Medical Exoskeleton Market by Component (Hardware (Sensor, Actuator, Control System, Power Source), Software), Type (Powered, Passive), Extremities (Lower, Upper and Full Body) & Mobility (Mobile, Stationary) - Global Forecasts to 2026

The global medical exoskeleton market boasts a total value of $0.2 billion in 2021 and is projected to register a growth rate of 45.0% to reach a value of $1.0 billion by 2026. The growth of this market is mainly driven by factors such as the increasing number of people with physical disabilities and subsequent growth in the demand for effective rehabilitation approaches; agreements and collaborations among companies and research organizations for the development of the exoskeleton technology, and increasing insurance coverage for medical exoskeletons in several countries driving the growth of the medical exoskeleton market. However, the high cost of medical exoskeletons may restrict market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Exoskeleton Market Dynamics

Driver: Increasing number of people with physical disabilities and subsequent growth in the demand for effective rehabilitation approaches

Globally, the number of people with physical disabilities is increasing majorly due to the rising geriatric population, increasing number of road accidents and severe trauma injuries, and increasing prevalence of stroke, among other factors. According to the US Census Bureau, the global elderly population is estimated to increase at a steady pace in the coming years, from 703 million in 2019 to 1.5 billion by 2050.

With the rising geriatric population, the number of people with disabilities is increasing as the elderly are more prone to conditions such as stroke and severe musculoskeletal injuries resulting from falls. The significant growth in the geriatric population thus not only indicates the presence of more potential users for medical exoskeletons but also implies that there would be a lesser number of active people to look after the elderly and disabled in the coming years. As a result, the demand for effective rehabilitation approaches, including the use of new and advanced technologies and products, is increasing across the globe. This is considered as a positive indicator for the growth of the medical exoskeleton market in all major regions.

Restraint: Regulatory Challenges for securing approvals for medical applications of exoskeletons

Manufacturers’ skills and expertise pertaining to technical designing can matter during the testing of the product. The malfunctioning of a medical device can lead to life-threatening consequences, and hence, exoskeletons developed for healthcare applications need to be thoroughly examined. Currently, there are a few standards that are directly applicable to the exoskeleton industry. The FDA recognizes ISO standards that are applicable to relevant industries, and only products that receive regulatory approvals can be sold in the market. There have been many advancements in powered lower-limb exoskeletons, but users are experiencing a hard time navigating sloping or slippery surfaces. The prototypes cannot yet cope with twisting motions, so users making turns while carrying objects could tire out easily, resulting in adverse events, which can include skin and tissue damages and bone fractures. Thus, regulatory bodies have established a very tight approval process for such devices so that a wearer’s safety is not compromised due to the high-power output of actuators used in them.

Opportunity: Increasing insurance coverage for medical exoskeletons in several countries

Assistive devices are an essential part of healthcare. In several countries, many rehabilitation centers use assistive devices provided by government organizations, special agencies, insurance companies, and charitable and non-governmental organizations.

Currently, coverage for the exoskeleton technology by insurance companies is low in several countries. However, companies are focusing on framing policies and entering into strategic collaborations and agreements with various public and private insurance providers for the reimbursement of medical exoskeleton devices. For instance, Ekso Bionics is approaching the Centers for Medicare and Medicaid Services and third-party insurers as they are expected to play an important role in the long-term commercial adoption of the Ekso GT device.

In March 2021, ReWalk Robotics entered into a contract with BKK Mobil Oil Insurance to provide ReWalk Personal Exoskeleton devices to its eligible beneficiaries with spinal cord injury. This contract provides, eligible individuals can receive a ReWalk Personal 6.0 exoskeleton, which enables them to stand and walk in their homes and communities after completing the training program.

