TABLE OF CONTENT

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 INCLUSIONS & EXCLUSIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH FLOW

FIGURE 2 MILITARY CABLES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key insights from primary sources

2.1.2.3 Key primary sources

2.1.2.4 Breakdown of primaries

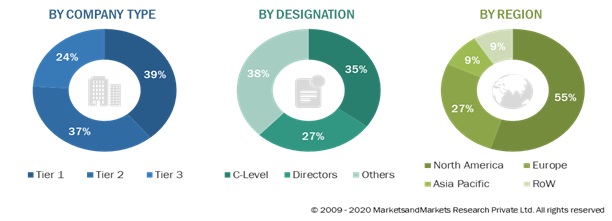

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Cross-border threats and separatist movements

2.2.2.2 Adoption of advanced computing technologies in defense platforms

2.2.3 SUPPLY-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

2.4 RESEARCH APPROACH & METHODOLOGY

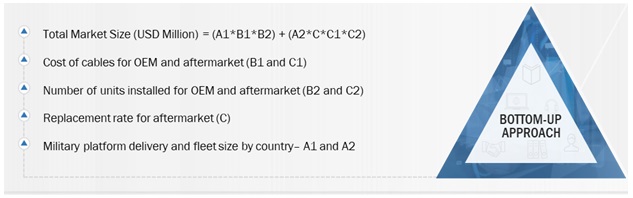

2.4.1 BOTTOM-UP APPROACH

2.4.2 MILITARY CABLES MARKET FOR OEM

FIGURE 4 MARKET SIZE CALCULATION FOR OEM

2.4.3 MILITARY CABLES AFTERMARKET

FIGURE 5 MARKET SIZE CALCULATION FOR AFTERMARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.4 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 9 MARINE SEGMENT TO COMMAND LARGEST SHARE DURING FORECAST PERIOD

FIGURE 10 AFTERMARKET SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 EUROPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN MILITARY CABLES MARKET

FIGURE 12 MODERNIZATION PROGRAMS AND INCREASING PROCUREMENT OF MILITARY FLEETS TO OFFER SEVERAL UNTAPPED OPPORTUNITIES

4.2 MILITARY CABLES MARKET, BY APPLICATION

FIGURE 13 MILITARY GROUND EQUIPMENT EXPECTED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4.3 MILITARY CABLES MARKET, BY END USE

FIGURE 14 AFTERMARKET EXPECTED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4.4 MILITARY CABLES MARKET, BY COUNTRY

FIGURE 15 ITALY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MILITARY CABLES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising military expenditure

FIGURE 17 GLOBAL MILITARY SPENDING: 2001 TO 2020

5.2.1.2 Digitalization and electrification of military systems

5.2.1.3 Rise in adoption of military unmanned and ground vehicles

5.2.2 RESTRAINTS

5.2.2.1 Saturated market in developed countries

5.2.2.2 Reduced demand due to wireless transmission

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets across the globe

5.2.4 CHALLENGES

5.2.4.1 Recovery from pandemic

5.2.4.2 Complexities with installing & upgrading large network of cables

5.3 IMPACT OF COVID-19 ON MILITARY CABLES MARKET

FIGURE 18 IMPACT OF COVID-19 ON MILITARY CABLES MARKET

5.4 RANGES AND SCENARIOS

FIGURE 19 IMPACT OF COVID-19 ON MILITARY CABLES MARKET: 3 GLOBAL SCENARIOS

5.5 VALUE CHAIN ANALYSIS OF MILITARY CABLES MARKET

FIGURE 20 VALUE CHAIN ANALYSIS

5.6 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY CABLE MANUFACTURERS

FIGURE 21 REVENUE SHIFT FOR MILITARY CABLES MARKET PLAYERS

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATION

FIGURE 22 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS

TABLE 1 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD MILLION)

5.8 MILITARY CABLES MARKET ECOSYSTEM

5.8.1 PROMINENT COMPANIES

5.8.2 PRIVATE AND SMALL ENTERPRISES

5.8.3 MARKET ECOSYSTEM

FIGURE 23 MARKET ECOSYSTEM MAP: MILITARY CABLES MARKET

TABLE 2 MILITARY CABLES MARKET ECOSYSTEM

5.9 TRADE DATA STATISTICS

5.9.1 IMPORT DATA STATISTICS

TABLE 3 IMPORT VALUE OF INSULATED WIRES AND CABLES, INCLUDING COAXIAL CABLES (PRODUCT HARMONIZED SYSTEM CODE: 8544) (USD THOUSAND)

