Metal Bonding Adhesives Market by Resin Type (Acrylic, Epoxy, Polyurethane, Silicone, and Modified Phenolic Resin), Application (Automotive & Transportation, Industrial, and Appliances), and Region - Global Forecast to 2021

[158 Pages Report] The Metal Bonding Adhesives Market was valued at USD 5.30 Billion in 2015 and is projected to reach USD 7.70 Billion by 2021, at a CAGR of 6.5% from 2016 to 2021. In terms of volume, the metal bonding adhesives market is projected to grow from 1,337.5 KT in 2015 to 1,871.1 KT by 2021, at a CAGR of 5.8% from 2016 to 2021.

In this study, 2015 has been considered as the base year, 2016 as the estimated year, and 2021 as the projected year.

The objectives of the study are:

- To define and segment the metal bonding adhesives market by resin type, application, and region

- To estimate and forecast the metal bonding adhesives market by application at country-level in different regions, namely, North America, the Asia-Pacific, Europe, South America, and the Middle East & Africa

- To estimate and forecast the market size of metal bonding adhesives, in terms of value (USD billion) and volume (KT), at global and regional levels

- To estimate and forecast the market size of metal bonding adhesives, in terms of value (USD billion) and volume (KT), at country-level

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the metal bonding adhesives market.

- To analyze recent market developments and competitive strategies such as expansions, product launches/developments, agreements/collaborations, and mergers & acquisitions to draw a competitive landscape of the metal bonding adhesives market

- To strategically identify and profile key market players and analyze their core competencies in each of the resin type and application segments of the metal bonding adhesives market

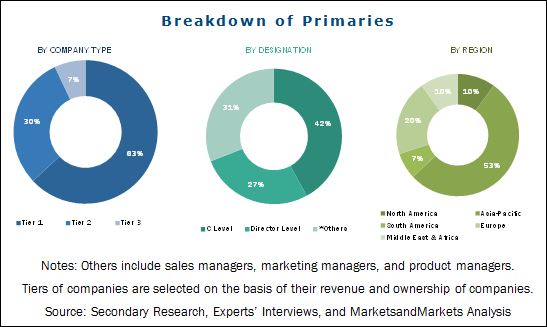

Varied secondary sources such as company websites, encyclopedias, directories, and databases that include Hoovers, Bloomberg, Businessweek, Factiva, and OneSource have been used to identify and collect information useful for this extensive and commercial study of the metal bonding adhesives market. Primary sources including experts from related industries have been interviewed to verify and collect critical information and assess the future prospects of the market. The top-down approach has been implemented to validate the market size in terms of value. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The metal bonding adhesives market has a diversified and established ecosystem of upstream players, such as raw material suppliers and downstream stakeholders such as manufacturers, vendors, end users, and government organizations.

This study answers several questions for stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. These stakeholders include metal bonding adhesives manufacturers such as Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), The 3M Company (U.S.), Sika AG (Switzerland), The Dow Chemical Company (U.S.), Arkema S.A. (France.), Solvay S.A., (Belgium), LORD Corporation (U.S.), DELO Industrie Klebstoffe GmbH & Co. KGaA (Germany), and Parson Adhesives, Inc. (U.S.).

Key Target Audience:

- Regional Manufacturers Associations and General Adhesives Manufacturers Associations

- Automotive Manufacturers Associations

- Raw Material Manufacturers

- Traders, Distributors, and Suppliers of Metal Bonding Adhesives

- Government and Regional Agencies, and Research Organizations

Scope of the Report:

This research report categorizes the metal bonding adhesives market based on resin type, application, and region, and forecasts the revenue growth and provides an analysis of trends in each of the submarkets.

On the Basis of Resin Type:

- Epoxy-based Metal Bonding Adhesives

- Acrylic-based Metal Bonding Adhesives

- Polyurethane-based Metal Bonding Adhesives

- Others (Silicone-based and Modified Phenolic Resin)

Each type is further described in detail in the report with value forecasts until 2021.

On the Basis of Application:

- Automotive & Transportation

- Industrial

- Appliances

Each application segment is further described in detail in the report, with value forecasts until 2021.

On the Basis of Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Each region is further segmented into key countries such as the U.S., Mexico, Canada, China, Japan, South Korea, India, Indonesia, Germany, the U.K., Italy, France, Turkey, Russia, Saudi Arabia, the UAE, Argentina, and Brazil.