North America accounted for the largest share of the global medical exoskeleton market

Based on the region, the medical exoskeleton market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). In 2020, North America is expected to dominate the market with a share of 44.4%. The growing geriatric population, increasing demand for self-assist exoskeletons, high prevalence of stroke, and growing number of spinal cord injuries (SCI) are the key factors driving the growth of the medical exoskeleton market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Medical Exoskeleton Market Key Players

The global Medical exoskeleton market is dominated by a few globally established players such as Ekso Bionics Holdings, Inc. (US), ReWalk Robotics Ltd. (Israel), Parker Hannifin Corp (US), CYBERDYNE Inc. (Japan), Bionik Laboratories Corp (Canada), Rex Bionics Ltd. (UK), B-TEMIA Inc. (Canada), Hocoma AG (a subsidiary of DIH Technologies) (Switzerland), Wearable Robotics SRL (Italy), Gogoa Mobility Robots SL (Spain), and ExoAtlet (Luxembourg) and among others.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component, Type, Mobility, Extremity, Structure, and Region |

|

Geographies covered |

North America (US and Canada), Asia (Japan, China, India, and RoA), Europe (Germany, UK, France and RoE), and the Rest of the World (Latin America, Middle East&Africa) |

|

Companies covered |

Ekso Bionics (US), ReWalk (Israel), and Parker Hannifin (US), Cyberdyne (Japan) and Bionik (Canada), Rex Bionics (UK), B-TEMIA Inc. (Canada), Bioventus (North Carolina), Hocoma AG (a subsidiary of DIH Technologies) (Switzerland), Wearable Robotics SRL (Italy), Gogoa Mobility Robots SL (Spain), ExoAtlet (Luxembourg), Meditouch (Israel), Suit X (US), P&S Mechanics (South Korea), Marsi Bionics (Spain), Rehab Robotics (Hong Kong), Myomo (US), Focal Meditech (Netherlands), Honda Motors (Japan), Wandercraft (France), BAMA Teknoloji (Turkey), Medexo Robotics (Hong Kong), Fourier Intelligence (China), TWIICE (Switzerland). |

The study categorizes the Medical ?exoskeleton market into the following segments and subsegments:

By Component

-

Hardware

-

Sensors

- Gyroscopes

- Microphones

- Accelerometers

- Tilt Sensors

- Force/Torque sensors

- Position Sensors

- Others

-

Actuators

- Electrical

- Pneumatic

- Hydraulic

- Piezoelectric

- Power Sources

- Control Systems

- Other Hardware Components

-

Sensors

- Software

By Type

- Powered Exoskeletons

- Passive Exoskeletons

By Extremity

- Upper Extremity Medical Exoskeletons

- Lower Extremity Medical Exoskeletons

- Full Body

By Mobility

- Mobile Exoskeletons

- Stationary Exoskeletons

- Medical exoskeleton Market, By Structure

- Rigid Exoskeletons

- Soft Exoskeleton

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia

- Japan

- China

- India

- Rest of Asia (RoA)

-

Rest of the World

- Latin America

- The Middle East and Africa

Recent Developments

- In 2021, CYBERDYNE received medical device approval from Thai Food and Medical Products Approval Authority (Thai FDA) for HAL Single Joint Type. The product is for patients with reduced mobility in the upper and lower limbs due to muscle weakness or paralysis.

- In 2020, Ekso Bionics received 501(k) clearance from the US Food and Drug Administration (FDA) to market its EksoNR robotic exoskeleton for patients with acquired brain injury (ABI). EksoNR is the first exoskeleton device to receive FDA clearance for rehabilitation use with ABI, significantly expanding the device’s indication to a broader group of patients.

- In 2019, ReWalk Robotics’ ReStore soft exo-suit system received clearance from the US Food and Drug Administration (FDA) for sale to rehabilitation centers across the United States

- In 2018, Parker Hannifin announced the release of its next generation Indego Therapy device for use in rehabilitation centers which is rapidly adjustable and can be custom-sized and perfectly fitted to patients

Frequently Asked Questions (FAQs):

What is the size of Medical Exoskeleton Market ?

The global medical exoskeleton market boasts a total value of $0.2 billion in 2021 and is projected to register a growth rate of 45.0% to reach a value of $1.0 billion by 2026.

What are the major growth factors of Medical Exoskeleton Market ?

The growth of this market is mainly driven by factors such as the increasing number of people with physical disabilities and subsequent growth in the demand for effective rehabilitation approaches; agreements and collaborations among companies and research organizations for the development of the exoskeleton technology, and increasing insurance coverage for medical exoskeletons in several countries driving the growth of the medical exoskeleton market. However, the high cost of medical exoskeletons may restrict market growth to a certain extent.

Who all are the prominent players of Medical Exoskeleton Market ?