5.9.2 EXPORT DATA STATISTICS

TABLE 4 EXPORT VALUE OF INSULATED WIRES AND CABLES, INCLUDING COAXIAL CABLES (PRODUCT HARMONIZED SYSTEM CODE: 8544) (USD THOUSAND)

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MILITARY CABLES: PORTER’S FIVE FORCE ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.11.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 NORTH AMERICA

5.12.3 EUROPE

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

FIGURE 26 TECHNOLOGY TRENDS IN MILITARY CABLES MARKET

6.2.1 MILITARY WEARABLE TRENDS

6.2.2 DIGITALIZATION OF DATA

6.2.3 HIGH-SPEED CONNECTIVITY SOLUTION

6.2.4 INCREASING MOBILITY IN MILITARY AND DEFENSE SECTORS

6.2.5 SHRINKING SIZE OF CABLES

6.2.6 5G TECHNOLOGY

6.3 TECHNOLOGY ANALYSIS

6.4 USE CASE ANALYSIS

TABLE 11 HYBRID CABLES FOR MILITARY APPLICATIONS

TABLE 12 CUSTOM CABLES FOR MARITIME APPLICATIONS

6.5 IMPACT OF MEGATRENDS

6.6 INNOVATIONS AND PATENT REGISTRATIONS

7 MILITARY CABLES MARKET, BY PRODUCT (Page No. - 70)

7.1 INTRODUCTION

7.2 COAXIAL

7.2.1 INCREASING NUMBER OF DEFENSE EQUIPMENT AND RF COMMUNICATION TO DRIVE THE SEGMENT

7.3 RIBBON

7.3.1 AEROSPACE APPLICATIONS AND SHRINKING MILITARY EQUIPMENT SIZE TO DRIVE THE SEGMENT

7.4 TWISTED PAIR

7.4.1 INCREASING VECTRONICS SYSTEMS TO DRIVE THE SEGMENT

8 MILITARY CABLES MARKET, BY PLATFORM (Page No. - 72)

8.1 INTRODUCTION

FIGURE 27 MARINE SEGMENT PROJECTED TO LEAD THE MARKET FROM 2021 TO 2026

TABLE 13 MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 14 MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

8.2 GROUND

TABLE 15 GROUND: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 16 GROUND: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

8.2.1 COMBAT VEHICLES

8.2.1.1 Growing demand for armored vehicles to drive the segment

8.2.2 BASE STATIONS

8.2.2.1 Electrification of equipment to drive the segment

8.2.3 UNMANNED GROUND VEHICLES

8.2.3.1 Increasing adoption of unmanned solutions to drive the segment

8.3 AIRBORNE

TABLE 17 AIRBORNE: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 18 AIRBORNE: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

8.3.1 FIGHTER AIRCRAFT

8.3.1.1 Rising need to gain airborne dominance across the globe to drive the segment

8.3.2 UNMANNED AERIAL VEHICLES (UAV)

8.3.2.1 Ability to carry heavy payloads and fly longer durations to drive the segment

8.3.3 MILITARY TRANSPORT AIRCRAFT

8.3.3.1 Increasing demand across regions to drive the segment

8.3.4 MILITARY HELICOPTERS

8.3.4.1 Increasing usage for ISR missions and rescue operations to drive the segment

8.4 MARINE

TABLE 19 MARINE: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 20 MARINE: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

8.4.1 DESTROYERS

8.4.1.1 Demand from major defense forces to drive the segment

8.4.2 FRIGATES

8.4.2.1 Demand from naval forces of countries like India to drive the segment

8.4.3 AMPHIBIOUS SHIPS

8.4.3.1 Amphibious warship development programs to drive the segment

8.4.4 UNMANNED MARINE VEHICLES

8.4.4.1 Adoption of unmanned solutions for marine operations to drive the segment

8.4.5 SUBMARINES

8.4.5.1 Higher adoption of electrification to drive the segment

8.4.6 OFFSHORE PATROL VEHICLES

8.4.6.1 Availability in hybrid and electric propulsion setups to drive the segment

8.4.7 AIRCRAFT CARRIERS

8.4.7.1 Replacement of aging carriers to drive the segment

9 MILITARY CABLES MARKET, BY APPLICATION (Page No. - 80)

9.1 INTRODUCTION

FIGURE 28 MILITARY GROUND EQUIPMENT SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 21 MILITARY CABLES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 22 MILITARY CABLES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 POWER TRANSFER

