributes up to 28% of the global GDP.North America is also considered as a key region for maritime activities, and the growth of coastal shipping in this region is also propelling the demand for military ships.The growth of the market in this region can be attributed to the high military spending in the US and the increasing procurement of highly advanced armored vehicles.

Mechanical Control Cables Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The US offshore sector offers attractive business opportunities for foreign shipbuilding companies. Thus, the growth of the US shipbuilding industry is one of the most significant factors which will lead to an increase in the market for shipbuilding related mechanical components, including mechanical control cables.

Moreover, in Canada, the presence of leading aircraft manufacturers such as Bombardier has bolstered the growth of aircraft manufacturing and aftermarket service provisions. Besides, a significant growth in the procurement of the naval vessels is also projected as Canada is focusing on shipbuilding and related services, thereby driving the demand for mechanical control cables.

Key Market Players:

Some of the Major players in the mechanical control cables market for aerospace and defense are Triumph Group, Inc. (US), Crane Aerospace & Electronics (US), Elliott Manufacturing (US), Loos & Co., Inc. (US), and Bergen Cable Technology (US). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the mechanical control cables market.

Triumph Group Inc. is one of the leading companies involved in designing, engineering, and manufacturing aviation and industrial components, accessories, subassemblies, systems, and aircraft structures. The company offers mechanical components through the integrated systems business segment for controls and actuation systems. These components include push-pull and ball-bearing cables, and low-resistance and backlash mechanical control system cables for transfer of linear and/or rotary motion on the aircraft, engine control, and thrust reversers. The company operates at 42 locations across North America, Europe, and Asia.

Crane Aerospace & Electronics is one of the industry leaders which provides critical systems and components to the aerospace, defense, and space markets. It operates through four business segments, such as fluid handling, payment & merchandising technologies, aerospace & electronics, and engineered materials. The company offers sensing & utility systems, fluid management, power solutions, landing systems, cabin systems, and microwave solutions through the aerospace & electronics segment. It also offers FAA flammability standard certified mechanical control cables for seating arrangements. The company is headquartered in Connecticut (US) and has ten main production locations across North America, Asia Pacific, and Europe.

Elliott Manufacturing provides a variety of mechanical control cables. It operates through eight business segments, namely, aerospace, agriculture, commercial, defense, marine, medical, lawn & garden, and power generation. The company offers products through the defense segment that can be used for military aircraft, rockets, ships, and vehicles around the world. Elliott caters to agriculture, aerospace, automotive, commercial, and industrial markets. The company has a presence in the US, Mexico, Asia, Europe, Australia, and New Zealand.

Loos & Co. Inc. offers specified military aircraft cables and assemblies. The company is one of the key suppliers of flight control assemblies to all major aircraft manufacturers, such as Boeing, General Dynamics, and Bombardier. The company serves aircraft cables, brush wires, wire ropes, stainless & alloy wire, fitness cables, and cable assemblies through the mechanical cables and electronics business segment. Product specialties include Military Specification Aircraft Cable, Galvanized Wire rope, EXERFLEXPRO Fitness Cable, Coated Cable, Medical Wire & Cable, Lashing Wire, Lock Wire, and Knitting Wire. The company has offices in Pomfret Center (US) Naples (US).

Bergen Cable Technology is one of the leading providers of custom wire rope and cable assemblies, push-pull control cables, lock clad cables, safety cables, and precision machining services to the aerospace and commercial industries. The company offers control cables that perform numerous functions including throttle control, brake control, power take-off, release actuation, and engagement and disengagement of various systems. Key customers of the company are KLX Aerospace Solutions, SEA Wire and Cables.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

20172025 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019-2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Type, Platform, Material, Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Crane Aerospace & Electronics (US), Triumph Group (US), Elliott Manufacturing (US), Orscheln Products (US), Glassmaster Controls Company, Inc. (US), Loos & Co. Inc. (US), Bergen Cable Technology, Inc. (US), Cable Manufacturing & Assembly, Inc. (US), Wescon Controls (US), Tyler Madison, Inc. (US), Escadean Ltd. (UK), Sila Group (Italy), Cablecraft Motion Controls (US), Ringspann GmbH (Germany), Lexco Cable Mfg. (US), Drallim Industries Limited (UK), Grand Rapids Controls, LLC. (US), VPS Control Systems, Inc. (US), AeroControlex (US) and Kόster Holding GmbH (Germany) |

This research report categorizes the mechanical control cables market for military and aerospace based on technology, application, system, component, platform, and region.