The global Medical exoskeleton market is dominated by a few globally established players such as Ekso Bionics Holdings, Inc. (US), ReWalk Robotics Ltd. (Israel), Parker Hannifin Corp (US), CYBERDYNE Inc. (Japan), Bionik Laboratories Corp (Canada), Rex Bionics Ltd. (UK), B-TEMIA Inc. (Canada), Hocoma AG (a subsidiary of DIH Technologies) (Switzerland), Wearable Robotics SRL (Italy), Gogoa Mobility Robots SL (Spain), and ExoAtlet (Luxembourg) and among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MEDICAL EXOSKELETON MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

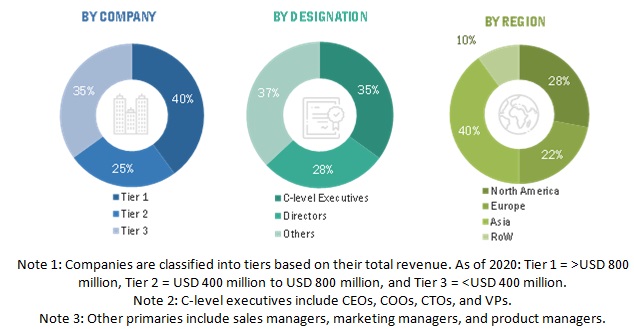

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 COMPANY REVENUE SHARE ANALYSIS ILLUSTRATION: MEDICAL EXOSKELETON MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis (demand side)

FIGURE 6 MEDICAL EXOSKELETON MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 7 MEDICAL EXOSKELETON MARKET: TOP-DOWN APPROACH

2.2.3 GROWTH FORECAST

FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MEDICAL EXOSKELETON MARKET (2021–2026)

FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 RESEARCH ASSUMPTIONS

FIGURE 11 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 12 MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

FIGURE 13 MEDICAL EXOSKELETON MARKET, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 14 MEDICAL EXOSKELETON MARKET, BY EXTREMITY, 2021–2026 (USD MILLION)

FIGURE 15 MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2021–2026 (USD MILLION)

FIGURE 16 GEOGRAPHIC SNAPSHOT: MEDICAL EXOSKELETON MARKET

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 MEDICAL EXOSKELETON MARKET: OVERVIEW

FIGURE 17 INCREASING DEMAND FOR EFFECTIVE REHABILITATION APPROACHES IS DRIVING MARKET GROWTH

4.2 MEDICAL EXOSKELETON MARKET, BY HARDWARE TYPE & REGION

FIGURE 18 ACTUATORS TO HOLD LARGEST SHARE OF MEDICAL EXOSKELETON HARDWARE MARKET IN 2021

4.3 MEDICAL EXOSKELETON MARKET, BY EXTREMITY

FIGURE 19 UPPER EXTREMITY SEGMENT TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4.4 GEOGRAPHIC SNAPSHOT: MEDICAL EXOSKELETON MARKET

FIGURE 20 ASIA TO BE FASTEST-GROWING REGIONAL SEGMENT DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MEDICAL EXOSKELETON MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing number of people with physical disabilities and subsequent growth in demand for effective rehabilitation approaches

FIGURE 22 AGING POPULATION, BY REGION, 2019 VS. 2050

FIGURE 23 PERCENTAGE OF DISABLED PEOPLE IN US, 2015–2020

FIGURE 24 PERCENTAGE OF DISABLED PEOPLE IN US, BY AGE GROUP, 2018

FIGURE 25 PERCENTAGE OF DISABLED PEOPLE IN US, BY TYPE OF DISABILITY, 2018

5.2.1.2 Agreements and collaborations among companies and research organizations for development of exoskeleton technology

5.2.1.3 Huge investments for development of exoskeleton technology

5.2.2 RESTRAINTS

5.2.2.1 Regulatory challenges for securing approvals for medical exoskeletons

5.2.3 OPPORTUNITIES

5.2.3.1 Introduction of soft actuators

5.2.3.2 Increasing insurance coverage for medical exoskeletons in several countries

5.2.4 CHALLENGES

5.2.4.1 High equipment cost

TABLE 2 COST OF MEDICAL EXOSKELETONS

5.2.4.2 Safety concerns associated with medical exoskeletons

5.2.4.3 Long-term power supply requirements

5.3 IMPACT OF COVID-19 ON MEDICAL EXOSKELETON MARKET

5.3.1 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS OF MEDICAL EXOSKELETON MARKET