9.2.1 INCREASING NEED FOR POWER TRANSFER CABLES FOR ELECTRIC AIRCRAFT TO DRIVE THE SEGMENT

9.3 COMMUNICATION & NAVIGATION

9.3.1 REPLACEMENT OF ANALOG ELECTRONICS INTO DIGITAL SYSTEMS TO DRIVE THE SEGMENT

9.4 MILITARY GROUND EQUIPMENT

9.4.1 INCREASING NUMBER OF MILITARY GROUND EQUIPMENT SYSTEMS TO DRIVE THE SEGMENT

9.5 WEAPON SYSTEM

9.5.1 ADVANCED WARFARE WEAPON SYSTEMS TO DRIVE THE SEGMENT

9.6 OTHERS

10 MILITARY CABLES MARKET, BY CONDUCTOR MATERIAL (Page No. - 84)

10.1 INTRODUCTION

FIGURE 29 COPPER ALLOYS SEGMENT TO COMMAND LARGEST MARKET DURING FORECAST PERIOD

TABLE 23 MILITARY CABLES MARKET, BY CONDUCTOR MATERIAL, 2018–2020 (USD MILLION)

TABLE 24 MILITARY CABLES MARKET, BY CONDUCTOR MATERIAL, 2021–2026 (USD MILLION)

10.2 STAINLESS STEEL ALLOYS

10.2.1 HIGH QUALITY AND CORROSION RESISTANCE TO DRIVE DEMAND

10.3 COPPER ALLOYS

10.3.1 EXCELLENT ELECTRICAL PROPERTIES TO DRIVE DEMAND

10.4 ALUMINUM ALLOYS

10.4.1 NEED FOR REDUCING EQUIPMENT WEIGHT TO DRIVE DEMAND

10.5 OTHERS

11 MILITARY CABLES MARKET, BY END USER (Page No. - 88)

11.1 INTRODUCTION

FIGURE 30 AFTERMARKET SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 25 MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 26 MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

11.2 OEM

11.2.1 ELECTRIFICATION OF SYSTEMS AND CHANGING TECHNOLOGY TO DRIVE THE SEGMENT

11.3 AFTERMARKET

11.3.1 REPLACEMENT OF EXISTING CABLES TO DRIVE THE SEGMENT

12 REGIONAL ANALYSIS (Page No. - 91)

12.1 INTRODUCTION

FIGURE 31 MILITARY CABLES MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST RATE FROM 2021 TO 2026

TABLE 27 MILITARY CABLES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 28 MILITARY CABLES MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 COVID-19 IMPACT ON NORTH AMERICA

12.2.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 32 NORTH AMERICA: MILITARY CABLES MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 30 NORTH AMERICA: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 32 NORTH AMERICA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 34 NORTH AMERICA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 36 NORTH AMERICA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 38 NORTH AMERICA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: MILITARY CABLES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 40 NORTH AMERICA: MILITARY CABLES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.3 US

12.2.3.1 Increased spending by US defense organizations and private players to drive the market

TABLE 41 US: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 42 US: MILITARY CABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 43 US: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 44 US: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 45 US: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 46 US: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 47 US: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 48 US: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 49 US: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 50 US: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Increasing military procurements and growing demand for UAVs to drive the market

TABLE 51 CANADA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 52 CANADA: MILITARY CABLES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 53 CANADA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 54 CANADA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 55 CANADA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 56 CANADA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 57 CANADA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 58 CANADA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 59 CANADA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 60 CANADA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3 EUROPE

12.3.1 COVID-19 IMPACT ON EUROPE

12.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 33 EUROPE: MILITARY CABLES MARKET SNAPSHOT

TABLE 61 EUROPE: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 62 EUROPE: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 63 EUROPE: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 64 EUROPE: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 65 EUROPE: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 66 EUROPE: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 67 EUROPE: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 68 EUROPE: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 69 EUROPE: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 70 EUROPE: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 71 EUROPE: MILITARY CABLES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 72 EUROPE: MILITARY CABLES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.3 UK

12.3.3.1 Airborne platforms to drive the market

TABLE 73 UK: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 74 UK: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 75 UK: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 76 UK: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 77 UK: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 78 UK: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 79 UK: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 80 UK: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 81 UK: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 82 UK: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Increased military spending to drive the market