Based on Type:

- Push-pull

- Pull-pull

Based on the Platform:

- Aerial

- Commercial

- Business & General Aviation

- Military Aviation

- Land

- Main Battle Tanks

- Armored Fighting Vehicles

- Light Tactical Vehicles

- Marine Resistant Ambush Protected Vehicles

- Amphibious Armored Vehicles

- Marine

- Aircraft Carriers

- Amphibious Ships

- Destroyers

- Frigates

- Submarines

- Corvettes

- Offshore Patrol vessels

Based on Material:

- Wire Material

- Jacket Material

Based on the Application:

- Aerial

- Flight Control

- Engine Control

- Auxiliary Control

- Landing Gears

- Others

- Land

- Engine Control

- Brake Control

- Others

- Marine

- Engine Control

- Others

Based on End-Use:

- Commercial

- Defense

- Non-aero Military

Based on the Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Mechanical Control Cables Market Highlights:

What is new?- Major developments that can change the business landscape as well as market forecasts.

The aerospace and defense (A&D) industry has witnessed numerous technological advancements over the years in terms of platform diversification and enhanced operational capabilities. Substantial investments have been made in the research & development and upgrades of several military platforms. R&D in the field of control technologies have enhanced the design of A&D platforms over the years. It has also led to changes in their size, endurance, power, and propulsion systems.

- Fly-by-optics

- Lightweight Cables

- Coverage of new market players and change in the market share of existing players of the mechanical control cables market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have total 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the mechanical control cables market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the mechanical control cables market.

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the context of the mechanical control cables for military and aerospace till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment and investment on research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2019 to 2022.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of start-ups /SME which covers details about employees, financial status, latest funding round and total funding.

- Inclusion of impact of megatrends on the mechanical control cables market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in the mechanical control cables market

- Inclusion of patent registrations to have an overview of R&D activities in the mechanical control cables market.

- The start-up evaluation matrix is added in this edition of the report, covering mechanical control cables start-ups focused on serving the military and aerospace sectors.

The new edition of the report consists of trends/disruptions on customers business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to enable a better understanding of the market dynamics for mechanical control cables.

Recent Developments

- In September 2019, Triumph Group secured a contract from Boom Technology, Inc. for the delivery of key engine throttle control system components for XB-1.

- In April 2019, Cablecraft Motion Controls entered a partnership with a large exhaust gas management system supplier to develop a special actuator linkage to control a diverter valve in the exhaust gas stream of hybrid vehicles.

Frequently Asked Questions (FAQs):

What is the current size of the mechanical control cables for military and aerospace?

The mechanical control cables for military and aerospace is projected to grow from USD XX million in 2022 to USD XX million by 2027, at a CAGR of XX% from 2022 to 2027.

Who are the winners in the mechanical control cables for military and aerospace?

Triumph Group, Inc. (US), Crane Aerospace & Electronics (US), Elliott Manufacturing (US), Loos & Co., Inc. (US), and Bergen Cable Technology (US).

What are some of the technological advancements in the market?

Fly-by-optics, also referred to as Fly-By-Light (FBL) systems, not only enable the transfer of data at high speed but are also immune to electromagnetic interference (EMI) and high intensity radiated fields (HIRFs). They are lightweight, have large data bandwidth, and are resistant to new generation hostile military environments. Due to their ability to handle high data speeds, fly-by-optics technology is expected to witness tremendous growth in the aviation industry.

Every aircraft contains around 200 km to 600 km of cables connecting crucial equipment throughout the airplane. For instance, in the Boeing 787, about 8,000 pounds of the total aircraft weight is from cables. Lowering the weight of these cables to 2,400 pounds would result in potential fuel savings of more than USD 30 million per year. Thus, manufacturers are looking to replace wires and cables in aircraft frames, wings, communication devices, and other flight surfaces with lightweight cables to reduce the total weight of the aircraft.

What are the factors driving the growth of the market?