5.3.2 ECOSYSTEM

FIGURE 27 MEDICAL EXOSKELETON ECOSYSTEM

TABLE 3 MEDICAL EXOSKELETON MARKET SUPPLY CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MEDICAL EXOSKELETON MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 DEGREE OF COMPETITION

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 CASE STUDIES FOR MEDICAL EXOSKELETON MARKET

5.5.1 PEER-REVIEWED CASE STUDY DEMONSTRATES VARIOUS HEALTH IMPROVEMENTS FOLLOWING REWALK EXOSKELETON USE

5.5.2 EKSO BIONICS IMPROVES PATIENT MOBILITY WITH HELP OF VODAFONE-MANAGED IOT CONNECTIVITY PLATFORM

5.5.3 RLS MAGNETIC ENCODERS ENABLED MARSI BIONICS TO DESIGN AND BUILD EXOSKELETON ORTHOPAEDIC DEVICES

5.6 TECHNOLOGY ANALYSIS

5.7 FUTURE TRENDS OF MEDICAL EXOSKELETON MARKET

5.8 PATENT ANALYSIS

5.9 STANDARDS AND REGULATIONS RELATED TO MEDICAL EXOSKELETON MARKET

6 MEDICAL EXOSKELETON MARKET, BY COMPONENT (Page No. - 66)

6.1 INTRODUCTION

TABLE 5 MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

6.2 HARDWARE

TABLE 6 MEDICAL EXOSKELETON HARDWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 7 EXOSKELETON MARKET FOR HARDWARE, BY REGION, 2019–2026 (USD MILLION)

6.2.1 SENSORS

6.2.1.1 Sensors help exoskeletons to acquire knowledge about surrounding environment

TABLE 8 MEDICAL EXOSKELETON HARDWARE MARKET FOR SENSORS , BY REGION, 2019–2026 (USD MILLION)

6.2.1.2 Gyroscopes

6.2.1.2.1 Gyroscopes are used in exoskeletons for orientation and rotation measurements

6.2.1.3 Microphones

6.2.1.3.1 Microphones assist medical exoskeletons in sound source localization by separating unwanted sound signals from other positions

6.2.1.4 Accelerometers

6.2.1.4.1 Accelerometers are integrated into medical exoskeletons for measurement of non-gravitational acceleration forces

6.2.1.5 Tilt sensors

6.2.1.5.1 Tilt sensors are used in medical exoskeletons to measure tilt angle with respect to Earth’s ground plane

6.2.1.6 Force/torque sensors

6.2.1.6.1 Force/torque sensors help medical exoskeletons control interaction with objects in manipulation tasks

6.2.1.7 Position sensors

6.2.1.7.1 Position sensors are used to measure distance traveled by medical exoskeletons from their origin

6.2.1.8 Others

6.2.2 ACTUATORS

6.2.2.1 Actuators are used to set systems in motion and control their mechanism

TABLE 9 MEDICAL EXOSKELETON HARDWARE MARKET FOR ACTUATORS, BY REGION, 2019–2026 (USD MILLION)

6.2.2.2 Electrical

6.2.2.2.1 Electrical actuators use motors to convert electrical energy into mechanical energy

6.2.2.3 Pneumatic

6.2.2.3.1 Pneumatic actuators convert electric energy into mechanical motion and are similar to capacitors in operation

6.2.2.4 Hydraulic

6.2.2.4.1 Hydraulic actuators are used in medical exoskeleton applications where heavy force and speed are required

6.2.2.5 Piezoelectric

6.2.2.5.1 Piezoelectric actuators use converse piezoelectric effect for precise positioning of systems, ultrasonic actuators, and microactuators in exoskeletons

6.2.3 POWER SOURCES

6.2.3.1 Exoskeletons mainly use lead-acid batteries, fuel cells, and lithium-ion batteries for electrical connectivity

TABLE 10 MEDICAL EXOSKELETON HARDWARE MARKET FOR POWER SOURCES , BY REGION, 2019–2026 (USD MILLION)