Available Customizations: The following customization options are available for the report:

- Company Information

Detailed analysis and profiles of additional market players (up to three)

The metal bonding adhesives market was valued at USD 5.30 Billion in 2015 and is projected to reach USD 7.70 Billion by 2021, at a CAGR of 6.5% from 2016 to 2021. In terms of volume, the metal bonding adhesives market is projected to grow from 1,337.5 KT in 2015 to 1,871.1 KT by 2021, at a CAGR of 5.8% during the forecast period.

Stringent government regulations to enhance fuel economy; growth of the automotive, pharmaceuticals, and mining industries; steadily improving GDPs; and increased adoption of adhesives in automotive applications are factors anticipated to propel the growth of the metal bonding adhesives market.

The epoxy-based metal bonding adhesives segment is the largest resin type segment of the metal bonding adhesives market, followed by acrylic-based metal bonding adhesives segment. Epoxy-based adhesives are widely preferred for metal bonding, owing to their durability, high strength, temperature resistance, and excellent depth of cure. These adhesives are also known as Crash Durable Adhesives (CDA), as they encompass superior bonding properties resulting into improved crash resistance. Hence, epoxy-based metal bonding adhesives are widely preferred in manufacturing lightweight automotive parts.

The automotive & transportation segment is the largest application segment of the metal bonding adhesives market. Metal bonding adhesives are extensively used in the automotive & transportation industry. These are widely used by Original Equipment Manufacturers (OEMs) for automotive exteriors and panel bonding. Metal bonding adhesives are also used for bonding body panels of buses and trucks. The industrial segment is the second-largest application segment of the metal bonding adhesives market. Metal bonding adhesives are used in industrial applications as an alternative to traditional bonding methods for heat treatment and fastening. Metal bonding adhesives are widely used in industrial applications, including ultracentrifuge rotors, machinery base plates, cooling water pumps, reaction injecting molding machines, cooling water pumps, and industrial pumps. These adhesives are utilized by the healthcare industry for bonding applications in dialysis machines, filters, needle bonding, and X-ray & imaging equipment. Metal-to-metal bonding applications in the construction industry such as scrapers and trenchers are considered under the industrial segment.

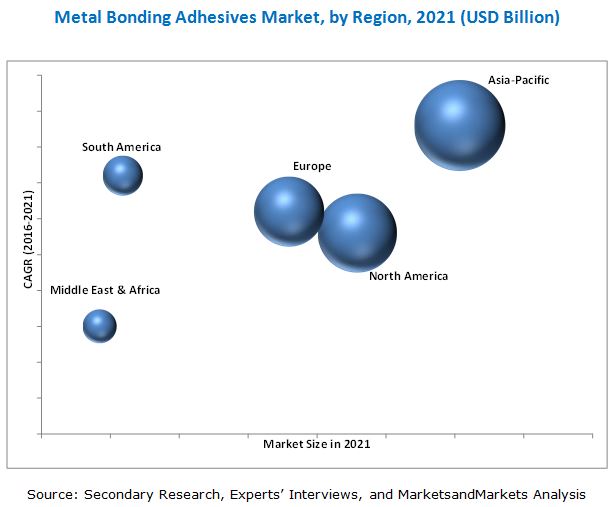

The Asia-Pacific region was the largest regional segment of the metal bonding adhesives, market, in terms of value and volume, in 2015. Industrial growth in countries such as India, Vietnam, Indonesia, and Thailand, and increased investments in chemicals, petrochemicals, oil & gas, and food & beverages industries are key factors driving the growth of the Asia-Pacific metal bonding adhesives market. Furthermore, increase in investments made by companies in the automotive sector, the shift of production facilities to emerging economies, and strong industrial base, are additional factors contributing to the growth of the metal bonding adhesives market in the Asia-Pacific region. Availability of raw materials across the globe and adoption of development strategies to meet the growing demand for metal bonding adhesives are propelling the growth of this market.

Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), The 3M Company (U.S.), Sika AG (Switzerland), The Dow Chemical Company (U.S.), Arkema S.A. (France.), Solvay S.A., (Belgium), LORD Corporation (U.S.), DELO Industrie Klebstoffe GmbH & Co. KGaA (Germany), and Parson Adhesives, Inc. (U.S.) are key players operating in the metal bonding adhesives market. Diverse product portfolios, strategically positioned R&D centers, and technological advancements are some of the factors that help strengthen the market position of these companies in the metal bonding adhesives market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.3.1 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in Metal Bonding Adhesives Market

4.2 Metal Bonding Adhesives Growth, By Application

4.3 Metal Bonding Adhesives Market, By Resin Type, 2015

4.4 Metal Bonding Adhesives Market Attractiveness

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Resin Type

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Demand in Automotive & Transportation and Industrial Applications

5.3.1.2 High Demand for Metal Bonding Adhesives in Asia-Pacific

5.3.2 Restraints

5.3.2.1 Volatility in Raw Material Prices

5.3.2.2 Economic Slowdown in Europe and South America Affecting the Sales of Metal Bonding Adhesives

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Lightweight and Low Carbon Emitting Vehicles

5.3.3.2 Growing Demand for Low Voc, Green, and Sustainable Metal Bonding Adhesives

5.3.4 Challenges

5.3.4.1 Stringent and Time-Consuming Regulatory Policies

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Macroeconomic Indicators

6.4.1 High Adoption Rate of Lightweight Materials in Automotive Industry

6.4.2 Growth of Middle-Class Population in Emerging Countries

7 Metal Bonding Adhesives Market, By Resin Type (Page No. - 49)

7.1 Introduction

7.2 Epoxy-Based Metal Bonding Adhesives

7.3 Acrylic-Based Metal Bonding Adhesives

7.4 Polyurethane-Based Metal Bonding Adhesives

7.5 Other Metal Bonding Adhesives

8 Metal Bonding Adhesives Market, By Application (Page No. - 59)

8.1 Introduction

8.2 Automotive & Transportation

8.3 Industrial

8.4 Appliances

9 Metal Bonding Adhesives Market, By Region (Page No. - 66)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Indonesia

9.2.6 Rest of Asia-Pacific

9.3 Europe

9.3.1 Western Europe

9.3.1.1 Germany

9.3.1.2 U.K.

9.3.1.3 France

9.3.1.4 Rest of Western Europe

9.3.2 Central & Eastern Europe

9.3.2.1 Russia

9.3.2.2 Turkey

9.3.2.3 Rest of Central & Eastern Europe

9.4 North America

9.4.1 U.S.

9.4.2 Mexico

9.4.3 Canada

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 UAE

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 126)

10.1 Overview

10.2 New Product Developments and Acquisitions: the Most Popular Growth Strategy

10.3 Key Growth Strategies in the Metal Bonding Adhesives Market, 20112016

10.3.1 New Product Developments

10.3.2 Acquisitions

10.3.3 Expansions

10.4 Metal Bonding Adhesives Market: Market Share Analysis

11 Company Profiles (Page No. - 131)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Henkel AG & Co. KGaA

11.2 H.B. Fuller

11.3 Sika AG

11.4 The 3m Company

11.5 The DOW Chemical Company

11.6 Lord Corporation

11.7 Delo Industrie Klebstoffe GmbH & Co. KGaA

11.8 Parson Adhesives, Inc.

11.9 Arkema S.A.

11.10 Solvay S.A.

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 149)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (142 Tables)

Table 1 Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 2 Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 3 Applications of Epoxy-Based Metal Bonding Adhesives

Table 4 Epoxy-Based Metal Bonding Adhesives Market Size, By Region, 20142021 (USD Million)

Table 5 Epoxy-Based Metal Bonding Adhesive Market Size, By Region, 20142021 (Kiloton)

Table 6 Acrylic-Based Metal Bonding Adhesives Market Size, By Region, 20142021 (USD Million)

Table 7 Acrylic-Based Metal Bonding Adhesive Market Size, By Region, 20142021 (Kiloton)

Table 8 Polyurethane-Based Metal Bonding Adhesives Market Size, By Region, 20142021 (USD Million)

Table 9 Polyurethane-Based Metal Bonding Adhesive Market Size, By Region, 20142021 (Kiloton)

Table 10 Other Metal Bonding Adhesives Market Size, By Region, 20142021 (USD Million)

Table 11 Other Metal Bonding Adhesive Market Size, By Region, 20142021 (Kiloton)

Table 12 Metal Bonding Adhesives Market Size, By Application, 20142021 (USD Million)