The demand for mechanical control cables is driven by the demand of aerospace and military platforms as part of the ongoing modernization initiatives undertaken by the defense forces.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Market Definition & Scope

2.1.3.1 Exclusion

2.1.4 Segment Definition

2.1.4.1 Type

2.1.4.2 Platform

2.1.4.3 Application

2.1.4.4 Material

2.1.4.5 End-Use

2.2 Research Approach & Methodology

2.2.1 Bottom-Up Approach

2.2.2 Market Approach

2.2.2.1 Mechanical Control Cables Market for Military and Aerospace Approach

2.2.2.1.1 for Commercial and Military Aerospace

2.2.2.1.2 for Military Vehicles

2.2.2.1.3 for Marine

2.3 Triangulation & Validation

2.3.1 Triangulation Through Secondary Research

2.4 Research Assumptions

2.5 Risk Analysis

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in Mechanical Control Cables Market for Military and Aerospace

4.2 Mechanical Control Cable Market for Military and Aerospace, By Type

4.3 Mechanical Control Cable Market for Military and Aerospace, By Platform

4.4 Mechanical Control Cable Market for Military and Aerospace, By Region

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Air Passenger Traffic and Demand for Commercial Aircraft

5.2.1.2 Increasing Demand for Military Land Vehicles

5.2.1.3 Increasing Demand for Military Vessels

5.2.2 Restraints

5.2.2.1 Existing Backlog of Aircraft Deliveries

5.2.2.2 Absence of Major Military Vehicle OEMs in the Middle East and Asia Pacific

5.2.3 Opportunities

5.2.3.1 Presence of Aircraft Manufacturers in the Asia Pacific Region

5.2.3.2 Military Modernization Plans

5.2.4 Challenges

5.2.4.1 Complexities Associated With Manufacturing and Installing Wire Harness

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Process Flow Chart for Mechanical Control Cables

6.2.1 Reeling Into Wire Harness

6.2.2 Twisting the Wire on the Wire Twisting Machine

6.2.3 Cutting, Coating, and Covering

6.2.4 Inspection and Dispatch

6.3 Criteria for Aerospace Mechanical Control Cables Selection

6.3.1 Fire Safety

6.3.1.1 Flammability

6.3.1.2 Smoke & Toxicity

6.3.2 Component Design

6.3.2.1 Weight

6.3.2.2 Strength & Stiffness

6.3.3 Airline Operations

6.3.3.1 Durability

6.3.3.2 Reparability

6.3.4 Manufacturing

6.3.4.1 Raw Materials

6.3.4.2 Reproducibility

6.4 Technology Trends

6.4.1 Fly-By-Optics

6.4.2 Lightweight Cables

7 Mechanical Control Cables Market for Military and Aerospace Market, By Type (Page No. - 52)

7.1 Introduction

7.2 Push-Pull

7.2.1 Increased Demand for New Commercial Aircraft is Fueling the Adoption of Push-Pull Cables

7.3 Pull-Pull

7.3.1 Growth of Military Vehicles is Expected to Drive the Demand for Pull-Pull Cables

8 Mechanical Control Cables Market for Military and Aerospace, By Platform (Page No. - 55)

8.1 Introduction

8.2 Aerial

8.2.1 Commercial Aviation

8.2.1.1 Narrow Body Aircraft

8.2.1.1.1 Increase in Domestic Travel and the Availability of Low-Cost Carriers is Increasing Demand for Narrow-Body Aircraft