6.2.4 CONTROL SYSTEMS/CONTROLLERS

6.2.4.1 Controllers allow all parts of exoskeletons to operate together

TABLE 11 MEDICAL EXOSKELETON HARDWARE MARKET FOR CONTROL SYSTEMS, BY REGION, 2019–2026 (USD MILLION)

6.2.5 OTHERS

TABLE 12 MEDICAL EXOSKELETON HARDWARE MARKET FOR OTHER HARDWARE COMPONENTS, BY REGION, 2019–2026 (USD MILLION)

6.3 SOFTWARE

6.3.1 SOFTWARE HELP TO PROGRAM EXOSKELETONS ACCORDING TO TASKS REQUIRED TO BE PERFORMED BY THEM

TABLE 13 MEDICAL EXOSKELETON MARKET FOR SOFTWARE , BY REGION, 2019–2026 (USD MILLION)

7 MEDICAL EXOSKELETON MARKET, BY TYPE (Page No. - 76)

7.1 INTRODUCTION

TABLE 14 MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.2 POWERED

7.2.1 POWERED EXOSKELETONS ARE USUALLY POWERED BY ELECTRIC MOTORS, ACTUATORS, SENSORS, AND BATTERIES

TABLE 15 POWERED EXOSKELETON MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 PASSIVE

7.3.1 PASSIVE EXOSKELETONS REQUIRE NO ELECTRIC POWER AND ARE SIMPLER IN COMPARISON TO POWERED EXOSKELETONS

TABLE 16 PASSIVE EXOSKELETON MARKET, BY REGION, 2019–2026 (USD MILLION)

8 MEDICAL EXOSKELETON MARKET, BY EXTREMITY (Page No. - 79)

8.1 INTRODUCTION

TABLE 17 MEDICAL EXOSKELETON MARKET, BY EXTREMITY, 2019–2026 (USD MILLION)

TABLE 18 MEDICAL EXOSKELETON MARKET, BY EXTREMITY, 2019–2026 (UNITS)

8.2 LOWER EXTREMITY

8.2.1 LOWER EXTREMITY EXOSKELETONS ARE DESIGNED TO PROVIDE PROTECTION, ASSISTANCE, AND SUPPORT TO LOWER LIMBS OF HUMAN BODY

TABLE 19 LOWER EXTREMITY MEDICAL EXOSKELETON MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 UPPER EXTREMITY

8.3.1 UPPER EXTREMITY EXOSKELETONS PROVIDE SUPPORT TO UPPER LIMBS FOR STRENGTHENING OR AUGMENTATION

TABLE 20 UPPER EXTREMITY MEDICAL EXOSKELETON MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 FULL BODY

8.4.1 FULL-BODY EXOSKELETONS ARE DESIGNED FOR HUMAN BODY STRENGTH AUGMENTATION

TABLE 21 FULL BODY MEDICAL EXOSKELETON MARKET, BY REGION, 2019–2026 (USD MILLION)

9 MEDICAL EXOSKELETON MARKET, BY STRUCTURE (Page No. - 83)

9.1 INTRODUCTION

9.2 RIGID EXOSKELETONS

9.2.1 RIGID EXOSKELETONS CAN DELIVER HIGHER FORCES QUICKLY AND ACCURATELY, EVEN IN EXTREME CASES OF PARALYSIS

9.3 SOFT EXOSKELETONS

9.3.1 SOFT EXOSKELETONS REDUCE RISKS OF INJURY, ARE EASIER TO FIT, AND IMPROVE MANEUVERABILITY

10 MEDICAL EXOSKELETON MARKET, BY MOBILITY (Page No. - 84)

10.1 INTRODUCTION

TABLE 22 MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

10.2 STATIONARY

10.2.1 STATIONARY EXOSKELETONS ARE MOSTLY USED IN MEDICAL APPLICATIONS

TABLE 23 STATIONARY MEDICAL EXOSKELETONS MARKET, BY REGION, 2019–2026 (USD MILLION)

10.3 MOBILE

10.3.1 MOBILE EXOSKELETONS PROVIDE EFFECTIVE AND REPETITIVE GAIT TRAINING FOR DISABLED PATIENTS

TABLE 24 MOBILE MEDICAL EXOSKELETONS MARKET, BY REGION, 2019–2026 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 88)