Table 13 Metal Bonding Adhesive Market Size, By Application, 20142021 (Kiloton)

Table 14 Market Size in Automotive & Transportation Application, By Region, 20142021 (USD Million)

Table 15 Market Size in Automotive & Transportation Application, By Region, 20142021 (Kiloton)

Table 16 Market Size in Industrial Application, By Region, 20142021 (USD Million)

Table 17 Market Size in Industrial Application, By Region, 20142021 (Kiloton)

Table 18 Market Size in Appliances Application, By Region, 20142021 (USD Million)

Table 19 Market Size in Appliances Application, By Region, 20142021 (Kiloton)

Table 20 Market Size, By Region, 20142021 (USD Million)

Table 21 Market Size, By Region, 20142021 (Kiloton)

Table 22 Asia-Pacific: Metal Bonding Adhesives Market Size, By Country, 20142021 (USD Million)

Table 23 Asia-Pacific: Metal Bonding Adhesive Market Size, By Country, 20142021 (Kiloton)

Table 24 Asia-Pacific: Market Size, By Resin Type, 20142021 (USD Million)

Table 25 Asia-Pacific: Market Size, By Resin Type, 20142021 (Kiloton)

Table 26 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 27 Asia-Pacific: Market Size, By Application, 20142021 (Kiloton)

Table 28 China: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 29 China: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 30 China: Market Size, By Application, 20142021 (USD Million)

Table 31 China: Market Size, By Application, 20142021 (Kiloton)

Table 32 Japan: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 33 Japan: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 34 Japan: Market Size, By Application, 20142021 (USD Million)

Table 35 Japan: Market Size, By Application, 20142021 (Kiloton)

Table 36 India: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 37 India: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 38 India: Market Size, By Application, 20142021 (USD Million)

Table 39 India: Market Size, By Application, 20142021 (Kiloton)

Table 40 South Korea: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 41 South Korea: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 42 South Korea: Market Size, By Application, 20142021 (USD Million)

Table 43 South Korea: Market Size, By Application, 20142021 (Kiloton)

Table 44 Indonesia: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 45 Indonesia: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 46 Indonesia: Market Size, By Application, 20142021 (USD Million)

Table 47 Indonesia: Market Size, By Application, 20142021 (Kiloton)

Table 48 Rest of Asia-Pacific: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 49 Rest of Asia-Pacific: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 50 Rest of Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 51 Rest of Asia-Pacific: Market Size, By Application, 20142021 (Kiloton)

Table 52 Europe: Metal Bonding Adhesives Market Size, By Country, 20142021 (USD Million)

Table 53 Europe: Metal Bonding Adhesive Market Size, By Country, 20142021 (Kiloton)

Table 54 Europe: Market Size, By Resin Type, 20142021 (USD Million)

Table 55 Europe: Market Size, By Resin Type, 20142021 (Kiloton)

Table 56 Europe: Market Size, By Application, 20142021 (USD Million)

Table 57 Europe: Market Size, By Application, 20142021 (Kiloton)

Table 58 Germany: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 59 Germany: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 60 Germany: Market Size, By Application, 20142021 (USD Million)

Table 61 Germany: Market Size, By Application, 20142021 (Kiloton)

Table 62 U.K.: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 63 U.K.: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 64 U.K.: Market Size, By Application, 20142021 (USD Million)

Table 65 U.K.: Market Size, By End-Use Application, 20142021 (Kiloton)

Table 66 France: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 67 France: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 68 France: Market Size, By Application, 20142021 (USD Million)

Table 69 France: Market Size, By Application, 20142021 (Kiloton)

Table 70 Rest of Western Europe: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 71 Rest of Western Europe: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 72 Rest of Western Europe: Market Size, By Application, 20142021 (USD Million)

Table 73 Rest of Western Europe: Market Size, By Application, 20142021 (Kiloton)

Table 74 Russia: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 75 Russia: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 76 Russia: Market Size, By Application, 20142021 (USD Million)

Table 77 Russia: Market Size, By Application, 20142021 (Kiloton)

Table 78 Turkey: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 79 Turkey: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 80 Turkey: Market Size, By Application, 20142021 (USD Million)

Table 81 Turkey: Market Size, By Application, 20142021 (Kiloton)