8.2.1.2 Wide Body Aircraft

8.2.1.2.1 Large Aircraft Orders are Expected to Fuel the Wba Segment and Thereby Increase the Demand for Mccs

8.2.1.3 Very Large Aircraft

8.2.1.3.1 Growing Preference for Long-Haul Journeys is Expected to Drive This Segment

8.2.1.4 Regional Transport Aircraft

8.2.1.4.1 The Growing Presence of Domestic Airlines Drive the Market for Regional Transport Aircraft

8.2.2 Business & General Aviation

8.2.2.1 Business Jets

8.2.2.1.1 Growing Affordability of Travelers Drive the Business Jets Market

8.2.2.2 Helicopters

8.2.2.2.1 Production of Cost-Effective and Multi-Purpose Helicopters Increases the Demand for Mechanical Control Cables

8.2.2.3 General Aviation Aircraft

8.2.2.3.1 Increased Flight Training Activities is Driving This Segment

8.2.3 Military Aviation

8.2.3.1 Fighter Jets

8.2.3.1.1 Increasing Emphasis on Strengthening Combat Capabilities Expected to Drive the Demand for Fighter Jets

8.2.3.2 Transport Aircraft

8.2.3.2.1 Growing Procurement Activities of Transport Aircraft is Expected to Drive the Transport Aircraft Market

8.2.3.3 Helicopters

8.2.3.3.1 New Procurement Plans are Expected to Drive the Military Helicopters Market

8.3 Land

8.3.1 Main Battle Tanks

8.3.1.1 New Product Developments, Product Launches, and Procurements Drive the Military Battle Tanks Segment

8.3.2 Armored Fighting Vehicles

8.3.2.1 Development of Light, Mobile, Fuel-Efficient, and Cost-Effective Armored Fighting Vehicles is Expected to Drive Its Market

8.3.3 Light Tactical Vehicles

8.3.3.1 Procurement Plans and New Modernization Programs are Expected to Drive the Market for Light Tactical Vehicles

8.3.4 Mine-Resistant Ambush Protected Vehicles

8.3.4.1 Protection Against Improvised Explosive Devices, Rocket-Propelled Grenades, and Small Arms Fire is Expected to Drive This Segment

8.3.5 Amphibious Armored Vehicles

8.3.5.1 Procurements and Demand for Amphibious Armored Vehicles Will Drive the Mechanical Control Cable Market for Military and Aerospace

8.4 Marine

8.4.1 Aircraft Carriers

8.4.1.1 Focus on Optimizing the Construction of Ships and Material Procurement Will Drive the Aircraft Carriers Market

8.4.2 Amphibious Ships

8.4.2.1 Naval Expansions and Modernization Programs in Asia Pacific Stimulates the Amphibious Ships Market

8.4.3 Destroyers

8.4.3.1 Development of Destroyers With Electric Propulsion Drives Its Market

8.4.4 Frigates

8.4.4.1 Procurement Programs Propelling the Market for Frigates

8.4.5 Submarines

8.4.5.1 Investments on the Development of Advanced Submarines are Stimulating Its Market

8.4.6 Corvettes

8.4.6.1 Major Procurement Activities Related to Corvettes are Driving the Demand for Mechanical Control Cables

8.4.7 Offshore Patrol Vessels

8.4.7.1 Regional Tensions Coupled With Low-Cost Capabilities Offered By Opvs is Increasing Its Market in Asia Pacific

9 Mechanical Control Cables Market for Military and Aerospace, By Application (Page No. - 67)

9.1 Introduction

9.2 Aerial

9.2.1 Flight Control

9.2.1.1 Increased Aircraft Orders are Expected to Drive the Demand for Flight Control-Based Mccs

9.2.2 Engine Control

9.2.2.1 Increasing Mro Activities is Driving This Segment

9.2.3 Auxiliary Control (Doors, Lavatory, and Seating)

9.2.3.1 Increased Demand for Premium Economy Seats in Aircraft Will Fuel the Demand for Aircraft-Based Mechanical Control Cables

9.2.4 Landing Gears

9.2.4.1 Advancements in New Landing Gear Technologies Propelled the Demand for New Aircraft Components

9.2.5 Others

9.2.5.1 Modernization in Aircraft Cabin Management Will Help Aircraft Cabin Management Service Providers to Develop Advanced Cabin Control Systems

9.3 Land

9.3.1 Engine Control

9.3.1.1 High Engine Repairs and Replacement in Military Vehicles Will Drive the Demand for Military Vehicles-Based Mechanical Control Cables

9.3.2 Brake Control

9.3.2.1 High Demand for Mechanical Brake Control Cables for Light Tactical Vehicles is Driving This Segment

9.3.3 Others

9.3.3.1 Development of Light, Mobile, Fuel-Efficient, and Cost-Effective Armored Fighting Vehicles is Driving the Market for Mechanical Control Cables

9.4 Marine

9.4.1 Engine Control

9.4.1.1 Mro Activities and Constant Support of Spare Part Provisions are Expected to Drive This Segment

9.4.2 Others

9.4.2.1 Frequent Replacement and Repairs of Mechanical Components Used in Marine Vessels are Expected to Drive the Market for Marine-Based Mechanical Control Cables