11.1 INTRODUCTION

TABLE 25 MEDICAL EXOSKELETON MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 MEDICAL EXOSKELETON MARKET, BY REGION, 2019–2026 (UNITS)

11.2 NORTH AMERICA

FIGURE 28 SNAPSHOT: EXOSKELETON MARKET IN NORTH AMERICA

TABLE 27 NORTH AMERICA: MEDICAL EXOSKELETON MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 28 NORTH AMERICA: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MEDICAL EXOSKELETON HARDWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: MEDICAL EXOSKELETON MARKET, BY EXTREMITY, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Increasing use of exoskeletons in healthcare to fuel market growth in US

TABLE 33 US: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 34 US: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 US: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing geriatric population and surging demand for personal assistance exoskeletons to drive market growth in Canada

TABLE 36 CANADA: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 37 CANADA: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 CANADA: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.3 EUROPE

FIGURE 29 SNAPSHOT: MEDICAL EXOSKELETON MARKET IN EUROPE

TABLE 39 EUROPE: MEDICAL EXOSKELETON MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 40 EUROPE: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 41 EUROPE: MEDICAL EXOSKELETON HARDWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 42 EUROPE: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 EUROPE: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

TABLE 44 EUROPE: MEDICAL EXOSKELETON MARKET, BY EXTREMITY, 2019–2026 (USD MILLION)

11.3.1 UK

11.3.1.1 Demand for exoskeletons in healthcare and personal assistance applications to support market growth

TABLE 45 UK: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 46 UK: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 47 UK: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Growing elderly population and increasing prevalence of diseases such as stroke are expected to drive market growth in Germany

TABLE 48 GERMANY: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 49 GERMANY: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 GERMANY: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Rising geriatric population and growing incidences of chronic diseases are expected to propel demand for medical exoskeletons in France

TABLE 51 FRANCE: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 52 FRANCE: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 FRANCE: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.3.4 REST OF EUROPE (ROE)

TABLE 54 ROE: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 55 ROE: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

11.4 ASIA

TABLE 56 ASIA: MEDICAL EXOSKELETON MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 57 ASIA: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 58 ASIA: MEDICAL EXOSKELETON HARDWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 ASIA: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 ASIA: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

TABLE 61 ASIA: MEDICAL EXOSKELETON MARKET, BY EXTREMITY, 2019–2026 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Aging population and reduced workforce would fuel demand for exoskeletons in Japan in near future

TABLE 62 JAPAN: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 63 JAPAN: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 JAPAN: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Emergence of new exoskeleton companies in China to augment market growth during forecast period

TABLE 65 CHINA: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 66 CHINA: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 CHINA: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Initiation of various automotive manufacturing projects in India would fuel exoskeleton market growth in coming years

TABLE 68 INDIA: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 69 INDIA: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 INDIA: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.4.4 REST OF ASIA

TABLE 71 ROA: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 72 ROA: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 ROA: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

11.5 REST OF THE WORLD

TABLE 74 ROW: MEDICAL EXOSKELETON MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 75 ROW: MEDICAL EXOSKELETON HARDWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 ROW: MEDICAL EXOSKELETON MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 ROW: MEDICAL EXOSKELETON MARKET, BY MOBILITY, 2019–2026 (USD MILLION)

TABLE 78 ROW: MEDICAL EXOSKELETON MARKET, BY EXTREMITY, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 111)

12.1 OVERVIEW

FIGURE 30 KEY DEVELOPMENTS OF PROMINENT PLAYERS OPERATING IN MEDICAL EXOSKELETON MARKET (2020–2021)

12.2 MARKET SHARE ANALYSIS: MEDICAL EXOSKELETON MARKET, 2020

TABLE 79 DEGREE OF COMPETITION

12.3 COMPANY EVALUATION QUADRANT

12.3.1 STAR

12.3.2 EMERGING LEADER

12.3.3 PERVASIVE

12.3.4 PARTICIPANT

FIGURE 31 MEDICAL EXOSKELETON MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.4 COMPANY EVALUATION QUADRANT FOR EMERGING PLAYERS

12.4.1 PROGRESSIVE COMPANY

12.4.2 RESPONSIVE COMPANY

12.4.3 DYNAMIC COMPANY

12.4.4 STARTING BLOCK

FIGURE 32 MEDICAL EXOSKELETON MARKET: COMPANY EVALUATION QUADRANT, 2020 (EMERGING PLAYERS)