Table 82 Rest of Central & Eastern Europe: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 83 Rest of Central & Eastern Europe: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 84 Rest of Central & Eastern Europe: Market Size, By Application, 20142021 (USD Million)

Table 85 Rest of Central & Eastern Europe: Market Size, By Application, 20142021 (Kiloton)

Table 86 North America: Metal Bonding Adhesives Market Size, By Country, 20142021 (USD Million)

Table 87 North America: Metal Bonding Adhesive Market Size, By Country, 20142021 (Kiloton)

Table 88 North America: Market Size, By Resin Type, 20142021 (USD Million)

Table 89 North America: Market Size, By Resin Type, 20142021 (Kiloton)

Table 90 North America: Market Size, By Application, 20142021 (USD Million)

Table 91 North America: Market Size, By Application, 20142021 (Kiloton)

Table 92 U.S.: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 93 U.S.: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 94 U.S.: Market Size, By Application, 20142021 (USD Million)

Table 95 U.S.: Market Size, By Application, 20142021 (Kiloton)

Table 96 Mexico: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 97 Mexico: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 98 Mexico: Market Size, By Application, 20142021 (USD Million)

Table 99 Mexico: Market Size, By Application, 20142021 (Kiloton)

Table 100 Canada: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 101 Canada: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 102 Canada: Market Size, By Application, 20142021 (USD Million)

Table 103 Canada: Market Size, By Application, 20142021 (Kiloton)

Table 104 South America: Metal Bonding Adhesives Market Size, By Country, 20142021 (USD Million)

Table 105 South America: Metal Bonding Adhesive Market Size, By Country, 20142021 (Kiloton)

Table 106 South America: Market Size, By Resin Type, 20142021 (USD Million)

Table 107 South America: Market Size, By Resin Type, 20142021 (Kiloton)

Table 108 South America: Market Size, By Application, 20142021 (USD Million)

Table 109 South America: Market Size, By Application, 20142021 (Kiloton)

Table 110 Brazil: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 111 Brazil: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 112 Brazil: Market Size, By Application, 20142021 (USD Million)

Table 113 Brazil: Market Size, By Application, 20142021 (Kiloton)

Table 114 Argentina: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 115 Argentina: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 116 Argentina: Market Size, By Application, 20142021 (USD Million)

Table 117 Argentina: Market Size, By Application, 20142021 (Kiloton)

Table 118 Rest of South America: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 119 Rest of South America: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 120 Rest of South America: Market Size, By Application, 20142021 (USD Million)

Table 121 Rest of South America: Market Size, By Application, 20142021 (Kiloton)

Table 122 Middle East & Africa: Metal Bonding Adhesives Market Size, By Country, 20142021 (USD Million)

Table 123 Middle East & Africa: Metal Bonding Adhesive Market Size, By Country, 20142021 (Kiloton)

Table 124 . Middle East & Africa: Market Size, By Resin Type, 20142021 (USD Million)

Table 125 Middle East & Africa: Market Size, By Resin Type, 20142021 (Kiloton)

Table 126 Middle East & Africa: Market Size, By Application, 20142021 (Million)

Table 127 Middle East & Africa: Market Size, By Application, 20142021 (Kiloton)

Table 128 Saudi Arabia: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 129 Saudi Arabia: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 130 Saudi Arabia: Market Size, By Application, 20142021 (USD Million)

Table 131 Saudi Arabia: Market Size, By Application, 20142021 (Kiloton)

Table 132 UAE: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 133 UAE: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 134 UAE: Market Size, By Application, 20142021 (USD Million)

Table 135 UAE: Market Size, By Application, 20142021 (Kiloton)

Table 136 Rest of Middle East & Africa: Metal Bonding Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 137 Rest of Middle East & Africa: Metal Bonding Adhesive Market Size, By Resin Type, 20142021 (Kiloton)

Table 138 Rest of Middle East & Africa: Market Size, By Application, 20142021 (USD Million)

Table 139 Rest of Middle East & Africa: Market Size, By Application, 20162021 (Kiloton)

Table 140 New Product Developments, 20112016

Table 141 Acquisitions, 20112016

Table 142 Expansions, 20112016

List of Figures (46 Figures)

Figure 1 Metal Bonding Adhesives Market Segmentation

Figure 2 Metal Bonding Adhesives Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Metal Bonding Adhesives Market: Data Triangulation