TABLE 83 FRANCE: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 84 FRANCE: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 85 FRANCE: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 86 FRANCE: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 87 FRANCE: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 88 FRANCE: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 89 FRANCE: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 90 FRANCE: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 91 FRANCE: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 92 FRANCE: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.5 GERMANY

12.3.5.1 Investments in UGVs to develop multifunctional and technologically advanced land or ground robots to drive the market

TABLE 93 GERMANY: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 94 GERMANY: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 95 GERMANY: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 96 GERMANY: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 97 GERMANY: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 98 GERMANY: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 99 GERMANY: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 100 GERMANY: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 101 GERMANY: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 102 GERMANY: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.6 RUSSIA

12.3.6.1 Increasing military R&D to drive the market

TABLE 103 RUSSIA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 104 RUSSIA: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 105 RUSSIA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 106 RUSSIA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 107 RUSSIA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 108 RUSSIA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 109 RUSSIA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 110 RUSSIA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 111 RUSSIA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 112 RUSSIA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.7 ITALY

12.3.7.1 Presence of major OEMs to drive the market

TABLE 113 ITALY: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 114 ITALY: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 115 ITALY: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 116 ITALY: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 117 ITALY: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 118 ITALY: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 119 ITALY: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 120 ITALY: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 121 ITALY: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 122 ITALY: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.8 REST OF EUROPE

TABLE 123 REST OF THE EUROPE: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 124 REST OF EUROPE: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 125 REST OF EUROPE: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 126 REST OF EUROPE: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 127 REST OF EUROPE: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 128 REST OF EUROPE: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 129 REST OF EUROPE: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 130 REST OF EUROPE: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 131 REST OF EUROPE: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 132 REST OF EUROPE: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 COVID-19 IMPACT ON ASIA PACIFIC

12.4.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: MILITARY CABLES MARKET SNAPSHOT

TABLE 133 ASIA PACIFIC: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 138 ASIA PACIFIC: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 140 ASIA PACIFIC: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MILITARY CABLES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 144 ASIA PACIFIC: MILITARY CABLES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Presence of several shipbuilding companies to drive the market

TABLE 145 CHINA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 146 CHINA: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 147 CHINA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 148 CHINA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 149 CHINA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 150 CHINA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 151 CHINA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 152 CHINA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 153 CHINA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 154 CHINA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.4 INDIA

12.4.4.1 In-house development of military equipment to drive the market

TABLE 155 INDIA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 156 INDIA: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 157 INDIA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 158 INDIA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 159 INDIA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 160 INDIA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 161 INDIA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 162 INDIA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 163 INDIA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 164 INDIA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.5 JAPAN

12.4.5.1 Technologically-advanced economy and significant defense budget to drive the market

TABLE 165 JAPAN: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 166 JAPAN: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 167 JAPAN: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 168 JAPAN: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 169 JAPAN: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 170 JAPAN: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 171 JAPAN: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 172 JAPAN: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 173 JAPAN: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 174 JAPAN: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.6 SOUTH KOREA

12.4.6.1 Tensions with North Korea to drive market

TABLE 175 SOUTH KOREA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 176 SOUTH KOREA: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 177 SOUTH KOREA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 178 SOUTH KOREA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 179 SOUTH KOREA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 180 SOUTH KOREA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 181 SOUTH KOREA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 182 SOUTH KOREA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 183 SOUTH KOREA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 184 SOUTH KOREA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

TABLE 185 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 187 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 188 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 189 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 190 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 191 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 192 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.5 MIDDLE EAST

12.5.1 COVID-19 IMPACT ON MIDDLE EAST

12.5.2 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 35 MIDDLE EAST: MILITARY CABLES MARKET SNAPSHOT

TABLE 195 MIDDLE EAST: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 196 MIDDLE EAST: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 197 MIDDLE EAST: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 198 MIDDLE EAST: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 199 MIDDLE EAST: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 200 MIDDLE EAST: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 201 MIDDLE EAST: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 202 MIDDLE EAST: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 203 MIDDLE EAST: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 204 MIDDLE EAST: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 205 MIDDLE EAST: MILITARY CABLES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 206 MIDDLE EAST: MILITARY CABLES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.5.3 SAUDI ARABIA