10 Mechanical Control Cables Market for Military and Aerospace, By End-Use (Page No. - 74)

10.1 Introduction

10.2 Commercial

10.2.1 OEM

10.2.1.1 Significant Demand for New Aircraft From the Asia Pacific as Well as Middle East Regions is Driving the OEM Segment

10.2.2 Aftermarket

10.2.2.1 Increase in Commercial Aircraft Fleet is Expected to Drive This Segment

10.3 Defense

10.3.1 OEM

10.3.1.1 Rising Demand for New Aircraft in North America Will Increase the Demand for Aircraft-Based Mechanical Control Cables

10.3.2 Aftermarket

10.3.2.1 The Increasing Aircraft Modernization and Retrofitting Activities is Expected to Increase the Demand for Mechanical Control Cables

10.4 Non-Aero Military

10.4.1 OEM

10.4.1.1 High Procurement of Armored Vehicles in North American and European Region is Expected to Increase the Demand for Mechanical Control Cables

10.4.2 Aftermarket

10.4.2.1 Growing Military Vessel Modernization Programs in Asia Pacific Region is Expected to Increase the Demand for Mechanical Control Cables

11 Mechanical Control Cables Market for Military and Aerospace, By Material (Page No. - 79)

11.1 Introduction

11.2 Wire Material

11.2.1 Wire Material is Used Widely in Flight Control, Engine Control, Auxiliary Control, and Landing Gear Applications

11.3 Jacket Material

11.3.1 Jacket Material is Used to Protect the Insulation and Conductor Core From External Physical Forces

12 Regional Analysis (Page No. - 82)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 Increased Investments of Foreign Shipbuilders are Driving the Market for Shipbuilding Which is Expected to Propel the Mechanical Control Cable Market for Military and Aerospace

12.2.2 Canada

12.2.2.1 Rise in Aircraft Deliveries Due to Increased Passenger Traffic is Expected to Drive the Mechanical Control Cable Market for Military and Aerospace

12.3 Europe

12.3.1 UK

12.3.1.1 Increasing Investments and Presence of Aircraft Manufacturers are Driving the Market in This Country

12.3.2 Germany

12.3.2.1 High Production of Armored Vehicles is One of the Factors Driving the Market in Germany

12.3.3 France

12.3.3.1 Modernization of Aging Armored Vehicles and Procuring New Generation Wheeled Combat Vehicles for Its Defense Forces are Fueling the Market in France

12.3.4 Italy

12.3.4.1 Major Focus on Modernization Programs for Armed Forces is Driving the Market in Italy

12.3.5 Russia

12.3.5.1 The Replacement of Aged Aircraft Fleet in Russia is Driving the Demand for Aircraft Based Mechanical Control Cables

12.3.6 Rest of Europe

12.3.6.1 Focus on Modernization Plans for Military Equipment is Fueling the Market in Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Presence of Leading Aircraft Manufacturing Companies is One of the Factors Driving the Market in China

12.4.2 India

12.4.2.1 Government Support Plays A Key Role in the Growth of the Aviation Industry and Thereby the Studied Market

12.4.3 Japan

12.4.3.1 Collaborations for the Development and Production of Armored Vehicles are Expected to Drive the Market for Armored Vehicle-Based Mechanical Control Cables in This Country

12.4.4 South Korea

12.4.4.1 Military Modernization Programs Drive the Growth of Armored Vehicles in South Korea

12.4.5 Australia

12.4.5.1 Development of Combat Vehicles Drives the Growth of the Market in Australia

12.4.6 Rest of Asia Pacific

12.4.6.1 Increased Military Budgets and Joint Ventures in Commercial Aviation are Driving the Market for Aircraft Based Mechanical Control Cables

12.5 Latin America

12.5.1 Brazil

12.5.1.1 Rise in Aircraft Deliveries is Expected to Drive the Mechanical Control Cable Market for Military and Aerospace in Brazil

12.5.2 Rest of Latin America

12.5.2.1 Increased Mro Activities are Expected to Drive the Mechanical Control Cable Market for Military and Aerospace

12.6 Middle East & Africa

12.6.1 UAE

12.6.1.1 Frequent Procurement Plans are Expected to Increase the Demand for Military Vehicle-Based Mechanical Control Cables in the UAE