12.5 COMPETITIVE BENCHMARKING

12.5.1 OVERALL COMPANY FOOTPRINT

TABLE 80 OVERALL COMPANY FOOTPRINT

12.5.2 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 81 COMPANY PRODUCT TYPE FOOTPRINT

12.5.3 COMPANY PRODUCT MOBILITY FOOTPRINT

TABLE 82 COMPANY PRODUCT MOBILITY FOOTPRINT

12.5.4 COMPANY REGION FOOTPRINT

TABLE 83 COMPANY REGION FOOTPRINT

12.6 COMPETITIVE SCENARIO

12.6.1 PRODUCT OR SERVICE LAUNCHES

TABLE 84 PRODUCT LAUNCHES & DEVELOPMENTS, 2020–2021

12.6.2 DEALS

TABLE 85 DEALS

12.6.3 OTHERS

TABLE 86 OTHERS

13 COMPANY PROFILES (Page No. - 128)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 CYBERDYNE INC.

TABLE 87 CYBERDYNE INC.: BUSINESS OVERVIEW

FIGURE 33 CYBERDYNE INC.: COMPANY SNAPSHOT (2020)

13.2 EKSO BIONICS

TABLE 88 EKSO BIONICS: BUSINESS OVERVIEW

FIGURE 34 COMPANY SNAPSHOT: EKSO BIONICS (2020)

13.3 REWALK ROBOTICS

TABLE 89 REWALK ROBOTICS: BUSINESS OVERVIEW

FIGURE 35 COMPANY SNAPSHOT: REWALK ROBOTICS (2020)

13.4 BIONIK LABORATORIES

TABLE 90 BIONIK LABORATORIES: BUSINESS OVERVIEW

FIGURE 36 BIONIK LABORATORIES: COMPANY SNAPSHOT

13.5 REX BIONICS

TABLE 91 REX BIONICS: BUSINESS OVERVIEW

13.6 PARKER HANNIFIN CORP

TABLE 92 PARKER HANNIFIN CORP: BUSINESS OVERVIEW

FIGURE 37 COMPANY SNAPSHOT: PARKER HANNIFIN CORP (2020)

13.7 B-TEMIA INC.

TABLE 93 B-TEMIA INC: BUSINESS OVERVIEW

13.8 BIOVENTUS

TABLE 94 BIOVENTUS BUSINESS OVERVIEW

FIGURE 38 COMPANY SNAPSHOT: BIOVENTUS (2020)

13.9 HOCOMA AG (A SUBSIDIARY OF DIH TECHNOLOGIES)

TABLE 95 HOCOMA AG: BUSINESS OVERVIEW

13.10 WEARABLE ROBOTICS

TABLE 96 WEARABLE ROBOTICS: BUSINESS OVERVIEW

13.11 OTHER KEY PLAYERS

13.11.1 GOGOA MOBILITY ROBOTS

13.11.2 EXOATLET

13.11.3 MEDITOUCH

13.11.4 SUITX

13.11.5 MEDEXO ROBOTICS

13.11.6 P & S MECHANICS

13.11.7 MARSI BIONICS S.L.

13.11.8 REHAB ROBOTICS

13.11.9 FOURIER INTELLIGENCE

13.11.10 MYOMO INC

13.11.11 FOCAL MEDITECH

13.11.12 HONDA MOTORS

13.11.13 WANDERCRAFT

13.11.14 BAMA TEKNOLOJI

13.11.15 TWIICE

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 171)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

This study involved four major activities in estimating the size of the medical exoskeleton market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

This research study involved widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and the SEC filings of companies.

Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the medical exoskeleton market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects. Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players

To know about the assumptions considered for the study, download the pdf brochure

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global medical exoskeleton market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of medical exoskeleton products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the medical exoskeleton market by type, component, extremity, mobility, structure, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall medical exoskeleton market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia, and RoW2

- To strategically analyze the market structure and profile key players in the medical exoskeleton market and comprehensively analyze their core competencies3

- To track and analyze company developments such as partnerships, agreements, and collaborations; expansions; acquisitions; and product launches in the medical exoskeleton market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Exoskeleton Market