12.5.3.1 High military expenditure to drive the market

TABLE 207 SAUDI ARABIA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 208 SAUDI ARABIA: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 209 SAUDI ARABIA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 210 SAUDI ARABIA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 211 SAUDI ARABIA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 212 SAUDI ARABIA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 213 SAUDI ARABIA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 214 SAUDI ARABIA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 215 SAUDI ARABIA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 216 SAUDI ARABIA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.5.4 ISRAEL

12.5.4.1 Technological advancements to tackle regional disputes to drive the market

TABLE 217 ISRAEL: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 218 ISRAEL: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 219 ISRAEL: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 220 ISRAEL: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 221 ISRAEL: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 222 ISRAEL: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 223 ISRAEL: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 224 ISRAEL: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 225 ISRAEL: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 226 ISRAEL: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.5.5 REST OF MIDDLE EAST

TABLE 227 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 228 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 229 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 230 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 231 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 232 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 233 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 234 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 235 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 236 REST OF MIDDLE EAST: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.6 REST OF THE WORLD

12.6.1 COVID-19 IMPACT ON REST OF THE WORLD

12.6.2 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 237 REST OF THE WORLD: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 238 REST OF THE WORLD: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 239 REST OF THE WORLD: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 240 REST OF THE WORLD: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 241 REST OF THE WORLD: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 242 REST OF THE WORLD: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 243 REST OF THE WORLD: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 244 REST OF THE WORLD: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 245 REST OF THE WORLD: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 246 REST OF THE WORLD: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 247 REST OF THE WORLD: MILITARY CABLES MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 248 REST OF THE WORLD: MILITARY CABLES MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Increasing demand for military unmanned vehicles to drive the market

TABLE 249 BRAZIL: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 250 BRAZIL: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 251 BRAZIL: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 252 BRAZIL: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 253 BRAZIL: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 254 BRAZIL: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 255 BRAZIL: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 256 BRAZIL: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 257 BRAZIL: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 258 BRAZIL: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.6.4 SOUTH AFRICA

12.6.4.1 Focus on securing borders and improving military capabilities to drive the market

TABLE 259 SOUTH AFRICA: MILITARY CABLES MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 260 SOUTH AFRICA: MILITARY CABLES MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 261 SOUTH AFRICA: MILITARY CABLES MARKET, BY GROUND, 2018–2020 (USD MILLION)

TABLE 262 SOUTH AFRICA: MILITARY CABLES MARKET, BY GROUND, 2021–2026 (USD MILLION)

TABLE 263 SOUTH AFRICA: MILITARY CABLES MARKET, BY AIRBORNE, 2018–2020 (USD MILLION)

TABLE 264 SOUTH AFRICA: MILITARY CABLES MARKET, BY AIRBORNE, 2021–2026 (USD MILLION)

TABLE 265 SOUTH AFRICA: MILITARY CABLES MARKET, BY MARINE, 2018–2020 (USD MILLION)

TABLE 266 SOUTH AFRICA: MILITARY CABLES MARKET, BY MARINE, 2021–2026 (USD MILLION)

TABLE 267 SOUTH AFRICA: MILITARY CABLES MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 268 SOUTH AFRICA: MILITARY CABLES MARKET, BY END USER, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 173)

13.1 INTRODUCTION

13.2 COMPETITIVE OVERVIEW

TABLE 269 KEY DEVELOPMENTS BY LEADING PLAYERS IN MILITARY CABLES MARKET BETWEEN 2018 AND 2021

FIGURE 36 MARKET EVALUATION FRAMEWORK: ACQUISITION IS A KEY STRATEGY ADOPTED BY MARKET PLAYERS

13.3 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2020

FIGURE 37 RANKING ANALYSIS OF TOP 5 PLAYERS: MILITARY CABLES MARKET, 2020

FIGURE 38 MARKET SHARE OF KEY PLAYERS, 2020

13.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

FIGURE 39 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

13.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 270 COMPANY PRODUCT FOOTPRINT

TABLE 271 COMPANY SOLUTION TYPE FOOTPRINT

TABLE 272 COMPANY REGION FOOTPRINT

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STAR

13.6.2 EMERGING LEADER

13.6.3 PERVASIVE

13.6.4 PARTICIPANT

FIGURE 40 MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANY

13.7.2 RESPONSIVE COMPANY

13.7.3 STARTING BLOCK

13.7.4 DYNAMIC COMPANY

FIGURE 41 MILITARY CABLES MARKET (STARTUP) COMPETITIVE LEADERSHIP MAPPING, 2020

13.7.5 COMPETITIVE BENCHMARKING

TABLE 273 MILITARY CABLES MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 274 MILITARY CABLES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