12.6.2 Saudi Arabia

12.6.2.1 Procurement Plans Will Boost the Demand of Modern Military Components and Thereby Mechanical Control Cables in This Country

12.6.3 Israel

12.6.3.1 Lucrative Market for Armored Vehicles is Expected to Drive the Mechanical Control Cable Market for Military and Aerospace

12.6.4 Turkey

12.6.4.1 Inter-Country Military Developments and Investments for Military Procurements are Expected to Drive the Market for Mechanical Control Cables Market for Military and Aerospace

12.6.5 Africa

12.6.5.1 Increasing Demand for New Rotary Wings and Small Aircraft is Driving the Mechanical Control Cable Market for Military and Aerospace in Africa

12.6.6 Rest of Middle East

12.6.6.1 Increased Military Spending and Higher Exports are Expected to Drive the Mechanical Control Cables Market for Military and Aerospace in This Region

13 Competitive Landscape (Page No. - 117)

13.1 Introduction

13.2 Ranking of Market Players, 2019

13.3 Competitive Scenario

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Innovators

13.4.3 Dynamic Differentiators

13.4.4 Emerging Companies

13.4.5 Competitive Scenario

13.4.6 New Product Launches

13.4.7 Contracts

13.4.8 Partnerships, Agreements, and Acquisitions

14 Company Profiles (Page No. - 121)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Customers and Application Areas, Unique Value Proposition, Right to Win, Growth Strategies )*

14.1 Crane Aerospace & Electronics

14.2 Triumph Group

14.3 Elliott Manufacturing

14.4 Orscheln Products

14.5 Glassmaster Controls Company, Inc

14.6 Loos & Co. Inc.

14.7 Bergen Cable Technology, Inc.

14.8 Cable Manufacturing & Assembly, Inc.

14.9 Wescon Controls

14.10 Tyler Madison, Inc.

14.11 Escadean LTD

14.12 Sila Group

14.13 Cablecraft Motion Controls

14.14 Ringspann GmbH

14.15 Lexco Cable Mfg.

14.16 Drallim Industries Limited

14.17 Grand Rapids Controls, LLC.

14.18 VPS Control Systems, Inc.

14.19 AeroControlex

14.20 Kόster Holding GmbH

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Customers and Application Areas, Unique Value Proposition, Right to Win, Growth Strategies Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 146)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (110 Tables)

Table 1 New Aircraft Deliveries, By Region, 20162035

Table 2 Mechanical Control Cables Market for Military and Aerospace Size, By Type, 20172025 (USD Million)

Table 3 Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 4 Market for Military and Aerospace Size in Aerial Platform, By Type, 20172025 (USD Million)

Table 5 Market for Military and Aerospace Size in Commercial Aviation, By Aircraft Type, 20172025 (USD Million)

Table 6 Market for Military and Aerospace in Business & General Aviation, By Aircraft Type, 20172025 (USD Million)

Table 7 Market for Military and Aerospace in Military Aviation Platform, By Aircraft Type, 20172025 (USD Million)

Table 8 Market for Military and Aerospace Size in Land Platform, By Type, 20172025 (USD Million)

Table 9 Market for Military and Aerospace in Marine Platform, By Type, 20172025 (USD Million)

Table 10 Mechanical Control Cables Market for Military and Aerospace, By Application, 20172025 (USD Million)

Table 11 Mechanical Control Cable Market for Military and Aerospace in Aerial Application, By Type, 20172025 (USD Million)

Table 12 Market for Military and Aerospace in Land Application, By Type, 20172025 (USD Million)

Table 13 Market for Military and Aerospace in Marine Application, By Type, 20172025 (USD Million)

Table 14 Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 15 Market for Military and Aerospace for Commercial, By Type, 20172025 (USD Million)

Table 16 Mechanical Control Cables Market for Military and Aerospace for Defense, By Type, 20172025 (USD Million)

Table 17 Market for Military and Aerospace for Non-Aero Military, By Type, 20172025 (USD Million)

Table 18 Market for Military and Aerospace, By Material, 20172025 (USD Million)