Figure 6 Epoxy-Based Metal Bonding Adhesives to Dominate the Market, 20162021

Figure 7 Automotive & Transportation to Be the Fastest-Growing Application of Metal Bonding Adhesives, 20162021

Figure 8 Asia-Pacific Dominated the Global Market of Metal Bonding Adhesives in 2015

Figure 9 Metal Bonding Adhesives to Witness Moderate Growth During Forecast Period

Figure 10 Automotive & Transportation to Be the Largest and Fastest-Growing Segment Between 2016 and 2021

Figure 11 Epoxy-Based Metal Bonding Adhesives Accounted for the Largest Market Share in 2015

Figure 12 Metal Bonding Adhesives to Register High Growth in Asia-Pacific and South America Between 2016 and 2021

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Metal Bonding Adhesives Market

Figure 14 Global Market of Metal Bonding Adhesives: Drivers Restraints Impact Analysis 2016-2021

Figure 15 Value Chain Analysis of Metal Bonding Adhesives Market

Figure 16 Porters Five Forces Analysis for Metal Bonding Adhesives Market

Figure 17 Future Outlook for Lightweight Automotive Materials in 2010 and 2030

Figure 18 Regional Share of Middle-Class Population in Emerging Countries

Figure 19 Epoxy-Based Metal Bonding Adhesives to Dominate the Market Between 2016 and 2021

Figure 20 Asia-Pacific to Be the Largest Market of Epoxy-Based Metal Bonding Adhesives Between 2016 and 2021

Figure 21 Asia-Pacific to Be the Largest Market of Acrylic-Based Metal Bonding Adhesives Between 2016 and 2021

Figure 22 Asia-Pacific to Be the Largest market of Polyurethane-Based Metal Bonding Adhesives Between 2016 and 2021

Figure 23 Europe to Dominate Other Metal Bonding Adhesives Market Between 2016 and 2021

Figure 24 Automotive & Transportation to Be the Largest Application of Metal Bonding Adhesives Market Between 2016 and 2021

Figure 25 Asia-Pacific to Be the Largest Market of Metal Bonding Adhesives in Automotive & Transportation Application Between 2016 and 2021

Figure 26 Asia-Pacific to Be the Largest Market of Metal Bonding Adhesives in Industrial Application Between 2016 and 2021

Figure 27 Asia-Pacific to Be the Largest Market of Metal Bonding Adhesives in Appliances Application Between 2016 and 2021

Figure 28 Regional Snapshot: India, China, and Brazil to Emerge as New Strategic Destinations for Metal Bonding Adhesives Market

Figure 29 Asia-Pacific Market Snapshot: China to Be the Largest and Fastest-Growing Market, 20162021

Figure 30 Market Snapshot: Germany is the Largest and Fastest-Growing Market

Figure 31 Aerospace Industry in Germany: High Growth Potential for Metal Bonding Adhesive Producers

Figure 32 Sales of German Aerospace Industry in 2015

Figure 33 Car Manufacturing Outlook in the U.K., 2018 (Million Unit)

Figure 34 Automotive Industry Dynamics of U.K.: Lucrative Growth Opportunities for Metal Bonding Adhesive Producers

Figure 35 North America Market Snapshot: U.S. to Be the Largest and Fastest-Growing Market, 20162021

Figure 36 South America Market Snapshot: Brazil is the Largest and Fastest-Growing Market, 20162021

Figure 37 Factors Driving Metal Bonding Adhesives Market in Brazil

Figure 38 Middle East & Africa Market Snapshot: Saudi Arabia to Be the Largest Market for Metal Bonding Adhesives During Forecast Period

Figure 39 Political and Social Factors Affecting Industrial Growth of Middle East & Africa

Figure 40 Companies Adopted New Product Developments as the Key Growth Strategy, 20112016

Figure 41 Key Growth Strategies in Metal Bonding Adhesives Market, 20112016

Figure 42 Henkel AG & Co. KGaA: SWOT Analysis

Figure 43 H.B. Fuller: SWOT Analysis

Figure 44 Sika AG: SWOT Analysis

Figure 45 The 3m Company: SWOT Analysis

Figure 46 The DOW Chemical Company: SWOT Analysis

Growth opportunities and latent adjacency in Metal Bonding Adhesives Market