13.8 COMPETITIVE SCENARIO

13.8.1 MARKET EVALUATION FRAMEWORK

13.8.2 PRODUCT LAUNCHES

TABLE 275 MILITARY CABLES MARKET: PRODUCT LAUNCHES, JANUARY 2018–DECEMBER 2021

13.8.3 DEALS

TABLE 276 MILITARY CABLES MARKET: DEALS, JANUARY 2018–DECEMBER 2021

13.8.4 OTHERS

TABLE 277 MILITARY CABLES MARKET: OTHERS, JANUARY 2018–DECEMBER 2021

14 COMPANY PROFILES: KEY PLAYERS (Page No. - 190)

14.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)*

14.1.1 PRYSMIAN GROUP

TABLE 278 PRYSMIAN GROUP: BUSINESS OVERVIEW

FIGURE 42 PRYSMIAN GROUP: COMPANY SNAPSHOT

TABLE 279 PRYSMIAN GROUP: DEALS

14.1.2 NEXANS S.A.

TABLE 280 NEXANS S.A.: BUSINESS OVERVIEW

FIGURE 43 NEXANS S.A.: COMPANY SNAPSHOT

TABLE 281 NEXANS SA: DEALS

14.1.3 SUMITOMO ELECTRIC INDUSTRIES, LTD

TABLE 282 SUMITOMO ELECTRIC INDUSTRIES, LTD: BUSINESS OVERVIEW

FIGURE 44 SUMITOMO ELECTRIC INDUSTRIES, LTD: COMPANY SNAPSHOT

14.1.4 COLLINS AEROSPACE

TABLE 283 COLLINS AEROSPACE: BUSINESS OVERVIEW

FIGURE 45 COLLINS AEROSPACE: COMPANY SNAPSHOT

TABLE 284 COLLINS AEROSPACE: DEALS

14.1.5 CARLISLE INTERCONNECT TECHNOLOGIES

TABLE 285 CARLISLE INTERCONNECT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 46 CARLISLE INTERCONNECT TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 286 CARLISLE INTERCONNECT TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 287 CARLISLE INTERCONNECT TECHNOLOGIES: NEW PRODUCT DEVELOPMENTS

TABLE 288 CARLISLE INTERCONNECT TECHNOLOGIES: DEALS

TABLE 289 CARLISLE INTERCONNECT TECHNOLOGIES: OTHERS

14.1.6 GALAXY WIRE & CABLE, INC.

TABLE 290 GALAXY WIRE & CABLE, INC: BUSINESS OVERVIEW

TABLE 291 GALAXY WIRE & CABLE, INC: DEALS

14.1.7 LS CABLE & SYSTEM LTD

TABLE 292 LS CABLE & SYSTEM LTD: BUSINESS OVERVIEW

TABLE 293 LS CABLE AND SYSTEM LTD: DEALS

14.1.8 MOLEX, LLC

TABLE 294 MOLEX, LLC: BUSINESS OVERVIEW

TABLE 295 MOLEX, LLC: DEALS

14.1.9 A.E. PETSCHE

TABLE 296 A.E. PETSCHE: BUSINESS OVERVIEW

14.1.10 W.L. GORE & ASSOCIATES INC

TABLE 297 W.L. GORE & ASSOCIATES INC: BUSINESS OVERVIEW

TABLE 298 W.L. GORE & ASSOCIATES INC: OTHERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)*

14.2 OTHER PLAYERS

14.2.1 PIC WIRE & CABLE

14.2.2 SANGHVI AEROSPACE (P.) LTD.

14.2.3 SPECTRUM CABLE TECH INDIA

14.2.4 AXON CABLE

14.2.5 GLENAIR, INC

14.2.6 JUDD WIRE, INC

14.2.7 CHAMPLAIN CABLE CORPORATION

14.2.8 SPECIALTY CABLE CORPORATION

14.2.9 RSCC WIRE AND CABLE LLC

14.2.10 IEWC

14.2.11 NATIONAL WIRE & CABLE CORPORATION

14.2.12 NEW ENGLAND WIRE TECHNOLOGIES

14.2.13 MINNESOTA WIRE & CABLE

14.2.14 MERCURY WIRE PRODUCTS, INC

14.2.15 MARMON AEROSPACE AND DEFENSE, LLC

15 APPENDIX (Page No. - 232)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORT

15.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Cables Market