Table 19 Market for Military and Aerospace, By Region, 20172025 (USD Million)

Table 20 North America: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 21 North America: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 22 North America: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 23 North America: Market for Military and Aerospace, By Country, 20172025 (USD Million)

Table 24 US: Mechanical Control Cable Market for Military and Aerospace Size, By Type, 20172025 (USD Million)

Table 25 US: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 26 US: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 27 Canada: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 28 Canada: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 29 Canada: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 30 Europe: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 31 Europe: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 32 Europe: Mechanical Control Cable Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 33 Europe: Mechanical Control Cable Market for Military and Aerospace, By Country, 20172025 (USD Million)

Table 34 UK: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 35 UK: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 36 UK: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 37 Germany: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 38 Germany: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 39 Germany: Mechanical Control Cable Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 40 France: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 41 France: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 42 France: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 43 Italy: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 44 Italy: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 45 Italy: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 46 Russia: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 47 Russia: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 48 Russia: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 49 Rest of Europe: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 50 Rest of Europe: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 51 Rest of Europe: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 52 Asia Pacific: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 53 Asia Pacific: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 54 Asia Pacific: Mechanical Control Cable Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 55 Asia Pacific: Mechanical Control Cable Market for Military and Aerospace, By Country, 20172025 (USD Million)

Table 56 China: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 57 China: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 58 China: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 59 India: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 60 India: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 61 India: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 62 Japan: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 63 Japan: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 64 Japan: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 65 South Korea: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 66 South Korea: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 67 South Korea: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 68 Australia: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 69 Australia: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 70 Australia: Mechanical Control Cable Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 71 Rest of Asia Pacific: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 72 Rest of Asia Pacific: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 73 Rest of Asia Pacific: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 74 Latin America: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 75 Latin America: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 76 Latin America: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 77 Latin America: Market for Military and Aerospace, By Country, 20172025 (USD Million)

Table 78 Brazil: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 79 Brazil: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 80 Brazil: Mechanical Control Cable Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 81 Rest of Latin America: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 82 Rest of Latin America: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 83 Rest of Latin America: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 84 Middle East: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 85 Middle East: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 86 Middle East: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 87 Middle East: Market for Military and Aerospace, By Country, 20172025 (USD Million)

Table 88 UAE: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 89 UAE: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 90 UAE: Market for Military and Aerospace, By End Use, 20172025 (USD Million)

Table 91 Saudi Arabia: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 92 Saudi Arabia: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 93 Saudi Arabia: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 94 Israel: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 95 Israel: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 96 Israel: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 97 Turkey: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 98 Turkey: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 99 Turkey: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 100 Africa: Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 101 Africa: Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 102 Africa: Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 103 Rest of Middle East: Mechanical Control Cable Market for Military and Aerospace, By Type, 20172025 (USD Million)

Table 104 Rest of Middle East: Mechanical Control Cable Market for Military and Aerospace, By Platform, 20172025 (USD Million)

Table 105 Rest of Middle East: Mechanical Control Cable Market for Military and Aerospace, By End-Use, 20172025 (USD Million)

Table 106 New Product Launches, July 2014 September 2019

Table 107 Contracts, July 2014 September 2019

Table 108 Partnerships, Agreements, and Acquisitions, July 2014 September 2019

Table 109 Crane Aerospace & Electronics: SWOT Analysis

Table 110 Triumph Group: SWOT Analysis

List of Figures (34 Figures)

Figure 1 Research Process Flow

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Approach 1 Bottom-Up (Demand Side)

Figure 4 Market Size Estimation Methodology: Approach 2 Top-Down (Supply Side):

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for the Research Study

Figure 8 Push-Pull Segment Projected to Lead the Mechanical Control Cable Market for Military and Aerospace During Forecast Period

Figure 9 Aerial Segment Projected to Lead the Mechanical Control Cable Market for Military and Aerospace Market During Forecast Period

Figure 10 Flight Control Subsegment Projected to Lead Aerial Application Segment During Forecast Period

Figure 11 North America Expected to Account for the Largest Share of Mechanical Control Cable Market for Military and Aerospace in 2019

Figure 12 Increasing Air Passenger Traffic and Demand for Commercial Aircraft Drive Mechanical Control Cable Market for Military and Aerospace From 2019 to 2025

Figure 13 Push-Pull Segment Expected to Lead Mechanical Control Cable Market for Military and Aerospace During Forecast Period

Figure 14 Aerial Segment Expected to Lead Mechanical Control Cable Market for Military and Aerospace During Forecast Period

Figure 15 Mechanical Control Cable Market in North America Expected to Grow at Highest CAGR During Forecast Period

Figure 16 Mechanical Control Cable Market for Military and Aerospace: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Global Commercial Aircraft Annual Deliveries: 20082017

Figure 18 Average Annual Change in Trip Frequency, By Country, 20182038

Figure 19 Order Backlog of Airbus and Boeing in 2018 and 2019

Figure 20 Process Flow Chart

Figure 21 Selection Criteria

Figure 22 Push-Pull Segment Expected to Lead Mechanical Control Cable Market for Military and Aerospace During Forecast Period

Figure 23 Aerial Segment Projected to Grow at Highest CAGR During Forecast Period

Figure 24 Aerial Segment Projected to Grow at Highest CAGR During Forecast Period

Figure 25 Commercial Segment Projected to Grow at the Highest CAGR During Forecast Period

Figure 26 Wire Material Segment Projected to Grow at A Higher CAGR During Forecast Period as Compared to Jacket Material

Figure 27 North America Accounted for Largest Share of Mechanical Control Cables Market for Military and Aerospace in 2019

Figure 28 North America Mechanical Control Cables Market for Military and Aerospace Snapshot

Figure 29 Europe Market for Military and Aerospace Snapshot

Figure 30 Asia Pacific Market for Military and Aerospace Snapshot

Figure 31 Major Players in Mechanical Control Cable Market for Military and Aerospace, 2019

Figure 32 Market for Military and Aerospace Competitive Leadership Mapping, 2019

Figure 33 Crane Aerospace & Electronics: Company Snapshot

Figure 34 Triumph Group.: Company Snapshot

The study involved four major activities in estimating the current market size for the global mechanical control cables market for military and aerospace. Exhaustive secondary research was undertaken to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and mechanical control cables databases.

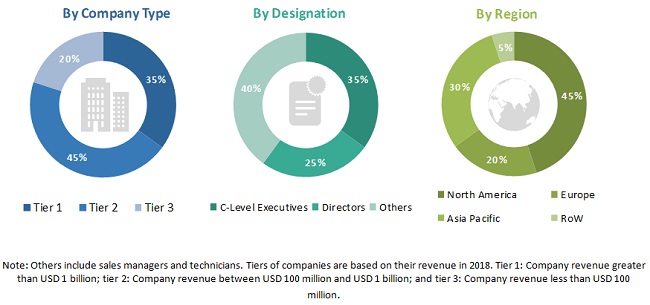

Primary Research

The mechanical control cables market for military and aerospace comprises several stakeholders, such as mechanical control cables providers, military and aerospace component manufacturers, and regulatory organizations in the supply chain. Aircraft manufacturers and military organizations majorly characterize the demand side of this market. The supply side is characterized by technological advancements in mechanical control cables. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the mechanical control cables market for military and aerospace. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size of mechanical control cables market for military and aerospaceusing the market size estimation process explained abovethe market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the mechanical control cables market in the aviation industry.

Report Objectives

- To define, describe, segment, and forecast the size of the mechanical control cables market based on type, platform, material, application, and end-use

- To analyze the demand- and supply-side indicators influencing the growth of the mechanical control cables market for military and aerospace

- To understand the market ecosystem by identifying high-growth segments and subsegments of the market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and challenges that influence the growth of the mechanical control cables market for military and aerospace

- To forecast the revenue of market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To analyze technological advancements and new product launches in the mechanical control cables market for military and aerospace

- To provide a detailed competitive landscape of the market, in addition to market rank analysis of leading players

- To identify financial positions, product portfolios, and key developments undertaken by leading players in the market

- To analyze micromarkets with respect to their individual growth trends, prospects, and contribution to the overall mechanical control cables market for military and aerospace

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players

- To profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a companys specific needs.

Company Information

- Detailed analysis and profiles of additional market players (up to five) within the global mechanical control cables market for military and aerospace

Growth opportunities and latent adjacency in Mechanical Control Cables Market